Johnson Controls Hits 52-Week High - Analyst Blog

15 May 2013 - 4:25AM

Zacks

Shares of Johnson Controls Inc. (JCI) hit a new

52-week high of $36.93 on May 13, which is above its previous level

of $36.55, and closed at $36.82 on the same date. The closing price

represented a solid one-year return of 19.3% and year-to-date

return of 18.0%.

Johnson Controls is a diversified industrial company that caters to

automotive, building and power solutions market at the same time.

It has a market cap of $25.2 billion. Average volume of shares

traded over the last three months stood at approximately

4,830.31K.

Shares of the company started escalating, following its impressive

guidance despite disappointing fiscal 2013-second quarter results

released on Apr 23.

Johnson Controls posted a 23.6% decline in adjusted earnings to 42

cents per share in the second quarter of fiscal 2013 ended Mar 31,

2013 from 55 cents in the same quarter of prior fiscal year, but

earnings were in line with the Zacks Consensus Estimate. Net income

declined 24.1% to $287.0 million from $378.0 million in the second

quarter of fiscal 2012.

Revenues in the quarter declined 1.3% $10.43 billion but marginally

exceeded the Zacks Consensus Estimate of $10.39 billion. The

decline was attributable to lower revenues in the company’s

Automotive Experience and Building Efficiency segments.

Johnson Controls reiterated its guidance to generate earnings

between $2.60 and $2.70 per share in fiscal 2013, which is higher

than $2.56 in fiscal 2012. For the third quarter of fiscal 2013,

the company expects earnings per share of 75 cents.

The company also expects that it will record better performance in

the second half of 2013 due to benefits from restructuring

initiatives, higher profitability from the Building Efficiency

segment and improvements in European and South American Automotive

Experience businesses. It also expects Power Solutions business to

record higher profitability in the second half of fiscal 2013.

Currently, shares of Johnson Controls retain a Zacks Rank #3, which

translates into a short-term rating (1–3 months) of Hold. Some

other stocks that are performing well in the broader industry where

Johnson Controls operates include STRATTEC Security

Corporation (STRT), Tower International,

Inc. (TOWR) and Visteon Corp. (VC). All

these companies carry a Zacks Rank #1 (Strong Buy).

JOHNSON CONTROL (JCI): Free Stock Analysis Report

STRATTEC SEC CP (STRT): Free Stock Analysis Report

TOWER INTL INC (TOWR): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

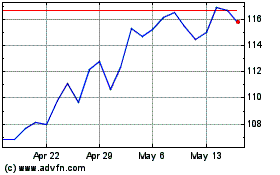

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

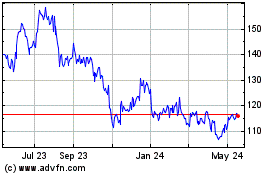

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024