false

0000767405

0000767405

2025-01-23

2025-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 28, 2025

(January 23, 2025)

SB FINANCIAL GROUP, INC

(Exact name of registrant

as specified in its charter)

| Ohio |

|

001-36785 |

|

34-1395608 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 401 Clinton Street, Defiance, OH |

|

43512 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (419) 783-8950

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registererd |

|

Common Shares, No Par Value 6,524,769 Outstanding at January 28, 2025 |

|

SBFG |

|

The NASDAQ Stock Market, LLC

(NASDAQ Capital Market) |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 23, 2025, SB Financial Group, Inc. (the

“Company”) issued a news release reporting financial results for the fourth quarter 2024. A copy of the January 23, 2025 news

release is furnished as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit

99.1 furnished herewith, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that Section, nor shall such information

be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933 or the

Exchange Act, except as otherwise stated in such filing.

Item 9.01. Financial Statements and Exhibits.

(a) Not Applicable

(b) Not Applicable

(c) Not Applicable

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SB FINANCIAL GROUP, INC. |

| |

|

|

| Dated: January 28, 2025 |

By: |

/s/ Anthony V. Cosentino |

| |

|

Anthony V. Cosentino |

| |

|

Chief Financial Officer |

INDEX TO EXHIBITS

Current Report on Form

8-K

Dated January 28, 2025

SB Financial Group,

Inc.

Exhibit 99.1

SB Financial Group Announces Fourth Quarter

2024 Results

DEFIANCE, OH, January 23, 2025 -- SB Financial

Group, Inc. (NASDAQ: SBFG) (“SB Financial” or the “Company”), a diversified financial services company

providing full-service community banking, mortgage banking, wealth management, private client and title insurance services today reported

earnings for the fourth quarter ended December 31, 2024.

Fourth Quarter 2024 Highlights compared to

the fourth quarter of the prior year:

| ● | Net

income of $3.6 million, which is down 6.4 percent with Diluted Earnings Per Share (“EPS”)

of $0.55. When adjusted for Originated Mortgage Servings Rights (“OMSR”) and

the Visa B share sale in the prior year, diluted EPS would be up $0.07 or 16.7 percent. |

| ● | Interest

income of $16.8 million increased by 11.4 percent from $15.1 million reported in the prior

year. |

| ● | Loan

growth of $46.5 million, or 4.7 percent from the prior-year quarter, and marks the third

consecutive quarter of sequential expanding loan growth, year over year. |

| ● | Tangible

book value per shared ended the quarter at $16.00 up $1.02 per share or 6.8 percent from

the prior year. |

Twelve

Months Ended December 31, 2024, highlights Over the Prior Year include:

| ● | Net

income decreased slightly to $11.5 million, a 5.2 percent decline from the prior year’s $12.1

million, and diluted EPS was $1.72, down 1.9 percent from $1.75. Adjusted EPS was up 4.2

percent compared to the prior year. |

| ● | Deposits

increased by $82.4 million, or 7.7 percent to $1.15 billion. |

| ● | Total

interest income of $64.3 million increased by $6.2 million, or 10.7 percent compared to the

$58.2 million reported for the previous twelve months, while net interest income improved

slightly to $39.9 million, or 1.7 percent. |

| Earnings Highlights | |

Three Months Ended | | |

Twelve Months Ended | |

| ($ in thousands, except per share & ratios) | |

Dec. 2024 | | |

Dec. 2023 | | |

% Change | | |

Dec. 2024 | | |

Dec. 2023 | | |

% Change | |

| Operating revenue | |

$ | 15,454 | | |

$ | 15,115 | | |

| 2.2 | % | |

$ | 56,939 | | |

$ | 56,994 | | |

| -0.1 | % |

| Interest income | |

| 16,847 | | |

| 15,126 | | |

| 11.4 | % | |

| 64,349 | | |

| 58,152 | | |

| 10.7 | % |

| Interest expense | |

| 5,950 | | |

| 5,542 | | |

| 7.4 | % | |

| 24,427 | | |

| 18,879 | | |

| 29.4 | % |

| Net interest income | |

| 10,897 | | |

| 9,584 | | |

| 13.7 | % | |

| 39,922 | | |

| 39,273 | | |

| 1.7 | % |

| Provision (recovery) for credit losses | |

| (76 | ) | |

| (74 | ) | |

| -2.7 | % | |

| 124 | | |

| 315 | | |

| -60.6 | % |

| Noninterest income | |

| 4,557 | | |

| 5,531 | | |

| -17.6 | % | |

| 17,017 | | |

| 17,721 | | |

| -4.0 | % |

| Noninterest expense | |

| 11,003 | | |

| 10,369 | | |

| 6.1 | % | |

| 42,959 | | |

| 41,962 | | |

| 2.4 | % |

| Net income | |

| 3,635 | | |

| 3,883 | | |

| -6.4 | % | |

| 11,470 | | |

| 12,095 | | |

| -5.2 | % |

| Earnings per diluted share | |

| 0.55 | | |

| 0.57 | | |

| -3.5 | % | |

| 1.72 | | |

| 1.75 | | |

| -1.7 | % |

| Return on average assets | |

| 1.04 | % | |

| 1.17 | % | |

| -11.1 | % | |

| 0.84 | % | |

| 0.91 | % | |

| -7.7 | % |

| Return on average equity | |

| 11.13 | % | |

| 13.23 | % | |

| -15.9 | % | |

| 9.19 | % | |

| 10.22 | % | |

| -10.1 | % |

“Our fourth-quarter and full-year 2024 results

underscore our ability to navigate challenges while delivering growth in key areas,” said Mark A. Klein, Chairman, President, and

CEO. “Net income for the quarter was $3.6 million, a 54.4 percent increase from the linked quarter. Diluted EPS for the quarter

was $0.55, with full-year diluted EPS reaching $1.72.

“In addition to our financial results, we

are pleased that we were able to close on the Marblehead acquisition earlier this month. Their presence will add substantial liquidity

via their low-cost deposit base and will expand our market presence in Northern Ohio.”

Interest income for the quarter grew by 11.4 percent

to $16.8 million, driven by strong loan performance. Loans increased by $46.5 million, compared to the prior year, and by $16.8 million

from the linked quarter. Deposits also rose by $82.4 million, or 7.7 percent, to $1.15 billion, a testament to the trust our clients place

in us. Tangible book value per share climbed by 6.8 percent to $16.00, underscoring our commitment to delivering shareholder value.

We achieved $64.3 million in total interest income

for the year, a 10.7 percent increase over 2023, which partially offset a slight decline in net income to $11.5 million. These results

highlight our disciplined approach to growth, operational efficiency, and long-term value creation for our stakeholders. As we move into

2025, we remain focused on leveraging our momentum and strengthening our financial position.”

RESULTS OF OPERATIONS

Consolidated Revenue

In the fourth quarter of 2024, total operating

revenue increased to $15.5 million, a 2.2 percent rise from $15.1 million in the prior year and an 8.0 percent increase from the linked

quarter, driven by growth in both net interest income and noninterest income. Net interest income reached $10.9 million, a strong 13.7

percent year-over-year increase, reflecting higher interest income on loans, which rose by $1.5 million to $15.0 million. However, rising

deposit costs contributed to a 7.4 percent increase in total interest expense, partially offsetting the gains in interest income. Despite

this, the net interest margin expanded by 24 basis points year-over-year to 3.35 percent, reflecting the continued strength of our interest-earning

assets and disciplined funding cost management.

Noninterest income for the quarter declined by

17.6 percent year-over-year to $4.6 million due to the Visa B share sale recorded in the prior year quarter. However, it improved by 10.5

percent compared to the linked quarter, highlighting recovery in key areas. Gains on the sale of mortgage loans and OMSR increased by

$448,000 year over year to $1.2 million, while wealth management fees and title insurance revenue rose by $78,000 and $100,000, respectively.

Moving forward, we remain focused on maintaining a balanced approach to driving revenue growth and managing costs to deliver consistent

shareholder value.

Mortgage Loan Business

“Our mortgage banking operations delivered

another quarter of strong results, reflecting our strategic focus on origination growth, portfolio expansion, and servicing efficiency.

Mortgage originations surged to $72.5 million, an impressive year-over-year increase of $33.0 million, or 83.3 percent,” continued

Mr. Klein. “The Indianapolis team contributed 43 percent of our volume this quarter and our newest market, Cincinnati, had volume

of $2.3 million in the quarter. Correspondingly, mortgage sales rose to $62.3 million, marking an 86.7 percent increase compared to the

same period, last year.”

The mortgage servicing portfolio expanded to $1.43

billion, achieving a year-over-year increase of $60.7 million, or 4.4 percent, further strengthening our recurring revenue streams, and

highlighting the effectiveness of our servicing retention strategies.

Net mortgage banking revenue for the quarter reached

$2.0 million, up $703,000 from the prior year quarter, and for the year was $6.7 million up 18.1 percent compared to 2023. Gains on the

sale of mortgages remained a key revenue driver, increasing by $448,000 year-over-year to $1.2 million. Loan servicing fees added $886,000

to revenue, reflecting an increase of $31,000 from the previous year quarter. Notably, the OMSR net valuation adjustment for full year

2024 was a positive $42,000 compared to a negative $51,000 for the full year of 2023.

| Mortgage Banking | |

| | |

| | |

| | |

| | |

| | |

Prior Year | |

| ($ in thousands) | |

Dec. 2024 | | |

Sep. 2024 | | |

Jun. 2024 | | |

Mar. 2024 | | |

Dec. 2023 | | |

Growth | |

| Mortgage originations | |

$ | 72,534 | | |

$ | 70,715 | | |

$ | 75,110 | | |

$ | 42,912 | | |

$ | 39,566 | | |

$ | 32,968 | |

| Mortgage sales | |

| 62,301 | | |

| 61,271 | | |

| 55,835 | | |

| 36,623 | | |

| 33,362 | | |

| 28,939 | |

| Mortgage servicing portfolio | |

| 1,427,318 | | |

| 1,406,273 | | |

| 1,389,805 | | |

| 1,371,713 | | |

| 1,366,667 | | |

| 60,651 | |

| Mortgage servicing rights | |

| 14,868 | | |

| 14,357 | | |

| 14,548 | | |

| 14,191 | | |

| 13,906 | | |

| 962 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loan servicing fees | |

| 886 | | |

| 874 | | |

| 862 | | |

| 855 | | |

| 855 | | |

| 31 | |

| OMSR amortization | |

| (358 | ) | |

| (370 | ) | |

| (335 | ) | |

| (273 | ) | |

| (282 | ) | |

| (76 | ) |

| Net administrative fees | |

| 528 | | |

| 504 | | |

| 527 | | |

| 582 | | |

| 573 | | |

| (45 | ) |

| OMSR valuation adjustment | |

| 288 | | |

| (465 | ) | |

| 38 | | |

| 181 | | |

| (12 | ) | |

| 300 | |

| Net loan servicing fees | |

| 816 | | |

| 39 | | |

| 565 | | |

| 763 | | |

| 561 | | |

| 255 | |

| Gain on sale of mortgages | |

| 1,196 | | |

| 1,311 | | |

| 1,277 | | |

| 781 | | |

| 747 | | |

| 449 | |

| Mortgage banking revenue, net | |

$ | 2,012 | | |

$ | 1,350 | | |

$ | 1,842 | | |

$ | 1,544 | | |

$ | 1,308 | | |

$ | 704 | |

Noninterest Income and Noninterest Expense

“Noninterest income for the fourth quarter

of 2024 totaled $4.6 million, with linked quarter noninterest income increasing by $434,000 or 10.5 percent, primarily due to increased

revenue in net mortgage loan servicing fees and higher wealth management fees. Compared to the prior year quarter, wealth management fees

grew modestly by $78,000 year over year, and title insurance revenue added $100,000, reflecting our ability to deliver consistent performance

across core revenue categories” Mr. Klein noted.

| Noninterest Income/Noninterest Expense | |

| | |

| | |

| | |

| | |

| | |

Prior Year | |

| ($ in thousands, except ratios) | |

Dec. 2024 | | |

Sep. 2024 | | |

Jun. 2024 | | |

Mar. 2024 | | |

Dec. 2023 | | |

Growth | |

| Noninterest Income (NII) | |

$ | 4,557 | | |

$ | 4,123 | | |

$ | 4,386 | | |

$ | 3,951 | | |

$ | 5,531 | | |

$ | (974 | ) |

| NII / Total Revenue | |

| 29.5 | % | |

| 28.8 | % | |

| 31.5 | % | |

| 30.1 | % | |

| 36.6 | % | |

| -7.1 | % |

| NII / Average Assets | |

| 1.3 | % | |

| 1.2 | % | |

| 1.3 | % | |

| 1.2 | % | |

| 1.7 | % | |

| -0.4 | % |

| Total Revenue Growth | |

| 2.2 | % | |

| 4.5 | % | |

| -0.6 | % | |

| -6.1 | % | |

| 3.4 | % | |

| -1.2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Noninterest Expense (NIE) | |

$ | 11,003 | | |

$ | 11,003 | | |

$ | 10,671 | | |

$ | 10,282 | | |

$ | 10,369 | | |

$ | 634 | |

| Efficiency Ratio | |

| 71.1 | % | |

| 76.8 | % | |

| 75.9 | % | |

| 78.2 | % | |

| 68.4 | % | |

| 2.7 | % |

| NIE / Average Assets | |

| 3.2 | % | |

| 3.2 | % | |

| 3.2 | % | |

| 3.1 | % | |

| 3.1 | % | |

| 0.1 | % |

| Net Noninterest Expense/Avg. Assets | |

| -1.9 | % | |

| -2.0 | % | |

| -1.9 | % | |

| -1.9 | % | |

| -1.4 | % | |

| -0.5 | % |

| Total Expense Growth | |

| 6.1 | % | |

| 5.0 | % | |

| 3.2 | % | |

| -4.6 | % | |

| 1.0 | % | |

| 5.1 | % |

Noninterest expense for the fourth quarter of

2024 was unchanged at $11.0 million compared to the third quarter but increased by $634,000, or 6.1 percent, year-over-year. The year-over-year

increase was primarily driven by a $533,000 increase in salaries and employee benefits, reflecting investments in talent to support operational

growth and increased business activity.

Noninterest expense increases were partially offset

by reductions in discretionary expense categories, including a $61,000 decrease in state, local, and other taxes, as well as a $44,000

reduction in net occupancy expense. Postage and delivery expenses also saw a modest decline of $51,000.

“Our efficiency ratio improved to 71.09

percent in the fourth quarter of 2024 from 76.78 percent in the linked quarter, highlighting our ability to manage costs while investing

strategically in growth areas. With a year-end headcount of 252 full-time equivalent employees, we remain focused on balancing growth

with operational efficiency” stated Mr. Klein.

Balance Sheet

As of December 31, 2024, SB Financial reported

total assets of $1.38 billion, higher from both the linked quarter and the previous year. This growth was primarily driven by a robust

increase in the loan portfolio, which reached $1.05 billion, marking a $46.5 million or 4.7 percent increase year over year. The strategic

reallocation of liquidity contributed to this expansion, as evidenced by a decline in cash and available-for-sale securities, demonstrated

the Company’s focus on maximizing returns while maintaining a solid financial position.

Total deposits increased to $1.15 billion, growing

$82.4 million or 7.7 percent year over year, reflecting SB Financial’s strength in deposit gathering and customer engagement. Shareholders’

equity ended the year at $127.5 million, representing a $3.2 million increase from the prior year. This growth reflects management’s commitment

to enhancing shareholder value and the Company’s disciplined approach to capital management.

During the fourth quarter, SB Financial repurchased

130,465 shares, continuing its active buyback program. This reflects the Company’s dedication to returning value to shareholders through

dividends and share repurchases while retaining sufficient capital to fund its long-term growth strategies.

“As we conclude 2024, our balance sheet strength

and strategic allocation of resources highlight our unwavering commitment to disciplined growth,” said Mr. Klein, Chairman, President,

and CEO. “Despite a challenging rate environment, we achieved our third consecutive quarter of loan growth, with balances increasing

by $46.5 million from the previous year. This performance underscores our ability to deepen client relationships while navigating competitive

dynamics. Our strong asset quality, supported by top-decile coverage ratios, remains a cornerstone of our financial stability, positioning

us to capitalize on emerging opportunities while maintaining operational excellence. Looking ahead, we remain focused on driving shareholder

value and sustaining robust financial performance in the evolving economic landscape.”

| Loan Balances | |

| | |

| | |

| | |

| | |

| | |

Annual | |

| ($ in thousands, except ratios) | |

Dec. 2024 | | |

Sep. 2024 | | |

Jun. 2024 | | |

Mar. 2024 | | |

Dec. 2023 | | |

Growth | |

| Commercial | |

$ | 124,764 | | |

$ | 123,821 | | |

$ | 123,287 | | |

$ | 120,016 | | |

$ | 126,716 | | |

$ | (1,952 | ) |

| % of Total | |

| 11.9 | % | |

| 12.0 | % | |

| 12.3 | % | |

| 12.1 | % | |

| 12.7 | % | |

| -1.5 | % |

| Commercial RE | |

| 479,573 | | |

| 459,449 | | |

| 434,967 | | |

| 429,362 | | |

| 424,041 | | |

| 55,532 | |

| % of Total | |

| 45.8 | % | |

| 44.6 | % | |

| 43.3 | % | |

| 43.3 | % | |

| 42.4 | % | |

| 13.1 | % |

| Agriculture | |

| 64,680 | | |

| 64,887 | | |

| 64,329 | | |

| 62,365 | | |

| 65,659 | | |

| (979 | ) |

| % of Total | |

| 6.2 | % | |

| 6.3 | % | |

| 6.4 | % | |

| 6.3 | % | |

| 6.6 | % | |

| -1.5 | % |

| Residential RE | |

| 308,378 | | |

| 314,010 | | |

| 316,233 | | |

| 314,668 | | |

| 318,123 | | |

| (9,745 | ) |

| % of Total | |

| 29.5 | % | |

| 30.5 | % | |

| 31.5 | % | |

| 31.7 | % | |

| 31.8 | % | |

| -3.1 | % |

| Consumer & Other | |

| 69,340 | | |

| 67,788 | | |

| 66,574 | | |

| 65,141 | | |

| 65,673 | | |

| 3,667 | |

| % of Total | |

| 6.6 | % | |

| 6.6 | % | |

| 6.6 | % | |

| 6.6 | % | |

| 6.6 | % | |

| 5.6 | % |

| Total Loans | |

$ | 1,046,735 | | |

$ | 1,029,955 | | |

$ | 1,005,390 | | |

$ | 991,552 | | |

$ | 1,000,212 | | |

$ | 46,523 | |

| Total Growth Percentage | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 4.7 | % |

| Deposit Balances | |

| | |

| | |

| | |

| | |

| | |

Annual | |

| ($ in thousands, except ratios) | |

Dec. 2024 | | |

Sep. 2024 | | |

Jun. 2024 | | |

Mar. 2024 | | |

Dec. 2023 | | |

Growth | |

| Non-Int DDA | |

$ | 232,155 | | |

$ | 222,425 | | |

$ | 208,244 | | |

$ | 219,395 | | |

$ | 228,713 | | |

$ | 3,442 | |

| % of Total | |

| 20.1 | % | |

| 19.2 | % | |

| 18.7 | % | |

| 19.7 | % | |

| 21.4 | % | |

| 1.5 | % |

| Interest DDA | |

| 201,085 | | |

| 202,097 | | |

| 190,857 | | |

| 169,171 | | |

| 166,413 | | |

| 34,672 | |

| % of Total | |

| 17.4 | % | |

| 17.4 | % | |

| 17.1 | % | |

| 15.2 | % | |

| 15.5 | % | |

| 20.8 | % |

| Savings | |

| 237,987 | | |

| 241,761 | | |

| 231,855 | | |

| 244,157 | | |

| 216,965 | | |

| 21,022 | |

| % of Total | |

| 20.6 | % | |

| 20.8 | % | |

| 20.8 | % | |

| 21.9 | % | |

| 20.3 | % | |

| 9.7 | % |

| Money Market | |

| 222,161 | | |

| 228,182 | | |

| 225,650 | | |

| 221,362 | | |

| 202,605 | | |

| 19,556 | |

| % of Total | |

| 19.3 | % | |

| 19.7 | % | |

| 20.2 | % | |

| 19.9 | % | |

| 18.9 | % | |

| 9.7 | % |

| Time Deposits | |

| 259,217 | | |

| 265,068 | | |

| 258,582 | | |

| 258,257 | | |

| 255,509 | | |

| 3,708 | |

| % of Total | |

| 22.5 | % | |

| 22.9 | % | |

| 23.2 | % | |

| 23.2 | % | |

| 23.9 | % | |

| 1.5 | % |

| Total Deposits | |

$ | 1,152,605 | | |

$ | 1,159,533 | | |

$ | 1,115,188 | | |

$ | 1,112,342 | | |

$ | 1,070,205 | | |

$ | 82,400 | |

| Total Growth Percentage | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 7.7 | % |

Asset Quality

As of December 31, 2024, SB Financial Group maintained

strong asset quality metrics. Nonperforming assets totaled $5.5 million, representing 0.40 percent of total assets, an increase of $2.2

million compared to the $3.3 million or 0.25 percent of total assets reported in the prior year. This year-over-year growth was driven

by weakness in three credits that we expect to resolve favorably by mid-year 2025.

The allowance for credit losses remained robust

at 1.44 percent of total loans, providing 273.7 percent coverage of nonperforming loans, a level slightly lower than the linked quarter

but indicative of the institution’s conservative approach to risk management. This strength underscores SB Financial’s commitment to disciplined

credit administration amidst evolving economic conditions. The net loan charge-offs to average loans ratio remained modest at 7 basis

points and for the full year just 2 basis points, reflecting effective collateral management and a strong credit culture.

“Our asset quality metrics demonstrate resilience

and our commitment to disciplined risk management,” stated Mark Klein, Chairman, President, and CEO. “While we observed an uptick

in nonperforming assets compared to the prior year, our reserve coverage ratio and low charge-off levels underscore the performance of

our loan portfolio. We remain focused on preserving the integrity of our credit processes while positioning our balance sheet for long-term

growth.” This balanced approach reflects SB Financial’s efforts to maintain top-tier asset quality ratios, support lending growth,

and ensure financial stability for the future.

| Nonperforming Assets | |

| | |

| | |

| | |

| | |

| | |

Annual | |

| ($ in thousands, except ratios) | |

Dec. 2024 | | |

Sep. 2024 | | |

Jun. 2024 | | |

Mar. 2024 | | |

Dec. 2023 | | |

Change | |

| Commercial & Agriculture | |

$ | 2,927 | | |

$ | 2,899 | | |

$ | 2,781 | | |

$ | 897 | | |

$ | 748 | | |

$ | 2,179 | |

| % of Total Com./Ag. loans | |

| 1.55 | % | |

| 1.54 | % | |

| 1.48 | % | |

| 0.49 | % | |

| 0.39 | % | |

| 291.3 | % |

| Commercial RE | |

| 807 | | |

| 813 | | |

| 475 | | |

| 49 | | |

| 168 | | |

| 639 | |

| % of Total CRE loans | |

| 0.17 | % | |

| 0.18 | % | |

| 0.11 | % | |

| 0.01 | % | |

| 0.04 | % | |

| 380.4 | % |

| Residential RE | |

| 1,539 | | |

| 1,536 | | |

| 1,247 | | |

| 1,295 | | |

| 1,690 | | |

| (151 | ) |

| % of Total Res. RE loans | |

| 0.50 | % | |

| 0.49 | % | |

| 0.39 | % | |

| 0.41 | % | |

| 0.53 | % | |

| -8.9 | % |

| Consumer & Other | |

| 243 | | |

| 270 | | |

| 231 | | |

| 193 | | |

| 212 | | |

| 31 | |

| % of Total Con./Oth. loans | |

| 0.35 | % | |

| 0.40 | % | |

| 0.35 | % | |

| 0.30 | % | |

| 0.32 | % | |

| 14.6 | % |

| Total Nonaccruing Loans | |

| 5,516 | | |

| 5,518 | | |

| 4,734 | | |

| 2,434 | | |

| 2,818 | | |

| 2,698 | |

| % of Total loans | |

| 0.53 | % | |

| 0.54 | % | |

| 0.47 | % | |

| 0.25 | % | |

| 0.28 | % | |

| 95.7 | % |

| Foreclosed Assets and Other Assets | |

| - | | |

| - | | |

| 510 | | |

| 510 | | |

| 511 | | |

| (511 | ) |

| Total Change (%) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| -100.0 | % |

| Total Nonperforming Assets | |

$ | 5,516 | | |

$ | 5,518 | | |

$ | 5,244 | | |

$ | 2,944 | | |

$ | 3,329 | | |

$ | 2,187 | |

| % of Total assets | |

| 0.40 | % | |

| 0.40 | % | |

| 0.39 | % | |

| 0.22 | % | |

| 0.25 | % | |

| 65.70 | % |

Webcast and Conference Call

The Company will hold the fourth quarter 2024

earnings conference call and webcast on January 24, 2025, at 11:00 a.m. EDT. Interested parties may access the conference call by dialing

1-888-338-9469. The webcast can be accessed at ir.yourstatebank.com. An audio replay of the call will be available on the Company’s

website.

About SB Financial Group

Headquartered in Defiance, Ohio, SB Financial

is a diversified financial services holding company for the State Bank & Trust Company (State Bank) and SBFG Title, LLC dba Peak Title

(Peak Title). State Bank provides a full range of financial services for consumers and small businesses, including wealth management,

private client services, mortgage banking and commercial and agricultural lending, operating through a total of 25 offices: 24 in ten

Ohio counties and one in Fort Wayne, Indiana, and 25 ATMs. State Bank has seven loan production offices located throughout the Tri-State

region of Ohio, Indiana and Michigan. Peak Title provides title insurance and title opinions throughout the Tri-State region. SB Financial’s

common stock is listed on the NASDAQ Capital Market with the ticker symbol “SBFG”.

Forward-Looking Statements

Certain statements within this document, which

are not statements of historical fact, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements involve risks and uncertainties, and actual results may differ materially from those predicted

by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks and uncertainties inherent in

the national and regional banking industry, changes in economic conditions in the market areas in which SB Financial and its subsidiaries

operate, changes in policies by regulatory agencies, changes in accounting standards and policies, changes in tax laws, fluctuations in

interest rates, demand for loans in the market areas in SB Financial and its subsidiaries operate, increases in FDIC insurance premiums,

changes in the competitive environment, losses of significant customers, geopolitical events, the loss of key personnel and other risks

identified in SB Financial’s Annual Report on Form 10-K and documents subsequently filed by SB Financial with the Securities and

Exchange Commission. Forward-looking statements speak only as of the date on which they are made, and SB Financial undertakes no obligation

to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made, except as required

by law. All subsequent written and oral forward-looking statements attributable to SB Financial or any person acting on its behalf are

qualified by these cautionary statements.

Non-GAAP Financial Measures

This press release contains financial information

determined by methods other than in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial

measures, specifically pre-tax, pre-provision income, tangible common equity, tangible assets, tangible book value per common share, tangible

common equity to tangible assets, return on average tangible common equity, total interest income – FTE, net interest income –

FTE and net interest margin – FTE are used by the Company’s management to measure the strength of its capital and analyze

profitability, including its ability to generate earnings on tangible capital invested by its shareholders. In addition, the Company excludes

the OMSR valuation adjustment and any gain on sale of assets from net income to report a non-GAAP adjusted net income level. Although

management believes these non-GAAP measures are useful to investors by providing a greater understanding of its business, they should

not be considered a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP

performance measures that may be presented by other companies.

Investor Contact Information:

Mark A. Klein

Chairman, President and

Chief Executive Officer

Mark.Klein@YourStateBank.com

Anthony V. Cosentino

Executive Vice President

and

Chief Financial Officer

Tony.Cosentino@YourStateBank.com

SB FINANCIAL GROUP, INC.

CONSOLIDATED BALANCE SHEETS - (Unaudited)

| | |

December | | |

September | | |

June | | |

March | | |

December | |

| ($ in thousands) | |

2024 | | |

2024 | | |

2024 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| | |

| |

| ASSETS | |

| | |

| | |

| | |

| | |

| |

| Cash and due from banks | |

$ | 25,928 | | |

$ | 49,348 | | |

$ | 21,983 | | |

$ | 26,602 | | |

$ | 22,965 | |

| Interest bearing time deposits | |

| 1,565 | | |

| 1,706 | | |

| 2,417 | | |

| 2,417 | | |

| 1,535 | |

| Available-for-sale securities | |

| 201,587 | | |

| 211,511 | | |

| 207,856 | | |

| 213,239 | | |

| 219,708 | |

| Loans held for sale | |

| 6,770 | | |

| 8,927 | | |

| 7,864 | | |

| 4,730 | | |

| 2,525 | |

| Loans, net of unearned income | |

| 1,046,735 | | |

| 1,029,955 | | |

| 1,005,390 | | |

| 991,552 | | |

| 1,000,212 | |

| Allowance for credit losses | |

| (15,096 | ) | |

| (15,278 | ) | |

| (15,612 | ) | |

| (15,643 | ) | |

| (15,786 | ) |

| Premises and equipment, net | |

| 20,456 | | |

| 20,715 | | |

| 20,860 | | |

| 20,985 | | |

| 21,378 | |

| Federal Reserve and FHLB Stock, at cost | |

| 5,223 | | |

| 5,223 | | |

| 5,204 | | |

| 6,512 | | |

| 7,279 | |

| Foreclosed assets and other assets | |

| - | | |

| - | | |

| 510 | | |

| 510 | | |

| 511 | |

| Interest receivable | |

| 4,908 | | |

| 4,842 | | |

| 4,818 | | |

| 3,706 | | |

| 4,657 | |

| Goodwill | |

| 23,239 | | |

| 23,239 | | |

| 23,239 | | |

| 23,239 | | |

| 23,239 | |

| Cash value of life insurance | |

| 30,685 | | |

| 30,488 | | |

| 30,294 | | |

| 30,103 | | |

| 29,121 | |

| Mortgage servicing rights | |

| 14,868 | | |

| 14,357 | | |

| 14,548 | | |

| 14,191 | | |

| 13,906 | |

| Other assets | |

| 12,649 | | |

| 8,916 | | |

| 12,815 | | |

| 13,869 | | |

| 11,999 | |

| Total assets | |

$ | 1,379,517 | | |

$ | 1,393,949 | | |

$ | 1,342,186 | | |

$ | 1,336,012 | | |

$ | 1,343,249 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non interest bearing demand | |

$ | 232,155 | | |

$ | 222,425 | | |

$ | 208,244 | | |

$ | 219,395 | | |

$ | 228,713 | |

| Interest bearing demand | |

| 201,085 | | |

| 202,097 | | |

| 190,857 | | |

| 169,171 | | |

| 166,413 | |

| Savings | |

| 237,987 | | |

| 241,761 | | |

| 231,855 | | |

| 244,157 | | |

| 216,965 | |

| Money market | |

| 222,161 | | |

| 228,182 | | |

| 225,650 | | |

| 221,362 | | |

| 202,605 | |

| Time deposits | |

| 259,217 | | |

| 265,068 | | |

| 258,582 | | |

| 258,257 | | |

| 255,509 | |

| Total deposits | |

| 1,152,605 | | |

| 1,159,533 | | |

| 1,115,188 | | |

| 1,112,342 | | |

| 1,070,205 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Short-term borrowings | |

| 10,585 | | |

| 15,240 | | |

| 15,178 | | |

| 12,916 | | |

| 13,387 | |

| Federal Home Loan Bank advances | |

| 35,000 | | |

| 35,000 | | |

| 35,000 | | |

| 35,000 | | |

| 83,600 | |

| Trust preferred securities | |

| 10,310 | | |

| 10,310 | | |

| 10,310 | | |

| 10,310 | | |

| 10,310 | |

| Subordinated debt net of issuance costs | |

| 19,690 | | |

| 19,678 | | |

| 19,666 | | |

| 19,654 | | |

| 19,642 | |

| Interest payable | |

| 2,351 | | |

| 3,374 | | |

| 2,944 | | |

| 2,772 | | |

| 2,443 | |

| Other liabilities | |

| 21,468 | | |

| 17,973 | | |

| 18,421 | | |

| 19,295 | | |

| 19,320 | |

| Total liabilities | |

| 1,252,009 | | |

| 1,261,108 | | |

| 1,216,707 | | |

| 1,212,289 | | |

| 1,218,907 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shareholders’ Equity | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock | |

| 61,319 | | |

| 61,319 | | |

| 61,319 | | |

| 61,319 | | |

| 61,319 | |

| Additional paid-in capital | |

| 15,194 | | |

| 15,090 | | |

| 15,195 | | |

| 14,978 | | |

| 15,124 | |

| Retained earnings | |

| 116,186 | | |

| 113,515 | | |

| 112,104 | | |

| 109,938 | | |

| 108,486 | |

| Accumulated other comprehensive loss | |

| (30,234 | ) | |

| (24,870 | ) | |

| (31,801 | ) | |

| (31,547 | ) | |

| (29,831 | ) |

| Treasury stock | |

| (34,957 | ) | |

| (32,213 | ) | |

| (31,338 | ) | |

| (30,965 | ) | |

| (30,756 | ) |

| Total shareholders’ equity | |

| 127,508 | | |

| 132,841 | | |

| 125,479 | | |

| 123,723 | | |

| 124,342 | |

| Total liabilities and shareholders’ equity | |

$ | 1,379,517 | | |

$ | 1,393,949 | | |

$ | 1,342,186 | | |

$ | 1,336,012 | | |

$ | 1,343,249 | |

SB FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENTS OF INCOME

- (Unaudited)

| | |

At and for the Three Months Ended | | |

Twelve Months Ended | |

| ($ in thousands, except per share & ratios) | |

December

2024 | | |

September

2024 | | |

June

2024 | | |

March

2024 | | |

December

2023 | | |

December

2024 | | |

December

2023 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Interest income | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Loans | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Taxable | |

$ | 14,920 | | |

$ | 14,513 | | |

$ | 13,883 | | |

$ | 13,547 | | |

$ | 13,438 | | |

$ | 56,863 | | |

$ | 51,407 | |

| Tax exempt | |

| 122 | | |

| 127 | | |

| 124 | | |

| 123 | | |

| 124 | | |

| 496 | | |

| 483 | |

| Securities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable | |

| 1,770 | | |

| 1,871 | | |

| 1,610 | | |

| 1,593 | | |

| 1,526 | | |

| 6,844 | | |

| 6,092 | |

| Tax exempt | |

| 35 | | |

| 37 | | |

| 37 | | |

| 37 | | |

| 38 | | |

| 146 | | |

| 170 | |

| Total interest income | |

| 16,847 | | |

| 16,548 | | |

| 15,654 | | |

| 15,300 | | |

| 15,126 | | |

| 64,349 | | |

| 58,152 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| 5,169 | | |

| 5,568 | | |

| 5,208 | | |

| 5,090 | | |

| 4,398 | | |

| 21,035 | | |

| 14,708 | |

| Repurchase agreements & other | |

| 41 | | |

| 43 | | |

| 36 | | |

| 34 | | |

| 39 | | |

| 154 | | |

| 74 | |

| Federal Home Loan Bank advances | |

| 369 | | |

| 369 | | |

| 370 | | |

| 613 | | |

| 720 | | |

| 1,721 | | |

| 2,603 | |

| Trust preferred securities | |

| 177 | | |

| 187 | | |

| 187 | | |

| 188 | | |

| 191 | | |

| 739 | | |

| 716 | |

| Subordinated debt | |

| 194 | | |

| 195 | | |

| 194 | | |

| 195 | | |

| 194 | | |

| 778 | | |

| 778 | |

| Total interest expense | |

| 5,950 | | |

| 6,362 | | |

| 5,995 | | |

| 6,120 | | |

| 5,542 | | |

| 24,427 | | |

| 18,879 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income | |

| 10,897 | | |

| 10,186 | | |

| 9,659 | | |

| 9,180 | | |

| 9,584 | | |

| 39,922 | | |

| 39,273 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Provision for credit losses | |

| (76 | ) | |

| 200 | | |

| - | | |

| - | | |

| (74 | ) | |

| 124 | | |

| 315 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income after provision

for loan losses | |

| 10,973 | | |

| 9,986 | | |

| 9,659 | | |

| 9,180 | | |

| 9,658 | | |

| 39,798 | | |

| 38,958 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Noninterest income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Wealth management fees | |

| 916 | | |

| 882 | | |

| 848 | | |

| 865 | | |

| 838 | | |

| 3,511 | | |

| 3,532 | |

| Customer service fees | |

| 842 | | |

| 870 | | |

| 875 | | |

| 880 | | |

| 844 | | |

| 3,467 | | |

| 3,403 | |

| Gain on sale of mtg. loans & OMSR | |

| 1,196 | | |

| 1,311 | | |

| 1,277 | | |

| 781 | | |

| 747 | | |

| 4,565 | | |

| 3,609 | |

| Mortgage loan servicing fees, net | |

| 816 | | |

| 39 | | |

| 565 | | |

| 763 | | |

| 561 | | |

| 2,183 | | |

| 2,101 | |

| Gain on sale of non-mortgage loans | |

| 10 | | |

| 20 | | |

| 105 | | |

| 10 | | |

| 177 | | |

| 145 | | |

| 429 | |

| Title insurance revenue | |

| 478 | | |

| 485 | | |

| 406 | | |

| 266 | | |

| 378 | | |

| 1,635 | | |

| 1,635 | |

| Net gain on sales of securities | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,453 | | |

| - | | |

| 1,453 | |

| Gain (loss) on sale of assets | |

| - | | |

| 200 | | |

| - | | |

| - | | |

| 16 | | |

| 200 | | |

| 20 | |

| Other | |

| 299 | | |

| 316 | | |

| 310 | | |

| 386 | | |

| 517 | | |

| 1,311 | | |

| 1,539 | |

| Total noninterest income | |

| 4,557 | | |

| 4,123 | | |

| 4,386 | | |

| 3,951 | | |

| 5,531 | | |

| 17,017 | | |

| 17,721 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Noninterest expense | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Salaries and employee benefits | |

| 6,185 | | |

| 6,057 | | |

| 6,009 | | |

| 5,352 | | |

| 5,652 | | |

| 23,603 | | |

| 22,777 | |

| Net occupancy expense | |

| 702 | | |

| 706 | | |

| 707 | | |

| 769 | | |

| 746 | | |

| 2,884 | | |

| 3,096 | |

| Equipment expense | |

| 1,127 | | |

| 1,069 | | |

| 1,060 | | |

| 1,077 | | |

| 1,027 | | |

| 4,333 | | |

| 4,078 | |

| Data processing fees | |

| 821 | | |

| 758 | | |

| 727 | | |

| 769 | | |

| 680 | | |

| 3,075 | | |

| 2,659 | |

| Professional fees | |

| 895 | | |

| 659 | | |

| 615 | | |

| 758 | | |

| 926 | | |

| 2,927 | | |

| 3,024 | |

| Marketing expense | |

| 207 | | |

| 241 | | |

| 176 | | |

| 197 | | |

| 182 | | |

| 821 | | |

| 782 | |

| Telephone and communication expense | |

| 136 | | |

| 128 | | |

| 156 | | |

| 105 | | |

| 132 | | |

| 525 | | |

| 501 | |

| Postage and delivery expense | |

| 116 | | |

| 145 | | |

| 89 | | |

| 97 | | |

| 167 | | |

| 447 | | |

| 432 | |

| State, local and other taxes | |

| 224 | | |

| 208 | | |

| 230 | | |

| 245 | | |

| 285 | | |

| 907 | | |

| 949 | |

| Employee expense | |

| 168 | | |

| 228 | | |

| 159 | | |

| 178 | | |

| 146 | | |

| 733 | | |

| 631 | |

| Other expenses | |

| 422 | | |

| 804 | | |

| 743 | | |

| 735 | | |

| 426 | | |

| 2,704 | | |

| 3,033 | |

| Total noninterest expense | |

| 11,003 | | |

| 11,003 | | |

| 10,671 | | |

| 10,282 | | |

| 10,369 | | |

| 42,959 | | |

| 41,962 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income before income tax expense | |

| 4,527 | | |

| 3,106 | | |

| 3,374 | | |

| 2,849 | | |

| 4,820 | | |

| 13,856 | | |

| 14,717 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| 892 | | |

| 752 | | |

| 261 | | |

| 481 | | |

| 937 | | |

| 2,386 | | |

| 2,622 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 3,635 | | |

$ | 2,354 | | |

$ | 3,113 | | |

$ | 2,368 | | |

$ | 3,883 | | |

$ | 11,470 | | |

$ | 12,095 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common share data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per common share | |

$ | 0.55 | | |

$ | 0.35 | | |

$ | 0.47 | | |

$ | 0.35 | | |

$ | 0.58 | | |

$ | 1.72 | | |

$ | 1.77 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted earnings per common share | |

$ | 0.55 | | |

$ | 0.35 | | |

$ | 0.47 | | |

$ | 0.35 | | |

$ | 0.57 | | |

$ | 1.72 | | |

$ | 1.75 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average shares outstanding (in thousands): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic: | |

| 6,575 | | |

| 6,660 | | |

| 6,692 | | |

| 6,715 | | |

| 6,748 | | |

| 6,660 | | |

| 6,829 | |

| Diluted: | |

| 6,599 | | |

| 6,675 | | |

| 6,700 | | |

| 6,723 | | |

| 6,851 | | |

| 6,680 | | |

| 6,917 | |

SB FINANCIAL GROUP, INC.

CONSOLIDATED FINANCIAL HIGHLIGHTS - (Unaudited)

| ($ in thousands, except per share & ratios) | |

At and for the Three Months Ended | | |

Twelve Months Ended | |

| SUMMARY OF OPERATIONS | |

December

2024 | | |

September

2024 | | |

June

2024 | | |

March

2024 | | |

December

2023 | | |

December

2024 | | |

December

2023 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net interest income | |

$ | 10,897 | | |

$ | 10,186 | | |

$ | 9,659 | | |

$ | 9,180 | | |

$ | 9,584 | | |

$ | 39,922 | | |

$ | 39,273 | |

| Tax-equivalent adjustment | |

| 42 | | |

| 44 | | |

| 43 | | |

| 43 | | |

| 43 | | |

| 171 | | |

| 174 | |

| Tax-equivalent net interest income | |

| 10,939 | | |

| 10,230 | | |

| 9,702 | | |

| 9,223 | | |

| 9,627 | | |

| 40,093 | | |

| 39,447 | |

| Provision for credit loss | |

| (76 | ) | |

| 200 | | |

| - | | |

| - | | |

| (74 | ) | |

| 124 | | |

| 315 | |

| Noninterest income | |

| 4,557 | | |

| 4,123 | | |

| 4,386 | | |

| 3,951 | | |

| 5,531 | | |

| 17,017 | | |

| 17,721 | |

| Total operating revenue | |

| 15,454 | | |

| 14,309 | | |

| 14,045 | | |

| 13,131 | | |

| 15,115 | | |

| 56,939 | | |

| 56,994 | |

| Noninterest expense | |

| 11,003 | | |

| 11,003 | | |

| 10,671 | | |

| 10,282 | | |

| 10,369 | | |

| 42,959 | | |

| 41,962 | |

| Pre-tax pre-provision income | |

| 4,451 | | |

| 3,306 | | |

| 3,374 | | |

| 2,849 | | |

| 4,746 | | |

| 13,980 | | |

| 15,032 | |

| Net income | |

| 3,635 | | |

| 2,354 | | |

| 3,113 | | |

| 2,368 | | |

| 3,883 | | |

| 11,470 | | |

| 12,095 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| PER SHARE INFORMATION: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per share (EPS) | |

| 0.55 | | |

| 0.35 | | |

| 0.47 | | |

| 0.35 | | |

| 0.58 | | |

| 1.72 | | |

| 1.77 | |

| Diluted earnings per share | |

| 0.55 | | |

| 0.35 | | |

| 0.47 | | |

| 0.35 | | |

| 0.57 | | |

| 1.72 | | |

| 1.75 | |

| Common dividends | |

| 0.145 | | |

| 0.140 | | |

| 0.140 | | |

| 0.135 | | |

| 0.135 | | |

| 0.560 | | |

| 0.520 | |

| Book value per common share | |

| 19.64 | | |

| 20.05 | | |

| 18.80 | | |

| 18.46 | | |

| 18.50 | | |

| 19.64 | | |

| 18.50 | |

| Tangible book value per common share (TBV) | |

| 16.00 | | |

| 16.49 | | |

| 15.26 | | |

| 14.93 | | |

| 14.98 | | |

| 16.00 | | |

| 14.98 | |

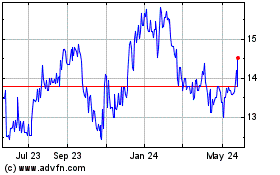

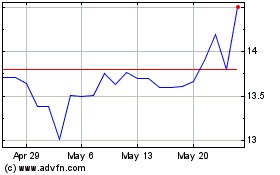

| Market price per common share | |

| 20.91 | | |

| 20.56 | | |

| 14.00 | | |

| 13.78 | | |

| 15.35 | | |

| 20.91 | | |

| 15.35 | |

| Market price to TBV | |

| 130.7 | % | |

| 124.7 | % | |

| 91.8 | % | |

| 92.3 | % | |

| 102.5 | % | |

| 130.7 | % | |

| 102.5 | % |

| Market price to trailing 12 month EPS | |

| 12.1 | | |

| 11.8 | | |

| 7.9 | | |

| 7.9 | | |

| 8.8 | | |

| 12.1 | | |

| 8.8 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| PERFORMANCE RATIOS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Return on average assets (ROAA) | |

| 1.04 | % | |

| 0.68 | % | |

| 0.93 | % | |

| 0.71 | % | |

| 1.17 | % | |

| 0.84 | % | |

| 0.91 | % |

| Pre-tax pre-provision ROAA | |

| 1.28 | % | |

| 0.96 | % | |

| 1.01 | % | |

| 0.85 | % | |

| 1.43 | % | |

| 1.10 | % | |

| 1.21 | % |

| Return on average equity (ROE) | |

| 11.13 | % | |

| 7.32 | % | |

| 10.16 | % | |

| 7.70 | % | |

| 13.23 | % | |

| 9.19 | % | |

| 10.22 | % |

| Return on average tangible equity | |

| 13.58 | % | |

| 8.97 | % | |

| 12.59 | % | |

| 9.53 | % | |

| 16.57 | % | |

| 11.34 | % | |

| 12.78 | % |

| Efficiency ratio | |

| 71.09 | % | |

| 76.78 | % | |

| 75.86 | % | |

| 78.17 | % | |

| 68.44 | % | |

| 75.33 | % | |

| 73.47 | % |

| Earning asset yield | |

| 5.18 | % | |

| 5.16 | % | |

| 5.02 | % | |

| 4.97 | % | |

| 4.89 | % | |

| 5.08 | % | |

| 4.67 | % |

| Cost of interest bearing liabilities | |

| 2.36 | % | |

| 2.53 | % | |

| 2.47 | % | |

| 2.55 | % | |

| 2.33 | % | |

| 2.48 | % | |

| 1.97 | % |

| Net interest margin | |

| 3.35 | % | |

| 3.17 | % | |

| 3.10 | % | |

| 2.98 | % | |

| 3.10 | % | |

| 3.15 | % | |

| 3.15 | % |

| Tax equivalent effect | |

| 0.01 | % | |

| 0.02 | % | |

| 0.01 | % | |

| 0.01 | % | |

| 0.01 | % | |

| 0.01 | % | |

| 0.01 | % |

| Net interest margin, tax equivalent | |

| 3.36 | % | |

| 3.19 | % | |

| 3.11 | % | |

| 2.99 | % | |

| 3.11 | % | |

| 3.16 | % | |

| 3.16 | % |

| Non interest income/Average assets | |

| 1.31 | % | |

| 1.20 | % | |

| 1.31 | % | |

| 1.19 | % | |

| 1.67 | % | |

| 1.25 | % | |

| 1.33 | % |

| Non interest expense/Average assets | |

| 3.15 | % | |

| 3.20 | % | |

| 3.18 | % | |

| 3.08 | % | |

| 3.12 | % | |

| 3.16 | % | |

| 3.14 | % |

| Net noninterest expense/Average assets | |

| -1.85 | % | |

| -2.00 | % | |

| -1.87 | % | |

| -1.90 | % | |

| -1.46 | % | |

| -1.91 | % | |

| -1.81 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| ASSET QUALITY RATIOS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross charge-offs | |

| 195 | | |

| 29 | | |

| - | | |

| 66 | | |

| 5 | | |

| 290 | | |

| 118 | |

| Recoveries | |

| 13 | | |

| 2 | | |

| 16 | | |

| 9 | | |

| 1 | | |

| 40 | | |

| 26 | |

| Net charge-offs | |

| 182 | | |

| 27 | | |

| (16 | ) | |

| 57 | | |

| 4 | | |

| 250 | | |

| 92 | |

| Nonperforming loans/Total loans | |

| 0.53 | % | |

| 0.54 | % | |

| 0.47 | % | |

| 0.25 | % | |

| 0.28 | % | |

| 0.53 | % | |

| 0.28 | % |

| Nonperforming assets/Loans & OREO | |

| 0.53 | % | |

| 0.54 | % | |

| 0.52 | % | |

| 0.30 | % | |

| 0.33 | % | |

| 0.53 | % | |

| 0.33 | % |

| Nonperforming assets/Total assets | |

| 0.40 | % | |

| 0.40 | % | |

| 0.39 | % | |

| 0.22 | % | |

| 0.25 | % | |

| 0.40 | % | |

| 0.25 | % |

| Allowance for credit loss/Nonperforming loans | |

| 273.68 | % | |

| 276.83 | % | |

| 329.78 | % | |

| 642.69 | % | |

| 560.18 | % | |

| 273.68 | % | |

| 560.18 | % |

| Allowance for credit loss/Total loans | |

| 1.44 | % | |

| 1.48 | % | |

| 1.55 | % | |

| 1.58 | % | |

| 1.58 | % | |

| 1.44 | % | |

| 1.58 | % |

| Net loan charge-offs/Average loans (ann.) | |

| 0.07 | % | |

| 0.01 | % | |

| (0.01 | %) | |

| 0.02 | % | |

| 0.00 | % | |

| 0.02 | % | |

| 0.01 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| CAPITAL & LIQUIDITY RATIOS: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans/ Deposits | |

| 90.81 | % | |

| 88.82 | % | |

| 90.15 | % | |

| 89.14 | % | |

| 93.46 | % | |

| 90.81 | % | |

| 93.46 | % |

| Equity/ Assets | |

| 9.24 | % | |

| 9.53 | % | |

| 9.35 | % | |

| 9.26 | % | |

| 9.26 | % | |

| 9.24 | % | |

| 9.26 | % |

| Tangible equity/Tangible assets | |

| 7.66 | % | |

| 7.97 | % | |

| 7.72 | % | |

| 7.63 | % | |

| 7.63 | % | |

| 7.66 | % | |

| 7.63 | % |

| Common equity tier 1 ratio (Bank) | |

| 13.43 | % | |

| 13.19 | % | |

| 13.98 | % | |

| 13.84 | % | |

| 13.42 | % | |

| 13.43 | % | |

| 13.42 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| END OF PERIOD BALANCES | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total assets | |

| 1,379,517 | | |

| 1,393,949 | | |

| 1,342,186 | | |

| 1,336,012 | | |

| 1,343,249 | | |

| 1,379,517 | | |

| 1,343,249 | |

| Total loans | |

| 1,046,735 | | |

| 1,029,955 | | |

| 1,005,390 | | |

| 991,552 | | |

| 1,000,212 | | |

| 1,046,735 | | |

| 1,000,212 | |

| Deposits | |

| 1,152,605 | | |

| 1,159,533 | | |

| 1,115,188 | | |

| 1,112,342 | | |

| 1,070,205 | | |

| 1,152,605 | | |

| 1,070,205 | |

| Shareholders equity | |

| 127,508 | | |

| 132,841 | | |

| 125,479 | | |

| 123,723 | | |

| 124,342 | | |

| 127,508 | | |

| 124,342 | |

| Goodwill and intangibles | |

| 23,597 | | |

| 23,613 | | |

| 23,630 | | |

| 23,646 | | |

| 23,662 | | |

| 23,597 | | |

| 23,662 | |

| Tangible equity | |

| 103,911 | | |

| 109,228 | | |

| 101,849 | | |

| 100,077 | | |

| 100,680 | | |

| 103,911 | | |

| 100,680 | |

| Mortgage servicing portfolio | |

| 1,427,318 | | |

| 1,406,273 | | |

| 1,389,805 | | |

| 1,371,713 | | |

| 1,366,667 | | |

| 1,427,318 | | |

| 1,366,667 | |

| Wealth/Brokerage assets under care | |

| 547,697 | | |

| 557,724 | | |

| 525,713 | | |

| 525,517 | | |

| 501,829 | | |

| 547,697 | | |

| 501,829 | |

| Total assets under care | |

| 3,354,532 | | |

| 3,357,946 | | |

| 3,257,704 | | |

| 3,233,242 | | |

| 3,211,745 | | |

| 3,354,532 | | |

| 3,211,745 | |

| Full-time equivalent employees | |

| 252 | | |

| 248 | | |

| 249 | | |

| 245 | | |

| 251 | | |

| 252 | | |

| 251 | |

| Period end common shares outstanding | |

| 6,494 | | |

| 6,624 | | |

| 6,676 | | |

| 6,702 | | |

| 6,720 | | |

| 6,494 | | |

| 6,720 | |

| Market capitalization (all) | |

| 135,780 | | |

| 136,189 | | |

| 93,458 | | |

| 92,359 | | |

| 103,147 | | |

| 135,780 | | |

| 103,147 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| AVERAGE BALANCES | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total assets | |

| 1,395,473 | | |

| 1,376,849 | | |

| 1,342,847 | | |

| 1,333,236 | | |

| 1,327,415 | | |

| 1,361,274 | | |

| 1,334,644 | |

| Total earning assets | |

| 1,301,872 | | |

| 1,283,407 | | |

| 1,246,099 | | |

| 1,230,736 | | |

| 1,236,165 | | |

| 1,267,794 | | |

| 1,246,531 | |

| Total loans | |

| 1,040,580 | | |

| 1,018,262 | | |

| 1,005,018 | | |

| 993,310 | | |

| 992,337 | | |

| 1,014,375 | | |

| 985,217 | |

| Deposits | |

| 1,163,531 | | |

| 1,145,964 | | |

| 1,120,367 | | |

| 1,091,803 | | |

| 1,084,939 | | |

| 1,130,973 | | |

| 1,094,547 | |

| Shareholders equity | |

| 130,647 | | |

| 128,608 | | |

| 122,510 | | |

| 123,058 | | |

| 117,397 | | |

| 124,742 | | |

| 118,315 | |

| Goodwill and intangibles | |

| 23,605 | | |

| 23,621 | | |

| 23,638 | | |

| 23,654 | | |

| 23,675 | | |

| 23,629 | | |

| 23,709 | |

| Tangible equity | |

| 107,042 | | |

| 104,987 | | |

| 98,872 | | |

| 99,404 | | |

| 93,722 | | |

| 101,113 | | |

| 94,606 | |

| Average basic shares outstanding | |

| 6,575 | | |

| 6,660 | | |

| 6,692 | | |

| 6,715 | | |

| 6,748 | | |

| 6,660 | | |

| 6,829 | |

| Average diluted shares outstanding | |

| 6,599 | | |

| 6,675 | | |

| 6,700 | | |

| 6,723 | | |

| 6,851 | | |

| 6,680 | | |

| 6,917 | |

SB FINANCIAL GROUP, INC.

Rate Volume Analysis - (Unaudited)

For the Three and Twelve Months Ended Dec. 31, 2024 and 2023

| | |

Three Months Ended Dec. 31, 2024 | | |

Three Months Ended Dec. 31, 2023 | |

| | |

Average | | |

| | |

Average | | |

Average | | |

| | |

Average | |

| ($ in thousands) | |

Balance | | |

Interest | | |

Rate | | |

Balance | | |

Interest | | |

Rate | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Assets | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Taxable securities/cash | |

$ | 254,989 | | |

$ | 1,770 | | |

| 2.78 | % | |

$ | 237,203 | | |

$ | 1,526 | | |

| 2.57 | % |

| Nontaxable securities | |

| 6,303 | | |

| 35 | | |

| 2.22 | % | |

| 6,625 | | |

| 38 | | |

| 2.29 | % |

| Loans, net | |

| 1,040,580 | | |

| 15,042 | | |

| 5.78 | % | |

| 992,337 | | |

| 13,562 | | |

| 5.47 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total earning assets | |

| 1,301,872 | | |

| 16,847 | | |

| 5.18 | % | |

| 1,236,165 | | |

| 15,126 | | |

| 4.89 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and due from banks | |

| 4,262 | | |

| | | |

| | | |

| 4,077 | | |

| | | |

| | |

| Allowance for loan losses | |

| (15,070 | ) | |

| | | |

| | | |

| (15,787 | ) | |

| | | |

| | |

| Premises and equipment | |

| 20,642 | | |

| | | |

| | | |

| 22,205 | | |

| | | |

| | |

| Other assets | |

| 83,767 | | |

| | | |

| | | |

| 80,755 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total assets | |

$ | 1,395,473 | | |

| | | |

| | | |

$ | 1,327,415 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Savings, MMDA and interest bearing demand | |

$ | 669,987 | | |

$ | 2,803 | | |

| 1.67 | % | |

$ | 601,034 | | |

$ | 2,232 | | |

| 1.49 | % |

| Time deposits | |

| 259,093 | | |

| 2,366 | | |

| 3.65 | % | |

| 247,382 | | |

| 2,166 | | |

| 3.50 | % |

| Repurchase agreements & other | |

| 13,229 | | |

| 41 | | |

| 1.24 | % | |

| 13,359 | | |

| 39 | | |

| 1.17 | % |

| Advances from Federal Home Loan Bank | |

| 35,000 | | |

| 369 | | |

| 4.22 | % | |

| 58,330 | | |

| 720 | | |

| 4.94 | % |

| Trust preferred securities | |

| 10,310 | | |

| 177 | | |

| 6.87 | % | |

| 10,310 | | |

| 191 | | |

| 7.41 | % |

| Subordinated debt | |

| 19,674 | | |

| 194 | | |

| 3.94 | % | |

| 19,634 | | |

| 194 | | |

| 3.95 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total interest bearing liabilities | |

| 1,007,293 | | |

| 5,950 | | |

| 2.36 | % | |

| 950,049 | | |

| 5,542 | | |

| 2.33 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non interest bearing demand | |

| 234,451 | | |

| - | | |

| | | |

| 236,523 | | |

| - | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total funding | |

| 1,241,744 | | |

| | | |

| 1.92 | % | |

| 1,186,572 | | |

| | | |

| 1.87 | % |

| | |

| | | |

| | | |

| 44.20 | % | |

| | | |

| 1 | | |

| | |

| Other liabilities | |

| 23,082 | | |

| | | |

| | | |

| 23,446 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total liabilities | |

| 1,264,826 | | |

| | | |

| | | |

| 1,210,018 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Equity | |

| 130,647 | | |

| | | |

| | | |

| 117,397 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total liabilities and equity | |

$ | 1,395,473 | | |

| | | |

| | | |

$ | 1,327,415 | | |

| - | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income | |

| | | |

$ | 10,897 | | |

| | | |

| | | |

$ | 9,584 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income as a percent of average interest-earning assets - GAAP measure | |

| | | |

| | | |

| 3.35 | % | |

| | | |

| | | |

| 3.10 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income as a percent of average interest-earning assets - non GAAP - Computed on a fully tax equivalent (FTE) basis | |

| | | |

| | | |

| 3.36 | % | |

| | | |

| | | |

| 3.11 | % |

| | |

Twelve Months Ended Dec. 31,

2024 | | |

Twelve Months Ended Dec. 31,

2023 | |

| | |

Average | | |

| | |

Average | | |

Average | | |

| | |

Average | |

| | |

Balance | | |

Interest | | |

Rate | | |

Balance | | |

Interest | | |

Rate | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Assets | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Taxable securities/cash | |

$ | 247,026 | | |

$ | 6,844 | | |

| 2.77 | % | |

$ | 254,133 | | |

$ | 6,092 | | |

| 2.40 | % |

| Nontaxable securities | |

| 6,393 | | |

| 146 | | |

| 2.28 | % | |

| 7,181 | | |

| 170 | | |

| 2.37 | % |

| Loans, net | |

| 1,014,375 | | |

| 57,359 | | |

| 5.65 | % | |

| 985,217 | | |

| 51,890 | | |

| 5.27 | % |

| Total earning assets | |

| 1,267,794 | | |

| 64,349 | | |

| 5.08 | % | |

| 1,246,531 | | |

| 58,152 | | |

| 4.67 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and due from banks | |

| 4,388 | | |

| | | |

| | | |

| 4,035 | | |

| | | |

| | |

| Allowance for loan losses | |

| (15,536 | ) | |

| | | |

| | | |

| (15,478 | ) | |

| | | |

| | |

| Premises and equipment | |

| 20,929 | | |

| | | |

| | | |

| 22,990 | | |

| | | |

| | |

| Other assets | |

| 83,699 | | |

| | | |

| | | |

| 76,566 | | |

| | | |

| | |

| Total assets | |

$ | 1,361,274 | | |

| | | |

| | | |

$ | 1,334,644 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Savings, MMDA and interest bearing demand | |

$ | 643,710 | | |

$ | 11,073 | | |

| 1.72 | % | |

$ | 619,906 | | |

$ | 7,599 | | |

| 1.23 | % |

| Time deposits | |

| 259,818 | | |

| 9,962 | | |

| 3.83 | % | |

| 236,665 | | |

| 7,109 | | |

| 3.00 | % |

| Repurchase agreements & Other | |

| 14,336 | | |

| 154 | | |

| 1.07 | % | |

| 15,765 | | |

| 74 | | |

| 0.47 | % |

| Advances from Federal Home Loan Bank | |

| 39,092 | | |

| 1,721 | | |

| 4.40 | % | |

| 55,044 | | |

| 2,603 | | |

| 4.73 | % |

| Trust preferred securities | |

| 10,310 | | |

| 739 | | |

| 7.17 | % | |

| 10,310 | | |

| 716 | | |

| 6.94 | % |

| Subordinated debt | |

| 19,665 | | |

| 778 | | |

| 3.96 | % | |

| 19,616 | | |

| 778 | | |

| 3.97 | % |

| Total interest bearing liabilities | |

| 986,931 | | |

| 24,427 | | |

| 2.48 | % | |

| 957,306 | | |

| 18,879 | | |

| 1.97 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non interest bearing demand | |

| 227,445 | | |

| | | |

| 2.01 | % | |

| 237,976 | | |

| | | |

| 1.58 | % |

| Total funding | |

| 1,214,376 | | |

| | | |

| | | |

| 1,195,282 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other liabilities | |

| 22,156 | | |

| | | |

| | | |

| 21,047 | | |

| | | |

| | |

| Total liabilities | |

| 1,236,532 | | |

| | | |

| | | |

| 1,216,329 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Equity | |

| 124,742 | | |

| | | |

| | | |

| 118,315 | | |

| | | |

| | |

| Total liabilities and equity | |

$ | 1,361,274 | | |

| | | |

| | | |

$ | 1,334,644 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income | |

| | | |

$ | 39,922 | | |

| | | |

| | | |

$ | 39,273 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income as a percent of average interest-earning assets - GAAP measure | |

| | | |

| | | |

| 3.15 | % | |

| | | |

| | | |

| 3.15 | % |

| Net interest income as a percent of average interest-earning assets - non GAAP - Computed on a fully tax equivalent (FTE) basis | |

| | | |

| | | |

| 3.16 | % | |

| | | |

| | | |

| 3.16 | % |

| Non-GAAP reconciliation | |

Three Months Ended | | |

Twelve Months Ended | |

| ($ in thousands, except per share & ratios) | |

Dec. 31, 2024 | | |

Dec. 31, 2023 | | |

Dec. 31, 2024 | | |

Dec. 31, 2023 | |

| | |

| | |

| | |

| | |

| |

| Total Operating Revenue | |

$ | 15,454 | | |

$ | 15,115 | | |

$ | 56,939 | | |

$ | 56,994 | |

| Adjustment to (deduct)/add OMSR recapture/impairment * | |

| (288 | ) | |

| 12 | | |

| (42 | ) | |

| 51 | |

| Adjusted Total Operating Revenue | |

| 15,166 | | |

| 15,127 | | |

| 56,897 | | |

| 57,045 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income before Income Taxes | |

| 4,527 | | |

| 4,820 | | |

| 13,856 | | |

| 14,717 | |

| Adjustment for OMSR * | |

| (288 | ) | |

| 12 | | |

| (42 | ) | |

| 51 | |

| Adjusted Income before Income Taxes | |

| 4,239 | | |

| 4,832 | | |

| 13,814 | | |

| 14,768 | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for Income Taxes | |

| 892 | | |

| 938 | | |

| 2,386 | | |

| 2,623 | |

| Adjustment for OMSR ** | |

| (60 | ) | |

| 3 | | |

| (9 | ) | |

| 11 | |

| Adjusted Provision for Income Taxes | |

| 832 | | |

| 941 | | |

| 2,377 | | |

| 2,634 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income | |

| 3,635 | | |

| 3,882 | | |

| 11,470 | | |

| 12,094 | |

| Adjustment for OMSR * | |

| (228 | ) | |

| 9 | | |

| (33 | ) | |

| 40 | |

| Adjusted Net Income | |

| 3,407 | | |

| 3,891 | | |

| 11,437 | | |

| 12,134 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted Earnings per Share | |

| 0.55 | | |

| 0.57 | | |

| 1.72 | | |

| 1.75 | |

| Adjustment for OMSR * | |

| (0.03 | ) | |

| 0.00 | | |

| (0.00 | ) | |

| 0.01 | |

| Adjusted Diluted Earnings per Share | |

$ | 0.52 | | |

$ | 0.57 | | |

$ | 1.71 | | |

$ | 1.75 | |

| | |

| | | |

| | | |

| | | |

| | |

| Return on Average Assets | |

| 1.04 | % | |

| 1.17 | % | |

| 0.84 | % | |

| 0.91 | % |

| Adjustment for OMSR * | |

| -0.07 | % | |

| 0.00 | % | |

| 0.00 | % | |

| 0.00 | % |

| Adjusted Return on Average Assets | |

| 0.98 | % | |

| 1.17 | % | |

| 0.84 | % | |

| 0.91 | % |

| * | valuation

adjustment to the Company’s mortgage servicing rights |

| ** | tax

effect is calculated using a 21% statutory federal corporate income tax rate |

v3.24.4

Cover

|

Jan. 23, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 23, 2025

|

| Entity File Number |

001-36785

|

| Entity Registrant Name |

SB FINANCIAL GROUP, INC

|

| Entity Central Index Key |

0000767405

|

| Entity Tax Identification Number |

34-1395608

|