WillScot Holdings Corporation (“WillScot” or the “Company”)

(Nasdaq: WSC), a leader in innovative temporary space solutions,

today announced fourth quarter and full year 2024 results including

key performance highlights and market updates. The Company also

announced its outlook for full year 2025.

Q4 20241,2

- Generated revenue of $603 million,

gross profit margin percentage of 55.8%, income from continuing

operations of $89 million and diluted earnings per share of

$0.48.

- Increased average monthly rates,

inclusive of Value-Added Products ("VAPS"), offset much of the

year-over-year impact from decreased units on rent.

- Delivered Adjusted EBITDA of $285

million, with Adjusted EBITDA Margin expanding sequentially to

47.3% and up 30 basis points year-over-year.

- Generated net cash provided by

operating activities of $179 million at a 29.7% margin. Adjusted

Free Cash Flow was $137 million at a 22.7% margin.

Full Year

20241,2

- Generated revenue of $2,396 million as

higher average monthly rates, inclusive of VAPS, offset the impact

from lower units on rent from the prior year at a gross profit

margin percentage of 54.3%.

- Income from continuing operations was

$28 million and diluted earnings per share was $0.15. Adjusted

Income from Continuing Operations was $310 million and

adjusted diluted earnings per share was $1.63.

- Delivered Adjusted EBITDA of $1,063

million at an Adjusted EBITDA Margin of 44.4%.

- Generated net cash provided by

operating activities of $562 million at a 23.4% margin, which

included $226 million of fees and costs from terminated

acquisitions. Adjusted Free Cash Flow was $554 million at a 23.1%

margin.

- Generated 16.7% Return on Invested

Capital ("ROIC") over the last 12 months.

- Returned $270 million to

shareholders by repurchasing 7.1 million shares of Common Stock,

reducing our outstanding share count by 3.4% over the twelve months

ended December 31, 2024.

2025

Outlook2,3

- FY 2025 Revenue and Adjusted EBITDA

ranges of $2,275 million to $2,475 million and $1,000 million to

$1,090 million, respectively, excluding the incremental

contribution from any acquisitions.

- Reflects expectations for (i)

continuing growth in average monthly rates, inclusive of VAPS, and

expanded product offerings, and (ii) moderating comparative

year-over-year headwinds in units on rent in the second half of the

year.

- On January 9, 2025, the Company

announced its 2025 Investor Day to be held on March 7, 2025, in

Phoenix, Arizona, at 9:00 AM MST. Members of the executive

management and operating team will present the Company's updated

operational strategy, long-term financial targets, and ongoing

approach to capital allocation. The event will be available both in

person and through live webcast at www.investors.willscot.com.

- On February 18, 2025, the Company

broadened its capital allocation framework with the Board of

Directors ("Board") initiating a quarterly cash dividend program of

$0.07 per share. The Board will regularly assess the cash dividend

program with a long-term focus on increasing the dividend payment

over time.

Brad Soultz, Chief Executive Officer of WillScot, commented “Our

fourth quarter financial results capped another solid year for

WillScot, notably Adjusted EBITDA margins of 47.3% in the period

and Adjusted Free Cash Flow of $137 million at a margin of 22.7%.

We believe we have a robust and sustainable free cash flow profile

that reflects the resiliency of our cash flows across the cycle,

the strength of our balance sheet, and our confidence in the

Company’s long-term growth strategy. The initiation of our

quarterly dividend program provides an additional avenue to return

surplus capital to shareholders."

Soultz added, "I would like to extend a heartfelt thank you to

our team, customers, and shareholders. In 2024, we focused on

aligning our people, systems, and products to drive deeper

engagement with our customers. With this foundational work largely

complete, we are prioritizing all aspects of sales and operations

excellence, which provide new levers to support our growth

strategy. We look forward to sharing more details with you at our

Investor Day in two weeks."

Fourth Quarter and Full Year

2024

Results2

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

(in thousands, except share data) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

602,515 |

|

|

$ |

612,376 |

|

|

$ |

2,395,718 |

|

|

$ |

2,364,767 |

|

| Income from continuing

operations |

$ |

89,215 |

|

|

$ |

86,328 |

|

|

$ |

28,129 |

|

|

$ |

341,844 |

|

| Adjusted income from

continuing operations2 |

$ |

90,469 |

|

|

$ |

91,497 |

|

|

$ |

309,512 |

|

|

$ |

353,618 |

|

| Adjusted EBITDA from

continuing operations2 |

$ |

284,712 |

|

|

$ |

287,802 |

|

|

$ |

1,063,160 |

|

|

$ |

1,061,465 |

|

| Gross profit margin from

continuing operations |

|

55.8 |

% |

|

|

56.0 |

% |

|

|

54.3 |

% |

|

|

56.4 |

% |

| Adjusted EBITDA Margin from

continuing operations (%)2 |

|

47.3 |

% |

|

|

47.0 |

% |

|

|

44.4 |

% |

|

|

44.9 |

% |

| Net cash provided by operating

activities |

$ |

178,919 |

|

|

$ |

219,322 |

|

|

$ |

561,644 |

|

|

$ |

761,240 |

|

| Adjusted Free Cash

Flow2,5 |

$ |

136,830 |

|

|

$ |

166,280 |

|

|

$ |

553,937 |

|

|

$ |

576,589 |

|

| Diluted earnings per share

from continuing operations |

$ |

0.48 |

|

|

$ |

0.44 |

|

|

$ |

0.15 |

|

|

$ |

1.69 |

|

| Adjusted diluted earnings per

share from continuing operations2 |

$ |

0.49 |

|

|

$ |

0.47 |

|

|

$ |

1.63 |

|

|

$ |

1.75 |

|

| Weighted average diluted

shares outstanding |

|

186,208,059 |

|

|

|

194,097,351 |

|

|

|

190,292,256 |

|

|

|

201,849,836 |

|

| Adjusted weighted average

diluted shares outstanding2 |

|

186,208,059 |

|

|

|

194,097,351 |

|

|

|

190,292,256 |

|

|

|

201,849,836 |

|

| Net cash provided by operating

activities margin |

|

29.7 |

% |

|

|

35.8 |

% |

|

|

23.4 |

% |

|

|

32.1 |

% |

| Adjusted Free Cash Flow Margin

(%)2,5 |

|

22.7 |

% |

|

|

27.2 |

% |

|

|

23.1 |

% |

|

|

24.3 |

% |

| Return on Invested

Capital2 |

|

18.3 |

% |

|

|

18.5 |

% |

|

|

16.7 |

% |

|

|

17.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matt Jacobsen, Chief Financial Officer of WillScot, commented,

“We achieved record revenues of $2,396 million and Adjusted EBITDA

of $1,063 million in 2024. We believe our ability to sustain solid

financial results and expand margins in the fourth quarter, despite

consistent end market headwinds, underscores the resilience of our

business model."

Jacobsen continued, "Turning to 2025, we believe our outlook

reflects the uncertain macroeconomic backdrop entering the year. At

the midpoint or better, it reflects modest top-line growth in the

second half of the year as we expect average monthly rates,

inclusive of VAPS, and expanded product offerings increasingly

offset the volume-related headwinds present heading into the year.

Finally, our Adjusted EBITDA and Net CAPEX outlook reflects our

demonstrated ability to flex our cost structure as the macro

environment changes. At the same time, we continue to see numerous

investment opportunities, both organic and inorganic, that we

anticipate will drive an increasing leasing revenue run rate into

2026 as we remain focused on growth and shareholder value

creation."

Capitalization and Liquidity Update2,

3, 6

As of and for the three months ended December

31, 2024, except where noted:

- Net cash

provided by operating activities was $178.9 million. Excluding

one-time, nonrecurring payments for terminated acquisitions of $13

million, the Company generated $137 million of Adjusted Free Cash

Flow.

- Invested $55

million of Net CAPEX in the quarter, primarily supporting growth in

new product lines.

- Invested

$37 million of capital in one acquisition during the quarter,

with $121 million invested in the last 12 months.

- Maintained

availability under our asset backed revolving credit facility of

approximately $1.6 billion.

- Total debt was

$3,708 million and net debt, or total debt net of cash and cash

equivalents, was $3,699 million.

- Weighted average

pre-tax interest rate, inclusive of $1.25 billion of

fixed-to-floating swaps at 3.55%, was approximately 5.8%. Annual

cash interest expense based on the current debt structure and

benchmark rates is approximately $219 million, or approximately

$230 million inclusive of non-cash deferred financing fees. Our

debt structure is approximately 87% / 13% fixed-to-floating after

giving effect to all interest rate swaps.

- Our 2025 notes

mature on June 15, 2025. We believe we have ample liquidity

available to redeem or refinance our $527 million 2025 notes,

using either our asset backed revolver or other sources of capital,

and intend to do so opportunistically prior to maturity in a manner

that optimizes our interest costs. Our subsequent debt maturity is

in 2027.

- Leverage is

at 3.5x based on our last 12 months Adjusted EBITDA from continuing

operations of $1,063 million, within the target range of 3.0x to

3.5x.

- Repurchased 3.5

million shares of Common Stock for $130 million in the fourth

quarter 2024, contributing to a 3.4% reduction in our outstanding

share count over the 12 months ending December 31, 2024.

2025 Outlook 2, 3,

4This guidance is subject to risks and uncertainties,

including those described in "Forward-Looking Statements"

below.

|

$M |

2024 ResultsFrom Continuing

Operations |

2025 Outlook |

| Revenue |

$2,396 |

$2,275 - $2,475 |

| Adjusted EBITDA2,3 |

$1,063 |

$1,000 - $1,090 |

| Net CAPEX3,4 |

$233 |

$225 - $305 |

1 - Assumes common shares outstanding as of

December 31, 2024 versus common shares outstanding as of December

31, 2023.2 - Adjusted EBITDA from continuing operations, Adjusted

EBITDA Margin from continuing operations, Adjusted income from

continuing operations, Adjusted Diluted Earnings Per Share,

Adjusted Weighted Average Diluted Shares Outstanding, Adjusted Free

Cash Flow, Adjusted Free Cash Flow Margin, Net Debt to Adjusted

EBITDA, and Return on Invested Capital are non-GAAP financial

measures. Further information and reconciliations for these

non-GAAP measures to the most directly comparable financial measure

under generally accepted accounting principles in the US ("GAAP")

are included at the end of this press release.3 - Information

reconciling forward-looking Adjusted EBITDA, Net CAPEX, and

Adjusted Free Cash Flow to GAAP financial measures is unavailable

to the Company without unreasonable effort and therefore neither

the most comparable GAAP measures nor reconciliations to the most

comparable GAAP measures are provided.4 - Net CAPEX is a non-GAAP

financial measure. Please see the non-GAAP reconciliation tables

included at the end of this press release.5 - Adjusted Free Cash

Flow incorporates results from discontinued operations. For

comparability, we add back discontinued operations to reported

revenue to calculate Adjusted Free Cash Flow Margin.6 - Leverage is

defined as Net Debt divided by Adjusted EBITDA from continuing

operations from the last twelve months. We define Net Debt as total

debt from continuing operations net of total cash and cash

equivalents from continuing operations.

Non-GAAP Financial MeasuresThis

press release includes non-GAAP financial measures, including

Adjusted EBITDA from continuing operations, Adjusted EBITDA Margin

from continuing operations, Adjusted income from continuing

operations, Adjusted diluted earnings per share, Adjusted Weighted

Average Diluted Shares Outstanding, Adjusted Free Cash Flow,

Adjusted Free Cash Flow Margin, Return on Invested Capital, Net

CAPEX, and Net Debt to Adjusted EBITDA ratio. Adjusted EBITDA from

continuing operations is defined as net income plus net interest

(income) expense, income tax expense (benefit), depreciation and

amortization adjusted to exclude certain non-cash items and the

effect of what we consider transactions or events not related to

our core business operations, including net currency gains and

losses, goodwill and other impairment charges, restructuring costs,

costs to integrate acquired companies, costs incurred related to

transactions, non-cash charges for stock compensation plans and

other discrete expenses. Adjusted EBITDA Margin from continuing

operations is defined as Adjusted EBITDA from continuing operations

divided by revenue. Adjusted income from continuing operations is

defined as income from continuing operations plus certain non-cash

items and the effect of what we consider transactions or events not

related to our core business operations, including goodwill and

other impairment charges, restructuring costs, costs to integrate

acquired companies, costs incurred related to transactions, and

other discrete expenses. Adjusted diluted earnings per share is

defined as adjusted income from continuing operations divided by

Adjusted diluted weighted average common shares outstanding. The

calculation of Adjusted Weighted Average Diluted Shares Outstanding

includes shares related to stock awards that are dilutive for

Adjusted diluted earnings per share. Adjusted Free Cash Flow is

defined as net cash provided by operating activities; less

purchases of rental equipment and property, plant and equipment and

plus proceeds from sale of rental equipment and property, plant and

equipment, which are all included in cash flows from investing

activities; excluding one-time, nonrecurring payments for the

McGrath termination fee and transaction costs from terminated

acquisitions. Adjusted Free Cash Flow Margin is defined as Adjusted

Free Cash Flow divided by revenue. Return on Invested Capital is

defined as adjusted earnings before interest and amortization

divided by average invested capital. Adjusted earnings before

interest and amortization is defined as Adjusted EBITDA (see

definition above) reduced by depreciation and estimated statutory

taxes. Given we are not a significant US taxpayer due to our

current tax attributes, we include estimated taxes at our current

statutory tax rate of approximately 25%. Average invested capital

is calculated as an average of net assets. Net assets is defined as

total assets less goodwill, intangible assets, net and all

non-interest bearing liabilities. Net CAPEX is defined as purchases

of rental equipment and refurbishments and purchases of property,

plant and equipment (collectively, "Total Capital Expenditures"),

less proceeds from the sale of rental equipment and proceeds from

the sale of property, plant and equipment (collectively, "Total

Proceeds"), which are all included in cash flows from investing

activities. Net Debt to Adjusted EBITDA ratio is defined as Net

Debt divided by Adjusted EBITDA. The Company believes that Adjusted

EBITDA and Adjusted EBITDA margin are useful to investors because

they (i) allow investors to compare performance over various

reporting periods on a consistent basis by removing from operating

results the impact of items that do not reflect core operating

performance; (ii) are used by our board of directors and management

to assess our performance; (iii) may, subject to the limitations

described below, enable investors to compare the performance of the

Company to its competitors; (iv) provide additional tools for

investors to use in evaluating ongoing operating results and

trends; and (v) align with definitions in our credit agreement. The

Company believes that Adjusted Free Cash Flow and Adjusted Free

Cash Flow Margin are useful to investors because they allow

investors to compare cash generation performance over various

reporting periods and against peers. The Company believes that

Return on Invested Capital provides information about the long-term

health and profitability of the business relative to the Company's

cost of capital. The Company believes that the presentation of Net

CAPEX provides useful information to investors regarding the net

capital invested into our rental fleet and plant, property and

equipment each year to assist in analyzing the performance of our

business. The Company believes that the presentation of Net Debt to

Adjusted EBITDA, Adjusted income from continuing operations and

Adjusted Diluted Earnings Per Share provide useful information to

investors regarding the performance of our business. Adjusted

EBITDA is not a measure of financial performance or liquidity under

GAAP and, accordingly, should not be considered as an alternative

to net income or cash flow from operating activities as an

indicator of operating performance or liquidity. These non-GAAP

measures should not be considered in isolation from, or as an

alternative to, financial measures determined in accordance with

GAAP. Other companies may calculate Adjusted EBITDA and other

non-GAAP financial measures differently, and therefore the

Company's non-GAAP financial measures may not be directly

comparable to similarly-titled measures of other companies. For

reconciliations of the non-GAAP measures used in this press release

(except as explained below), see “Reconciliation of Non-GAAP

Financial Measures" included in this press release.

Information regarding the most comparable GAAP

financial measures and reconciling forward-looking Adjusted EBITDA,

Net CAPEX, and Adjusted Free Cash Flow to those GAAP financial

measures is unavailable to the Company without unreasonable effort.

We cannot provide the most comparable GAAP financial measures nor

reconciliations of forward-looking Adjusted EBITDA, Net CAPEX, and

Adjusted Free Cash Flow to GAAP financial measures because certain

items required for such reconciliations are outside of our control

and/or cannot be reasonably predicted, such as the provision for

income taxes. Preparation of such reconciliations would require a

forward-looking balance sheet, statement of income and statement of

cash flow, prepared in accordance with GAAP, and such

forward-looking financial statements are unavailable to the Company

without unreasonable effort. Although we provide ranges of Adjusted

EBITDA and Net CAPEX that we believe will be achieved, we cannot

accurately predict all the components of the Adjusted EBITDA and

Net CAPEX calculations. The Company provides Adjusted EBITDA and

Net CAPEX guidance because we believe that Adjusted EBITDA and Net

CAPEX, when viewed with our results under GAAP, provides useful

information for the reasons noted above.

Conference Call InformationWillScot will host a

conference call and webcast to discuss its fourth quarter 2024

results and 2025 outlook at 5:30 p.m. Eastern Time on Thursday,

February 20, 2025. To access the live call by phone, use the

following

link: https://register.vevent.com/register/BI81afef892a684237874777ee0f09923f

You will be provided with dial-in details after

registering. To avoid delays, we recommend that participants dial

into the conference call 15 minutes ahead of the scheduled start

time. A live webcast will also be accessible via the "Events &

Presentations" section of the Company's investor relations website:

www.investors.willscot.com. Choose "Events" and select the

information pertaining to the WillScot Fourth Quarter 2024

Conference Call. Additionally, there will be slides accompanying

the webcast. Please allow at least 15 minutes prior to the call to

register, download and install any necessary software. For those

unable to listen to the live broadcast, an audio webcast of the

call will be available for 12 months on the Company’s investor

relations website.

About WillScotListed on the

Nasdaq stock exchange under the ticker symbol “WSC,” WillScot is

the premier provider of highly innovative and turnkey space

solutions in North America. The Company’s comprehensive range of

products includes modular office complexes, mobile offices,

classrooms, temporary restrooms, portable storage containers,

protective buildings and climate-controlled units, and clearspan

structures, as well as a curated selection of furnishings,

appliances, and other supplementary services, ensuring turnkey

solutions for its customers. Headquartered in Phoenix, Arizona, and

operating from a network of approximately 260 branch locations and

additional drop lots across the United States, Canada, and Mexico,

WillScot’s business services are essential for diverse customer

segments spanning all sectors of the economy.

Forward-Looking StatementsThis

news release contains forward-looking statements (including the

guidance/outlook contained herein) within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995 and Section 21E of

the Securities Exchange Act of 1934, as amended. The words

"estimates," "expects," "anticipates," "believes," "forecasts,"

"plans," "intends," "may," "will," "should," "shall," "outlook,"

"guidance," "see," "have confidence" and variations of these words

and similar expressions identify forward-looking statements, which

are generally not historical in nature. Certain of these

forward-looking statements include statements relating to: our

mergers and acquisitions pipeline, acceleration of our run rate,

acceleration toward and the timing of our achievement of our three

to five year milestones, growth and acceleration of cash flow,

driving higher returns on invested capital, and Adjusted EBITDA

margin expansion. Forward-looking statements are subject to a

number of risks, uncertainties, assumptions and other important

factors, many of which are outside our control, which could cause

actual results or outcomes to differ materially from those

discussed in the forward-looking statements. Although the Company

believes that these forward-looking statements are based on

reasonable assumptions, they are predictions and we can give no

assurance that any such forward-looking statement will materialize.

Important factors that may affect actual results or outcomes

include, among others, our ability to acquire and integrate new

assets and operations; our ability to judge the demand outlook; our

ability to achieve planned synergies related to acquisitions;

regulatory approvals; our ability to successfully execute our

growth strategy, manage growth and execute our business plan; our

estimates of the size of the markets for our products; the rate and

degree of market acceptance of our products; the success of other

competing modular space and portable storage solutions that exist

or may become available; rising costs and inflationary pressures

adversely affecting our profitability; potential litigation

involving our Company; general economic and market conditions

impacting demand for our products and services and our ability to

benefit from an inflationary environment; our ability to maintain

an effective system of internal controls; and such other risks and

uncertainties described in the periodic reports we file with the

SEC from time to time (including our Form 10-K for the year ended

December 31, 2024), which are available through the SEC’s EDGAR

system at www.sec.gov and on our website. Any forward-looking

statement speaks only at the date on which it is made, and the

Company disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Additional Information and Where to Find

ItAdditional information can be found on the company's

website at www.willscot.com.

|

Contact Information |

|

|

| |

|

|

| Investor

Inquiries: |

|

Media

Inquiries: |

| Charlie Wohlhuter |

|

Juliana Welling |

| investors@willscot.com |

|

juliana.welling@willscot.com |

| |

|

|

|

WillScot Holdings Corporation |

|

Consolidated Statements of Operations |

| |

| |

Unaudited |

|

|

|

|

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

(in thousands, except share and per share

data) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenues: |

|

|

|

|

|

|

|

|

Leasing and services revenue: |

|

|

|

|

|

|

|

|

Leasing |

$ |

465,104 |

|

$ |

477,895 |

|

|

$ |

1,839,875 |

|

$ |

1,833,935 |

|

|

Delivery and installation |

|

95,607 |

|

|

102,197 |

|

|

|

418,881 |

|

|

437,179 |

|

|

Sales revenue: |

|

|

|

|

|

|

|

|

New units |

|

21,772 |

|

|

18,313 |

|

|

|

74,499 |

|

|

48,129 |

|

|

Rental units |

|

20,032 |

|

|

13,971 |

|

|

|

62,463 |

|

|

45,524 |

|

|

Total revenues |

|

602,515 |

|

|

612,376 |

|

|

|

2,395,718 |

|

|

2,364,767 |

|

| Costs: |

|

|

|

|

|

|

|

|

Costs of leasing and services: |

|

|

|

|

|

|

|

|

Leasing |

|

88,386 |

|

|

98,065 |

|

|

|

385,078 |

|

|

398,467 |

|

|

Delivery and installation |

|

78,093 |

|

|

78,680 |

|

|

|

328,880 |

|

|

317,117 |

|

|

Costs of sales: |

|

|

|

|

|

|

|

|

New units |

|

14,258 |

|

|

10,340 |

|

|

|

45,554 |

|

|

26,439 |

|

|

Rental units |

|

10,017 |

|

|

6,938 |

|

|

|

32,224 |

|

|

23,141 |

|

|

Depreciation of rental equipment |

|

75,412 |

|

|

75,177 |

|

|

|

302,143 |

|

|

265,733 |

|

|

Gross profit |

|

336,349 |

|

|

343,176 |

|

|

|

1,301,839 |

|

|

1,333,870 |

|

| Other operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

136,795 |

|

|

146,405 |

|

|

|

630,705 |

|

|

596,090 |

|

|

Other depreciation and amortization |

|

23,666 |

|

|

20,550 |

|

|

|

82,829 |

|

|

72,921 |

|

|

Termination fee |

|

— |

|

|

— |

|

|

|

180,000 |

|

|

— |

|

|

Impairment loss on intangible asset |

|

— |

|

|

— |

|

|

|

132,540 |

|

|

— |

|

|

Restructuring costs |

|

19 |

|

|

— |

|

|

|

8,559 |

|

|

— |

|

|

Currency losses, net |

|

687 |

|

|

(131 |

) |

|

|

593 |

|

|

6,754 |

|

|

Other expense (income), net |

|

763 |

|

|

(821 |

) |

|

|

2,698 |

|

|

(15,354 |

) |

|

Operating income |

|

174,419 |

|

|

177,173 |

|

|

|

263,915 |

|

|

673,459 |

|

|

Interest expense, net |

|

59,352 |

|

|

59,125 |

|

|

|

227,311 |

|

|

205,040 |

|

| Income from continuing

operations before income tax |

|

115,067 |

|

|

118,048 |

|

|

|

36,604 |

|

|

468,419 |

|

|

Income tax expense from continuing operations |

|

25,852 |

|

|

31,720 |

|

|

|

8,475 |

|

|

126,575 |

|

| Income from continuing

operations |

|

89,215 |

|

|

86,328 |

|

|

|

28,129 |

|

|

341,844 |

|

| |

|

|

|

|

|

|

|

| Discontinued operations: |

|

|

|

|

|

|

|

|

Income from discontinued operations before income tax |

|

— |

|

|

— |

|

|

|

— |

|

|

4,003 |

|

|

Gain on sale of discontinued operations |

|

— |

|

|

— |

|

|

|

— |

|

|

176,078 |

|

|

Income tax expense from discontinued operations |

|

— |

|

|

— |

|

|

|

— |

|

|

45,468 |

|

| Income from discontinued

operations |

|

— |

|

|

— |

|

|

|

— |

|

|

134,613 |

|

| |

|

|

|

|

|

|

|

| Net income |

$ |

89,215 |

|

$ |

86,328 |

|

|

$ |

28,129 |

|

$ |

476,457 |

|

| |

|

|

|

|

|

|

|

| Earnings per

share from continuing operations: |

|

|

| Basic |

$ |

0.48 |

|

$ |

0.45 |

|

|

$ |

0.15 |

|

$ |

1.72 |

|

| Diluted |

$ |

0.48 |

|

$ |

0.44 |

|

|

$ |

0.15 |

|

$ |

1.69 |

|

| Earnings per

share from discontinued operations: |

|

|

| Basic |

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

$ |

0.68 |

|

| Diluted |

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

$ |

0.67 |

|

| Earnings per

share: |

|

|

|

|

| Basic |

$ |

0.48 |

|

$ |

0.45 |

|

|

$ |

0.15 |

|

$ |

2.40 |

|

| Diluted |

$ |

0.48 |

|

$ |

0.44 |

|

|

$ |

0.15 |

|

$ |

2.36 |

|

| Weighted average shares: |

|

|

|

|

|

|

|

| Basic |

|

184,347,088 |

|

|

191,171,967 |

|

|

|

188,101,693 |

|

|

198,554,885 |

|

| Diluted |

|

186,208,059 |

|

|

194,097,351 |

|

|

|

190,292,256 |

|

|

201,849,836 |

|

|

WillScot Holdings Corporation |

|

Consolidated Balance Sheets |

| |

| |

December 31, |

|

(in thousands, except share data) |

2024 |

|

2023 |

| Assets |

|

|

|

|

Cash and cash equivalents |

$ |

9,001 |

|

|

$ |

10,958 |

|

|

Trade receivables, net of allowances for credit losses at December

31, 2024 and December 31, 2023 of $101,693 and $81,656,

respectively |

|

430,381 |

|

|

|

451,130 |

|

|

Inventories |

|

47,473 |

|

|

|

47,406 |

|

|

Prepaid expenses and other current assets |

|

67,751 |

|

|

|

57,492 |

|

|

Assets held for sale |

|

2,904 |

|

|

|

2,110 |

|

|

Total current assets |

|

557,510 |

|

|

|

569,096 |

|

|

Rental equipment, net |

|

3,377,939 |

|

|

|

3,381,315 |

|

|

Property, plant and equipment, net |

|

363,073 |

|

|

|

340,887 |

|

|

Operating lease assets |

|

266,761 |

|

|

|

245,647 |

|

|

Goodwill |

|

1,201,353 |

|

|

|

1,176,635 |

|

|

Intangible assets, net |

|

251,164 |

|

|

|

419,709 |

|

|

Other non-current assets |

|

17,111 |

|

|

|

4,626 |

|

|

Total long-term assets |

|

5,477,401 |

|

|

|

5,568,819 |

|

| Total assets |

$ |

6,034,911 |

|

|

$ |

6,137,915 |

|

| Liabilities and equity |

|

|

|

|

Accounts payable |

$ |

96,597 |

|

|

$ |

86,123 |

|

|

Accrued expenses |

|

121,583 |

|

|

|

129,621 |

|

|

Accrued employee benefits |

|

25,062 |

|

|

|

45,564 |

|

|

Deferred revenue and customer deposits |

|

250,790 |

|

|

|

224,518 |

|

|

Operating lease liabilities – current |

|

66,378 |

|

|

|

57,408 |

|

|

Current portion of long-term debt |

|

24,598 |

|

|

|

18,786 |

|

|

Total current liabilities |

|

585,008 |

|

|

|

562,020 |

|

|

Long-term debt |

|

3,683,502 |

|

|

|

3,538,516 |

|

|

Deferred tax liabilities |

|

505,913 |

|

|

|

554,268 |

|

|

Operating lease liabilities – non-current |

|

200,875 |

|

|

|

187,837 |

|

|

Other non-current liabilities |

|

41,020 |

|

|

|

34,024 |

|

|

Long-term liabilities |

|

4,431,310 |

|

|

|

4,314,645 |

|

| Total liabilities |

|

5,016,318 |

|

|

|

4,876,665 |

|

|

Preferred Stock: $0.0001 par, 1,000,000 shares authorized and zero

shares issued and outstanding at December 31, 2024 and December 31,

2023 |

|

— |

|

|

|

— |

|

|

Common Stock: $0.0001 par, 500,000,000 shares authorized and

183,564,899 and 189,967,135 shares issued and outstanding at

December 31, 2024 and December 31, 2023, respectively |

|

19 |

|

|

|

20 |

|

|

Additional paid-in-capital |

|

1,836,165 |

|

|

|

2,089,091 |

|

|

Accumulated other comprehensive loss |

|

(70,627 |

) |

|

|

(52,768 |

) |

|

Accumulated deficit |

|

(746,964 |

) |

|

|

(775,093 |

) |

| Total shareholders' equity |

|

1,018,593 |

|

|

|

1,261,250 |

|

| Total liabilities and

shareholders' equity |

$ |

6,034,911 |

|

|

$ |

6,137,915 |

|

|

Reconciliation of Non-GAAP Financial Measures |

|

|

In addition to using GAAP financial

measurements, we use certain non-GAAP financial information that we

believe is important for purposes of comparison to prior periods

and development of future projections and earnings growth

prospects. This information is also used by management to measure

the profitability of our ongoing operations and analyze our

business performance and trends.

We evaluate business performance on Adjusted

EBITDA, a non-GAAP measure that excludes certain items as described

below. We believe that evaluating performance excluding such items

is meaningful because it provides insight with respect to intrinsic

and ongoing operating results of the Company.

We also regularly evaluate gross profit to

assist in the assessment of the operational performance. We

consider Adjusted EBITDA to be the more important metric because it

more fully captures the business performance, inclusive of indirect

costs.

We also evaluate Free Cash Flow, a non-GAAP

measure that provides useful information concerning cash flow

available to fund our capital allocation alternatives.

Adjusted EBITDA From Continuing

Operations

We define EBITDA as net income (loss) plus

interest (income) expense, income tax expense (benefit),

depreciation and amortization. Our adjusted EBITDA ("Adjusted

EBITDA") reflects the following further adjustments to EBITDA to

exclude certain non-cash items and the effect of what we consider

transactions or events not related to our core business

operations:

- Goodwill and

other impairment charges related to non-cash costs associated with

impairment charges to goodwill, other intangibles, rental fleet and

property, plant and equipment.

- Restructuring

costs, lease impairment expense, and other related charges

associated with restructuring plans designed to streamline

operations and reduce costs including employee termination

costs.

- Currency (gains)

losses, net on monetary assets and liabilities denominated in

foreign currencies other than the subsidiaries’ functional

currency.

- Transaction

costs including legal and professional fees and other transaction

specific related costs.

- Costs to

integrate acquired companies, including outside professional fees,

non-capitalized costs associated with system integrations,

non-lease branch and fleet relocation expenses, employee training

costs, and other costs required to realize cost or revenue

synergies.

- Non-cash charges

for stock compensation plans.

- Other expense,

including consulting expenses related to certain one-time projects,

financing costs not classified as interest expense, gains and

losses on disposals of property, plant, and equipment, and

unrealized gains and losses on investments.

Adjusted EBITDA has limitations as an analytical

tool, and you should not consider the measure in isolation or as a

substitute for net income (loss), cash flow from operations or

other methods of analyzing the Company’s results as reported under

GAAP. Some of these limitations are:

- Adjusted EBITDA

does not reflect changes in, or cash requirements for our working

capital needs;

- Adjusted EBITDA

does not reflect our interest expense, or the cash requirements

necessary to service interest or principal payments, on our

indebtedness;

- Adjusted EBITDA

does not reflect our tax expense or the cash requirements to pay

our taxes;

- Adjusted EBITDA

does not reflect historical cash expenditures or future

requirements for capital expenditures or contractual

commitments;

- Adjusted EBITDA

does not reflect the impact on earnings or changes resulting from

matters that we consider not to be indicative of our future

operations;

- Although

depreciation and amortization are non-cash charges, the assets

being depreciated and amortized will often have to be replaced in

the future and Adjusted EBITDA does not reflect any cash

requirements for such replacements; and

- Other companies

in our industry may calculate Adjusted EBITDA differently, limiting

its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA

should not be considered as discretionary cash available to

reinvest in the growth of our business or as a measure of cash that

will be available to meet our obligations.

The following table provides reconciliations of

Income from continuing operations to Adjusted EBITDA from

continuing operations:

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

(in thousands) |

2024 |

2023 |

|

2024 |

2023 |

|

Income from continuing operations |

$ |

89,215 |

|

$ |

86,328 |

|

|

$ |

28,129 |

|

$ |

341,844 |

|

|

Income tax expense from continuing operations |

|

25,852 |

|

|

31,720 |

|

|

|

8,475 |

|

|

126,575 |

|

|

Interest expense, net |

|

59,352 |

|

|

59,125 |

|

|

|

227,311 |

|

|

205,040 |

|

|

Depreciation and amortization |

|

99,078 |

|

|

95,727 |

|

|

|

384,972 |

|

|

338,654 |

|

|

Currency losses (gains), net |

|

687 |

|

|

(131 |

) |

|

|

593 |

|

|

6,754 |

|

|

Restructuring costs, lease impairment expense and other related

charges |

|

28 |

|

|

— |

|

|

|

9,435 |

|

|

22 |

|

|

Termination fee |

|

— |

|

|

— |

|

|

|

180,000 |

|

|

— |

|

|

Impairment loss on intangible asset |

|

— |

|

|

— |

|

|

|

132,540 |

|

|

— |

|

|

Impairment loss on long-lived asset |

|

374 |

|

|

— |

|

|

|

374 |

|

|

— |

|

|

Transaction costs |

|

376 |

|

|

1,472 |

|

|

|

651 |

|

|

2,259 |

|

|

Integration costs |

|

121 |

|

|

3,466 |

|

|

|

7,521 |

|

|

10,366 |

|

|

Stock compensation expense |

|

7,719 |

|

|

8,352 |

|

|

|

35,966 |

|

|

34,486 |

|

|

Other(a) |

|

1,910 |

|

|

1,743 |

|

|

|

47,193 |

|

|

(4,535 |

) |

| Adjusted EBITDA from

continuing operations |

$ |

284,712 |

|

$ |

287,802 |

|

|

$ |

1,063,160 |

|

$ |

1,061,465 |

|

(a) Includes $1.1 million and $42.4 million in

legal and professional fees related to the terminated McGrath

transaction for the three months ended December 31, 2024 and the

year ended December 31, 2024, respectively.

Adjusted EBITDA Margin From Continuing

Operations

We define Adjusted EBITDA Margin as Adjusted

EBITDA divided by revenue. Management believes that the

presentation of Adjusted EBITDA Margin provides useful information

to investors regarding the performance of our business. The

following table provides comparisons of Adjusted EBITDA Margin to

Gross Profit Margin:

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

(in thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Adjusted EBITDA from continuing operations (A) |

$ |

284,712 |

|

|

$ |

287,802 |

|

|

$ |

1,063,160 |

|

|

$ |

1,061,465 |

|

| Revenue (B) |

$ |

602,515 |

|

|

$ |

612,376 |

|

|

$ |

2,395,718 |

|

|

$ |

2,364,767 |

|

|

Adjusted EBITDA Margin from Continuing Operations (A/B) |

|

47.3 |

% |

|

|

47.0 |

% |

|

|

44.4 |

% |

|

|

44.9 |

% |

| Gross profit (C) |

$ |

336,349 |

|

|

$ |

343,176 |

|

|

$ |

1,301,839 |

|

|

$ |

1,333,870 |

|

|

Gross Profit Margin (C/B) |

|

55.8 |

% |

|

|

56.0 |

% |

|

|

54.3 |

% |

|

|

56.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Debt to Adjusted EBITDA From

Continuing Operations Ratio

Net Debt to Adjusted EBITDA ratio is defined as

Net Debt divided by Adjusted EBITDA from continuing operations from

the last twelve months. We define Net Debt as total debt from

continuing operations net of total cash and cash equivalents from

continuing operations. Management believes that the presentation of

Net Debt to Adjusted EBITDA ratio provides useful information to

investors regarding the performance of our business. The following

table provides a reconciliation of Net Debt to Adjusted EBITDA

ratio:

|

(in thousands) |

December 31, 2024 |

|

Long-term debt |

$ |

3,683,502 |

| Current portion of long-term

debt |

|

24,598 |

|

Total debt |

|

3,708,100 |

| Cash and cash equivalents |

|

9,001 |

|

Net debt (A) |

$ |

3,699,099 |

| |

|

| Adjusted EBITDA from

continuing operations (B) |

$ |

1,063,160 |

| Net Debt to Adjusted EBITDA

ratio (A/B) |

|

3.5 |

| |

|

|

Adjusted Income from Continuing Operations and Adjusted

Diluted Earnings Per Share

We define adjusted income from continuing

operations as income from continuing operations, plus certain

non-cash items and the effect of what we consider transactions not

related to our core business operations including:

- Goodwill and

other impairment charges related to non-cash costs associated with

impairment charges to goodwill, other intangibles, rental fleet and

property, plant and equipment.

- Restructuring

costs, lease impairment expense, and other related charges

associated with restructuring plans designed to streamline

operations and reduce costs including employee and lease

termination costs.

- Transaction

costs including legal and professional fees and other transaction

specific related costs.

- Costs to

integrate acquired companies, including outside professional fees,

non-capitalized costs associated with system integrations,

non-lease branch and fleet relocation expenses, employee training

costs, and other costs required to realize cost or revenue

synergies.

- Transaction

costs, including legal and professional fees and other

transaction-specific costs, for terminated acquisitions.

We define adjusted diluted earnings per share

from continuing operations as adjusted income from continuing

operations divided by adjusted diluted weighted average common

shares outstanding. Management believes that the presentation of

adjusted income from continuing operations and adjusted diluted

earnings per share from continuing operations provide useful

information to investors regarding the performance of our

business.

The following table provides reconciliations of

income from continuing operations to adjusted income from

continuing operations and comparisons of diluted earnings per share

to adjusted diluted earnings per share:

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

(in thousands, except share data) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Income from continuing operations |

$ |

89,215 |

|

|

$ |

86,328 |

|

|

$ |

28,129 |

|

|

$ |

341,844 |

|

|

Restructuring costs, lease impairment expense and other related

charges, net |

|

28 |

|

|

|

— |

|

|

|

9,435 |

|

|

|

22 |

|

|

Termination fee |

|

— |

|

|

|

— |

|

|

|

180,000 |

|

|

|

— |

|

|

Impairment loss on intangible asset |

|

— |

|

|

|

— |

|

|

|

132,540 |

|

|

|

— |

|

|

Transaction costs |

|

376 |

|

|

|

1,472 |

|

|

|

651 |

|

|

|

2,259 |

|

|

Integration costs |

|

121 |

|

|

|

3,466 |

|

|

|

7,521 |

|

|

|

10,366 |

|

|

Transaction costs from terminated acquisitions |

|

1,147 |

|

|

|

2,047 |

|

|

|

45,031 |

|

|

|

3,264 |

|

|

Estimated tax impact1 |

|

(418 |

) |

|

|

(1,816 |

) |

|

|

(93,795 |

) |

|

|

(4,137 |

) |

| Adjusted income from

continuing operations |

$ |

90,469 |

|

|

$ |

91,497 |

|

|

$ |

309,512 |

|

|

$ |

353,618 |

|

| |

|

|

|

|

|

|

|

| Income from continuing

operations per adjusted diluted share2 |

$ |

0.48 |

|

|

$ |

0.44 |

|

|

$ |

0.15 |

|

|

$ |

1.69 |

|

|

Restructuring costs, lease impairment expense and other related

charges, net |

|

— |

|

|

|

— |

|

|

|

0.05 |

|

|

|

— |

|

|

Termination fee |

|

— |

|

|

|

— |

|

|

|

0.95 |

|

|

|

— |

|

|

Impairment loss on intangible asset |

|

— |

|

|

|

— |

|

|

|

0.70 |

|

|

|

— |

|

|

Transaction costs |

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

|

Integration costs |

|

— |

|

|

|

0.02 |

|

|

|

0.04 |

|

|

|

0.05 |

|

|

Transaction costs from terminated acquisitions |

|

0.01 |

|

|

|

0.01 |

|

|

|

0.24 |

|

|

|

0.02 |

|

|

Estimated tax impact1 |

|

— |

|

|

|

(0.01 |

) |

|

|

(0.50 |

) |

|

|

(0.02 |

) |

| Adjusted Diluted Earnings Per

Share |

$ |

0.49 |

|

|

$ |

0.47 |

|

|

$ |

1.63 |

|

|

$ |

1.75 |

|

| |

|

|

|

|

|

|

|

| Weighted average diluted

shares outstanding |

|

186,208,059 |

|

|

|

194,097,351 |

|

|

|

190,292,256 |

|

|

|

201,849,836 |

|

| Adjusted weighted average

dilutive shares outstanding |

|

186,208,059 |

|

|

|

194,097,351 |

|

|

|

190,292,256 |

|

|

|

201,849,836 |

|

1 We include estimated taxes at our current

statutory tax rate of approximately 25% for the three and twelve

months ended December 31, 2024 and 26% for the three and twelve

months ended December 31, 2023.

Adjusted Free Cash Flow and Adjusted Free Cash Flow

Margin

We define Adjusted Free Cash Flow as net cash

provided by operating activities; less purchases of rental

equipment and property, plant and equipment and plus proceeds from

sale of rental equipment and property, plant and equipment, which

are all included in cash flows from investing activities; excluding

one-time, nonrecurring payments for the McGrath termination fee and

transaction costs from terminated acquisitions. Adjusted Free Cash

Flow Margin is defined as Adjusted Free Cash Flow divided by Total

Revenue including discontinued operations. Management believes that

the presentation of Adjusted Free Cash Flow and Adjusted Free Cash

Flow Margin provides useful additional information concerning cash

flow available to fund our capital allocation alternatives.

Adjusted Free Cash Flow as presented includes amounts for the

former UK Storage Solutions segment through January 31, 2023. The

following table provides reconciliations of Adjusted Free Cash Flow

and Adjusted Free Cash Flow Margin:

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

(in thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net cash provided by operating activities |

$ |

178,919 |

|

|

$ |

219,322 |

|

|

$ |

561,644 |

|

|

$ |

761,240 |

|

| Purchase of rental equipment

and refurbishments |

|

(73,868 |

) |

|

|

(60,879 |

) |

|

|

(280,857 |

) |

|

|

(226,976 |

) |

| Proceeds from sale of rental

equipment |

|

20,091 |

|

|

|

13,316 |

|

|

|

63,997 |

|

|

|

51,290 |

|

| Purchase of property, plant

and equipment |

|

(2,316 |

) |

|

|

(5,485 |

) |

|

|

(18,435 |

) |

|

|

(22,237 |

) |

| Proceeds from the sale of

property, plant and equipment |

|

734 |

|

|

|

6 |

|

|

|

1,867 |

|

|

|

13,272 |

|

| Cash paid for termination

fee |

|

— |

|

|

|

— |

|

|

|

180,000 |

|

|

|

— |

|

| Cash paid for transaction

costs from terminated acquisitions |

|

13,270 |

|

|

|

— |

|

|

|

45,721 |

|

|

|

— |

|

|

Adjusted Free Cash Flow (A) |

$ |

136,830 |

|

|

$ |

166,280 |

|

|

$ |

553,937 |

|

|

$ |

576,589 |

|

| |

|

|

|

|

|

|

|

| Revenue from continuing

operations (B) |

$ |

602,515 |

|

|

$ |

612,376 |

|

|

$ |

2,395,718 |

|

|

$ |

2,364,767 |

|

| Revenue from discontinued

operations |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,694 |

|

| Total Revenue including

discontinued operations (C) |

$ |

602,515 |

|

|

$ |

612,376 |

|

|

$ |

2,395,718 |

|

|

$ |

2,373,461 |

|

|

Adjusted Free Cash Flow Margin (A/C) |

|

22.7 |

% |

|

|

27.2 |

% |

|

|

23.1 |

% |

|

|

24.3 |

% |

| |

|

|

|

|

|

|

|

| Net cash provided by operating

activities (D) |

$ |

178,919 |

|

|

$ |

219,322 |

|

|

$ |

561,644 |

|

|

$ |

761,240 |

|

|

Net cash provided by operating activities margin (D/C) |

|

29.7 |

% |

|

|

35.8 |

% |

|

|

23.4 |

% |

|

|

32.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net CAPEX

We define Net CAPEX as purchases of rental

equipment and refurbishments and purchases of property, plant and

equipment (collectively, "Total Capital Expenditures"), less

proceeds from the sale of rental equipment and proceeds from the

sale of property, plant and equipment (collectively, "Total

Proceeds"), which are all included in cash flows from investing

activities. Management believes that the presentation of Net CAPEX

provides useful information regarding the net capital invested in

our rental fleet and property, plant and equipment each year to

assist in analyzing the performance of our business. As presented

below, Net CAPEX includes amounts for the former UK Storage

Solutions segment through January 31, 2023.

The following table provides reconciliations of

Net CAPEX:

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

(in thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Purchases of rental equipment and refurbishments |

$ |

(73,868 |

) |

|

$ |

(60,879 |

) |

|

$ |

(280,857 |

) |

|

$ |

(226,976 |

) |

| Proceeds from sale of rental

equipment |

|

20,091 |

|

|

|

13,316 |

|

|

|

63,997 |

|

|

|

51,290 |

|

|

Net CAPEX for Rental Equipment |

|

(53,777 |

) |

|

|

(47,563 |

) |

|

|

(216,860 |

) |

|

|

(175,686 |

) |

| Purchases of property, plant and

equipment |

|

(2,316 |

) |

|

|

(5,485 |

) |

|

|

(18,435 |

) |

|

|

(22,237 |

) |

| Proceeds from sale of property,

plant and equipment |

|

734 |

|

|

|

6 |

|

|

|

1,867 |

|

|

|

13,272 |

|

|

Net CAPEX |

$ |

(55,359 |

) |

|

$ |

(53,042 |

) |

|

$ |

(233,428 |

) |

|

$ |

(184,651 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Invested Capital

Return on Invested Capital is defined as

Adjusted earnings before interest and amortization divided by

Average Invested Capital. Management believes that the presentation

of Return on Invested Capital provides useful information regarding

the long-term health and profitability of the business relative to

the Company's cost of capital. We define Adjusted earnings before

interest and amortization as Adjusted EBITDA (see reconciliation

above) reduced by depreciation and estimated taxes. Given we are

not a significant US taxpayer due to our current tax attributes, we

include estimated taxes at our current statutory tax rate.

The Average Invested Capital is calculated as an

average of Net Assets, a four quarter average for annual metrics

and two quarter average for quarterly metrics. Net assets is

defined for purposes of the calculation below as total assets less

goodwill, intangible assets, net, and all non-interest bearing

liabilities.

The following table provides reconciliations of

Return on Invested Capital and includes amounts for the former UK

Storage Solutions segment through January 31, 2023.

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

(in thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Total Assets |

$ |

6,034,911 |

|

|

$ |

6,137,915 |

|

|

$ |

6,034,911 |

|

|

$ |

6,137,915 |

|

| Goodwill |

|

(1,201,353 |

) |

|

|

(1,176,635 |

) |

|

|

(1,201,353 |

) |

|

|

(1,176,635 |

) |

| Intangible Assets, net |

|

(251,164 |

) |

|

|

(419,709 |

) |

|

|

(251,164 |

) |

|

|

(419,709 |

) |

| Total Liabilities |

|

(5,016,318 |

) |

|

|

(4,876,665 |

) |

|

|

(5,016,318 |

) |

|

|

(4,876,665 |

) |

| Long Term Debt |

|

3,683,502 |

|

|

|

3,538,516 |

|

|

|

3,683,502 |

|

|

|

3,538,516 |

|

| Net Assets, as defined

above |

$ |

3,249,578 |

|

|

$ |

3,203,422 |

|

|

$ |

3,249,578 |

|

|

$ |

3,203,422 |

|

| Average Invested Capital (A) |

$ |

3,237,093 |

|

|

$ |

3,208,368 |

|

|

$ |

3,217,513 |

|

|

$ |

3,124,064 |

|

| |

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

284,712 |

|

|

$ |

287,802 |

|

|

$ |

1,063,160 |

|

|

$ |

1,061,465 |

|

| Depreciation |

|

(87,203 |

) |

|

|

(87,716 |

) |

|

|

(346,467 |

) |

|

|

(312,830 |

) |

| Adjusted EBITA (B) |

$ |

197,509 |

|

|

$ |

200,086 |

|

|

$ |

716,693 |

|

|

$ |

748,635 |

|

| |

|

|

|

|

|

|

|

| Statutory Tax Rate (C) |

|

25 |

% |

|

|

26 |

% |

|

|

25 |

% |

|

|

26 |

% |

| Estimated Tax (B*C) |

$ |

49,377 |

|

|

$ |

52,022 |

|

|

$ |

179,173 |

|

|

$ |

194,645 |

|

| Adjusted earnings before

interest and amortization (D) |

$ |

148,132 |

|

|

$ |

148,064 |

|

|

$ |

537,520 |

|

|

$ |

553,990 |

|

| ROIC (D/A), annualized |

|

18.3 |

% |

|

|

18.5 |

% |

|

|

16.7 |

% |

|

|

17.7 |

% |

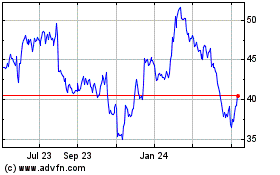

WillScot (NASDAQ:WSC)

Historical Stock Chart

From Jan 2025 to Feb 2025

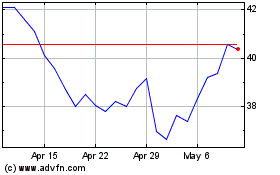

WillScot (NASDAQ:WSC)

Historical Stock Chart

From Feb 2024 to Feb 2025