Apollo to Provide USD $500 Million Hybrid Capital Solution to Aldar in Fourth Transaction

01 February 2025 - 12:00AM

Apollo (NYSE: APO) today announced an agreement for Apollo-managed

affiliates, funds and clients to invest USD $500 million in

Subordinated Notes issued by Aldar Properties PJSC (“Aldar”). The

transaction represents one of the region’s largest-ever corporate

hybrid private placements and brings aggregate investment in Aldar

led by Apollo to approximately USD $1.9 billion across four

transactions since 2022.

Apollo Partner Jamshid Ehsani said, “We are

pleased to broaden our partnership and provide another scaled

capital solution to Aldar by investing in a leading real estate

franchise that we believe offers an attractive investment

opportunity for our clients. Apollo’s fourth investment in Aldar

underscores our strong partnership with the company as well as our

commitment to serving as a leading capital provider to the broader

Abu Dhabi ecosystem.”

The hybrid private placement marks Apollo’s

latest commitment to Abu Dhabi and the UAE and follows an August

2022 transaction in which Apollo-managed funds and clients invested

a total of USD $1.4 billion in strategic capital in Aldar,

including a USD $400 million equity investment in Aldar Investment

Properties. In November 2024, Apollo also announced a multi-year

extension of the firm’s multi-billion-dollar partnership with

Mubadala Investment Company focused on global origination

opportunities.

Since 2020, under its High-Grade Capital

Solutions strategy, Apollo has originated nearly $100 billion of

bespoke capital solutions for leading companies such as Intel,

Sony, Air France, AB InBev and more.

About Apollo

Apollo is a high-growth, global alternative

asset manager. In our asset management business, we seek to provide

our clients excess return at every point along the risk-reward

spectrum from investment grade credit to private equity. For more

than three decades, our investing expertise across our fully

integrated platform has served the financial return needs of our

clients and provided businesses with innovative capital solutions

for growth. Through Athene, our retirement services business, we

specialize in helping clients achieve financial security by

providing a suite of retirement savings products and acting as a

solutions provider to institutions. Our patient, creative, and

knowledgeable approach to investing aligns our clients, businesses

we invest in, our employees, and the communities we impact, to

expand opportunity and achieve positive outcomes. As of September

30, 2024, Apollo had approximately $733 billion of assets under

management. To learn more, please visit www.apollo.com.

Contacts

Noah Gunn

Global Head of Investor Relations

Apollo Global Management, Inc.

(212) 822-0540

IR@apollo.com

Joanna Rose

Global Head of Corporate Communications

Apollo Global Management, Inc.

(212) 822-0491

Communications@apollo.com

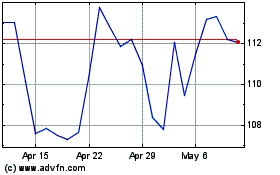

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Jan 2025 to Feb 2025

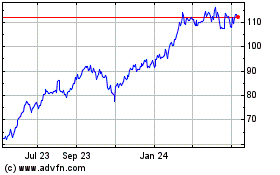

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Feb 2024 to Feb 2025