false

0001411579

0001411579

2024-07-24

2024-07-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 24, 2024

AMC

ENTERTAINMENT HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-33892 |

|

26-0303916 |

| (State

or Other Jurisdiction of |

|

(Commission

File Number) |

|

(I.R.S. Employer Identification |

| Incorporation) |

|

|

|

Number) |

One AMC Way

11500 Ash Street, Leawood, KS 66211

(Address of Principal Executive Offices, including

Zip Code)

(913)

213-2000

(Registrant’s Telephone Number, including

Area Code)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Class A common stock |

|

AMC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On July 24, 2024, AMC

Entertainment Holdings, Inc. (the “Company”) issued a press release announcing select preliminary estimated financial

results for the quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report

on Form 8-K.

The information furnished pursuant to Item 2.02

of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be deemed to

be incorporated by reference into any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934,

as amended, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except

to the extent expressly set forth by specific reference in such a filing.

The select preliminary estimated

financial results for the quarter and six months ended June 30, 2024 and corresponding Non-GAAP Reconciliations contained in the

press release furnished as Exhibit 99.1 to this Current Report on Form 8-K are incorporated herein by reference.

The preliminary estimated

financial information contained in this Current Report on Form 8-K reflects management’s estimates based solely upon information

available to it as of the date of this Current Report on Form 8-K and is not a comprehensive statement of our financial results for

the quarter or six months ended June 30, 2024. The preliminary estimated financial results described above constitute forward-looking

statements. The preliminary estimated financial information incorporated herein is subject to change, and our actual financial results

may differ from such preliminary estimates and such differences could be material. Accordingly, you should not place undue reliance upon

these preliminary estimates.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AMC ENTERTAINMENT HOLDINGS, INC. |

| |

|

| Date: July 24, 2024 |

By: |

/s/ Sean

D. Goodman |

| |

|

Sean D. Goodman |

| |

|

Executive Vice President, International Operations, Chief Financial Officer and Treasurer |

Exhibit 99.1

|

INVESTOR

RELATIONS:

John Merriwether, 866-248-3872

InvestorRelations@amctheatres.com

MEDIA CONTACTS:

Ryan Noonan, (913) 213-2183

rnoonan@amctheatres.com |

FOR IMMEDIATE RELEASE

AMC

ENTERTAINMENT HOLDINGS, INC. PREVIEWS

SECOND

QUARTER 2024 PRELIMINARY RESULTS AND

ANNOUNCES SECOND

QUARTER 2024 EARNINGS WEBCAST

LEAWOOD, KANSAS

– July 24, 2024: AMC Entertainment Holdings, Inc. (NYSE: AMC) (the “Company,” or “AMC”),

today released preliminary results for the second quarter ended June 30, 2024. The preliminary results are unaudited, subject to

completion of the Company’s financial reporting processes, based on information known by management as of the date of this press

release and do not represent a comprehensive statement of our financial results for the quarter ended June 30, 2024. AMC expects:

| · | Total

revenues for the quarter ended June 30, 2024, to be approximately $1,030.6 million compared

to $1,347.9 million for the quarter ended June 30, 2023. |

| · | Net

loss for the quarter ended June 30, 2024, to be approximately $32.8 million, compared

to net earnings of $8.6 million for the quarter ended June 30, 2023. |

| · | Diluted

loss per share for the quarter ended June 30, 2024, to be approximately $(0.10) compared

to diluted earnings per share of $0.06 for the quarter ended June 30, 20231. |

| · | Adjusted

EBITDA to be approximately $29.4 million for the quarter ended June 30, 2024, compared

to Adjusted EBITDA of $182.5 million for the quarter ended June 30, 2023. |

| · | Cash

and cash equivalents at June 30, 2024 to be approximately $770.3 million. |

1

Based on 321.6 million weighted average shares outstanding as of June 30, 2024 and 151.3

million weighted average shares outstanding as of June 30, 2023.

Adjusted EBITDA

is a non-GAAP financial measure and tables reconciling this non-GAAP financial measure to its closest respective GAAP financial measures

are included in this press release.

Adam Aron, Chairman

and CEO of AMC Entertainment, commented, “As we accurately predicted and previously disclosed, the prolonged actors and writers

strikes of 2023 severely reduced the number of movies being released theatrically in the early months of 2024. This explains the weakness

in our preliminary Q2 2024 results, as contrasted with the same quarter of a year ago. “

Aron

importantly added, “But if looking only at the full quarter, the lay observer might easily miss the incredibly good news that

transpired within the second quarter. Finally, moviegoing in theatres appears again to be on an upwards trajectory. AMC enjoyed a

significant increase in our daily revenues in June of 2024 as compared to those of April and May of 2024. Indeed, the

industry box office for June was only 1.4% less than that of April and May combined. This in turn led to a positive

swing in our results for the month of June as compared to April and May. So far, the impressive box office performance has

continued into July. And AMC continues to be confident that industry-wide movie revenues for the second half of 2024, and into 2025

and 2026 will continue to show increasing strength. This in turn suggests that AMC should enjoy increasing Adjusted EBITDA, if as

and when overall industry revenues are climbing. Such improvements in revenues, earnings and Adjusted EBITDA are our current

expectations going forward, all of which shine brightly on AMC’s future. “

AMC will report its full results for

the second quarter ended June 30, 2024, after the market closes on Friday August 2, 2024.

The

Company will host an earnings webcast accessible through the Investor Relations section of AMC’s website at investor.amctheatres.com/.

During the webcast the company will take questions from both AMC Investor Connect members and equity research analysts. AMC investors

can visit www.amctheatres.com/stockholders to sign up for membership in AMC Investor Connect and submit their written questions.

The link to submit questions will be available from July 25, 2024 until August 1, 2024.

Investors

and interested parties should go to the website (investor.amctheatres.com/)

at least 15 minutes before the earnings webcast to register, and/or download and install any necessary audio software.

| ● | Date:

Friday, August 2, 2024 |

| ● | Time:

4:00 PM CDT / 5:00 PM EDT |

An

archive of the webcast will be available on the Company’s website after the webcast for a limited time.

Information

Regarding Preliminary Results

The preliminary estimated financial

information contained in this press release reflects management’s estimates based solely upon information available to it as of

the date of this press release and is not a comprehensive statement of our financial results for the quarter ended June 30, 2024.

The preliminary estimated financial results described above constitute forward-looking statements. The preliminary estimated financial

information presented above is subject to change, and our actual financial results may differ from such preliminary estimates and such

differences could be material. Accordingly, you should not place undue reliance upon these preliminary estimates.

About AMC Entertainment Holdings, Inc.

AMC is the largest

movie exhibition company in the United States, the largest in Europe and the largest throughout the world with approximately 900 theatres

and 10,000 screens across the globe. AMC has propelled innovation in the exhibition industry by: deploying its Signature power-recliner

seats; delivering enhanced food and beverage choices; generating greater guest engagement through its loyalty and subscription programs,

website, and mobile apps; offering premium large format experiences and playing a wide variety of content including the latest Hollywood

releases and independent programming. In addition, in 2023 AMC launched AMC Theatres Distribution with the highly successful releases

of TAYLOR SWIFT | THE ERAS TOUR and RENAISSANCE: A FILM BY BEYONCÉ. AMC Theatres Distribution expects to release more concert

films with the world’s leading musical artists in the years ahead. For more information, visit www.amctheatres.com.

Forward-Looking Statements

This communication includes “forward-looking

statements” within the meaning of the federal securities laws, including the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. In many cases, these forward-looking statements may be identified by the use of words such as “will,”

“may,” “could,” “would,” “should,” “believes,” “expects,” “anticipates,”

“estimates,” “intends,” “indicates,” “projects,” “goals,” “objectives,”

“targets,” “predicts,” “plans,” “seeks,” and variations of these words and similar expressions.

Examples of forward-looking statements include statements we make regarding our expected revenue, net loss, capital expenditure, Adjusted

EBITDA and estimated cash and cash equivalents, as well as the box office outlook for the second, third and fourth quarters. Any forward-looking

statement speaks only as of the date on which it is made. These forward-looking statements may include, among other things, statements

related to AMC’s current expectations regarding the performance of its business, financial results, liquidity and capital resources,

and the impact to its business and financial condition of, and measures being taken in response to, the COVID-19 virus, and are based

on information available at the time the statements are made and/or management’s good faith belief as of that time with respect

to future events, and are subject to risks, trends, uncertainties and other facts that could cause actual performance or results to differ

materially from those expressed in or suggested by the forward-looking statements. These risks, trends, uncertainties and facts include,

but are not limited to: the sufficiency of AMC’s existing cash and cash equivalents and available borrowing capacity; availability

of financing upon favorable terms or at all; AMC’s ability to obtain additional liquidity, which if not realized or insufficient

to generate the material amounts of additional liquidity that will be required unless it is able to achieve more normalized levels of

operating revenues, likely would result with AMC seeking an in-court or out-of-court restructuring of its liabilities; the impact of

the COVID-19 virus on AMC, the motion picture exhibition industry, and the economy in general; increased use of alternative film delivery

methods or other forms of entertainment; the continued recovery of the North American and international box office; AMC’s significant

indebtedness, including its borrowing capacity and its ability to meet its financial maintenance and other covenants and limitations

on AMC's ability to take advantage of certain business opportunities imposed by such covenants; shrinking exclusive theatrical release

windows; the seasonality of AMC’s revenue and working capital; intense competition in the geographic areas in which AMC operates;

risks relating to impairment losses, including with respect to goodwill and other intangibles, and theatre and other closure charges;

motion picture production and performance (including as a result of production delays to the release of movies caused by labor stoppages,

including but not limited to the Writers Guild of America strike and the Screen Actors Guild-American Federation of Television and Radio

Artists strike that occurred during 2023); general and international economic, political, regulatory and other risks, including but not

limited to rising interest rates; AMC’s lack of control over distributors of films; limitations on the availability of capital,

including on the authorized number of common stock; dilution of voting power through the issuance of preferred stock; AMC’s ability

to achieve expected synergies, benefits and performance from its strategic initiatives; AMC’s ability to refinance its indebtedness

on favorable terms; AMC’s ability to optimize its theatre circuit; AMC’s ability to recognize interest deduction carryforwards,

net operating loss carryforwards, and other tax attributes to reduce future tax liability; supply chain disruptions, labor shortages,

increased cost and inflation; and other factors discussed in the reports AMC has filed with the SEC. Should one or more of these risks,

trends, uncertainties, or facts materialize, or should underlying assumptions prove incorrect, actual results may vary materially from

those indicated or anticipated by the forward-looking statements contained herein. Accordingly, we caution you against relying on forward-looking

statements, which speak only as of the date they are made.

Forward-looking statements should not

be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which

such performance or results will be achieved. For a detailed discussion of risks, trends and uncertainties facing AMC, see the section

entitled “Risk Factors” and elsewhere in our most recent annual report on Form 10-K and quarterly report on Form 10-Q,

as well as our other filings with the SEC, copies of which may be obtained by visiting our Investor Relations website at investor.amctheatres.com

or the SEC’s website at www.sec.gov.

AMC does not intend, and undertakes

no duty, to update any information contained herein to reflect future events or circumstances, except as required by applicable law.

Non-GAAP Reconciliations

A reconciliation

of the Company’s net earnings (loss), the closest GAAP measure, to Adjusted EBITDA is presented in the following table:

| | |

Reconciliation of Adjusted EBITDA | |

| | |

Quarter Ended | | |

Six Months Ended | |

| | |

(Preliminary Estimates) | | |

| | |

(Preliminary Estimates) | | |

| |

| (Unaudited, in millions) | |

June 30, 2024 | | |

June 30, 2023 | | |

June 30, 2024 | | |

June 30, 2023 | |

| Net earnings (loss) | |

$ | (32.8 | ) | |

$ | 8.6 | | |

$ | (196.3 | ) | |

$ | (226.9 | ) |

| Plus: | |

| | | |

| | | |

| | | |

| | |

| Income tax provision | |

| 0.7 | | |

| 0.4 | | |

| 2.5 | | |

| 2.3 | |

| Interest expense | |

| 99.0 | | |

| 102.6 | | |

| 200.2 | | |

| 203.7 | |

| Depreciation and amortization | |

| 78.8 | | |

| 96.8 | | |

| 160.4 | | |

| 190.4 | |

| Certain operating expenses (1) | |

| 1.0 | | |

| (0.9 | ) | |

| 1.5 | | |

| 0.2 | |

| Equity in earnings of non-consolidated entities | |

| (1.0 | ) | |

| (0.8 | ) | |

| (4.7 | ) | |

| (2.2 | ) |

| Cash distributions from non-consolidated entities (2) | |

| 1.6 | | |

| 1.7 | | |

| 2.9 | | |

| 1.7 | |

| Attributable EBITDA (3) | |

| (0.7 | ) | |

| (0.3 | ) | |

| (0.1 | ) | |

| 0.2 | |

| Investment expense (income) (4) | |

| (6.1 | ) | |

| 5.1 | | |

| (11.2 | ) | |

| (8.4 | ) |

| Other expense (income) (5) | |

| (105.0 | ) | |

| (30.1 | ) | |

| (143.8 | ) | |

| 12.7 | |

| Other non-cash rent benefit (6) | |

| (10.7 | ) | |

| (9.0 | ) | |

| (22.4 | ) | |

| (18.6 | ) |

| General and administrative expense-unallocated: | |

| | | |

| | | |

| | | |

| | |

| Merger, acquisition and transaction costs (7) | |

| 0.1 | | |

| 0.6 | | |

| — | | |

| 0.8 | |

| Stock-based compensation expense (8) | |

| 4.5 | | |

| 7.8 | | |

| 8.8 | | |

| 33.7 | |

| Adjusted EBITDA | |

$ | 29.4 | | |

$ | 182.5 | | |

$ | (2.2 | ) | |

$ | 189.6 | |

| 1) | Amounts

represent preopening expense related to temporarily closed screens under renovation, theatre

and other closure expense for the permanent closure of screens, including the related accretion

of interest, disposition of assets and other non-operating gains or losses included in operating

expenses. We have excluded these items as they are non-cash in nature or are non-operating

in nature. |

| 2) | Includes

U.S. non-theatre distributions from equity method investments and International non-theatre

distributions from equity method investments to the extent received. We believe including

cash distributions is an appropriate reflection of the contribution of these investments

to our operations. |

| 3) | Attributable

EBITDA includes the EBITDA from equity investments in theatre operators in certain International

markets. See below for a reconciliation of our equity in earnings of non-consolidated entities

to attributable EBITDA. Because these equity investments are in theatre operators in regions

where we hold a significant market share, we believe attributable EBITDA is more indicative

of the performance of these equity investments and management uses this measure to monitor

and evaluate these equity investments. We also provide services to these theatre operators

including information technology systems, certain on-screen advertising services and our

gift card and package ticket program. |

| | |

Quarter Ended | | |

Six Months Ended | |

| | |

(Preliminary Estimates) | | |

| | |

(Preliminary Estimates) | | |

| |

| (Unaudited, in millions) | |

June 30, 2024 | | |

June 30, 2023 | | |

June 30, 2024 | | |

June 30, 2023 | |

| Equity in (earnings) of non-consolidated entities | |

$ | (1.0 | ) | |

$ | (0.8 | ) | |

$ | (4.7 | ) | |

$ | (2.2 | ) |

| Less: | |

| | | |

| | | |

| | | |

| | |

| Equity in (earnings) of non-consolidated entities excluding International theatre joint ventures | |

| (2.1 | ) | |

| (1.5 | ) | |

| (5.6 | ) | |

| (2.6 | ) |

| Equity in (loss) of International theatre joint ventures | |

| (1.1 | ) | |

| (0.7 | ) | |

| (0.9 | ) | |

| (0.4 | ) |

| Income tax benefit | |

| (0.1 | ) | |

| (0.1 | ) | |

| (0.1 | ) | |

| (0.2 | ) |

| Investment expense | |

| — | | |

| — | | |

| 0.1 | | |

| 0.1 | |

| Interest expense | |

| 0.1 | | |

| 0.1 | | |

| 0.1 | | |

| 0.1 | |

| Depreciation and amortization | |

| 0.4 | | |

| 0.4 | | |

| 0.7 | | |

| 0.6 | |

| Attributable EBITDA | |

$ | (0.7 | ) | |

$ | (0.3 | ) | |

$ | (0.1 | ) | |

$ | 0.2 | |

| 4) | Investment

expense (income) during the quarter ended June 30, 2024 includes appreciation in the

estimated fair value of our investment in common shares of Hycroft Mining Holding Corporation

(“Hycroft”) of $(0.4) million, appreciation in estimated fair value of our investment

in warrants to purchase common shares of Hycroft of $(0.3) million and interest income of

$(5.4) million. |

Investment

expense (income) during the six months ended June 30, 2024 includes deterioration in estimated fair value of our investment in common

shares of Hycroft of $0.1 million, deterioration in estimated fair value of our investment in warrants to purchase common shares of Hycroft

of $0.2 million, and interest income of $(11.5) million.

| 5) | Other

expense (income) during the quarter ended June 30, 2024 includes gross shareholder litigation

settlement proceeds of $(19.1) million, foreign currency transaction gains of $(0.6) million

and gains on debt extinguishment of $(85.3) million. |

Other

expense (income) during the six months ended June 30, 2024 includes gross shareholder litigation settlement proceeds of $(19.1)

million, gains on debt extinguishment of $(91.1) million, a vendor dispute settlement of $(36.2) million and foreign currency transaction

losses of $2.6 million.

| 6) | Reflects

amortization of certain intangible assets reclassified from depreciation and amortization

to rent expense, due to the adoption of ASC 842, Leases and deferred rent benefit related

to the impairment of right-of-use operating lease assets. |

| 7) | Merger,

acquisition and other costs are excluded as they are non-operating in nature. |

| 8) | Non-cash

expense included in general and administrative: other. |

###

Source: AMC Entertainment Holdings

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

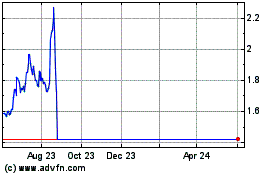

AMC Entertainment Hldg P... (NYSE:APE)

Historical Stock Chart

From Mar 2025 to Apr 2025

AMC Entertainment Hldg P... (NYSE:APE)

Historical Stock Chart

From Apr 2024 to Apr 2025