false000183136300018313632024-12-032024-12-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 03, 2024 |

Terns Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39926 |

98-1448275 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1065 East Hillsdale Blvd. Suite 100 |

|

Foster City, California |

|

94404 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 525-5535 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

TERN |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On December 3, 2024, Terns Pharmaceuticals, Inc. (the “Company” or “Terns”) issued a press release announcing encouraging early data from the ongoing dose escalation part of the Phase 1 CARDINAL study evaluating TERN-701 in patients with relapsed/refractory chronic myeloid leukemia (CML). A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On December 3, 2024, Terns announced encouraging early data from the ongoing dose escalation part of the Phase 1 CARDINAL study evaluating TERN-701 in patients with relapsed/refractory CML. TERN-701 is an investigational, oral, potent, small molecule allosteric BCR-ABL inhibitor being developed for patients with CML. CARDINAL is a global, multicenter, open-label, two-part Phase 1 clinical trial to evaluate the safety, pharmacokinetics (PK), and efficacy of TERN-701 in patients with relapsed/refractory CML with or without BCR-ABL resistance mutations who were previously treated with at least one 2G tyrosine kinase inhibitor (TKI). Patients previously treated with asciminib are also eligible.

Terns believes the emerging safety data show a profile supporting best-in-class potential with no dose limiting toxicities across three completed dose levels, no clinically meaningful changes in liver or pancreatic enzymes, and no AE-related dose reductions or discontinuations at doses that achieve plasma exposures well above target efficacious concentrations. Taken together, the clinical activity and safety data across the dose range in these heavily pre-treated patients with refractory disease support a potential wide therapeutic index that allows for high levels of target coverage with favorable safety/tolerability.

As of the October 28, 2024 cutoff date, 15 patients were enrolled across three dose levels of 160mg (n=7), 320mg (n=5), and 400mg (n=3) of TERN-701 dosed once daily, with an overall median treatment duration of 3 months (range 0.79 - 7.5 months). Enrolled patients were heavily pretreated with a median of 4 prior TKIs (range: 1-6) and 80% having had 3 or more TKIs. 47% and 40% of patients, respectively, had previously received ponatinib and asciminib. 73% were not in MMR at baseline, with 60% having a baseline BCR-ABL transcript >1% international scale (IS). As of the data cutoff, 14 of 15 patients remain on treatment.

Twelve patients were efficacy evaluable, defined as having baseline BCR-ABL transcript and at least two post-baseline BCR-ABL transcript levels (centrally assessed). All efficacy evaluable patients were in the 160mg and 320mg dose levels. Key efficacy highlights include:

•88% (7/8) of patients with baseline transcript > 1% had decreases in BCR-ABL on treatment, with 7 ongoing as of data cutoff

•Cumulative MMR rate of 50% (5/10) in non-T315i mutation patients with 3 or more months of treatment and/or MMR or better at baseline

•100% (4/4) of patients with MMR or better at baseline have maintained their response and remain on treatment

•Additional notable responses include:

oMR2 within 5 months in a 4L patient at 160mg QD with baseline transcript > 1% and suboptimal response and intolerance to asciminib

oMR4 (deep molecular response) within 3 months in a 5L patient treated at 320mg with baseline transcript >10% and treatment failure on bosutinib at study entry

TERN-701 showed a highly encouraging safety profile across the 160mg to 400mg dose levels, with 500mg undergoing evaluation as of data cutoff. Key safety highlights:

•No dose limiting toxicities (DLT) through 400mg dose level

•No adverse event (AE)-related treatment discontinuations or dose reductions

•No Grade 3 or higher treatment-related AEs

•No treatment related serious AEs

The incidence of treatment emergent hematologic AEs was notably low in this heavily pre-treated population, with no Grade 3 or higher treatment-related cytopenias. There were no non-hematologic treatment-related AEs more than Grade 2 in severity. Finally, no clinically meaningful changes in liver and pancreatic enzymes, blood pressure and other vitals, or electrocardiogram were seen.

Steady state PK data, available for the 160mg and 320mg dose levels at data cutoff, showed linear PK with dose proportional increases in exposure. Plasma protein binding-corrected Caverage for TERN-701 exceeded the in vitro IC90 for multiple mutated and non-mutated BCR-ABL variants with once daily dosing. Importantly, at 160mg and 320mg QD, TERN-701 achieved average free drug concentrations approximately 4-fold and 8-fold higher, respectively, than in vivo exposures where potent inhibition of the BCR-ABL signaling pathway in was seen in CML mouse tumor models, indicating robust pharmacodynamic effects at these clinical doses.

As of December 3, 2024, the CARDINAL study has enrolled 19 patients inclusive of the 500mg cohort, with all dose escalation cohorts having enrolled at least 3 patients. The study is on track to initiate dose expansion in the first half of 2025 with additional efficacy data expected in the fourth quarter of 2025, including longer term MMR rates.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements about the Company within the meaning of the federal securities laws, including those related to expectations, timing and potential results of the clinical trials and other development activities of the Company and its partners; the potential indications to be targeted by the Company with its small-molecule product candidates; the therapeutic potential of the Company’s small-molecule product candidates; the potential for the mechanisms of action of the Company’s product candidates to be therapeutic targets for their targeted indications; the potential utility and progress of the Company’s product candidates in their targeted indications, including the clinical utility of the data from and the endpoints used in the Company’s clinical trials; the Company’s clinical development plans and activities, including the results of any interactions with regulatory authorities on its programs; the Company’s expectations regarding the profile of its product candidates, including efficacy, tolerability, safety, metabolic stability and pharmacokinetic profile and potential differentiation as compared to other products or product candidates; the Company’s plans for and ability to continue to execute on its current development strategy, including potential combinations involving multiple product candidates; the potential commercialization of the Company’s product candidates; the Company’s plans and expectations around the addition of key personnel; and the Company’s expectations with regard to its cash runway and sufficiency of its cash resources. All statements other than statements of historical facts contained in this press release, including statements regarding the Company’s strategy, future financial condition, future operations, future trial results, projected costs, prospects, plans, objectives of management and expected market growth, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “positioned,” “potential,” “predict,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. The Company has based these forward-looking statements largely on its current expectations, estimates, forecasts and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. These statements are subject to risks and uncertainties that could cause the actual results and the implementation of the Company’s plans to vary materially, including the risks associated with the initiation, cost, timing, progress, results and utility of the Company’s current and future research and development activities and preclinical studies and clinical trials. These risks are not exhaustive. For a detailed discussion of the risk factors that could affect the Company’s actual results, please refer to the risk factors identified in the Company’s SEC reports, including but not limited to its Annual Report on Form 10-K for the year ended December 31, 2023. Except as required by law, the Company undertakes no obligation to update publicly any forward-looking statements for any reason.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TERNS PHARMACEUTICALS, INC. |

|

|

|

|

Date: |

December 3, 2024 |

By: |

/s/ Elona Kogan |

|

|

|

Elona Kogan

Chief Legal Officer |

Exhibit 99.1

Terns Pharmaceuticals Announces Positive Early Data from Phase 1 CARDINAL Trial of TERN-701 for Chronic Myeloid Leukemia

Compelling molecular responses starting at lowest dose level in heavily pre-treated patients with high baseline BCR-ABL transcript levels

Encouraging safety profile with no dose limiting toxicities, adverse event-related treatment discontinuations, or dose reductions across three dose escalation cohorts

High levels of target coverage achieved with once daily dosing at all doses

Completion of dose escalation and initiation of dose expansion expected in 1H25

Additional efficacy data expected in 4Q25, including longer term major molecular response (MMR) rates

Company to host webcast at 8:00 am ET today

FOSTER CITY, Calif., December 3, 2024 (GLOBE NEWSWIRE) -- Terns Pharmaceuticals, Inc. (“Terns” or the “Company”) (Nasdaq: TERN), a clinical-stage biopharmaceutical company developing a portfolio of small-molecule product candidates to address serious diseases, including oncology and obesity, today announced encouraging early data from the ongoing dose escalation part of the Phase 1 CARDINAL study evaluating TERN-701 in patients with relapsed/refractory chronic myeloid leukemia (CML).

TERN-701 is an investigational, oral, potent, small molecule allosteric BCR-ABL inhibitor being developed for patients with CML. CARDINAL is a global, multicenter, open-label, two-part Phase 1 clinical trial to evaluate the safety, pharmacokinetics (PK), and efficacy of TERN-701 in patients with relapsed/refractory CML with or without BCR-ABL resistance mutations who were previously treated with at least one 2G tyrosine kinase inhibitor (TKI). Patients previously treated with asciminib are also eligible.

“These exciting early data from our Phase 1 dose escalation cohorts clearly show TERN-701 has compelling clinical activity with a highly encouraging cumulative MMR rate of 50% at 3 months. At the first two dose levels, we see clinically meaningful molecular and hematologic responses in patients with high baseline BCR-ABL transcript levels who had poor responses on prior 2G TKIs, 3G TKIs including ponatinib, as well as asciminib,” said Emil Kuriakose MD, chief medical officer of Terns.

“The emerging safety data show a profile supporting best-in-class potential with no dose limiting toxicities across three completed dose levels, no clinically meaningful changes in liver or pancreatic enzymes, and no AE-related dose reductions or discontinuations at doses that achieve plasma exposures well above target efficacious concentrations. Taken together, the clinical activity and safety data across the dose range in these heavily pre-treated patients with refractory disease support a potential wide therapeutic index that allows for high levels of target coverage with favorable safety/tolerability.”

“We are thrilled to share these impactful early data from the Phase 1 CARDINAL study of TERN-701, which support its potential to be a best-in-class allosteric inhibitor for the treatment of CML,” said Amy Burroughs, chief executive officer of Terns. “In addition to the meaningful clinical data, the CARDINAL study highlights yet another example of excellent clinical and operational execution at Terns, with patients enrolled in all four dose escalation cohorts in less than a year. We are well-positioned to initiate dose expansion cohorts in the first half of 2025 and look forward to sharing additional safety and efficacy data, including longer term MMR data in late 2025.”

As of the October 28, 2024 cutoff date, 15 patients were enrolled across three dose levels of 160mg (n=7), 320mg (n=5), and 400mg (n=3) of TERN-701 dosed once daily, with an overall median treatment duration of 3 months (range 0.79 - 7.5 months). Enrolled patients were heavily pretreated with a median of 4 prior TKIs (range: 1-6) and 80% having had 3 or more TKIs. 47% and 40% of patients, respectively, had previously received ponatinib and asciminib. 73% were not in MMR at baseline, with 60% having a baseline BCR-ABL transcript >1% international scale (IS). As of the data cutoff, 14 of 15 patients remain on treatment.

Twelve patients were efficacy evaluable, defined as having baseline BCR-ABL transcript and at least two post-baseline BCR-ABL transcript levels (centrally assessed). All efficacy evaluable patients were in the 160mg and 320mg dose levels. Key efficacy highlights include:

•88% (7/8) of patients with baseline transcript > 1% had decreases in BCR-ABL on treatment, with 7 ongoing as of data cutoff

•Cumulative MMR rate of 50% (5/10) in non-T315i mutation patients with 3 or more months of treatment and/or MMR or better at baseline

•100% (4/4) of patients with MMR or better at baseline have maintained their response and remain on treatment

•Additional notable responses include:

oMR2 within 5 months in a 4L patient at 160mg QD with baseline transcript > 1% and suboptimal response and intolerance to asciminib

oMR4 (deep molecular response) within 3 months in a 5L patient treated at 320mg with baseline transcript >10% and treatment failure on bosutinib at study entry

TERN-701 showed a highly encouraging safety profile across the 160mg to 400mg dose levels, with 500mg undergoing evaluation as of data cutoff. Key safety highlights:

•No dose limiting toxicities (DLT) through 400mg dose level

•No adverse event (AE)-related treatment discontinuations or dose reductions

•No Grade 3 or higher treatment-related AEs

•No treatment related serious AEs

The incidence of treatment emergent hematologic AEs was notably low in this heavily pre-treated population, with no Grade 3 or higher treatment-related cytopenias. There were no non-hematologic treatment-related AEs more than Grade 2 in severity. Finally, no clinically meaningful changes in liver and pancreatic enzymes, blood pressure and other vitals, or electrocardiogram were seen.

Steady state PK data, available for the 160mg and 320mg dose levels at data cutoff, showed linear PK with dose proportional increases in exposure. Plasma protein binding-corrected Caverage for TERN-701 exceeded the in vitro IC90 for multiple mutated and non-mutated BCR-ABL variants with once daily dosing. Importantly, at 160mg and 320mg QD, TERN-701 achieved average free drug concentrations approximately 4-fold and 8-fold higher, respectively, than in vivo exposures where potent inhibition of the BCR-ABL signaling pathway in was seen in CML mouse tumor models, indicating robust pharmacodynamic effects at these clinical doses.

As of December 3, 2024, the CARDINAL study has enrolled 19 patients inclusive of the 500mg cohort, with all dose escalation cohorts having enrolled at least 3 patients. The study is on track to initiate dose expansion in the first half of 2025 with additional efficacy data expected in the fourth quarter of 2025, including longer term MMR rates.

Company Webcast

Terns will host a company webcast at 8:00 am ET today. The discussion will cover TERN-701’s Phase 1 interim data, next steps for the CARDINAL program, and TERN-701’s potential role in the CML treatment landscape.

The event will be webcast live and can be accessed by visiting the investor relations section of the Company’s website at https://ir.ternspharma.com. An archived webcast will be available following the event.

About CARDINAL

The CARDINAL trial is an ongoing global, multicenter, open-label, two-part Phase 1 clinical trial to evaluate the safety, PK, and efficacy of TERN-701 in patients with previously treated CML. Part 1 is the dose escalation portion of the trial evaluating once-daily TERN-701 monotherapy in up to five dose cohorts in up to 60 adults with chronic phase CML with confirmed BCR-ABL and a history of treatment failure or suboptimal response to at least one second generation TKI (nilotinib, dasatinib or bosutinib). Participants who are intolerant to prior TKI treatment (including asciminib) are also allowed. The primary endpoints for Part 1 are the incidence of DLTs during the first treatment cycle, and additional measures of safety and tolerability. Secondary endpoints include TERN-701 PK and efficacy assessments, such as hematologic and molecular responses as measured by the change from baseline in BCR-ABL transcript levels. The starting dose is 160 mg QD (once-daily) with dose escalations as high as 500 mg QD and the option to explore a lower dose of 80 mg QD. Part 2 is the dose expansion portion of the trial that will enroll approximately 40 patients, randomized to once-daily treatment with one of two doses of TERN-701 to be selected based on data from Part 1. The primary endpoint of the dose expansion portion of the trial is efficacy, measured by hematologic and molecular responses. Secondary endpoints include safety, tolerability and PK. The overall objective of the CARDINAL trial is to select the optimal dose(s) of TERN-701 to move forward to a potential pivotal trial in chronic phase CML.

About Terns Pharmaceuticals

Terns Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company developing a portfolio of small-molecule product candidates to address serious diseases, including oncology and obesity. Terns’ pipeline contains three clinical stage development programs including an allosteric BCR-ABL inhibitor, a small-molecule GLP-1 receptor agonist, a THR-β agonist, and a preclinical GIPR modulator discovery effort, prioritizing a GIPR antagonist nomination candidate. For more information, please visit: www.ternspharma.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements about the Company within the meaning of the federal securities laws, including those related to expectations, timing and potential results of the clinical trials and other development activities of the Company and its partners; the potential indications to be targeted by the Company with its small-molecule product candidates; the therapeutic potential of the Company’s small-molecule product candidates; the potential for the mechanisms of action of the Company’s product candidates to be therapeutic targets for their targeted indications; the potential utility and progress of the Company’s product candidates in their targeted indications, including the clinical utility of the data from and the endpoints used in the Company’s clinical trials; the Company’s clinical development plans and activities, including the results of any interactions with regulatory authorities on its programs; the Company’s expectations regarding the profile of its product candidates, including efficacy, tolerability, safety, metabolic stability and pharmacokinetic profile and potential differentiation as compared to other products or product candidates; the Company’s plans for and ability to continue to execute on its current development strategy, including potential combinations involving multiple product candidates; the potential commercialization of the Company’s product candidates; the Company’s plans and expectations around the addition of key personnel; and the Company’s expectations with regard to its cash runway and sufficiency of its cash resources. All statements other than statements of historical facts contained in this press release, including statements regarding the Company’s strategy, future financial condition, future operations, future trial results, projected costs, prospects, plans, objectives of management and expected market growth, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “positioned,” “potential,” “predict,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. The Company has based these forward-looking statements largely on its current expectations, estimates, forecasts and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. These statements are subject to risks and uncertainties that could cause the actual results and the implementation of the Company’s plans to vary materially, including the risks associated with the initiation, cost, timing, progress, results and utility of the Company’s current and future research and development activities and preclinical studies and clinical trials. These risks are not exhaustive. For a detailed discussion of the risk factors that could affect the Company’s actual results, please refer to the risk factors identified in the Company’s SEC reports, including but not limited to its Annual Report on Form 10-K for the year ended December 31, 2023. Except as required by law, the Company undertakes no obligation to update publicly any forward-looking statements for any reason.

Contacts for Terns

Investors

Justin Ng

investors@ternspharma.com

Media

Jenna Urban

Berry & Company Public Relations

media@ternspharma.com

v3.24.3

Document And Entity Information

|

Dec. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 03, 2024

|

| Entity Registrant Name |

Terns Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001831363

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-39926

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

98-1448275

|

| Entity Address, Address Line One |

1065 East Hillsdale Blvd.

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Foster City

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94404

|

| City Area Code |

(650)

|

| Local Phone Number |

525-5535

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

TERN

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

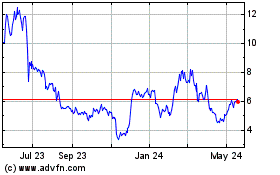

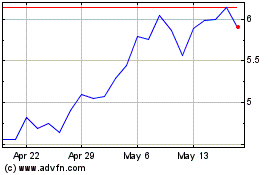

Terns Pharmaceuticals (NASDAQ:TERN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Terns Pharmaceuticals (NASDAQ:TERN)

Historical Stock Chart

From Dec 2023 to Dec 2024