false

0000946486

0000946486

2024-12-04

2024-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 4, 2024

Windtree Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| |

|

|

|

Delaware

|

001-39290

|

94-3171943

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

2600 Kelly Road, Suite 100, Warrington, Pennsylvania

|

18976

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (215) 488-9300

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.001 per share

|

|

WINT

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On December 4, 2024, Windtree Therapeutics, Inc. (the “Company”) issued a press release announcing that the Company has engaged a strategic advisor to lead a process in respect of its cardiovascular portfolio. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

The following exhibits are being filed herewith:

|

Exhibit

No.

|

|

Document

|

| |

|

|

|

99.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Windtree Therapeutics, Inc.

|

|

| |

|

|

|

| |

By:

|

/s/ Jed Latkin

|

|

| |

Name:

|

Jed Latkin

|

|

| |

Title:

|

President and Chief Executive Officer

|

|

Date: December 4, 2024

Exhibit 99.1

Windtree Announces Partnership with New Growth Advisors

to Leverage Positive Phase 2 Istaroxime Study in Cardiogenic Shock for a Potential Strategic Transaction

WARRINGTON, PA – December 4, 2024 – Windtree Therapeutics, Inc. (“Windtree” or the “Company”) (NasdaqCM: WINT), a biotechnology company focused on advancing early and late-stage innovative therapies for critical conditions and diseases, today announced that it has engaged New Growth Advisors (“NGA”), a leading life sciences consulting firm chosen by companies seeking discreet, conflict-free, and knowledgeable advice on complex M&A, asset sale, research, capital markets, and licensing transactions, as its strategic advisor to lead a process in respect of Windtree’s cardiovascular portfolio, including a potential out-licensing transaction or asset sale. NGA has advised on transactions with an aggregate value approaching $400 million from 2023 through 2024.

The Company seeks to leverage the positive early cardiogenic shock and acute heart failure results (including the recent positive Phase 2b in early cardiogenic shock) to better address the breadth of opportunities and secure potentially non-dilutive funding via a partnership for istaroxime as well as the next generation, oral SERCA2a activators for all global territory ex-Greater China. NGA has been engaged to manage the current inbound interest as well as to run an expanded out-licensing process.

The Company currently has a licensing agreement for the Greater China territory for istaroxime, dual mechanism SERCA2a activators and rostafuroxin with Lee’s Pharmaceuticals (HK) Limited (“Lee’s”) for which it may receive up to $138 million in potential milestones and low double-digit royalties. Lee’s pays for all development costs and is working with Windtree on the planning, Lee’s expects to start Phase 3 in acute heart failure in its licensed territory in the first half of 2025.

“It seems that there has been a heightened focus on cardiovascular assets and programs by the larger pharmaceutical companies and with our four positive Phase 2 istaroxime studies, including the recent positive Phase 2b SEISMiC study in early cardiogenic shock, we believe it is a good time to run a rigorous outreach and process with an experienced, well-connected business development advisor,” said Jed Latkin, CEO of Windtree. “We look forward to discussions with pharmaceutical companies to evaluate the opportunities with our first-in-class cardiovascular assets. If a deal is consummated, Windtree plans to leverage the partner to progress the cardiovascular program and use some of the proceeds to support advancement of its novel, preclinical oncology platform.”

About New Growth Advisors

NGA is a strategic advisor to emerging companies in the life sciences industry. Partners and team members are veteran bankers and executives with deep industry experience, knowledge, and networks. NGA is chosen by companies seeking discreet, conflict-free, and knowledgeable advice on complex M&A, asset sale, research, capital markets, and licensing transactions. The firm is further differentiated from boutique life sciences advisory practices by the breadth of global relations – clients and strategic partners. Approximately 1/3 of transactions advised on are cross-border. NGA has advised on transactions with an aggregate value approaching $400 million from 2023 through 2024.

About Istaroxime

Istaroxime is a first-in-class dual-mechanism therapy designed to improve both systolic and diastolic cardiac function. Istaroxime is designed as a positive inotropic agent that increases myocardial contractility through inhibition of Na+/K+- ATPase with a complimentary mechanism that facilitates myocardial relaxation through activation of the SERCA2a calcium pump on the sarcoplasmic reticulum enhancing calcium reuptake from the cytoplasm. Data from multiple Phase 2 studies in patients with early cardiogenic shock or acute decompensated heart failure have demonstrated that istaroxime infused intravenously significantly improves cardiac function and blood pressure without increasing heart rate or the incidence of cardiac rhythm disturbances.

About Windtree Therapeutics, Inc.

Windtree Therapeutics, Inc. is a biotechnology company focused on advancing early and late-stage innovative therapies for critical conditions and diseases. Windtree’s portfolio of product candidates includes istaroxime, a Phase 2 candidate with SERCA2a activating properties for acute heart failure and associated cardiogenic shock, preclinical SERCA2a activators for heart failure and preclinical precision aPKCi inhibitors that are being developed for potential in rare and broad oncology applications. Windtree also has a licensing business model with partnership out-licenses currently in place.

Forward Looking Statements

This press release contains statements related to the potential clinical effects of istaroxime; the potential benefits and safety of istaroxime; the clinical development of istaroxime; and our research and development program for treating patients in early cardiogenic shock due to heart failure. Such statements constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. The Company may, in some cases, use terms such as “predicts,” “believes,” “potential,” “proposed,” “continue,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Such statements are based on information available to the Company as of the date of this press release and are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from the Company’s current expectations. Examples of such risks and uncertainties include, among other things: the Company’s ability to secure significant additional capital as and when needed; the Company’s ability to achieve the intended benefits of the aPKCi asset acquisition with Varian Biopharmaceuticals, Inc.; the Company’s risks and uncertainties associated with the success and advancement of the clinical development programs for istaroxime and the Company’s other product candidates, including preclinical oncology candidates; the Company’s ability to access the debt or equity markets; the Company’s ability to secure and successfully complete an out-licensing or asset acquisition transaction; the Company’s ability to manage costs and execute on its operational and budget plans; the results, cost and timing of the Company’s clinical development programs, including any delays to such clinical trials relating to enrollment or site initiation; risks related to technology transfers to contract manufacturers and manufacturing development activities; delays encountered by the Company, contract manufacturers or suppliers in manufacturing drug products, drug substances, and other materials on a timely basis and in sufficient amounts; risks relating to rigorous regulatory requirements, including that: (i) the U.S. Food and Drug Administration or other regulatory authorities may not agree with the Company on matters raised during regulatory reviews, may require significant additional activities, or may not accept or may withhold or delay consideration of applications, or may not approve or may limit approval of the Company’s product candidates, and (ii) changes in the national or international political and regulatory environment may make it more difficult to gain regulatory approvals and risks related to the Company’s efforts to maintain and protect the patents and licenses related to its product candidates; risks that the Company may never realize the value of its intangible assets and have to incur future impairment charges; risks related to the size and growth potential of the markets for the Company’s product candidates, and the Company’s ability to service those markets; the Company’s ability to develop sales and marketing capabilities, whether alone or with potential future collaborators; the rate and degree of market acceptance of the Company’s product candidates, if approved; the economic and social consequences of the COVID-19 pandemic and the impacts of political unrest, including as a result of geopolitical tension, including the conflict between Russia and Ukraine, the People’s Republic of China and the Republic of China (Taiwan), and the evolving events in the Middle East, and any sanctions, export controls or other restrictive actions that may be imposed by the United States and/or other countries which could have an adverse impact on the Company’s operations, including through disruption in supply chain or access to potential international clinical trial sites, and through disruption, instability and volatility in the global markets, which could have an adverse impact on the Company’s ability to access the capital markets. These and other risks are described in the Company’s periodic reports, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, filed with or furnished to the Securities and Exchange Commission and available at www.sec.gov. Any forward-looking statements that the Company makes in this press release speak only as of the date of this press release. The Company assumes no obligation to update forward-looking statements whether as a result of new information, future events or otherwise, after the date of this press release.

Contact Information:

Windtree:

Eric Curtis

ecurtis@windtreetx.com

New Growth Advisors:

Stephen Cervieri

scervieri@ngadvisorsltd.com

v3.24.3

Document And Entity Information

|

Dec. 04, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Windtree Therapeutics, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 04, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-39290

|

| Entity, Tax Identification Number |

94-3171943

|

| Entity, Address, Address Line One |

2600 Kelly Road

|

| Entity, Address, Address Line Two |

Suite 100

|

| Entity, Address, City or Town |

Warrington

|

| Entity, Address, State or Province |

PA

|

| Entity, Address, Postal Zip Code |

18976

|

| City Area Code |

215

|

| Local Phone Number |

488-9300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

WINT

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000946486

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

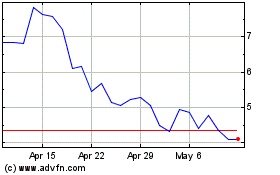

Windtree Therapeutics (NASDAQ:WINT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Windtree Therapeutics (NASDAQ:WINT)

Historical Stock Chart

From Dec 2023 to Dec 2024