Shineco Announces Closing of $2 Million Underwritten Public Offering

16 July 2024 - 6:05AM

Shineco, Inc. (“Shineco” or the “Company”) (NASDAQ: SISI), a

provider of innovative diagnostic medical products and related

medical devices, today announced the closing of its underwritten

public offering of 1,869,160 shares of its common stock at a public

offering price of $1.07 per share of common stock, for aggregate

gross proceeds of approximately $2 million, prior to deducting

underwriting discounts and other offering expenses. In addition,

the Company has granted the underwriters a 45-day option to

purchase up to an additional 280,374 shares of common stock at the

public offering price per share, less the underwriting discounts to

cover over-allotments, if any.

EF Hutton LLC acted as the sole book-running

manager for the offering.

The common stock was offered by the Company

pursuant to an effective shelf registration statement on Form S-3

(File No. 333-261229), which was filed with the U.S. Securities and

Exchange Commission (SEC) and declared effective by the SEC on June

10, 2022, and the accompanying prospectus contained therein.

The offering was made only by means of a

prospectus supplement and the accompanying prospectus that form a

part of the registration statement. A prospectus supplement

describing the terms of the public offering was filed with the SEC

and formed a part of the effective registration statement. The

final prospectus supplement and accompanying prospectus relating to

this offering were filed with the SEC on July 15, 2024.

Copies of the prospectus supplement and the

accompanying prospectus relating to this Offering may be obtained

on the SEC’s website at http://www.sec.gov or by contacting EF

Hutton LLC Attention: Syndicate Department, 590 Madison Avenue,

39th Floor, New York, NY 10022, by email at syndicate@efhutton.com,

or by telephone at (212) 404-7002.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described herein, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. Any offer, if at all, was made only by means of the

prospectus supplement and accompanying prospectus forming a part of

the effective registration statement.

About Shineco, Inc.

Shineco Inc. (“Shineco” or the “Company”) aims

to ‘care for a healthy life and improve the quality of life’, by

providing safe, efficient and high-quality health and medical

products and services to society. Shineco, operating through

subsidiaries, has researched and developed 33 vitro diagnostic

reagents and related medical devices to date, and the Company also

produces and sells healthy and nutritious foods. For more

information about Shineco, please visit www.biosisi.com/.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of U.S. federal securities laws.

Words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,” “potential,” “continue” and

similar expressions are intended to identify such forward-looking

statements. These statements include, among others, statements

regarding the proposed public offering, and the timing of the

offering. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to

differ materially from the expected results and, consequently, you

should not rely on these forward-looking statements as predictions

of future events. These forward-looking statements and factors that

may cause such differences include, without limitation, the risks

disclosed in the Company’s Annual Report on Form 10-K filed with

the SEC on September 28, 2023, and in the Company’s other filings

with the SEC. Readers are cautioned not to place undue reliance

upon any forward-looking statements, which speak only as of the

date made. Except as required by law, the Company disclaims any

obligation to update or publicly announce any revisions to any of

the forward-looking statements contained in this press release.

For more information, please contact:

Shineco,Inc.secretary@shineco.techMobile:

+86-010-68130220

Precept Investor Relations LLCDavid J.

Rudnickdavid.rudnick@preceptir.comMobile: +1-646-694-8538

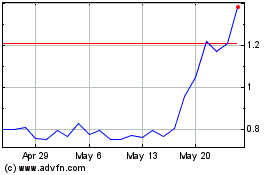

Shineco (NASDAQ:SISI)

Historical Stock Chart

From Oct 2024 to Nov 2024

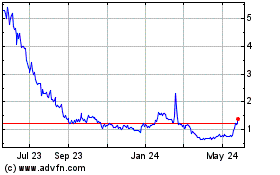

Shineco (NASDAQ:SISI)

Historical Stock Chart

From Nov 2023 to Nov 2024