Alamos Gold Inc. (

TSX:AGI;

NYSE:AGI) (“Alamos” or the “Company”) today announced it

has been granted approval of an amendment to its existing

environmental impact assessment (Manifestación de Impacto Ambiental

“MIA") by Mexico’s Secretariat of Environment and Natural Resources

(“SEMARNAT”), allowing for the start of construction on the Puerto

Del Aire (“PDA”) project located within the Mulatos District.

“Mulatos is our founding operation and a steady

producer since 2005. Through a long-track record of exploration

success, we have discovered and developed a number of high-return

projects that have continued to extend the mine life of the Mulatos

District. Having achieved this key permitting milestone through

long-standing community, state, and federal government support, PDA

is expected to significantly extend the mine life of the District,

as our next high-return project with significant exploration

upside. With an initial Mineral Reserve and Resource declared on

PDA at the end of 2021, the transition from discovery to

construction has been rapid and exemplifies the exploration upside

within the District,” said John A. McCluskey, President and Chief

Executive Officer.

As outlined earlier this month, construction

activities on PDA are expected to begin ramping up toward the

middle of 2025. Capital spending on PDA is expected to total $37 to

$40 million in 2025 to advance underground development and

procurement of mill long lead time items. The remainder of the

total initial capital estimate of $165 million will be spent in

2026 and 2027 with first production anticipated mid-2027.

PDA is a higher-grade underground deposit

located adjacent to the main Mulatos pit. The results of a positive

internal economic study were announced in September 2024 and

highlighted an attractive, low-cost, high-return project. Annual

gold production is expected to average 127,000 ounces over the

first four years, and 104,000 ounces over an eight-year mine life

based on Mineral Reserves at the end of 2023. Mine-site all-in

sustaining costs are expected to average $1,003 per payable

ounce.

Combined with a low capital intensity, PDA has

an estimated after-tax Net Present Value (“NPV”) (5%) of $269

million, and after-tax Internal Rate of Return (“IRR”) of 46%,

using a base case gold price of $1,950 per ounce and MXN/USD

foreign exchange rate of 18:1. At a $2,500 per ounce gold price,

PDA has an estimated after-tax NPV (5%) of $492 million and an

after-tax IRR of 73%.

The project contains significant exploration

upside with PDA open in multiple directions and higher grade

mineralization intersected below the past producing Cerro Pelon

open pit. This is expected to support an initial underground

Mineral Resource at Cerro Pelon with the 2024 year-end update to be

released in February 2025. Cerro Pelon represents upside as a

potential source of additional feed to the PDA sulphide mill that

could extend the higher rates of production beyond the first four

years of the current mine plan.

About Alamos

Alamos is a Canadian-based intermediate gold

producer with diversified production from three operations in North

America. This includes the Island Gold District and Young-Davidson

mine in northern Ontario, Canada, and the Mulatos District in

Sonora State, Mexico. Additionally, the Company has a strong

portfolio of growth projects, including the Phase 3+ Expansion at

Island Gold, and the Lynn Lake project in Manitoba, Canada. Alamos

employs more than 2,400 people and is committed to the highest

standards of sustainable development. The Company’s shares are

traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. Parsons Senior Vice President,

Corporate Development & Investor Relations (416) 368-9932 x

5439

Khalid ElhajVice President, Business

Development & Investor Relations(416) 368-9932 x

5427ir@alamosgold.com

The TSX and NYSE have not reviewed and do not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward

Looking Statements

This news release contains or incorporates by

reference “forward-looking statements” and “forward-looking

information” as defined under applicable Canadian and U.S.

securities laws. All statements in this news release, other than

statements of historical fact, which address events, results,

outcomes or developments that the Company expects to occur are, or

may be deemed to be, forward-looking statements and are generally,

but not always, identified by the use of forward-looking

terminology such as "expect", “anticipate”, “potential”,

“opportunity”, “estimate”, “continue”, “budget”, or variations of

such words and phrases and similar expressions or statements that

certain actions, events or results “may", “could”, “would”, "might"

or "will" be taken, occur or be achieved or the negative

connotation of such terms. Forward-looking statements contained in

this news release are based on information, expectations, estimates

and projections as of the date of this news release.

Forward-looking statements in this news release

include, but may not be limited to, information as to strategy,

plans, expectations or future financial or operating performance

pertaining to, or anticipated to result from, the PDA development

project, such as expectations, assumptions and estimations

regarding: the project and its attractive economics and significant

exploration upside; construction and development of the project;

timing of construction activities; development focusses; initial

underground Mineral Resource at Cerro Pelon; mine life; mine plan;

exploration potential; anticipated production; gold grades;

mineralization; budget allocation for PDA development; initial

capital estimates and anticipated spending; operating costs

including mine-site all-in sustaining costs; cash costs; economic

analysis including after-tax net present value and internal rate of

return; gold price, other metal prices and foreign exchange rates;

the nature and stability of relationships with the Mexican

authorities and administration; community support; and other

statements that express management's expectations or estimates of

future performance, operational, geological or financial

results.

The Company cautions that forward-looking

statements are necessarily based upon several factors and

assumptions that, while considered reasonable by management at the

time of making such statements, are inherently subject to

significant business, economic, technical, legal, political, and

competitive uncertainties, and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements, and undue reliance

should not be placed on such statements and information.

Such factors include (without limitation): the

actual results of current exploration activities; conclusions of

economic and geological evaluations; changes in project parameters

as plans continue to be refined; any impacts of any illnesses,

diseases, epidemics or pandemics on operations and the broader

market, including the nature and duration of any regulatory

responses; state and federal orders or mandates (including with

respect to mining operations generally or auxiliary businesses or

services required for the Company’s operations) in Mexico; changes

in national and local government legislation, controls or

regulations; failure to comply with environmental and health and

safety laws and regulations; labour and contractor availability

(and being able to secure the same on favourable terms); ability to

sell or deliver gold doré bars; disruptions in the maintenance or

provision of required infrastructure and information technology

systems; fluctuations in the price of gold or certain other

commodities such as, diesel fuel, natural gas, and electricity;

operating or technical difficulties in connection with mining or

development activities, including geotechnical challenges and

changes to production estimates (which assume accuracy of projected

ore grade, mining rates, recovery timing and recovery rate

estimates and may be impacted by unscheduled maintenance); changes

in foreign exchange rates (particularly the Canadian dollar, U.S.

dollar, and Mexican peso); the impact of inflation; employee and

community relations; litigation and administrative proceedings;

disruptions affecting operations; availability of and increased

costs associated with mining inputs and labour; delays in the

development or updating of mine and/or development plans; changes

that may be required to the intended method of accessing and mining

the deposit at Puerto Del Aire and changes related to the intended

method of processing any ore from the deposit at Puerto Del Aire;

inherent risks and hazards associated with mining and mineral

processing including environmental hazards, industrial accidents,

unusual or unexpected formations, pressures and cave-ins; the risk

that the Company’s mines may not perform as planned;

uncertainty with the Company's ability to secure additional capital

to execute its business plans; the speculative nature of mineral

exploration and development, risks in obtaining and maintaining

necessary licenses, permits and authorizations, contests over title

to properties; expropriation or nationalization of property;

political or economic developments in Canada or Mexico and other

jurisdictions in which the Company may carry on business in the

future; increased costs and risks related to the potential impact

of climate change; the costs and timing of construction and

development of new deposits; risk of loss due to sabotage, protests

and other civil disturbances; the impact of global liquidity and

credit availability and the values of assets and liabilities based

on projected future cash flows; and business opportunities that may

be pursued by the Company.

For a more detailed discussion of such risks and

other risk factors that may affect the Company's ability to achieve

the expectations set forth in the forward-looking statements

contained in this news release, see the Company’s latest

40-F/Annual Information Form and Management’s Discussion and

Analysis, each under the heading “Risk Factors” available on the

SEDAR+ website at www.sedarplus.ca or on EDGAR at www.sec.gov. The

foregoing should be reviewed in conjunction with the information,

risk factors and assumptions found in this news release.

The Company disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

except as required by applicable law.

Cautionary Note to U.S.

Investors

Alamos prepares its disclosure in accordance

with the requirements of securities laws in effect in Canada.

Unless otherwise indicated, all Mineral Resource and Mineral

Reserve estimates included in this document have been prepared in

accordance with Canadian National Instrument 43-101 - Standards of

Disclosure for Mineral Projects (“NI 43-101”) and the Canadian

Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM

Definition Standards on Mineral Resources and Mineral Reserves,

adopted by the CIM Council, as amended (the “CIM Standards”). NI

43-101 is a rule developed by the Canadian Securities

Administrators, which established standards for all public

disclosure an issuer makes of scientific and technical information

concerning mineral projects. Mining disclosure in the United States

was previously required to comply with SEC Industry Guide 7 (“SEC

Industry Guide 7”) under the United States Securities Exchange Act

of 1934, as amended. The U.S. Securities and Exchange Commission

(the “SEC”) has adopted final rules, to replace SEC Industry Guide

7 with new mining disclosure rules under sub-part 1300 of

Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”)

which became mandatory for U.S. reporting companies beginning with

the first fiscal year commencing on or after January 1, 2021. Under

Regulation S-K 1300, the SEC now recognizes estimates of “Measured

Mineral Resources”, “Indicated Mineral Resources” and “Inferred

Mineral Resources”. In addition, the SEC has amended its

definitions of “Proven Mineral Reserves” and “Probable Mineral

Reserves” to be substantially similar to international

standards.

Investors are cautioned that while the above

terms are “substantially similar” to CIM Definitions, there are

differences in the definitions under Regulation S-K 1300 and the

CIM Standards. Accordingly, there is no assurance any mineral

reserves or mineral resources that the Company may report as

“proven mineral reserves”, “probable mineral reserves”, “measured

mineral resources”, “indicated mineral resources” and “inferred

mineral resources” under NI 43-101 would be the same had the

Company prepared the mineral reserve or mineral resource estimates

under the standards adopted under Regulation S-K 1300. U.S.

investors are also cautioned that while the SEC recognizes

“measured mineral resources”, “indicated mineral resources” and

“inferred mineral resources” under Regulation S-K 1300, investors

should not assume that any part or all of the mineralization in

these categories will ever be converted into a higher category of

mineral resources or into mineral reserves. Mineralization

described using these terms has a greater degree of uncertainty as

to its existence and feasibility than mineralization that has been

characterized as reserves. Accordingly, investors are cautioned not

to assume that any measured mineral resources, indicated mineral

resources, or inferred mineral resources that the Company reports

are or will be economically or legally mineable.

Cautionary Note Regarding non-GAAP

Measures and Additional GAAP Measures

Note that for purposes of this section, GAAP

refers to IFRS. The Company believes that investors use certain

non-GAAP and additional GAAP measures as indicators to assess gold

mining companies. They are intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared with GAAP.

“Cash flow from operating activities before

changes in non-cash working capital” is a non-GAAP performance

measure that could provide an indication of the Company’s ability

to generate cash flows from operations and is calculated by adding

back the change in non-cash working capital to “cash provided by

(used in) operating activities” as presented on the Company’s

consolidated statements of cash flows. “Cash flow per share” is

calculated by dividing “cash flow from operations before changes in

working capital” by the weighted average number of shares

outstanding for the period. “Free cash flow” is a non-GAAP

performance measure that is calculated as cash flows from

operations net of cash flows invested in mineral property, plant

and equipment and exploration and evaluation assets as presented on

the Company’s consolidated statements of cash flows and that would

provide an indication of the Company’s ability to generate cash

flows from its mineral projects. “Mine site free cash flow” is a

non-GAAP measure which includes cash flow from operating activities

at, less capital expenditures at each mine site. “Return on equity”

is defined as earnings from continuing operations divided by the

average total equity for the current and previous year. “Mining

cost per tonne of ore” and “cost per tonne of ore” are non-GAAP

performance measures that could provide an indication of the mining

and processing efficiency and effectiveness of the mine. These

measures are calculated by dividing the relevant mining and

processing costs and total costs by the tonnes of ore processed in

the period. “Cost per tonne of ore” is usually affected by

operating efficiencies and waste-to-ore ratios in the period.

“Total capital expenditures per ounce produced” is a non-GAAP term

used to assess the level of capital intensity of a project and is

calculated by taking the total growth and sustaining capital of a

project divided by ounces produced life of mine. “Total cash costs

per ounce”, “all-in sustaining costs per ounce”, “mine-site all-in

sustaining costs”, and “all-in costs per ounce” as used in this

analysis are non-GAAP terms typically used by gold mining companies

to assess the level of gross margin available to the Company by

subtracting these costs from the unit price realized during the

period. These non-GAAP terms are also used to assess the ability of

a mining company to generate cash flow from operations. There may

be some variation in the method of computation of these metrics as

determined by the Company compared with other mining companies. In

this context, “total cash costs” reflects mining and processing

costs allocated from in-process and doré inventory and associated

royalties with ounces of gold sold in the period. Total cash costs

per ounce are exclusive of exploration costs. “All-in sustaining

costs per ounce” include total cash costs, exploration, corporate

and administrative, share based compensation and sustaining capital

costs. “Mine-site all-in sustaining costs” include total cash

costs, exploration, and sustaining capital costs for the mine-site,

but exclude an allocation of corporate and administrative and share

based compensation. “Adjusted net earnings” and “adjusted earnings

per share” are non-GAAP financial measures with no standard meaning

under IFRS. “Adjusted net earnings” excludes the following from net

earnings: foreign exchange gain (loss), items included in other

loss, certain non-reoccurring items, and foreign exchange gain

(loss) recorded in deferred tax expense. “Adjusted earnings per

share” is calculated by dividing “adjusted net earnings” by the

weighted average number of shares outstanding for the period.

Additional GAAP measures that are presented on

the face of the Company’s consolidated statements of comprehensive

income and are not meant to be a substitute for other subtotals or

totals presented in accordance with IFRS, but rather should be

evaluated in conjunction with such IFRS measures. This includes

“Earnings from operations”, which is intended to provide an

indication of the Company’s operating performance and represents

the amount of earnings before net finance income/expense, foreign

exchange gain/loss, other income/loss, and income tax expense.

Non-GAAP and additional GAAP measures do not have a standardized

meaning prescribed under IFRS and therefore may not be comparable

to similar measures presented by other companies. A reconciliation

of historical non-GAAP and additional GAAP measures are detailed in

the Company’s latest Management’s Discussion and Analysis available

online on the SEDAR+ website at www.sedarplus.ca or on EDGAR at

www.sec.gov and at www.alamosgold.com.

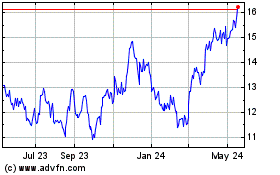

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Dec 2024 to Jan 2025

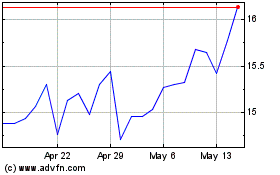

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Jan 2024 to Jan 2025