false

0001389050

0001389050

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

August 12, 2024

Commission File Number 001-33666

ARCHROCK, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

74-3204509 |

| (State or other jurisdiction of incorporation) |

|

(I.R.S. Employer Identification No.) |

9807 Katy Freeway, Suite 100, Houston,

TX 77024

Houston, Texas

(Address of principal executive offices,

zip code)

(281) 836-8000

Registrant’s telephone number, including

area code

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

| Common stock, par value $0.01 per share |

|

AROC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

On August 12, 2024, Archrock,

Inc. (the “Company”) issued a press release announcing that Archrock Partners, L.P. (the “Partnership”), its wholly

owned, indirect subsidiary, intends, subject to market and other conditions, to offer and sell to eligible purchasers $500 million aggregate

principal amount of senior notes due 2032 (the “Notes”). Archrock Partners Finance Corp., a wholly owned subsidiary of the

Partnership (together with the Partnership, the “Issuers”), will serve as co-issuer of the Notes. A copy of the press release

is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information included in

this Item 7.01 and Exhibit 99.1 attached hereto are being furnished and shall not be deemed “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information included

in this Item 7.01 and Exhibit 99.1 attached hereto shall not be incorporated by reference into any registration statement or other document

pursuant to the Securities Act of 1933, as amended.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ARCHROCK, INC. |

| |

|

|

| By: |

/s/ Stephanie C. Hildebrandt |

| |

|

Stephanie C. Hildebrandt |

| |

|

Senior Vice President, General Counsel and Secretary |

| August 12, 2024 |

|

|

Exhibit 99.1

Archrock

Announces Private Offering of $500 Million of Senior Notes

HOUSTON, August 12, 2024 – Archrock, Inc.

(NYSE: AROC) (“Archrock”) today announced that Archrock Partners, L.P. (“Archrock Partners”), a wholly-owned subsidiary

of Archrock, intends, subject to market and other conditions, to offer and sell to eligible purchasers $500 million aggregate principal

amount of senior notes due 2032 (the “Notes”). Archrock Partners Finance Corp., a wholly-owned subsidiary of Archrock Partners

(together with Archrock Partners, the “Issuers”), will serve as co-issuer of the Notes.

Archrock intends to use the net proceeds from

the offering of the Notes to fund a portion of the cash consideration for the previously announced acquisition of 100% of the issued and

outstanding membership interests of Total Operations and Production Services, LLC (the “Acquisition”). Archrock intends to

use any remaining net proceeds for general corporate purposes, which may include the repayment of indebtedness, including a portion of

the outstanding borrowings under Archrock’s revolving credit facility. The Acquisition is not conditioned on the consummation of

the offering and the offering is not conditioned on the consummation of the Acquisition.

The Notes have not been registered under the Securities

Act of 1933, as amended (the “Securities Act”), or any state securities laws and, unless so registered, may not be offered

or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of

the Securities Act and the rules promulgated thereunder and applicable state securities laws. The Notes will be offered only to qualified

institutional buyers in reliance on Rule 144A under the Securities Act and non-U.S. persons in transactions outside the United States

in reliance on Regulation S under the Securities Act.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy the securities described herein, nor shall there be any sale of these securities in any

jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction.

About Archrock

Archrock is an energy infrastructure company with

a primary focus on midstream natural gas compression and a commitment to helping its customers produce, compress and transport natural

gas in a safe and environmentally responsible way. Headquartered in Houston, Texas, Archrock is a premier provider of natural gas compression

services to customers in the energy industry throughout the U.S. and a leading supplier of aftermarket services to customers that own

compression equipment. For more information on how Archrock embodies its purpose, WE POWER A CLEANER AMERICA, please visit www.archrock.com.

About Archrock Partners

Archrock Partners is a leading provider of natural

gas compression services to customers in the oil and natural gas industry throughout the United States. Archrock owns all of the limited

and general partnership interests in Archrock Partners.

Forward-Looking Statements

All statements in this release (and oral statements

made regarding the subjects of this release) other than historical facts are forward-looking statements within the meaning of Section 21E

of the Securities Exchange Act of 1934, as amended. These forward-looking statements rely on a number of assumptions concerning future

events and are subject to a number of uncertainties and factors that could cause actual results to differ materially from such statements,

many of which are outside Archrock or Archrock Partners’ control. Forward-looking information includes, but is not limited to: statements

regarding Archrock Partners’ proposed offering, the completion of such offering, the intended use of net proceeds from the proposed

offering, and the impact of market conditions on such offering.

While Archrock and Archrock Partners believe that

the assumptions concerning future events are reasonable, they caution that there are inherent difficulties in predicting certain important

factors that could impact the future performance or results of its business. Among the factors that could cause results to differ materially

from those indicated by such forward-looking statements are: local, regional and national economic conditions and the impact they may

have on Archrock Partners’ and its customers; conditions in the oil and gas industry, including the level of production of, demand

for or price of oil or natural gas; changes in safety, health, environmental and other regulations; the financial condition of Archrock

Partners’ customers; the failure of any customer to perform its contractual obligations; and the performance of Archrock.

These forward-looking statements are also affected

by the risk factors, forward-looking statements and challenges and uncertainties described in Archrock’s Annual Report on Form 10-K

for the year ended December 31, 2023, as amended by Amendment No. 1 on Form 10-K/A, Quarterly Report on Form 10-Q

for the quarter ended March 31, 2024, Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, and those reports

set forth from time to time in Archrock’s filings with the Securities and Exchange Commission, which are available at www.archrock.com.

Except as required by law, Archrock and Archrock Partners expressly disclaim any intention or obligation to revise or update any forward-looking

statements whether as a result of new information, future events or otherwise.

SOURCE: Archrock, Inc.

For information, contact:

| Archrock, Inc. |

|

INVESTORS

Megan Repine

VP of Investor Relations

281-836-8360

investor.relations@archrock.com |

|

MEDIA

Andrew Siegel / Jed Repko

Joele Frank

212-355-4449 |

v3.24.2.u1

Cover

|

Aug. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 12, 2024

|

| Entity File Number |

001-33666

|

| Entity Registrant Name |

ARCHROCK, INC.

|

| Entity Central Index Key |

0001389050

|

| Entity Tax Identification Number |

74-3204509

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

9807 Katy Freeway

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77024

|

| City Area Code |

281

|

| Local Phone Number |

836-8000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

AROC

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

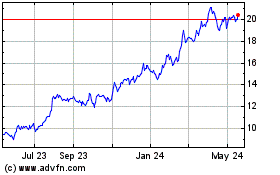

Archrock (NYSE:AROC)

Historical Stock Chart

From Dec 2024 to Jan 2025

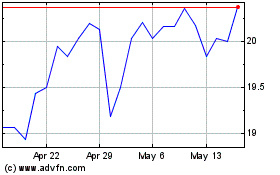

Archrock (NYSE:AROC)

Historical Stock Chart

From Jan 2024 to Jan 2025