TechTarget, Inc. (Nasdaq: TTGT) (“Informa TechTarget”) today

announced that it has commenced tender offers to repurchase any and

all of Informa TechTarget’s outstanding 0.125% Convertible Senior

Notes due 2025 (the “2025 Notes”) and 0.000% Convertible Senior

Notes due 2026 (the “2026 Notes” and, together with the 2025 Notes,

the “Notes”) in compliance with the terms of the indentures

governing the Notes (the “Indentures”).

The tender offers are required to be made as a result of the

transactions consummated on December 2, 2024 (the “Closing Date”)

pursuant to the Agreement and Plan of Merger, dated as of January

10, 2024, among TechTarget Holdings Inc. (formerly known as

TechTarget, Inc.) (“Former TechTarget”), Informa TechTarget, Toro

Acquisition Sub, LLC, Informa PLC, Informa US Holdings Limited, and

Informa Intrepid Holdings Inc. (the “Transactions”).

Under the terms of the Indentures, the Transactions constituted

a Fundamental Change (as defined in each of the Indentures), and

Informa TechTarget is required to offer to repurchase the Notes for

cash at a purchase price equal to 100% of the aggregate principal

amount of their Notes to be repurchased, plus, in the case of the

2025 Notes, accrued and unpaid interest on the 2025 Notes to, but

excluding, January 24, 2025 (the “Fundamental Change Repurchase

Date”).

As a result of the Transactions, holders also have the right to

convert their Notes in whole or in part (in a principal amount of

$1,000 or an integral multiple thereof) during the period from the

Closing Date to the close of business on January 23, 2025 (the

“Fundamental Change Conversion Period”), at the applicable

conversion rate. As a result of the Transactions, the Notes are

convertible into units of reference property equal to the

consideration paid to holders of Former TechTarget’s common stock

in the Transactions of $11.6955 in cash and one share of Informa

TechTarget common stock per share. During the Fundamental Change

Conversion Period, the Conversion Rate for (i) the 2025 Notes will

be 14.1977 units of reference property per $1,000 principal amount

2025 Note and (ii) the 2026 Notes will be 7.6043 units of reference

property per $1,000 principal amount 2026 Note. Although the

Transactions constituted a Make-Whole Fundamental Change for both

series of Notes, Holders of the Notes will not be entitled an

increase in the Conversion Rate under the terms of the applicable

Indenture because the average of the last reported sales prices of

Former TechTarget’s common stock over the five trading day period

ended on November 29, 2024 was less than the minimum price per

share that is required under the applicable Indenture for the Notes

for holders of the Notes to be entitled to receive an increase in

the conversion rate.

Informa TechTarget will settle all conversions of Notes

surrendered for conversion during the Fundamental Change Conversion

Period pursuant to the cash settlement provisions of the applicable

Indenture. The Offer to Purchase contains a comparison of the

amount holders would currently receive if they converted their

Notes and the amount holders will receive if they accept the offer

to repurchase their Notes.

As of December 19, 2024, there was $3,040,000 in aggregate

principal amount of the 2025 Notes outstanding and $414,000,000 in

aggregate principal amount of the 2026 Notes outstanding. If all

outstanding Notes are surrendered for repurchase for cash, the

aggregate cash purchase price paid by Informa TechTarget will be

$3,040,411.67 and $414,000,000 for the 2025 Notes and the 2026

Notes, respectively.

The tender offers will expire at 5:00 p.m., New York City time,

on January 23, 2025 (the “Expiration Date”). Informa TechTarget

does not intend to extend the period that holders have to tender

their Notes for repurchase by Informa TechTarget unless required by

applicable law. The repurchase date for any Notes tendered pursuant

to the tender offers will be the Fundamental Change Repurchase

Date.

In order to tender Notes for repurchase by Informa TechTarget, a

holder must follow the procedures set forth in the Informa

TechTarget’s Offer to Purchase, which is available through the

Depository Trust Company and U.S. Bank Trust Company, National

Association. Holders may withdraw any previously tendered Notes at

any time prior to 5:00 p.m., New York City time, on the Expiration

Date, or as otherwise provided by applicable law, through

compliance with the proper withdrawal procedure described in the

Offer to Purchase for the applicable series of Notes.

None of Informa TechTarget, Informa TechTarget’s board of

directors, the trustee, paying agent or conversion agent for the

Notes and the respective tender offers, is making any

recommendation to holders of the Notes as to whether to tender or

refrain from tendering their Notes in the tender offers or whether

to convert their Notes. Holders of the Notes must decide how many

Notes they will tender or convert, if any. The terms and conditions

of the tender offers are described in the Offers to Purchase

distributed to holders of the Notes.

The trustee, paying agent and conversion agent for the tender

offers is U.S. Bank Trust Company, National Association, as

successor-in-interest to U.S. Bank National Association. Offers to

Purchase will today be distributed to noteholders of record and

filed with the Securities and Exchange Commission. For questions

and requests for assistance in connection with the mechanics of

surrender of Notes for repurchase or the conversion of the Notes

may be directed to the paying agent and conversion agent at the

following address: c/o U.S. Bank Trust Company, National

Association, 111 Fillmore Avenue St. Paul, MN 55107-1402.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any offer or sale of securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful. The tender offers

are being made only pursuant to the Offers to Purchase and related

materials that Informa TechTarget will distribute to holders of the

Notes after Informa TechTarget files with the Securities and

Exchange Commission its Schedule TO and Offers to Purchase. Holders

of the Notes should read carefully the applicable Offer to Purchase

and related materials because they contain important information,

including the various terms of, and conditions to, the applicable

tender offer. After Informa TechTarget files its Schedule TO and

Offers to Purchase with the Securities and Exchange Commission,

holders of the Notes may obtain a free copy of the tender offer

statement on Schedule TO, the Offers to Purchase and other

documents that Informa TechTarget will be filing with the

Securities and Exchange Commission at the Securities and Exchange

Commission’s website at www.sec.gov or by contacting U.S. Bank

Trust Company, National Association, the trustee, paying agent and

conversion agent for the tender offers, at the following address:

c/o 111 Fillmore Avenue St. Paul, MN 55107-1402. Holders of the

Notes are urged to carefully read these materials prior to making

any decision with respect to the applicable tender offer.

About Informa TechTarget TechTarget, Inc. (Nasdaq: TTGT),

which also refers to itself as Informa TechTarget, informs,

influences and connects the world’s technology buyers and sellers,

helping accelerate growth from R&D to ROI.

With a vast reach of over 220 highly targeted

technology-specific websites and over 50 million permissioned

first-party audience members, Informa TechTarget has a unique

understanding of and insight into the technology market.

Underpinned by those audiences and their data, we offer

expert-led, data-driven, and digitally enabled services that have

the potential to deliver significant impact and measurable outcomes

to our clients:

- Trusted information that shapes the industry and informs

investment

- Intelligence and advice that guides and influences

strategy

- Advertising that grows reputation and establishes thought

leadership

- Custom content that engages and prompts action

- Intent and demand generation that more precisely targets and

converts

Informa TechTarget is headquartered in Boston, MA and has

offices in 19 global locations. For more information, visit

informatechtarget.com and follow us on LinkedIn.

© 2024 TechTarget, Inc. All rights reserved. All trademarks are

the property of their respective owners.

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements”. All

statements, other than historical facts, are forward-looking

statements, including: statements regarding the expected benefits

of the Transactions, such as improved operations, enhanced revenues

and cash flow, synergies, growth potential, market profile,

business plans, expanded portfolio and financial strength; the

competitive ability and position of Informa TechTarget; legal,

economic, and regulatory conditions; and any assumptions underlying

any of the foregoing. Forward-looking statements concern future

circumstances and results and other statements that are not

historical facts and are sometimes identified by the words “may,”

“will,” “should,” “potential,” “intend,” “expect,” “endeavor,”

“seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,”

“believe,” “plan,” “could,” “would,” “project,” “predict,”

“continue,” “target,” or the negatives of these words or other

similar terms or expressions that concern Informa TechTarget’s

expectations, strategy, priorities, plans, or intentions.

Forward-looking statements are based upon current plans, estimates,

and expectations that are subject to risks, uncertainties, and

assumptions. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those indicated or

anticipated by such forward-looking statements. We can give no

assurance that such plans, estimates, or expectations will be

achieved, and therefore, actual results may differ materially from

any plans, estimates, or expectations in such forward-looking

statements.

Important factors that could cause actual results to differ

materially from such plans, estimates, or expectations include,

among others: unexpected costs, charges, or expenses resulting from

the Transactions; uncertainty regarding the expected financial

performance of Informa TechTarget; failure to realize the

anticipated benefits of the Transactions, including as a result of

integrating the Informa Tech Digital Businesses with the business

of Former TechTarget; the ability of Informa TechTarget to

implement its business strategy; difficulties and delays in Informa

TechTarget achieving revenue and cost synergies; evolving legal,

regulatory, and tax regimes; changes in economic, financial,

political, and regulatory conditions, in the United States and

elsewhere, and other factors that contribute to uncertainty and

volatility, natural and man-made disasters, civil unrest,

pandemics, geopolitical uncertainty, and conditions that may result

from legislative, regulatory, trade, and policy changes associated

with the current or subsequent U.S. administrations; Informa

TechTarget’s ability to meet expectations regarding the accounting

and tax treatments of the Transactions; market acceptance of

Informa TechTarget’s products and services; the impact of pandemics

and future health epidemics and any related economic downturns on

Informa TechTarget and the markets in which it and its customers

operate; changes in economic or regulatory conditions or other

trends affecting the internet, internet advertising and IT

industries; data privacy and artificial intelligence laws, rules,

and regulations; the impact of foreign currency exchange rates;

certain macroeconomic factors facing the global economy, including

instability in the regional banking sector, disruptions in the

capital markets, economic sanctions and economic slowdowns or

recessions, rising inflation and interest rate fluctuations on the

operating results of Informa TechTarget; and other matters included

in Risk Factors of Informa TechTarget’s definitive proxy

statement/prospectus filed by Informa TechTarget pursuant to Rule

424(b)(3) on October 25, 2024 relating to the registration

statement on Form S-4 (File No. 333-280529) initially filed with

the United States Securities and Exchange Commission (the “SEC”) on

June 27, 2024, and declared effective by the SEC on October 25,

2024 and other documents filed by Informa TechTarget from time to

time with the SEC. This summary of risks and uncertainties should

not be considered to be a complete statement of all potential risks

and uncertainties that may affect Informa TechTarget. Other factors

may affect the accuracy and reliability of forward-looking

statements. We caution you not to place undue reliance on any of

these forward-looking statements as they are not guarantees of

future performance or outcomes. Actual performance and outcomes,

including, without limitation, Informa TechTarget’s actual results

of operations, financial condition and liquidity, may differ

materially from those made in or suggested by the forward-looking

statements contained in this press release.

Any forward-looking statements speak only as of the date of this

press release. None of Informa TechTarget, its affiliates, advisors

or representatives, undertake any obligation to update any

forward-looking statements, whether as a result of new information

or developments, future events, or otherwise, except as required by

law. Readers are cautioned not to place undue reliance on any of

these forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241220070754/en/

Media Inquiries Garrett Mann Vice

President, Corporate Communications Informa TechTarget

garrett.mann@informatechtarget.co

Investor Inquiries Daniel Noreck

Chief Financial Officer Informa TechTarget

dan.noreck@informatechtarget.co

TechTarget (NASDAQ:TTGT)

Historical Stock Chart

From Nov 2024 to Dec 2024

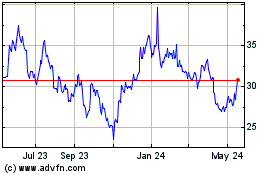

TechTarget (NASDAQ:TTGT)

Historical Stock Chart

From Dec 2023 to Dec 2024