UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

(Amendment No.__)

Under the Securities Exchange Act of 1934

AMC ENTERTAINMENT HOLDINGS, INC.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

00165C302

(CUSIP Number)

July 22, 2024

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate

the rule pursuant to which this Schedule is filed:

¨

Rule 13d-1(b)

x

Rule 13d-1(c)

¨

Rule 13d-1(d)

*The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act

of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| CUSIP No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick Capital Management, L.P. |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨

|

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

17,605,138 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

17,605,138 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

17,605,138 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

4.6% (2) |

| 12 |

Type of Reporting Person

PN |

| |

|

|

|

|

(1) Includes

17,605,138 shares of common stock (“Common Stock”) of AMC Entertainment Holdings, Inc. (the “Issuer”) issuable

upon conversion of the 6.00%/8.00% Cash/PIK Toggle Senior Secured Exchangeable Notes due 2030 (“Convertible

Notes”) directly held by Mudrick Distressed Opportunity Fund Global, L.P., Mudrick Distressed

Opportunity Drawdown Fund II, L.P., Mudrick CAV Master, LP, Mudrick Distressed Opportunity 2020 Dislocation

Fund, L.P., Mudrick Distressed Opportunity SIF Master Fund, L.P., Mudrick Distressed Opportunity Drawdown Fund II SC, L.P. and certain

accounts managed by Mudrick Capital Management, L.P., in the aggregate.

(2) Based on 378,960,093 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 17,605,138 shares of Common Stock issuable upon conversion of Convertible Notes beneficially owned by the Reporting Persons.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick Capital Management, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

17,605,138 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

17,605,138 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

17,605,138 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

4.6% (2) |

| 12 |

Type of Reporting Person

OO |

| |

|

|

|

|

(1) Includes 17,605,138 shares of Common

Stock of the Issuer issuable upon conversion of Convertible Notes directly held by Mudrick Distressed Opportunity Fund Global, L.P., Mudrick Distressed Opportunity Drawdown Fund II, L.P., Mudrick CAV Master,

LP, Mudrick Distressed Opportunity 2020 Dislocation Fund, L.P., Mudrick Distressed Opportunity SIF Master Fund, L.P., Mudrick Distressed

Opportunity Drawdown Fund II SC, L.P. and certain accounts managed by Mudrick Capital Management, L.P., in the aggregate.

(2) Based on 378,960,093 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 17,605,138 shares of Common Stock issuable upon conversion of Convertible Notes beneficially owned by the Reporting Persons.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Jason Mudrick |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

17,605,138 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

17,605,138 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

17,605,138 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

4.6% (2) |

| 12 |

Type of Reporting Person

IN |

| |

|

|

|

|

(1) Includes 17,605,138 shares of Common

Stock of the Issuer issuable upon conversion of Convertible Notes directly held by Mudrick Distressed Opportunity Fund Global, L.P., Mudrick Distressed Opportunity Drawdown Fund II, L.P., Mudrick CAV Master,

LP, Mudrick Distressed Opportunity 2020 Dislocation Fund, L.P., Mudrick Distressed Opportunity SIF Master Fund, L.P. and Mudrick Distressed

Opportunity Drawdown Fund II SC, L.P. and certain accounts managed by Mudrick Capital Management, L.P., in the aggregate.

(2) Based on 378,960,093 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 17,605,138 shares of Common Stock issuable upon conversion of Convertible Notes beneficially owned by the Reporting Persons.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick Distressed Opportunity Fund Global, L.P. |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

3,320,369 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

3,320,369 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,320,369 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

0.9% (2) |

| 12 |

Type of Reporting Person

PN |

| |

|

|

|

|

(1) Includes 3,320,369 shares of Common Stock

issuable upon conversion of Convertible Notes directly held by Mudrick Distressed Opportunity Fund Global, L.P. (“Global LP”).

Mudrick GP, LLC (“Mudrick GP”) is the general partner of Global LP and may be deemed to beneficially own the number of securities

of the Issuer directly held by Global LP. Mudrick Capital Management, L.P. (“MCM”) is the investment manager to Global LP.

Mudrick Capital Management, LLC (“MCM GP”) is the general partner of MCM. Mr. Mudrick is the sole member of Mudrick GP

and MCM GP. By virtue of these relationships, each of MCM, MCM GP, Mr. Mudrick and Mudrick GP may be deemed to beneficially own the

securities held directly by Global LP.

(2) Based on 364,675,324 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 3,320,369 shares of Common Stock issuable upon conversion of Convertible Notes directly held by Global LP.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick GP, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

3,320,369 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

3,320,369 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

3,320,369 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

0.9% (2) |

| 12 |

Type of Reporting Person

OO |

| |

|

|

|

|

(1) Includes securities directly held by Global LP. Mudrick GP

is the general partner of Global LP and may be deemed to beneficially own the number of securities of the Issuer directly held by Global

LP. MCM is the investment manager to Global LP. MCM GP is the general partner of MCM. Mr. Mudrick is the sole member of Mudrick GP

and MCM GP. By virtue of these relationships, each of MCM, MCM GP, Mr. Mudrick and Mudrick GP may be deemed to beneficially own the

securities held directly by Global LP.

(2) Based on 364,675,324 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 3,320,369 shares of Common Stock issuable upon conversion of Convertible Notes directly held by Global LP.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick Distressed Opportunity Drawdown Fund II, L.P. |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

4,276,840 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

4,276,840 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,276,840 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

1.2% (2) |

| 12 |

Type of Reporting Person

PN |

| |

|

|

|

|

(1) Includes 4,276,840 shares of Common Stock

issuable upon conversion of Convertible Notes directly held by Mudrick Distressed Opportunity Drawdown Fund II, L.P. (“Drawdown

II”). Mudrick Distressed Opportunity Drawdown Fund II GP, LLC (“Drawdown II GP”) is the general partner of Drawdown

II and may be deemed to beneficially own the securities of the Issuer directly held by Drawdown II. MCM is the investment manager to Drawdown

II. MCM GP is the general partner of MCM. Mr. Mudrick is the sole member of Drawdown II GP and MCM GP. By virtue of these relationships,

each of MCM, MCM GP, Mr. Mudrick and Drawdown II GP may be deemed to beneficially own the securities held directly by Drawdown II.

(2) Based on 365,631,795 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 4,276,840 shares of Common Stock issuable upon conversion of Convertible Notes directly held by Drawdown II.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick CAV Master, LP |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Cayman Islands |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

1,284,388(1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

1,284,388 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,284,388(1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

0.4% (2) |

| 12 |

Type of Reporting Person

PN |

|

|

| |

|

|

|

|

(1) Includes

1,284,388 shares of Common Stock issuable upon conversion of Convertible Notes directly held by Mudrick CAV Master, LP.

(“Mudrick CAV”). MCM is the investment manager to Mudrick CAV. MCM GP is the general partner of MCM. Mr. Mudrick is

the sole member of MCM GP. By virtue of these relationships, each of MCM, MCM GP and Mr. Mudrick may be deemed to beneficially

own the securities held directly by Mudrick CAV.

(2) Based on 362,639,343 shares of Common Stock outstanding, which

includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s Prospectus Supplement

filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and (ii) 1,284,388shares

of Common Stock issuable upon conversion of Convertible Notes directly held by Mudrick CAV.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick Distressed Opportunity 2020 Dislocation Fund, L.P. |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

1,033,950 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

1,033,950 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,950 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

0.3% (2) |

| 12 |

Type of Reporting Person

PN |

| |

|

|

|

|

(1) Includes 1,033,950 shares of Common Stock issuable upon conversion

of Convertible Notes directly held by Mudrick Distressed Opportunity 2020 Dislocation Fund, L.P. (“DISL”). Mudrick Distressed

Opportunity 2020 Dislocation Fund GP, LLC (“DISL GP”) is the general partner of DISL and may be deemed to beneficially own

the number of securities of the Issuer held by DISL. MCM is the investment manager to DISL. MCM GP is the general partner of MCM. Mr. Mudrick

is the sole member of MCM GP and DISL GP. By virtue of these relationships, each of MCM, MCM GP, Mr. Mudrick and DISL GP may be deemed

to beneficially own the securities held directly by DISL.

(2) Based on 362,388,905 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 1,033,950 shares of Common Stock issuable upon conversion of Convertible Notes directly held by DISL.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick Distressed Opportunity 2020 Dislocation Fund GP, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

1,033,950 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

1,033,950 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,950 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

0.3% (2) |

| 12 |

Type of Reporting Person

OO |

| |

|

|

|

|

(1) Includes securities directly held by

DISL. DISL GP is the general partner of DISL and may be deemed to beneficially own the number of securities of the Issuer held by DISL.

MCM is the investment manager to DISL. MCM GP is the general partner of MCM. Mr. Mudrick is the sole member of MCM GP and DISL GP.

By virtue of these relationships, each of MCM, MCM GP, Mr. Mudrick and DISL GP may be deemed to beneficially own the securities held

directly by DISL.

(2) Based on 362,388,905 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 1,033,950 shares of Common Stock issuable upon conversion of Convertible Notes directly held by DISL.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick Distressed Opportunity SIF Master Fund, L.P. |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

851,993 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

851,993 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

851,993 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

0.2% (2) |

| 12 |

Type of Reporting Person

PN |

| |

|

|

|

|

(1) Includes 851,993 shares of Common Stock

issuable upon conversion of Convertible Notes directly held by Mudrick Distressed Opportunity SIF Master Fund, L.P. (“SIF”).

Mudrick Distressed Opportunity SIF GP, LLC (“SIF GP”) is the general partner of SIF and may be deemed to beneficially own

the securities of the Issuer directly held by SIF. MCM is the investment manager to SIF. MCM GP is the general partner of MCM. Mr. Mudrick

is the sole member of MCM GP and SIF GP. By virtue of these relationships, each of MCM, MCM GP, Mr. Mudrick and SIF GP may be deemed

to beneficially own the securities held directly by SIF.

(2) Based on 362,206,948 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 851,993 shares of Common Stock issuable upon conversion of Convertible Notes directly held by SIF.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick Distressed Opportunity Drawdown Fund II SC, L.P. |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

United States |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

421,286 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

421,286 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

421,286 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

0.1% (2) |

| 12 |

Type of Reporting Person

PN |

| |

|

|

|

|

(1) Includes 421,286 shares of Common Stock

issuable upon conversion of Convertible Notes directly held by Mudrick Distressed Opportunity Drawdown Fund II SC, L.P. (“Drawdown

II SC”). Drawdown II GP is the general partner of Drawdown II SC and may be deemed to beneficially own the securities of the Issuer

directly held by Drawdown II SC. MCM is the investment manager to Drawdown II SC. MCM GP is the general partner of MCM. Mr. Mudrick

is the sole member of Drawdown II GP and MCM GP. By virtue of these relationships, each of MCM, MCM GP, Mr. Mudrick and Drawdown

II GP may be deemed to beneficially own the securities held directly by Drawdown II SC.

(2) Based on 361,776,241 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 421,286 shares of Common Stock issuable upon conversion of Convertible Notes directly held by Drawdown II SC.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick Distressed Opportunity Drawdown Fund II GP, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

4,698,126 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

4,698,126 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,698,126 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

1.3% (2) |

| 12 |

Type of Reporting Person

OO |

| |

|

|

|

|

(1) Includes securities directly held by

Drawdown II and Drawdown II SC. Drawdown II GP is the general partner of Drawdown II and Drawdown II SC and may be deemed to beneficially

own the securities of the Issuer directly held by Drawdown II and Drawdown II SC. MCM is the investment manager to Drawdown II and Drawdown

II SC. MCM GP is the general partner of MCM. Mr. Mudrick is the sole member of Drawdown II GP and MCM GP. By virtue of these relationships,

each of MCM, MCM GP, Mr. Mudrick and Drawdown II GP may be deemed to beneficially own the securities held directly by Drawdown II

and Drawdown II SC.

(2) Based on 366,053,081, shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 4,698,126 shares of Common Stock issuable upon conversion of Convertible Notes, in each case, directly held collectively by

Drawdown II and Drawdown II SC.

| CUSIP

No. 00165C302 |

Schedule

13G |

| 1 |

Names of Reporting Persons

Mudrick Distressed Opportunity SIF GP, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨ (b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

Delaware |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

851,993 (1) |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

851,993 (1) |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

851,993 (1) |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨ |

| 11 |

Percent of Class Represented by Amount in Row (9)

0.2% (2) |

| 12 |

Type of Reporting Person

OO |

| |

|

|

|

|

(1) Includes securities directly held by

SIF. SIF GP is the general partner of SIF and may be deemed to beneficially own the securities of the Issuer directly held by SIF. MCM

is the investment manager to SIF. MCM GP is the general partner of MCM. Mr. Mudrick is the sole member of MCM GP and SIF GP. By virtue

of these relationships, each of MCM, MCM GP, Mr. Mudrick and SIF GP may be deemed to beneficially own the securities held directly

by SIF.

(2) Based on 362,206,948 shares of Common

Stock outstanding, which includes (i) 361,354,955 shares of Common Stock outstanding as of July 22, 2024, according to the Issuer’s

Prospectus Supplement filed with the SEC pursuant to Rule 424(b)(7) under the Securities Act of 1933, as amended, on July 22, 2024, and

(ii) 851,993 shares of Common Stock issuable upon conversion of Convertible Notes directly held by SIF.

| Item 1(a). | Name of Issuer: |

AMC Entertainment Holdings, Inc. (“Issuer”)

| Item 1(b). | Address of Issuer’s Principal Executive Offices: |

One AMC Way, 11500 Ash Street, Leawood, KS 66211

| Item 2(a). | Name of Person Filing: |

This Schedule 13G is filed by Mudrick Capital Management, L.P. (“MCM”), Mudrick Capital Management, LLC (“MCM GP”),

Jason Mudrick, Mudrick Distressed Opportunity Fund Global, L.P. (“Global LP”), Mudrick Distressed Opportunity Drawdown Fund II, L.P. (“Drawdown II”), Mudrick CAV Master, LP (“Mudrick CAV”), Mudrick Distressed Opportunity Drawdown Fund II SC, L.P. (“Drawdown II SC”),

Mudrick GP, LLC (“Mudrick GP”), Mudrick Distressed Opportunity Drawdown Fund II GP, LLC (“Drawdown II GP”), Mudrick

Distressed Opportunity 2020 Dislocation Fund, L.P. (“DISL”), Mudrick Distressed Opportunity 2020 Dislocation Fund GP, LLC

(“DISL GP”), Mudrick Distressed Opportunity SIF Master Fund, L.P. (“SIF”), and Mudrick Distressed Opportunity

SIF GP, LLC (“SIF GP”). Each of the foregoing is referred to as a “Reporting Person” and collectively as the “Reporting

Persons.”

Mudrick GP is the general partner of Global LP and may be deemed to beneficially own the number of securities of the Issuer directly held

by Global LP. Drawdown II GP is the general partner of Drawdown II and Drawdown II SC and may be deemed to beneficially own the securities

of the Issuer directly held by Drawdown II and Drawdown II SC. DISL GP is the general partner of DISL and may be deemed to beneficially

own the number of securities of the Issuer held by DISL. SIF GP is the general partner of SIF and may be deemed to beneficially own the

securities of the Issuer directly held by SIF. MCM is the investment manager to Drawdown II, Global LP, Drawdown II SC, DISL, SIF, Mudrick CAV and certain managed accounts. MCM GP is the general partner of MCM. Mr. Mudrick is the sole member of Mudrick

GP, Drawdown II GP, MCM GP, DISL GP, SIF GP. By virtue of these relationships, each of MCM, MCM GP and Mr. Mudrick may be deemed to beneficially

own the securities held directly by Global LP, Drawdown II, Drawdown II SC, DISL, SIF, Mudrick CAV and certain managed accounts.

The filing of this Schedule 13G shall not be construed as an admission that the Reporting Persons are, for purposes of Section 13(d) of

the Securities Exchange Act of 1934, as amended, the beneficial owners of any of the securities reported herein. Each of the Reporting

Persons disclaims beneficial ownership of the securities directly held by any other Reporting Person except to the extent of such entity

or individual’s pecuniary interest therein, if any.

| Item 2(b). | Address of Principal Business Office or, if none, Residence: |

The principal business office of the Reporting Persons is 527 Madison

Avenue, 6th Floor, New York, NY 10022.

See responses to Item 4 of the Cover Page for each Reporting Person,

which is incorporated herein by reference.

| Item 2(d). | Title of Class of Securities: |

Common stock, par value $0.01 per share, of the Issuer (“Common Stock”).

00165C302

See Cover Page Item 9 for each Reporting Person and Item 2(a), incorporated herein by reference. The filing of this Schedule 13G shall

not be construed as an admission that the Reporting Persons are, for purposes of Section 13(d) of the Securities Exchange Act of 1934,

as amended, the beneficial owners of any of the Shares reported herein. Each of the Reporting Persons specifically disclaims beneficial

ownership of the Shares reported herein that are not directly held by such Reporting Person except to the extent of his or its pecuniary

interest therein, if any.

| Item 4(b): | Percent of Class: |

See Cover Page Item 11 and related footnote for each Reporting

Person, incorporated herein by reference.

| Item 4(c): | Number of Shares of Which Such Person Has: |

(i) Sole power to vote or direct the vote:

See Cover Page Item 5 for each Reporting Person, incorporated

herein by reference.

(ii) Shared power to vote or direct the vote:

See Cover Page Item 6 for each Reporting Person, incorporated

herein by reference.

(iii) Sole power to dispose or direct the disposition of:

See Cover Page Item 7 for each Reporting Person, incorporated

herein by reference.

(iv) Shared power to dispose or direct the disposition of:

See Cover Page Item 8 for each Reporting Person, incorporated

herein by reference.

| Item

5. | Ownership of Five Percent or

Less of a Class |

Since its acquisition of the Convertible

Notes, MCM, MCM GP and Jason Mudrick have, under their discretionary authority, disposed of shares underlying some of its Convertible

Notes previously held, with the resulting position being less than five percent.

| Item 6. | Ownership of More Than Five Percent on Behalf of Another Person |

See Cover Page Item 11 and related footnote for MCM, MCM GP and Jason Mudrick, incorporated herein by reference.

| Item 7. | Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on by the Parent Holding Company |

Not applicable.

| Item 8. | Identification and Classification of Members of the Group |

See Exhibit 1 to this Schedule 13G.

| Item 9. | Notice of Dissolution of Group |

Not applicable.

By signing below I certify that, to the best of my knowledge and belief, the securities referred to above were not acquired and are not

held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired

and are not held in connection with or as a participant in any transaction having that purpose or effect, other than activities solely

in connection with a nomination under § 240.14a-11.

Signature

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 1, 2024

| |

/s/ Jason Mudrick |

| |

JASON MUDRICK |

| |

MUDRICK

CAPITAL MANAGEMENT, L.P. |

| |

|

|

| |

By: |

Mudrick Capital Management,

LLC, its general partner |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK

DISTRESSED OPPORTUNITY FUND GLOBAL, L.P. |

| |

|

| |

By: |

Mudrick GP, LLC, its general

partner |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member

|

| |

MUDRICK CAV MASTER, LP |

| |

|

| |

By: |

Mudrick Capital Management, L.P., its Investment Manager |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK DISTRESSED OPPORTUNITY DRAWDOWN

FUND II, L.P. |

| |

|

|

| |

By: |

Mudrick Distressed Opportunity Drawdown Fund II GP,

LLC, its general partner |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK CAPITAL MANAGEMENT, LLC |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK DISTRESSED OPPORTUNITY DRAWDOWN

FUND II SC, L.P. |

| |

|

|

| |

By: |

Mudrick Distressed Opportunity Drawdown Fund II GP,

LLC, its general partner |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK DISTRESSED OPPORTUNITY DRAWDOWN FUND II GP, LLC |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK DISTRESSED OPPORTUNITY 2020

DISLOCATION FUND, L.P. |

| |

|

|

| |

By: |

Mudrick Distressed Opportunity 2020 Dislocation Fund GP, LLC,

its general partner |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK DISTRESSED OPPORTUNITY 2020 DISLOCATION FUND GP, LLC |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK DISTRESSED OPPORTUNITY SIF MASTER

FUND, L.P. |

| |

|

|

| |

By: |

Mudrick Distressed Opportunity SIF GP, LLC, its general partner |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK DISTRESSED OPPORTUNITY SIF GP, LLC |

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

EXHIBIT INDEX

Exhibit 1

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k) under the Securities

Exchange Act of 1934, as amended, the persons named below agree to the joint filing on behalf of each of them of the Schedule 13G to which

this Agreement is an exhibit (and any further amendment filed by them) with respect to the shares of common stock, par value $0.01, of

AMC Entertainment Holdings, Inc. This agreement may be executed simultaneously in any number of counterparts, all of which together shall

constitute one and the same instrument.

Dated: August 1, 2024

| |

/s/ Jason Mudrick |

| |

JASON MUDRICK |

| |

|

|

| |

MUDRICK CAPITAL MANAGEMENT, L.P. |

| |

|

|

| |

By: |

Mudrick Capital Management, LLC, its general partner |

| |

|

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

|

|

| |

MUDRICK DISTRESSED OPPORTUNITY FUND GLOBAL, L.P. |

| |

|

| |

By: |

Mudrick GP, LLC, its general partner |

| |

|

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

|

|

| |

MUDRICK GP, LLC |

| |

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK DISTRESSED OPPORTUNITY DRAWDOWN FUND II, L.P. |

| |

|

|

| |

By: |

Mudrick Distressed Opportunity Drawdown Fund II GP, LLC, its general partner |

| |

|

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

|

|

| |

MUDRICK CAPITAL MANAGEMENT, LLC |

| |

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

|

|

| |

MUDRICK DISTRESSED OPPORTUNITY DRAWDOWN FUND II SC, L.P. |

| |

|

|

| |

By: |

Mudrick Distressed Opportunity Drawdown Fund II GP, LLC, its general partner |

| |

|

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

|

|

| |

MUDRICK DISTRESSED OPPORTUNITY DRAWDOWN FUND II GP, LLC |

| |

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK DISTRESSED OPPORTUNITY 2020 DISLOCATION FUND, L.P. |

| |

|

| |

By: |

Mudrick Distressed Opportunity 2020 Dislocation Fund GP, LLC,

its general partner |

| |

|

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

|

|

| |

MUDRICK DISTRESSED OPPORTUNITY 2020 DISLOCATION FUND GP, LLC |

| |

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

|

|

| |

MUDRICK DISTRESSED OPPORTUNITY SIF MASTER FUND, L.P. |

| |

|

| |

By: |

Mudrick Distressed Opportunity SIF GP, LLC, its general partner |

| |

|

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

|

|

| |

MUDRICK DISTRESSED OPPORTUNITY SIF GP, LLC |

| |

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

| |

MUDRICK CAV MASTER, LP |

| |

|

| |

By: |

Mudrick Capital Management, L.P., its Investment Manager |

| |

|

| |

By: |

/s/ Jason Mudrick |

| |

Name: |

Jason Mudrick |

| |

Title: |

Sole Member |

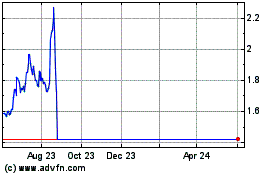

AMC Entertainment Hldg P... (NYSE:APE)

Historical Stock Chart

From Dec 2024 to Jan 2025

AMC Entertainment Hldg P... (NYSE:APE)

Historical Stock Chart

From Jan 2024 to Jan 2025