UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-34152

WESTPORT FUEL SYSTEMS INC.

(Translation of registrant's name into English)

1691 West 75th Avenue, Vancouver, British Columbia, Canada, V6P 6P2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

On August 13, 2024, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

(c) Exhibit 99.1. Press release dated August 13, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | WESTPORT FUEL SYSTEMS INC. |

| | | (Registrant) |

| | | |

| | | |

| Date: August 13, 2024 | | /s/ William Larkin |

| | | William Larkin |

| | | Chief Financial Officer |

| | | |

EXHIBIT 99.1

Westport Reports Second Quarter 2024 Financial Results and Revises Segment Reporting

VANCOUVER, British Columbia, Aug. 13, 2024 (GLOBE NEWSWIRE) -- Westport Fuel Systems Inc. (“Westport") (TSX:WPRT / Nasdaq:WPRT), a leading supplier of advanced alternative fuel systems and components for the global transportation industry, reported financial results for the second quarter ended June 30, 2024, and provided an update on operations. All figures are in U.S. dollars unless otherwise stated.

“In the second quarter of 2024, we remained focused on implementing the Company’s three strategic pillars: harnessing the potential of our HPDI joint venture, enhancing operational excellence, and continuous innovation to shape the world’s hydrogen-powered future. We celebrated several accomplishments consistent with our priorities and continue to recognize we have more work to do. The closing of our HPDI joint venture with Volvo Group in June was a transformational step forward and represents one of many steps we are taking to evolve the Company. Our financial results in the quarter were strong, with results from our cost cutting initiatives, along with recent growth projects delivering demonstrated margin improvement.

On July 4th, together with Volvo Group, we celebrated our partnership for the future of HPDI. By combining their extensive expertise in commercial vehicle manufacturing with our innovative fuel system technology, we are creating a powerful force for change. Together we are committed to delivering sustainable, efficient, and economically viable solutions for long-haul transportation.

Finally, our evolving business strategy has long recognized the value of strategic partnerships, and our collaboration within the HPDI joint venture exemplifies this approach. By aligning with the right partners, we amplify our strengths and leverage shared expertise to drive innovation more efficiently and effectively. As we continue to adapt and refine our focus, we have restructured our business into five key segments – HPDI JV, Light-Duty, High-Pressure Controls and Systems, Heavy-Duty OEM and Corporate. This reorganization strengthens the alignment between our competitive strategy and internal operations, positioning us to deliver sustainable, profitable growth over time. Our new structure empowers our team to be more agile, accountable, and sharply focused on achieving our long-term goals."

Dan Sceli, Chief Executive Officer, Westport Fuel Systems

Q2 2024 Highlights

- Revenues decreased by 2% to $83.4 million compared to $85.0 million in the same quarter last year, primarily driven by decreased sales volumes in our Light-Duty segment. This was partially offset by increased sales volume in our High-Pressure Controls and Systems and Heavy-Duty Original Equipment Manufacturer ("OEM") segments in the quarter. Revenue for the three months ended June 30, 2024 includes two months of revenue from Heavy-Duty OEM.

- Net income of $5.8 million for the quarter compared to net loss of $13.2 million for the same quarter last year. This was primarily the result of a $13.3 million gain on deconsolidation of the HPDI business and formation of the HPDI joint venture ("HPDI JV") with Volvo Group, improvement in gross margin of $2.7 million, decrease in foreign exchange loss by $2.3 million and depreciation and amortization by $1.3 million, partially offset by an increase in research and development expenditures of $0.8 million.

- Adjusted EBITDA[1] of negative $2.0 million compared to negative $4.0 million for the same period in 2023.

- Cash and cash equivalents were $41.5 million at the end of the second quarter 2024. Cash provided by operating activities was $1.5 million, primarily driven by net cash generated from working capital of $4.5 million, partially offset by operating losses in the quarter. Investing activities included the sale of investments for $20.4 million related to partial sale of our ownership interest in the HPDI JV and the Minda Westport JV, offset by cash capital contributions into the newly formed HPDI JV of $9.9 million and the purchase of capital assets of $5.4 million. Cash used in financing activities was primarily attributed to net debt repayments of $8.9 million in the period. An additional $8.4 million related to the closing of the HPDI JV was received following the end of the second quarter.

- Announced the closing the HPDI joint venture with Volvo Group, working together to accelerate the commercialization and global adoption of the HPDI™ fuel system technology for long-haul and off-road applications.

| CONSOLIDATED RESULTS | | | |

($ in millions, except per share amounts)

| | Over / (Under) %

| | Over / (Under) %

|

| 2Q24 | 2Q23 | 1H24 | 1H23 |

| Revenues | $ | 83.4 | | $ | 85.0 | | (2 | )% | $ | 161.0 | | $ | 167.3 | | (4 | )% |

| Gross Margin(2) | | 17.1 | | | 14.4 | | 19 | % | | 28.8 | | | 27.7 | | 4 | % |

| Gross Margin % | | 21 | % | | 17 | % | | | 18 | % | | 17 | % | |

| Income (loss) from Investments Accounted for by the Equity Method(1) | | (0.7 | ) | | 0.1 | | (800 | )% | | (0.7 | ) | | 0.2 | | (450 | )% |

| Net Income (Loss) | $ | 5.8 | | $ | (13.2 | ) | 144 | % | $ | (7.8 | ) | $ | (23.8 | ) | 67 | % |

| Net Income (Loss) per Share - Basic | $ | 0.34 | | $ | (0.77 | ) | 144 | % | $ | (0.45 | ) | $ | (1.39 | ) | 68 | % |

| Net Income (Loss) per Share - Diluted | $ | 0.33 | | $ | (0.77 | ) | 143 | % | $ | (0.45 | ) | $ | (1.39 | ) | 68 | % |

| EBITDA(2) | $ | 9.0 | | $ | (10.1 | ) | 189 | % | $ | (0.2 | ) | $ | (16.4 | ) | 99 | % |

| Adjusted EBITDA(2) | $ | (2.0 | ) | $ | (4.0 | ) | 50 | % | $ | (8.6 | ) | $ | (8.5 | ) | (1 | )% |

(1) This includes income from our Minda Westport Technologies Limited joint ventures.

(2) Gross margin, EBITDA and Adjusted EBITDA are non-GAAP measures. Please refer to GAAP and NON-GAAP FINANCIAL MEASURES for the reconciliation to equivalent GAAP measures and limitations on the use of such measures.

Revised Segment Reporting

Aligning with Westport's evolving business strategy, the Company has refined its business operations and decision-making. Beginning with the second quarter of 2024, Westport will report results under five reportable segments: HPDI JV, Light-Duty, High-Pressure Controls and Systems, Heavy-Duty OEM and Corporate. Financial results from the HPDI joint venture are being accounted for under the equity method of accounting for investments and are also supported by enhanced disclosures in the Company's Management Discussion and Analysis as well as in the Company's condensed consolidated financial statements. The new segments are aligned more strongly with Westport's strategic priorities and provide enhanced disclosure regarding the High-Pressure Controls and Systems and Light-Duty businesses.

Our High-Pressure Controls and Systems segment is at the forefront of the clean energy revolution, designing, developing, and producing high-demand components for transportation and industrial applications. We partner with the world's leading fuel cell and hydrogen engine manufacturers and companies committed to decarbonizing transport, offering versatile solutions that serve a variety of fuel types. While hydrogen is key to the future decarbonization of transport, our components and solutions are already powering emission reducing innovation today across a range of gaseous fuels. While we're still small, our strategic position and innovative capabilities put us on the cusp of significant growth, ensuring we're the go-to choice for those shaping the future of clean energy, today and tomorrow.

Our Light-Duty segment manufactures LPG and CNG fuel storage solutions and supplies fuel storage tanks to the aftermarket, OEM, and other market segments across a wide range of brands. The Light-Duty segment includes the consolidated results from our delayed OEM, independent aftermarket, light-duty OEM operations and electronics businesses.

Our Heavy-Duty OEM business represents historical results from our heavy-duty business for the period January 1 until the formation of the joint venture which occurred on June 3, 2024 and for comparative purposes, for the period January 1 to June 30, 2023. Following the close of the HPDI JV in June 2024, the results of this business are reflected in the HPDI JV business segment. Going forward, the Heavy-Duty OEM segment will reflect revenue earned from a transitional services agreement in place with the HPDI joint venture. This transitional services agreement is intended to support the HPDI joint venture in the short-term as the organization transitions to its own operating entity.

The Company has recast previously reported quarterly segment financial information for the years ended December 31, 2022 and 2023 along with the first quarter of 2024 to reflect the new segments. The change in reporting has no impact on consolidated historical financial results. The recast financial information can be found under the supplemental information section of this press release.

Segment Information

Light-Duty Segment

Revenue for the three and six months ended June 30, 2024 was $69.5 million and $132.7 million, respectively, compared with $73.7 million and $140.2 million for the three and six months ended June 30, 2023.

Light-Duty revenue decreased by $4.2 million for the three months ended June 30, 2024 compared to the prior year quarter and decreased by $7.5 million for the six months ended June 30, 2024 compared to the prior year period. This was primarily driven by a decrease in sales in our delayed OEM, independent aftermarket and fuel storage businesses, and partially offset by increases in sales in our light-duty OEM and electronics businesses.

Gross margin increased by $2.4 million to $15.1 million, or 22% of revenue, for the three months ended June 30, 2024 compared to $12.7 million, or 17% of revenue, for the three months ended June 30, 2023. This was primarily driven by a change in sales mix with increases in sales to European customers and reduction in sales to developing regions.

Gross margin increased by $2.5 million to $27.5 million, or 21% of revenue, for the six months ended June 30, 2024 compared to $25.0 million, or 18% of revenue, for the six months ended June 30, 2023.

High-Pressure Controls and Systems Segment

Revenue for the three and six months ended June 30, 2024 was $3.4 million and $5.8 million, respectively, compared with $2.8 million and $5.7 million for the three and six months ended June 30, 2023. The increase in revenue for the three months ended June 30, 2024 compared to the prior year quarter was primarily driven by increased sales volumes in product and service revenue.

Gross margin increased by $0.1 million to $0.7 million, or 21% of revenue, for the three months ended June 30, 2024 compared to $0.6 million or 21% of revenue, for the three months ended June 30, 2023.

Gross margin decreased by $0.3 million to $1.1 million, or 19% of revenue, for the six months ended June 30, 2024 compared to $1.4 million, or 25% of revenue, for the six months ended June 30, 2023. The decrease in gross margin was primarily related to higher production overhead costs related to the development of new products.

Heavy-Duty OEM Segment

Revenues for the three and six months ended June 30, 2024 includes revenue until the closing of the transaction to form the HPDI JV, which occurred June 3, 2024. Revenue for the three and six months ended June 30, 2024 was $10.5 million and $22.5 million, respectively, compared with $8.5 million and $21.4 million for the three and six months ended June 30, 2023. The increase in revenue for the three months ended June 30, 2024 primarily relates to an increase in product and engineering sales for the two months when the Company wholly owned the HPDI business. Additionally, there is one month of inventory sales from the Company to HPDI JV for $0.5 million under the transitional services agreement.

Gross margin increased by $0.2 million to $1.3 million, or 12% of revenue, for the three months ended June 30, 2024 compared to $1.1 million or 13% of revenue, for the three months ended June 30, 2023.

Gross margin decreased by $1.1 million to $0.2 million, or 1% of revenue, for the six months ended June 30, 2024 compared to $1.3 million, or 6% of revenue, for the six months ended June 30, 2023.

Selected HPDI JV Statements of Operations Data

We account for the HPDI JV using the equity method of accounting for investments.

The following table sets forth a summary of the financial results of HPDI JV for the period June 3, 2024 to June 30, 2024:

| | | Three months

ended June 30,

| | | Change | | Six months

ended June 30,

| | | Change |

| (in millions of U.S. dollars) | | | 2024 | | | | 2023 | | | $ | | % | | | 2024 | | | | 2023 | | | $ | | % |

| Total revenue | | $ | 4.1 | | | $ | — | | | $ | 4.1 | | | — | % | | $ | 4.1 | | | $ | — | | | $ | 4.1 | | | — | % |

| Gross margin1 | | $ | 0.2 | | | $ | — | | | $ | 0.2 | | | — | % | | $ | 0.2 | | | $ | — | | | $ | 0.2 | | | — | % |

| Gross margin % | | | 5 | % | | | — | % | | | | | | | 5 | % | | | — | % | | | | |

| Loss before income taxes | | $ | (2.0 | ) | | $ | — | | | $ | (2.0 | ) | | — | % | | $ | (2.0 | ) | | $ | — | | | $ | (2.0 | ) | | — | % |

| Net loss attributable to the Company | | $ | (1.1 | ) | | $ | — | | | $ | — | | | — | % | | $ | (1.1 | ) | | $ | — | | | $ | — | | | — | % |

(1) Gross margin is a non-GAAP measure. Please refer to GAAP and NON-GAAP FINANCIAL MEASURES for the reconciliation to equivalent GAAP measures and limitations on the use of such measures.

| SEGMENT RESULTS | Three months ended June 30, 2024 |

| |

Revenue | | Operating

income (loss) | |

Depreciation

& amortization | | Equity income

(loss) |

| Light-Duty | $ | 69.5 | | $ | 3.3 | | | $ | 1.5 | | $ | 0.5 | |

| High-Pressure Controls & Systems | | 3.4 | | | (0.9 | ) | | | 0.1 | | | — | |

| Heavy-Duty OEM | | 10.5 | | | (2.3 | ) | | | — | | | — | |

| Corporate | | — | | | (5.4 | ) | | | 0.1 | | | (1.2 | ) |

| HPDI JV | | 4.1 | | | (2.0 | ) | | | 0.3 | | | — | |

| Total segment | | 87.5 | | | (7.3 | ) | | | 2.0 | | | (0.7 | ) |

| Less: HPDI JV | | 4.1 | | | (2.0 | ) | | | 0.3 | | | — | |

| Total consolidated | $ | 83.4 | | $ | (5.3 | ) | | $ | 1.7 | | $ | (0.7 | ) |

| SEGMENT RESULTS | Three months ended June 30, 2023 |

| | Revenue | | Operating

income (loss) | |

Depreciation

& amortization | | Equity income

(loss) |

| Light-Duty | $ | 73.7 | | $ | (1.8 | ) | | $ | 1.7 | | $ | 0.1 |

| High-Pressure Controls & Systems | | 2.8 | | | (0.6 | ) | | | 0.1 | | | — |

| Heavy-Duty OEM | | 8.5 | | | (3.3 | ) | | | 1.1 | | | — |

| Corporate | | — | | | (4.5 | ) | | | 0.1 | | | — |

| HPDI JV | | — | | | — | | | | — | | | — |

| Total segment | | 85.0 | | | (10.2 | ) | | | 3.0 | | | 0.1 |

| Less: HPDI JV | | — | | | — | | | | — | | | — |

| Total Consolidated | $ | 85.0 | | $ | (10.2 | ) | | $ | 3.0 | | $ | 0.1 |

| |

Q2 2024 Conference Call

Westport has scheduled a conference call on August 14, 2024, at 7:00 am Pacific Time (10:00 am Eastern Time) to discuss these results. To access the conference call please register at https://register.vevent.com/register/BIe166497326ef478e85dda36eea3f3316. The live webcast of the conference call can be accessed through the Westport website at https://investors.wfsinc.com/.

The webcast will be archived on Westport’s website and a replay will be available at https://investors.wfsinc.com beginning August 15, 2024

Financial Statements and Management's Discussion and Analysis

To view Westport financials for the second quarter ended June 30th, 2024, please visit https://investors.wfsinc.com/financials/

About Westport Fuel Systems

At Westport Fuel Systems, we are driving innovation to power a cleaner tomorrow. We are a leading supplier of advanced fuel delivery components and systems for clean, low-carbon fuels such as natural gas, renewable natural gas, propane, and hydrogen to the global transportation industry. Our technology delivers the performance and fuel efficiency required by transportation applications and the environmental benefits that address climate change and urban air quality challenges. Headquartered in Vancouver, Canada, with operations in Europe, Asia, North America, and South America, we serve our customers in more than 70 countries with leading global transportation brands. At Westport Fuel Systems, we think ahead. For more information, visit www.wfsinc.com.

Cautionary Note Regarding Forward Looking Statements

This press release contains forward-looking statements, including statements regarding revenue and cash usage expectations, future strategic initiatives and future growth, future of our development programs (including those relating to HPDI and Hydrogen), the demand for our products, the future success of our business and technology strategies, intentions of partners and potential customers, the performance and competitiveness of Westport Fuel Systems’ products and expansion of product coverage, future market opportunities, speed of adoption of natural gas for transportation and terms and timing of future agreements as well as Westport Fuel Systems management’s response to any of the aforementioned factors. These statements are neither promises nor guarantees, but involve known and unknown risks and uncertainties and are based on both the views of management and assumptions that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activities, performance or achievements expressed in or implied by these forward looking statements. These risks, uncertainties and assumptions include those related to our revenue growth, operating results, industry and products, the general economy, conditions of and access to the capital and debt markets, solvency, governmental policies and regulation, technology innovations, fluctuations in foreign exchange rates, operating expenses, continued reduction in expenses, ability to successfully commercialize new products, the performance of our joint ventures, the availability and price of natural gas, global government stimulus packages and new environmental regulations, the acceptance of and shift to natural gas vehicles, the relaxation or waiver of fuel emission standards, the inability of fleets to access capital or government funding to purchase natural gas vehicles, the development of competing technologies, our ability to adequately develop and deploy our technology, the actions and determinations of our joint venture and development partners, ongoing supply chain challenges as well as other risk factors and assumptions that may affect our actual results, performance or achievements or financial position discussed in our most recent Annual Information Form and other filings with securities regulators. Readers should not place undue reliance on any such forward-looking statements, which speak only as of the date they were made. We disclaim any obligation to publicly update or revise such statements to reflect any change in our expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in these forward looking statements except as required by National Instrument 51-102. The contents of any website, RSS feed or twitter account referenced in this press release are not incorporated by reference herein.

Contact Information

Investor Relations

Westport Fuel Systems

T: +1 604-718-2046

GAAP and NON-GAAP FINANCIAL MEASURES

Management reviews the operational progress of its business units and investment programs over successive periods through the analysis of gross margin, gross margin as a percentage of revenue, net income, EBITDA and Adjusted EBITDA. The Company defines gross margin as revenue less cost of revenue. The Company defines EBITDA as net income or loss from continuing operations before income taxes adjusted for interest expense (net), depreciation and amortization. Westport Fuel Systems defines Adjusted EBITDA as EBITDA from continuing operations excluding expenses for stock-based compensation, unrealized foreign exchange gain or loss, and non-cash and other adjustments. Management uses Adjusted EBITDA as a long-term indicator of operational performance since it ties closely to the business units’ ability to generate sustained cash flow and such information may not be appropriate for other purposes. Adjusted EBITDA includes the company's share of income from joint ventures.

The terms gross margin, gross margin as a percentage of revenue, EBITDA and Adjusted EBITDA are not defined under U.S. generally accepted accounting principles ("U.S. GAAP") and are not a measure of operating income, operating performance or liquidity presented in accordance with U.S. GAAP. EBITDA and Adjusted EBITDA have limitations as an analytical tool, and when assessing the company's operating performance, investors should not consider EBITDA and Adjusted EBITDA in isolation, or as a substitute for net loss or other consolidated statement of operations data prepared in accordance with U.S. GAAP. Among other things, EBITDA and Adjusted EBITDA do not reflect the company's actual cash expenditures. Other companies may calculate similar measures differently than Westport Fuel Systems, limiting their usefulness as comparative tools. The company compensates for these limitations by relying primarily on its U.S. GAAP results and using EBITDA and Adjusted EBITDA as supplemental information.

| Gross margin and Gross margin as percentage of Revenue |

| (expressed in millions of U.S. dollars) | | 2Q23

| | 3Q23

| | 4Q23

| | 1Q24

| | 2Q24

|

| Three months ended | | | | | |

| Revenue | | $ | 85.0 | | | $ | 77.4 | | | $ | 87.2 | | | $ | 77.6 | | | $ | 83.4 | |

| Less: Cost of revenue | | | 70.6 | | | | 64.2 | | | | 79.2 | | | | 65.9 | | | | 66.3 | |

| Gross margin | | | 14.4 | | | | 13.2 | | | | 8.0 | | | | 11.7 | | | | 17.1 | |

| Gross margin % | | | 16.9 | % | | | 17.1 | % | | | 9.2 | % | | | 15.1 | % | | | 20.5 | % |

| EBITDA and Adjusted EBITDA |

| (expressed in millions of U.S. dollars) | | 2Q23

| | 3Q23

| | 4Q23

| | 1Q24

| | 2Q24

|

| Three months ended | | | | | |

| Income (Loss) before income taxes | | $ | (13.0 | ) | | $ | (12.0 | ) | | $ | (14.0 | ) | | $ | (12.9 | ) | | $ | 6.8 | |

| Interest expense (income), net | | | (0.1 | ) | | | 0.2 | | | | (0.2 | ) | | | 0.5 | | | | 0.5 | |

| Depreciation and amortization | | | 3.0 | | | | 3.2 | | | | 3.3 | | | | 3.2 | | | | 1.7 | |

| EBITDA | | | (10.1 | ) | | | (8.6 | ) | | | (10.9 | ) | | | (9.2 | ) | | | 9.0 | |

| Stock based compensation | | | 0.8 | | | | (0.3 | ) | | | 1.4 | | | | 0.3 | | | | 1.2 | |

| Unrealized foreign exchange (gain) loss | | | 2.4 | | | | 1.4 | | | | (0.9 | ) | | | 1.8 | | | | 0.1 | |

| Loss on extinguishment of royalty payable | | | 2.9 | | | | — | | | | — | | | | — | | | | — | |

| Severance costs | | | — | | | | 4.5 | | | | — | | | | 0.5 | | | | 0.2 | |

| Gain on deconsolidation | | | — | | | | — | | | | — | | | | — | | | | (13.3 | ) |

| Restructuring costs | | | — | | | | — | | | | — | | | | — | | | | 0.8 | |

| Impairment of long-term investments | | | — | | | | — | | | | 0.4 | | | | — | | | | — | |

| Adjusted EBITDA | | $ | (4.0 | ) | | $ | (3.0 | ) | | $ | (10.0 | ) | | $ | (6.6 | ) | | $ | (2.0 | ) |

WESTPORT FUEL SYSTEMS INC.

Condensed Consolidated Interim Balance Sheets (unaudited)

(Expressed in thousands of United States dollars, except share amounts)

June 30, 2024 and December 31, 2023 |

| |

| | | June 30, 2024 | | | December 31, 2023 | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents (including restricted cash) | | $ | 41,522 | | | $ | 54,853 | |

| Accounts receivable | | | 93,789 | | | | 88,077 | |

| Inventories | | | 56,407 | | | | 67,530 | |

| Prepaid expenses | | | 6,482 | | | | 6,323 | |

| Total current assets | | | 198,200 | | | | 216,783 | |

| Long-term investments | | | 45,647 | | | | 4,792 | |

| Property, plant and equipment | | | 40,351 | | | | 69,489 | |

| Operating lease right-of-use assets | | | 19,859 | | | | 22,877 | |

| Intangible assets | | | 6,032 | | | | 6,822 | |

| Deferred income tax assets | | | 10,637 | | | | 11,554 | |

| Goodwill | | | 2,966 | | | | 3,066 | |

| Other long-term assets | | | 9,438 | | | | 20,365 | |

| Total assets | | $ | 333,130 | | | $ | 355,748 | |

| Liabilities and shareholders’ equity | | | | |

| Current liabilities: | | | | |

| Accounts payable and accrued liabilities | | $ | 103,703 | | | $ | 95,374 | |

| Current portion of operating lease liabilities | | | 2,435 | | | | 3,307 | |

| Short-term debt | | | 3,351 | | | | 15,156 | |

| Current portion of long-term debt | | | 14,464 | | | | 14,108 | |

| Current portion of warranty liability | | | 4,448 | | | | 6,892 | |

| Total current liabilities | | | 128,401 | | | | 134,837 | |

| Long-term operating lease liabilities | | | 17,382 | | | | 19,300 | |

| Long-term debt | | | 26,363 | | | | 30,957 | |

| Warranty liability | | | 1,269 | | | | 1,614 | |

| Deferred income tax liabilities | | | 3,326 | | | | 3,477 | |

| Other long-term liabilities | | | 4,864 | | | | 5,115 | |

| Total liabilities | | | 181,605 | | | | 195,300 | |

| Shareholders’ equity: | | | | |

| Share capital: | | | | |

| Unlimited common and preferred shares, no par value | | | | |

| 17,258,364 (2023 - 17,174,502) common shares issued and outstanding | | | 1,245,651 | | | | 1,244,539 | |

| Other equity instruments | | | 9,193 | | | | 9,672 | |

| Additional paid in capital | | | 11,516 | | | | 11,516 | |

| Accumulated deficit | | | (1,082,265 | ) | | | (1,074,434 | ) |

| Accumulated other comprehensive loss | | | (32,570 | ) | | | (30,845 | ) |

| Total shareholders' equity | | | 151,525 | | | | 160,448 | |

| Total liabilities and shareholders' equity | | $ | 333,130 | | | $ | 355,748 | |

WESTPORT FUEL SYSTEMS INC.

Condensed Consolidated Interim Statements of Operations and Comprehensive Income (Loss) (unaudited)

(Expressed in thousands of United States dollars, except share and per share amounts)

Three and six months ended June 30, 2024 and 2023 |

| |

| | | Three months ended June 30, | | | Six months ended June 30, | |

| | | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 | |

| Revenue | | $ | 83,386 | | | $ | 85,022 | | | $ | 160,960 | | | $ | 167,262 | |

| Cost of revenue and expenses: | | | | | | | | |

| Cost of revenue | | | 66,264 | | | | 70,653 | | | | 132,115 | | | | 139,532 | |

| Research and development | | | 6,560 | | | | 5,785 | | | | 14,253 | | | | 13,048 | |

| General and administrative | | | 11,603 | | | | 10,546 | | | | 21,956 | | | | 20,314 | |

| Sales and marketing | | | 3,440 | | | | 4,820 | | | | 6,727 | | | | 8,469 | |

| Foreign exchange loss | | | 57 | | | | 2,420 | | | | 1,877 | | | | 3,496 | |

| Depreciation and amortization | | | 720 | | | | 1,021 | | | | 1,763 | | | | 2,058 | |

| | | | 88,644 | | | | 95,245 | | | | 178,691 | | | | 186,917 | |

| Loss from operations | | | (5,258 | ) | | | (10,223 | ) | | | (17,731 | ) | | | (19,655 | ) |

| | | | | | | | | |

| Income (loss) from investments accounted for by the equity method | | | (688 | ) | | | 56 | | | | (657 | ) | | | 185 | |

| Gain on deconsolidation | | | 13,266 | | | | — | | | | 13,266 | | | | — | |

| Interest on long-term debt and accretion on royalty payable | | | (394 | ) | | | (643 | ) | | | (1,206 | ) | | | (1,490 | ) |

| Loss on extinguishment of royalty payable | | | — | | | | (2,909 | ) | | | — | | | | (2,909 | ) |

| Interest and other income (loss), net of bank charges | | | (149 | ) | | | 733 | | | | 192 | | | | 1,199 | |

| Income (loss) before income taxes | | | 6,777 | | | | (12,986 | ) | | | (6,136 | ) | | | (22,670 | ) |

| Income tax expense | | | 960 | | | | 221 | | | | 1,695 | | | | 1,165 | |

| Net income (loss) for the period | | | 5,817 | | | | (13,207 | ) | | | (7,831 | ) | | | (23,835 | ) |

| | | | | | | | | |

| Changes in foreign currency translation adjustment | | | (1,212 | ) | | | (7,322 | ) | | | (1,642 | ) | | | (5,352 | ) |

| Ownership share of equity method investments' other comprehensive loss | | | (83 | ) | | | — | | | | (83 | ) | | $ | — | |

| Other comprehensive loss | | | (1,295 | ) | | | (7,322 | ) | | | (1,725 | ) | | | (5,352 | ) |

| Comprehensive income (loss) | | $ | 4,522 | | | $ | (20,529 | ) | | $ | (9,556 | ) | | $ | (29,187 | ) |

| | | | | | | | | |

| Net income (loss) per share: | | | | | | | | |

| Net income (loss) per share - basic | | $ | 0.34 | | | $ | (0.77 | ) | | $ | (0.45 | ) | | $ | (1.39 | ) |

| Net income (loss) per share - diluted | | $ | 0.33 | | | $ | (0.77 | ) | | $ | (0.45 | ) | | | (1.39 | ) |

| Weighted average common shares outstanding: | | | | | | | | |

| Basic | | | 17,239,460 | | | | 17,173,252 | | | | 17,230,000 | | | | 17,171,137 | |

| Diluted | | | 17,488,070 | | | | 17,173,252 | | | | 17,230,000 | | | | 17,171,137 | |

WESTPORT FUEL SYSTEMS INC.

Condensed Consolidated Interim Statements of Operations and Comprehensive Income (Loss) (unaudited)

(Expressed in thousands of United States dollars, except share and per share amounts)

Three and six months ended June 30, 2024 and 2023 |

| |

| | | Three months ended June 30, | | | Six months ended June 30, | |

| | | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 | |

| Operating activities: | | | | | | | | |

| Net income (loss) for the period | | $ | 5,817 | | | $ | (13,207 | ) | | $ | (7,831 | ) | | $ | (23,835 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

| Depreciation and amortization | | | 1,716 | | | | 2,993 | | | | 4,963 | | | | 6,020 | |

| Stock-based compensation expense | | | 302 | | | | 742 | | | | 633 | | | | 1,375 | |

| Unrealized foreign exchange loss | | | 57 | | | | 2,420 | | | | 1,877 | | | | 3,496 | |

| Deferred income tax (recovery) | | | 385 | | | | 125 | | | | 345 | | | | (23 | ) |

| (Income) loss from investments accounted for by the equity method | | | 688 | | | | (56 | ) | | | 657 | | | | (185 | ) |

| Interest on long-term debt and accretion on royalty payable | | | 13 | | | | 67 | | | | 35 | | | | 172 | |

| Change in inventory write-downs | | | 1,023 | | | | 992 | | | | 1,436 | | | | 1,578 | |

| Loss on extinguishment of royalty payable | | | — | | | | 2,909 | | | | — | | | | 2,909 | |

| Change in bad debt expense | | | (28 | ) | | | 288 | | | | (149 | ) | | | 372 | |

| Gain on sale of assets | | | — | | | | (21 | ) | | | — | | | | (21 | ) |

| Gain on deconsolidation | | | (13,266 | ) | | | — | | | | (13,266 | ) | | | — | |

| Other | | | 280 | | | | — | | | | 32 | | | | — | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (2,743 | ) | | | 469 | | | | 9,783 | | | | (572 | ) |

| Inventories | | | 980 | | | | (537 | ) | | | (6,454 | ) | | | (1,128 | ) |

| Prepaid expenses | | | (188 | ) | | | 3,091 | | | | (588 | ) | | | 1,407 | |

| Accounts payable and accrued liabilities | | | 7,470 | | | | 287 | | | | 12,195 | | | | 1,050 | |

| Warranty liability | | | (1,007 | ) | | | (1,179 | ) | | | (2,027 | ) | | | (2,561 | ) |

| Net cash provided by (used in) operating activities | | | 1,499 | | | | (617 | ) | | | 1,641 | | | | (9,946 | ) |

| Investing activities: | | | | | | | | |

| Purchase of property, plant and equipment | | | (5,437 | ) | | | (4,905 | ) | | | (10,330 | ) | | | (7,912 | ) |

| Proceeds from sale of investments | | | 20,430 | | | | — | | | | 20,430 | | | | — | |

| Proceeds on sale of assets | | | 434 | | | | 35 | | | | 569 | | | | 133 | |

| Dividends received from investments accounted for by the equity method | | | 297 | | | | — | | | | 297 | | | | — | |

| Capital contributions to investments accounted for by the equity method | | | (9,900 | ) | | | — | | | | (9,900 | ) | | | — | |

| Net cash provided by (used in) investing activities | | | 5,824 | | | | (4,870 | ) | | | 1,066 | | | | (7,779 | ) |

| Financing activities: | | | | | | | | |

| Repayments of operating lines of credit and long-term facilities | | | (16,388 | ) | | | (10,564 | ) | | | (34,077 | ) | | | (21,558 | ) |

| Drawings on operating lines of credit and long-term facilities | | | 7,488 | | | | 4,845 | | | | 19,336 | | | | 13,096 | |

| Payment of royalty payable | | | — | | | | (8,687 | ) | | | — | | | | (8,687 | ) |

| Net cash used in financing activities | | | (8,900 | ) | | | (14,406 | ) | | | (14,741 | ) | | | (17,149 | ) |

| Effect of foreign exchange on cash and cash equivalents | | | (803 | ) | | | 195 | | | | (1,297 | ) | | | 955 | |

| Net decrease in cash and cash equivalents | | | (2,380 | ) | | | (19,698 | ) | | | (13,331 | ) | | | (33,919 | ) |

| Cash and cash equivalents, beginning of period (including restricted cash) | | | 43,902 | | | | 71,963 | | | | 54,853 | | | | 86,184 | |

| Cash and cash equivalents, end of period (including restricted cash) | | $ | 41,522 | | | $ | 52,265 | | | $ | 41,522 | | | $ | 52,265 | |

WESTPORT FUEL SYSTEMS INC.

Condensed Consolidated Interim Statements of Cash Flows (unaudited)

(Expressed in thousands of United States dollars)

Three and six months ended June 30, 2024 and 2023 |

| |

| Supplemental Information |

| |

| Historical Segment Results | | | | | | | | |

| (expressed in millions of U.S. dollars) | | 1Q22

| | 2Q22

| | 3Q22

| | 4Q22

| | 1Q23

| | 2Q23

| | 3Q23

| | 4Q23

| | 1Q24

|

| Three months ended | | | | | | | | | |

| Light-Duty | | | | | | | | | | | | | | | | | | |

| Revenue | | $62.0 | | $63.8 | | $57.5 | | $64.0 | | $66.4 | | $73.7 | | $60.2 | | $63.4 | | $63.2 |

| Gross margin | | $10.5 | | $11.6 | | $11.4 | | $9.0 | | $12.3 | | $12.7 | | $12.0 | | $12.1 | | $12.4 |

| Gross margin % | | 16.9% | | 18.2% | | 19.8% | | 14.1% | | 18.5% | | 17.2% | | 19.9% | | 19.1% | | 19.6% |

| | | | | | | | | | | | | | | | | | | |

| High-Pressure Controls & Systems | | | | | | | | | | | | | | | | | | |

| Revenue | | $2.0 | | $4.4 | | $3.5 | | $4.7 | | $2.9 | | $2.8 | | $3.7 | | $2.5 | | $2.4 |

| Gross margin | | $0.2 | | $1.2 | | $1.0 | | $1.3 | | $0.8 | | $0.6 | | $1.0 | | $0.4 | | $0.4 |

| Gross margin % | | 10.0% | | 27.3% | | 28.6% | | 27.7% | | 27.6% | | 21.4% | | 27.0% | | 16.0% | | 16.7% |

| | | | | | | | | | | | | | | | | | | |

| Heavy-Duty OEM | | | | | | | | | | | | | | | | | | |

| Revenue | | $12.5 | | $11.8 | | $10.2 | | $9.3 | | $12.9 | | $8.5 | | $13.5 | | $21.3 | | $12.0 |

| Gross margin | | $(0.8) | | $(2.3) | | $(1.1) | | $(5.8) | | $0.2 | | $1.1 | | $0.2 | | $(4.5) | | $(1.1) |

| Gross margin % | | (6.4)% | | (19.5)% | | (10.8)% | | (62.4)% | | 1.6% | | 12.9% | | 1.5% | | (21.1)% | | (9.2)% |

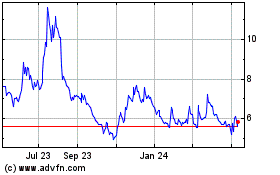

Westport Fuel Systems (NASDAQ:WPRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

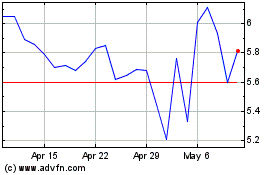

Westport Fuel Systems (NASDAQ:WPRT)

Historical Stock Chart

From Feb 2024 to Feb 2025