ZyVersa Therapeutics, Inc. (Nasdaq: ZVSA, or “ZyVersa”), a

clinical-stage specialty biopharmaceutical company developing

first-in-class drugs for the treatment of renal and inflammatory

diseases with high unmet medical needs, reports financial results

for the quarter ended September 30, 2024, and provides business

update.

“We are pleased to announce the progress that ZyVersa has made

toward achieving our key near-term development milestones,” stated

Stephen C. Glover, ZyVersa’s Co-founder, Chairman, CEO, and

President. “Our Phase 2a clinical trial with Cholesterol Efflux

Mediator™ VAR 200 in diabetic kidney disease is expected to

begin Q1-2025, with an initial data read-out around mid-year 2025.

In preparation for an IND submission for Inflammasome ASC Inhibitor

IC 100 and a subsequent Phase 1 trial in healthy overweight

subjects at risk for certain metabolic complications, we are

initiating two proof-of-concept studies with IC 100 in obesity DIO

models. At least one of the studies is expected to begin in

Q4-2024. One study will evaluate IC 100 as monotherapy compared to

semaglutide, and the other will evaluate IC 100 in combination with

semaglutide. Our newly formed Obesity, Metabolic & Inflammatory

Disease SAB has been instrumental in designing these two studies to

optimize the parameters to be evaluated. We are pleased with the

level of scientific evidence from our preclinical program and

published third party data that support the potential of IC 100 to

control the damaging obesity-driven inflammation and its associated

comorbidities. Unlike NLRP3 inhibitors in development for obesity

with metabolic complications, IC 100 targets ASC to inhibit

multiple inflammasomes, including NLRP3 and AIM2 associated with

obesity. More importantly, IC 100 uniquely disrupts the function of

ASC specks to attenuate chronic, systemic inflammation leading to

obesity comorbidities. We are excited about the promise of our two

lead compounds in development to improve health and transform

lives. We believe our near-term milestone achievement will be a key

inflection point for ZyVersa that will drive shareholder

value.”

BUSINESS UPDATE

CHOLESTEROL EFFLUX MEDIATOR™ VAR

200 FOR RENAL DISEASE

Phase 2a clinical trial in diabetic kidney disease planned to

begin Q1-2025.

- All necessary regulatory preparation

has been completed by ZyVersa, our CRO, George Clinical, and our

two clinical sites who are gearing up for site initiation and

patient recruitment in the new year.

INFLAMMASOME ASC INHIBITOR IC 100 FOR OBESITY WITH

METABOLIC COMPLICATIONS

IC 100 IND submission planned for Q2-2025, to be followed by

initiation of a Phase 1 clinical trial in healthy overweight

patients at risk for certain metabolic complications. Safety data

expected before year end 2025.

- New Obesity, Metabolic &

Inflammatory Disease SAB established to provide expert advice on IC

100’s obesity clinical program.

- SAB comprised of five top tier

experts in the areas of obesity and metabolic diseases, and four

world-renowned inflammasome experts and inventors of IC 100 from

University of Miami Miller School of Medicine who have provided

advisory support for IC 100 since its license.

- Two IC 100 obesity proof-of-concept

studies in DIO mouse models designed with expert advice from SAB.

- One will evaluate IC 100 monotherapy

in comparison to semaglutide, and the other will evaluate IC 100 in

combination with semaglutide.

- At least one of the DIO model

studies is planned to begin Q4-2024.

- Data read-outs expected within six

months of initiation.

- IC 100 GLP toxicology studies are

anticipated to begin Q4-2024/Q1-2025

THIRD QUARTER FINANCIAL RESULTS

Net losses were approximately $2.4 million for the three months

ended September 30, 2024, with an improvement of approximately $0.5

million or 17.3% compared to a net loss of approximately $2.9

million for the three months ended September 30, 2023.

Based on its current operating plan, ZyVersa expects its cash of

approximately $0.1 million as of September 30, 2024, will be

sufficient to fund its operating expenses and capital expenditure

requirements on a month-to-month basis. ZyVersa will need

additional financing to support its continuing operations and to

meet its stated milestones. ZyVersa will seek to fund its

operations and clinical activity through public or private equity

or debt financings or other sources, which may include government

grants, collaborations with third parties or outstanding warrant

exercises.

Research and development expenses were approximately $0.4

million for the three months ended September 30, 2024, a decrease

of approximately $0.2 million or 35.3% from the three months ended

September 30, 2023. The decrease is primarily attributable to a

decrease of approximately $0.2 million in the costs of

manufacturing, pre-clinical costs for IC 100, and clinical costs

for VAR 200.

General and administrative expenses were approximately $1.8

million for the three months ended September 30, 2024, a decrease

of approximately $0.4 million or 17.7% from the three months ended

September 30, 2023. The decrease is attributable to an approximate

$0.1 million decrease in professional fees due to reduced fees of

public auditors and legal counsel, an approximate $0.2 million

decrease in director and officer insurance due to reduced costs in

the second year of being a public company, and an approximate $0.1

million decrease in stock-based compensation as a result of options

becoming fully amortized in 2024.

About ZyVersa Therapeutics, Inc.

ZyVersa (Nasdaq: ZVSA) is a clinical stage specialty

biopharmaceutical company leveraging advanced proprietary

technologies to develop first-in-class drugs for patients with

inflammatory or kidney diseases with high unmet medical needs. We

are well positioned in the rapidly emerging inflammasome space with

a highly differentiated monoclonal antibody, Inflammasome ASC

Inhibitor IC 100, and in kidney disease with phase 2 Cholesterol

Efflux Mediator™ VAR 200. The lead indication for IC 100 is

obesity and its associated metabolic complications, and for VAR

200, focal segmental glomerulosclerosis (FSGS). Each therapeutic

area offers a “pipeline within a product,” with potential for

numerous indications. The total accessible market is over $100

billion. For more information, please visit www.zyversa.com.

Cautionary Statement Regarding Forward-Looking

Statements

Certain statements contained in this press release regarding

matters that are not historical facts, are forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. These include statements regarding

management’s intentions, plans, beliefs, expectations, or forecasts

for the future, and, therefore, you are cautioned not to place

undue reliance on them. No forward-looking statement can be

guaranteed, and actual results may differ materially from those

projected. ZyVersa uses words such as “anticipates,” “believes,”

“plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,”

“should,” “could,” “estimates,” “predicts,” “potential,”

“continue,” “guidance,” and similar expressions to identify these

forward-looking statements that are intended to be covered by the

safe-harbor provisions. Such forward-looking statements are based

on ZyVersa’s expectations and involve risks and uncertainties;

consequently, actual results may differ materially from those

expressed or implied in the statements due to a number of factors,

including ZyVersa’s plans to develop and commercialize its product

candidates, the timing of initiation of ZyVersa’s planned

preclinical and clinical trials; the timing of the availability of

data from ZyVersa’s preclinical and clinical trials; the timing of

any planned investigational new drug application or new drug

application; ZyVersa’s plans to research, develop, and

commercialize its current and future product candidates; the

clinical utility, potential benefits and market acceptance of

ZyVersa’s product candidates; ZyVersa’s commercialization,

marketing and manufacturing capabilities and strategy; ZyVersa’s

ability to protect its intellectual property position; and

ZyVersa’s estimates regarding future revenue, expenses, capital

requirements and need for additional financing, as well as

ZyVersa’s ability to successfully complete any such financing.

New factors emerge from time-to-time, and it is not possible for

ZyVersa to predict all such factors, nor can ZyVersa assess the

impact of each such factor on the business or the extent to which

any factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements. Forward-looking statements included in this press

release are based on information available to ZyVersa as of the

date of this press release. ZyVersa disclaims any obligation to

update such forward-looking statements to reflect events or

circumstances after the date of this press release, except as

required by applicable law.

This press release does not constitute an offer to sell, or the

solicitation of an offer to buy, any securities.

Corporate, Media, IR Contact

Karen CashmereChief Commercial

Officerkcashmere@zyversa.com786-251-9641

| |

| ZYVERSA

THERAPEUTICS, INC. |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| |

| |

|

|

|

|

|

|

|

September 30, |

|

December 31, |

| |

|

|

2024 |

|

2023 |

| |

|

|

(Unaudited) |

|

|

|

Assets |

|

|

|

| |

|

|

|

|

|

|

Current Assets: |

|

|

|

| |

Cash |

$ |

122,921 |

|

|

$ |

3,137,674 |

|

| |

Prepaid expenses and other current assets |

|

267,494 |

|

|

|

215,459 |

|

| |

|

Total Current Assets |

|

390,415 |

|

|

|

3,353,133 |

|

|

Equipment, net |

|

- |

|

|

|

6,933 |

|

|

In-process research and development |

|

18,647,903 |

|

|

|

18,647,903 |

|

|

Vendor deposit |

|

178,476 |

|

|

|

98,476 |

|

|

Deferred offering costs |

|

207,130 |

|

|

|

- |

|

|

Operating lease right-of-use asset |

|

- |

|

|

|

7,839 |

|

| |

|

|

|

|

|

| |

|

Total

Assets |

$ |

19,423,924 |

|

|

$ |

22,114,284 |

|

| |

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

| |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

| |

Accounts payable |

$ |

9,284,631 |

|

|

$ |

8,431,583 |

|

| |

Accrued expenses and other current liabilities |

|

2,257,372 |

|

|

|

1,754,533 |

|

| |

Operating lease liability |

|

- |

|

|

|

8,656 |

|

| |

|

Total

Current Liabilities |

|

11,542,003 |

|

|

|

10,194,772 |

|

|

Deferred tax liability |

|

854,621 |

|

|

|

844,914 |

|

| |

|

Total

Liabilities |

|

12,396,624 |

|

|

|

11,039,686 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

| |

Preferred stock, $0.0001 par value, 1,000,000 shares

authorized: |

|

|

|

| |

Series A preferred stock, 8,635 shares designated, 50 shares

issued |

|

|

|

| |

and outstanding as of September 30, 2024 and December 31, 2023,

respectively |

|

- |

|

|

|

- |

|

| |

Series B preferred stock, 5,062 shares designated, 5,062 shares

issued |

|

|

|

| |

and outstanding as of September 30, 2024 and December 31, 2023 |

|

1 |

|

|

|

1 |

|

| |

Common stock, $0.0001 par value, 250,000,000 shares

authorized; |

|

|

|

| |

1,074,203 and 405,212 shares issued at September 30, 2024 and

December 31, 2023, |

|

|

|

| |

respectively, and 1,074,196 and 402,205 shares outstanding as

of |

|

|

|

| |

September 30, 2024 and December 31, 2023, respectively |

|

107 |

|

|

|

40 |

|

| |

Additional paid-in-capital |

|

118,245,220 |

|

|

|

114,300,849 |

|

| |

Accumulated deficit |

|

(111,210,860 |

) |

|

|

(103,219,124 |

) |

| |

Treasury stock, at cost, 7 shares at September 30, 2024 and

December 31, 2023, |

|

|

|

| |

respectively |

|

(7,168 |

) |

|

|

(7,168 |

) |

| |

|

Total

Stockholders' Equity |

|

7,027,300 |

|

|

|

11,074,598 |

|

| |

|

|

|

|

|

| |

|

Total

Liabilities and Stockholders' Equity |

$ |

19,423,924 |

|

|

$ |

22,114,284 |

|

| |

|

|

|

|

|

| |

| ZYVERSA

THERAPEUTICS, INC. |

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

|

|

|

September 30, |

|

September 30, |

| |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Operating Expenses: |

|

|

|

|

|

|

|

| |

Research and development |

$ |

436,043 |

|

|

$ |

673,943 |

|

|

$ |

1,658,030 |

|

|

$ |

2,950,462 |

|

| |

General and administrative |

|

1,833,578 |

|

|

|

2,228,735 |

|

|

|

6,192,205 |

|

|

|

9,694,097 |

|

| |

Impairment of in-process research and development |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

69,280,171 |

|

| |

Impairment of goodwill |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

11,895,033 |

|

| |

|

Total Operating Expenses |

|

2,269,621 |

|

|

|

2,902,678 |

|

|

|

7,850,235 |

|

|

|

93,819,763 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Loss From

Operations |

|

(2,269,621 |

) |

|

|

(2,902,678 |

) |

|

|

(7,850,235 |

) |

|

|

(93,819,763 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Other Income (Expense): |

|

|

|

|

|

|

|

| |

Interest (income) expense |

|

131,635 |

|

|

|

210 |

|

|

|

131,794 |

|

|

|

(555 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

|

Pre-Tax Net Loss |

|

(2,401,256 |

) |

|

|

(2,902,888 |

) |

|

|

(7,982,029 |

) |

|

|

(93,819,208 |

) |

| |

|

Income tax (provision) benefit |

|

- |

|

|

|

485 |

|

|

|

(9,707 |

) |

|

|

8,859,762 |

|

| |

|

Net

Loss |

|

(2,401,256 |

) |

|

|

(2,902,403 |

) |

|

|

(7,991,736 |

) |

|

|

(84,959,446 |

) |

| |

|

Deemed dividend to preferred stockholders |

|

- |

|

|

|

(32,373 |

) |

|

|

- |

|

|

|

(7,948,209 |

) |

| |

|

Net

Loss Attributable to Common Stockholders |

$ |

(2,401,256 |

) |

|

$ |

(2,934,776 |

) |

|

$ |

(7,991,736 |

) |

|

$ |

(92,907,655 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Net Loss Per

Share |

|

|

|

|

|

|

|

| |

|

-

Basic and Diluted |

$ |

(2.43 |

) |

|

$ |

(30.18 |

) |

|

$ |

(9.79 |

) |

|

$ |

(1,591.46 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

|

Weighted

Average Number of |

|

|

|

|

|

|

|

| |

|

Common Shares Outstanding |

|

|

|

|

|

|

|

| |

|

-

Basic and Diluted |

|

988,378 |

|

|

|

97,252 |

|

|

|

816,293 |

|

|

|

58,379 |

|

| |

|

|

|

|

|

|

|

|

|

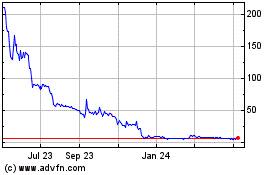

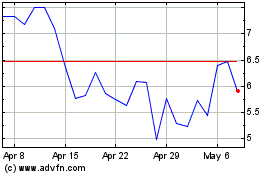

ZyVersa Therapeutics (NASDAQ:ZVSA)

Historical Stock Chart

From Dec 2024 to Dec 2024

ZyVersa Therapeutics (NASDAQ:ZVSA)

Historical Stock Chart

From Dec 2023 to Dec 2024