Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 September 2024 - 6:55AM

Edgar (US Regulatory)

AllianceBernstein National Municipal Income Fund, Inc.

Portfolio of Investments

July 31, 2024 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| MUNICIPAL OBLIGATIONS – 161.2% |

|

|

|

|

|

|

|

|

|

|

| Long-Term Municipal Bonds – 161.2% |

|

|

|

|

|

|

|

|

|

|

| Alabama – 2.4% |

|

|

|

|

|

|

|

|

|

|

| County of Jefferson AL Sewer Revenue

Series 2024

5.25%, 10/01/2049 |

|

|

|

$ |

3,000 |

|

|

$ |

3,235,024 |

|

| 5.50%, 10/01/2053 |

|

|

|

|

5,000 |

|

|

|

5,463,706 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,698,730 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Alaska – 0.3% |

|

|

|

|

|

|

|

|

|

|

| Municipality of Anchorage AK Solid Waste Services Revenue

Series

2022-A

5.25%, 11/01/2062 |

|

|

|

|

1,000 |

|

|

|

1,067,730 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Arizona – 3.3% |

|

|

|

|

|

|

|

|

|

|

| Arizona Industrial Development Authority

(Heritage Academy Laveen & Gateway Obligated Group)

Series 2021

5.00%, 07/01/2051(a) |

|

|

|

|

1,000 |

|

|

|

926,133 |

|

| Salt Verde Financial Corp.

(Citigroup, Inc.)

Series 2007

5.00%, 12/01/2032 |

|

|

|

|

1,200 |

|

|

|

1,294,565 |

|

| 5.00%, 12/01/2037 |

|

|

|

|

8,700 |

|

|

|

9,599,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,820,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Arkansas – 0.6% |

|

|

|

|

|

|

|

|

|

|

| Pulaski County Public Facilities Board

(Baptist Health Obligated Group)

Series 2014

5.00%, 12/01/2042 |

|

|

|

|

2,000 |

|

|

|

2,000,836 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| California – 9.0% |

|

|

|

|

|

|

|

|

|

|

| Alameda Corridor Transportation Authority

Series 2022-A

5.40%,

10/01/2050(b) |

|

|

|

|

10,000 |

|

|

|

5,795,473 |

|

| AGM Series 2024-A

Zero Coupon, 10/01/2052 |

|

|

|

|

6,500 |

|

|

|

1,734,896 |

|

| Zero Coupon, 10/01/2053 |

|

|

|

|

6,000 |

|

|

|

1,520,412 |

|

| California Housing Finance Agency

Series 2019-2,

Class A

4.00%, 03/20/2033 |

|

|

|

|

1,086 |

|

|

|

1,102,263 |

|

| Series 2021-1, Class A

3.50%, 11/20/2035 |

|

|

|

|

950 |

|

|

|

910,769 |

|

| California Pollution Control Financing Authority

(Poseidon Resources Channelside LP)

Series 2012

5.00%,

07/01/2037(a) |

|

|

|

|

3,075 |

|

|

|

3,085,361 |

|

| California Statewide Communities Development Authority

(Enloe Medical Center Obligated Group) AGM

Series 2022-A

5.375%,

08/15/2057 |

|

|

|

|

2,000 |

|

|

|

2,170,734 |

|

1

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| California Statewide Communities Development Authority

(Loma Linda University Medical Center)

Series 2016-A

5.00%, 12/01/2036(a) |

|

|

|

$ |

800 |

|

|

$ |

814,975 |

|

| 5.25%, 12/01/2056(a) |

|

|

|

|

2,000 |

|

|

|

2,022,170 |

|

| Long Beach Bond Finance Authority

(Bank of America Corp.)

Series 2007-A

5.50%, 11/15/2037 |

|

|

|

|

2,000 |

|

|

|

2,289,382 |

|

| M-S-R Energy Authority

(Citigroup, Inc.)

Series 2009-A

6.50%, 11/01/2039 |

|

|

|

|

2,000 |

|

|

|

2,556,249 |

|

| Series 2009-C

6.50%, 11/01/2039 |

|

|

|

|

2,000 |

|

|

|

2,556,248 |

|

| Southern California Public Power Authority

(Goldman Sachs Group, Inc. (The))

Series 2007-A

5.00%, 11/01/2033 |

|

|

|

|

3,335 |

|

|

|

3,511,472 |

|

| Washington Township Health Care District AGM

Series

2023-B

4.50%, 08/01/2053 |

|

|

|

|

2,625 |

|

|

|

2,690,183 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32,760,587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Colorado – 3.8% |

|

|

|

|

|

|

|

|

|

|

| Colorado Health Facilities Authority

(CommonSpirit Health)

Series 2019-A

5.00%, 08/01/2044 |

|

|

|

|

705 |

|

|

|

732,871 |

|

| E-470 Public Highway Authority

Series 2024-B

4.335% (SOFR + 0.75%), 09/01/2039(c) |

|

|

|

|

2,000 |

|

|

|

1,998,923 |

|

| Public Authority for Colorado Energy

(Bank of America Corp.)

Series 2008

6.50%, 11/15/2038 |

|

|

|

|

8,975 |

|

|

|

11,095,524 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,827,318 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Connecticut – 0.3% |

|

|

|

|

|

|

|

|

|

|

| Connecticut State Health & Educational Facilities Authority

(University of Hartford (The))

Series 2019

4.00%, 07/01/2049 |

|

|

|

|

1,500 |

|

|

|

1,140,596 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Florida – 8.2% |

|

|

|

|

|

|

|

|

|

|

| County of Miami-Dade FL

Series 2021

4.00%, 07/01/2050 |

|

|

|

|

6,355 |

|

|

|

6,080,825 |

|

| Florida Development Finance Corp.

(Brightline Trains Florida LLC)

AGM Series 2024

5.25%, 07/01/2053 |

|

|

|

|

2,000 |

|

|

|

2,087,237 |

|

| Florida Development Finance Corp.

(Cornerstone Charter Academy, Inc. Obligated Group)

Series 2022

5.125%, 10/01/2052(a) |

|

|

|

|

1,000 |

|

|

|

991,765 |

|

2

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| Florida Development Finance Corp.

(Mater Academy, Inc.)

Series 2022-A

4.00%, 06/15/2052 |

|

|

|

$ |

3,250 |

|

|

$ |

2,813,987 |

|

| Florida Higher Educational Facilities Financial Authority

(Ringling College of Art and Design, Inc.)

Series 2017

5.00%, 03/01/2042 |

|

|

|

|

1,000 |

|

|

|

1,014,761 |

|

| Lakewood Ranch Stewardship District

(Lakewood Ranch Stewardship District Series 2023 Assessment)

Series 2023

6.30%, 05/01/2054 |

|

|

|

|

990 |

|

|

|

1,047,738 |

|

| Lee County Industrial Development Authority/FL

(Shell Point Obligated Group)

Series 2024

5.25%, 11/15/2054 |

|

|

|

|

2,000 |

|

|

|

2,107,847 |

|

| Miami-Dade County Expressway Authority

Series 2014-A

5.00%,

07/01/2044 |

|

|

|

|

5,000 |

|

|

|

5,003,166 |

|

| School District of Broward County/FL

Series 2022

5.00%, 07/01/2046 |

|

|

|

|

8,020 |

|

|

|

8,707,528 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29,854,854 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Georgia – 3.6% |

|

|

|

|

|

|

|

|

|

|

| Augusta Development Authority

(WellStar Health System Obligated Group)

Series 2018

5.00%, 07/01/2036 |

|

|

|

|

4,170 |

|

|

|

4,383,425 |

|

| Main Street Natural Gas, Inc.

(Citadel LP)

Series 2022-C

4.00%, 08/01/2052(a) |

|

|

|

|

1,000 |

|

|

|

984,508 |

|

| Municipal Electric Authority of Georgia

Series 2019

5.00%, 01/01/2038 |

|

|

|

|

100 |

|

|

|

103,739 |

|

| 5.00%, 01/01/2049 |

|

|

|

|

2,000 |

|

|

|

2,057,146 |

|

| 5.00%, 01/01/2063 |

|

|

|

|

3,165 |

|

|

|

3,231,806 |

|

| Series 2021

4.00%, 01/01/2046 |

|

|

|

|

330 |

|

|

|

316,608 |

|

| 4.00%, 01/01/2051 |

|

|

|

|

1,275 |

|

|

|

1,199,746 |

|

| 5.00%, 01/01/2056 |

|

|

|

|

650 |

|

|

|

660,251 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,937,229 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Illinois – 14.8% |

|

|

|

|

|

|

|

|

|

|

| Chicago Board of Education

Series 2018-D

5.00%,

12/01/2046 |

|

|

|

|

5,005 |

|

|

|

4,975,347 |

|

| Chicago O’Hare International Airport

Series 2017-D

5.00%,

01/01/2042 |

|

|

|

|

6,500 |

|

|

|

6,603,122 |

|

| Series 2022

4.625%, 01/01/2053 |

|

|

|

|

6,000 |

|

|

|

6,005,451 |

|

| Illinois Finance Authority

(OSF Healthcare System Obligated Group)

Series 2015-A

5.00%, 11/15/2045 |

|

|

|

|

4,500 |

|

|

|

4,526,954 |

|

3

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| Illinois Finance Authority

(University of Illinois)

Series 2020

4.00%, 10/01/2055 |

|

|

|

|

|

$ |

3,565 |

|

|

$ |

3,173,890 |

|

| Metropolitan Pier & Exposition Authority

Series

2017-A

5.00%, 06/15/2057 |

|

|

|

|

|

|

8,755 |

|

|

|

8,904,814 |

|

| State of Illinois

Series 2014

5.00%, 04/01/2030 |

|

|

|

|

|

|

1,655 |

|

|

|

1,656,594 |

|

| 5.00%, 05/01/2030 |

|

|

|

|

|

|

1,300 |

|

|

|

1,301,251 |

|

| 5.00%, 05/01/2033 |

|

|

|

|

|

|

1,150 |

|

|

|

1,150,831 |

|

| 5.00%, 02/01/2039 |

|

|

|

|

|

|

2,400 |

|

|

|

2,400,174 |

|

| Series 2022-C

5.50%, 10/01/2040 |

|

|

|

|

|

|

6,250 |

|

|

|

7,046,621 |

|

| Series 2024-B

4.25%, 05/01/2046 |

|

|

|

|

|

|

4,900 |

|

|

|

4,831,300 |

|

| Village of Elk Grove Village IL

Series 2017

5.00%, 01/01/2028 |

|

|

|

|

|

|

1,060 |

|

|

|

1,113,687 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

53,690,036 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Indiana – 0.8% |

|

|

|

|

|

|

|

|

|

|

|

|

| Indiana Finance Authority

(University of Evansville)

Series 2022

5.25%, 09/01/2057 |

|

|

|

|

|

|

3,000 |

|

|

|

2,987,583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Iowa – 1.5% |

|

|

|

|

|

|

|

|

|

|

|

|

| Iowa Finance Authority

(Iowa Fertilizer Co., LLC)

Series 2022

5.00%, 12/01/2050 |

|

|

|

|

|

|

5,000 |

|

|

|

5,304,954 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Louisiana – 4.6% |

|

|

|

|

|

|

|

|

|

|

|

|

| City of New Orleans LA

Series 2021-A

5.00%, 12/01/2046 |

|

|

|

|

|

|

15,000 |

|

|

|

15,902,797 |

|

| Parish of St. John the Baptist LA

(Marathon Oil Corp.)

Series 2019

2.20%, 06/01/2037 |

|

|

|

|

|

|

950 |

|

|

|

919,416 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,822,213 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Maryland – 0.6% |

|

|

|

|

|

|

|

|

|

|

|

|

| Maryland Economic Development Corp.

(Maryland Economic Development Corp. Morgan View & Thurgood Marshall Student Hsg)

Series 2022

6.00%,

07/01/2058 |

|

|

|

|

|

|

2,000 |

|

|

|

2,216,468 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Massachusetts – 6.0% |

|

|

|

|

|

|

|

|

|

|

|

|

| Commonwealth of Massachusetts

Series 2023

5.00%, 05/01/2053(d) |

|

|

|

|

|

|

10,000 |

|

|

|

10,788,167 |

|

| Series 2023-D

5.00%, 10/01/2053 |

|

|

|

|

|

|

5,000 |

|

|

|

5,409,756 |

|

4

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| Massachusetts Development Finance Agency

(Emerson College)

Series 2016-A

5.00%, 01/01/2047 |

|

|

|

$ |

5,750 |

|

|

$ |

5,776,202 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,974,125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Michigan – 11.0% |

|

|

|

|

|

|

|

|

|

|

| Ann Arbor School District

AGM Series 2023

4.00%, 05/01/2042 |

|

|

|

|

4,170 |

|

|

|

4,218,967 |

|

| City of Detroit MI

Series 2020

5.50%, 04/01/2050 |

|

|

|

|

1,970 |

|

|

|

2,076,871 |

|

| Series 2023-C

6.00%, 05/01/2043 |

|

|

|

|

2,300 |

|

|

|

2,649,488 |

|

| Detroit City School District

AGM Series 2001-A

6.00%,

05/01/2029 |

|

|

|

|

7,875 |

|

|

|

8,417,344 |

|

| Detroit Downtown Development Authority

(Detroit Downtown Development Authority Catalyst Development Area)

Series 2024

5.00%, 07/01/2048 |

|

|

|

|

6,000 |

|

|

|

6,307,978 |

|

| Detroit Downtown Development Authority

(Pre-refunded - US Treasuries)

AGM Series

2018-A

5.00%, 07/01/2043 |

|

|

|

|

3,020 |

|

|

|

3,028,148 |

|

| 5.00%, 07/01/2048 |

|

|

|

|

10,000 |

|

|

|

10,026,980 |

|

| Michigan Finance Authority

(Public Lighting Authority)

Series 2014-B

5.00%, 07/01/2034 |

|

|

|

|

2,250 |

|

|

|

2,251,976 |

|

| Plymouth Educational Center Charter School

Series 2005

5.125%, 11/01/2023(e) (f) |

|

|

|

|

2,140 |

|

|

|

1,070,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,047,752 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Minnesota – 1.8% |

|

|

|

|

|

|

|

|

|

|

| City of Ramsey MN

(Pact Charter School)

Series 2022-A

5.00%, 06/01/2032 |

|

|

|

|

1,000 |

|

|

|

1,013,898 |

|

| Duluth Economic Development Authority

(Essentia Health Obligated Group)

Series 2018

5.00%, 02/15/2053 |

|

|

|

|

5,625 |

|

|

|

5,710,961 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,724,859 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nebraska – 2.6% |

|

|

|

|

|

|

|

|

|

|

| Central Plains Energy Project

(Goldman Sachs Group, Inc. (The))

Series 2017-A

5.00%, 09/01/2029 |

|

|

|

|

4,000 |

|

|

|

4,214,042 |

|

| 5.00%, 09/01/2031 |

|

|

|

|

5,000 |

|

|

|

5,353,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,567,994 |

|

|

|

|

|

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| Nevada – 2.9% |

|

|

|

|

|

|

|

|

|

|

| Las Vegas Valley Water District

Series 2022-A

4.00%,

06/01/2051 |

|

|

|

$ |

8,645 |

|

|

$ |

8,389,075 |

|

| State of Nevada Department of Business & Industry

(DesertXpress Enterprises LLC)

Series 2023

8.125%,

01/01/2050(a) |

|

|

|

|

695 |

|

|

|

728,876 |

|

| Series 2024

8.125%, 01/01/2050(g) |

|

|

|

|

1,500 |

|

|

|

1,520,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,638,583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New Hampshire – 1.0% |

|

|

|

|

|

|

|

|

|

|

| New Hampshire Business Finance Authority

Series 2020-1,

Class A

4.125%, 01/20/2034 |

|

|

|

|

750 |

|

|

|

746,025 |

|

| New Hampshire Business Finance Authority

(Reworld Holding Corp.)

Series 2020-A

3.625%, 07/01/2043(a) |

|

|

|

|

1,000 |

|

|

|

836,104 |

|

| New Hampshire Health and Education Facilities Authority Act

(Dartmouth-Hitchcock Obligated Group)

Series 2020-A

5.00%, 08/01/2059 |

|

|

|

|

2,000 |

|

|

|

2,118,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,700,286 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New Jersey – 5.4% |

|

|

|

|

|

|

|

|

|

|

| New Jersey Economic Development Authority

(NYNJ Link Borrower LLC)

Series 2013

5.125%, 01/01/2034 |

|

|

|

|

1,000 |

|

|

|

1,001,014 |

|

| New Jersey Health Care Facilities Financing Authority

(New Jersey Transportation Trust Fund Authority State Lease)

Series 2017

5.00%, 10/01/2036 |

|

|

|

|

2,500 |

|

|

|

2,594,010 |

|

| New Jersey Transportation Trust Fund Authority

(New Jersey Transportation Fed Hwy Grant)

Series 2016

5.00%, 06/15/2029 |

|

|

|

|

4,750 |

|

|

|

4,894,096 |

|

| New Jersey Transportation Trust Fund Authority

(New Jersey Transportation Trust Fund Authority State Lease)

Series 2019-B

4.00%,

06/15/2037 |

|

|

|

|

800 |

|

|

|

806,175 |

|

| South Jersey Transportation Authority

Series 2022

4.625%, 11/01/2047 |

|

|

|

|

1,000 |

|

|

|

1,024,670 |

|

| Tobacco Settlement Financing Corp./NJ

Series 2018-A

5.25%,

06/01/2046 |

|

|

|

|

8,990 |

|

|

|

9,310,823 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19,630,788 |

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| New York – 11.9% |

|

|

|

|

|

|

|

|

|

|

| City of New York NY

Series 2023

4.125%, 08/01/2053 |

|

|

|

$ |

11,300 |

|

|

$ |

11,128,609 |

|

| 5.00%, 08/01/2051 |

|

|

|

|

2,000 |

|

|

|

2,167,893 |

|

| Long Island Power Authority

Series 2023-E

5.00%,

09/01/2053 |

|

|

|

|

3,500 |

|

|

|

3,809,546 |

|

| New York City Transitional Finance Authority Future Tax Secured Revenue

Series 2015A-1

5.00%, 08/01/2034 |

|

|

|

|

6,000 |

|

|

|

6,092,822 |

|

| 5.00%, 08/01/2037 |

|

|

|

|

4,000 |

|

|

|

4,055,970 |

|

| New York State Thruway Authority

(State of New York Pers Income Tax)

Series 2022

4.125%, 03/15/2056 |

|

|

|

|

4,000 |

|

|

|

3,895,350 |

|

| New York Transportation Development Corp.

(JFK NTO LLC)

AGM Series 2024

5.00%, 06/30/2049 |

|

|

|

|

10,000 |

|

|

|

10,437,949 |

|

| Ulster County Capital Resource Corp.

(Woodland Pond at New Paltz)

Series 2017

5.00%, 09/15/2037 |

|

|

|

|

490 |

|

|

|

440,948 |

|

| 5.25%, 09/15/2042 |

|

|

|

|

205 |

|

|

|

178,718 |

|

| 5.25%, 09/15/2047 |

|

|

|

|

355 |

|

|

|

294,883 |

|

| 5.25%, 09/15/2053 |

|

|

|

|

760 |

|

|

|

608,190 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43,110,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North Carolina – 1.2% |

|

|

|

|

|

|

|

|

|

|

| Greater Asheville Regional Airport Authority

AGM Series 2023

5.25%, 07/01/2053 |

|

|

|

|

4,000 |

|

|

|

4,270,335 |

|

| North Carolina Turnpike Authority

AGM Series 2024

Zero Coupon, 01/01/2053 |

|

|

|

|

1,000 |

|

|

|

256,023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,526,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North Dakota – 0.7% |

|

|

|

|

|

|

|

|

|

|

| City of Grand Forks ND

(Altru Health System Obligated Group)

AGM Series 2023-A

5.00%, 12/01/2053 |

|

|

|

|

2,000 |

|

|

|

2,079,079 |

|

| County of Ward ND

(Trinity Health Obligated Group)

Series 2017-C

5.00%, 06/01/2043 |

|

|

|

|

500 |

|

|

|

488,277 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,567,356 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ohio – 3.1% |

|

|

|

|

|

|

|

|

|

|

| Buckeye Tobacco Settlement Financing Authority

Series

2020-A

4.00%, 06/01/2048 |

|

|

|

|

2,000 |

|

|

|

1,862,934 |

|

| City of Chillicothe OH

(Adena Health System Obligated Group)

Series 2017

5.00%, 12/01/2047 |

|

|

|

|

1,800 |

|

|

|

1,822,720 |

|

7

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| County of Cuyahoga OH

(MetroHealth System (The))

Series 2017

5.00%, 02/15/2052 |

|

|

|

$ |

2,240 |

|

|

$ |

2,248,522 |

|

| 5.50%, 02/15/2052 |

|

|

|

|

4,585 |

|

|

|

4,684,038 |

|

| Ohio Higher Educational Facility Commission

(Kenyon College)

Series 2020

4.00%, 07/01/2040 |

|

|

|

|

730 |

|

|

|

731,641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,349,855 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Oklahoma – 2.0% |

|

|

|

|

|

|

|

|

|

|

| Oklahoma City Airport Trust

Series 2018

5.00%, 07/01/2043 |

|

|

|

|

2,000 |

|

|

|

2,048,286 |

|

| 5.00%, 07/01/2047 |

|

|

|

|

5,000 |

|

|

|

5,094,433 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,142,719 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Oregon – 0.4% |

|

|

|

|

|

|

|

|

|

|

| Multnomah County School District No. 40

Series 2023-A

Zero

Coupon, 06/15/2051 |

|

|

|

|

5,000 |

|

|

|

1,309,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pennsylvania – 5.7% |

|

|

|

|

|

|

|

|

|

|

| Berks County Municipal Authority (The)

(Tower Health Obligated Group)

Series 2020-B

5.00%, 02/01/2040 |

|

|

|

|

1,000 |

|

|

|

640,000 |

|

| Bucks County Industrial Development Authority

(Grand View Hospital/Sellersville PA Obligated Group)

Series 2021

4.00%, 07/01/2051 |

|

|

|

|

2,250 |

|

|

|

1,713,785 |

|

| Chester County Industrial Development Authority

(Collegium Charter School)

Series 2022

6.00%, 10/15/2052(a) |

|

|

|

|

1,000 |

|

|

|

1,035,209 |

|

| Pennsylvania Economic Development Financing Authority

(Commonwealth of Pennsylvania Department of Transportation)

AGM Series 2022

5.75%, 12/31/2062 |

|

|

|

|

7,500 |

|

|

|

8,203,267 |

|

| Pennsylvania Economic Development Financing Authority

(PA Bridges Finco LP)

Series 2015

5.00%, 12/31/2038 |

|

|

|

|

1,940 |

|

|

|

1,960,683 |

|

| 5.00%, 06/30/2042 |

|

|

|

|

6,060 |

|

|

|

6,100,613 |

|

| Scranton School District/PA BAM

Series 2017-E

4.00%,

12/01/2037 |

|

|

|

|

1,025 |

|

|

|

1,023,231 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,676,788 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Puerto Rico – 0.2% |

|

|

|

|

|

|

|

|

|

|

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue

Series

2019-A

4.329%, 07/01/2040 |

|

|

|

|

615 |

|

|

|

609,603 |

|

|

|

|

|

|

|

|

|

|

|

|

8

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| South Carolina – 6.4% |

|

|

|

|

|

|

|

|

|

|

| South Carolina Jobs-Economic Development Authority

(Novant Health Obligated Group)

Series 2024

4.50%, 11/01/2054 |

|

|

|

$ |

10,000 |

|

|

$ |

10,033,651 |

|

| South Carolina Jobs-Economic Development Authority

(Prisma Health Obligated Group)

Series 2018-A

5.00%, 05/01/2048 |

|

|

|

|

5,900 |

|

|

|

5,986,402 |

|

| South Carolina Public Service Authority

Series 2016-B

5.00%,

12/01/2041 |

|

|

|

|

5,000 |

|

|

|

5,057,521 |

|

| Series 2022

3.00%, 12/01/2046 |

|

|

|

|

1,132 |

|

|

|

867,817 |

|

| 3.00%, 12/01/2049 |

|

|

|

|

1,566 |

|

|

|

1,157,551 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,102,942 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| South Dakota – 0.2% |

|

|

|

|

|

|

|

|

|

|

| County of Lincoln SD

(Augustana College Association/SD)

Series 2021

4.00%, 08/01/2061 |

|

|

|

|

1,000 |

|

|

|

814,060 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tennessee – 0.1% |

|

|

|

|

|

|

|

|

|

|

| Chattanooga Health Educational & Housing Facility Board

(CommonSpirit Health)

Series 2019-A

4.00%, 08/01/2037 |

|

|

|

|

145 |

|

|

|

145,354 |

|

| 4.00%, 08/01/2038 |

|

|

|

|

275 |

|

|

|

274,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

419,357 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Texas – 30.0% |

|

|

|

|

|

|

|

|

|

|

| Arlington Higher Education Finance Corp.

(Uplift Education)

Series 2023-A

4.375%, 12/01/2058 |

|

|

|

|

3,000 |

|

|

|

2,998,653 |

|

| Celina Independent School District

Series 2023

4.00%, 02/15/2053 |

|

|

|

|

10,000 |

|

|

|

9,616,754 |

|

| County of Smith TX

Series 2023

5.00%, 08/15/2048 |

|

|

|

|

7,000 |

|

|

|

7,545,321 |

|

| Dallas Independent School District

Series 2024

4.00%, 02/15/2054(d) |

|

|

|

|

12,000 |

|

|

|

11,590,573 |

|

| Denton Independent School District

Series 2023

5.00%, 08/15/2048(d) |

|

|

|

|

10,000 |

|

|

|

10,900,255 |

|

| Greenwood Independent School District

Series 2024

4.00%, 02/15/2054 |

|

|

|

|

14,250 |

|

|

|

13,591,100 |

|

9

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| Hidalgo County Regional Mobility Authority

Series 2022-A

Zero

Coupon, 12/01/2043 |

|

|

|

|

|

$ |

2,000 |

|

|

$ |

783,123 |

|

| Zero Coupon, 12/01/2044 |

|

|

|

|

|

|

2,420 |

|

|

|

900,752 |

|

| Zero Coupon, 12/01/2045 |

|

|

|

|

|

|

3,360 |

|

|

|

1,188,820 |

|

| Lamar Consolidated Independent School District

Series

2023-A

5.00%, 02/15/2053(d) |

|

|

|

|

|

|

15,000 |

|

|

|

16,122,943 |

|

| Melissa Independent School District

Series 2023

4.25%, 02/01/2053(d) |

|

|

|

|

|

|

12,780 |

|

|

|

12,800,217 |

|

| New Hope Cultural Education Facilities Finance Corp.

(CHF-Collegiate Housing Denton LLC)

AGM Series

2018-A1

5.00%, 07/01/2038 |

|

|

|

|

|

|

500 |

|

|

|

515,888 |

|

| Pflugerville Independent School District

Series 2023-A

4.00%,

02/15/2044 |

|

|

|

|

|

|

5,000 |

|

|

|

4,912,241 |

|

| Prosper Independent School District

Series 2024

4.00%, 02/15/2054 |

|

|

|

|

|

|

15,000 |

|

|

|

14,512,887 |

|

| Texas Water Development Board

(State Water Implementation Revenue Fund for Texas)

Series 2022

5.00%, 10/15/2057 |

|

|

|

|

|

|

1,000 |

|

|

|

1,075,357 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

109,054,884 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Utah – 1.3% |

|

|

|

|

|

|

|

|

|

|

|

|

| City of Salt Lake City UT Airport Revenue

BAM Series

2018-A

5.00%, 07/01/2043 |

|

|

|

|

|

|

4,500 |

|

|

|

4,620,063 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Virginia – 1.4% |

|

|

|

|

|

|

|

|

|

|

|

|

| Virginia Small Business Financing Authority

(Capital Beltway Express LLC)

Series 2022

5.00%, 12/31/2047 |

|

|

|

|

|

|

5,000 |

|

|

|

5,203,142 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Washington – 3.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| Grays Harbor County Public Hospital District No. 1

Series 2023

6.875%, 12/01/2053 |

|

|

|

|

|

|

1,000 |

|

|

|

1,097,986 |

|

| State of Washington

Series 2023-2

5.00%, 08/01/2048 |

|

|

|

|

|

|

7,685 |

|

|

|

8,338,383 |

|

| Washington State Housing Finance Commission

Series 2021-1,

Class A

3.50%, 12/20/2035 |

|

|

|

|

|

|

953 |

|

|

|

884,216 |

|

| Series 2023-1, Class A

3.375%, 04/20/2037 |

|

|

|

|

|

|

994 |

|

|

|

896,960 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,217,545 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| West Virginia – 1.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| West Virginia Hospital Finance Authority

(West Virginia United Health System Obligated Group)

Series 2018-A

5.00%,

06/01/2052 |

|

|

|

|

|

|

3,875 |

|

|

|

3,961,060 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal

Amount (000) |

|

|

U.S. $ Value |

|

|

|

|

|

| Wisconsin – 7.9% |

|

|

|

|

|

|

|

|

|

|

| Wisconsin Health & Educational Facilities Authority

(Marshfield Clinic Health System Obligated Group)

BAM Series 2024

4.50%, 02/15/2054 |

|

|

|

$ |

5,000 |

|

|

$ |

5,001,360 |

|

| Wisconsin Public Finance Authority

(CFC-SA LLC)

Series 2022

5.00%, 02/01/2062 |

|

|

|

|

10,000 |

|

|

|

10,177,490 |

|

| Wisconsin Public Finance Authority

(CHF - Wilmington LLC)

AGM Series 2018

5.00%, 07/01/2058 |

|

|

|

|

10,000 |

|

|

|

10,196,603 |

|

| Wisconsin Public Finance Authority

(Pre-refunded - US Treasuries)

Series 2022

4.00%, 04/01/2052(a) |

|

|

|

|

90 |

|

|

|

96,532 |

|

| Wisconsin Public Finance Authority

(Queens University of Charlotte)

Series 2022

5.25%, 03/01/2047 |

|

|

|

|

2,000 |

|

|

|

2,043,014 |

|

| Wisconsin Public Finance Authority

(Southeastern Regional Medical Center Obligated Group)

Series 2021

4.00%, 02/01/2037 |

|

|

|

|

1,505 |

|

|

|

1,269,135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28,784,134 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Municipal Obligations

(cost $579,083,279) |

|

|

|

|

|

|

|

|

585,884,793 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

|

|

|

|

|

|

| SHORT-TERM INVESTMENTS – 1.6% |

|

|

|

|

|

|

|

|

|

|

| Investment Companies – 1.6% |

|

|

|

|

|

|

|

|

|

|

| AB Fixed Income Shares, Inc. - Government Money Market Portfolio - Class AB, 5.20%(h) (i) (j)

(cost $5,874,754) |

|

|

|

|

5,874,754 |

|

|

|

5,874,754 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments – 162.8%

(cost

$584,958,033)(k) |

|

|

|

|

|

|

|

|

591,759,547 |

|

| Other assets less liabilities – (62.8)% |

|

|

|

|

|

|

|

|

(228,189,261 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Assets – 100.0% |

|

|

|

|

|

|

|

$ |

363,570,286 |

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Security is exempt from registration under Rule 144A or Regulation S of the Securities Act of 1933. These securities

are considered restricted, but liquid and may be resold in transactions exempt from registration. At July 31, 2024, the aggregate market value of these securities amounted to $11,521,633 or 3.2% of net assets. |

| (b) |

Coupon rate adjusts periodically based upon a predetermined schedule. Stated interest rate in effect at July 31,

2024. |

| (c) |

Floating Rate Security. Stated interest/floor/ceiling rate was in effect at July 31, 2024.

|

| (d) |

Security represents the underlying municipal obligation of an inverse floating rate obligation held by the Fund.

|

| (e) |

Non-income producing security. |

11

| (f) |

Defaulted matured security. |

| (g) |

When-Issued or delayed delivery security. |

| (h) |

Affiliated investments. |

| (i) |

The rate shown represents the 7-day yield as of period end.

|

| (j) |

To obtain a copy of the fund’s shareholder report, please go to the Securities and Exchange Commission’s

website at www.sec.gov, or call AB at (800) 227-4618. |

| (k) |

As of July 31, 2024, the cost basis of investment securities owned was substantially identical for both book and

tax purposes. Gross unrealized appreciation of investments was $13,756,409 and gross unrealized depreciation of investments was $(6,954,895), resulting in net unrealized appreciation of $6,801,514. |

As of July 31, 2024, the Fund’s percentages of investments in municipal bonds that are insured and in insured municipal bonds that have been pre-refunded or escrowed to maturity are 15.2% and 0.0%, respectively.

Glossary:

AGM – Assured Guaranty Municipal

BAM – Build American Mutual

CFC – Community Finance Corporation

CHF – Collegiate

Housing Foundation

OSF – Order of St. Francis

SOFR –

Secured Overnight Financing Rate

12

AllianceBernstein National Municipal Income Fund, Inc.

July 31, 2024 (unaudited)

In accordance with U.S. GAAP

regarding fair value measurements, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes a

framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability (including those valued based on their market values). Inputs may be

observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on

market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available

in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| |

• |

|

Level 1 - quoted prices in active markets for identical investments |

| |

• |

|

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates,

prepayment speeds, credit risk, etc.) |

| |

• |

|

Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value

of investments) |

The fair value of debt instruments, such as bonds, and over-the-counter derivatives is generally based on market price quotations, recently executed market transactions (where observable) or industry recognized modeling techniques and are generally classified as

Level 2. Pricing vendor inputs to Level 2 valuations may include quoted prices for similar investments in active markets, interest rate curves, coupon rates, currency rates, yield curves, option adjusted spreads, default rates, credit

spreads and other unique security features in order to estimate the relevant cash flows which is then discounted to calculate fair values. If these inputs are unobservable and significant to the fair value, these investments will be classified as

Level 3. In addition, non-agency rated investments are classified as Level 3.

Other fixed income

investments, including non-U.S. government and corporate debt, are generally valued using quoted market prices, if available, which are typically impacted by current interest rates, maturity dates and any

perceived credit risk of the issuer. Additionally, in the absence of quoted market prices, these inputs are used by pricing vendors to derive a valuation based upon industry or proprietary models which incorporate issuer specific data with relevant

yield/spread comparisons with more widely quoted bonds with similar key characteristics. Those investments for which there are observable inputs are classified as Level 2. Where the inputs are not observable, the investments are classified as

Level 3.

Valuations of mortgage-backed or other asset backed securities, by pricing vendors, are based on both proprietary and industry

recognized models and discounted cash flow techniques. Significant inputs to the valuation of these instruments are value of the collateral, the rates and timing of delinquencies, the rates and timing of prepayments, and default and loss

expectations, which are driven in part by housing prices for residential mortgages. Significant inputs are determined based on relative value analyses, which incorporate comparisons to instruments with similar collateral and risk profiles, including

relevant indices. Mortgage and asset backed securities for which management has collected current observable data through pricing services are generally categorized within Level 2. Those investments for which current observable data has not

been provided are classified as Level 3.

13

The following table summarizes the valuation of the Fund’s investments by the above fair value

hierarchy levels as of July 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investments in Securities: |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Assets: |

|

| Long-Term Municipal Bonds |

|

$ |

— |

|

|

$ |

585,884,793 |

|

|

$ |

— |

|

|

$ |

585,884,793 |

|

| Short-Term Investments |

|

|

5,874,754 |

|

|

|

— |

|

|

|

— |

|

|

|

5,874,754 |

|

| Total Investments in Securities |

|

|

5,874,754 |

|

|

|

585,884,793 |

|

|

|

— |

|

|

|

591,759,547 |

|

| Other Financial Instruments(a) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

5,874,754 |

|

|

$ |

585,884,793 |

|

|

$ |

— |

|

|

$ |

591,759,547 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Fund holds liabilities for floating rate note obligations which are not reflected in the table above. The fair value of the

Fund’s liabilities for floating rate note obligations approximates their liquidation values. Floating rate note obligations are generally classified as level 2.

| (a) |

Other financial instruments include reverse repurchase agreements and derivative instruments, such as futures, forwards

and swaps. Derivative instruments are valued at the unrealized appreciation (depreciation) on the instrument. Other financial instruments may also include swaps with upfront premiums, written options and written swaptions which are valued at market

value. |

A summary of the Fund’s transactions in AB mutual funds for the nine months ended July 31, 2024 is as

follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fund |

|

Market Value

10/31/2023 (000) |

|

|

Purchases

at Cost (000) |

|

|

Sales

Proceeds (000) |

|

|

Market Value

07/31/2024 (000) |

|

|

Dividend

Income (000) |

|

| Government Money Market Portfolio |

|

$ |

9,713 |

|

|

$ |

123,505 |

|

|

$ |

127,343 |

|

|

$ |

5,875 |

|

|

$ |

239

|

|

14

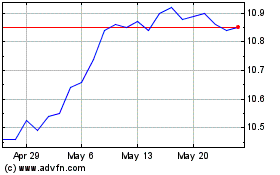

AllianceBernstein Nation... (NYSE:AFB)

Historical Stock Chart

From Jan 2025 to Feb 2025

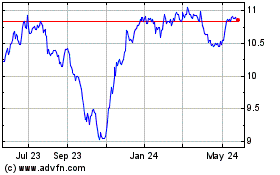

AllianceBernstein Nation... (NYSE:AFB)

Historical Stock Chart

From Feb 2024 to Feb 2025