0001327811FALSE00013278112025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 5, 2025

WORKDAY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35680 | 20-2480422 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

6110 Stoneridge Mall Road

Pleasanton, California 94588

(Address of principal executive offices)

Registrant’s telephone number, including area code: (925) 951-9000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 | WDAY | The Nasdaq Stock Market LLC |

| | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition

Workday, Inc. (“Workday”) expects its fiscal 2025 fourth quarter and full-year financial results to be in-line with or above its guidance as provided on its fiscal 2025 third quarter earnings call on November 26, 2024, with the exception of its GAAP operating margin, due to the restructuring plan discussed in Item 2.05 below (the “Plan”). Workday now expects its fiscal 2025 fourth quarter GAAP operating margin to be 22 to 23 percentage points lower than its fourth quarter non-GAAP operating margin and its fiscal 2025 full-year GAAP operating margin to be 21 percentage points lower than its full-year non-GAAP operating margin. Workday intends to exclude the charges associated with the Plan from its non-GAAP financial measures.

These results are based on preliminary unaudited financial and other information, and subject to normal quarterly closing processes and accounting review. As previously announced, Workday is scheduled to report its fiscal 2025 fourth quarter and full-year financial results on Tuesday, February 25, 2025.

Item 2.05 - Costs Associated with Exit or Disposal Activities

On February 5, 2025, Workday announced a restructuring Plan intended to prioritize its investments and continue advancing Workday’s ongoing focus on durable growth. The Plan is expected to result in the elimination of approximately 1,750 positions, or 8.5% of Workday’s current workforce. Workday expects to continue to hire in key strategic areas and locations throughout its fiscal year ending January 31, 2026. In connection with the Plan, Workday expects to exit certain owned office space.

Workday estimates that it will incur approximately $230 million to $270 million in charges in connection with the Plan, of which approximately $60 million to $70 million is expected to be recognized in the fourth quarter of fiscal 2025, and the remainder is expected to be recognized in the first quarter of fiscal 2026. These charges consist primarily of approximately $145 million to $175 million of future cash expenditures related to severance payments, employee benefits, and related costs; and approximately $50 million to $60 million in non-cash charges for stock-based compensation. The charges also consist of approximately $35 million in non-cash charges related to the impairment of office space that Workday expects to record in the first quarter of fiscal 2026.

The actions associated with the Plan are expected to be substantially complete by the second quarter of fiscal 2026, subject to local law and consultation requirements.

The estimates of the charges and expenditures that Workday expects to incur in connection with the Plan, and the timing thereof, are subject to a number of assumptions, including local law requirements in various jurisdictions, and actual amounts may differ materially from estimates. In addition, Workday may incur other charges or cash expenditures not currently contemplated due to unanticipated events that may occur, including in connection with the implementation of the Plan.

Item 2.06 - Material Impairments

The information contained in Item 2.05 above with respect to impairment charges related to office space is incorporated herein by reference.

Item 7.01 – Regulation FD Disclosure

A note to Workday’s employees from Workday’s Chief Executive Officer regarding these actions is attached to this Current Report on Form 8-K as Exhibit 99.1 The information in the note attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Forward-Looking Statements

This Current Report on Form 8-K and the accompanying note to Workday’s employees contain forward-looking statements including, but not limited to, statements related to the expected benefits and impact of the Plan, the number and percentage of employees to be impacted, the estimate and timing of the charges that will be incurred, and Workday’s financial outlook for the fourth quarter and fiscal year ended January 31, 2025. These forward-looking statements are based only on currently available information and Workday’s current beliefs, expectations, and assumptions. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties, assumptions, and changes in circumstances that are difficult to predict and many of which are outside of Workday’s control. If the risks materialize, assumptions prove incorrect, or Workday experiences unexpected changes in circumstances, actual results could differ materially from the results implied by these forward-looking statements, and therefore you should not rely on any forward-looking statements. Risks include, but are not limited to, the risk that we may not realize the anticipated benefits of the Plan to the extent or as quickly as anticipated or at all, the risk that the Plan costs and charges may be greater than anticipated, the risk the Plan could negatively impact to our ability to recruit and retain skilled personnel, the risk that the Plan could negatively impact our business operations, as well as the risks described in Workday’s filings with the Securities and Exchange Commission (“SEC”), including Workday’s most recent report on Form 10-Q or Form 10-K and other reports that Workday has filed and will file with the SEC from time to time, which could cause actual results to vary from expectations. Workday assumes no obligation to, and does not currently intend to, update any such forward-looking statements after the date of this report, except as required by law.

Item 9.01 – Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 5, 2025 | | | | | |

| | Workday, Inc. |

| | /s/ Richard H. Sauer |

| | Richard H. Sauer |

| Chief Legal Officer, Head of Corporate Affairs, and Corporate Secretary |

Exhibit 99.1

Subject: Changes to Position Workday for the Future

Workmates,

Our journey at Workday has always been about challenging the status quo, embracing change, and putting our customers at the heart of everything we do. As we start our new fiscal year, we’re at a pivotal moment. Companies everywhere are reimagining how work gets done, and the increasing demand for AI has the potential to drive a new era of growth for Workday.

This creates a massive opportunity for us, but we need to make some changes to better align our resources with our customers' evolving needs. This means investing strategically, helping teams work better together, bringing innovations to market faster, and making it easier for our customers and partners to work with us.

To help us achieve this, we have made the difficult, but necessary, decision to eliminate approximately 1,750 positions, or 8.5% of our current workforce. We'll start meeting with affected employees shortly, with the goal of reaching as many as possible today, subject to local requirements where a consultation period is required.

I realize this is tough news, and it affects all of us—the Workmates who are leaving and those who’ll continue with us. I encourage you to work from home or head home, if you’re already in the office.

Why We’re Making These Changes

The environment we’re operating in today demands a new approach, particularly given our size and scale. We have to adapt by thinking differently, acting boldly, and investing strategically. We’ll be evolving throughout FY26 in a few important ways:

•Prioritizing investments: While we are eliminating some positions, we will continue to hire in key strategic areas and locations throughout FY26. We're also prioritizing innovation investments like AI and platform development, and rigorously evaluating the ROI of others across the board.

•Re-engineering processes: We're evolving our processes to empower faster decision-making and to accelerate innovation.

•Clarifying roles and responsibilities: We're ensuring everyone has a clear understanding of their contributions to our shared success.

•Expanding our global footprint: We're investing in strategic locations with strong talent to better serve our customers worldwide.

Supporting our Workmates

To those who are leaving us, I want to express my sincere gratitude for your hard work, dedication, and the valuable contributions you've made to Workday's success. We are committed to providing support and resources to help you navigate this transition.

Affected employees in the U.S. will be offered a minimum of 12 weeks of pay, with additional weeks based on tenure. In addition, they will be offered additional vesting of restricted stock unit grants, career services, benefits support, and immigration support. Outside the U.S., affected employees will be offered packages based on local standards, which will be aligned with U.S. packages, where possible.

Next Steps

To those of you who will continue this journey with us, I'm grateful for your dedication and partnership as we move into Workday's next chapter. Your contributions will be vital to our future success. I will share additional thoughts on this news in our company meeting tomorrow, including our approach to hiring and location strategy.

In a couple of weeks, we’ll hold our company kickoff to go deeper into our updated strategic plans and key investment areas. This will be an important opportunity to connect and hear more about our vision for the future.

We have so much opportunity ahead of us, especially with the potential of AI, and we have a strong foundation to build upon. While we have work ahead to realize our vision and full potential, today is about focusing on taking care of each other. I am proud and grateful for how you support one another, our customers and partners—particularly in moments like these.

Carl

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

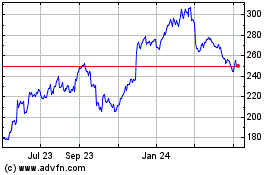

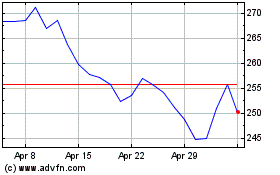

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Feb 2024 to Feb 2025