Smart for Life Announces Engagement of Amerivest Group in Expansion of its Acquisition Pipeline

22 August 2024 - 10:00PM

Smart for Life, Inc. (Nasdaq: SMFL) (“Smart for Life” or the

“Company”), a distinguished leader in the Health & Wellness

sector specializing in the marketing and manufacturing of

nutritional supplements and foods, announced today the expansion of

the Company’s acquisition pipeline through the engagement of

Amerivest Group, providing the Company with M&A opportunities

through their established network. The announcement was made

jointly by A.J. Cervantes, Jr., Chairman of Smart for Life and

Scott A. Levine, Regional Director of Amerivest Group.

“Amerivest Group is a premier M&A advisory

firm that has been in business for over 40 years, and we are

delighted to partner with them on our proactive M&A program,”

stated Mr. Cervantes. “As we have announced previously, despite our

acquisition activity being reduced during our restructuring

initiatives, we are anticipating reinvigorating our M&A

strategy. As we work to complete our 10-K and 10-Q filings and

pursue our capital raise, we anticipate our activity to pick up

speed, including our previously announced transactions. We are

looking forward to working with the Amerivest team as an additional

component of our pipeline.”

“With our deep experience in the M&A sector,

we have worked with numerous acquirers over the years completing

transactions of all sizes,” said Mr. Levine. “It is clear that the

Smart for Life team is comprised of seasoned capital markets

executives, and we look forward to working with them to execute

efficient acquisitions as part of their Buy-and-Build strategy in

the nutraceutical industry.”

Smart for Life is seeking profitable companies

in the nutraceutical industry across the United States, with

between $5 million and $25 million in annual revenue. We

pursue targets that are committed to innovation, high quality

standards, organic growth, and that want to be part of a larger

publicly held organization.

“Working with the team at Amerivest, they have

already identified dozens of opportunities and potential

acquisition targets,” stated Darren Minton, Smart for Life’s Chief

Executive Officer. “We believe this represents a significant

addition to our M&A initiatives, and while there is no

assurance that any particular acquisition will be completed, we

believe the pure size of the pipeline creates an enormous

prospective opportunity for the Company, as we continue to

implement our strategy and drive toward our publicly stated goal of

$100 million in revenue through both organic growth and M&A

initiatives.”

Completion of any acquisitions in the Company’s

pipeline is subject to a number of conditions including successful

due diligence and financing.

About Amerivest Group

Amerivest Group and its affiliate, Amerivest

Advisors LLC, is an M&A firm offering exceptional transactional

and financial expertise to lower middle market companies seeking a

divestiture, merger, acquisition, recapitalization, or growth

capital through a variety of time tested mechanisms. With a team of

accomplished deal makers, Amerivest offers a unique blend of

sophisticated solutions and extraordinary client service to an

underserved segment of the market. The firm is comprised of

seasoned professionals who have diverse backgrounds in Mergers

& Acquisitions, strategic planning, corporate development and

corporate finance. Our team has worked extensively as principals

and intermediaries in structuring and closing transactions with an

aggregate value in excess of $250 million. For more information

about Amerivest, please visit: www.amerivestgroup.com.

About Smart for Life, Inc.

Smart for Life, Inc. (Nasdaq: SMFL) is an

emerging growth company in the nutraceutical industry, committed to

delivering innovative solutions that promote Health & Wellness.

With a focus on research-driven formulations and consumer-centric

approaches, Smart for Life is dedicated to redefining the

boundaries of nutritional science. The Company is engaged in the

development, marketing, manufacturing, acquisition, operation and

sale of a broad spectrum of nutritional and products. Structured as

a publicly held holding company, the Company is executing a

Buy-and-Build strategy with serial accretive acquisitions creating

a vertically integrated company. To drive growth and earnings,

Smart for Life is developing proprietary and related products as

well as acquiring other profitable companies, encompassing brands,

manufacturing and distribution channels. The Company recently

concluded the execution of a restructuring plan including

recapitalization of the Company with equity and debt financings,

the sale of certain non-performing assets, and the successful

liquidation of the Company’s senior debt facility. In addition, the

Company converted substantial debt obligations to equity materially

improving the Company’s balance sheet. For more information about

Smart for Life, please visit: www.smartforlifecorp.com.

Forward-Looking Statements

This press release may contain information about

our views of future expectations, plans and prospects that

constitute forward-looking statements. All forward-looking

statements are based on management’s beliefs, assumptions and

expectations of Smart for Life’s future economic performance,

taking into account the information currently available to it.

These statements are not statements of historical fact. Although

Smart for Life believes the expectations reflected in such

forward-looking statements are based on reasonable assumptions, it

can give no assurance that its expectations will be attained. Smart

for Life does not undertake any duty to update any statements

contained herein (including any forward-looking statements), except

as required by law. No assurances can be made that Smart for Life

will successfully acquire its acquisition targets. Forward-looking

statements are subject to a number of factors, risks and

uncertainties, some of which are not currently known to us, that

may cause Smart for Life’s actual results, performance or financial

condition to be materially different from the expectations of

future results, performance or financial position. Actual results

may differ materially from the expectations discussed in

forward-looking statements. Factors that could cause actual results

to differ materially from expectations include general industry

considerations, regulatory changes, changes in local or national

economic conditions and other risks set forth in “Risk Factors”

included in our filings with the Securities and Exchange

Commission.

Disclaimer

The information provided in this press release

is intended for general knowledge only and is not a substitute for

professional medical advice or treatment for specific medical

conditions. Always seek the advice of your physician or other

qualified health care provider with any questions you may have

regarding a medical condition. This information is not intended to

diagnose, treat, cure or prevent any disease.

Investor Relations Contact

Crescendo Communications, LLCTel: (212)

671-1021SMFL@crescendo-ir.com

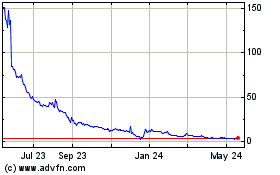

Smart for Life (NASDAQ:SMFL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Smart for Life (NASDAQ:SMFL)

Historical Stock Chart

From Jan 2024 to Jan 2025