0001698530false00016985302025-01-232025-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K/A

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2025

____________________

EXICURE, INC.

(Exact name of Registrant as specified in its charter)

____________________

| | | | | | | | |

| Delaware | 001-39011

| 81-5333008 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

2430 N. Halsted St.

Chicago, IL 60614

(Address of principal executive offices)

Registrant’s telephone number, including area code: (847) 673-1700

____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Recommencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | XCUR | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

EXPLANATORY NOTE

The purpose of this Amendment No. 1 to the Current Report on Form 8-K filed by Exicure, Inc. on January 22, 2025 is to amend such report for the sole purpose of replacing the press release attached thereto as Exhibit 99.1. A corrected version of the press release was published on January 23, 2025, which is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: January 23, 2025 | EXICURE, INC. |

| | |

| By: | /s/ Andy Yoo |

| | Andy Yoo |

| | Chief Executive Officer |

| | |

Exicure, Inc. Announces Purchase Agreement with GPCR Therapeutics Inc.

CHICAGO, IL. – January 23, 2025 - Exicure, Inc. (Nasdaq: XCUR, “the Company”, “Exicure”), today announced that on January 19, 2025, Exicure Inc. (“the Company”) entered into a Share Purchase Agreement with GPCR Therapeutics Inc., a Korean corporation (“GPCR”), pursuant to which the Company acquired from GPCR all of the issued and outstanding equity securities of GPCR Therapeutics USA Inc., a California corporation (“GPCR USA”). The transactions completed under the Share Purchase Agreement closed concurrently with execution. GPCR USA was, until immediately prior to closing under the Share Purchase Agreement, a wholly owned subsidiary of GPCR.

In connection with the closing of the Share Purchase Agreement, the Company and GPCR entered into a License and Collaboration Agreement (“L&C Agreement”) to further develop and commercialize GPCR’s technologies related to certain intellectual properties and patents. The L&C Agreement requires the Company to make milestone payments to GPCR upon the achievement of specific milestone events relating to clinical trials, marketing authorizations, and net sales, as well as for the Company to pay a recurring royalty payment based on at least 10% of net sales, as set forth in the L&C Agreement.

About GPCR USA, Inc.

GPCR USA is a biotech company that is currently led by Dr. Pina Cardarelli, the CSO and president of GPCR USA. The company has an ongoing Phase 2 clinical trial focused on blood cancer patients, particularly those eligible for hematopoietic stem cell transplantation (HSCT). The trial involves the combined administration of G-CSF, GPC-100 (Burixafor) and propranolol. Per Dr. Cardarelli, "Two additional patients will receive treatment in January 2025. GPCR USA plans to complete the administration of GPC-100 to 20 patients by the end of April and aim to announce the clinical trial results by September."

In December of last year, GPCR USA presented results at the American Society of Hematology conference evaluating the impact of inhibiting CXCR4 and ADRB2 (beta-2 adrenergic receptor) on stem cell mobilization. Interim data from 10 patients for burixafor in combination with propranolol and G-CSF is promising. Results suggest that the treatment regimen can mobilize CD34+ stem cells sufficiently for autologous stem cell transplant. Notably, burixafor allowed for same day administration of both mobilizing agent and leukapheresis. This fast kinetics of mobilization is differentiated from the FDA approved plerixafor or motixafortide, which require overnight pre-treatment prior to leukapheresis. The median times to neutrophil and platelet engraftment, 11 and 14 days respectively, are slightly less than what has been observed for standard of care. Importantly, 100% of the patients met the primary objective and the combination regimen exhibited excellent safety profiles in patients receiving the new front line blood cancer drug, Daratumumab. Dr. Cardarelli stated, "After completing patient treatment, we will conduct follow-up observations until July and then start data analysis", adding that positive results from the GPC-100 trial could have a beneficial impact on attracting additional investment and enhancing corporate value.

Currently, the ongoing clinical trials have met all primary end points and are at the stage of deciding whether to proceed to Phase 3. A proposed double-blind clinical trial comparing the mobilization agent Plerixafor with GPC-100 is under discussion. Additionally, research has shown that the combination of GPC-100 and propranolol increases the number of specific T cells, which are favorable for enhancing CAR-T (Chimeric Antigen Receptor T-cell) response rates, and relevant papers are being published. Thus, this could assist Exicure in expanding its additional pipeline for cell and gene therapies.

Dr. Cardarelli suggested that in the future, it will be essential to prioritize discussions with various partners based on the likelihood of success and high return on investment. She concluded, "If the hypotheses presented to GPCR USA are validated, there may be potential G-Protein Coupled Receptor targets that could be applicable to various diseases. We are considering steps such as establishing collaborations with companies possessing antibody manufacturing technologies, testing those technologies, and conducting joint research on multiple G-Protein Coupled Receptors.

Dr. Cardarelli was an inventor of the CXCR4 antibody, Ulocuplumab developed by BMS, and in 2019 she joined GPCR Therapeutics evaluating the combination of CXCR4 and ADRB2. She later served as the Chief Scientific Officer (CSO) of GPCR USA, contributing to the establishment of GPCR USA, talent acquisition, formation of a scientific advisory board, and the introduction of cell analysis and high-throughput screening technologies. She also successfully designed clinical trials for GPC-100 and secured FDA orphan drug designation.

About Exicure, Inc.

Exicure, Inc. is an early-stage biotechnology company focused on developing nucleic acid therapies targeting ribonucleic acid against validated targets. Following its recent restructuring and suspension of clinical and development activities, the Company is exploring strategic alternatives to maximize stockholder value, both with respect to its historical biotechnology assets and more broadly. For further information, see www.exicuretx.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Forward looking statements are those which are not historical in nature. They are often identified by their inclusion of words such as “will,” “anticipate,” “estimate,” “plan,” “should,” “expect,” “believe,” “intend” and similar expressions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual outcomes to differ materially from the outcomes expressed or implied by this report. Such risks include, among others, the accuracy of projections, targets, or plans, the possibility of listing deficiencies, and the risk that Nasdaq will ultimately delist the Company’s common stock. All such factors are difficult to predict and may be beyond the Company’s control. The Company undertakes no obligation and does not intend to update or revise any forward-looking statements contained herein, except as required by law or regulation. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

Media Contact:

Josh Miller

847-673-1700

media@exicuretx.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

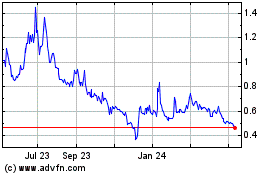

Exicure (NASDAQ:XCUR)

Historical Stock Chart

From Jan 2025 to Feb 2025

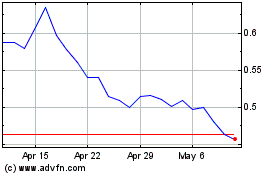

Exicure (NASDAQ:XCUR)

Historical Stock Chart

From Feb 2024 to Feb 2025