Sterling Bancorp, Inc. (NASDAQ: SBT) (“Sterling” or the

“Company”), the holding company of Sterling Bank and Trust, F.S.B.

(the “Bank”), today reported its unaudited financial results for

the quarter and year ended December 31, 2024.

Fourth Quarter and Year-End 2024

Highlights

- Fourth quarter net income of $1.2 million, or $0.02 per

diluted share; full year net income of $2.1 million, or $0.04 per

diluted share

- Fourth quarter net interest margin of 2.24%; full year net

interest margin of 2.37%

- Fourth quarter provision for (recovery of) credit losses of

$(4.2) million; full year provision for (recovery of) credit losses

of $(8.5) million

- Nonperforming loans of $14.6 million, or 1.26% of total

loans and 0.60% of total assets

- Ratio of allowance for credit losses to total loans of

1.80%

- Fourth quarter non-interest expense of $15.9 million; full

year non-interest expense of $61.8 million

- Shareholders’ equity of $334.0 million

- Consolidated Company’s and Bank’s leverage ratio of 14.08%

and 13.76%, respectively

- Total deposits of $2.1 billion

- Total gross loans of $1.2 billion

The Company reported net income of $1.2 million, or $0.02 per

diluted share, for the quarter ended December 31, 2024, compared to

a net loss of $(0.1) million, or $(0.00) per diluted share, for the

quarter ended September 30, 2024. For the year ended December 31,

2024, net income was $2.1 million, or $0.04 per diluted share,

compared to net income of $7.4 million, or $0.15 per diluted share,

for the year ended December 31, 2023.

As previously disclosed, on September 15, 2024, Sterling, the

Bank and EverBank Financial Corp (“EverBank”) entered into a

definitive stock purchase agreement providing for the purchase by

EverBank of all of the issued and outstanding shares of capital

stock of the Bank from Sterling (the “Transaction”) for cash

consideration of $261.0 million. Also on September 15, 2024,

Sterling’s board of directors unanimously approved a plan of

dissolution providing for the dissolution of Sterling under

Michigan law following the closing of the Transaction. The

Company’s shareholders approved the definitive stock purchase

agreement for the Transaction and the plan of dissolution at a

Special Meeting of Shareholders held on December 18, 2024. The

Transaction is expected to close in the first quarter of 2025. The

Transaction is subject to customary closing conditions, including

the receipt of required regulatory approvals.

Balance Sheet

Total Assets – Total assets were $2.4 billion at December

31, 2024, essentially unchanged as compared to September 30, 2024,

and an increase of $20.5 million, or 1%, from December 31,

2023.

Cash and due from banks increased $167.8 million, or 24%, to

$878.2 million at December 31, 2024 compared to $710.4 million at

September 30, 2024 primarily due to net cash inflows from

maturities in the debt securities portfolio and loan repayments.

Cash and due from banks increased $300.2 million, or 52% from

$578.0 million at December 31, 2023. Debt securities of $338.1

million decreased $98.3 million, or 23%, from $436.4 million at

September 30, 2024 and decreased $81.1 million, or 19%, from $419.2

at December 31, 2023. All debt securities are available for sale,

have a relatively short duration and are considered part of our

liquid assets.

Total gross loans of $1.2 billion at December 31, 2024 decreased

$68.0 million, or 6%, from September 30, 2024. Residential real

estate loans were $849.4 million at December 31, 2024, a decrease

of $55.1 million, or 6%, from September 30, 2024. Commercial real

estate loans were $296.5 million at December 31, 2024, a decrease

of $10.5 million, or 3%, from September 30, 2024. Total gross loans

at December 31, 2024 declined $193.2 million, or 14%, from December

31, 2023 with residential real estate loans decreasing $236.4

million, or 22%, and commercial real estate loans increasing $59.5

million, or 25%.

Total Deposits – Total deposits were $2.1 billion at

December 31, 2024 and September 30, 2024 and were $2.0 billion at

December 31, 2023. During the fourth quarter of 2024, money market,

savings and NOW deposits increased $16.0 million, or 2% and time

deposits decreased $19.1 million, or 2%. During 2024, time deposits

increased $79.8 million, or 9% and money market, savings and NOW

deposits decreased $15.8 million, or 1%. We continue to offer

competitive interest rates on our deposit products to maintain our

existing customer deposit base and maintain our liquidity.

Capital – Total shareholders’ equity was $334.0 million

at December 31, 2024, a decrease of $0.6 million from September 30,

2024 primarily due to a $2.7 million increase in the unrealized

loss on our debt securities portfolio included in accumulated other

comprehensive loss, partially offset by the $1.2 million net income

in the fourth quarter of 2024. During 2024, total shareholders’

equity increased $6.2 million, or 2%, due primarily to the $2.1

million in net income and a $1.7 million reduction in the

unrealized loss on our debt securities portfolio included in

accumulated other comprehensive loss.

At December 31, 2024, the consolidated Company’s and Bank’s

leverage ratios were 14.08% and 13.76%, respectively. Both the

Company and the Bank are required to maintain a Tier 1 leverage

ratio of greater than 9.0% to have satisfied the minimum regulatory

capital requirements as well as the capital ratio requirements to

be considered well capitalized for regulatory purposes.

Asset Quality and Provision for (Recovery of) Credit

Losses – A provision for (recovery of) credit losses of $(4.2)

million was recorded for the fourth quarter of 2024 compared to

$(2.3) million for the third quarter of 2024. In the fourth quarter

of 2024, the recovery of credit losses was primarily due to the

reduction in the commercial real estate portfolio’s allowance

reflecting a decrease in criticized and classified assets. In

addition, the residential mortgage portfolio’s allowance had a

reduction primarily due to continued run-off of that portfolio. The

allowance for credit losses was $20.8 million, $25.0 million and

$29.4 million, or 1.80%, 2.04% and 2.18% of total loans at December

31, 2024, September 30, 2024 and December 31, 2023,

respectively.

Recoveries of loan losses during the fourth and third quarter of

2024 were $2 thousand and $10 thousand, respectively, with no

charge offs in either quarter. Recoveries of loan losses during the

year ended December 31, 2024 and 2023 were $0.5 million in both

years, with no charge offs in 2024 and $6.5 million in 2023

pertaining to the reclassification of $41.1 million of nonaccrual

and delinquent residential loans as held for sale and charged off

down to their fair value in the first quarter of 2023.

Nonperforming loans, comprised primarily of nonaccrual

residential real estate loans, totaled $14.6 million, or 0.60% of

total assets, at December 31, 2024 and $13.2 million, or 0.54% of

total assets at September 30, 2024.

Results of Operations

Net Interest Income and Net Interest Margin – Net

interest income for the fourth quarter of 2024 was $13.5 million

compared to $13.6 million for the prior quarter of 2024 and $15.1

million for the fourth quarter of 2023. The net interest margin of

2.24% for the fourth quarter of 2024 decreased from the prior

quarter’s net interest margin of 2.30% and decreased from the net

interest margin of 2.52% for the fourth quarter of 2023. The

decrease in net interest income during the fourth quarter of 2024

compared to the prior quarter was primarily due to a 23 basis point

decrease in the average yield on interest-earning assets which was

partially offset by a 17 basis point decrease in the average rate

paid on interest-bearing deposits. The decrease in net interest

income during the fourth quarter of 2024 compared to the fourth

quarter of 2023 was primarily due to a 41 basis point increase in

the average rate paid on interest-bearing deposits and a $186.9

million, or 14%, decline in average loans, partially offset by a 7

basis point increase in the average yield on total interest-earning

assets during the same period.

Net interest income for the year ended December 31, 2024 was

$56.5 million, a decrease of $8.5 million, or 13%, from the year

ended December 31, 2023. The net interest margin of 2.37% decreased

31 basis points from the prior year’s net interest margin of 2.68%.

The decrease in net interest income for the year ended December 31,

2024 is primarily attributable to a 100 basis point increase in the

average rate paid on interest-bearing deposits and a $237.8

million, or 16%, decline in the average balance of loans. This was

partially offset by the impact of a 45 basis point increase in the

average yield of other interest-earning assets and the redemption

of all of the Company’s subordinated notes in 2023 which decreased

interest expense by $3.7 million.

Non-Interest Income – Non-interest income for the year

ended December 31, 2024 was $1.1 million, a decrease of $1.7

million from $2.8 million for the year ended December 31, 2023. The

decrease was primarily attributable to a $1.6 million gain on the

sale of all loans that were held for sale, comprised primarily of

nonperforming and chronically delinquent residential real estate

loans, which occurred in the second quarter of 2023.

Non-Interest Expense – Non-interest expense of $15.9

million for the fourth quarter of 2024 reflected an increase of

$0.3 million, or 2%, compared to $15.6 million for the third

quarter of 2024 and an increase of $3.1 million, or 24%, compared

to $12.8 million for the fourth quarter of 2023. The increase in

non-interest expense from the fourth quarter versus the third

quarter of 2024 was primarily due to a $0.7 million increase in

other expenses, partially offset by decreases of $0.2 million in

salaries and employee benefits and $0.3 million in professional

fees. Professional fees for the fourth and third quarter of 2024

included Transaction related expense of $2.1 million and $1.4

million, respectively. The increase to the fourth quarter of 2024

compared to same quarter last year was primarily due to $3.8

million received in the fourth quarter of 2023 from our insurance

carriers for previously incurred expenses related to the prior

government investigations, offset in part by Transaction related

expenses included in professional fees incurred in the fourth

quarter of 2024.

Non-interest expense for the year ended December 31, 2024 was

$61.8 million, inclusive of $3.5 million of expenses incurred in

connection with the Transaction, a decrease of $3.9 million, or 6%,

compared to $65.7 million for the year ended December 31, 2023. The

decrease was primarily attributable to salaries and employee

benefits which were $2.4 million, or 7% lower in 2024 as compared

to 2023 due to reductions in staffing levels. Professional fees

remained flat in 2024 compared to 2023, although the components of

our professional fees changed significantly as compliance related

professional fees declined in 2024, we received substantial

reimbursements from our insurance carriers in 2023 and we incurred

significant Transaction related expenses in 2024.

Income Tax Expense – The Company recorded an income tax

expense of $2.1 million, a 49.7% effective rate, for the year ended

December 31, 2024 and $3.1 million, or an effective rate of 29.8%,

for the year ended December 31, 2023. Income tax expense includes

an additional $0.6 million in the third quarter of 2024 to reverse

a tax position previously taken on the deductibility of interest

earned on U.S. government obligations under applicable state tax

law. Our effective tax rate varies from the statutory rate

primarily due to the adjustment in the third quarter of 2024 as

well as the impact of non-deductible compensation-related

expenses.

About Sterling Bancorp, Inc.

Sterling Bancorp, Inc. is a unitary thrift holding company. Its

wholly owned subsidiary, Sterling Bank and Trust, F.S.B., has

primary branch operations in the San Francisco and Los Angeles,

California metropolitan areas and New York City. Sterling also has

an operations center and a branch in Southfield, Michigan. Sterling

offers a range of loan products as well as retail and business

banking services. For additional information, please visit the

Company’s website at http://www.sterlingbank.com.

Forward-Looking Statements

This Press Release contains certain statements that are, or may

be deemed to be, “forward-looking statements” regarding the

Company’s plans, expectations, thoughts, beliefs, estimates, goals

and outlook for the future. These forward-looking statements

reflect our current views with respect to, among other things,

future events and our financial performance, including any

statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions. These statements are often, but not always,

made through the use of words or phrases such as “may,” “might,”

“should,” “could,” “predict,” “potential,” “believe,” “expect,”

“attribute,” “continue,” “will,” “anticipate,” “seek,” “estimate,”

“intend,” “plan,” “projection,” “goal,” “target,” “outlook” and

“would” or the negative versions of those words or other comparable

words or phrases of a future or forward-looking nature, though the

absence of these words does not mean a statement is not

forward-looking. All statements other than statements of historical

facts, including but not limited to statements regarding

expectations for the anticipated sale of the Bank and ensuing Plan

of Dissolution, the economy and financial markets, credit quality,

the regulatory scheme governing our industry, competition in our

industry, interest rates, our liquidity, our business and our

governance, are forward-looking statements. We have based the

forward-looking statements in this Press Release primarily on our

current expectations and projections about future events and trends

that we believe may affect our business, financial condition,

results of operations, prospects, business strategy and financial

needs. These forward-looking statements are not historical facts,

and they are based on current expectations, estimates and

projections about our industry, management's beliefs and certain

assumptions made by management, many of which, by their nature, are

inherently uncertain and beyond our control. There can be no

assurance that future developments will be those that have been

anticipated. We may not actually achieve the plans, intentions or

expectations disclosed in our forward-looking statements. Our

statements should not be read to indicate that we have conducted an

exhaustive inquiry into, or review of, all potentially available

relevant information. Accordingly, we caution you that any such

forward-looking statements are not guarantees of future performance

and are subject to risks, assumptions, estimates and uncertainties

that are difficult to predict. The risks, uncertainties and other

factors detailed from time to time in our public filings, including

those included in the disclosures under the headings “Cautionary

Note Regarding Forward-Looking Statements” and “Risk Factors” in

our Annual Report on Form 10-K filed with the Securities and

Exchange Commission on March 14, 2024, subsequent periodic reports

and future periodic reports, could affect future results and

events, causing those results and events to differ materially from

those views expressed or implied in the Company’s forward-looking

statements. These risks are not exhaustive. Other sections of this

Press Release and our filings with the Securities and Exchange

Commission include additional factors that could adversely impact

our business and financial performance. Moreover, we operate in a

very competitive and rapidly changing environment. New risks and

uncertainties emerge from time to time, and it is not possible for

us to predict all risks and uncertainties that could have an impact

on the forward-looking statements contained in this Press Release.

Should one or more of the foregoing risks materialize, or should

underlying assumptions prove incorrect, actual results or outcomes

may vary materially from those projected in, or implied by, such

forward-looking statements. Accordingly, you should not place undue

reliance on any such forward-looking statements. The Company

disclaims any obligation to update, revise, or correct any

forward-looking statements based on the occurrence of future

events, the receipt of new information or otherwise.

Sterling Bancorp, Inc. Consolidated Financial Highlights

(Unaudited)

At and for the Three Months

Ended

At and for the Year

Ended

December 31,

September 30,

December 31,

December 31,

December 31,

(dollars in thousands, except per share data)

2024

2024

2023

2024

2023

Net income (loss)

$

1,162

$

(143

)

$

5,063

$

2,138

$

7,413

Income (loss) per share, diluted

$

0.02

$

(0.00

)

$

0.10

$

0.04

$

0.15

Net interest income

$

13,523

$

13,618

$

15,105

$

56,470

$

64,959

Net interest margin

2.24

%

2.30

%

2.52

%

2.37

%

2.68

%

Non-interest income

$

67

$

379

$

213

$

1,057

$

2,786

Non-interest expense

$

15,888

$

15,610

$

12,830

$

61,813

$

65,710

Loans, net of allowance for credit losses

$

1,134,925

$

1,198,767

$

1,319,568

$

1,134,925

$

1,319,568

Total deposits

$

2,070,890

$

2,067,193

$

2,003,986

$

2,070,890

$

2,003,986

Asset Quality Nonperforming loans

$

14,584

$

13,214

$

8,973

$

14,584

$

8,973

Allowance for credit losses to total loans

1.80

%

2.04

%

2.18

%

1.80

%

2.18

%

Allowance for credit losses to total nonaccrual loans

143

%

189

%

329

%

143

%

329

%

Nonaccrual loans to total loans

1.26

%

1.08

%

0.66

%

1.26

%

0.66

%

Nonperforming loans to total loans

1.26

%

1.08

%

0.67

%

1.26

%

0.67

%

Nonperforming loans to total assets

0.60

%

0.54

%

0.37

%

0.60

%

0.37

%

Net charge offs (recoveries) to average loans during the period

(0.00

)%

(0.00

)%

(0.00

)%

(0.04

)%

0.40

%

Provision for (recovery of) credit losses

$

(4,160

)

$

(2,338

)

$

(4,357

)

$

(8,536

)

$

(8,527

)

Net charge offs (recoveries)

$

(2

)

$

(10

)

$

(64

)

$

(452

)

$

5,944

Performance Ratios Return on average assets

0.19

%

(0.02

)%

0.83

%

0.09

%

0.30

%

Return on average shareholders' equity

1.39

%

(0.17

)%

6.34

%

0.65

%

2.35

%

Efficiency ratio (1)

116.91

%

111.52

%

83.76

%

107.45

%

97.00

%

Yield on average interest-earning assets

5.56

%

5.79

%

5.49

%

5.68

%

5.23

%

Cost of average interest-bearing liabilities

3.91

%

4.08

%

3.47

%

3.89

%

3.02

%

Net interest spread

1.65

%

1.71

%

2.02

%

1.79

%

2.21

%

Leverage Capital Ratios(2) Consolidated

14.08

%

14.19

%

13.95

%

14.08

%

13.95

%

Bank

13.76

%

13.70

%

13.38

%

13.76

%

13.38

%

____________________

(1) Efficiency ratio is computed

as the ratio of non-interest expense divided by the sum of net

interest income and non-interest income.

(2) Leverage capital ratio is

Tier 1 (core) capital to average total assets. December 31, 2024

capital ratios are estimated.

Sterling Bancorp, Inc. Condensed Consolidated Balance

Sheets (Unaudited) December 31, September

30, % December 31, % (dollars in

thousands)

2024

2024

change

2023

change

Assets Cash and due from banks

$

878,181

$

710,372

24

%

$

577,967

52

%

Interest-bearing time deposits with other banks

—

4,983

(100

)%

5,226

(100

)%

Debt securities available for sale

338,105

436,409

(23

)%

419,213

(19

)%

Equity securities

4,661

4,797

(3

)%

4,703

(1

)%

Loans, net of allowance for credit losses of $20,805, $24,970 and

$29,404

1,134,925

1,198,767

(5

)%

1,319,568

(14

)%

Accrued interest receivable

8,592

9,650

(11

)%

8,509

1

%

Mortgage servicing rights, net

1,279

1,338

(4

)%

1,542

(17

)%

Leasehold improvements and equipment, net

4,480

4,710

(5

)%

5,430

(17

)%

Operating lease right-of-use assets

10,640

10,765

(1

)%

11,454

(7

)%

Federal Home Loan Bank stock, at cost

18,423

18,423

0

%

18,923

(3

)%

Federal Reserve Bank stock, at cost

9,238

9,187

1

%

9,048

2

%

Company-owned life insurance

8,926

8,872

1

%

8,711

2

%

Deferred tax asset, net

15,389

15,023

2

%

16,959

(9

)%

Other assets

3,673

5,258

(30

)%

8,750

(58

)%

Total assets

$

2,436,512

$

2,438,554

(0

)%

$

2,416,003

1

%

Liabilities Noninterest-bearing deposits

$

38,086

$

31,276

22

%

$

35,245

8

%

Interest-bearing deposits

2,032,804

2,035,917

(0

)%

1,968,741

3

%

Total deposits

2,070,890

2,067,193

0

%

2,003,986

3

%

Federal Home Loan Bank borrowings

—

—

N/M

50,000

(100

)%

Operating lease liabilities

11,589

11,753

(1

)%

12,537

(8

)%

Other liabilities

20,070

24,999

(20

)%

21,757

(8

)%

Total liabilities

2,102,549

2,103,945

(0

)%

2,088,280

1

%

Shareholders’ Equity Preferred stock, authorized

10,000,000 shares; no shares issued and outstanding

—

—

—

—

—

Common stock, no par value, authorized shares 500,000,000; shares

issued and outstanding 52,305,036, 52,313,933 and 52,070,361

84,323

84,323

0

%

84,323

0

%

Additional paid-in capital

19,053

18,210

5

%

16,660

14

%

Retained earnings

244,102

242,940

0

%

241,964

1

%

Accumulated other comprehensive loss

(13,515

)

(10,864

)

(24

)%

(15,224

)

11

%

Total shareholders’ equity

333,963

334,609

(0

)%

327,723

2

%

Total liabilities and shareholders’ equity

$

2,436,512

$

2,438,554

(0

)%

$

2,416,003

1

%

____________________ N/M - Not Meaningful

Sterling

Bancorp, Inc. Condensed Consolidated Statements of

Operations (Unaudited)

Three Months Ended

Year Ended

(dollars in thousands, except

per share amounts)

December 31,

2024

September 30,

2024

% change

December 31,

2023

% change

December 31,

2024

December 31,

2023

% change

Interest income Interest and fees on loans

$

19,960

$

20,506

(3

)%

$

20,969

(5

)%

$

82,055

$

86,684

(5

)%

Interest and dividends on investment securities and restricted

stock

3,965

4,993

(21

)%

3,800

4

%

17,734

12,056

47

%

Interest on interest-bearing cash deposits

9,710

8,855

10

%

8,159

19

%

35,346

28,049

26

%

Total interest income

33,635

34,354

(2

)%

32,928

2

%

135,135

126,789

7

%

Interest expense Interest on deposits

20,112

20,736

(3

)%

17,572

14

%

78,298

57,109

37

%

Interest on Federal Home Loan Bank borrowings

—

—

N/M

251

(100

)%

367

994

(63

)%

Interest on Subordinated Notes

—

—

N/M

—

N/M

—

3,727

(100

)%

Total interest expense

20,112

20,736

(3

)%

17,823

13

%

78,665

61,830

27

%

Net interest income

13,523

13,618

(1

)%

15,105

(10

)%

56,470

64,959

(13

)%

Provision for (recovery of) credit losses

(4,160

)

(2,338

)

(78

)%

(4,357

)

5

%

(8,536

)

(8,527

)

(0

)%

Net interest income after provision for (recovery of) credit losses

17,683

15,956

11

%

19,462

(9

)%

65,006

73,486

(12

)%

Non-interest income Service charges and fees

66

69

(4

)%

75

(12

)%

314

344

(9

)%

Loss on sale of investment securities

—

—

N/M

(111

)

100

%

—

(113

)

100

%

Gain (loss) on sale of loans held for sale

—

—

N/M

(72

)

100

%

—

1,623

(100

)%

Unrealized gain (loss) on equity securities

(136

)

160

N/M

198

N/M

(42

)

61

N/M

Net servicing income

56

61

(8

)%

40

40

%

238

308

(23

)%

Income earned on company-owned life insurance

81

84

(4

)%

83

(2

)%

332

327

2

%

Other

—

5

(100

)%

—

N/M

215

236

(9

)%

Total non-interest income

67

379

(82

)%

213

(69

)%

1,057

2,786

(62

)%

Non-interest expense Salaries and employee benefits

8,387

8,540

(2

)%

8,500

(1

)%

33,583

35,937

(7

)%

Occupancy and equipment

2,015

2,019

(0

)%

2,096

(4

)%

8,123

8,369

(3

)%

Professional fees

2,731

3,005

(9

)%

(908

)

N/M

10,065

10,076

(0

)%

FDIC insurance

264

260

2

%

264

0

%

1,048

1,058

(1

)%

Data processing

760

715

6

%

704

8

%

2,950

2,941

0

%

Other

1,731

1,071

62

%

2,174

(20

)%

6,044

7,329

(18

)%

Total non-interest expense

15,888

15,610

2

%

12,830

24

%

61,813

65,710

(6

)%

Income before income taxes

1,862

725

N/M

6,845

(73

)%

4,250

10,562

(60

)%

Income tax expense

700

868

(19

)%

1,782

(61

)%

2,112

3,149

(33

)%

Net income (loss)

$

1,162

$

(143

)

N/M

$

5,063

(77

)%

$

2,138

$

7,413

(71

)%

Income (loss) per share, basic and diluted

$

0.02

$

(0.00

)

$

0.10

$

0.04

$

0.15

Weighted average common shares outstanding: Basic

51,062,757

51,059,012

50,703,220

50,971,884

50,630,928

Diluted

51,409,877

51,059,012

51,182,011

51,340,966

50,778,559

____________________ N/M - Not Meaningful

Sterling

Bancorp, Inc.

Yield Analysis and Net Interest Income (Unaudited)

Three Months Ended

December 31, 2024 September 30, 2024 December 31,

2023 Average Average Average

Average Average

Average (dollars in thousands) Balance

Interest Yield/Rate Balance

Interest Yield/Rate Balance

Interest Yield/Rate Interest-earning

assets Loans(1)

Residential real estate

and other consumer

$

877,536

$

15,400

7.02

%

$

936,941

$

16,005

6.83

%

$

1,111,391

$

17,181

6.18

%

Commercial real estate

304,178

4,298

5.65

%

296,632

4,160

5.61

%

237,997

3,065

5.15

%

Construction

4,846

123

10.15

%

5,069

150

11.84

%

13,789

347

10.07

%

Commercial and industrial

7,358

139

7.56

%

7,427

191

10.29

%

17,611

376

8.54

%

Total loans

1,193,918

19,960

6.69

%

1,246,069

20,506

6.58

%

1,380,788

20,969

6.07

%

Securities, includes restricted stock(2)

424,824

3,965

3.73

%

476,506

4,993

4.19

%

431,994

3,800

3.52

%

Other interest-earning assets

799,605

9,710

4.86

%

650,089

8,855

5.45

%

585,703

8,159

5.57

%

Total interest-earning assets

2,418,347

33,635

5.56

%

2,372,664

34,354

5.79

%

2,398,485

32,928

5.49

%

Noninterest-earning assets

Cash and due from banks

3,616

7,038

3,822

Other assets

26,872

29,906

30,305

Total assets

$

2,448,835

$

2,409,608

$

2,432,612

Interest-bearing liabilities

Money market, savings and NOW

$

1,077,654

$

9,296

3.42

%

$

1,077,346

$

10,265

3.78

%

$

1,116,533

$

9,745

3.46

%

Time deposits

965,544

10,816

4.44

%

938,514

10,471

4.43

%

873,928

7,827

3.55

%

Total interest-bearing deposits

2,043,198

20,112

3.91

%

2,015,860

20,736

4.08

%

1,990,461

17,572

3.50

%

FHLB borrowings

-

-

0.00

%

-

-

0.00

%

50,000

251

1.96

%

Subordinated notes, net

-

-

0.00

%

-

-

0.00

%

-

-

0.00

%

Total borrowings

-

-

0.00

%

-

-

0.00

%

50,000

251

1.96

%

Total interest-bearing liabilities

2,043,198

20,112

3.91

%

2,015,860

20,736

4.08

%

2,040,461

17,823

3.47

%

Noninterest-bearing liabilities

Demand deposits

38,316

31,507

38,310

Other liabilities

33,764

33,719

36,768

Shareholders' equity

333,557

328,522

317,073

Total liabilities and shareholders' equity

$

2,448,835

$

2,409,608

$

2,432,612

Net interest income and spread(2)

$

13,523

1.65

%

$

13,618

1.71

%

$

15,105

2.02

%

Net interest margin(2)

2.24

%

2.30

%

2.52

%

____________________

(1) Nonaccrual loans are included in the respective average

loan balances. Income, if any, on such loans is recognized on a

cash basis. (2) Interest income does not include taxable

equivalence adjustments.

Year Ended December 31, 2024

December 31, 2023 Average

Average Average Average

(dollars in thousands) Balance

Interest Yield/Rate Balance

Interest Yield/Rate

Interest-earning assets

Loans(1)

Residential real estate and other consumer

$

970,830

$

65,609

6.76

%

$

1,231,559

$

71,491

5.80

%

Commercial real estate

275,043

14,923

5.43

%

228,963

11,401

4.98

%

Construction

5,536

645

11.65

%

29,020

2,987

10.29

%

Commercial and industrial

10,167

878

8.64

%

9,827

805

8.19

%

Total loans

1,261,576

82,055

6.50

%

1,499,369

86,684

5.78

%

Securities, includes restricted stock(2)

450,861

17,734

3.93

%

393,767

12,056

3.06

%

Other interest-earning assets

668,760

35,346

5.29

%

532,789

28,049

5.26

%

Total interest-earning assets

2,381,197

135,135

5.68

%

2,425,925

126,789

5.23

%

Noninterest-earning assets

Cash and due from banks

3,811

4,326

Other assets

29,001

28,648

Total assets

$

2,414,009

$

2,458,899

Interest-bearing liabilities

Money market, savings and

NOW

$

1,073,095

$

39,043

3.63

%

$

1,049,818

$

29,559

2.82

%

Time deposits

925,058

39,255

4.23

%

912,966

27,550

3.02

%

Total interest-bearing deposits

1,998,153

78,298

3.91

%

1,962,784

57,109

2.91

%

FHLB borrowings

18,443

367

1.98

%

50,000

994

1.99

%

Subordinated notes, net

-

-

0.00

%

34,683

3,727

10.60

%

Total borrowings

18,443

367

1.96

%

84,683

4,721

5.50

%

Total interest-bearing liabilities

2,016,596

78,665

3.89

%

2,047,467

61,830

3.02

%

Noninterest-bearing liabilities

Demand deposits

34,279

43,702

Other liabilities

33,940

52,220

Shareholders' equity

329,194

315,510

Total liabilities and shareholders'

equity

$

2,414,009

$

2,458,899

Net interest income and spread(2)

$

56,470

1.79

%

$

64,959

2.21

%

Net interest margin(2)

2.37

%

2.68

%

____________________

(1) Nonaccrual loans are included in the

respective average loan balances. Income, if any, on such loans is

recognized on a cash basis. (2) Interest income does not include

taxable equivalence adjustments.

Sterling Bancorp, Inc.

Loan Composition (Unaudited) December 31,

September 30, % December 31, %

(dollars in thousands)

2024

2024

change

2023

change

Residential real estate

$

849,350

$

904,438

(6

)%

$

1,085,776

(22

)%

Commercial real estate

296,457

306,927

(3

)%

236,982

25

%

Construction

2,509

5,212

(52

)%

10,381

(76

)%

Commercial and industrial

7,395

7,158

3

%

15,832

(53

)%

Other consumer

19

2

N/M

1

N/M

Total loans held for investment

1,155,730

1,223,737

(6

)%

1,348,972

(14

)%

Less: allowance for credit losses

(20,805

)

(24,970

)

(17

)%

(29,404

)

(29

)%

Loans, net

$

1,134,925

$

1,198,767

(5

)%

$

1,319,568

(14

)%

Sterling Bancorp, Inc. Allowance for Credit

Losses - Loans (Unaudited) Three Months Ended

Year Ended December 31, September 30,

December 31, December 31, December 31,

(dollars in thousands)

2024

2024

2023

2024

2023

Balance at beginning of period

$

24,970

$

27,556

$

34,267

$

29,404

$

45,464

Adjustment to adopt ASU 2016-13

—

—

—

—

(1,651

)

Adjustment to adopt ASU 2022-02

—

—

—

—

380

Balance after adoption

24,970

27,556

34,267

29,404

44,193

Provision for (recovery of) credit losses

(4,167

)

(2,596

)

(4,927

)

(9,051

)

(8,844

)

Charge offs

—

—

—

—

(6,478

)

Recoveries

2

10

64

452

533

Balance at end of period

$

20,805

$

24,970

$

29,404

$

20,805

$

29,404

Sterling Bancorp, Inc. Deposit Composition

(Unaudited)

December 31,

September 30,

%

December 31,

%

(dollars in thousands)

2024

2024

change

2023

change

Noninterest-bearing deposits

$

38,086

$

31,276

22

%

$

35,245

8

%

Money Market, Savings and NOW

1,079,744

1,063,746

2

%

1,095,521

(1

)%

Time deposits

953,060

972,171

(2

)%

873,220

9

%

Total deposits

$

2,070,890

$

2,067,193

0

%

$

2,003,986

3

%

Sterling Bancorp, Inc. Credit Quality Data

(Unaudited)

At and for the Three Months

Ended

December 31,

September 30,

December 31,

(dollars in thousands)

2024

2024

2023

Nonaccrual loans(1) Residential real estate

$

13,136

$

13,187

$

8,942

Commercial real estate

1,422

—

—

Total nonaccrual loans

$

14,558

$

13,187

$

8,942

Loans past due 90 days or more and still accruing interest

26

27

31

Nonperforming loans

$

14,584

$

13,214

$

8,973

Total loans (1)

$

1,155,730

$

1,223,737

$

1,348,972

Total assets

$

2,436,512

$

2,438,554

$

2,416,003

Allowance for credit losses to total loans

1.80

%

2.04

%

2.18

%

Allowance for credit losses to total nonaccrual loans

143

%

189

%

329

%

Nonaccrual loans to total loans

1.26

%

1.08

%

0.66

%

Nonperforming loans to total loans

1.26

%

1.08

%

0.67

%

Nonperforming loans to total assets

0.60

%

0.54

%

0.37

%

Net charge offs (recoveries) to average loans during the period

(0.00

)%

(0.00

)%

(0.00

)%

____________________ (1) Loans are classified as held for

investment and are presented before the allowance for credit

losses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130937083/en/

Investor Contact: Sterling Bancorp, Inc. Karen Knott

Executive Vice President and Chief Financial Officer (248) 359-6624

kzaborney@sterlingbank.com

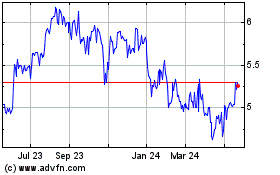

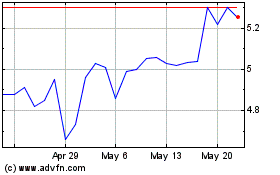

Sterling Bancorp (NASDAQ:SBT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sterling Bancorp (NASDAQ:SBT)

Historical Stock Chart

From Feb 2024 to Feb 2025