StoneX Group CEO Philip Smith on Gold Market Volatility

22 February 2025 - 3:00AM

Amid growing uncertainty over Trump’s tariff policies and concerns

surrounding gold market volatility, physical gold flows, and

pricing disparities, Philip Smith, Chief Executive, StoneX Group,

recently appeared on Sky News Arabia’s morning business segment

sharing his insights on the subject.

Smith also pointed to a major pricing disconnect

between New York futures contracts and the London OTC physical

market. He believes that the major disconnect—ranging from $25 to

$30 an ounce, compared to the December high of $60—has been

affecting the market’s overall efficiency. This divergence is

fueled by a lack of clarity from the new administration over

tariffs.

Smith also noted a significant surge in physical

gold moving into the United States over the past two months. “What

we’ve seen in the past 7, 8 weeks in the market was probably one of

the largest physical movements of gold from all over the world into

the US. We estimate over 2,000 tons,” he stated.

When asked about his forecast on gold, Smith

remained cautious about making firm predictions. He explained that

the existing price discrepancies between New York and London are

unlikely to narrow until there is greater clarity on the tariff

policies from the Trump administration.

Smith believes that the ongoing ambiguity

surrounding tariffs is exerting a “disproportionate and distorting

effect on gold prices.” He stressed that once certainty is

established, gold markets can revert to normal fundamentals,

allowing for greater price stability and more predictable trading

conditions.

This perspective aligns with recent analysis

from Fawad Razaqzada, UK Market Analyst for StoneX, who noted that

Trump’s “aggressive fiscal policies and protectionist stance may

fuel inflationary pressures, which could prompt further delays in

the Federal Reserve’s rate cut. Any delay in monetary easing would,

in turn, support bond yields, creating headwinds for gold.”

From a StoneX standpoint, Smith remains

optimistic. “We’re all seeing a very good position to be able to

facilitate others who are struggling to bring gold into the United

States,” he stated. StoneX’s Precious Metals division provides a

comprehensive suite of gold services, including physical trading,

financial derivatives, vaulting, and storage. Smith believes that

StoneX is well-positioned to support large banks and financial

institutions that lack direct access to physical gold, helping them

navigate uncertainties related to tariffs and market

disruptions.

About StoneX Group Inc.

StoneX Group Inc., through its subsidiaries, operates a global

financial services network that connects companies, organizations,

traders and investors to the global market ecosystem through a

unique blend of digital platforms, end-to-end clearing and

execution services, high touch service and deep expertise. The

Company strives to be the one trusted partner to its clients,

providing its network, product and services to allow them to pursue

trading opportunities, manage their market risks, make investments

and improve their business performance. A Fortune 100 company

headquartered in New York City and listed on the Nasdaq Global

Select Market (NASDAQ:SNEX), StoneX Group Inc. and its more than

4,500 employees serve more than 54,000 commercial, institutional,

and payments clients, and more than 400,000 retail accounts, from

more than 80 offices spread across six continents. Further

information on the Company is available at www.stonex.com.

SNEX-G

Contact: Mia Porter, VP of Marketing for EMEA, at mia.porter@stonex.com

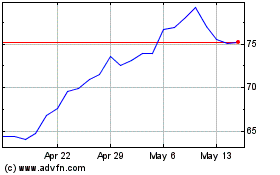

StoneX (NASDAQ:SNEX)

Historical Stock Chart

From Jan 2025 to Feb 2025

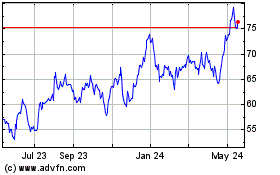

StoneX (NASDAQ:SNEX)

Historical Stock Chart

From Feb 2024 to Feb 2025