Expion360 Reports Select Preliminary, Unaudited Fourth Quarter 2024 Financial Results

03 January 2025 - 12:35AM

Expion360 Inc. (Nasdaq: XPON) (“Expion360” or the “Company”),

an industry leader in lithium-ion battery power storage solutions,

today announced select preliminary, unaudited financial results for

the fourth quarter ended December 31, 2024.

Key Financial Highlights for the Fourth

Quarter of 2024

- Preliminary, unaudited revenue for

Q4 2024 in the range of approximately $1.8 to $2.0 million, up

sequentially from $1.4 million in Q3 2024.

- Preliminary, unaudited gross profit

for Q4 2024 is expected to be in the range of approximately

$350,000 to $450,000, compared to gross profit of $205,000 in the

prior year period.

- Preliminary, unaudited net loss for

Q4 2024 is expected to be in the range of approximately $450,000 to

$350,000, compared to a net loss of $2.2 million in the prior year

period as the Company continued to invest in new product

development and launches. Preliminary, unaudited net loss from

operations1 for Q4 2024 is expected to be in the range of

approximately $1.3 to $1.2 million.

“In the fourth quarter of 2024, we achieved

preliminary unaudited revenue of $1.8 to $2.0 million, representing

strong sequential growth from the third quarter in both the top and

bottom lines,” said Brian Schaffner, Chief Executive Officer of

Expion360. “We believe we are making significant progress against

our goals with the ongoing expansion of our OEM relationships and

distribution network to meet the increasing demand for high-quality

lithium battery technology from existing and recent new customers

including Scout Campers, Alaskan Campers, and K-Z Recreational

Vehicles. Our progress also expands beyond this vertical, having

just announced that we will begin shipping our Home Energy Storage

Solutions to our key integration partner, Wellspring Solar, in

January 2025. We look forward to providing additional updates

regarding the timing of our next conference call and to discussing

our financial results for the quarter and year ended December 31,

2024, which are expected to be announced in March 2025.”

1 Net loss from operations reflects the

Company’s net loss for Q4 2024 less approximately $5.8 million in a

change in fair value of the Series A and Series B warrants issued

by the Company in the quarter ended September 30, 2024, offset by a

$5.0 million contingent liability arising in connection with the

warrant issuance, the aggregate of which resulted in a gain in net

income of approximately $887,000.

Financial Disclosure

Advisory

The Company reports its financial results in

accordance with U.S. generally accepted accounting principles

(“GAAP”). The select preliminary, unaudited results described in

this press release are estimates only and are subject to revision

until the Company reports its full financial and business results

for the fourth quarter ended December 31, 2024. These estimates are

not a comprehensive statement of the Company’s financial results

for the fourth quarter ended December 31, 2024 and actual results

may differ materially from these estimates as a result of the

completion of year-end accounting procedures and adjustments,

including the execution of the Company’s internal control over

financial reporting, the completion of the preparation and audit of

the Company’s financial statements and the subsequent occurrence or

identification of events prior to the formal issuance of the

audited financial statements for the year ended December 31,

2024.

Non-GAAP Financial Measures

Certain non-GAAP financial measures, including

operational net loss, are presented in this press release to

provide information that may assist investors in understanding the

Company's financial and operating results. The Company believes

these non-GAAP financial measures are important performance

indicators because they exclude items that are unrelated to, and

may not be indicative of, the Company's core financial and

operating results. These non-GAAP financial measures, as

calculated, may not necessarily be comparable to similarly titled

measures of other companies and may not be appropriate measures for

comparing the performance of other companies relative to the

Company. These non-GAAP financial measures are not intended to

represent, and should not be considered to be more meaningful

measures than, or alternatives to, measures of operating

performance as determined in accordance with GAAP. To the extent

the Company utilizes such non-GAAP financial measures in the

future, it expects to calculate them using a consistent method from

period to period.

About Expion360

Expion360 is an industry leader in premium

lithium iron phosphate (LiFePO4) batteries and accessories for

recreational vehicles and marine applications, with residential and

industrial applications under development. On December 19, 2023,

the Company announced its entrance into the home energy storage

market with the introduction of two premium LiFePO4 battery storage

systems that enable residential and small business customers to

create their own stable micro-energy grid and lessen the impact of

increasing power fluctuations and outages.

The Company’s lithium-ion batteries feature half

the weight of standard lead-acid batteries while delivering three

times the power and ten times the number of charging cycles.

Expion360 batteries also feature better construction and

reliability compared to other lithium-ion batteries on the market

due to their superior design and quality materials. Specially

reinforced, fiberglass-infused, premium ABS and solid mechanical

connections help provide top performance and safety. With Expion360

batteries, adventurers can enjoy the most beautiful and remote

places on Earth even longer.

The Company is headquartered in Redmond, Oregon.

Expion360 lithium-ion batteries are available today through more

than 300 dealers, wholesalers, private-label customers, and OEMs

across the country. To learn more about the Company, visit

expion360.com.

Forward-Looking Statements and Safe

Harbor Notice

This press release contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, which statements are

subject to considerable risks and uncertainties. The Company

intends such forward-looking statements to be covered by the safe

harbor provisions contained in the Private Securities Litigation

Reform Act of 1995. All statements other than statements of

historical facts included in this press release, including

statements about our beliefs and expectations, are "forward-looking

statements" and should be evaluated as such. Examples of such

forward-looking statements include statements that use

forward-looking words such as "projected," "expect," "possibility,”

“believe,” “aim,” “goal,” “plan,” and "anticipate," or similar

expressions. Forward-looking statements included in this press

release include, but are not limited to, statements relating to the

Company’s preliminary, unaudited financial results for the fourth

quarter ended December 31, 2024, the Company’s progress against its

strategic objectives and ability to meet the demand for lithium

battery technology, and the plans for and timing of the Company’s

the Company’s release of its financial and business results for the

quarter and year ended December 31, 2024. Forward-looking

statements are subject to and involve risks, uncertainties, and

assumptions that may cause the Company’s actual results,

performance or achievements to be materially different from any

future results, performance or achievements predicted, assumed or

implied by such forward-looking statements.

Company Contact:Brian Schaffner,

CEO541-797-6714Email Contact

External Investor Relations:Chris Tyson,

Executive Vice PresidentMZ Group - MZ North

America949-491-8235XPON@mzgroup.us www.mzgroup.us

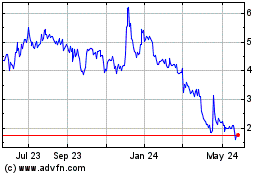

Expion360 (NASDAQ:XPON)

Historical Stock Chart

From Jan 2025 to Feb 2025

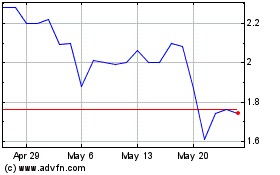

Expion360 (NASDAQ:XPON)

Historical Stock Chart

From Feb 2024 to Feb 2025