Exicure, Inc. (Nasdaq: XCUR, the "Company") has historically

been an early-stage biotechnology company focused on developing

nucleic acid therapies targeting ribonucleic acid against validated

targets. In September 2022, the Company announced a significant

reduction in force, suspension of preclinical activities and

halting of all research and development, and that the Company was

exploring strategic alternatives to maximize stockholder value.

Equity Financing

In an agreement dated November 6, 2024 and executed on November

12, 2024, the Company agreed to sell and issue to HiTron Systems

Inc. (“HiTron”) 433,333 shares of common stock, par value $0.0001

per share, for $1.3 million, at a purchase price of $3.00 per

share. The closing of this transaction is expected to occur within

10 days from its execution. On November 13, 2024, in a subsequent

agreement, the Company agreed to sell and issue to HiTron 2,900,000

additional shares of common stock, par value $0.0001 per share, for

$8.7 million, at a purchase price of $3.00 per share. The closing

of the investment pursuant to this subsequent agreement is

conditioned on stockholder approval, among other customary

conditions.

Upon closing of the initial $1.3 million investment, HiTron will

have the right to appoint two nominees to the Company’s board of

directors, subject to certain conditions. Upon closing of the

subsequent $8.7 million investment, HiTron will have the right to

appoint additional nominees in proportion to its equity interest,

subject to certain conditions.

Request for Subsequent Extension to

Nasdaq Hearings Panel

As previously disclosed, the Nasdaq Hearings Panel granted an

extension through November 14, 2024 to continue the Company’s

listing subject to the Company evidencing compliance with all

applicable criteria for continued listing on The Nasdaq Capital

Market. As of September 30, 2024, the Company did not meet the

continued listing requirement related to stockholders’ equity,

primarily due to the litigation accrual described below. However,

the Company believes it will be in pro forma compliance with the

stockholders’ equity requirement once the $1.3 million sale to

HiTron closes. Therefore, the Company has requested an additional

extension through December 17, 2024. We cannot provide any

assurance as to whether the Panel will grant the extension or, if

granted, whether we can adequately demonstrate to the Panel’s

satisfaction that we have regained, and will be able to maintain,

compliance with the continued listing standards in order to avoid

delisting.

Third Quarter 2024 Financial

Results

Cash Position: Cash and cash equivalents were $0.3

million as of September 30, 2024, as compared to $0.8 million as of

December 31, 2023. The Company believes that its cash and cash

equivalents are insufficient to continue to fund operations and

additional funding is needed in the very near term.

General and Administrative (G&A) Expense: General and

administrative expenses were $1.46 million for the quarter ended

September 30, 2024, as compared to $2.4 million for the quarter

ended September 30, 2023. The decrease in G&A expense of $0.2

million for the three months ended September 30, 2024 was mostly

due to lower expenses as a result of reduced operations and higher

costs in 2023 resulting from the separation costs of former

employees.

Litigation legal expense: The increase of $1.1 million

for the three months ended September 30, 2024 was due to accruals

recorded for the amount of the unsatisfied self insured retainer

and legal defense costs related to the securities litigation

lawsuit.

Other Income: The Company will receive gross proceeds of

$1.5 million from closing the sale of certain assets pursuant to

the Asset Purchase Agreement. The Purchaser acquired the Company’s

historical biotechnology intellectual property and other assets and

include spherical nucleic acid-related technology, research and

development programs, and clinical assets.

Net Loss: The Company had a net loss of $1.1 million for

the quarter ended September 30, 2024, as compared to a net loss of

$5.3 million for the quarter ended September 30, 2023. The decrease

in net loss of $4.2 million was primarily driven by the $1.5

million of revenue from the Asset Purchase Agreement, the $2

million loss incurred in 2023 from the write down of its investment

in convertible bonds, and the reduction of payroll and operating

costs due to reduced operations.

Going Concern: Management believes that the Company’s

existing cash and cash equivalents is not sufficient to continue to

fund operations. The Company has already engaged in significant

cost reductions, so our ability to further cut costs and extend the

Company’s operating runway is limited. As a result, substantial

additional financing is needed in very near term to pay expenses,

fund the ongoing exploration of strategic alternatives and pursue

any alternatives that may be identified. The Company needs to raise

capital to fund its operations. There can be no assurance that such

additional financing will be available and, if available, can be

obtained on acceptable terms.

About Exicure

Exicure, Inc. has historically been an early-stage biotechnology

company focused on developing nucleic acid therapies targeting

ribonucleic acid against validated targets. Following its recent

restructuring and suspension of clinical and development

activities, the Company is exploring strategic alternatives to

maximize stockholder value, both with respect to its historical

biotechnology assets and more broadly. For further information, see

www.exicuretx.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements in this press release other than statements of

historical fact may be deemed forward looking including, but not

limited to, statements regarding: the Company’s current business

plans and objectives, including the pursuit of strategic

alternatives to maximize stockholder value, the timing of the

equity investment closing and potential additional equity

investment and the Nasdaq Hearings Panel process and potential

results. Words such as “plans,” “expects,” “will,” “anticipates,”

“continue,” “advance,” “believes,” “target,” “may,” “intend,”

“could,” and other words and terms of similar meaning and

expression are intended to identify forward-looking statements,

although not all forward-looking statements contain such terms.

Forward-looking statements are based on management’s current

beliefs and assumptions that are subject to risks and uncertainties

and are not guarantees of future performance. For a discussion of

other risks and uncertainties, and other important factors, any of

which could cause the Company’s actual results to differ from those

contained in the forward-looking statements, see the section titled

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023 filed with the Securities and Exchange

Commission on June 6, 2024, as updated by the Company’s subsequent

filings with the Securities and Exchange Commission. All

information in this press release is as of the date of the release,

and the Company undertakes no duty to update this information or to

publicly announce the results of any revisions to any of such

statements to reflect future events or developments, except as

required by law.

EXICURE, INC. UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except share

and per share data)

September 30,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

343

$

816

Accounts receivable

—

—

Other receivable

1,350

15

Prepaid expenses and other current

assets

907

1,193

Total current assets

2,600

2,024

Property and equipment, net

33

54

Right-of-use asset

5,926

6,517

Other noncurrent assets

2,072

2,985

Total assets

$

10,631

$

11,580

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

1,337

1,631

Accrued expenses and other current

liabilities

2,318

879

Total current liabilities

3,655

2,510

Lease liability, noncurrent

5,431

6,039

Total liabilities

9,086

8,549

Commitments and Contingencies (Note

12)

Stockholders’ equity:

Preferred stock, $0.0001 par value per

share; 10,000,000 shares authorized, no shares issued and

outstanding, September 30, 2024 and December 31, 2023

—

—

Common stock, $0.0001 par value per share;

200,000,000 shares authorized, 2,172,323 issued and outstanding,

September 30, 2024; 1,832,988 issued and outstanding, December 31,

2023*

—

—

Additional paid-in capital

193,628

192,594

Accumulated deficit

(192,083

)

(189,563

)

Total stockholders' equity

1,545

3,031

Total liabilities and stockholders’

equity

$

10,631

$

11,580

* reflects a one-for-five (1:5) reverse

stock split effected on August 27, 2024

EXICURE, INC. UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands,

except share and per share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue:

Revenue

$

—

$

—

$

500

$

—

Total revenue

—

—

500

—

Operating expenses:

Research and development expense

—

—

—

1,423

General and administrative expense

1,434

2,397

4,005

11,155

Litigation legal expense

1,138

—

1,138

—

Loss from sale of property and

equipment

—

920

—

920

Total operating expenses

2,572

3,317

5,143

13,498

Operating income (loss)

(2,572

)

(3,317

)

(4,643

)

(13,498

)

Other income (expense), net:

Dividend income

—

(2,000

)

—

(2,000

)

Interest income

—

13

5

45

Interest expense

1

4

7

28

Other income

(12

)

—

(18

)

—

Other expense

1,500

44

2,137

(0.002

)

Total other income (expense), net

1,489

(1,939

)

2,131

(1,929

)

Net income (loss) before provision for

income taxes

(1,083

)

(5,256

)

(2,512

)

(15,427

)

Provision for income taxes

(8

)

—

(8

)

—

Net income (loss)

$

(1,091

)

$

(5,256

)

$

(2,520

)

$

(15,427

)

Basic and diluted loss per common share

*

$

(0.57

)

$

(3.04

)

$

(1.36

)

$

(9.89

)

Weighted-average basic and diluted common

shares outstanding *

1,899,412

1,730,104

1,855,286

1,559,868

* reflects a one-for-five (1:5) reverse

stock split effected on August 27, 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114173277/en/

Media Contact: Josh Miller 847-673-1700

media@exicuretx.com

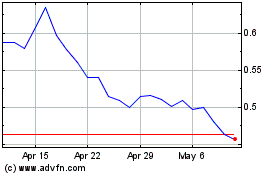

Exicure (NASDAQ:XCUR)

Historical Stock Chart

From Nov 2024 to Dec 2024

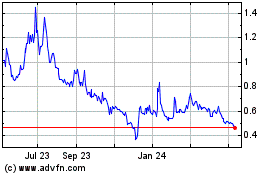

Exicure (NASDAQ:XCUR)

Historical Stock Chart

From Dec 2023 to Dec 2024