UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th Floor,

Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

On February 20, 2025, Azul S.A. (the “Company”)

announced that, at a meeting held on February 20, 2025, the board of directors of the Company approved, subject to the approval of the

change in the limit of its authorized capital at the Company’s extraordinary general meeting of shareholders to be held on of February

25, 2025 (the “EGM”), a capital increase of the Company (the “Capital Increase”), within the limit

of the authorized capital, under the proposed new wording of article 6 of the Company's bylaws submitted for approval at the EGM, through

the private subscription of new common shares and new preferred shares of the Company, as described in a notice to shareholders issued

on February 20, 2025 (the “Notice to Shareholders”). A copy of the Notice to Shareholders is attached hereto as Exhibit

99.1. Further details are also included in the material fact (fato relevante) issued by the Company on February 20, 2025 which

was furnished to the Securities and Exchange Commission on Form 6-K.

This communication is not and shall not constitute

offer to sell, or the solicitation of an offer to buy, any common shares, preferred shares or other securities of the Company. There will

be no offer or sale of securities in any jurisdiction in which such offer or sale would be unlawful. Any offer will only be made to the

persons and in the jurisdictions permitted by applicable law. The offering of any Securities has not been, and will not be, registered

under the Securities Act of 1933, as amended (the “Securities Act”). No Securities may be offered or sold absent registration

under the Securities Act or pursuant to an offer or sale under one or more exemptions from, or in a transaction not subject to, the registration

requirements of the Securities Act.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: February 21, 2025

Azul S.A.

By: /s/ Alexandre Wagner

Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

Azul S.A.

Publicly-Held

Company

CNPJ/MF No.

09.305.994/0001-29

NIRE 35.300.361.130

NOTICE

TO SHAREHOLDERS

In

compliance with article 33, XXXI, of Resolution No. 80 issued by the Brazilian Securities and Exchange Commission (the “CVM”

– Comissão de Valores Mobiliários) on March 29, 2022 (“RCVM 80”), Azul S.A. (“Azul”

or “Company”) hereby provides to its shareholders the information required under “Annex E” to RCVM 80 with

respect to the capital increase approved by the Company’s Board of Directors at a meeting held on February 20, 2025, subject

to the approval of the change in the limit of the authorized capital at the Extraordinary General Meeting of February 25, 2025 (“EGM”

and “Capital Increase”, respectively), as follows:

Art.

1. The issuer must disclose to the market the value of the increase and the new capital stock, and if the increase will be carried out

by:

I

– conversion of debentures or other debt securities into shares;

II

– exercise of subscription rights or subscription bonuses;

III

– capitalization of profits or reserves; or

IV

– subscription of new shares.

Subject

to the approval of the change within the limit of the authorized capital at the EGM, the Capital Increase

will be carried out within the capital authorized, under the new wording of article 6 of the Company’s Bylaws (Estatuto Social)

submitted to the EGM, through a private subscription of new common shares and new preferred shares,

to be issued in the current existing proportion, in the amount of at least BRL 72,000,000.00 (seventy-two million reais) (“Minimum

Subscription”) and at most BRL 3,370,258,632.00 (three billion three hundred and seventy million two hundred and fifty-eight

thousand six hundred and thirty-two reais) (“Maximum Subscription”), with the issuance of at least 1,200,000,000 (one

billion, two hundred million) new common shares (“Minimum Number”), and a maximum of 2,000,000,000 (two billion) new

common shares and 722,279,696 (seven hundred and twenty-two million, two hundred and seventy-nine thousand, six hundred and ninety-six)

new preferred shares (“Maximum Number”), all of which will be registered shares without par value (“New

Common Shares”, New Preferred Shares” and, collectively, “New Shares”).

The

New Shares will be paid up in local currency, and the subscribers may pay up the amount subscribed in installments. The subscribers that

wish to pay up the New Shares in installments must pay up at least 10% (ten percent) of the amount subscribed at the time of subscription, and the

excess amount must be paid in within 6 (six) months, according to capital calls to be disclosed by the Company, with a period of no less

than 30 (thirty) days, in accordance with article 106 of Law 6,404/1976. The subscribers that wish to (i) pay up the New Shares in installments

must do so before the Company's Bookkeeper; and (ii) pay up the New Shares in cash may do so directly at B3 S.A. – Brasil, Bolsa,

Balcão (“B3”) or before the Company's Bookkeeper.

As

a result of the Capital Increase, the Company’s share capital will increase from BRL 2,315,627,892.68, (two billion, three

hundred and fifteen million, six hundred and twenty-seven thousand, eight hundred and ninety-two reais and sixty-eight cents) divided

into 1,264,715,854 (one billion, two hundred and sixty-four million, seven hundred and fifteen thousand, eight hundred and fifty-four)

shares, all registered and without par value, of which 928,965,058 (nine hundred and twenty-eight million, nine hundred and sixty-five

thousand and fifty-eight) are common shares and 335,750,796 (three hundred and thirty-five million, seven hundred and fifty thousand,

seven hundred and ninety-six) are preferred shares to, (i) based on the Minimum Subscription, BRL 2,387,627,892.68 (two billion

three hundred and eighty-seven million six hundred and twenty-seven thousand eight hundred and ninety-two reais and sixty-eight cents),

divided into 2,464,715,854 (two billion four hundred and sixty-four million seven hundred and fifteen thousand eight hundred and fifty-four)

shares, all registered and without par value, of which 2,128,965,058 (two billion one hundred and twenty-eight million nine hundred and

sixty-five thousand and fifty-eight) will be common shares and 335,750,796 (three hundred and thirty-five million, seven hundred and fifty

thousand, seven hundred and ninety-six) will be preferred shares; and (ii) based on the Maximum Subscription, BRL 5,685,886,524.68 (five

billion six hundred and eighty-five million eight hundred and eighty-six thousand five hundred and twenty-four reais and sixty-eight cents),

divided into 3,986,995,550 (three billion nine hundred and eighty-six million nine hundred and ninety-five thousand five hundred and fifty)

shares, all registered and without par value, of which 2,928,965,058 (two billion nine hundred and twenty-eight million nine hundred and

sixty-five thousand fifty-eight) will be common shares and 1,058,030,492 (one billion fifty-eight million thirty thousand four hundred

and ninety-two) will be preferred shares.

The

Company informs that the amounts described above are subject to change, considering that the capital increase, approved by the Board of

Directors on February 4, 2025, is being made, within the limit of the authorized capital provided for in article 6 of the Bylaws, in the

amount of, at least, BRL 1,509,287,753.48 (one billion, five hundred and nine million, two hundred and eighty-seven thousand, seven hundred

and fifty-three reais and forty-eight centavos) and, at most, BRL 6,132,392,670.01 (six billion, one hundred and thirty-two million, three

hundred and ninety-two thousand, six hundred and seventy reais and one centavo), with the issue of, at least, 47,033,273 (forty-seven

million, thirty-three thousand, two hundred and seventy-three) new preferred shares, and, at most, 191,101,066 (one hundred and ninety-one

million, one hundred and one thousand and sixty-six) new preferred shares, all of which are

registered and without par value (“Capital Increase – Lessors/OEMs”).

Sole

paragraph. The issuer must also:

I

– explain, in detail, the reasons for the increase and its legal and economic consequences; It is

II

– provide a copy of the fiscal council’s opinion, if applicable.

The

Capital Increase is part of the restructuring of the Company's indebtedness, object of the Material Facts disclosed by the Company on

October 07 and 28, November 14, December 9 and 18, 2024, January 08, 16, 22 and 28, and February 4, 2025, which aims to restructure the

Company's principal indebtedness, lease obligations and other obligations, in order to strengthen the Company's cash generation and improve

its future capital structure (“Restructuring”).

The

Restructuring process involves equitization of part of the Company’s obligations (i) with lessors and original equipment manufacturers

(“Lessors/OEM”), under the terms of the Capital Increase – Lessors/OEMs; and (ii) with other creditors, through

the issue of new preferred shares issued by the Company, under the terms set forth in the documents entered into by the Company within

the scope of the Restructuring, notably:

| (i) | the preferred shares issued or issuable pursuant to Azul's first issue of convertible

debentures (originally issued on October 26, 2020, as amended from time to time), including any additional convertible debentures or exchangeable

securities issued or guaranteed by Azul, for the purpose of representing an additional 6.5% of the principal amount of such convertible

debentures; |

| (ii) | the preferred shares issued or issuable in mandatory exchange of 11,500% of Senior

Secured Second Out Notes due 2029 and 10,875% of Senior Secured Second Out Notes due 2030, in both cases issued by Azul Secured Finance

LLP and guaranteed by Azul S.A. and certain of its subsidiaries, issued on January 28, 2025 (the “2L Notes”); |

| (iii) | the issued or issuable preferred shares upon the optional or mandatory exercise

of the second out exchangeable notes to be issued by Azul Secured Finance LLP and guaranteed by Azul S.A. and certain of its subsidiaries,

which are either (a) issued in mandatory exchange for the 2L Notes or (b) issued in a maximum aggregate principal amount of USD 25 million

to an aircraft lessor; and |

| (iv) | the preferred shares issued or issuable upon the exercise of the first out exchangeable

notes to be issued by Azul Secured Finance LLP and guaranteed by Azul S.A. and certain of its subsidiaries in mandatory exchange for 11,930%

of Senior Secured First Out Notes due 2028, issued by Azul Secured Finance LLP and guaranteed by Azul S.A.

and certain of its subsidiaries, issued on January 28, 2025. |

The

measures agreed under the Restructuring also involve a long-term incentive for managers and other employees to be selected by the Board

of Directors, in the form of a Stock Option Plan submitted to the approval of the EGM, in the context of which a maximum number of 250,000,000

(two hundred and fifty million) new preferred shares issued by the Company will be issued, over several years and depending on certain

conditions.

Considering

the issue of preferred shares within the scope of the Restructuring, the Capital Increase is measured not only to obtain new financial

resources for the Company, contributing to improve its future capital structure and to increase the Company's liquidity with the funds

from the payment of the Capital Increase, but also seeks to maintain the Company's qualification to the limit of 50% of preferred shares

with restricted vote issued, provided for in article 15, paragraph 2 of Law No. 6.404/1976, considering that part of the credits held

by the Company's creditors will be converted into preferred shares due to the operations involved in the Restructuring, described above.

The Capital Increase will be supported by the Company's controlling shareholders, who will subscribe for New Shares in the context of

the Capital Increase.

Within

the scope of the Capital Increase, the preemptive right of the current holders of common and preferred shares issued by the Company will

be ensured in the subscription of, respectively, the New Preferred Shares and the New Common Shares to be issued, in proportion to their

holdings in the Company at close of trading on February 25, 2025 (“Cut-Off Date”). The preemptive right may be exercised

within the period of 30 calendar days from February 26, 2025 (inclusive) to March 27, 2025

(inclusive) (“Preemptive Right Exercise Period” and “Preemptive Right”, respectively).

Shares in the Company will be traded ex preemptive right from February 26, 2025 (inclusive).

It

should be remembered that the Preemptive Right is guaranteed only with respect to the shares issued by the Company held on the Cut-Off

Date, so that any subscription rights related to the Capital Increase – Lessors/OEMs will not grant their holders the right to subscribe

for the New Shares issued in this Capital Increase, even if such subscription rights have already been exercised.

Given

that the New Shares will be issued in compliance with the proportion of common shares and preferred shares issued by the Company, pursuant

to art. 171, paragraph 1, ‘a’ of Law No. 6,404/1976, each shareholder shall exercise the Preemptive Right over shares identical

to those held on the Cut-Off Date.

Since

the Company’s current common and preferred shareholders will have Preemptive Right to subscribe for, respectively, New Common Shares

and New Preferred Shares, there will be no dilution of shareholders

who exercise their Preemptive Right to take up all the New Shares to which they are entitled. Dilution will occur only if shareholders

choose not to exercise their Preemptive Right, or to exercise them in part.

In

accordance article 170, paragraph 1 of Law 6.404/1976, the issue price of the New Common Shares and New Preferred Shares was uniformly

fixed, without unjustified dilution for the current shareholders, taking into consideration, among other factors, (i) the Company's future

profitability forecast, which, at the management's discretion, may be positively impacted by the implementation of the ongoing Restructuring

measures described above and the potential future financial performance of the Company; and (ii) the market value of the preferred shares

issued by the Company traded on B3 (considering

that the preferred shares are listed on B3 and publicly traded with liquidity and that the common shares are not listed or publicly traded),

with a premium to reflect the valuation perspective under item (i).

Thus,

(i) the issue price of the New Preferred Shares was fixed based on the Company's future profitability perspective, considering the effects

of the Restructuring and the potential future financial performance of the Company, and the volume-weighted average price (VWAP) of the

preferred shares issued by the Company in the 30 trading sessions on B3, held in the period from January 9, 2025 to February 19, 2025,

applying a premium of approximately 7%, according to art. 170, Paragraph 1, I and III of Law No. 6,404/1976; and (ii) considering that

the common shares are not listed on the B3 and in order to reflect the difference in the economic benefit attributed to the common shares

and the preferred shares, provided for in article 5, §12(i) of the Company's Bylaws, the issue price of the New Common Shares is

fixed based on the issue price of the new preferred shares, pursuant to item (i) above, divided by 75 (seventy-five). The difference between

the issue price of the New Common Shares and New Preferred Shares arises exclusively from the ratio of 1:75 corresponding to the economic

benefit attributed by the Bylaws to the preferred shares, with the issue prices having been defined based on the same criteria, with no

difference between them.

The

New Shares will be paid up in local currency, and the subscribers may pay up the amount subscribed in installments. The subscribers that

wish to pay up the New Shares in installments must pay up at least 10% (ten percent) of the amount subscribed at the time of subscription,

and the excess amount must be paid in within 6 (six) months, according to capital calls to be disclosed by the Company, with a period

of no less than 30 (thirty) days, in accordance with article 106 of Law 6,404/1976. The subscribers that wish to (i) pay up the New Shares

in installments must do so before the Company's Bookkeeper; and (ii) pay up the New Shares in cash may do so directly at B3 or before

the Company's Bookkeeper.

As no

Fiscal Council has been installed, there is no opinion by the audit committee on the Capital Increase.

Art.

2 In case of capital increase through subscription of shares, the issuer must:

I

– describe the allocation of resources;

The

funds obtained by the Company as a result of the exercise of the Preemptive Right by the holders of Azul's common and preferred shares

will be used to strengthen the Company's financial condition, and will be used for general corporate purposes in the ordinary course of

the Company's business.

II

– inform the number of shares issued of each type and class;

In

the Capital Increase, 1,200,000,000 (one billion, two hundred million) of new common shares will be issued, in the case of the Minimum

Subscription, and 2,000,000,000 (two billion) of new common shares and 722,279,696 (seven hundred and twenty-two million, two hundred

and seventy-nine thousand, six hundred and ninety-six) new preferred shares, in the case of the Maximum Subscription.

III

– describe the rights, advantages and restrictions attributed to the shares to be issued;

The

New Shares will be identical, and will be entitled to the same rights and advantages conferred by outstanding shares in the Company, as

provided for in its Bylaws, including the right to dividends in any distribution of dividends declared by the Company after ratification

of the Capital Increase by the Board of Directors and the issue of the New Shares.

IV

– inform whether related parties, as defined by the accounting rules that deal with this matter, will subscribe shares in the capital

increase, specifying the respective amounts, when these amounts are already known;

David

Gary Neeleman, considering the Minimum Subscription, will subscribe for New Common Shares in sufficient number to maintain the Company's

classification within the limit of 50% of preferred shares with restricted vote issued, provided for in article 15, paragraph 2 of Law

No. 6,404/1976, considering the Company's current estimates of preferred share issues to be carried out within the scope of the Restructuring.

In

addition, Trip Participações S.A., Trip Investimentos Ltda. and Rio Novo Locações Ltda, the Company's controlling

shareholders, and the members of Azul’s management who hold common and/or preferred shares in the Company on the Cut-Off Date may

subscribe for New Shares by exercising their Preemptive Right.

V

– inform the issue price of the new shares;

The

issue price is BRL 0.06 per common share and BRL 4.50 per preferred share.

VI

– inform the nominal value of the shares issued or, in the case of shares with no nominal value, the portion of the issue price

that will be allocated to the capital reserve;

The

New Shares will have no par value and the amount of the Capital Increase will be fully allocated to the share capital account. No amount

will be allocated to the capital reserve.

VII

- provide the administrators’ opinion on the effects of the capital increase, especially with regard to the dilution caused by the

increase;

The

Capital Increase is part of the Company’s Restructuring, and seeks not only to obtain financial funds for the Company, contributing

to improve its future capital structure and to increase the Company's liquidity with the funds from the payment of the Capital Increase,

as well as to maintain the Company's classification to the limit of 50% of preferred shares with restricted vote issued, provided for

in article 15, paragraph 2 of Law No. 6,404/1976, considering that part of the credits held by the Company's creditors will be converted

into preferred shares due to the operations involved in the ongoing Restructuring, described above. The Capital Increase will be supported

by the Company's controlling shareholders, who will subscribe for New Shares in the context of the Capital Increase.

Since

the Company’s current common and preferred shareholders will have Preemptive Right to subscribe for, respectively, New Common Shares

and New Preferred Shares, there will be no dilution of shareholders who exercise their Preemptive Right over all the New Shares to which

they are entitled. Only shareholders who choose not to exercise their Preemptive Right or to exercise it partially will have their stake

diluted.

VIII

– inform the criteria for calculating the issue price and justify, in detail, the economic aspects that determined its choice;

In

accordance article 170, paragraph 1 of Law 6.404/1976, the issue price for the New Common Shares and New Preferred Shares was uniformly

fixed, without unjustified dilution for the current shareholders, taking into consideration, among other factors, (i) the Company's future

profitability perspective, which, at the management's discretion, may be positively impacted by the implementation of the ongoing Restructuring

measures described above and the potential future financial performance of the Company; and (ii) the market value of the preferred shares

issued by the Company traded on B3 (considering that the preferred shares are listed on B3 and publicly traded with liquidity and that

the common shares are not listed or publicly traded), with a premium to reflect the valuation perspective under item (i).

Thus,

(i) the issue price of the New Preferred Shares was fixed based on the Company's future profitability perspective, considering the effects

of the Restructuring and the potential future financial performance of the Company, and the volume-weighted average price (VWAP) of the

preferred shares issued by the Company in the 30 trading sessions on B3, held in the period from January 9, 2025 to February 19, 2025,

applying a premium of approximately 7%, according to art. 170, Paragraph 1, I and III of Law No. 6,404/1976; and (ii) considering that

the common shares are not listed on the B3 and in order to reflect the difference in the economic benefit attributed to the common shares

and the preferred shares, provided for in article 5, paragraph 12(i) of the Company's Bylaws, the issue price of the New Common Shares

is fixed based on the issue price of the new preferred shares, pursuant to item (i) above, divided by 75 (seventy-five). As clarified,

the difference between the issue price of the New Common Shares and New Preferred Shares arises exclusively from the ratio of 1:75 corresponding

to the economic benefit attributed by the Bylaws to the preferred shares, with the issue prices having been defined based on the same

criteria, with no difference between them.

IX

- if the issue price was set at a premium or discount in relation to the market value, identify the reason for the premium or discount

and explain how it was determined;

The

issue price of the New Shares was not determined on the premium of approximately 7% with respect to the volume-weighted average

price (VWAP) of preferred shares issued by the Company in the 30 trading sessions on B3, held in the period

from January 9, 2025 to February 19, 2025, since the Company understands that the premium contributes to reflect the Company's future

profitability perspective, the potential future financial performance of the Company and the potential

increase in liquidity of the preferred shares issued by the Company, which, at the management’s discretion, may be positively impacted

by the implementation of the ongoing Restructuring measures.

X

– provide a copy of all reports and studies that supported the fixing of the issue price;

Not

applicable, considering that no reports were drawn up to fix the issue price of the New Shares.

XII

– inform the issue prices of shares in capital increases carried out in the last 3 (three) years;

| · | February 22, 2022 - 35,050 (thirty-five thousand and fifty) preferred shares were issued at an

issue price of BRL 3.42 (three reais and forty two cents) per share, as fixed in accordance with the First Program under the First Stock

Option Plan (Primeiro Programa do Primeiro Plano de Outorga de Opção de Compra de Ações). |

| · | May 5, 2022 - (i) 4,500 (four thousand and five hundred) preferred shares were issued at

an issue price of BRL 3.42 (three reais and forty two cents) per share, fixed in accordance with the First Program under the First Stock

Option Plan; (ii) 10,914 (ten thousand, nine hundred and fourteen) preferred shares, at an issue price of BRL 15.16 (fifteen reais

and sixteen cents) per share, fixed in accordance with the First Program under the Second Stock Option Plan; (iii) 10,691 (ten

thousand, six hundred and ninety-one) preferred shares, at an issue price of BRL 17.27 (seventeen reais and twenty-seven cents) per share,

fixed in accordance with the Second Program under the Second Stock Option Plan; (iv) 18,041 (eighteen thousand and forty-one) preferred

shares, at an issue price of BRL 19.37 (nineteen reais and thirty-seven cents) per share, fixed in accordance with the Third Program under

the Second Stock Option Plan; and (v) 1,868,702 (one million, eight hundred and sixty-eight thousand, seven hundred and two) preferred

shares, at an issue price of BRL 11.85 (eleven and eighty-five hundredths Brazilian reais) per share, fixed in accordance with the First

Program under the Third Stock Option Plan. |

| · | August 8, 2022 - 20,000 (twenty Thousand) new preferred shares were issued at an issue price of

BRL 3.42 (three reais and forty two cents) per share, fixed in accordance with the First Program under the First Stock Option Plan. |

| · | November 7, 2022 - 5,050 (five thousand and fifty) new preferred shares were issued at an issue

price of BRL 3.42 (three reais and forty-two cents) per share, fixed in accordance with the First Program under the First Stock Option

Plan. |

| · | March 6, 2023 - 5,500 (five thousand and Fifty) new preferred shares were issued at an issue price

of BRL 11.07 (eleven reais and seven cents) per share, fixed in accordance with the Sixth Program under the Second Stock Option Plan. |

| · | August 10, 2023 - 74,000 (seventy four thousand) new preferred shares were issued at an issue price

of BRL 11.07 (eleven reais and seven cents) per share, fixed in accordance with the Sixth Program under the Second Stock Option Plan. |

| · | February 9, 2024 - 500 (five hundred) preferred shares at an issue price of BRL 6.44 (six reais

and forty four cents) per share, fixed in accordance with the Third Program under the First Stock Option Plan; (ii) 250 (two hundred and

fifty) preferred shares at an issue price of BRL 11.07 (eleven reais and seven cents) per share, fixed in accordance with the Sixth Program

under the Second Stock Option Plan; (iii) 800 (eight hundred) preferred shares at an issue price of BRL 6.44 (six reais and forty four

cents) per share, fixed in accordance with the First Stock Option Plan; (iv) 31,020 (thirty-one thousand and twenty) preferred shares

at an issue price of BRL 15.16 (fifteen reais and sixteen cents) per share, fixed in accordance with the First Program under the Second

Stock Option Plan; and (v) 17,818 (seventeen thousand, eight hundred and eighteen) preferred shares at an issue price of BRL 17.27 (seventeen

reais and twenty-seven cents) per share, fixed in accordance with the Second Program under the Second Stock Option Plan. |

| · | May 10, 2024 - 2,000 (two thousand) preferred shares at an issue price of BRL 3.42 (three reais

and forty two cents) per share, fixed in accordance with the First Program under the First Stock Option Plan; and (ii) 1,000 (one thousand)

preferred shares at an issue price of BRL 11.07 (eleven reais and seven cents) per share, fixed in accordance with the Sixth Program under

the Second Stock Option Plan. |

| · | February 4, 2025 – For purposes of clarification, the Company informs that a capital increase

was approved and it is still being made, within the limit of the authorized capital provided for in article 6 of the Bylaws, in the amount

of, at least, BRL 1,509,287,753.48 (one billion, five hundred and nine million, two hundred and eighty-seven thousand, seven hundred and

fifty-three reais and forty-eight centavos) and, at most, BRL 6,132,392,670.01 (six billion, one hundred and thirty-two million, three

hundred and ninety-two thousand, six hundred and seventy reais and one centavo), with the issue of, at least, 47,033,273 (forty-seven

million, thirty-three thousand, two hundred and seventy-three) new preferred shares, and, at most, 191,101,066 (one hundred and ninety-one

million, one hundred and one thousand and sixty-six) new preferred shares, all of which are registered and without par value, for the

issue price of BRL 32.0897878718 per preferred share, fixed based on negotiations between Lessors/OEMs and the Company, as independent

and not bound parties, with different interests, taking into consideration, among other aspects, the criteria set in items I and II of

article 170, paragraph 1 of Law No. 6,404/1976. |

XIII

– present the percentage of potential dilution resulting from the issue;

If

the shareholders choose not to exercise their Preemptive Right to subscribe for New Shares, their maximum dilution per shareholder will

be 68% (sixty-eight percent), based on the Maximum Subscription, and 49% (forty-nine percent), based

on the Minimum Subscription.

XIV

– inform the deadlines, conditions and form of subscription and payment of shares issued;

The

New Shares will be paid up in local currency, and the subscribers may pay up the amount subscribed in installments. The subscribers that

wish to pay up the New Shares in installments must pay up at least 10% (ten percent) of the amount subscribed at the time of subscription,

and the excess amount must be paid in within 6 (six) months, according to capital calls to be disclosed by the Company, with a period

of no less than 30 (thirty) days, in accordance with article 106 of Law 6,404/1976. The subscribers that wish to (i) pay up the

New Shares in installments must do so before the Company's Bookkeeper; and (ii) pay up the New Shares in cash may do so directly at B3

or before the Company's Bookkeeper. The investors with subscription rights deposited at B3's Central Depository and who choose to subscribe

in installments must contact their respective custodial agents and

request the withdrawal of the rights to the book-entry environment and will be subject to the rules and procedures of the Bookkeeper.

The

holders of common and preferred shares issued by the Company may exercise their respective Preemptive Right to subscribe for the New Shares

during the Preemptive Right Exercise Period, beginning on February 26, 2025 (inclusive) and ending on March 27, 2025 (inclusive).

The

shareholders may exercise their Preemptive Right in the proportion of: 2.1529335068 New Common Shares for each common share issued by

the Company held by the shareholder at the close of trading on the Cut-Off Date and (ii) 2.1529335058 New Preferred Shares for each preferred

share issued by the Company held by the shareholder at the close of trading on the Cut-Off Date.

The

New Shares that are paid up in cash, in local currency, at the time of subscription, must comply with the rules and procedures of Itaú

Corretora de Valores S.A., as the institution responsible for the bookkeeping of the shares issued by the Company (“Bookkeeper”),

and of the Central Asset Depositary (Central Depositária de Ativos) of B3 (“Central Depositary”). The

New Shares that are paid in installments will only be paid up before the Bookkeeper, and must comply with the Bookkeeper's own rules and

procedures. The same payment procedure will apply to the allocation of unsubscribed shares, as described below.

The

holders of Preemptive Right arising from shares held in custody at the Central Depositary who wish to exercise those rights must do so

through their custodial agents, in accordance with the rules established by the Central Depositary. The holders of subscription rights

held in custody at the Bookkeeper who wish to exercise their Preemptive Right to subscribe for New Shares must, within the Preemptive

Right Exercise Period, go to any branch of the Bookkeeper in Brazil. The preemptive right must be exercised by signing the subscription

form, in accordance with the model to be made available by the Bookkeeper, and submitting the documentation listed below, which must be

presented by the shareholder (or assignee of the pre-emptive right) for the exercise of their Preemptive Right directly to the Bookkeeper.

Shareholders

who choose not to exercise some or all of their Preemptive Right to subscribe for the New Shares may assign those rights, in whole or

in part, to third parties during the Preemptive Right Exercise Period. Shareholders holding shares issued by the Company in the custody

of the Bookkeeper who wish to privately assign their Preemptive Right must fill in the specific form that will be available at any branch

of the Bookkeeper. The form must be signed, and the parties

must present documentation to prove their identity and powers of representation, where applicable. Shareholders whose shares are deposited

in the Central Depositary and who wish to assign their Preemptive Right should contact their custodial agents.

Holders

of Preemptive Right arising from shares held in custody at the Central Depositary who wish to exercise or assign those rights should consult

their custodial agents regarding the required documentation.

Holders

of subscription rights held in custody by the Bookkeeper who wish to exercise their Preemptive Rights or assign such rights directly through

the Bookkeeper must submit the following documents:

| (1) | natural persons: (a) identity document (RG or RNE); (b) proof of registration with

the Individual Taxpayer Register (“CPF/MF”); and (c) proof of residence; and |

| (2) | legal entities: (a) original and copy of the bylaws and minutes of election of

the current executive management (diretoria) or certified copy of the consolidated articles of association or bylaws; (b) National

Register of Legal Entities of the Ministry of Finance (“CNPJ/MF”); (c) certified copy of corporate documents granting

powers to sign the subscription form; and (d) certified copy of the identity document, CPF/MF and proof of residence of the person(s)

signing the subscription form. |

When

any person acts under power of attorney, the public instrument granting specific powers to do so must be presented, together with the

documents mentioned above, as applicable, for both the grantor and the grantee of the power of attorney.

Investors

resident abroad may be required to submit other documents of identification or representation, as required by the applicable law.

In

case of doubt, shareholders can contact the Bookkeeper on business days, from 9 a.m. to 6 p.m., at the following telephone numbers: (i)

capital cities and metropolitan regions in Brazil: +55 (11) 3003-9285; and (ii) other locations: 0800 7209285.

Holders

of Preemptive Right arising from shares held in custody at the Central Depositary must exercise those rights through their custodial agents,

in compliance with the deadlines stipulated by B3 and the terms of this Notice to Shareholders.

The

signing of the subscription form shall represent the subscriber's irrevocable and irreversible expression of will to acquire the New Shares

subscribed for, giving rise to the subscriber's irrevocable and irreversible obligation to pay for them.

XV

- inform whether shareholders will have preemptive rights to subscribe to the new shares issued and detail the terms and conditions to

which this right is subject;

The

Company’s common shareholders and preferred shareholders will have Preemptive Right to subscribe for, respectively, the New Common

Shares and the New Preferred Shares to be issued in the Capital Increase, in proportion to their holding in the Company’s share

capital on the Cut-Off Date.

It

is important to remember that the Preemptive Right is guaranteed only in relation to the shares issued by the Company held on the Cut-Off

Date, so that any subscription rights relating to the Capital Increase - Lessors/OEMs will not entitle their holders to subscribe to the

New Shares issued in this Capital Increase, even if such subscription rights have already been exercised.

Preemptive

right may be exercised by the Company’s common and preferred shareholders within the period of 30 (thirty) days from February 26,

2025 (inclusive) and ending on March 27, 2025 (inclusive).

The

fractions of common and preferred shares resulting from the calculation of the percentage for the exercise of the Preemptive Right in

the subscription of the New Common Shares and New Preferred Shares will be disregarded. Such fractional shares will subsequently be grouped

into whole numbers of shares and will be treated as unsubscribed shares, which may be subscribed by shareholders who express an interest

in unsubscribed shares during the subscription period.

XVI

– inform the administration’s proposal for the treatment of any leftovers;

After

the end of the Preemptive Right Exercise Period, the

Company's management must verify the number of New Shares subscribed during the Preemptive Right

Exercise Period and, if the Minimum Subscription has been reached, the Board of Directors may partially

approve the Capital Increase, canceling the unsubscribed New Shares, or determine that any Unsubscribed New Shares (“Unsubscribed

Shares”) be allocated to the shareholders or assignees of Preemptive Right who have expressed their interest in reserving Unsubscribed

Shares, during the Preemptive Right Exercise Period, on

the share subscription form.

The

Company will publish a notice to the shareholders to inform them of the result of the subscriptions during the Preemptive

Right Exercise Period and, if applicable, inform the

number of Unsubscribed Shares of New Shares and the beginning of the term for the shareholders to subscribe for those Unsubscribed Shares,

which term will be between 3 (three) and 5 (five) business days from the publication of the notice to take up the Unsubscribed Shares

for which they have expressed an interest, by completing and signing a new subscription form and

the respective pay-up of the Unsubscribed Shares of New Shares to be subscribed.

If

event of an allocation of Unsubscribed Shares of New Shares, the proportional percentage for the exercise of the right to subscribe Unsubscribed

Preference Shares shall be obtained by dividing, as the case may be, the number of unsubscribed New Common Shares and New Preference Shares

by the total number of New Common Shares and New Preference Shares subscribed by the subscribers who have expressed an interest in the

Unsubscribed Preference Shares during the Preemptive Right Exercise Period, multiplying the quotient obtained by 100 (one hundred).

If

there are still unsubscribed New Shares after the procedure described above, the Company will partially ratify the Capital Increase with

the cancellation of the remaining unsubscribed New Shares, in accordance with the procedure described below.

XVII

– describe, in detail, the procedures that will be adopted, if partial approval of the capital increase is expected; and

Considering

the possibility of partial ratification of the Capital Increase, each subscriber may, at the time of subscription, condition the subscription

of the number of preferred shares to which he is entitled: (a) on the subscription of the maximum amount of the Capital Increase; or (b)

on the subscription of a certain minimum amount of the Capital Increase, provided that such minimum amount is not less than the Minimum

Subscription, and must indicate, in the latter case, whether he wishes to receive: (1) all the New Shares subscribed by him/her; or (2)

the amount equivalent to the proportion between the number of New Shares actually subscribed and the maximum number of New Shares subject

to the Capital Increase.

If

the subscriber does not state a choice, it will be presumed that the subscriber wishes to receive all the New Shares subscribed for. In

all cases, the subscriber’s choice will be final and irreversible, and may not be changed subsequently.

Subscribers

who make their subscription conditional must provide the following information on the subscription form, so that the Company may make

reimbursement if necessary: the name of the subscriber’s bank, the branch number, the subscriber’s account number, the subscriber’s

name, the subscriber’s CPF/MF or CNPJ/MF, as applicable, and the subscriber’s address and telephone number.

Company

shareholders and/or assignees of Preemptive Right to subscribe for New Shares who make their participation in the Capital Increase conditional,

in function of certification in part of the Capital Increase, will receive the amount they paid in, without interest, adjustment for inflation,

or reimbursement of any taxes they may have paid, subject to deduction, if applicable, of any taxes that may attach.

Since,

during the Preemptive Right Exercise Period, the shareholders may, at the time of signing the subscription form, make their subscription

conditional on the hypotheses described above, and there will be no final deadline for reviewing the investment, thus the shareholders

will have to express their decision in advance at the time of the subscription.

XVIII

– if the issue price of the shares can be, totally or partially, realized in assets: a) present a complete description of the goods

that will be accepted; b) clarify the relationship between the assets and their corporate purpose; and c) provide a copy of the asset

valuation report, if available.

Not

applicable.

Art.

3. When the increase of capital is done by capitalization of profits or reserves, the issuer must:

I

– inform whether it will involve changing the nominal value of the shares, if any, or distributing new shares among shareholders;

II

– inform whether the capitalization of profits or reserves will be carried out with or without changing the number of shares, in

companies with shares with no par value;

III

– in case of distribution of new shares: a) inform the number of shares issued of each type and class; b) inform the percentage

that shareholders will receive in shares; c) describe the rights, advantages and restrictions attributed to the shares to be issued; d)

inform the acquisition cost, in reais per share, to be attributed so that shareholders can comply with article 10 of Law 9,249, of December

26, 1995; and e) inform the treatment of fractions, if applicable;

IV

– inform the deadline provided for in paragraph 3 of article 169 of Law 6,404, of 1976; and

V

– inform and provide the information and documents provided for in article 2nd above, when applicable.

Not

applicable.

Art.

4. When the increase of capital is done by conversion of debentures or other debt securities into shares or by exercise of subscription

bonds, the issuer must:

I

– inform the number of shares issued of each type and class; and

II

– describe the rights, advantages and restrictions attributed to the shares to be issued.

Not

applicable.

Art.

5. The provisions of articles 1st to 4th of this Annex do not apply to capital increases arising from an option plan, in which case the

issuer must inform:

I

– date of the general meeting at which the option plan was approved;

II

– value of the capital increase and new capital stock;

III

– number of shares issued of each type and class;

IV

– issue price of new shares;

V

– Revoked;

VI

– percentage of potential dilution resulting from the issuance.

Not

applicable.

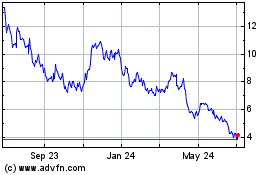

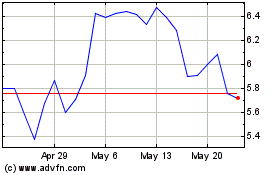

Azul (NYSE:AZUL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Azul (NYSE:AZUL)

Historical Stock Chart

From Feb 2024 to Feb 2025