- Q2 Total Revenue of $31.0 Million, In Line

with Guidance -

- Public Sector Record Sales Pipeline Exceeds

$100 Million, Highlighted by iDEMs Solutions across the US Federal

Government -

- Total ARR (SaaS and Consumption) of $67.9

Million from 3,437 Total Software Products & Services

Customers, Including ARR (SaaS) of $49.2 Million, Representing 72%

of Total ARR from Subscription-Based Customers -

- Q2 Total New Bookings of $14.0 Million, up

67% Year over Year -

- Continued Organizational and Cost

Restructuring Actions Driving Year over Year Improvements of 37%

and 47% in Q2 Operating Loss and Non-GAAP Net Loss, respectively,

compared to Q2 2023 -

- Announced Formal Process to Divest

Non-software Asset; expected to raise substantial cash proceeds, in

2024, to be used to retire a portion of existing term debt and to

fund future operations -

Veritone, Inc. (NASDAQ:VERI), a leader in designing

human-centered AI solutions, today reported results for the second

quarter ended June 30, 2024.

“Veritone delivered a strong performance in the second quarter,

driven by accelerated growth across our AI software products and

services and advertising managed services. During the quarter, we

secured 17 new Public Sector customers and saw our Public Sector

sales pipeline reach unprecedented levels, and completed a landmark

deal with the NCAA, representing our largest contract to date based

on run rate,” said Ryan Steelberg, CEO & President of Veritone.

“Our strategic partnership with Amazon Web Services continues to

expand rapidly through our Strategic Collaboration Agreement,

unlocking new opportunities and driving innovation. The focused

execution of our strategic initiatives, including cost reductions

and resource alignment, is yielding tangible results. We also

announced we are in a formal process and are progressing towards

divesting one of our non-software assets, advancing our objectives

to improve our balance sheet and overall liquidity, and enhance our

operational efficiency. As we transition our focus from cost

reductions back to growth, we are confident in our ability to

capitalize on the demand for AI-driven solutions and deliver

long-term value to our shareholders."

Second Quarter 2024 Financial

Highlights

Calculated on a Pro Forma basis where noted; for additional

information on these calculations, see “Note Regarding Pro Forma

Information” and the definitions provided for each metric

cited.

- Revenue of $31.0 million, an increase of 11% compared to Q2

2023.

- Software Products and Services revenues of $15.6 million, an

increase of 11% compared to GAAP revenue of $14.1 million in Q2

2023, and a decrease of 25% when compared to Pro Forma Software

Revenue for Q2 2023 driven by the decline in consumption-based

revenue from customers, including Amazon.

- Managed Services revenue of $15.4 million, an increase of 11%

compared to Q2 2023 driven by an increase in advertising year over

year.

- Total Software Products & Services Customers of 3,437, down

7% year over year, as compared to June 30, 2023 on a pro forma

basis, largely driven by planned migration of legacy CareerBuilder

customers off the Broadbean software platform.

- Total New Bookings of $14.0 million, up 67% from $8.4 million

in Q2 2023 driven by an increase in subscription-based customer

bookings.

- Annual Recurring Revenue (“ARR”) of $67.9 million, down from

$107.9 million in Q2 2023 on a Pro Forma basis driven by declines

in consumption-based revenue principally from our largest customer,

offset by a 3% increase from recurring subscription-based SaaS

revenue customers.

- Loss from Operations of $17.7 million, as compared to a loss of

$28.2 million in Q2 2023 driven by the increase in revenue and

lower overall operating expenses resulting from our past cost

reduction plans and lower professional fees related to past

acquisitions and divestitures.

- Non-GAAP gross profit of $24.4 million, an increase of 21% or

$4.2 million as compared to Q2 2023 primarily due to an increase in

revenue and improved Non-GAAP gross margins of 78.8% as compared to

72.2% in Q2 2023.

- Net Loss of $22.2 million, as compared to $23.3 million in Q2

2023.

- Non-GAAP Net Loss of $6.9 million, improving 47% as compared to

Q2 2023.

About Our Sales Pipeline

Our sales pipeline represents revenue we expect to receive based

on the total fees payable during the full contract term for new

contracts outstanding at the end of the quarter and contracts that

we believe have a high probability of closing in the next three to

twelve months. We include in our sales pipeline fees payable during

any cancellable portion and an estimate of license fees that may

fluctuate over the term and we do not include any variable fees

under the contract (e.g., fees for cognitive processing, storage,

professional services and other variable services) and any fees

payable after contract renewals or extensions that are at the

discretion of our client. Many of our contracts require us to

provide services over more than one year and may include

professional fees required to enable our technology in certain

environments we do not host or have direct control over. In some

cases, our customers may have the ability to terminate our

agreements on short notice and our pipeline does not consider the

potential impact of any early termination. No assurance can be

given that we will ultimately realize our full sales pipeline.

Note Regarding Pro Forma

Information

"Pro Forma” information provided in this press release

represents the historical information of Veritone combined with the

historical information of Broadbean (as defined below) for the

applicable period on a Pro Forma basis as if Veritone had acquired

Broadbean on January 1, 2022. Veritone completed its acquisition of

(i) all of the issued and outstanding share capital of (a)

Broadbean Technology Pty Ltd ACN 116 011 959 / ABN 79 116 011 959,

a limited company incorporated under the laws of Australia, (b)

Broadbean Technology Limited, a limited company incorporated under

the laws of England and Wales, (c) Broadbean, Inc., a Delaware

corporation and (d) CareerBuilder France S.A.R.L., a limited

liability company organized (société à responsabilité limitée)

under the laws of France, and (ii) certain assets and liabilities

related thereto (the foregoing clauses (i) and (ii) together,

“Broadbean”) on June 13, 2023. Periods commencing after June 13,

2023 are not presented on a Pro Forma basis."

Three Months Ended June

30,

Six Months Ended June

30,

Unaudited

Percent

Percent

(in $000s)

2024

2023

Change

2024

2023

Change

Revenue

$

30,992

$

27,967

11

%

$

62,628

$

58,230

8

%

Loss from operations

$

(17,662

)

$

(28,180

)

(37

)%

$

(39,502

)

$

(51,769

)

(24

)%

Net income (loss)

$

(22,231

)

$

(23,296

)

(5

)%

$

(47,429

)

$

(46,259

)

3

%

Non-GAAP gross profit*

$

24,412

$

20,202

21

%

$

49,002

$

43,656

12

%

Non-GAAP net income (loss)*

$

(6,850

)

$

(13,026

)

(47

)%

$

(14,469

)

$

(22,581

)

(36

)%

Three Months Ended June

30,

Six Months Ended June

30,

Unaudited

Percent

Percent

(in $000s, except customers)

2024

2023(1)

Change

2024

2023(1)

Change

Software Products & Services

Pro Forma Software Revenue(2)*

$

15,632

$

20,859

(25

)%

$

30,855

$

43,282

(29

)%

Total Software Products & Services

Customers(3)

3,437

3,705

(7

)%

3,437

3,705

(7

)%

Annual Recurring Revenue(4)*

$

67,924

$

107,949

(37

)%

$

67,924

$

107,949

(37

)%

Total New Bookings(5)

$

14,047

$

8,388

67

%

$

14,047

$

8,388

67

%

Gross Revenue Retention(6)

>90%

>90%

>90%

>90%

(1)All of the supplemental financial information for this period

is presented on a Pro Forma basis inclusive of Broadbean. (2)“Pro

Forma Software Revenue” is a non-GAAP measure that represents

Software Products & Services revenue, including on a Pro Forma

basis where indicated. (3)“Total Software Products & Services

Customers” includes Software Products & Services customers as

of the end of each respective quarter set forth above with net

revenues in excess of $10 and also excludes any customers

categorized by us as trial or pilot status. In prior periods, we

provided “Ending Software Customers,” which represented Software

Products & Services customers as of the end of each fiscal

quarter with trailing twelve-month revenues in excess of $2,400 for

both Veritone, Inc. and PandoLogic Ltd. and/or deemed by Veritone

to be under an active contract for the applicable periods. Total

Software Products & Services Customers is not comparable to

Ending Software Customers. Total Software Products & Services

Customers includes customers based on revenues in the last month of

the quarter rather than on a trailing twelve month basis and

excludes any customers that are on trial or pilot status with us

rather than including customers with active contracts. Management

uses Total Software Products & Services Customers and we

believe Total Software Products & Services Customers are useful

to investors because it more accurately reflects our total

customers for our Software Products & Services inclusive of

Broadbean. (4) “Annual Recurring Revenue” is calculated as Annual

Recurring Revenue (SaaS), which is an annualized calculation of the

monthly recurring revenue in the last month of the calculated

quarter for all active Software Products & Services customers,

combined with Annual Recurring Revenue (Consumption) which is the

trailing twelve month calculation of all non-recurring and/or

consumption-based revenue for all active Software Products &

Services customers. In prior periods, we provided “Average Annual

Revenue,” which was calculated as the aggregate of trailing

twelve-month Software Products & Services revenue divided by

the average number of customers over the same period for both

Veritone, Inc. and PandoLogic Ltd. Annual Recurring Revenue is not

comparable to Average Annual Revenue. Annual Recurring Revenue is

on a Pro Forma basis where indicated, is not averaged among active

customers and uses a calculation of recurring revenue as described

above instead of annual revenue. Management uses “Annual Recurring

Revenue” and we believe Annual Recurring Revenue is useful to

investors because Broadbean significantly increases our mix of

subscription-based SaaS revenues as compared to non-recurring

and/or consumption-based revenues. (5)“Total New Bookings”

represents the total fees payable during the full contract term for

new contracts received in the quarter (including fees payable

during any cancellable portion and an estimate of license fees that

may fluctuate over the term), excluding any variable fees under the

contract (e.g., fees for cognitive processing, storage,

professional services and other variable services), in each case on

a Pro Forma basis where indicated. (6) “Gross Revenue Retention”

represents our dollar-based gross retention rate as of the period

end by starting with the revenue from Software Products &

Services Customers as of the 3 months in the prior year quarter to

such period, or Prior Year Quarter Revenue. We then deduct from the

Prior Year Quarter Revenue any revenue from Software Products &

Services Customers who are no longer customers as of the current

period end, or Current Period Ending Software Customer Revenue. We

then divide the total Current Period Ending Software Customer

Revenue by the total Prior Year Quarter Revenue to arrive at our

dollar-based gross retention rate, which is the percentage of

revenue from all Software Products & Services Customers from

our Software Products & Services as of the year prior that is

not lost to customer churn. All numbers used to determine Gross

Revenue Retention are calculated on a Pro Forma basis where

indicated. * See tables below for reconciliation of non-GAAP

financial measures to directly comparable GAAP measures and for the

definitions used for Software Products & Services Supplemental

Financial Information.

Recent Business

Highlights

- Public Sector closed 17 new public safety and government

customers, including the Defense Logistics Agency, a division of US

Department of Defense and the US Senate, and announced the

appointment of Gus Hunt, former CIA Chief Technology Officer, as an

advisor.

- Signed over 23 new Media & Entertainment deals in the

second quarter, including a multi-year contract with the NCAA,

which is expected to generate up to $40 million over the term, new

deals with Tennis Australia and notable renewals and deal

expansions with NBC Universal, CNBC, CNN, and Bloomberg.

- Veritone Hire signed significant new enterprise programmatic

advertising and job distribution software deals, including global

brands such as Sevita, Whole Foods, Best Buy, and Harrods and

completed the beta launch of programmatic advertising solution and

programmatic publisher network in Australia.

- Announced Strategic Collaboration Agreement (SCA) with Amazon

Web Services (AWS), which will leverage Veritone’s and AWS’ unique

strengths to accelerate cloud-native enterprise AI and generative

AI innovation for new and existing customers across sectors.

- Continued strong advertising momentum, with top-line media

bookings increasing 12% year-over-year from Veritone One and saw

substantial growth from key customers such as Mint Mobile,

LinkedIn, DraftKings, and Quince.

- Announced formal process to divest a non-software asset with

multiple qualified bidders, which, if consummated, is expected to

generate substantial cash proceeds to be used to repay a portion of

the Company’s term debt and fund future operations.

Financial Results for Three Months

Ended June 30, 2024

Delivered second quarter revenue of $31.0 million, an increase

of $3.0 million or 11% from $28.0 million in the second quarter of

2023. Software Products & Services revenue of $15.6 million

increased $1.5 million or 11% year over year driven by the Q2 2023

acquisition of Broadbean, which generated $8.7 million in revenue

in Q2 2024, offset by the decline in legacy Veritone Hire revenue

over the same period, including declines in revenue from Amazon.

Managed Services revenue of $15.4 million increased $1.5 million or

11% year over year principally due to an improvement in advertising

services.

Loss from operations of $17.7 million improved by $10.5 million

as compared to a loss of $28.2 million in Q2 2023 driven in part by

a net $7.5 million decrease in operating expenses including the

impact of the Q2 2023 Broadbean Acquisition, and the $3.0 million

increase in revenue. The $7.5 million net decline in operating

expenses was driven by legacy cost reductions, coupled with lower

professional fees related to acquisitions and divestitures of $4.0

million year over year driven by the second quarter 2023 Broadbean

acquisition. Non-GAAP gross margin of 78.8% improved by 660 basis

points from 72.2% in the second quarter of 2023. GAAP net loss was

$22.2 million, compared to GAAP net loss of $23.3 million in the

second quarter of 2023, driven by the $10.5 million improvement in

loss from operations, offset by (i) an increase of $3.8 million in

net interest expense largely associated with the Company’s December

2023 term loan, which included $1.4 million of non-cash

amortization associated with the initial discount and issuance

costs of the term loan, (ii) a one-time gain of $2.6 million from

the divestiture of the Company’s energy division in the second

quarter of 2023, (iii) a $1.6 million decline in foreign currency

gains and (iv) a $1.3 million decline in the Company's tax benefit.

Non-GAAP net loss of $6.9 million improved by 47% when compared to

Non-GAAP net loss of $13.0 million in the second quarter of 2023,

largely driven by the increase in Non-GAAP gross profit, coupled

with reductions in our cost structure since the first quarter of

2023.

As of June 30, 2024, Total Software Product & Services

Customers of 3,437 was down 7% year over year relative to Total

Software Product & Services Customers on a Pro Forma basis as

of June 30, 2023, principally due to planned migration of legacy

CareerBuilder customers off the Broadbean software platform. Total

New Bookings on a Pro Forma basis increased by 67% to $14.0 million

versus the comparable period a year ago largely driven by an

increase in subscription-based customer bookings, offset by a

reduction in revenue from consumption-based customers, including

Amazon. Annual Recurring Revenue on a Pro Forma basis of $67.9

million decreased 37% year over year driven in large part by the

decline in consumption spending from customers, offset by a 3% year

over year increase in Annual Recurring Revenue from

subscription-based SaaS customers. Excluding the decline in

consumption-based spending from Amazon, Software Products &

Services revenue growth would have increased over 50% year over

year.

As of June 30, 2024, the Company had cash and cash equivalents

of $46.0 million, including approximately $39.3 million of cash

received from advertising customers for future payments to

vendors.

Business Outlook

Third Quarter 2024

- Revenue is expected to be in the range of $34.0 million to

$35.0 million, as compared to $35.1 million in the third quarter of

2023.

- Non-GAAP net loss is expected to be in the range of $2.6

million to $4.0 million, compared to non-GAAP net loss of $7.9

million in the third quarter of 2023.

Full Year 2024

- Revenue is expected to be in the range of $136.0 million to

$142.0 million, as compared to $127.6 million for fiscal 2023.

- Non-GAAP net loss is expected to be in the range of $11.0

million to $15.0 million, compared to non-GAAP net loss of $37.3

million for fiscal 2023.

These updated financial guidance ranges supersede any previously

disclosed financial guidance and investors should not rely on any

previously disclosed financial guidance.

Conference Call

Veritone will hold a conference call to deliver management’s

prepared remarks on August 8, 2024, at 5:00 p.m. Eastern Time (2:00

p.m. Pacific Time) to discuss its second quarter 2024 results,

provide an update on the business and conduct a question-and-answer

session. To participate, please join the audio webcast or dial-in

and ask to be connected to the Veritone earnings conference call.

To avoid a delay, if dialing in, please pre-register or join the

live audio webcast.

- Pre-Registration*

- Live Audio Webcast

- Domestic Call Number: (844) 750-4897

- International Call Number: (412) 317-5293

A replay of the conference call can be accessed one hour after

the end of the conference call through August 15, 2024. The full

webcast replay will be available through August 8, 2025. To access

the earnings webcast replay please visit the Veritone Investor

Relations website.

- Domestic Replay Number: (877) 344-7529

- International Replay Number: (412) 317-0088

- Replay Access Code: 7195217

* Please note that pre-registered participants will receive

their dial-in number and unique PIN upon registration.

About the Presentation of Supplemental

Non-GAAP Financial Information and Key Performance

Indicators

In this news release, the Company has supplemented its financial

measures prepared in accordance with U.S. generally accepted

accounting principles (GAAP) with certain non-GAAP financial

measures, including Pro Forma Software Revenue, Non-GAAP gross

profit, Non-GAAP gross margin, Non-GAAP net income (loss) and

Non-GAAP net income (loss) per share. The Company also provides

certain key performance indicators (KPIs), including Total Software

Products & Services Customers, Annual Recurring Revenue, Annual

Recurring Revenue (SaaS), Annual Recurring Revenue (Consumption),

Total New Bookings and Gross Revenue Retention. The Company has

posted additional supplemental financial information on its website

at investors.veritone.com concurrently with this press release.

Pro Forma Software Revenue represents Software Products &

Services revenue on a Pro Forma basis. Non-GAAP gross profit is

defined as revenue less cost of revenue. Non-GAAP gross margin is

defined as Non-GAAP gross profit divided by revenue. Non-GAAP net

income (loss) and non-GAAP net income (loss) per share,

respectively, is the Company’s net income (loss) and net income

(loss) per share, adjusted to exclude provision for income taxes,

depreciation expense, amortization expense, stock-based

compensation expense, changes in fair value of warrant liability,

changes in fair value of contingent consideration, interest income,

interest expense, foreign currency gains and losses, acquisition

and due diligence costs, gain on sale of energy group, contribution

of business held for sale, variable consultant performance bonus

expense, and severance and executive transition costs. The items

excluded from these non-GAAP financial measures, as well as a

breakdown of GAAP net income (loss), non-GAAP net income (loss) and

these excluded items between the Company’s Core Operations and

Corporate, are detailed in the reconciliations included following

the financial statements attached to this news release. In

addition, following the financial statements attached to this news

release, the Company has provided additional supplemental non-GAAP

measures of operating expenses, loss from operations, other income

(expense), net, and loss before income taxes, excluding the items

excluded from non-GAAP net loss as noted above, and reconciling

such non-GAAP measures to the most directly comparable GAAP

measures.

The Company has provided these non-GAAP financial measures and

KPIs because management believes such information to be important

supplemental measures of performance that are commonly used by

securities analysts, investors and other interested parties in the

evaluation of companies in its industry. Management also uses this

information internally for forecasting and budgeting. The non-GAAP

financial measures should not be considered as an alternative to

revenue, net income (loss), operating income (loss) or any other

financial measures so calculated and presented, nor as an

alternative to cash flow from operating activities as a measure of

liquidity. Other companies (including the Company’s competitors)

may define these non-GAAP financial measures differently. The

non-GAAP financial measures may not be indicative of the historical

operating results of Veritone or predictive of potential future

results. Investors should not consider these non-GAAP financial

measures in isolation or as a substitute for analysis of the

Company’s results as reported in accordance with GAAP.

In addition, the Company defines the following capitalized terms

in this news release as follows:

Core Operations consists of the Company’s aiWARE operating

platform of software, SaaS and related services; content licensing

and advertising agency services; and their supporting operations,

including direct costs of sales as well as operating expenses for

sales, marketing and product development and certain general and

administrative costs dedicated to these operations.

Corporate principally consists of general and administrative

functions such as executive, finance, legal, people operations,

fixed overhead expenses (including facilities and information

technology expenses), other income (expenses) and taxes, and other

expenses that support the entire Company, including public company

driven costs.

Software Products & Services consists of revenues generated

from commercial enterprise and government and regulated industries

customers using our aiWARE platform and Hiring Solutions, any

related support and maintenance services, and any related

professional services associated with the deployment and/or

implementation of such solutions.

Managed Services consist of revenues generated from commercial

enterprise customers using our content licensing services and

advertising agency and related services.

About Veritone

Veritone (NASDAQ: VERI) builds human-centered enterprise AI

solutions. Serving customers in the media, entertainment, public

sector and talent acquisition industries, Veritone’s software and

services empower individuals at the world’s largest and most

recognizable brands to run more efficiently, accelerate decision

making and increase profitability. Veritone’s leading enterprise AI

platform, aiWARE™, orchestrates an ever-growing ecosystem of

machine learning models, transforming data sources into actionable

intelligence. By blending human expertise with AI technology,

Veritone advances human potential to help organizations solve

problems and achieve more than ever before, enhancing lives

everywhere.

To learn more, visit Veritone.com.

Safe Harbor Statement

This news release contains forward-looking statements, including

without limitation, statements regarding our prospects for the

remainder of 2024, our ability to deliver AI solutions to our

customers and serve customer demand, our expectations about

customer demand for our products, our ability to capitalize on

actual or potential acceleration of enterprise-wide generative AI,

our ability to divest non-software assets in a manner that improves

our balance sheet and overall liquidity, our ability to realize

annualized cost-savings including from our recent restructuring,

our ability to drive long-term shareholder value, our ability to

achieve our annual cost savings forecast, our ability to achieve

cash flow profitability as early as Q4 2024, our expected total

revenue from our contract with the NCAA, and our expected total

revenue and non-GAAP net loss for Q2 2024 and for full year 2024.

In addition, words such as “may,” “will,” “expect,” “believe,”

“anticipate,” “intend,” “plan,” “outlook,” “should,” “could,”

“estimate,” “confident” or “continue” or the plural, negative or

other variations thereof or comparable terminology are intended to

identify forward-looking statements, and any statements that refer

to expectations, projections or other characterizations of future

events or circumstances are forward-looking statements. These

forward-looking statements speak only as of the date hereof, and

are based on management’s current assumptions, expectations,

beliefs and information. As such, our actual results could differ

materially and adversely from those expressed in any

forward-looking statement as a result of various factors. Important

factors that could cause such differences include, among other

things, our ability to expand our aiWARE SaaS business; declines or

limited growth in the market for AI-based software applications and

concerns over the use of AI that may hinder the adoption of AI

technologies; our requirements for additional capital and liquidity

to support our operations, our business growth, service our debt

obligations and refinance maturing debt obligations, and the

availability of such capital on acceptable terms, if at all; our

reliance upon a limited number of key customers for a significant

portion of our revenue; declines in customers’ usage of our

products and other offerings; our ability to realize the intended

benefits of our acquisitions, divestitures, and other planned or

ongoing cost-saving measures, including our ability to successfully

integrate our recent acquisition of Broadbean; our identification

of existing material weaknesses in our internal control over

financial reporting; fluctuations in our results over time; the

impact of seasonality on our business; our ability to manage our

growth, including through acquisitions and expansion into

international markets; our ability to enhance our existing products

and introduce new products that achieve market acceptance and keep

pace with technological developments; actions by our competitors,

partners and others that may block us from using third party

technologies in our aiWARE platform, offering it for free to the

public or making it cost prohibitive to continue to incorporate

such technologies into our platform; interruptions, performance

problems or security issues with our technology and infrastructure,

or that of our third party service providers; the impact of the

continuing economic disruption caused by macroeconomic and

geopolitical factors, including the Russia-Ukraine conflict, the

war in Israel, financial instability, high interest rates,

inflationary pressures and the responses by central banking

authorities to control inflation, monetary supply shifts and the

threat of recession in the United States and around the world on

our business operations and those of our existing and potential

customers; and future business decisions, all of which are

difficult or impossible to predict accurately and many of which are

beyond our control. Certain of these judgments and risks are

discussed in more detail in our most recently-filed Annual Report

on Form 10-K, and our most recently-filed Quarterly Report on Form

10-Q and other periodic reports filed from time to time with the

Securities and Exchange Commission. In light of the significant

uncertainties inherent in the forward-looking information included

herein, the inclusion of such information should not be regarded as

a representation by us or any other person that our objectives or

plans will be achieved. The forward-looking statements contained

herein reflect our beliefs, estimates and predictions as of the

date hereof, and we undertake no obligation to revise or update the

forward-looking statements contained herein to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events for any reason, except as required by law.

VERITONE, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(in thousands)

As of

June 30, 2024

December 31, 2023

ASSETS

Cash and cash equivalents

$

46,024

$

79,439

Accounts receivable, net

53,927

69,266

Expenditures billable to clients

28,949

19,608

Prepaid expenses and other current

assets

13,010

14,457

Total current assets

141,910

182,770

Property, equipment and improvements,

net

9,788

8,656

Intangible assets, net

71,447

83,423

Goodwill

79,828

80,247

Long-term restricted cash

933

867

Other assets

17,896

19,851

Total assets

$

321,802

$

375,814

LIABILITIES AND STOCKHOLDERS'

EQUITY (DEFICIT)

Accounts payable

$

33,366

$

32,756

Accrued media payments

69,300

93,896

Client advances

33,341

15,452

Deferred revenue

13,466

12,813

Term Loan, current portion

7,750

5,813

Accrued purchase consideration,

current

919

1,000

Other accrued liabilities

23,516

27,095

Total current liabilities

181,658

188,825

Convertible Notes, non-current

89,846

89,572

Term Loan, non-current

43,890

45,012

Accrued purchase consideration,

non-current

600

633

Other non-current liabilities

11,502

13,625

Total liabilities

327,496

337,667

Total stockholders' equity (deficit)

(5,694

)

38,147

Total liabilities and stockholders' equity

(deficit)

$

321,802

$

375,814

VERITONE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

AND COMPREHENSIVE INCOME

(LOSS)

(in thousands, except per

share and share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue

$

30,992

$

27,967

$

62,628

$

58,230

Operating expenses:

Cost of revenue

6,580

7,765

13,626

14,574

Sales and marketing

12,674

13,124

24,478

25,814

Research and development

6,645

10,519

15,860

22,046

General and administrative

16,765

19,025

36,185

36,422

Amortization

5,990

5,714

11,981

11,143

Total operating expenses

48,654

56,147

102,130

109,999

Loss from operations

(17,662

)

(28,180

)

(39,502

)

(51,769

)

Other income (expense), net

(4,612

)

3,510

(9,015

)

3,865

Loss before provision for income taxes

(22,274

)

(24,670

)

(48,517

)

(47,904

)

(Benefit from) provision for income

taxes

(43

)

(1,374

)

(1,088

)

(1,645

)

Net loss

$

(22,231

)

$

(23,296

)

$

(47,429

)

$

(46,259

)

Net loss per share:

Basic and diluted

$

(0.59

)

$

(0.63

)

$

(1.26

)

$

(1.26

)

Weighted average shares outstanding:

Basic and diluted

37,814,019

36,848,602

37,583,623

36,718,994

Comprehensive loss:

Net loss

$

(22,231

)

$

(23,296

)

$

(47,429

)

$

(46,259

)

Foreign currency translation (loss) gain,

net of income taxes

(220

)

(997

)

(1

)

(1,763

)

Total comprehensive loss

$

(22,451

)

$

(24,293

)

$

(47,430

)

$

(48,022

)

VERITONE, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS (UNAUDITED)

(in thousands)

Six Months Ended June

30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(47,429

)

$

(46,259

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

14,460

12,296

Provision for credit losses

548

(15

)

Stock-based compensation expense

3,747

6,614

Gain on sale of energy group

—

(2,572

)

Change in fair value of contingent

consideration

—

651

Change in deferred taxes

(2,464

)

(1,828

)

Amortization of debt issuance costs

3,027

432

Amortization of right-of-use assets

237

649

Imputed non-cash interest income

(194

)

(65

)

Changes in assets and liabilities:

Accounts receivable

14,792

16,308

Expenditures billable to clients

(9,341

)

70

Prepaid expenses and other assets

1,641

(3,501

)

Other assets

187

(1,613

)

Accounts payable

609

(7,286

)

Deferred revenue

653

8

Accrued media payments

(24,596

)

(34,592

)

Client advances

17,889

(2,264

)

Other accrued liabilities

(898

)

6,652

Other liabilities

341

(2,218

)

Net cash used in operating activities

(26,791

)

(58,533

)

Cash flows from investing

activities:

Proceeds from divestiture

1,800

504

Capital expenditures

(3,399

)

(2,697

)

Acquisitions, net of cash acquired

—

(50,195

)

Settlement of deferred consideration for

acquisitions

—

(2,690

)

Net cash used in investing activities

(1,599

)

(55,078

)

Cash flows from financing

activities:

Payment of debt principal

(1,938

)

—

Payment of purchase consideration

(1,000

)

(7,772

)

Taxes paid related to net share settlement

of equity awards

(456

)

(1,003

)

Proceeds from issuances of stock under

employee stock plans, net

235

643

Settlement of deferred consideration for

acquisitions

(1,800

)

—

Net cash used in financing activities

(4,959

)

(8,132

)

Net decrease in cash and cash equivalents

and restricted cash

(33,349

)

(121,743

)

Cash and cash equivalents and restricted

cash, beginning of period

80,306

185,282

Cash and cash equivalents and restricted

cash, end of period

$

46,957

$

63,539

VERITONE, INC.

REVENUE DETAIL

(UNAUDITED)

(in thousands)

Three Months Ended June

30,

2024

2023

Commercial

Public

Commercial

Public

Enterprise

Sector

Total

Enterprise

Sector

Total

Total Software Products &

Services

$

14,510

$

1,122

$

15,632

$

12,492

$

1,601

$

14,093

Managed Services

Advertising

10,475

—

10,475

8,417

—

8,417

Licensing

4,885

—

4,885

5,457

—

5,457

Total Managed Services

15,360

—

15,360

13,874

—

13,874

Total Revenue

$

29,870

$

1,122

$

30,992

$

26,366

$

1,601

$

27,967

VERITONE, INC.

REVENUE DETAIL

(UNAUDITED)

(in thousands)

Six Months Ended June

30,

2024

2023

Commercial

Public

Commercial

Public

Enterprise

Sector

Total

Enterprise

Sector

Total

Total Software Products &

Services

$

28,212

$

2,640

$

30,852

$

25,224

$

2,996

$

28,220

Managed Services

Advertising

21,450

—

21,450

18,952

—

18,952

Licensing

10,326

—

10,326

11,058

—

11,058

Total Managed Services

31,776

—

31,776

30,010

—

30,010

Total Revenue

$

59,988

$

2,640

$

62,628

$

55,234

$

2,996

$

58,230

VERITONE, INC.

RECONCILIATION OF NON-GAAP NET

INCOME (LOSS) TO GAAP NET LOSS (UNAUDITED)

(in thousands)

Three Months Ended June

30,

2024

2023

Core

Operations(1)

Corporate(2)

Total

Core

Operations(1)

Corporate(2)

Total

Net loss

$

(9,026

)

$

(13,205

)

$

(22,231

)

$

(15,205

)

$

(8,091

)

$

(23,296

)

(Benefit from) provision for income

taxes

(43

)

—

(43

)

(742

)

(632

)

(1,374

)

Depreciation and amortization

6,835

123

6,958

5,818

571

6,389

Stock-based compensation expense

698

1,441

2,139

1,929

768

2,697

Purchase consideration expense(3)

—

568

568

—

—

—

Interest expense, net

—

4,497

4,497

—

720

720

Foreign currency impact

—

(49

)

(49

)

(1,631

)

(28

)

(1,659

)

Gain on debt extinguishment

—

(8

)

(8

)

—

—

—

Acquisition and due diligence costs(4)

—

241

241

—

4,271

4,271

Loss (gain) on sale

—

172

172

—

(2,572

)

(2,572

)

Contribution of business held for

sale(5)

(5

)

—

(5

)

872

—

872

Variable consultant performance bonus

expense (6)

—

—

—

237

—

237

Severance and executive transition

costs

831

80

911

474

215

689

Non-GAAP net loss

$

(710

)

$

(6,140

)

$

(6,850

)

$

(8,248

)

$

(4,778

)

$

(13,026

)

Six Months Ended June

30,

2024

2023

Core

Operations(1)

Corporate(2)

Total

Core

Operations(1)

Corporate(2)

Total

Net loss

$

(20,018

)

$

(27,411

)

$

(47,429

)

$

(27,775

)

$

(18,484

)

$

(46,259

)

(Benefit from) provision for income

taxes

(1,088

)

—

(1,088

)

(1,246

)

(399

)

(1,645

)

Depreciation and amortization

14,244

216

14,460

11,572

724

12,296

Stock-based compensation expense

1,738

2,009

3,747

4,264

2,350

6,614

Change in fair value of contingent

consideration

—

—

—

—

651

651

Purchase consideration expense(3)

—

885

885

—

—

—

Interest expense, net

—

8,488

8,488

9

1,516

1,525

Foreign currency impact

—

363

363

(2,777

)

(43

)

(2,820

)

Gain on debt extinguishment

—

(8

)

(8

)

—

—

—

Acquisition and due diligence costs(4)

140

1,042

1,182

—

5,076

5,076

Loss (gain) on sale

—

172

172

—

(2,572

)

(2,572

)

Contribution of business held for

sale(5)

(2

)

—

(2

)

1,789

—

1,789

Variable consultant performance bonus

expense (6)

—

—

—

631

—

631

Severance and executive transition

costs

3,098

1,663

4,761

1,501

632

2,133

Non-GAAP net loss

$

(1,888

)

$

(12,581

)

$

(14,469

)

$

(12,032

)

$

(10,549

)

$

(22,581

)

(1) Core operations consists of our

consolidated Software Products & Services and Managed Services

that include our content licensing and advertising services, and

their supporting operations, including direct costs of sales as

well as operating expenses for sales, marketing and product

development and certain general and administrative costs dedicated

to these operations.

(2) Corporate consists of general and

administrative functions such as executive, finance, legal, people

operations, fixed overhead expenses (including facilities and

information technology expenses), other income (expenses) and

taxes, and other expenses that support the entire company,

including public company driven costs.

(3) Purchase consideration expense

includes consideration related to acquisitions.

(4) For the three and six months ended

June 30, 2024, acquisition and due diligence costs are comprised of

professional fees related to our acquisitions and divestitures.

(5) Contribution of business held for sale

relates to the net loss for the periods presented for our Energy

Group that we divested during the second quarter of 2023.

(6) Variable consultant performance bonus

expense represents the bonus payments paid to Mr. Chad Steelberg as

a result of his achievement of the performance goals pursuant to

his consulting agreement with us.

VERITONE, INC.

RECONCILIATION OF EXPECTED

NON-GAAP NET INCOME (LOSS) RANGE

TO EXPECTED GAAP NET LOSS

RANGE (UNAUDITED)

(in millions)

Three Months Ended

Year Ended

September 30, 2024

December 31, 2024

Net loss

($15.9) to ($14.9)

($72.2) to ($68.2)

Provision for (benefit from) income

taxes

($0.5)

($0.8)

Interest expense, net

$4.1

$16.6

Depreciation and amortization

$7.0

$30.0

Stock-based compensation expense

$1.5

$6.7

Purchase consideration expense

$0.0

$1.0

Severance and executive transition

costs

$0.0

$3.7

Non-GAAP net income (loss)

($4.0) to ($2.6)

($15.0) to ($11.0)

VERITONE, INC.

RECONCILIATION OF NON-GAAP TO

GAAP FINANCIAL INFORMATION (UNAUDITED)

(in thousands, except per

share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue

$

30,992

$

27,967

$

62,628

$

58,230

Cost of revenue

6,580

7,765

13,626

14,574

Non-GAAP gross profit

24,412

20,202

49,002

43,656

GAAP cost of revenue

6,580

7,765

13,626

14,574

Stock-based compensation expense

—

(17

)

1

(37

)

Non-GAAP cost of revenue

6,580

7,748

13,627

14,537

GAAP sales and marketing expenses

12,674

13,124

24,478

25,814

Depreciation

(24

)

(6

)

(48

)

(12

)

Stock-based compensation expense

(306

)

(529

)

(482

)

(705

)

Contribution of business held for sale

(2)

—

(221

)

—

(484

)

Severance and executive transition

costs

(477

)

(190

)

(980

)

(503

)

Non-GAAP sales and marketing expenses

11,867

12,178

22,968

24,110

GAAP research and development expenses

6,645

10,519

15,860

22,046

Depreciation

(562

)

(292

)

(1,352

)

(519

)

Stock-based compensation expense

(96

)

(1,127

)

(628

)

(2,669

)

Contribution of business held for sale

(2)

—

(559

)

—

(1,117

)

Severance and executive transition

costs

(265

)

(151

)

(1,457

)

(680

)

Non-GAAP research and development

expenses

5,722

8,390

12,423

17,061

GAAP general and administrative

expenses

16,765

19,025

36,185

36,422

Depreciation

(382

)

(377

)

(1,079

)

(622

)

Stock-based compensation expense

(1,737

)

(1,024

)

(2,638

)

(3,203

)

Change in fair value of contingent

consideration

—

—

—

(651

)

Purchase consideration expense (3)

(568

)

—

(885

)

—

Variable consultant performance bonus

expense (4)

—

(237

)

—

(631

)

Contribution of business held for sale

(2)

5

(92

)

2

(188

)

Acquisition and due diligence costs

(5)

(241

)

(4,271

)

(1,182

)

(5,076

)

Severance and executive transition

costs

(169

)

(348

)

(2,324

)

(950

)

Non-GAAP general and administrative

expenses

13,673

12,676

28,079

25,101

GAAP amortization

(5,990

)

(5,714

)

(11,981

)

(11,143

)

GAAP loss from operations

(17,662

)

(28,180

)

(39,502

)

(51,769

)

Total non-GAAP adjustments (1)

10,812

15,155

25,033

29,190

Non-GAAP loss from operations

(6,850

)

(13,025

)

(14,469

)

(22,579

)

GAAP other income (expense), net

(4,612

)

3,510

(9,015

)

3,865

Gain on debt extinguishment

(8

)

—

(8

)

—

Loss (gain) on sale

172

(2,572

)

172

(2,572

)

Foreign currency impact

(49

)

(1,659

)

363

(2,820

)

Interest expense, net

4,497

720

8,488

1,525

Non-GAAP other expense, net

—

(1

)

—

(2

)

GAAP loss before income taxes

(22,274

)

(24,670

)

(48,517

)

(47,904

)

Total non-GAAP adjustments (1)

15,424

11,644

34,048

25,323

Non-GAAP loss before income taxes

(6,850

)

(13,026

)

(14,469

)

(22,581

)

(Benefit from) provision for income

taxes

(43

)

(1,374

)

(1,088

)

(1,645

)

GAAP net loss

(22,231

)

(23,296

)

(47,429

)

(46,259

)

Total non-GAAP adjustments (1)

15,381

10,270

32,960

23,678

Non-GAAP net loss

$

(6,850

)

$

(13,026

)

$

(14,469

)

$

(22,581

)

Shares used in computing non-GAAP basic

and diluted net loss per share (in 000's)

37,814

36,849

37,584

36,719

Non-GAAP basic and diluted net loss per

share

$

(0.18

)

$

(0.35

)

$

(0.38

)

$

(0.61

)

(1) Adjustments are comprised of the

adjustments to GAAP cost of revenue, sales and marketing expenses,

research and development expenses and general and administrative

expenses and other income (expense), net (where applicable) listed

above.

(2) Contribution of business held for sale

relates to the net loss for the periods presented for our Energy

Group that we divested during Q2 2023.

(3) Purchase consideration expense

includes consideration related to acquisitions.

(4) Variable consultant performance bonus

expense represents the bonus payments paid to Mr. Chad Steelberg as

a result of his achievement of the performance goals pursuant to

his consulting agreement with us.

(5) For the three and six months ended

June 30, 2024, acquisition and due diligence costs are comprised of

professional fees related to our acquisitions and divestitures.

VERITONE, INC. SUPPLEMENTAL FINANCIAL

INFORMATION

We are providing the following unaudited supplemental financial

information as a lookback of prior years to explain our recent

historical and year-over-year performance. The Software Products

& Services supplemental financial information is presented on a

Pro Forma basis, as further described below.

Software Products & Services Supplemental Financial

Information

Quarter Ended

Mar 31,

Jun 30,

Sept 30,

Dec 31,

Mar 31,

Jun 30,

Sept 30,

Dec 31,

Mar 31,

Jun 30,

2022 (1)

2022 (1)

2022 (1)

2022 (1)

2023 (1)

2023 (1)

2023

2023

2024

2024

Pro Forma Software Revenue (in

000's) (2)

$

26,319

$

26,650

$

28,603

$

35,612

$

22,423

$

20,859

$

20,361

$

19,824

$

15,223

$

15,632

Total Software Products &

Services Customers (3)

3,673

3,718

3,787

3,824

3,773

3,705

3,536

3,459

3,384

3,437

Annual Recurring Revenue (SaaS)

(in 000's) (4)

$

48,392

$

44,465

$

43,925

$

46,248

$

45,453

$

47,720

$

47,756

$

49,122

$

49,064

$

49,223

Annual Recurring Revenue

(Consumption) (in 000's) (5)

$

87,445

$

85,901

$

85,091

$

71,754

$

67,242

$

60,229

$

41,543

$

30,967

$

23,510

$

18,701

Total New Bookings (in 000's)

(6)

$

16,643

$

22,009

$

23,793

$

26,342

$

22,794

$

8,388

$

15,501

$

17,457

$

12,964

$

14,047

Gross Revenue Retention (7)

>90%

>90%

>90%

>90%

>90%

>90%

>90%

>90%

>90%

>90%

(1) All of the supplemental financial

information for this period is presented on a Pro Forma basis

inclusive of Broadbean.

(2) “Pro Forma Software Revenue” is a

non-GAAP measure that represents Software Products & Services

revenue on a Pro Forma basis.

(3) “Total Software Products &

Services Customers” includes Software Products & Services

customers as of the end of each respective quarter set forth above

with net revenues in excess of $10 and also excludes any customers

categorized by us as trial or pilot status. In prior periods, we

provided “Ending Software Customers,” which represented Software

Products & Services customers as of the end of each fiscal

quarter with trailing twelve-month revenues in excess of $2,400 for

both Veritone, Inc. and PandoLogic Ltd. and/or deemed by the

Company to be under an active contract for the applicable periods.

Total Software Products & Services Customers is not comparable

to Ending Software Customers. Total Software Products &

Services Customers includes customers based on revenues in the last

month of the quarter rather than on a trailing twelve-month basis.

Total Software Products & Services Customers includes customers

based on revenues in the last month of the quarter rather than on a

trailing twelve-month basis and excludes any customers that are on

trial or pilot status with us rather than including customers with

active contracts. Management uses Total Software Products &

Services Customers and we believe Total Software Products &

Services Customers are useful to investors because it more

accurately reflects our total customers for our Software Products

& Services customers inclusive of Broadbean.

(4) “Annual Recurring Revenue (SaaS)”

represents an annualized calculation of monthly recurring revenue

during the last month of the applicable quarter for all Total

Software Products & Services customers, in each case on a Pro

Forma basis. In prior periods, we provided “Average Annual

Revenue,” which was calculated as the aggregate of trailing

twelve-month Software Products & Services revenue divided by

the average number of customers over the same period for both

Veritone, Inc. and PandoLogic Ltd. Annual Recurring Revenue is not

comparable to Average Annual Revenue (SaaS). Annual Recurring

Revenue (SaaS) includes only subscription-based SaaS revenue, is

not averaged among active customers and uses a calculation of

recurring revenue as described above instead of annual revenue.

Management uses “Annual Recurring Revenue (SaaS)” and we believe

Annual Recurring Revenue (SaaS) is useful to investors because

Broadbean significantly increases our mix of subscription-based

SaaS revenues as compared to Consumption revenues and the split

between the two allows the reader to delineate between predictable

recurring SaaS revenues and more volatile Consumption revenues.

(5) “Annual Recurring Revenue

(Consumption)” represents the trailing twelve months of all

non-recurring and/or consumption-based revenue for all active Total

Software Products & Services customers, in each case, on a Pro

Forma basis. In prior periods, we provided “Average Annual

Revenue,” which was calculated as the aggregate of trailing

twelve-month Software Products & Services revenue divided by

the average number of customers over the same period for both

Veritone, Inc. and PandoLogic Ltd. Annual Recurring Revenue

(Consumption) is not comparable to Average Annual Revenue. Annual

Recurring Revenue (Consumption) includes only non-recurring and/or

consumption-based revenue, is not averaged among active customers

and uses a calculation of recurring revenue as described above

instead of annual revenue. Management uses “Annual Recurring

Revenue (Consumption)” and we believe Annual Recurring Revenue

(Consumption) is useful to investors because Broadbean

significantly increases our mix of subscription-based SaaS revenues

as compared to Consumption revenues and the split between the two

allows the reader to delineate between predictable recurring SaaS

revenues and more volatile Consumption revenues.

(6) “Total New Bookings” represents the

total fees payable during the full contract term for new contracts

received in the quarter (including fees payable during any

cancellable portion and an estimate of license fees that may

fluctuate over the term), excluding any variable fees under the

contract (e.g., fees for cognitive processing, storage,

professional services and other variable services), in each case on

a Pro Forma basis.

(7) “Gross Revenue Retention” represents a

calculation of our dollar-based gross revenue retention rate as of

the period end by starting with the revenue from Software Products

& Services Customers as of the 3 months in the prior year

quarter to such period, or Prior Year Quarter Revenue. We then

deduct from the Prior Year Quarter Revenue any revenue from

Software Products & Services Customers who are no longer

customers as of the current period end, or Current Period Ending

Software Customer Revenue. We then divide the total Current Period

Ending Software Customer Revenue by the total Prior Year Quarter

Revenue to arrive at our dollar-based gross retention rate, which

is the percentage of revenue from all Software Products &

Services Customers from our Software Products & Services as of

the year prior that is not lost to customer churn. All numbers used

to determine Gross Revenue Retention are calculated on a Pro Forma

basis.

The following table sets forth the reconciliation of revenue to

pro forma revenue and the calculation of pro forma annual recurring

revenue.

Quarter Ended

Mar 31,

Jun 30,

Sept 30,

Dec 31,

Mar 31,

Jun 30,

Sept 30,

Dec 31,

Mar 31,

Jun 30,

2022

2022

2022

2022

2023

2023

2023

2023

2024

2024

Software Products & Services Revenue

(in 000’s)

$

18,167

$

18,379

$

20,812

$

27,220

$

14,127

$

14,093

$

20,361

$

19,820

$

15,220

$

15,632

Broadbean Revenue (in 000’s) (1)

6,204

6,974

7,639

8,230

8,156

8,374

8,739

8,662

8,517

8,690

Broadbean Revenue included in Software

Products & Services Revenue (in 000’s)

—

—

—

—

—

(1,716

)

(8,739

)

(8,662

)

(8,517

)

(8,690

)

Pro Forma Software Revenue (in 000’s)

$

24,371

$

25,353

$

28,451

$

35,450

$

22,283

$

20,751

$

20,361

$

19,820

$

15,220

$

15,632

Managed Services Revenue (in 000’s)

16,240

15,856

16,384

16,670

16,136

13,874

14,772

14,377

16,416

15,360

Total Pro Forma Revenue (in 000’s)

$

40,611

$

41,209

$

44,835

$

52,120

$

38,419

$

34,625

$

35,133

$

34,197

$

31,636

$

30,992

Trailing Twelve Months

Ended

Mar 31,

Jun 30,

Sept 30,

Dec 31,

Mar 31,

Jun 30,

Sept 30,

Dec 31,

Mar 31,

Jun 30,

2022

2022

2022

2022

2023

2023

2023

2023

2024

2024

Software Products & Services Revenue

(in 000’s)

$

72,997

$

85,796

$

97,581

$

84,578

$

80,538

$

76,252

$

75,801

$

68,401

$

69,494

$

71,033

Broadbean Revenue (in 000’s) (1)

29,599

30,006

30,136

29,047

30,999

32,399

33,499

33,931

34,292

34,608

Broadbean Revenue included in Software

Products & Services Revenue (in 000’s)

—

—

—

—

—

(1,716

)

(10,455

)

(19,117

)

(27,634

)

(34,608

)

Pro Forma Software Revenue (in 000’s)

$

102,596

$

115,802

$

127,717

$

113,625

$

111,537

$

106,935

$

98,845

$

83,215

$

76,152

$

71,033

Managed Services Revenue (in 000’s)

58,419

60,546

63,406

65,150

65,046

63,064

61,452

59,159

59,439

60,925

Total Pro Forma Revenue (in 000’s)

$

161,015

$

176,348

$

191,123

$

178,775

$

176,583

$

169,999

$

160,297

$

142,374

$

135,591

$

131,958

Pro Forma Total Number of Customers

3,673

3,718

3,787

3,824

3,773

3,705

3,536

3,459

3,384

3,437

Pro Forma Annual Recurring Revenue (in

000’s) (2)

$

135,837

$

130,366

$

129,016

$

118,002

$

112,695

$

107,949

$

89,299

$

80,089

$

72,574

$

67,924

(1) “Pro Forma Software Revenue” includes

historical Software Products & Services Revenue from the past

eight (8) fiscal quarters of each of Veritone, Inc. and Broadbean

and presents such revenue on a combined pro forma basis treating

Broadbean as owned by Veritone, Inc. since January 1, 2022.

(2) “Pro Forma Annual Recurring Revenue”

represents an annualized calculation of the monthly recurring

revenue in the last period of the calculated quarter, combined with

the trailing twelve month calculation for all non-recurring and/or

consumption based revenue for all active customers.

Managed Services Supplemental Financial Information

The following table sets forth the results for each of the key

performance indicators for Managed Services.

Quarter Ended

Mar 31,

Jun 30,

Sept 30,

Dec 31,

Mar 31,

Jun 30,

Sept 30,

Dec 31,

Mar 31,

Jun 30,

2022

2022

2022

2022

2023

2023

2023

2023

2024

2024

Avg billings per active Managed Services

client (in 000's)(1)

$

684

$

736

$

747

$

823

$

771

$

576

$

620

$

647

$

793

$

727

Revenue during quarter (in 000's)(2)

$

10,735

$

9,625

$

10,035

$

11,074

$

9,337

$

6,876

$

8,827

$

8,612

$

9,333

$

8,402

(1) Avg billings per active Managed

Services customer for each quarter reflects the average quarterly

billings per active Managed Services customer over the twelve-month

period through the end of such quarter for Managed Services

customers that are active during such quarter.

(2) Managed Services revenue and metrics

exclude content licensing and media services and Table Rock

Management.

VERITONE, INC.

RECONCILIATION OF NON-GAAP

GROSS PROFIT TO LOSS FROM OPERATIONS

(in thousands)

(dollars in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Loss from operations

$

(17,662

)

$

(28,180

)

$

(39,502

)

$

(51,769

)

Sales and marketing

12,674

13,124

24,478

25,814

Research and development

6,645

10,519

15,860

22,046

General and administrative

16,765

19,025

36,185

36,422

Amortization

5,990

5,714

11,981

11,143

Non-GAAP gross profit

$

24,412

$

20,202

$

49,002

$

43,656

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808718004/en/

Company Contact: Mike Zemetra Chief Financial Officer

Veritone, Inc. investors@veritone.com

IR Agency Contact: Stefan Norbom Prosek Partners

203-644-5475 snorbom@prosek.com

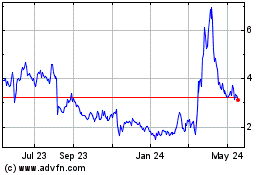

Veritone (NASDAQ:VERI)

Historical Stock Chart

From Dec 2024 to Jan 2025

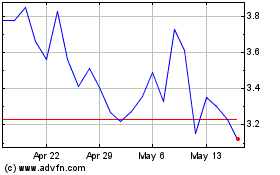

Veritone (NASDAQ:VERI)

Historical Stock Chart

From Jan 2024 to Jan 2025