UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil.

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Contents

Declaration of the officers on the interim condensed individual and consolidated

financial statements |

3 |

Declaration of the officers on the independent auditor’s report |

4 |

Summary report of the statutory audit committee |

5 |

Independent auditor report |

6 |

| |

|

Statements of financial position |

8 |

Statements of operations |

10 |

Statements of comprehensive income |

11 |

Statements of changes in equity |

12 |

Statements of cash flows |

13 |

Statements of value added |

14 |

Notes to the interim condensed individual and consolidated financial statements |

15 |

| AZUL S.A. Declaration of the officers March 31, 2024 |

| | |

Declaration of the officers on

the interim condensed individual and consolidated financial statements

In accordance with item VI of article 27 of CVM Resolution

No. 80, of March 29, 2022, the Board of Directors declares that it reviewed, discussed and agreed with the interim condensed individual

and consolidated financial statements for the three months ended March 31, 2024.

Barueri, May 10, 2024.

John Peter Rodgerson

CEO

Alexandre Wagner Malfitani

Vice President of Finance and Investor Relations

Antonio Flavio Torres Martins Costa

Technical Vice President

Abhi Manoj Shah

Vice President of Revenue

| AZUL S.A. Declaration of the officers March 31, 2024 |

| | |

Directors' statement on the independent

auditor's report

In accordance with item V of article 27 of CVM Resolution

No. 80, of March 29, 2022, the Board of Directors declares that it reviewed, discussed and agreed with the opinion expressed in the independent

auditor's report on the examination of the interim condensed individual and consolidated financial statements relating to for the three

months ending March 31, 2024.

Barueri, May 10, 2024.

John Peter Rodgerson

CEO

Alexandre Wagner Malfitani

Vice President of Finance and Investor Relations

Antonio Flavio Torres Martins Costa

Technical Vice President

Abhi Manoj Shah

Vice President of Revenue

| AZUL S.A.

Summary report of the statutory audit committee

March 31, 2024 |

| | |

Opinion of the statutory audit

committee

In compliance with the legal provisions, the Statutory

Audit Committee reviewed the management report and the interim condensed individual and consolidated financial statements for the three

months ended March 31, 2024. Based on this review and also considering the information and clarifications provided by the Company management

and by Ernst & Young Auditores Independentes S/S.Ltda. during the three months , the Statutory Audit Committee expressed a favorable

opinion on the management report and on the interim condensed individual and consolidated financial statements for the three months ended

March 31, 2024, together with the independent auditor’s report issued by Ernst & Young Auditores Independentes S/S.Ltda. recommending

the Board of Directors to approve them.

Barueri, May 10, 2024.

Sergio Eraldo de Salles Pinto

Member, Coordinator of the Audit Committee and

Financial Specialist

Gilberto Peralta

Member of the Audit Committee

Renata Faber Rocha Ribeiro

Member of the Audit Committee

A free translation from Portuguese into English of Independent Auditor’s

Review Report on quarterly information prepared in Brazilian currency in accordance with NBC TG 21 and IAS 34 - Interim Financial Reporting,

and with the rules issued by the Brazilian Securities and Exchange Commission (CVM) applicable to the preparation of Quarterly Information

(ITR)

Independent auditor’s review report on quarterly information

To the

Shareholders, Board of Directors and Officers

Azul S.A.

Barueri - São Paulo

Introduction

We have reviewed the individual and consolidated interim financial

information of Azul S.A. (Company) contained in the Quarterly Information Form (ITR) for the quarter ended March 31, 2024, which comprises

the statement of financial position as at March 31, 2024 and the related statements of profit or loss, of comprehensive income, of changes

in equity, and of cash flows for the three-month period then ended, and notes to the individual and consolidated interim financial information,

including material accounting policies and other explanatory information.

Executive board’s responsibility for the interim financial

information

The executive board is responsible for preparation of the individual and

consolidated interim financial information in accordance with NBC TG 21 and IAS 34 – Interim Financial Reporting, issued by the

International Accounting Standards Board (IASB), as well as for the fair presentation of this information in conformity with the rules

issued by the Brazilian Securities and Exchange Commission (CVM) applicable to the preparation of Quarterly Information (ITR). Our responsibility

is to express a conclusion on this interim financial information based on our review.

Scope of review

We conducted our review in accordance with Brazilian and International

Standards on Review Engagements (NBC TR 2410 and ISRE 2410 - Review of Interim Financial Information Performed by the Independent Auditor

of the Entity, respectively). A review of interim financial information consists of making inquiries, primarily of persons responsible

for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than

an audit conducted in accordance with auditing standards and, consequently, does not enable us to obtain assurance that we would become

aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion on the individual and consolidated interim financial

information

Based on our review, nothing has come to our attention that causes

us to believe that the individual and consolidated interim financial information included in the quarterly information referred to above

was not prepared, in all material respects, in accordance with NBC TG 21 and IAS 34 applicable to the preparation of Quarterly Information

(ITR), and presented consistently with the rules issued by the CVM.

Other matters

Statements of value added

The quarterly information referred to above includes the individual

and consolidated statements of value added (SVA) for the three-month period ended March 31, 2024, prepared under the responsibility of

the Company’s executive board, and presented as supplementary information for IAS 34 purposes. These statements were subject to

review procedures conducted jointly with the review of the quarterly information for the purpose of concluding whether they are reconciled

with the interim financial information and accounting records, as applicable, and whether their form and content are in accordance with

the criteria defined in NBC TG 09 – Statement of Value Added. Based on our review, nothing has come to our attention that causes

us to believe that these statements of value added were not prepared, in all material respects, pursuant to such standard and consistently

with the individual and consolidated interim financial information taken as a whole.

São Paulo, May 10, 2024.

ERNST & YOUNG

Auditores Independentes S/S Ltda.

CRC SP-034519/O

Emerson Pompeu Bassetti

Accountant CRC SP-251558/O

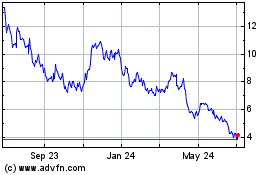

| AZUL S.A.

Statement of financial position

March 31, 2024 and December 31, 2023

(In thousands of Brazilian reais – R$)

|

| | |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

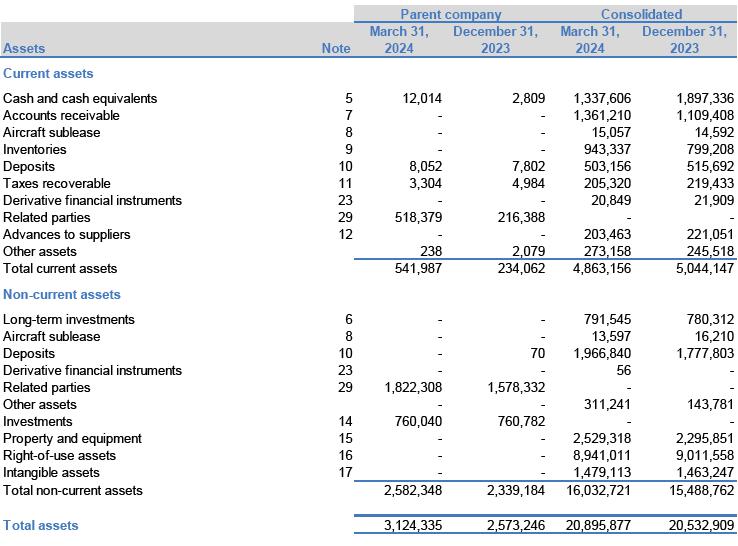

| AZUL S.A.

Statement of financial position

March 31, 2024 and December 31, 2023

(In thousands of Brazilian reais – R$)

|

| | |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

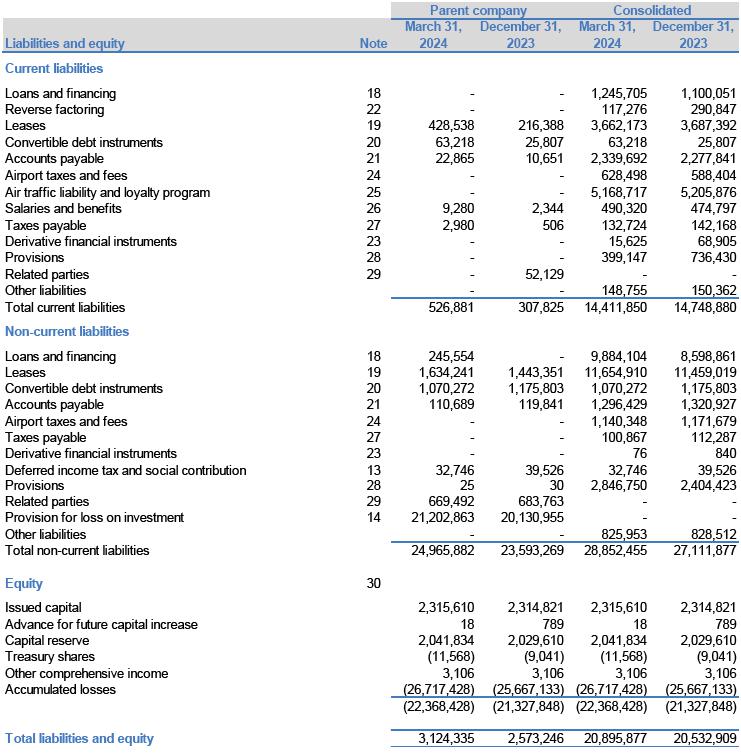

| AZUL S.A.

Statement of operations

Three months ended March 31, 2024 and 2023

(In thousands of Brazilian reais – R$, except

basic and diluted loss per share)

|

| | |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

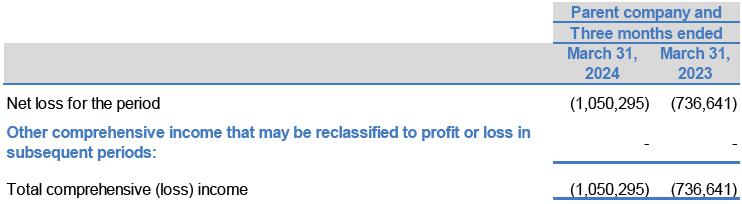

| AZUL S.A.

Statement of comprehensive (loss) income

Three months ended March 31, 2024 and 2023

(In thousands of Brazilian reais – R$)

|

| | |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

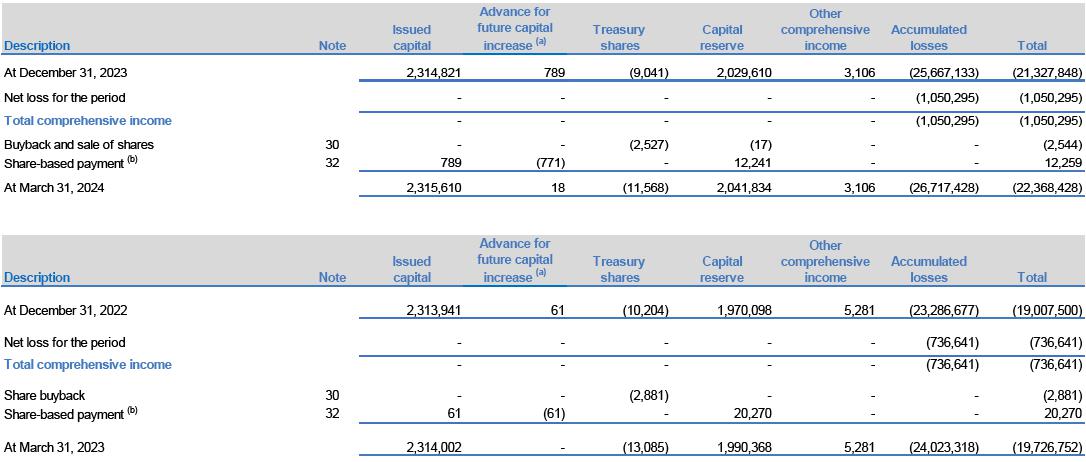

| AZUL S.A.

Statement of changes in equity

Three months ended March 31, 2024 and 2023

(In thousands of Brazilian reais – R$)

|

| | |

| (a) | Advance for future capital increase |

| (b) | Refers to the receipt of the exercise of share options and

the vesting of share-based compensation plans. |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

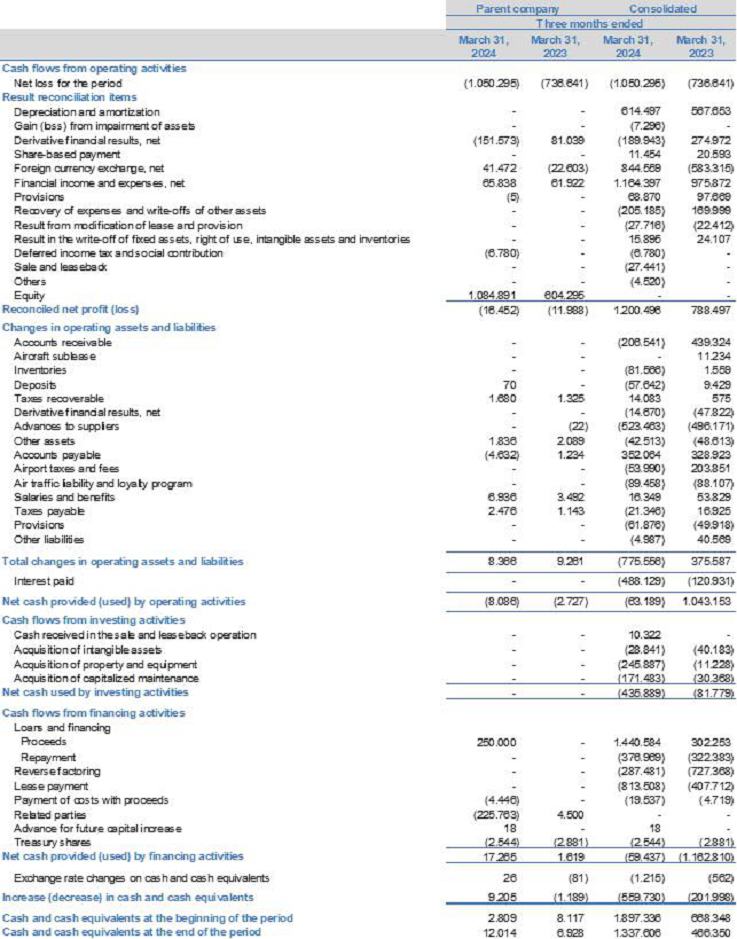

| AZUL S.A.

Statement of cash flows

Three months ended March 31, 2024 and 2023

(In thousands of Brazilian reais – R$)

|

| | |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

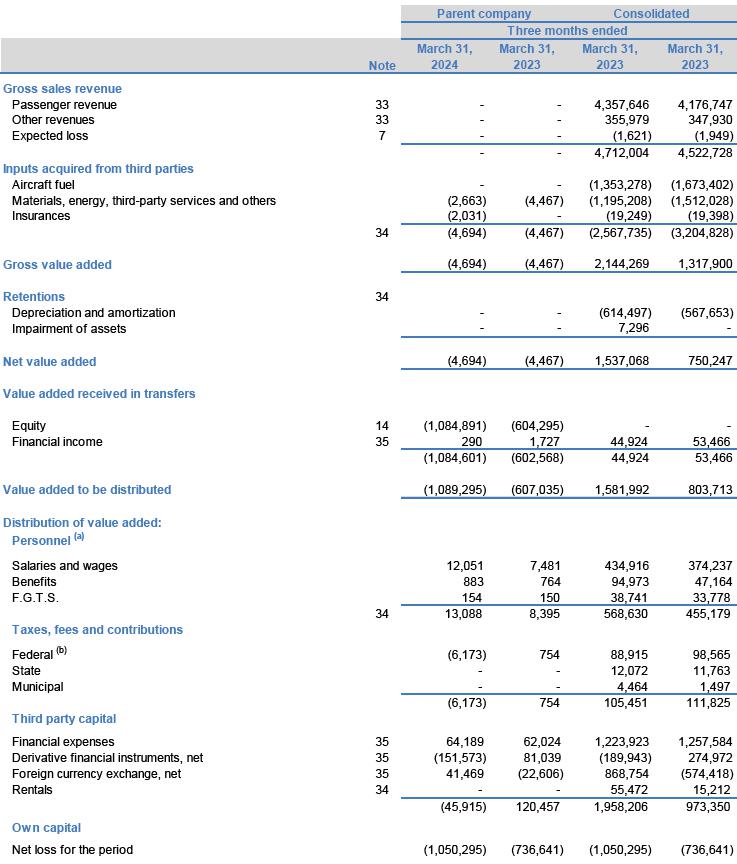

| AZUL S.A.

Statement of value added

Periods ended March 31, 2024 and 2023

(In thousands of Brazilian reais – R$)

|

| | |

| (a) | Not including INSS in the amount

of R$605 in the parent company R$106,041 in the consolidated, as it is in the federal tax line. |

| (b) | Includes deferred income tax and

social contribution accounted for in the parent company. |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

Azul S.A. (“Azul”), together with its subsidiaries

(“Company”) is a corporation governed by its bylaws, as per Law No. 6404/76 and by the corporate governance level 2 listing

regulation of B3 S.A. – Brasil, Bolsa, Balcão (“B3”). The Azul was incorporated on January 3, 2008, and its core

business comprises the operation of regular and non-regular airline passenger services, cargo or mail, passenger charter, provision of

maintenance and hangarage services for aircraft, engines, parts and pieces, aircraft acquisition and lease, development of frequent-flyer

programs, development of related activities and equity holding in other companies since the beginning of its operations on December 15,

2008.

The Azul carries out its activities through its subsidiaries,

mainly Azul Linhas Aéreas Brasileiras S.A. (“ALAB”) and Azul Conecta Ltda. (“Conecta”), which hold authorization

from government authorities to operate as airlines and ATS Viagens e Turismo Ltda (“Azul Viagens”).

The Azul shares are traded on B3 and on the New York

Stock Exchange (“NYSE”) under tickers AZUL4 and AZUL, respectively.

The Azul is headquartered at Avenida Marcos Penteado

de Ulhôa Rodrigues, 939, 8th floor, in the city of Barueri, state of São Paulo, Brazil.

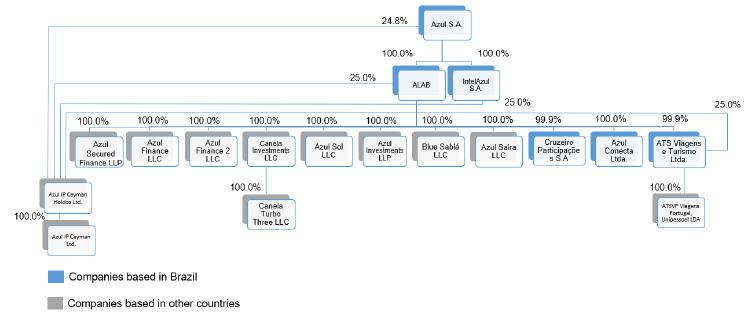

| 1.1 | Organizational

structure |

The Company organizational structure as of March 31,

2024 is as follows:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

The table below lists the operational activities in

which the Azul subsidiaries are engaged, as well as the changes in ownership that occurred in period, when applicable.

The Company’s operating revenues depend substantially

on the general volume of passenger and cargo traffic, which is subject to seasonal changes. Our passenger revenues are generally higher

during the summer and winter holidays, in January and July respectively, and in the last two weeks of December, which corresponds to the

holiday season. Considering the distribution of fixed costs, this seasonality tends to cause variations in operating results between periods

of the fiscal year.

| 2. | NET WORKING CAPITAL AND CAPITAL STRUCTURE |

2.1 Contextualization

During the three months ended March 31, 2024, Azul's

Management continued the process of restructuring its debts as presented in detail in this interim condensed individual and consolidated

financial statements.

2.2 Net working capital and capital

structure

As of March 31, 2024, the Company's working capital

and liquid equity position are as shown below:

The positive variation in the balance of net working

capital, which represents a reduction in the deficit of approximately 1.6%, is a consequence of the company's restructuring actions.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

The negative variation of equity is mainly due to the

Company's negative financial result, which exceeds by R$1,057,075 the operating profit.

In view of the above, management assessed and concluded

that the Company is capable of continuing its operations and fulfilling its obligations in accordance with the contracted maturities.

This assessment is based on the Company's business plan approved by the Board of Directors in December, 2023. The Company's business plans

include planned future actions, macroeconomic and aviation sector assumptions, such as level of demand for air transport with corresponding

increase in traffic and fares, estimated exchange rates and fuel prices. The Company's Management monitors and informs the Board of Directors

about performance in relation to the approved plan.

Based on this conclusion, this interim condensed individual

and consolidated financial statements were prepared based on the going concern principle operational.

| 3. | DECLARATION OF MANAGEMENT, BASIS OF PREPARATION AND PRESENTATION OF THE INTERIM CONDENSED INDIVIDUAL AND

CONSOLIDATED FINANCIAL STATEMENTS |

The Company’s interim condensed individual and

consolidated financial statements have been prepared in accordance with accounting practices adopted in Brazil and the International Financial

Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”), specifically IAS

34 – Interim Financial Reporting. The accounting practices adopted in Brazil include those included in the Brazilian corporation

law and the technical pronouncements, guidelines and interpretations issued by the Accounting Pronouncements Committee (“CPC”),

approved by the Federal Accounting Council (“CFC”) and the Brazilian Securities and Exchange Commission (“CVM”).

The Company’s

interim condensed individual and consolidated financial statements have been prepared based on the real

(“R$”) as a functional and presentation currency. All currencies shown are expressed in thousands unless otherwise noted.

The Company operates mainly through its aircraft and

other assets that support flight operations, making up its cash generating unit (CGU) and its only reportable segment: air transport.

The preparation of the Company's interim condensed

individual and consolidated financial statements requires Management to make judgments, use estimates and adopt assumptions that affect

the reported amounts of assets, liabilities, revenues, and expenses. However, the uncertainty related to these judgments, assumptions

and estimates can lead to results that require a significant adjustment to the carrying amount of assets, liabilities, income, and expenses

in future years.

When preparing these interim condensed individual

and consolidated financial statements of the Company, Management used the following disclosure criteria to understand the changes observed

in the equity and in its performance, since the end of the last fiscal year ended December 31, 2023, disclosed on April 12, 2024: (i)

regulatory requirements; (ii) relevance and specificity of the information on the operations; (iii) informational needs of users of the

interim condensed individual and consolidated financial statements; and (iv) information from other entities participating in the passenger

air transport market and cargo.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

Management confirms that all relevant information specific

to the interim condensed individual and consolidated financial statements, is presented and corresponds to that used by Management when

carrying out its business management activities.

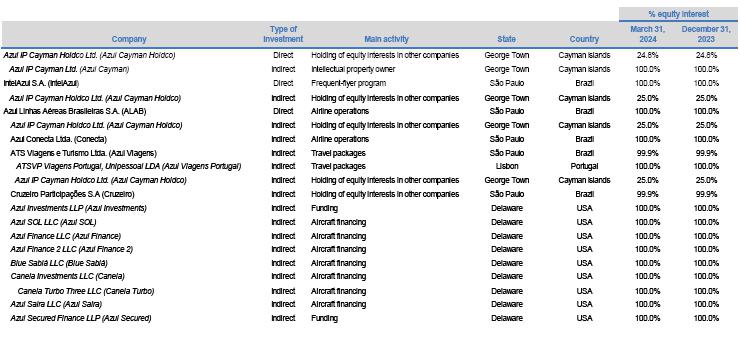

As a consequence of the improvements made to the presentation

of some items in the statements of cash flows and costs and expenses by nature of the current quarter, the following reclassifications

were carried out to ensure comparability of balances from the previous period:

The interim condensed individual and consolidated financial

statements have been prepared based on the historical cost, except for the items significant:

Fair value:

·

Short-term investments classified as cash and cash equivalents;

·

Short-term investments;

·

Derivative financial instruments; and

·

Debenture conversion right.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

Other:

·

Investments accounted for under the equity method.

| 3.1 | Approval and

authorization for issue of the interim condensed individual and consolidated financial statements |

The approval and authorization for issue of these interim

condensed individual and consolidated financial statements occurred at the Board of Directors’ meeting held on May,10 2024.

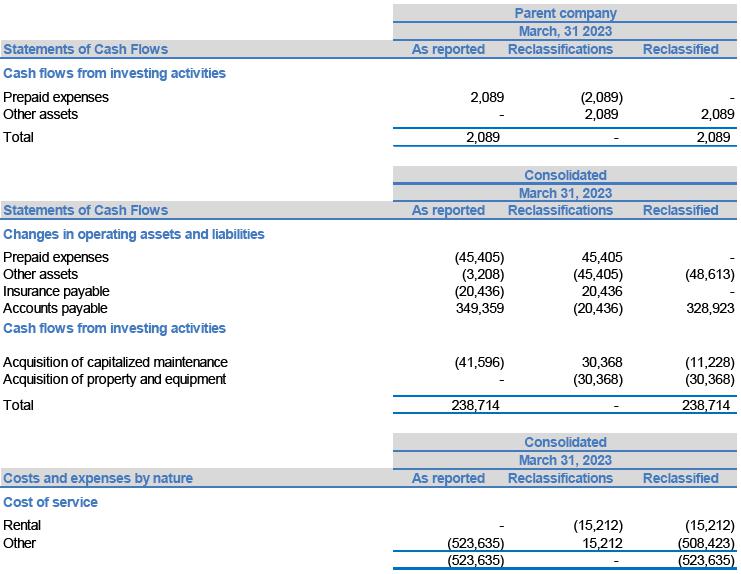

| 4. | MATERIAL ACCOUNTING POLICIES |

The interim condensed individual and consolidated financial

statements of the company was prepared based on the policies, practices and methods of calculating estimates adopted and presented in

detail in the financial statements for the year ended December 31, 2023 and disclosed on April 12, 2024 and, therefore, must be read together.

| 4.1 | New, changes

and interpretations of relevant accounting standards and pronouncements |

The following accounting standards

came into effect on January 1, 2024 and did not significantly impact the Company's balance sheet or income statement.

| 4.2 | Foreign currency transactions |

Foreign currency transactions are recorded at the exchange

rate in effect at the date the transactions take place. Monetary assets and liabilities designated in foreign currency are determined

based on the exchange rate in effect on the balance sheet date, and any difference resulting from currency conversion is recorded under

the heading “Foreign currency exchange, net” in the statements of operation.

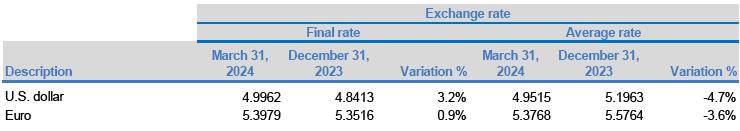

The exchange rates to Brazilian reais are as follows:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

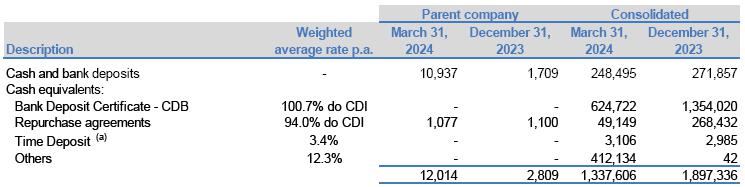

| 5. | CASH AND CASH EQUIVALENTS |

| (a) | Investment in U.S. dollar. |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

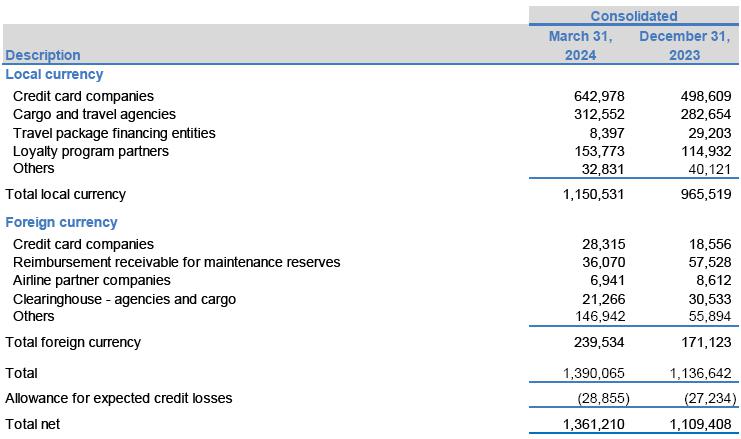

In Brazil, credit card receivables are not exposed

to credit risk of the cardholder. The balances can easily be converted into cash, when necessary, through advance payment with credit

card companies.

During the three months ended March 31, 2024, the Company

anticipated the receipt of R$2,610,173 in accounts receivable from credit card administrators, without right of return, with an average

cost of 0.9% on the anticipated amount. On the same date, the balance of accounts receivable is net of R$1,854,310 due to such advances

(R$3,349,391 on December 31, 2023).

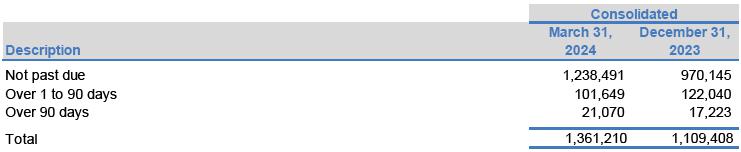

The breakdown of accounts receivable by maturity, net

of allowance for expected losses, is as follows:

Until

May 3, 2024, of the total amount due within, R$41,423 was received.

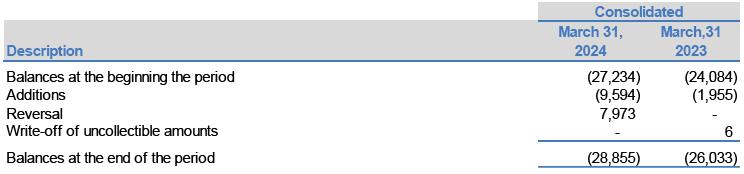

The movement of expected losses is presented below:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

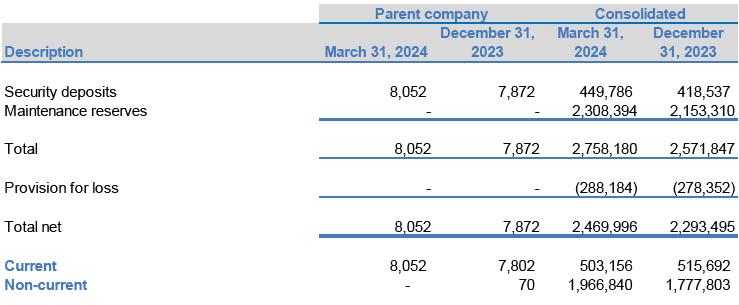

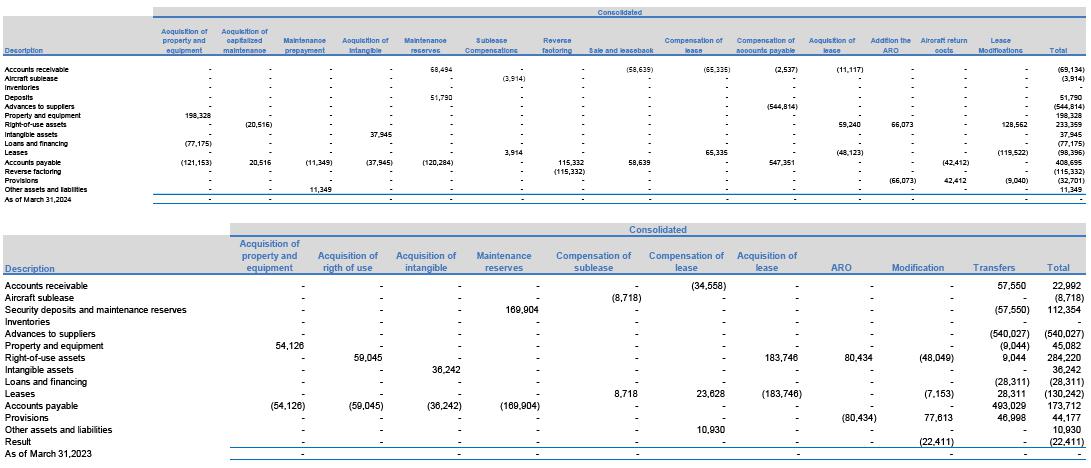

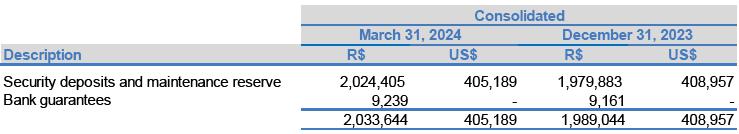

The movement of security deposits and maintenance

reserves is as follows:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

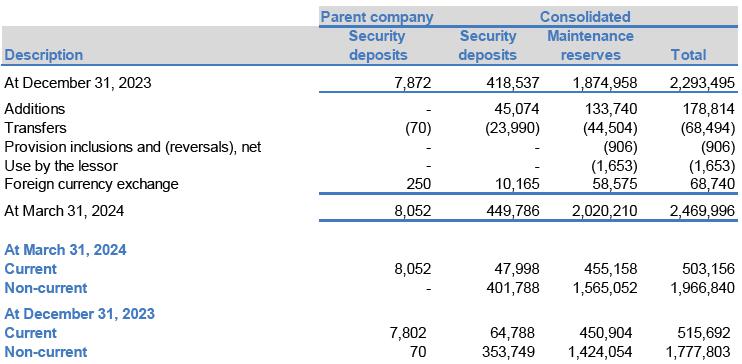

The movement of the allowance for maintenance reserves losses is as

follows:

These amounts are presented net of provisions for losses in the amount of

R$32,440 (R$28,676 as of December 31, 2023).

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

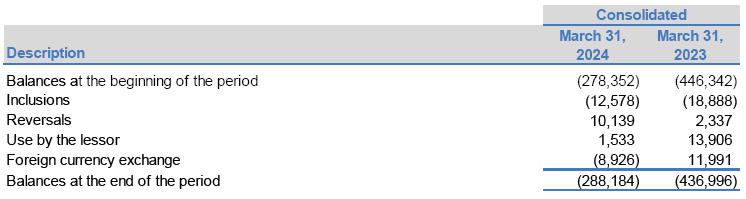

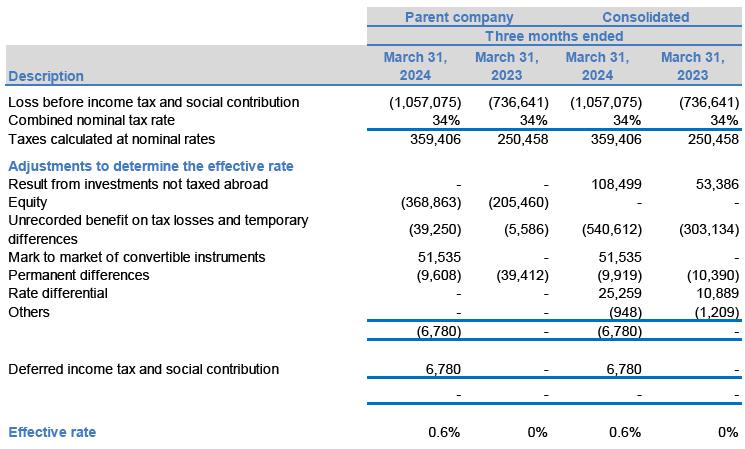

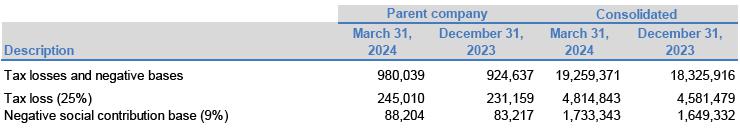

| 13. | INCOME TAX AND CONTRIBUTION |

| 13.1 | Reconciliation of the effective income tax rate |

The Company has tax losses that are available indefinitely

for offset against 30% of future taxable profits on which deferred tax assets were not created as it is not probable that future taxable

profits will be available for the Company to use the benefits thereof, as below:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

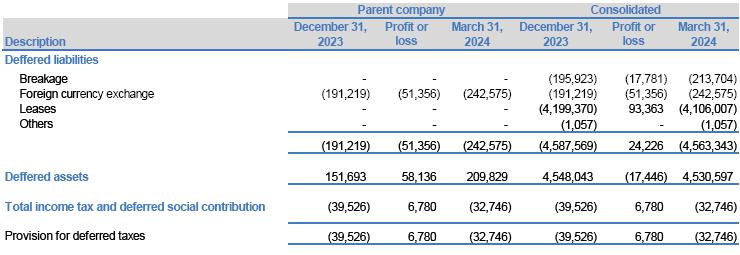

| 13.2 | Breakdown of deferred taxes |

(a) Considering indirect investments, the Company's

share totals 99.8%.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

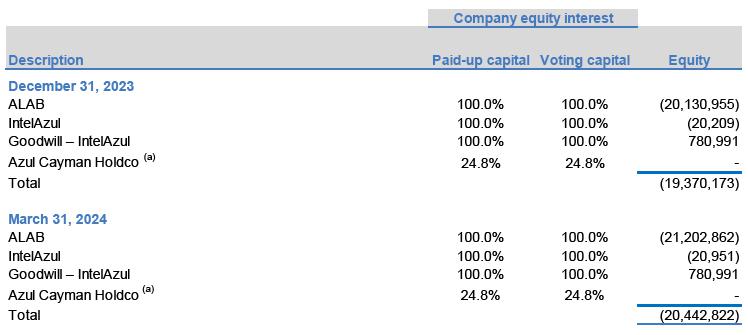

| 14.2 | Movement of

the investments |

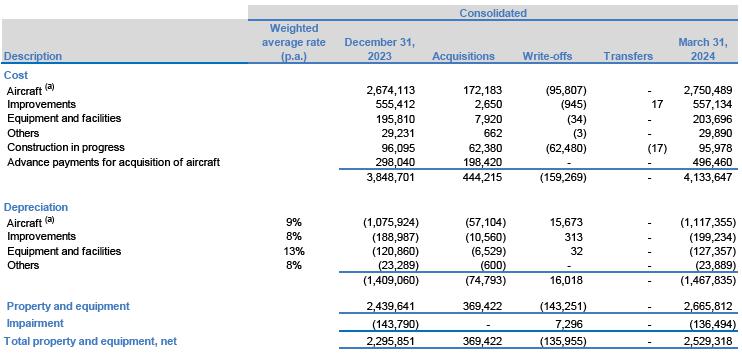

| 15. | PROPERTY AND EQUIPMENT |

(a)

Includes aircraft, engines, simulators and equipment flight.

During the three months ended March 31, 2024, the Company

carried out “sale and leaseback” transactions for an engine, where the revenue, net of sales costs, corresponds to a gain

of R$27,441 (R$0 on March 31 2023) and is recognized under the heading “Other costs of services provided”

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

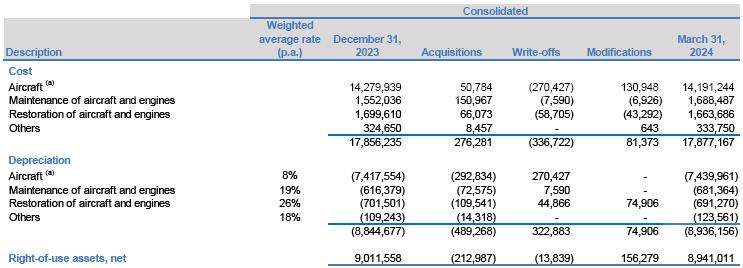

| (a) | Includes aircraft, engines and

simulators. |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

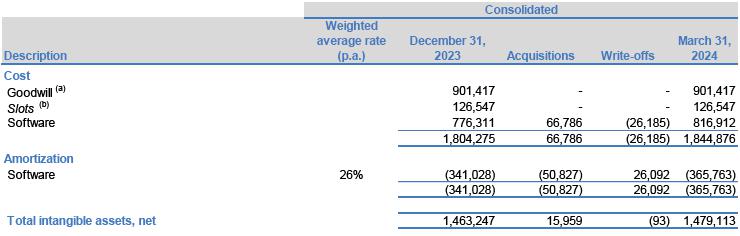

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

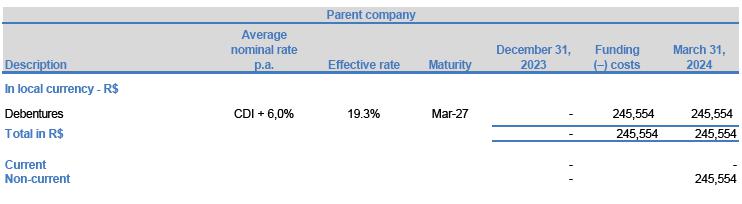

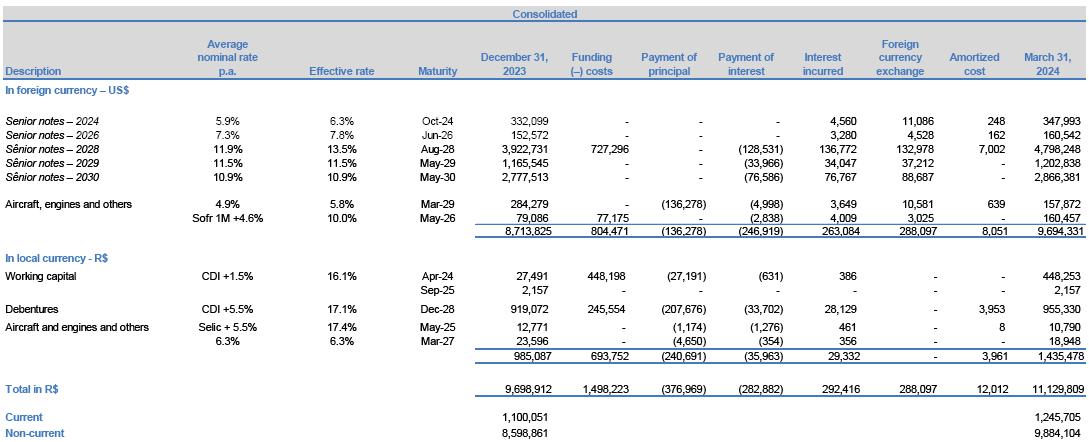

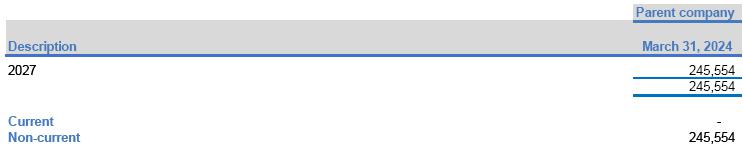

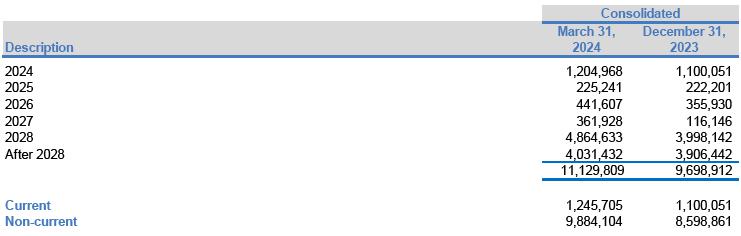

18.1

Schedule of amortization of debt

There was no comparative balance as of December 31,

2023.

18.2.1

Senior notes 2028

In February 2024, the subsidiary Azul Secured issued

additional notes in the principal amount of R$740,585 (equivalent to US$148,700), with funding costs of R$13,289. These notes were issued

to qualified institutional investors and there was no change in payment and interest conditions.

18.2.2

Aircraft and engines

In January 2024, the subsidiary Azul Finance financed

R$77,175, with interest of 4.6% p.a. plus the variation in the Secured Overnight Financing Rate (“SOFR”) and maturity in May

2026.

18.2.3

Working capital

In March 2024, the subsidiary ALAB raised R$450,000,

with funding costs of R$1,802, with interest equivalent to CDI+1.5% p.a. and single payment of interest and principal in the second quarter

of 2024.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

18.2.4

Debentures

In March 2024, the Board of Directors approved the

issuance of simple debentures not convertible into shares, of the type with real guarantee, with additional personal guarantee, in a single

series, in the total amount of R$250,000, with fundraising costs of R$4,446, with a nominal unit value of R$1, rate equivalent to CDI+6.0%

p.a., payment of quarterly interest from June 2024 and maturity in March 2027.

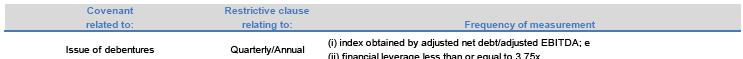

In the three months ended , the Company had restrictive

has measurement clauses (“covenants”) in one of its loan and financing contracts, as shown below.

The Company complied covenants.

19.

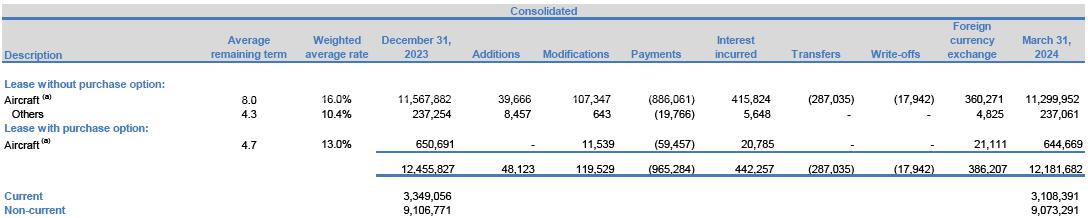

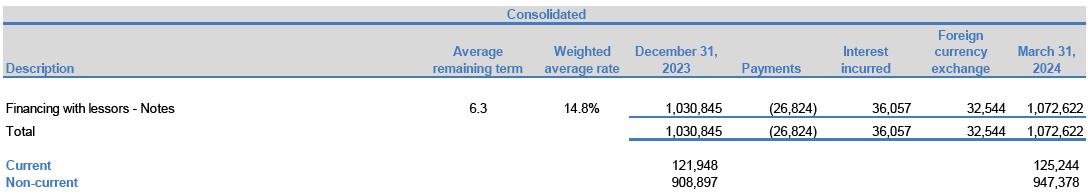

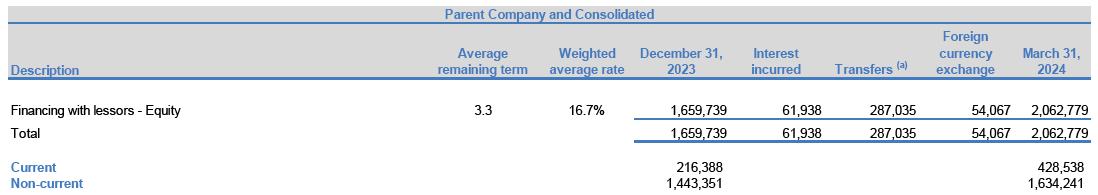

LEASES

In 2023, the Company defined the renegotiation conditions

and began to sign definitive agreements with the lessors, who agreed to receive negotiable debt securities maturing in 2030 (“Notes”)

and debt with the possibility of settlement in Azul preferred shares or cash, at the discretion of the Company (“Convertible to

equity”) in order to reflect the Company's new cash generation, its better capital structure and the reduction in its credit risk.

During the three months ended March 31, 2024, the Company

renegotiated 17 lease contracts under these conditions. In general, the conditions agreed between the Company and lessors are as follows:

| · | Convertible to equity: R$372,635

(equivalent to US$74,777) with consecutive quarterly payments, starting in January 2025. |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

(a)

Includes aircraft, engines and simulators.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

(a)

Transfer balances are classified as “Leases”.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

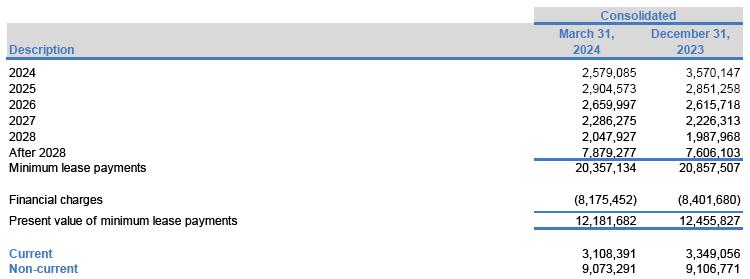

| 19.4 | Schedule of amortization of leases |

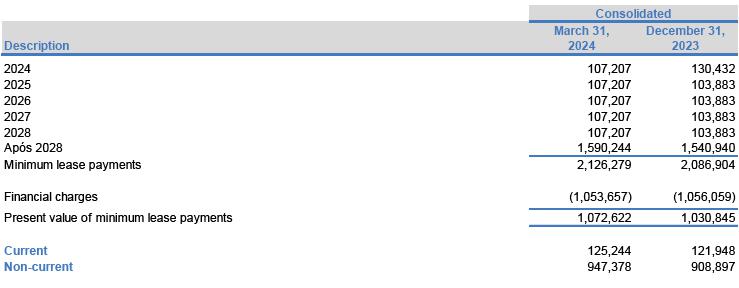

| 19.5Schedule | of amortization of leases

– Notes |

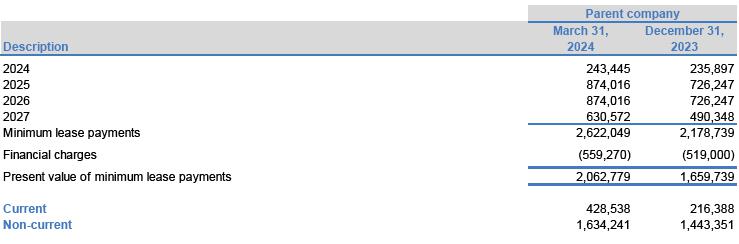

| 19.6Schedule | of amortization of leases

– Equity |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

The Company has restrictive clauses (“covenants”)

in some of its lease contracts, as disclosed in the financial statements for the year ended December 31, 2023.

These conditions will only be verified on December

31, 2024, therefore, the related debt remains classified in this interim condensed individual and consolidated financial statements in

accordance with the contractual flow originally established.

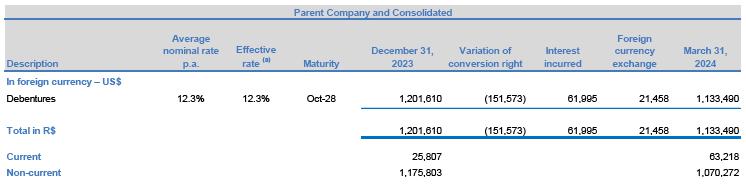

| 20. | CONVERTIBLE DEBT INSTRUMENTS |

| (a) | Does not consider the conversion

right. |

The balance includes the right to convert the debt

into Company shares in the amount of R$337,202 (R$488,775 as of December 31, 2023).

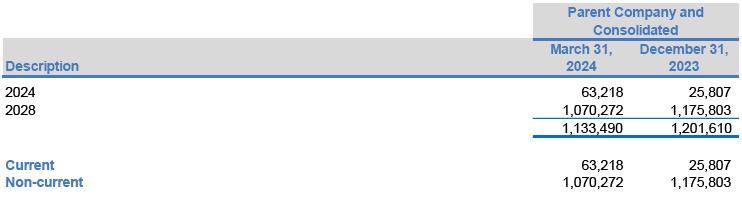

| 20.1 | Schedule of amortization |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

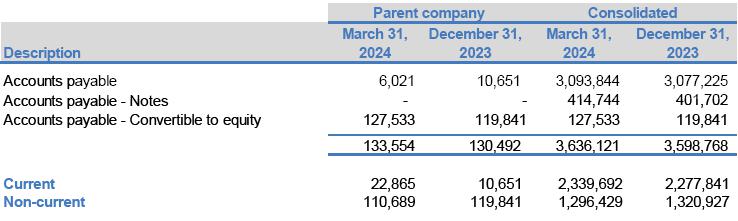

22.

REVERSE FACTORING

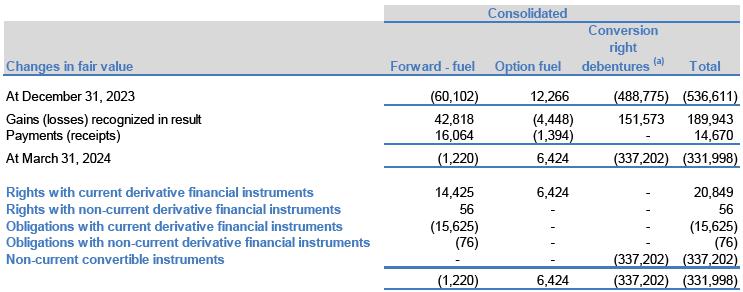

| 23. | DERIVATIVE FINANCIAL INSTRUMENTS |

| (a) | Balance recorded in the parent

company. |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

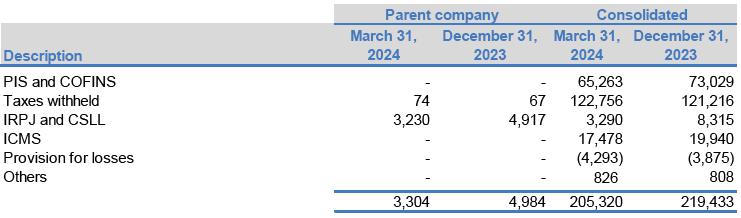

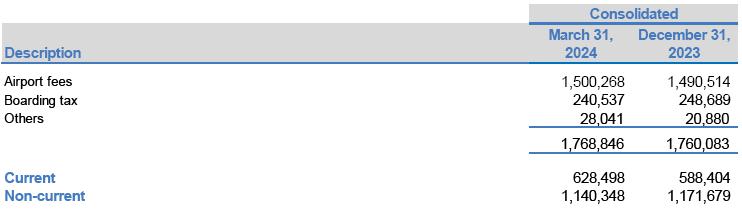

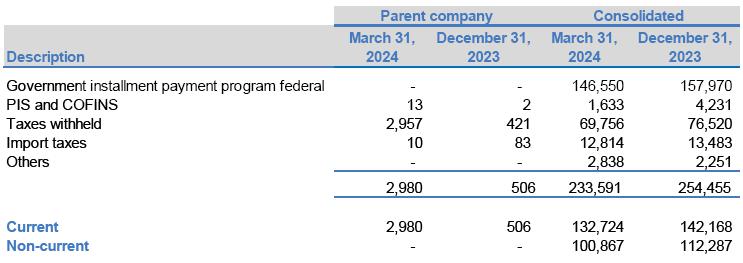

| 24. | AIRPORT TAXES AND FEES |

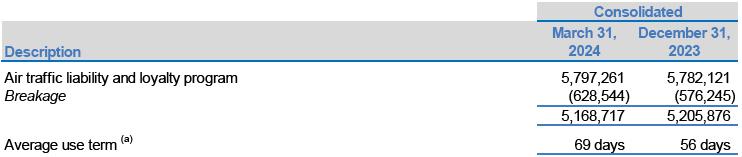

| 25. | AIR TRAFFIC LIABILITY AND LOYALTY PROGRAM |

(a)

Does not consider the loyalty program.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

28.1

Composition of provisions

(a)

Nominal discount rate 10.7% p.a. (10.7% p.a. as of December

31, 2023).

(b)

Considers provision for civil risks in the amount of R$25

in the parent company.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

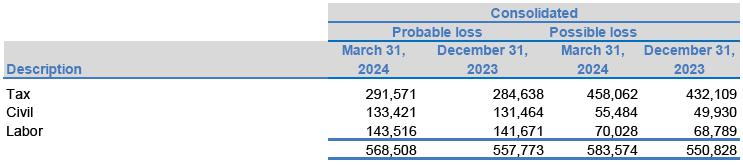

28.1.1 Tax,

civil, labor and other risks

The balances of the proceedings with estimates of probable

and possible losses are shown below:

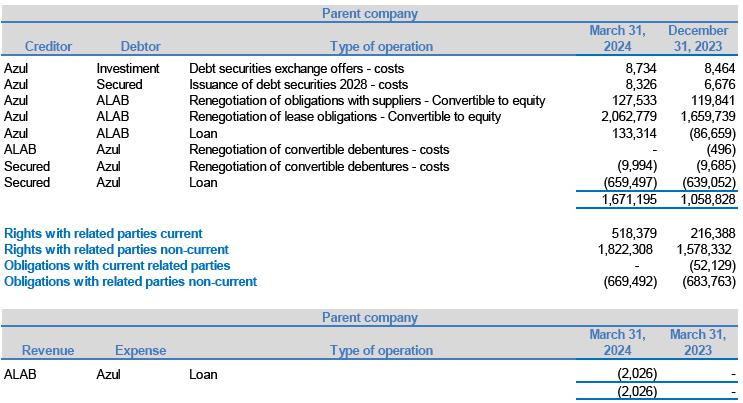

| 29. | RELATED-PARTY TRANSACTIONS |

| 29.1 | Transactions between companies |

Observing accounting standards, such transactions were

duly eliminated for consolidation purposes:

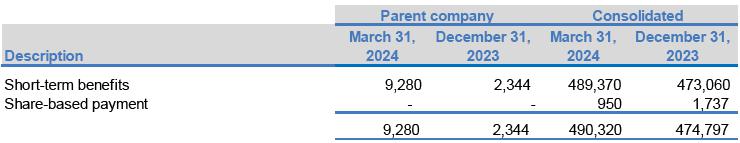

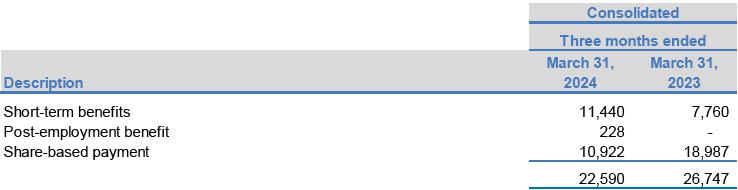

| 29.2 | Compensation of key management personnel |

The Company´s employees are entitled to profit

sharing based on certain goals agreed annually. In turn, executives are entitled to bonus based on statutory provisions proposed by the

Board of Directors and approved by the shareholders. The amount of profit sharing is recognized in profit or loss for the year in which

the goals are achieved.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

Key management personnel comprise the directors, officers

and members of the Executive Committee and directors. Expenses incurred with remuneration and the respective charges, paid or payable,

are shown below:

Stock-based compensation plan, considers the option

plan, RSU and phantom shares. Such plans are expected to be settled in up to eight years and, therefore, and does not represent a cash

outflow.

| 29.3 | Guarantees and pledges granted by the Parent Company |

The Company has granted guarantees on rental properties

for some of its executives and the total amount involved is not significant.

| 29.4 | Ticket sales contract |

On March, 2018, the Company entered into a ticket sales

contract with Caprioli Turismo Ltda., a travel agency owned by the Caprioli family (which holds an indirect stake in the Company through

TRIP former shareholders), whereby Caprioli Turismo Ltda. is granted a R$20 credit line for the purchase and resale of tickets for flights

operated by the Company. This credit line is guaranteed by a non-interest bearing promissory note in the same amount payable.

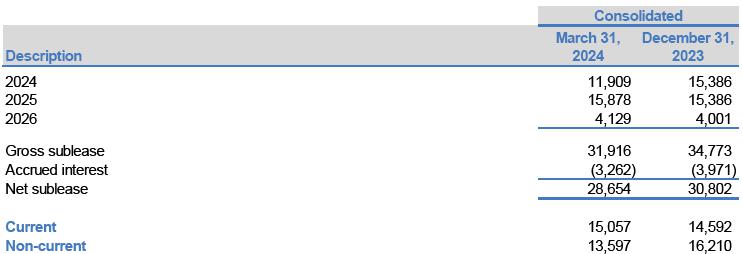

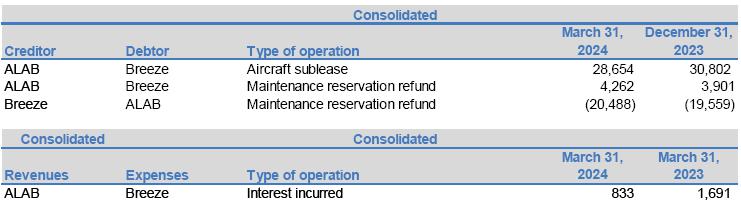

The Company signed sublease agreements with Breeze

Aviation Group (“Breeze”), an airline founded by the controlling shareholder of Azul, headquartered in the United States.

The transaction was voted and approved by 97% of the Azul's shareholders at the Extraordinary General Meeting held on March 2020. Following

good corporate practices, the controlling shareholder did not participate in the voting.

As of March 31, 2024, the operations with Breeze as

recorded the following balances:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

In August 2021, the Company announced plans to make

a strategic partnership with Lilium GmbH, a wholly owned subsidiary of Lilium N.V. (“Lilium), which has ultimately become a related

party as the Company’s Board of Directors’ Chairman was elected independent member of Lilium’s Board of Directors.

As of March 31, 2024, the Company has no outstanding

balances with Lilium.

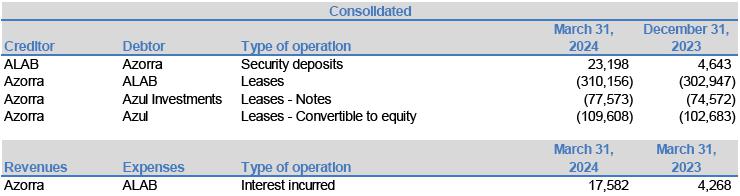

In August 2022, the Company made agreements for purchase

and sale of aircraft and engines with entities that are part of Azorra Aviation Holdings LLC. (“Azorra”), which has become

a related party as the Company’s Board of Directors’ Chairman was elected independent member of Azorra’s Board of Directors.

The transactions between the Company and the Azorra

group are shown below:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

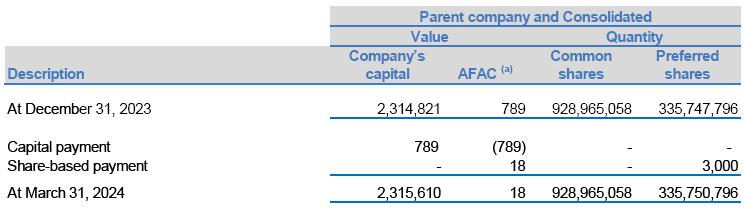

(a) Advance for future capital increase.

As established in the Company's bylaws, each common

share entitles you to 1 (one) vote. Preferred shares of any class do not confer voting rights, however, they provide their holders with

rights that were disclosed in detail in the financial statements for the year ended December 31, 2023.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

The Company's shareholding structure is presented below:

| (a) | This

refers to Trip Participações S.A., Trip Investimentos Ltda. and Rio Novo Locações Ltda. |

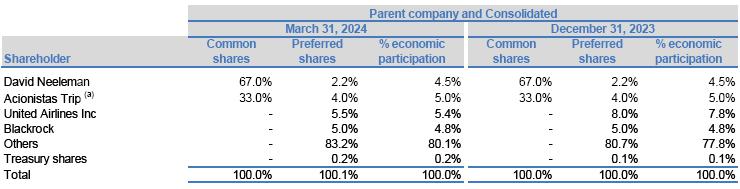

In November 2022, the buyback plan for 1,300,000 preferred

shares was approved, maturing in 18 months, in order to keep them in treasury to later meet the obligations of the RSU plan. Until March

31, 2024, within said plan, the Company reacquired 1,061,868 shares.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

31.

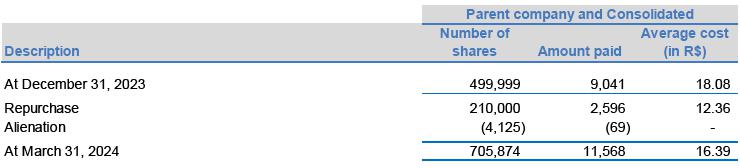

EARNINGS (LOSS) PER SHARE

| (a) | This refers to the participation

in the value of the Company's total equity, calculated as if all 928,965,058 common shares had been converted into 12,386,201 preferred

shares at the conversion ratio of 75 common shares for each preferred share. |

| (b) | This refers to the participation

in the value of the Company's total equity, calculated as if the weighted average of preferred shares had been converted into common shares

at the conversion ratio of 75 common shares for each one preferred share. |

The diluted result per share is calculated by adjusting

the weighted average number of shares in circulation, except those in treasury, for instruments potentially convertible into shares. However,

due to the losses recorded in the three months ended March 31, 2024 and 2023, these instruments issued by the Company have a non-dilutive

effect and, therefore, were not considered in the total number of shares in circulation to determine the diluted loss per share.

32.

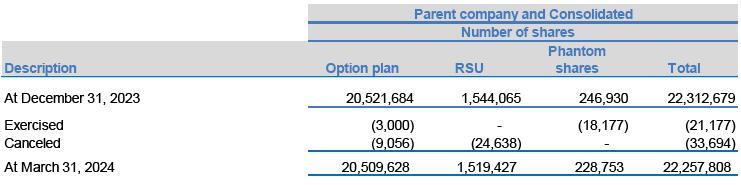

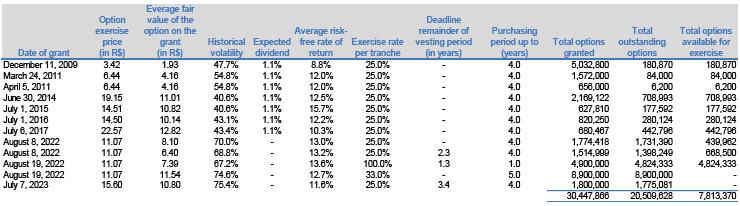

SHARE-BASED PAYMENT

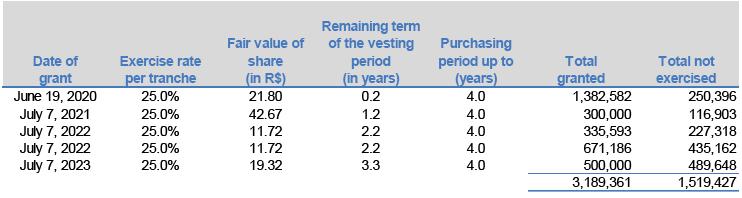

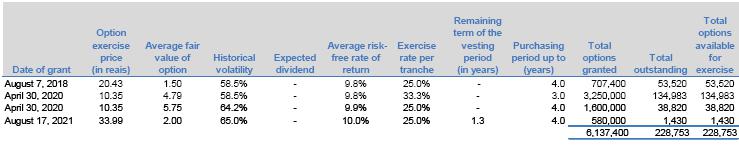

The conditions of the share-based grant plans were

disclosed in detail in the financial statements for the year ended December 31, 2023 and were not modified during the three months ended

March 31, 2024.

The movement of the plans is shown below:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

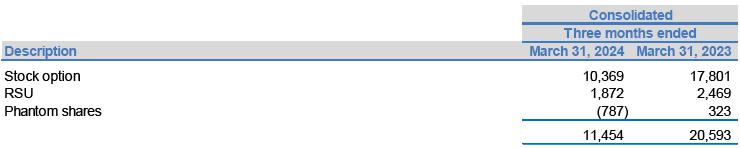

The expenses of share-based compensation plans are

shown below:

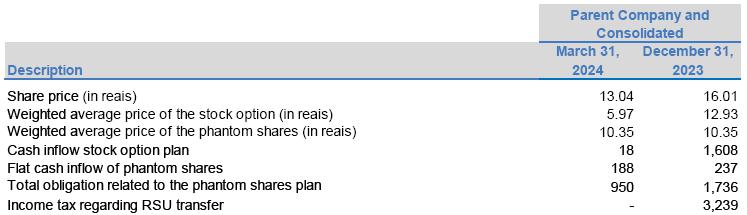

32.1.1 Stock

option plan

32.1.2 Restricted

stock option plan

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

32.1.3 Phantom

shares

33.

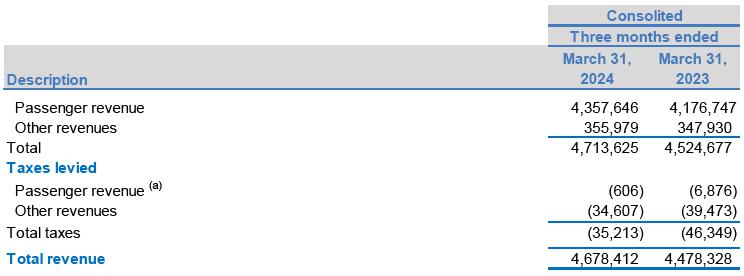

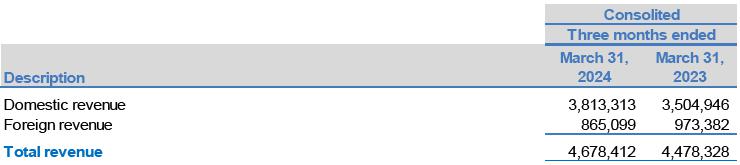

SALES REVENUE

| (a) | As of January 1, 2023, the PIS and COFINS rates on revenues

arising from regular passenger air transport activities were reduced to zero, in accordance with Law 14,592/2023. |

Revenues by geographical location are as follows:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

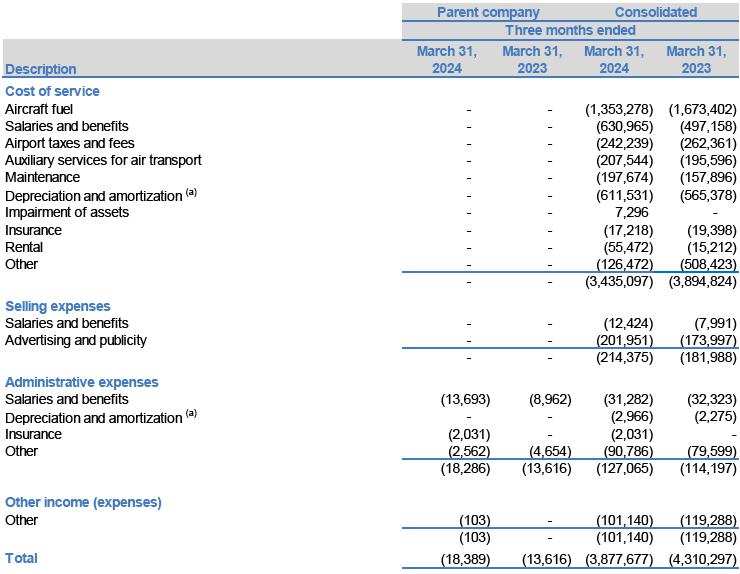

34.

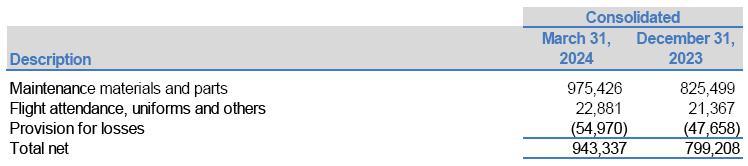

COSTS AND EXPENSES BY NATURE

(a)

Net of PIS and COFINS credits in the amount of R$391.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

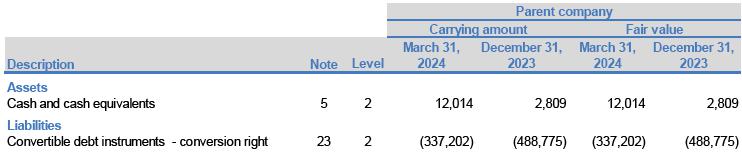

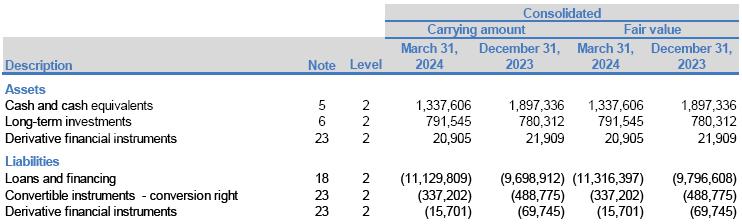

| 36.1 | Fair value hierarchy of financial instruments |

The fair value hierarchy of the Company's consolidated financial

instruments, as well as the comparison between book value and fair value, are identified below:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

Financial instruments whose fair value approximates

their carrying value, based on established conditions, mainly due to the short maturity period, of these assets and liabilities, were

not disclosed.

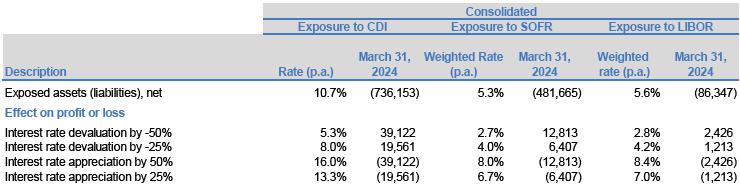

36.2.1 Interest

rate risk

36.2.1.1 Sensitivity

analysis

As of March 31, 2024, the Company held financial assets

and liabilities linked to various types of rates. In the sensitivity analysis of non-derivative financial instruments, the impact on annual

interest was only considered on positions with values exposed to such fluctuations:

Assets and liabilities linked to LIBOR are being reviewed

and will be updated using alternative published rates. The Company estimates that the updated cash flows will be economically equivalent

to the original ones.

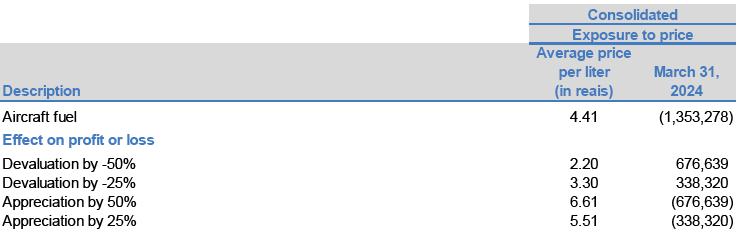

36.2.2 Aircraft

fuel price risk (“QAV”)

The price of fuel may vary depending on the volatility

of the price of crude oil and its derivatives. To mitigate losses linked to variations in the fuel market, the Company had, as of March

31, 2024, forward and options transactions on fuel (note 23).

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

36.2.2.1 Sensitivity

analysis

The following table demonstrates the sensitivity analysis

in US dollars of the price fluctuation of QAV liter:

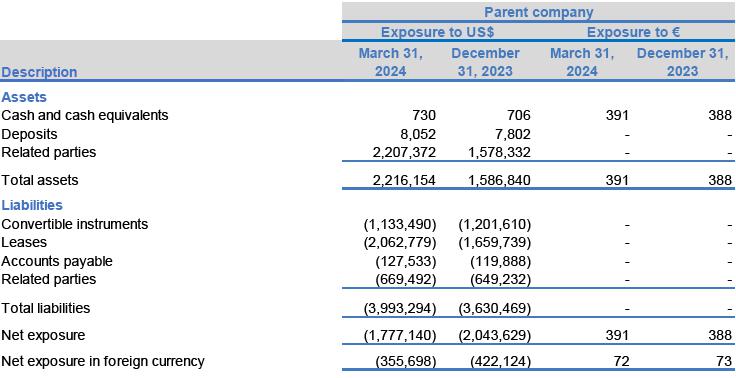

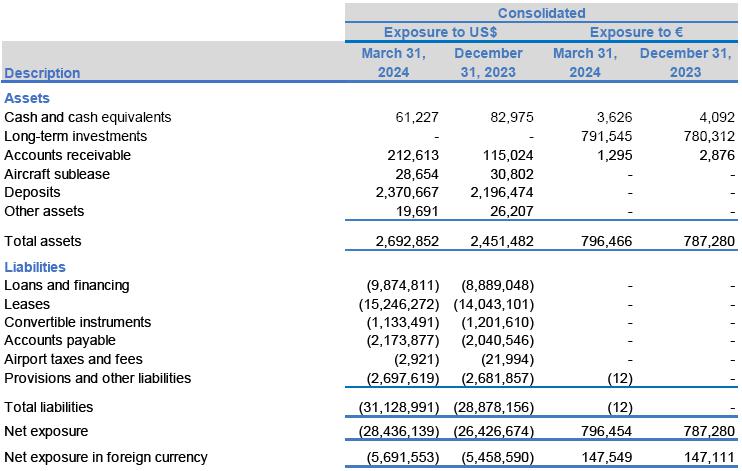

36.2.3 Foreign

exchange risk

The foreign exchange risk arises from the possibility

of unfavorable exchange differences to which the Company's cash flows are exposed.

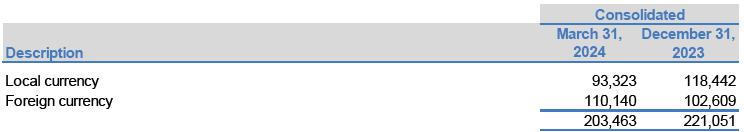

The equity exposure to the main variations in exchange

rates is shown below:

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

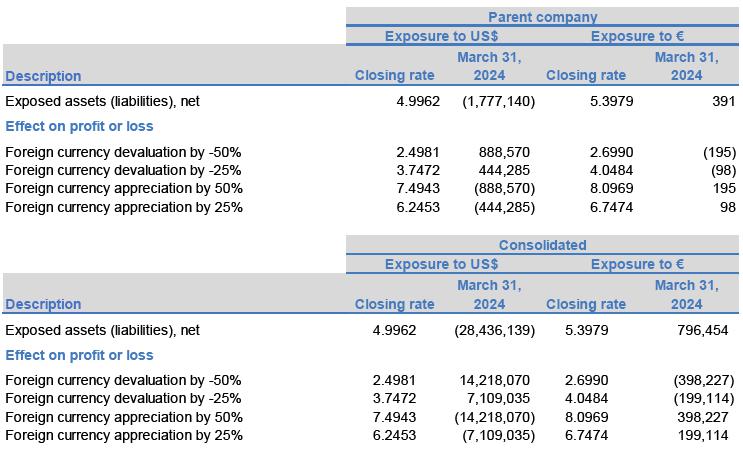

36.2.3.1 Sensitivity

analysis

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

Credit risk is inherent to the Company's operating

and financial activities, mainly disclosed in cash and cash equivalents, long-term investments, accounts receivable, aircraft sublease,

security deposits and maintenance reserves. Financial assets classified as cash and cash equivalents are deposited with counterparties

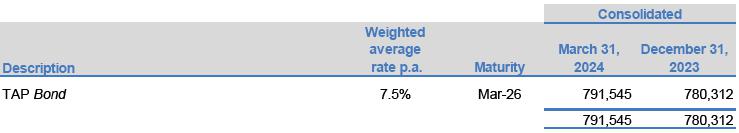

that have a minimum investment grade rating in the assessment made by agencies S&P Global Ratings, Moody's or Fitch. The TAP Bond

is guaranteed by intellectual property rights and credits related to the TAP mileage program.

Credit limits are established for all customers based

on internal classification criteria and the carrying amounts represent the maximum credit risk exposure. Outstanding receivables from

customers are frequently monitored by the Company and, when necessary, allowances for expected credit losses are recognized.

Derivative financial instruments are contracted on

the over-the-counter market (OTC) from counterparties with a minimum investment grade rating with the company, or on commodities and futures

exchanges (B3 and NYMEX), which substantially mitigates the credit risk. The Company assesses the risks of counterparties in financial

instruments and diversifies its exposure periodically.

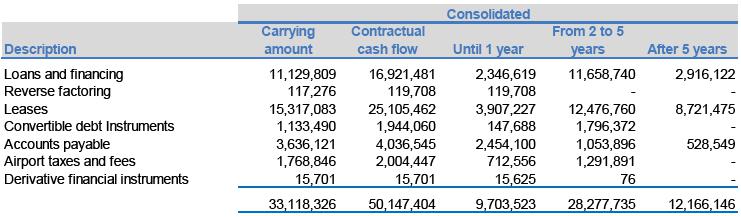

The maturity schedules of the Company’s consolidated

financial liabilities as of March 31, 2024 are as follows:

The Company seeks capital alternatives in order to

satisfy its operational needs, aiming for a capital structure that it considers adequate for the financial costs and the maturity terms

of the funding and its guarantees. The Company's Management continually monitors its net debt.

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements March 31, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated)

|

| | |

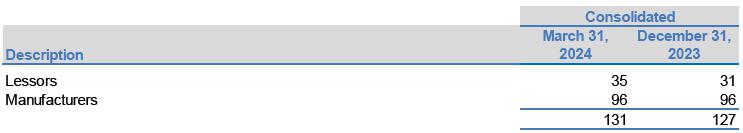

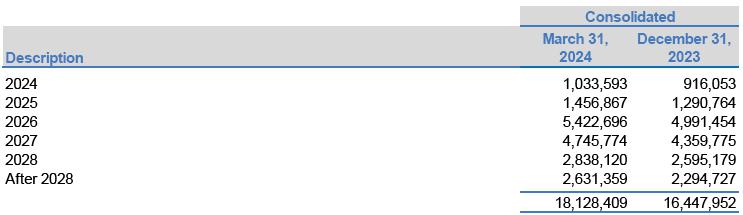

Through contracts with manufacturers and lessors, the

Company committed to acquiring certain aircraft, as follows:

The amounts shown below are brought to present value

using the weighted discount rate for lease operations, equivalent to 15.8% (15.8% on December 31, 2023) and do not necessarily represent

a cash outflow, as the Company is evaluating the acquisition of financing to meet these commitments.

The position of the letters of credit in use by the

Company follows, for the following purposes:

Elton Flavio Ribeiro

CRC 1SP 253891/O-0

Controllership, tax and internal control director

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 10, 2024

Azul S.A.

By: /s/ Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

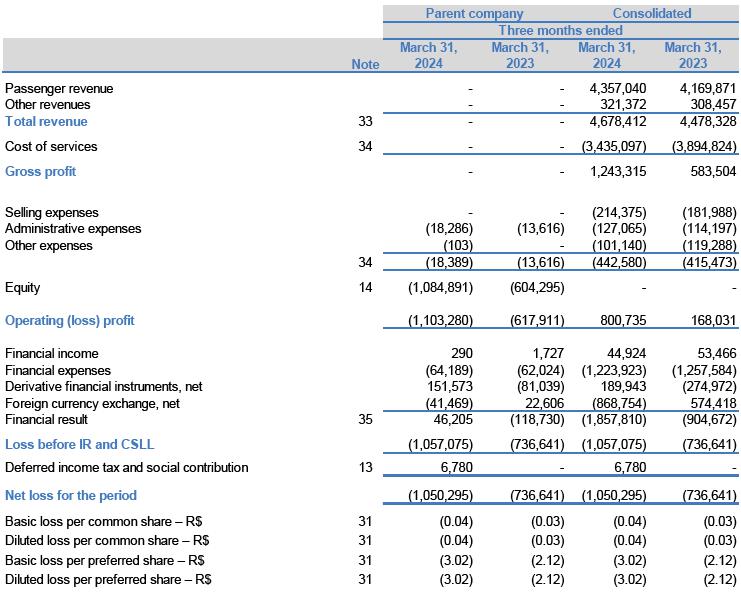

Azul (NYSE:AZUL)

Historical Stock Chart

From Apr 2024 to May 2024

Azul (NYSE:AZUL)

Historical Stock Chart

From May 2023 to May 2024