0001545654DEF 14Afalseiso4217:USDxbrli:pure00015456542024-01-012024-12-310001545654alex:LanceK.ParkerMember2024-01-012024-12-310001545654alex:LanceK.ParkerMember2023-01-012023-12-310001545654alex:ChristopherJ.BenjaminMember2023-01-012023-12-3100015456542023-01-012023-12-310001545654alex:ChristopherJ.BenjaminMember2022-01-012022-12-3100015456542022-01-012022-12-310001545654alex:ChristopherJ.BenjaminMember2021-01-012021-12-3100015456542021-01-012021-12-310001545654alex:ChristopherJ.BenjaminMember2020-01-012020-12-3100015456542020-01-012020-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:LanceK.ParkerMember2024-01-012024-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:LanceK.ParkerMember2023-01-012023-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:LanceK.ParkerMember2024-01-012024-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:LanceK.ParkerMember2023-01-012023-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberalex:LanceK.ParkerMember2024-01-012024-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberalex:LanceK.ParkerMember2023-01-012023-12-310001545654ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberalex:LanceK.ParkerMember2024-01-012024-12-310001545654ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberalex:LanceK.ParkerMember2023-01-012023-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberalex:LanceK.ParkerMember2024-01-012024-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberalex:LanceK.ParkerMember2023-01-012023-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberalex:LanceK.ParkerMember2024-01-012024-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberalex:LanceK.ParkerMember2023-01-012023-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberalex:LanceK.ParkerMember2024-01-012024-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberalex:LanceK.ParkerMember2023-01-012023-12-310001545654ecd:PeoMemberalex:LanceK.ParkerMember2024-01-012024-12-310001545654ecd:PeoMemberalex:LanceK.ParkerMember2023-01-012023-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2023-01-012023-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2022-01-012022-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2021-01-012021-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2020-01-012020-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2023-01-012023-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2022-01-012022-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2021-01-012021-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2020-01-012020-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2023-01-012023-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2022-01-012022-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2021-01-012021-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2020-01-012020-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2023-01-012023-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2022-01-012022-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2021-01-012021-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2020-01-012020-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2023-01-012023-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2022-01-012022-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2021-01-012021-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2020-01-012020-12-310001545654ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2023-01-012023-12-310001545654ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2022-01-012022-12-310001545654ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2021-01-012021-12-310001545654ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2020-01-012020-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2023-01-012023-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2022-01-012022-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2021-01-012021-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberalex:ChristopherJ.BenjaminMember2020-01-012020-12-310001545654ecd:PeoMemberalex:ChristopherJ.BenjaminMember2023-01-012023-12-310001545654ecd:PeoMemberalex:ChristopherJ.BenjaminMember2022-01-012022-12-310001545654ecd:PeoMemberalex:ChristopherJ.BenjaminMember2021-01-012021-12-310001545654ecd:PeoMemberalex:ChristopherJ.BenjaminMember2020-01-012020-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001545654ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001545654ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310001545654ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310001545654ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001545654ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001545654ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001545654ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001545654ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001545654ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001545654ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001545654ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001545654ecd:NonPeoNeoMember2024-01-012024-12-310001545654ecd:NonPeoNeoMember2023-01-012023-12-310001545654ecd:NonPeoNeoMember2022-01-012022-12-310001545654ecd:NonPeoNeoMember2021-01-012021-12-310001545654ecd:NonPeoNeoMember2020-01-012020-12-31000154565412024-01-012024-12-31000154565422024-01-012024-12-31000154565432024-01-012024-12-31000154565442024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Alexander & Baldwin, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11.

| | |

| LETTER TO OUR SHAREHOLDERS |

To the Shareholders of Alexander & Baldwin, Inc.:

You are invited to attend the 2025 Annual Meeting of Shareholders of Alexander & Baldwin, Inc. (“A&B” or the “Company”), to be held on Tuesday, April 22, 2025 at 8:00 a.m. Hawaii Standard Time in a virtual format by live audio webcast. Information on how to attend our virtual Annual Meeting is included in the Proxy Statement. We hope that you can join us.

Whether or not you plan to attend the Annual Meeting, we encourage you to read the Proxy Statement and vote your shares. You may vote via the Internet, by telephone or by requesting a paper proxy card to complete and return by mail. Specific instructions for shareholders are included in the enclosed proxy or on a Notice of Internet Availability of Proxy Materials being distributed to shareholders on or around March 11, 2025.

Your vote is important and your shares should be represented. Thank you for your continued support of A&B.

Sincerely,

LANCE K. PARKER

President and Chief Executive Officer

March 11, 2025

822 Bishop Street • Honolulu, Hawaii 96813

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | | | |

| When: | Meeting Agenda: |

Tuesday, April 22, 2025

8:00 a.m., Hawaii Standard Time Where: The 2025 Annual Meeting will be held in a virtual format via live audio webcast. Shareholders may attend virtually and participate in the Annual Meeting, and vote their shares electronically, by visiting www.meetnow.global/M9L456Y. To participate in the Annual Meeting, a record shareholder will need to enter the 15-digit control number found on the proxy card. | 1.Elect six directors to serve until the next Annual Meeting of Shareholders and until their successors are duly elected and qualified;

2.Conduct an advisory vote on executive compensation;

3.Conduct an advisory vote on the frequency of future advisory votes on executive compensation;

4.Ratify the appointment of the independent registered public accounting firm for the ensuing year; and

5.Transact such other business as properly may be brought before the meeting or any adjournment or postponement thereof. |

The Board of Directors has set the close of business on February 13, 2025 as the record date for the meeting. Owners of Alexander & Baldwin, Inc. stock at the close of business on that date are entitled to receive notice of and to vote at the meeting.

By Order of the Board of Directors,

ALYSON J. NAKAMURA

Vice President and Corporate Secretary

March 11, 2025

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. PLEASE PROMPTLY VOTE VIA THE INTERNET OR BY TELEPHONE, OR REQUEST A PAPER PROXY CARD TO COMPLETE AND RETURN BY MAIL.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders of Alexander & Baldwin, Inc. to be held on April 22, 2025:

This Proxy Statement and our 2024 Annual Report are available at www.envisionreports.com/ALEX

SUMMARY INFORMATION

To assist you in reviewing this Proxy Statement, we would like to call your attention to key elements of this document. The following description is only a summary. For more information, please read the complete Proxy Statement.

Annual Meeting of Shareholders

| | | | | |

When: | Tuesday, April 22, 2025, 8:00 a.m. Hawaii Standard Time |

Where: | The 2025 Annual Meeting will be virtual, conducted entirely via live audio webcast |

Record Date: | February 13, 2025 |

Voting: | Shareholders as of the record date are entitled to vote |

Attendance: | Record shareholders must have the control number printed on their proxy card in order to access the virtual meeting. Shareholders who hold their shares through an intermediary must register and provide a Legal Proxy. Further information is included in this Proxy Statement. |

Meeting Agenda

| | | | | | | | |

| Agenda Item | Board Recommendation | Page Reference |

| | |

| | |

| ANNUAL | |

| | |

Board Nominees

The following table provides summary information about each director nominee. Each director nominee is elected until the next Annual Meeting of Shareholders. The Board believes that the Company benefits from having directors with a wide range of viewpoints, backgrounds and experiences.

| | | | | | | | | | | |

| Name | Director

Since | Occupation | Committees |

| Shelee M. T. Kimura | 2023 | President and Chief Executive Officer, Hawaiian Electric Company, Inc. | •Compensation |

| Diana M. Laing | 2019 | Retired CFO, American Homes 4 Rent | •Compensation, Chair •Audit •Nominating & Corporate Governance |

| John T. Leong | 2020 | Co-Founder & CEO of Kupu Co-Founder & CEO of Pono Pacific Land

Management, LLC | •Audit |

| Lance K. Parker | 2023 | President and Chief Executive Officer, Alexander & Baldwin, Inc. | — |

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

i

| | | | | | | | | | | |

| Name | Director

Since | Occupation | Committees |

| Douglas M. Pasquale | 2012 | Founder & CEO of Capstone Enterprises

Corporation | •Audit, Chair •Nominating & Corporate Governance |

| Eric K. Yeaman | 2012 | Founder & Managing Partner, Hoku Capital LLC | •Audit •Nominating & Corporate Governance, Chair |

Sound principles of corporate governance are a priority for A&B’s Board of Directors. Governance highlights include:

•All directors, other than the CEO, are independent

•Independent leadership, consisting of an independent, non-executive chair, a lead independent director and a chief executive officer

•Multiple skill sets represented on the Board, as reflected in the skills matrix in the Director Nominees and Qualifications of Directors section of this Proxy Statement

•Annual election of directors

•A majority voting standard in uncontested director elections

•Shareholders can amend the bylaws with a majority vote

•Shareholders can call special meetings with a 10% vote

•No poison pill

•Meaningful director share ownership guidelines

•Annual board evaluations

•An Audit Committee composed of a majority of Audit Committee Financial Experts

•Mandatory retirement age of 75

•Average tenure of less than seven years

•Robust shareholder engagement program

•As nominated for the 2025 Annual Meeting, the Board will be 33% women and 66% people of color

Executive Compensation Linked to Performance

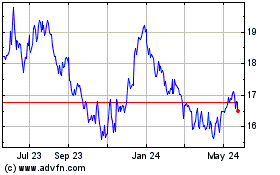

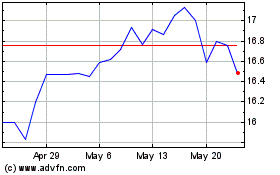

2024 results reflected the strong performance of A&B's high-quality portfolio of grocery-anchored retail, industrial and ground lease assets. The Company generated diluted earnings per share available to A&B shareholders of $0.83 and Funds from Operations ("FFO") per diluted share of $1.37, representing an increase from the prior year of 102.4% and 25.7%, respectively.

The Commercial Real Estate ("CRE") portfolio grew its Same-Store Net Operating Income by 2.87%. Leasing activity remained robust, finishing the year with total leased occupancy of 94.6%. Comparable new and renewal leasing spreads for the improved portfolio were 11.6% and 11.7%, respectively. Proceeds from the sale of Waipouli Town Center were used to fund the acquisition of an 81,500 square-foot distribution facility. We began construction of a 29,550 square foot warehouse and distribution center at Maui Business Park II, and continued to expand our photovoltaic program. The Land Operations segment generated $18.9 million in operating profit due primarily to land sales and earnings from an unconsolidated investment in a legacy joint venture.

The Company maintained a strong and flexible balance sheet. As of December 31, 2024, our net debt to Consolidated Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA") ratio was 3.6 times, and we had total liquidity of $333.4 million. We also recast our revolving credit facility and renewed our $200 million at-the-market equity offering program. General and administrative expenses were reduced by $4.2 million, or 12.4%, compared to 2023.

The Company firmly believes in pay for performance and aligning pay with shareholder interests and the Company’s business objectives. Accordingly, the majority of executive compensation is tied to performance. As displayed in the charts below, in 2024, 81% of the target compensation for our President and Chief Executive Officer (“CEO”), Lance

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

ii

Parker, was in the form of performance-based pay, consisting of annual incentives (cash) and long-term incentives (equity), with the remaining 19% set as fixed pay. For our other Named Executive Officers (“NEOs”), 59% of their target compensation was performance-based with the remaining 41% set as fixed pay. All elements of executive compensation are generally targeted at the 50th percentile of market pay data. In 2024, our executive compensation program received strong support from shareholders with over 96% of Say-on-Pay votes cast in favor of the program.

* Jeffrey Pauker served as EVP and Chief Investment Officer through October 25, 2024. Mr. Pauker's percentage was calculated using his annualized cash compensation and 2024 equity award.

We encourage you to read our Compensation Discussion and Analysis (“CD&A”), which begins on page 21 and describes our pay for performance philosophy and each element of compensation. Our Board of Directors recommends approval, on an advisory basis, of the compensation of our Named Executive Officers, as further described in the CD&A and “Proposal No. 2: Advisory Vote on Executive Compensation” beginning on page 47.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

iii

TABLE OF CONTENTS

| | | | | |

| Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Director Share Ownership Guidelines | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

iv

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

v

PROXY STATEMENT

ANNUAL MEETING INFORMATION

Why am I receiving these materials?

The Board of Directors of Alexander & Baldwin, Inc. (“A&B” or the “Company”) is soliciting proxies for the Annual Meeting of Shareholders to be held on April 22, 2025 and at any adjournment or postponement of the meeting (the “Annual Meeting”).

Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the full set of proxy materials?

On or around March 11, 2025, we mailed to our shareholders (other than to certain street name shareholders or those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials, which contains instructions for accessing and reviewing on the Internet all of our proxy materials, including this Proxy Statement and our 2024 Annual Report to Shareholders. In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission (“SEC”), instead of mailing a printed copy of our proxy materials to each shareholder of record, we are furnishing proxy materials on the Internet. This process is designed to expedite shareholders’ receipt of proxy materials, lower the cost of the Annual Meeting and help conserve natural resources.

How can I request a paper copy of these materials?

You will not receive a printed copy of the proxy materials unless you request it. If you would prefer to receive printed proxy materials, please follow the instructions for requesting such materials contained in the Notice of Internet Availability of Proxy Materials. This process is designed to expedite shareholders’ receipt of proxy materials, lower the cost of the Annual Meeting and help conserve natural resources.

Can I vote using the Internet?

The Notice of Internet Availability of Proxy Materials also provides instructions for voting your shares using the Internet.

Who is entitled to vote at the Annual Meeting?

Shareholders of record at the close of business on February 13, 2025 are entitled to notice of and to vote at the Annual Meeting. On that date, there were 72,711,414 shares of common stock outstanding, each of which is entitled to one vote.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

1

Why is the 2025 Annual Meeting of Shareholders being held virtually?

Holding a virtual Annual Meeting allows shareholders who are located outside of Hawaii to participate. We have designed the virtual Annual Meeting to ensure that shareholders are given the same rights and opportunities to participate in the meeting as they would at an in-person meeting, using online tools to facilitate shareholder access and participation.

How will I be able to participate in the virtual 2025 Annual Meeting of Shareholders?

Record shareholders may join the virtual 2025 Annual Meeting using the 15-digit control number provided on their proxy card or Notice of Internet Availability of Proxy Materials and logging on to www.meetnow.global/M9L456Y. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance and provide Computershare, our transfer agent, a Legal Proxy from your bank or broker by 5:00 p.m. Eastern Time on April 17, 2025. Requests for registration should be directed to us at the following:

By email: Forward the email from your broker, or attach an image of your Legal Proxy, to legalproxy@computershare.com

By mail:

Computershare

Alexander & Baldwin Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. Eastern Time on April 17, 2025. You will receive a confirmation of your registration by email after we receive your Legal Proxy.

Shareholders have the same rights and opportunities to participate in the meeting as they would at an in-person meeting through on-line tools that facilitate shareholder access and participation. Only shareholders are invited to attend the meeting.

Will there be a question and answer session?

You will be able to ask questions and vote your shares during the virtual meeting. Questions must comply with the Annual Meeting procedures and be pertinent to A&B and the meeting matters. If you wish to submit a question during the meeting, log in to the virtual meeting website, type your question in to the “Ask a Question” field and click “Submit.” Questions and answers will be grouped by topic and substantially similar questions will be grouped and answered once.

What if I have technical questions?

If you need technical support prior to and during the meeting you may contact customer support at (888) 724-2416. In addition, a link on the meeting page will provide further assistance should you need it during the meeting. The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones). Please note that Internet Explorer is not a supported browser. Participants should ensure that they have a strong Internet connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time.

What is the voting requirement to approve each of the proposals?

Provided a quorum is present, a majority of the votes cast will be necessary for the election of directors, the ratification of the appointment of the independent registered public accounting firm, and the approval, on an advisory basis, of our executive compensation. Shareholders are being asked to express a preference on the frequency of future advisory votes on executive compensation, and the frequency receiving a plurality of votes cast will be considered the preference of shareholders.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

2

What effect do abstentions and broker non-votes have on the proposals?

Abstentions and broker non-votes will be included for purposes of establishing a quorum at the Annual Meeting. However, abstentions and broker non-votes will have no effect on the voting results for any matter, as they are not considered to be votes cast.

Who will bear the cost of soliciting votes for the Annual Meeting?

Officers, employees and directors of A&B and its subsidiaries may, without additional compensation, solicit proxies by telephone or by other appropriate means. Arrangements also will be made with brokerage firms and other persons that are record holders of A&B’s common stock to forward proxy soliciting material to the beneficial owners of the stock, and A&B will reimburse those record holders for their reasonable expenses. A&B has retained the firm of D.F. King & Co., Inc. to assist in the solicitation of proxies at a cost of $11,500 plus reasonable out-of-pocket expenses.

May I change my vote or revoke my proxy?

You may revoke your proxy or change your vote any time before it is voted at the Annual Meeting by:

•Filing a written revocation with the Corporate Secretary;

•Submitting a later-dated proxy or a later-dated vote by Internet or telephone; or

•Voting at the Annual Meeting.

When were the Proxy Statement materials made publicly available?

This Proxy Statement and the enclosed proxy are being mailed to shareholders and are being made available on the Internet at www.alexanderbaldwin.com on or about March 11, 2025.

What do the references to the term “A&B Predecessor” mean in this document?

References in this Proxy Statement to “A&B Predecessor” mean Alexander & Baldwin, Inc. prior to its separation from Matson, Inc. on June 29, 2012. A&B converted to a real estate investment trust (“REIT”) in 2017.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

3

PROPOSAL NO. 1: ELECTION OF DIRECTORS

In line with best practices, A&B’s directors stand for election annually, and elections are conducted using a majority voting standard in uncontested elections. We ask for your voting support for our six directors named below, to serve until the next Annual Meeting of Shareholders and until their successors are duly elected and qualified.

Director Nominees and Qualification of Directors. The nominees of the Board of Directors are the six persons named below. All nominees are current members of the Board of Directors. The Board of Directors believes that all nominees will be able to serve. However, if any nominee should decline or become unable to serve for any reason, shares represented by proxy will be voted for the replacement person nominated by the Board of Directors, or the Board may choose to reduce the number of directors serving on the Board. Each director nominee identified below was unanimously nominated by the Board at the recommendation of the Nominating and Corporate Governance Committee.

Thomas A. Lewis, Jr., who has served as a director of A&B since 2017, is retiring from the Board at the Annual Meeting. The Board and management thank Mr. Lewis for his years of service and valued advice.

Below are the names, ages (as of March 31, 2025), and principal occupations of each person nominated by the A&B Board, their business experience during at least the last five years, the year each first was elected or appointed a director and qualifications of each director.

Our Nominating Committee is focused on creating a Board that consists of members that have a wide range of professional experience and a combined skill set to help oversee our business effectively. The Board weighs the alignment of Board capabilities with the needs of A&B as part of the Board’s self-assessment process. The Nominating Committee’s processes for selecting director nominees are described in greater detail in “Board of Directors Information” below.

Our Board members have a wide range of perspectives and are knowledgeable about our businesses. Each director contributes in establishing a board climate of trust and respect, where deliberations are open and constructive.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

4

The following skills matrix represents the diverse skill sets of our six directors being proposed for re-election:

Directors' Skills Matrix

Extensive Experience - X; Moderate Experience - O

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Commercial

Real

Estate/

REIT | Executive

Leadership | Finance/

Accounting | Other

Public

Company

Board | Hawaii

Market/

Community

Knowledge | Technology/

Cybersecurity | Environmental | Risk

Management |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

| Shelee M. T. Kimura | | X | X | X | X | O | X | X |

| Diana M. Laing | X | X | X | X | O | O | O | X |

| John T. Leong | O | X | X | | X | O | X | X |

| Lance K. Parker | X | X | O | | X | | O | X |

| Douglas M. Pasquale | X | X | X | X | O | O | O | X |

| Eric K. Yeaman | X | X | X | X | X | O | O | X |

| | | | | | | | |

| (1) Experience in the real estate and/or real estate investment trust ("REIT") industries, including experience with leasing, acquisitions, sales, financing, tax laws and operation of commercial real estate and REITs |

| (2) Experience in leadership role as CEO, President or other key executive position of another company and/or institution |

| (3) Financial or accounting experience and an understanding of financial reporting, internal controls, compliance requirements and investor relations |

| (4) Experience as a board member or extensive participation as senior executive management of another public company |

| (5) Familiarity with and understanding of Hawaii's unique real estate market, culture, and community issues |

| (6) Experience with technology and cybersecurity issues |

| (7) Experience with environmental issues, including climate-related and sustainability matters |

| (8) Experience in identifying, managing and mitigating enterprise risks, including strategic, regulatory, operational and financial risks |

Highlights of the Director Nominees

| | | | | | | | | | | |

✓ | Commitment to strong corporate governance | ✓ | Focus on long-term value creation |

✓ | High ethical standards | ✓ | Wide range of relevant experience |

✓ | Operating segment expertise | ✓ | Knowledge of and involvement in Hawaii |

In selecting nominees, the Board has considered the factors noted above, the current mix of skills and experience represented by our directors, and the qualifications of each nominated director as follows.

| | | | | |

| Shelee M. T. Kimura Age: 51

Director Since: 2023 |

•President, Chief Executive Officer and Director of Hawaiian Electric Company, Inc. ("HECO") since January 2022

•Senior Vice President of Customer Service and Public Affairs of HECO from March 2021 through December 2021

•Senior Vice President of Customer Service of HECO from February 2019 through March 2021

•Senior Vice President of Business Development and Strategic Planning of HECO from January 2017 through February 2019

•Vice President, Corporate Planning & Business Development of HECO from May 2014 through January 2017

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

5

•Manager, Investor Relations and Strategic Planning of Hawaiian Electric Industries, Inc. ("HEI") (NYSE:HE) from November 2009 through May 2014

Director Qualifications: As President and Chief Executive Officer of HECO, which serves the energy needs of 95% of Hawaii's population, Ms. Kimura brings to the Board experience in managing a complex business organization. She also has financial and accounting expertise, with a background as a consulting manager at Arthur Andersen LLP and its successor firm. Ms. Kimura also has board experience, including her service on various corporate and non-profit boards, and is knowledgeable about Hawaii and A&B’s operating markets through her involvement in the Hawaii business community and local community organizations.

| | | | | |

| Diana M. Laing Age: 70

Director Since: 2019 |

•Interim Chief Financial Officer of A&B from November 2018 through May 2019 and Interim Executive Vice President of A&B from October 2018 through May 2019

•Chief Financial Officer of American Homes 4 Rent (NYSE:AMH) from May 2014 through June 2018

•Chief Financial Officer of Thomas Properties Group, Inc. from May 2004 through December 2013

•Director of CareTrust REIT, Inc. (Nasdaq:CTRE) since January 2019

•Director of Host Hotels (Nasdaq:HST) since October 2022

•Director of The Macerich Company (NYSE:MAC) from October 2003 through December 2022 and since July 2024

•Director of Spirit Realty Capital, Inc. (NYSE:SRC) from August 2018 through January 2024

Director Qualifications: As former Chief Financial Officer of American Homes 4 Rent, a REIT focused on the acquisition, renovation, leasing and operation of single-family homes as rental properties, as well as the former Chief Financial Officer of a number of other publicly-traded REITs, Ms. Laing contributes in-depth REIT experience, as well as experience in finance, accounting and managing a complex business organization. She has been designated by the Board of Directors as an Audit Committee Financial Expert. She also has board experience, including her service on the boards of other publicly traded companies.

| | | | | |

| John T. Leong Age: 47

Director Since: 2020 |

•Co-Founder and Chief Executive Officer of Kupu (a non-profit entity focused on conservation and youth education) since January 2007

•Co-Founder and Chief Executive Officer of Pono Pacific Land Management, LLC (“Pono Pacific”) since August 2000

Director Qualifications: As Co-Founder and Chief Executive Officer of both Kupu and Pono Pacific, Mr. Leong brings to the Board experience in non-profit, environmental and community matters. In addition, he has commercial real estate experience and expertise through his family’s real estate holdings. Mr. Leong also has board experience, including his service on various corporate and non-profit boards, and is knowledgeable about Hawaii and A&B’s operating markets through his involvement in the Hawaii business community and local community organizations.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

6

| | | | | |

| Lance K. Parker Age: 51

Director Since: 2023 |

•Chief Executive Officer and Director of A&B since July 2023

•President of A&B since January 2023

•Chief Operating Officer of A&B from November 2021 through June 2023

•President of A & B Properties Hawaii, LLC ("ABP") since September 2015

•Executive Vice President of A&B from March 2018 through December 2022

•Chief Real Estate Officer of A&B, October 2017 through October 2021

•Senior Vice President of ABP from June 2013 through August 2015

Director Qualifications: As a member of A&B’s senior management team for over a decade, Mr. Parker, who is the President and Chief Executive Officer of A&B, brings to the Board an in-depth knowledge of all aspects of the Company’s real estate operations, including commercial real estate and real estate development. He is knowledgeable about Hawaii and A&B’s operating markets through his involvement in the Hawaii business community and local community organizations.

| | | | | |

| Douglas M. Pasquale Age: 70

Director Since: 2012

Lead Independent Director since 2018 |

•Founder and Chief Executive Officer of Capstone Enterprises Corporation (investment and consulting firm) since January 2012

•Interim Chief Executive Officer of Sunstone Hotel Investors, Inc. (NYSE:SHO) (“Sunstone”) from September 2021 to March 2022; Executive Chairman of the Board of Sunstone from March 2022 through September 2022; director of Sunstone since November 2011

•Senior Advisor to HCP, Inc. (healthcare REIT) from June 2017 through December 2019

•Director of Ventas, Inc. (NYSE:VTR) (“Ventas”) (healthcare REIT) from July 2011 through May 2017

•Senior Advisor to the Chief Executive Officer of Ventas from July 2011 through December 2011, upon Ventas’s acquisition of Nationwide Health Properties, Inc. (formerly NYSE:NHP) (“NHP”) in July 2011

•Chairman of the Board, President and Chief Executive Officer of NHP (healthcare REIT) from May 2009 to July 2011; President and Chief Executive Officer of NHP from April 2004 to July 2011; Executive Vice President and Chief Operating Officer of NHP from November 2003 to April 2004

•Director of NHP from November 2003 through July 2011

•Director of Terreno Realty Corporation (NYSE:TRNO) since February 2010

•Director of Dine Brands Global, Inc. (NYSE:DIN) since March 2013

Director Qualifications: As Chief Executive Officer of Capstone Enterprises and as former President, Chief Executive Officer and Chairman of the Board of Nationwide Health Properties, Inc., Mr. Pasquale contributes in-depth REIT experience, as well as experience in finance, accounting and managing a complex business organization. This experience has provided Mr. Pasquale with financial expertise, and he has been designated by the Board of Directors as an Audit Committee Financial Expert. He also has board experience, including his service on the boards of other publicly traded companies.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

7

| | | | | |

| Eric K. Yeaman Age: 57

Director Since: 2012

Chairman of the Board since October 2020 |

•Founder and Managing Partner, Hoku Capital LLC (strategic advisory services) since August 2019

•President and Chief Operating Officer of First Hawaiian, Inc. (Nasdaq:FHB) from August 2016 through August 2019

•President, Chief Operating Officer and Director of First Hawaiian Bank from June 2015 through August 2019

•President and Chief Executive Officer of Hawaiian Telcom Holdco, Inc. (Nasdaq:HCOM) (“Hawaiian Telcom”) (telecommunications) from June 2008 to June 2015

•Director of Hawaiian Telcom from June 2008 to July 2018

•Chief Operating Officer of HECO from January 2008 through June 2008

•Financial Vice President, Treasurer and Chief Financial Officer of HEI (NYSE:HE) from January 2003 through January 2008

•Chief Operating Officer and Chief Financial Officer of The Kamehameha Schools from 2000 to January 2003

•Director of Alaska Air Group, Inc., (NYSE:ALK) since November 2012

•Director of Par Pacific Holdings, Inc. (NYSE:PARR) since April 2024

Director Qualifications: As former President and Chief Operating Officer of FHB and former Chief Executive Officer of Hawaiian Telecom, the state’s leading integrated communications company, Mr. Yeaman brings to the Board experience in managing complex business organizations. He also has financial and accounting expertise and has been designated by the Board of Directors as an Audit Committee Financial Expert. Mr. Yeaman has board experience, including his service on the boards of other publicly traded companies. He is knowledgeable about Hawaii and A&B’s operating markets through his involvement in the Hawaii business community and local community organizations.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

8

BOARD OF DIRECTORS INFORMATION

Corporate Governance Profile. Sound principles of corporate governance are a priority for A&B’s Board of Directors. Governance highlights include:

•All directors, other than the CEO, are independent.

•Independent leadership, consisting of an independent, non-executive chair, a lead independent director and a chief executive officer

•Multiple skill sets represented on the board, as reflected in the skills matrix in the Director Nominees and Qualifications of Directors section of this Proxy Statement

•Annual election of directors

•A majority voting standard in uncontested director elections

•Shareholders can amend the bylaws with a majority vote

•Shareholders can call special meetings with a 10% vote

•No poison pill

•Meaningful director share ownership guidelines

•Annual board evaluations

•An Audit Committee composed of a majority of Audit Committee Financial Experts

•Mandatory retirement age of 75

•Average tenure of less than seven years

•Robust shareholder engagement program

•As nominated for the 2025 Annual Meeting, the Board will be 33% women and 66% people of color

Shareholder Engagement. A&B values the views of its shareholders. During the past year, members of our management team met or offered to meet with shareholders who cumulatively owned approximately 70 percent of our stock to discuss our operations, corporate governance, environmental and social initiatives, and executive compensation, and to solicit feedback on these and a variety of other topics. Shareholder perspectives are shared with the Board.

Director Independence. The Board has reviewed each of its current directors and nominees and has determined that Ms. Kimura, Ms. Laing, Mr. Leong, Mr. Lewis (who is not standing for re-election), Mr. Pasquale and Mr. Yeaman are independent under New York Stock Exchange (“NYSE”) rules.

Board Leadership Structure. The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. It understands that there is no single approach to providing Board leadership and that the right Board leadership structure may vary as circumstances warrant.

The Board currently has a separate non-executive Chairman, a CEO and a Lead Independent Director. At this time, the Board believes that a separate Chairman is beneficial in providing oversight and leadership in handling board responsibilities. This also allows our CEO to focus on Company strategy and business operations. The Lead Independent Director’s duties include consulting with the Chairman of the Board on agendas and meeting schedules, facilitating the process for the Board’s self-evaluation, presiding at Board meetings in the absence of the Chairman or over matters on which the Chairman may be conflicted, including executive sessions of the Board in the event the Chairman is a management director, and consulting with the Chairman on key issues related to the Company.

Mr. Yeaman serves as A&B's independent, non-executive Chairman of the Board, offering his extensive executive experience, knowledge of the Hawaii community, contributions on A&B’s Audit and Compensation Committees, board tenure, leadership abilities and integrity in that role. Mr. Pasquale, who has significant REIT experience, serves in the role of Lead Independent Director, where he works closely with our Chairman and our CEO. The Board has determined that its leadership structure is appropriate for A&B at this time and enables Messrs. Yeaman, Pasquale and Parker to bring complementary skills and areas of expertise, while also creating an independent and effective Board.

The Board’s Role in Strategy and Risk Oversight. The Board oversees the strategic direction of the Company. It has provided leadership on critical strategic issues, including focusing and growing the commercial real estate portfolio in Hawaii and the simplification of the Company’s business model. It receives regular strategic presentations from management and reviews and evaluates the Company’s strategic and operating plans, as appropriate.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

9

The Board also has oversight of the risk management process, which it administers in part through the Audit Committee. One of the Audit Committee’s responsibilities involves discussing policies regarding risk assessment and risk management. Risk oversight plays a role in all major Board decisions and the evaluation of risk is a key part of the decision-making process. For example, the identification of risks and the development of sensitivity analyses are key requirements for capital requests that are presented to, and evaluated by, the Board.

This risk management process occurs throughout all levels of the organization, but is also facilitated through a formal process in which the Company identifies significant risks through regular discussions with all levels of management. Risk management is reflected in the Company’s compliance, auditing and risk management functions, and its risk-based approach to strategic and operating decision-making. Management reviews its risk management activities with the Audit Committee and the full Board of Directors on a regular basis. In addition, risk management perspectives from each of A&B’s business segments are included in the Company’s operating and strategic plans.

Cybersecurity and information security risks are among the risks discussed with the Audit Committee quarterly and reported to the full Board annually. Mandatory cybersecurity training is required annually for employees, and annual assessments of employee security awareness are performed. Cybersecurity reviews by a national security firm are conducted and insurance exists to cover information security risks.

The Board also provides oversight of sustainability-related risks, which are described in the Corporate Responsibility and Sustainability section of this Proxy Statement.

The Board believes that its current leadership structure is conducive to the risk oversight process.

Pay Risk Assessment. The Compensation Committee reviews compensation policies, plans and structure for the Company’s executive group, to ascertain whether any of the compensation programs and practices create excessive risks or motivate risky behaviors that are reasonably likely to have a material adverse effect on the Company. Management has worked with the Compensation Committee to review the NEOs’ incentive plans and related policies and practices, and the overall structure and positioning of total pay, pay mix, the risk management process and related internal controls.

Based on its formal review process, the Compensation Committee concluded that there continues to be no material adverse effects due to pay risk. Management and the Compensation Committee concluded that A&B’s NEO compensation programs represent an appropriate balance of fixed and variable pay, cash and equity, short-term and long-term compensation, financial and non-financial performance, and an appropriate level of enterprise-wide risk oversight. The Company periodically reviews the compensation policies, plans and structure for the Company’s employees and, based on such review, our compensation programs do not create risks that are reasonably likely to have a material adverse effect on the Company.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

10

| | |

Strong Compensation Risk Management •Robust stock ownership guidelines •Multi-year vesting periods of equity awards •Capped incentive payments •Use of multiple performance metrics across incentives •Pay philosophy for all elements of pay targeted at the 50th percentile •Reasonable payout tied to company and individual performance (e.g., incentive award opportunity of 50% at threshold, 100% at target, and 150% or 200% at maximum*, with linear interpolation between each goal) •30% to 50%** of NEOs’ equity awards granted are performance-based, using multiple performance metrics (i.e., relative total shareholder return (“TSR”) and net debt to trailing 12 months consolidated adjusted EBITDA) •Review of goal-setting by the Compensation Committee to ensure that goals are appropriate •Mix of pay that is consistent with competitive practices for organizations similar in size and complexity •Insider trading and hedging prohibitions •Review realizable pay for performance analysis to determine pay design alignment with shareholders •A compensation clawback policy •Oversight by a Compensation Committee composed of independent directors * Mr. Parker, Mr. Chun, Ms. Ching and Mr. Pauker: 200% maximum incentive award; Mr. Kanehira and Mr. Morita: 150% maximum incentive award ** Mr. Parker, Mr. Chun, Ms. Ching and Mr. Pauker: 50% performance-based; Mr. Kanehira and Mr. Morita: 30% performance-based |

Board of Directors and Committees of the Board. The Board of Directors held seven meetings during 2024. At all regularly scheduled meetings, the independent directors of A&B met in executive sessions, led by the Chairman of the Board. In 2024, all directors attended at least 75%, and five of six nominated directors attended 100%, of the meetings of the A&B Board of Directors and Committees of the Board on which they serve. The Board of Directors has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which is governed by a charter, which is available on the corporate governance page of A&B’s website, www.alexanderbaldwin.com. The information on or accessible through any website referenced herein is not incorporated into, and does not form a part of this Proxy Statement.

| | | | | | | | | | | |

| Name | Audit

Committee | Compensation

Committee | Nominating and Corporate

Governance Committee |

| Shelee M. T. Kimura | | Member | |

| Diana M. Laing | Member | Chair | Member |

| John T. Leong | Member | | |

| Thomas A. Lewis, Jr. | | Member | |

| Lance K. Parker | | | |

| Douglas M. Pasquale | Chair | | Member |

| Eric K. Yeaman | Member | | Chair |

Audit Committee: The current members of the Audit Committee are:

•Mr. Pasquale, Chair

•Ms. Laing

•Mr. Leong

•Mr. Yeaman

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

11

The Board has determined that each member is independent under the applicable NYSE listing standards and SEC rules. In addition, the Board has determined that Mr. Pasquale, Mr. Yeaman and Ms. Laing are “audit committee financial experts” under SEC rules. The duties and responsibilities of the Audit Committee are set forth in a written charter adopted by the Board of Directors and are summarized in the Audit Committee Report, which appears in this Proxy Statement. The Audit Committee met four times during 2024.

Compensation Committee: The current members of the Compensation Committee are:

•Ms. Laing, Chair

•Ms. Kimura

•Mr. Lewis

The Board has determined that each member is independent under the applicable NYSE listing standards. The Compensation Committee has general responsibility for management and other salaried employee compensation and benefits, including incentive compensation and stock incentive plans, and for making recommendations to the Board on director compensation. The Compensation Committee may form subcommittees and delegate such authority as the Committee deems appropriate, subject to any restrictions by law or listing standard. For further information on the processes and procedures for consideration of executive compensation, see the “Compensation Discussion and Analysis” section below. The Compensation Committee met four times during 2024.

Nominating and Corporate Governance Committee: The current members of the Nominating and Corporate Governance Committee (the “Nominating Committee”) are:

•Mr. Yeaman, Chair

•Ms. Laing

•Mr. Pasquale

The Board has determined that each member is independent under the applicable NYSE listing standards. The functions of the Nominating Committee include recommending to the Board individuals qualified to serve as directors; recommending to the Board the size and composition of committees of the Board and monitoring the functioning of the committees; advising on Board composition and procedures; reviewing corporate governance issues; overseeing the annual evaluation of the Board; and ensuring that an evaluation of management is occurring. The Nominating Committee met four times during 2024.

Nominating Committee Processes. The Nominating Committee is responsible for recommending to the Board individuals qualified to serve as directors of the Company. The Nominating Committee believes that the minimum qualifications for serving as a director are high ethical standards, a commitment to shareholders, a genuine interest in A&B and a willingness and ability to devote adequate time to a director’s duties. The Nominating Committee also may consider other factors it deems to be in the best interests of A&B and its shareholders, such as business experience, financial expertise and knowledge and involvement in Hawaii communities and businesses.

Board Qualities: The Board believes that the Company benefits from having directors with a wide range of viewpoints, backgrounds and experiences. The Nominating Committee considers diversity with respect to knowledge, skills, tenure, professional experience, education and expertise, and representation in industries and geographies relevant to the Company as important factors in its evaluation of candidates. Hawaii, where we have been headquartered for over 150 years, has a unique culture. The Board is aware of the range of cultural influences of our workforce, community, tenants and stakeholders as it evaluates its composition.

The Nominating Committee identifies potential nominees through various methods, including engaging, when appropriate, firms that specialize in identifying director candidates and by asking current directors to notify the Nominating Committee of qualified persons who might be available to serve on the Board.

The Nominating Committee will consider director candidates recommended by shareholders. In considering such candidates, the Nominating Committee will take into consideration the needs of the Board and the qualifications of the candidate. To have a candidate considered by the Nominating Committee, a shareholder must submit a written recommendation that includes the name of the shareholder, evidence of the shareholder’s ownership of A&B stock (including the number of shares owned and the length of time of ownership), the name of the candidate, the candidate’s qualifications to be a director and the candidate’s consent for such consideration.

The shareholder recommendation and information described above must be sent to the Corporate Secretary at 822 Bishop Street, Honolulu, Hawaii, 96813 and must be received not less than 120 days before the anniversary of the

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

12

date on which A&B’s Proxy Statement was released to shareholders in connection with the previous year’s annual meeting.

Once a potential candidate has been identified by the Nominating Committee, the Nominating Committee reviews information regarding the person to determine whether the person should be considered further. If appropriate, the Nominating Committee may request information from the candidate, review the person’s accomplishments, qualifications and references, and conduct interviews with the candidate. The Nominating Committee’s evaluation process does not vary based on whether a candidate is recommended by a shareholder.

Board Composition. The Board is focused on ensuring an optimal board structure and composition to effectively oversee the Company.

Board and Committee Self-Evaluation Process. The Board of Directors conducts annual board and committee evaluations to assess its performance and effectiveness. As part of this process, each board member responds to a questionnaire that includes areas for comments. Responses are discussed and both board and committee performance are evaluated at a subsequent Board meeting. In addition, the Chairman of the Board, who also heads the Nominating Committee, reaches out individually to each director nominee to provide an opportunity for a candid discussion of performance, board governance and other matters.

Board Refreshment. The Board is constantly evaluating its composition and recognizes the value of having a board with directors of varied tenures. While all our directors bring extensive experience from outside of the Company, longer tenured directors also provide a deep understanding of the Company's operations and strategy, and the ability to mentor newer directors; newer directors can provide fresh perspectives and challenge long-held assumptions. The average tenure of our six directors nominated for reelection is less than seven years, and half of the six nominated directors joined the board in the past five years.

Other Public Company Directorships. The Board recognizes the time commitments attendant to Board membership and expects that directors be fully committed to devoting the time necessary to fulfill their Board responsibilities. Under A&B’s Corporate Governance Guidelines, directors may sit on no more than four public company boards (including A&B’s). The Nominating and Corporate Governance Committee conducts an annual review of director commitment levels in connection with its recommendation of directors for election to the Board at the annual meeting of stockholders, with consideration given to public company leadership roles and outside commitments. It also will consider the number of other public company boards and other boards (or comparable governing bodies) on which a prospective nominee is a member. The Committee has reviewed the 2025 director nominees and affirms that all directors are compliant at this time.

Corporate Governance Guidelines. The Board of Directors has adopted Corporate Governance Guidelines to assist the Board in the exercise of its responsibilities and to promote the more effective functioning of the Board and its committees. The guidelines provide details on matters such as:

| | |

Select Corporate Governance Guideline Topics •Goals and responsibilities of the Board •Selection of directors, including the Chairman of the Board •Board membership criteria, director retirement age and limits on board seats •Stock ownership guidelines •Director independence, and executive sessions of non-management directors •Board self-evaluation •Board compensation •Board access to management and outside advisors •Board orientation and continuing education •Leadership development, including annual evaluations of the CEO and management succession plans |

The full text of the A&B Corporate Governance Guidelines is available on the corporate governance page of A&B’s corporate website, www.alexanderbaldwin.com.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

13

Code of Ethics. A&B has adopted a Code of Ethics (the “Code”) that applies to the CEO, Chief Financial Officer and Controller. A copy of the Code is posted on the corporate governance page of A&B’s corporate website, www.alexanderbaldwin.com. A&B intends to disclose any changes in or waivers from its Code by posting such information on its website.

Code of Conduct. A&B has adopted a Code of Conduct, which is applicable to all directors, officers and employees, and is posted on the corporate governance page of A&B’s corporate website, www.alexanderbaldwin.com.

Insider Trading Policy. A&B has adopted an Insider Trading Policy that applies to members of the Board, our officers and all other employees, which we believe is reasonably designed to promote compliance with applicable insider trading laws, rules and regulations and listing standards.

Culture. A&B’s Partners for Hawai‘i motto serves as the foundation for its culture, guiding our business and relationships with all stakeholders. We are committed to fostering a culture of integrity, respect, and collaboration while driving sustainable growth. Our vision, mission and values statements guide our daily actions:

Our Vision: As Hawaii’s premier commercial real estate company, we will own and operate a superior portfolio of properties that enhances the lives of Hawaii’s people, enables our tenants to thrive and creates value for our shareholders.

Our Mission: Utilize A&B’s extensive assets, expertise, long history and deep relationships to benefit Hawaii and all our stakeholders. Develop, acquire and manage commercial real estate in a way that fulfills the everyday needs of Hawaii’s residents and promotes the sustainability of our communities. Support our employees in their quest to further their careers, provide for their families, enjoy their work and give back to the community.

Our Values:

| | | | | |

Integrity | Be guided in all actions by strong moral principles, in keeping with A&B’s legacy of honesty and fairness. |

Respect | Value and respect the unique qualities, perspectives and contributions of each employee and seek to understand the priorities of community members. |

Adaptability | Embrace innovation and seek better approaches. |

Collaboration | Share information and ideas and work together to find the best solutions. |

Decisiveness | Make clear and timely decisions and communicate them widely. |

Accountability | Hold ourselves accountable for delivering results and recognizing achievement. |

Corporate Responsibility. Corporate responsibility is essential to A&B’s success. Our corporate responsibility strategy is centered on doing what is right for all stakeholders while driving business performance that creates shared value. By prioritizing sustainability initiatives, we align our operations with our mission and values to contribute to a sustainable future.

Governance and Sustainability Oversight. Our leadership team and Board of Directors are deeply committed to sustainability. Sustainability considerations are integrated into our strategic planning, risk management, and business operations. The Board of Directors provides oversight and receives regular reports on sustainability topics, including human capital management and climate risk, at both its Nominating and Corporate Governance Committee meetings and Board meetings.

We actively engage with investors on sustainability and other matters. In the past year, we met with or offered to meet with governance teams from investors representing approximately 70% of A&B's stock, including some of our largest investors. This outreach underscores our commitment to transparency and shareholder engagement.

Climate Change: A&B is committed to mitigating climate risk and improving environmental sustainability across our portfolio. We align our disclosures with industry-leading frameworks such as the Task Force on Climate-Related Financial Disclosures (“TCFD”) and the Sustainability Accounting Standards Board (“SASB”). As the TCFD disbanded in late 2023, we are evaluating ISSB-aligned disclosures under IFRS S1 and IFRS S2.

In 2024, we issued our fifth annual Corporate Responsibility Report, expanding on our disclosures and providing insights into climate change governance, risk management, and sustainability performance. Key environmental metrics include:

•Greenhouse Gas Emissions (Scopes 1, 2 and 3)

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

14

•Energy and Water Usage

•Renewable Energy Production

Environmental Reduction Targets. We have established environmental reduction targets by 2025 for our commercial real estate portfolio, using a 2017 baseline for properties owned and operated in both years. The data reflects whole-building usage, including tenant consumption, which will vary due to occupancy and type of operations. The following data provides progress for those targets:

•GHG Emissions: 35% reduction of GHG Scope 2 emissions by 2025.

◦Status (2023 year-end): 28% reduction — on track to meet goal

•Energy Usage: 15% reduction of whole building energy consumption by 2025.

◦Status (2023 year-end): 16% reduction — met goal

•Water Usage: 15% reduction of whole building water consumption by 2025.

◦Status (2023 year-end): 5% reduction — currently not on track to meet goal. (Due to variability of tenant uses and operations. We continue tenant outreach and common area water reduction initiatives; however, achieving a significant decrease in whole building water consumption remains challenging given the landlord’s limited control over tenant water usage.)

We remain committed to reducing our environmental impact while balancing the evolving needs of tenants and their operations, and the growth of our portfolio.

Renewable Energy and Clean Energy Initiatives. Clean energy is a key component in combating climate change. A&B has been a renewable energy producer since 1906 with the operation of its first hydroelectric facility. As of December 31, 2024, we have installed four photovoltaic (PV) systems totaling 1.83 megawatts (MW) across our O‘ahu properties, including:

•Pearl Highlands Center (2022): 1.3 MW system

•Kakaako Commerce Center (2023): 0.5 MW system

•Wai‘anae Mall and 151 Hekili Street Building in Kailua Town (2024): 0.3 MW systems

In addition, four properties are in various stages of development, reinforcing our commitment to expanding rooftop solar across our portfolio.

Environmental and Social Councils: A&B's Environmental and Social Councils play a vital role in advancing our sustainability and social responsibility efforts. These cross-functional teams drive efforts to reduce our environmental impact, foster workplace inclusion and well-being, and strengthen connections with the communities where we operate.

Inclusion and Belonging: We are committed to building an inclusive workplace where all employees feel valued and empowered. Additional information regarding our workforce is included in our Corporate Responsibility Report.

Employee Engagement and Development

•Conducted our eighth annual employee survey, receiving a 91% favorable rating for employee engagement.

•Hosted our second annual employee Collaboration & Learning Day, fostering professional development and corporate culture.

•Promoted employee learning and development opportunities with live and online training programs, professional development stipends and tuition reimbursement for the pursuit of higher education degrees.

•Provided a health and wellness program in which approximately 60% of employees participated. Maintained a 0.0 recordable incident rate ("RIR") during the year, which is significantly lower than the U.S. Bureau of Labor Statistics’ 1.7 RIR for our industry.

Key Sustainability Achievements

•Continued our environmentally responsible development with the renovation of Manoa Marketplace, incorporating energy efficient lighting, sustainable materials, cool roofs, efficient air conditioning systems, a rideshare parking area and an open, family-friendly concept.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

15

•Completed 36 lighting retrofit projects since 2017, with six additional projects planned for 2025. These upgrades benefit lighting fixtures in common areas, occupied spaces, exteriors, and parking lots, resulting in substantial energy and maintenance savings.

•Reduced over 1,000 KWH of energy in 2023 at various properties in our portfolio, with a ten-year program targeting a 10,000-metric-ton of carbon reduction.

•Conducted portfolio-wide common area lighting reviews, identifying LED lighting retrofit opportunities and offering free energy audits to tenants.

•Strengthened board governance, conducting meaningful director evaluations and enhancing director skills disclosures.

A&B remains committed to responsible corporate citizenship, balancing sustainable growth with environmental stewardship and social impact.

For more information, visit our corporate responsibility report at www.alexanderbaldwin.com/commitment/sustainability/.

Compensation of Directors. The Compensation Committee periodically reviews the compensation of A&B’s non-employee directors with the assistance of its independent compensation consultant, WTW. The compensation levels and components were reviewed in July 2023 along with the annual review of the Company’s share-ownership guidelines. The share-ownership guidelines were deemed to be well aligned with market competitive practices and remain unchanged in 2024. With regard to director compensation, certain compensation levels were considered to be below market levels and, at the recommendation of WTW, were revised effective January 2024.

The following table summarizes the compensation earned by or paid to our directors (other than Mr. Parker, A&B's CEO, whose compensation is included in the Summary Compensation Table and who received no compensation for serving on the Board) for services as a member of our Board of Directors for the period from January 1, 2024 through December 31, 2024.

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

16

2024 DIRECTOR COMPENSATION

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Fees

Earned

or Paid

in Cash

($) | Stock

Awards

($)(1) | Option

Awards

($)(2) | Non-Equity

Incentive

Plan

Compen-

sation

($) | Change in

Pension

Value and

Nonqualified

Deferred

Compen-

sation

Earnings

($) | All Other

Compen-

sation

($) | | Total

($) |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | | (h) |

Shelee M. T. Kimura | 70,000 | | 110,009 | | N/A | N/A | N/A | 0 | | 180,009 | |

| Diana M. Laing | 100,000 | | 110,009 | | N/A | N/A | N/A | 0 | | 210,009 | |

| John T. Leong | 72,500 | | 110,009 | | N/A | N/A | N/A | 0 | | 182,509 | |

| Thomas A. Lewis, Jr. | 70,000 | | 110,009 | | N/A | N/A | N/A | 0 | | 180,009 | |

Douglas M. Pasquale (4) | 119,000 | | 110,009 | | N/A | N/A | N/A | 2,000 | (3) | 231,009 | |

Eric K. Yeaman (5) | 127,500 | | 160,001 | | N/A | N/A | N/A | 0 | | 287,501 | |

(1)Represents the aggregate grant-date fair value of the annual automatic grant of Restricted Stock Unit (“RSU”) awards made in 2024. For a discussion of the assumptions underlying the valuation of equity awards, see Note 14 of the Company’s consolidated financial statements, included in the Company’s 2024 Annual Report on Form 10-K. At the end of 2024, Ms. Kimura, Ms. Laing, Mr. Leong and Mr. Pasquale each held 6,749 RSUs, Mr. Lewis held 10,749 RSUs and Mr. Yeaman held 9,816 RSUs.

(2)No director holds any outstanding stock options and no stock options have been granted to directors by A&B or by A&B Predecessor since 2007.

(3)Represents charitable contributions under the matching gifts program described in the Matching Gift Program section below.

(4)Includes compensation paid to Mr. Pasquale for his service as Lead Independent Director.

(5)Includes compensation paid to Mr. Yeaman for his service as non-executive Chairman of the Board.

Our Board of Directors approved the following non-employee director compensation schedule of annual fees, which was developed with the assistance of WTW.

| | | | | | | | | | | |

Pay Elements | | | Amount |

| Board Cash Retainer | | | $60,000 |

Chairman of the Board

Cash Retainer | | | $100,000 |

Lead Director Cash Retainer | | | $85,000 |

| Committee Member Cash Retainers (in addition to Board Cash Retainer) | •Audit | | $12,500 |

•Compensation | | $10,000 |

•Nominating and Corporate Governance | | $7,500 |

Committee Chair Cash

Retainers (in addition to

Committee Member Cash Retainer) | •Audit | | $14,000 |

•Compensation | | $10,000 |

•Nominating and Corporate Governance | | $7,500 |

| Equity Award | | | $110,000 |

Chairman of the Board

Equity Award | | | $160,000 |

ALEXANDER & BALDWIN, INC. ▪ 2025 PROXY STATEMENT

17

Directors are provided an additional per meeting fee of $750 if the number of board or committee meetings they attend exceeds an annual predefined number, which is currently set at:

•Board – 7 meetings

•Audit – 6 meetings

•Compensation – 5 meetings

•Nominating and Corporate Governance – 4 meetings

Under the terms of A&B's 2022 Omnibus Incentive Plan (our "2022 Plan"), an annual grant of RSUs is made to each director at each Annual Meeting of Shareholders. A prorated grant is made upon appointment as a director at any time between Annual Meetings. Awards vest in their entirety on the earlier of their one-year grant date anniversary or immediately prior to the first regular annual meeting of stockholders that occurs in the year following the year of the award date. Accelerated vesting occurs upon cessation of service by reason of death, permanent disability or retirement during the vesting period. Directors who are management employees of A&B or its subsidiaries do not receive compensation for serving as directors.

Director Business Travel Accident Coverage. Non-employee directors have coverage of $250,000 for themselves and $50,000 for their accompanying spouse while traveling on A&B business.

Matching Gift Program. Directors may participate in A&B’s matching gifts program for employees, in which A&B matches contributions to any non-profit organization serving Hawaii communities or any educational institution in the United States up to an aggregate maximum of $2,000 annually.

Director Share Ownership Guidelines. The Board has adopted guidelines that encourage each non-employee director to own A&B common stock (including RSUs) with a value of $300,000 for a Board member and $500,000 for the Chairman of the Board, which is five times the current annual board retainer of $60,000 and $100,000 for the Chairman, within five years of becoming a director. All current directors have met or are on track to meet the established guidelines within the required timeframe.

Communications with Directors. Shareholders and other interested parties may contact any of the directors by mailing correspondence “c/o A&B Law Department” to A&B’s headquarters at 822 Bishop Street, Honolulu, Hawaii 96813. The Law Department will forward such correspondence to the appropriate director(s). However, the Law Department reserves the right not to forward any offensive or otherwise inappropriate materials.

In addition, A&B’s directors are encouraged to attend the Annual Meeting of Shareholders. All of our directors attended our 2024 Annual Meeting.

SHAREHOLDERS SECURITY OWNERSHIP