Apollo Advances Financial Advisor Education and Access to Alternative Investments with Launch of Apollo Allocation Pro

04 February 2025 - 12:00AM

Apollo (NYSE: APO) today announced the launch of Apollo Allocation

Pro. Designed for a financial advisor audience, Apollo Allocation

Pro seeks to provide an intuitive, hands-on experience to explore

portfolio construction strategies that include alternatives,

particularly private markets. The tool is now available on

Apollo.com.

Apollo Allocation Pro is the latest step in Apollo’s commitment

to enhancing access to alternatives and empowering financial

intermediaries with ongoing education and resources for integrating

private markets into client portfolios.

The tool builds off Apollo Academy, the firm’s

alternative-investment educational platform. Launched in September

2022, Apollo Academy offers financial advisors a variety of

educational programs, from its cornerstone course, Alternative

Investing Essentials (a 10-hour, CE-credit course), to pinpointed

CE-credit classes, white papers, podcasts and the Daily Spark blog

with Apollo’s Chief Economist Torsten Slok.

“With Apollo Allocation Pro, we’re continuing to educate and

empower financial advisors as they seek greater diversification and

excess return on behalf of their clients,” said Apollo’s Stephanie

Drescher, Partner and Chief Client and Product Development Officer.

“This tool highlights our commitment to providing advisors with

resources to integrate private market strategies into portfolios,

enabling them to deliver tailored solutions that align with their

clients’ financial goals.”

Key Features of Apollo Allocation Pro:

- Interactive

Portfolio Design: Create and model illustrative portfolio

allocations that integrate alternatives alongside traditional

public market indices with varying levels of risk tolerance across

asset classes.

-

Advisor-Focused Insights: Leverage custom insights

to address diverse client objectives by accessing 17 different

indices from which to allocate.

- Broader

Education Initiatives: Aligned with Apollo’s educational

framework, the tool complements the resources offered through

Apollo Academy.

The tool was developed in partnership with iCapital1, the global

fintech platform driving the world’s alternative investment

marketplace for the wealth and asset management industries, and is

powered by iCapital Architect.

__________________________________1 iCapital, Inc. and its

affiliates (together, “iCapital”)

About ApolloApollo is a high-growth, global

alternative asset manager. In our asset management business, we

seek to provide our clients excess return at every point along the

risk-reward spectrum from investment grade credit to private

equity. For more than three decades, our investing expertise across

our fully integrated platform has served the financial return needs

of our clients and provided businesses with innovative capital

solutions for growth. Through Athene, our retirement services

business, we specialize in helping clients achieve financial

security by providing a suite of retirement savings products and

acting as a solutions provider to institutions. Our patient,

creative, and knowledgeable approach to investing aligns our

clients, businesses we invest in, our employees, and the

communities we impact, to expand opportunity and achieve positive

outcomes. As of September 30, 2024, Apollo had approximately $733

billion of assets under management. To learn more, please visit

www.apollo.com.

Contacts

Noah GunnGlobal Head of Investor RelationsApollo Global

Management, Inc.(212) 822-0540IR@apollo.com

Joanna RoseGlobal Head of Corporate CommunicationsApollo Global

Management, Inc.(212) 822-0491Communications@apollo.com

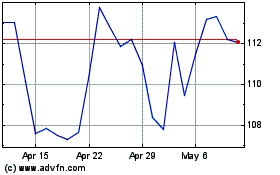

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Jan 2025 to Feb 2025

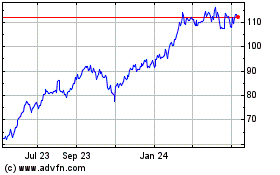

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Feb 2024 to Feb 2025