Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

05 February 2025 - 8:33AM

Edgar (US Regulatory)

Issuer Free Writing Prospectus filed pursuant to Rule 433

supplementing the Preliminary Prospectus Supplement dated February 4, 2025

Registration No. 333-271553

Pricing Term Sheet

T-MOBILE USA, INC.

€2,750,000,000

3.150%

Senior Notes due 2032 (the “2032 Notes”)

3.500% Senior Notes due 2037 (the “2037 Notes”)

3.800% Senior Notes due 2045 (the “2045 Notes” and, together with the 2032

Notes and the 2037 Notes, the “Notes”)

Pricing Supplement, dated February 4, 2025, to

Preliminary Prospectus Supplement, dated February 4, 2025 (the “Preliminary Prospectus Supplement”), of T-Mobile USA, Inc. The information in this Pricing Supplement supplements the Preliminary

Prospectus Supplement and supersedes the information in the Preliminary Prospectus Supplement only to the extent it is inconsistent with the information in the Preliminary Prospectus Supplement. Capitalized terms used in this Pricing Supplement but

not defined herein have the meanings given them in the Preliminary Prospectus Supplement.

1

|

|

|

|

|

|

|

| |

|

2032 Notes |

|

2037 Notes |

|

2045 Notes |

| Principal Amount: |

|

€1,000,000,000 |

|

€1,000,000,000 |

|

€750,000,000 |

| Title of Securities: |

|

3.150% Senior Notes due 2032 |

|

3.500% Senior Notes due 2037 |

|

3.800% Senior Notes due 2045 |

| Final Maturity Date: |

|

February 11, 2032 |

|

February 11, 2037 |

|

February 11, 2045 |

| Public Offering Price: |

|

99.981% of principal amount, plus accrued and unpaid interest, if any, from February 11, 2025 |

|

99.826% of principal amount, plus accrued and unpaid interest, if any, from February 11, 2025 |

|

99.710% of principal amount, plus accrued and unpaid interest, if any, from February 11, 2025 |

| Coupon: |

|

3.150% |

|

3.500% |

|

3.800% |

|

Yield-to-Maturity: |

|

3.153% |

|

3.518% |

|

3.821% |

| Mid-Swap Yield: |

|

2.273% |

|

2.368% |

|

2.341% |

| Spread to Mid-Swap Yield: |

|

+88 bps |

|

+115 bps |

|

+148 bps |

| Benchmark: |

|

0.000% DBR due February 15, 2032 |

|

0.000% DBR due May 15, 2036 |

|

2.500% DBR due July 4, 2044 |

| Benchmark Yield: |

|

2.206% |

|

2.489% |

|

2.645% |

| Spread to Benchmark: |

|

+94.7 bps |

|

+102.9 bps |

|

+117.6 bps |

| Gross Proceeds Before Expenses: |

|

€999,810,000 |

|

€998,260,000 |

|

€747,825,000 |

| Net Proceeds Before Expenses: |

|

€997,060,000 |

|

€994,560,000 |

|

€744,450,000 |

| ISIN Numbers / Common Codes: |

|

ISIN: XS2997534768 Common Code:

299753476 |

|

ISIN: XS2997535062 Common Code:

299753506 |

|

ISIN: XS2997535146 Common Code:

299753514 |

2

|

|

|

| Terms Applicable to All Notes |

|

|

| Issuer: |

|

T-Mobile USA, Inc., a Delaware corporation |

|

|

| Optional Redemption: |

|

Prior to the applicable Par Call Date with respect to each series of Notes, the Issuer may redeem the Notes of such series at its option, in

whole or in part, at any time and from time to time, at a redemption price (expressed as a percentage of principal amount and rounded to three decimal places) equal to the greater of:

(i) 100% of the principal amount of the

Notes to be redeemed; and

(ii) (a) the sum of the present values of the remaining scheduled payments of principal and interest

thereon, not including any portion of these payments of interest accrued as of the date of which the notes are to be redeemed, discounted to the redemption date (assuming that such Notes matured on their applicable Par Call Date) on an annual basis

(ACTUAL / ACTUAL (ICMA)) at the applicable Comparable Government Bond Rate plus 15 basis points in the case of the 2032 Notes, 20 basis points in the case of the 2037 Notes and 20 basis points in the case of the 2045 Notes less (b) unpaid

interest accrued to the date of redemption (any excess of the amount described in this bullet point over the amount described in the immediately preceding bullet point, the “Make-Whole Premium”);

plus, in either case, accrued and unpaid interest thereon to the redemption date.

On or after the applicable Par Call Date with respect to each series of Notes, the

Issuer may redeem the Notes of such series, in whole or in part, at any time or from time to time, at a redemption price equal to 100% of the principal amount of the Notes being redeemed plus accrued and unpaid interest thereon to the redemption

date. “Par Call Date” with respect to the applicable Series

means: |

|

|

|

|

|

| |

|

Series |

|

Par Call Date |

|

|

2032 Notes |

|

November 11, 2031 |

|

|

2037 Notes |

|

November 11, 2036 |

|

|

2045 Notes |

|

August 11, 2044 |

|

|

|

| Clearing and Settlement: |

|

Euroclear / Clearstream |

|

|

| Anticipated Listing: |

|

The Nasdaq Bond Exchange |

|

|

| Interest Payment Dates: |

|

Annually on February 11, commencing February 11, 2026 |

|

|

| Record Dates: |

|

The Business Day immediately preceding each interest payment date. |

|

|

| Underwriters: |

|

Joint Book-Running Managers: Citigroup

Global Markets Limited Goldman Sachs & Co. LLC J.P.

Morgan Securities plc Société Générale

Banco Santander, S.A. Barclays Bank PLC

BNP PARIBAS Commerzbank Aktiengesellschaft

Crédit Agricole Corporate & Investment Bank

Deutsche Bank AG, London Branch |

3

|

|

|

|

|

Mizuho International plc Morgan

Stanley & Co. International plc MUFG Securities EMEA plc

RBC Europe Limited SMBC Bank International plc

The Toronto-Dominion Bank Truist Securities, Inc.

UBS AG London Branch U.S. Bancorp Investments, Inc.

Wells Fargo Securities International Limited

Co-Managers: ING

Bank N.V., Belgian Branch NatWest Markets Plc PNC Capital

Markets LLC Scotiabank (Ireland) Designated Activity Company |

|

|

| Trade Date: |

|

February 4, 2025 |

|

|

| Settlement Date: |

|

February 11, 2025 (T+5)

We expect that delivery of the Notes will be made to investors on or about February 11, 2025, which will be the fifth business day following the date of

this pricing supplement (such settlement being referred to as “T+5”). Under Rule 15c6-1 under the Exchange Act, trades in the secondary market generally are required to settle in one business day

unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the business day before the settlement date will be required, by virtue of the fact that the Notes initially will settle in

T+5, to specify an alternative settlement cycle at the time of any such trade to prevent failed settlement and should consult their own advisors. |

|

|

| Form of Offering: |

|

SEC Registered (Registration No. 333-271553) |

|

|

| Denominations: |

|

€100,000 and integral multiples of €1,000 |

The Issuer has filed a registration statement (Registration No. 333-271553) (including a

Prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the Prospectus in that registration statement, the related Preliminary Prospectus Supplement and other documents the Issuer has filed

with the SEC, for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Issuer, the underwriters or any dealer participating in the

offering will arrange to send you the Prospectus and related Preliminary Prospectus Supplement if you request it by contacting Citigroup Global Markets Limited, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717,

Telephone: +1-800-831-9146, Email: prospectus@citi.com; Goldman Sachs & Co. LLC, Prospectus Department, 200 West Street,

New York, New York 10282, Telephone: +1-866-471-2526, Facsimile:

+1-212-902-9316, Email: Prospectus-ny@ny.email.gs.com; J.P. Morgan Securities plc, 25

Bank Street, Canary Wharf, London E14 5JP, United Kingdom, Attention: Head of International Syndicate, Telephone (for non-US investors):

+44-20-7134-2468, Email: emea_syndicate@jpmorgan.com or J.P. Morgan Securities LLC (for U.S. investors) at +1-212-834-4533 (call collect) and Société Générale, 29, boulevard Haussmann, 75009 Paris, France, Attention: Syndicate Desk

GLBA/SYN/CAP/BND, Telephone: +33 (0)1 42 13 32 16, Email: eur-glba-syn-cap@sgcib.com.

4

Manufacturer target market (MiFID II product governance) is eligible counterparties and professional clients only (all distribution channels). No PRIIPs key

information document (KID) pursuant to Regulation (EU) 1286/2014 has been prepared as not available to retail in EEA.

Manufacturer target market (UK

MiFIR product governance) is eligible counterparties and professional clients only (all distribution channels). No UK PRIIPs key information document (KID) pursuant to Regulation (EU) 1286/2014 as it forms part of UK domestic law by virtue of the

EUWA has been prepared as not available to retail in the UK.

Any disclaimers or other notices that may appear below are not applicable to this

communication and should be disregarded. Such disclaimers and other notices were automatically generated as a result of this communication being sent via Bloomberg or another communication system.

5

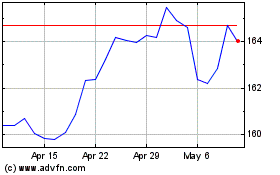

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2025 to Apr 2025

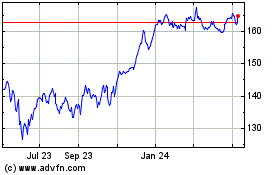

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2024 to Apr 2025