UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

| For the month of: December 2024 |

|

Commission File Number: 001-41563 |

Brookfield

Asset Management LTD.

(Name of Registrant)

Brookfield Place

250 Vesey Street, 15th Floor

New York, NY 10281-0221

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Exhibits 99.2 of this Form 6-K shall be incorporated

by reference into the registrant’s registration statements on Form S-8 filed on December 13, 2022 (File No. 333-268783)

and on Form F-10 filed on May 22, 2024 (File No. 333-279599) with the Securities and Exchange Commission.

EXHIBIT INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

BROOKFIELD ASSET MANAGEMENT LTD. |

| |

|

Date: December 27, 2024 |

By: |

/s/ Kathy Sarpash |

| |

|

Name: |

Kathy Sarpash |

| |

|

Title: |

Managing Director, Legal & Regulatory |

Exhibit 99.1

Brookfield Asset Management

Ltd.

PROXY, solicited by management, for the Special

Meeting of Shareholders of Brookfield Asset Management Ltd. (the “Corporation”) to be held on Monday, January 27, 2025

at 10:00 a.m. (Toronto time), via live audio webcast online at https://meetings.lumiconnect.com/400-755-930-608 (the “Meeting”)

password “brookfield2025” (case sensitive), and at all adjournments thereof.

Capitalized terms used and not otherwise defined

herein have the meaning given to them in the management information circular of the Corporation dated December 1, 2024 (the “Circular”).

If you wish to appoint a proxyholder other than

the Corporation’s nominees below YOU MUST enter the name of your proxyholder below AND call 1-866-751-6315 (within North America)

or 416-682-3860 (outside of North America) or visit online at https://www.tsxtrust.com/control-number-request by 5:00 p.m. (Toronto

time) on January 23, 2025 and provide TSX Trust Company ("TSX Trust") with the required information for your chosen proxyholder

so that TSX Trust may provide the proxyholder with a control number via email. This control number will allow your proxyholder to log

in to and vote at the Meeting. Without a control number your proxyholder will only be able to log in to the Meeting as a guest and will

not be able to ask questions or vote.

The undersigned holder of Class A Limited

Voting Shares of the Corporation hereby appoints MARCEL R. COUTU, or failing him SAMUEL J.B. POLLOCK, (or in lieu thereof ________________________________________),

as proxy of the undersigned to attend and vote, in respect of all the Class A Limited Voting Shares registered in the name of the

undersigned, at the Meeting, and at any adjournments thereof, with full power of substitution, on the following matters:

| 1. | Arrangement

Resolution (Mark either (a) or (b)) |

| (a) | ¨ |

FOR the Arrangement Resolution, the full text of which is set

forth in Appendix A to the Circular; or |

| (b) | ¨ |

AGAINST the Arrangement Resolution, the full text of which is

set forth in Appendix A to the Circular. |

| 2. | Special

Resolution Increasing Number of Directors (Mark either (a) or (b)) |

| (a) | ¨ |

FOR the Director Increase Resolution increasing the number of directors of the Corporation, the full text

of which is set forth in Appendix F to the Circular; or |

| (b) | ¨ |

AGAINST the Director Increase Resolution increasing the number of directors of the Corporation, the full

text of which is set forth in Appendix F to the Circular. |

In addition, the undersigned appoints such person

as proxy to vote and act as aforesaid upon any amendments or variations to the matters identified in the notice of meeting accompanying

the Circular and on all other matters that may properly come before the Meeting. Unless otherwise specified above, the shares represented

by this proxy will be voted by the persons whose names are printed above for the Arrangement Resolution and Director Increase Resolution

set out in the Circular.

| Number of Class A Limited Voting Shares: | |

|

Signature

NOTES:

| 1. | If this proxy is not dated in the space provided, it will be deemed to be dated as of the date on which

it was mailed to you by management of the Corporation. |

| 2. | If the shareholder is an individual, please sign exactly as your shares are registered. |

If the

shareholder is a corporation, this proxy must be executed by a duly authorized officer or attorney of the shareholder and, if the corporation

has a corporate seal, its corporate seal should be affixed. If shares are registered in the name of an executor, administrator or trustee,

please sign exactly as the shares are registered. If the shares are registered in the name of the deceased or other shareholder, the

shareholder's name must be printed in the space provided, the proxy must be signed by the legal representative with his/her name printed

below his/her signature and evidence of authority to sign on behalf of the shareholder must be attached to this proxy.

| 3. | To be valid, this proxy must be signed, dated and deposited with the Secretary of the Corporation c/o

TSX Trust Company via one of the below options, not later than 5:00 p.m. (Toronto time) on Thursday, January 23, 2025 or, if

the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before any adjournment of the Meeting: by mail, to Attention:

Proxy Department, P.O. Box 721, Agincourt, Ontario M1S 0A1; by fax at 416-595-9593; by email, with a scanned copy to proxyvote@tmx.com;

by telephone, toll-free at 1-888-489-5760 or by Internet, at www.meeting-vote.com and by following the instructions for electronic voting.

A shareholder will be prompted to provide the control number printed near the preprinted name and address. The telephone voting service

is not available on the day of the Meeting. |

| 4. | A shareholder has the right to appoint a person (who need not be a shareholder) to represent the shareholder

at the Meeting other than the management nominees named in this form of proxy. Such right may be exercised by inserting in the space provided

the name of the other person the shareholder wishes to appoint and delivering the completed proxy to the Secretary of the Corporation,

as set out above. In addition, YOU MUST call 1-866-751-6315 (within North America) or 416-682-3860 (outside of North America) or visit

online at https://www.tsxtrust.com/control-number-request by 5:00 p.m. (Toronto time) on January 23, 2025 and provide TSX Trust

with the required information for your chosen proxyholder so that TSX Trust may provide the proxyholder with a control number via email.

This control number will allow your proxyholder to log in to and vote at the Meeting. Without a control number your proxyholder will only

be able to log in to the Meeting as a guest and will not be able to ask questions or vote. |

| 5. | Reference is

made to the Circular for further information regarding completion and use of this proxy and

other information pertaining to the Meeting. |

| 6. | If a share is held by two or more persons, any one of them present or represented by proxy at the Meeting

may, in the absence of the other or others, vote in respect thereof, but if more than one of them are present or represented by proxy,

they shall vote together in respect of each share so held. |

| 7. | The shares represented

by this proxy will be voted or withheld from voting in accordance with the instructions of

the shareholder on any ballot that may be called for and, if the shareholder specifies a

choice with respect to any matter to be acted upon, the shares will be voted accordingly. |

Exhibit 99.2

NOTICE OF SPECIAL MEETING

OF SHAREHOLDERS

AND

MANAGEMENT

INFORMATION CIRCULAR

WITH

RESPECT TO A PLAN OF ARRANGEMENT

INVOLVING

BROOKFIELD ASSET MANAGEMENT LTD.,

Brookfield

Corporation AND OTHERS

Monday, January 27, 2025

at 10:00 a.m. (Toronto time)

The Board, on the recommendation

of the Governance,

Nominating and Compensation Committee, recommends that

you vote FOR the Arrangement Resolution

NOTICE

OF SPECIAL MEETING OF SHAREHOLDERS

A

special meeting of shareholders of Brookfield Asset Management Ltd. (“BAM”) will be held on Monday, January 27,

2025 at 10:00 a.m. (Toronto time) in a virtual meeting format via live audio webcast at: https://meetings.lumiconnect.com/400-755-930-608,

to:

| 1. | consider, pursuant to a varied interim

order (the “Interim Order”) of the Supreme Court of British Columbia dated December 9,

2024, and, if deemed advisable, to pass a special resolution (the “Arrangement Resolution”),

the full text of which is set forth in Appendix A to the accompanying management information

circular (the “Circular”), with or without variation, approving an arrangement

(the “Arrangement”) involving BAM, Brookfield Corporation (“BN”)

and others under the provisions of Division 5 Part 9 of the Business Corporations

Act (British Columbia) and as more particularly described in the Circular; |

| 2. | consider and, if deemed advisable, to

pass a special resolution increasing the number of directors of BAM from 12 to 14; and |

| 3. | to transact such other business as may

properly come before the meeting or any adjournment or postponement thereof. |

Specific details relating to the Arrangement

are set forth in the Circular.

The

board of directors of BAM (the “Board”), with Mr. Bruce Flatt, who serves as CEO of both BAM and BN, having abstained,

based on, among other things, the recommendation of the Governance, Nominating and Compensation Committee of the Board,

unanimously determined that the Arrangement is in the best interests of BAM and unanimously approved the Arrangement. Accordingly, the

Board, with Mr. Bruce Flatt having abstained, unanimously recommends that shareholders vote FOR the Arrangement Resolution

at the meeting.

The meeting will be held in a virtual meeting

format only. Shareholders will be able to listen to, participate in and vote at the meeting in real time through a web-based platform

instead of attending the meeting in person. You can attend and vote at the virtual meeting by joining the live audio webcast at: https://meetings.lumiconnect.com/400-755-930-608,

entering your control number and password “brookfield2025” (case sensitive). See “Q&A on Voting” in the Circular

for more information on how to listen, register for and vote at the meeting.

You have the right to vote at the meeting by

online ballot through the live audio webcast platform if you are a shareholder of BAM at the close of business on November 12, 2024.

Before casting your vote, we encourage you to review the meeting’s business in the section “Part Three – Business

of the Meeting” of the Circular.

We

are posting an electronic version of the Circular on our website for shareholder review – a process known as “Notice and

Access”. An electronic copy of the Circular may be accessed at https://bam.brookfield.com

under “Notice and Access 2025” and at www.sedarplus.ca and www.sec.gov/edgar.

Under

Notice and Access, if you would like paper copies of the Circular, please contact us at 1-866-989-0311 or bam.enquiries@brookfield.com and

we will mail materials free of charge within three business days of your request, provided the request is made before the date of

the meeting or any adjournment thereof and mail service. See “Canada Post Disruption” below. In order to receive the

Circular in advance of the deadline to submit your vote, we recommend that you contact us before 5:00 p.m. (Toronto time) on

January 9, 2025. All shareholders who have signed up for electronic delivery of the Circular will continue to receive it by

email.

Instructions on Voting at the Virtual Meeting

Registered shareholders and duly appointed proxyholders

will be able to attend the virtual meeting and vote in real time, provided they are connected to the Internet and follow the instructions

in the Circular. See “Q&A on Voting” in the Circular. Non-registered shareholders who have not duly appointed themselves

as proxyholder will be able to attend the virtual meeting as guests but will not be able to ask questions or vote at the meeting.

If you wish to appoint a person other than the

management nominees identified in the form of proxy or voting instruction form (including if you are a non-registered shareholder who

wishes to appoint themselves to attend the virtual meeting) you must carefully follow the instructions in the Circular and on the form

of proxy or voting instruction form. See “Q&A on Voting” in the Circular. These instructions include the additional step

of registering your proxyholder with our transfer agent, TSX Trust Company, after submitting the form of proxy or voting instruction

form. Failure to register the proxyholder with our transfer agent will result in the proxyholder not receiving a control number to

participate in the virtual meeting and only being able to attend as a guest. Guests will be able to listen to the virtual meeting but

will not be able to ask questions or vote.

Information for Registered Holders

Registered shareholders and duly appointed proxyholders

(including non-registered shareholders who have duly appointed themselves as proxyholder) that attend the meeting online will be able

to vote by completing a ballot online during the meeting through the live webcast platform.

If you are not attending the virtual meeting

and wish to vote by proxy, we must receive your vote by 5:00 p.m. (Toronto time) on Thursday, January 23, 2025. You can cast

your proxy vote in the following ways:

| · | On

the Internet at www.meeting-vote.com; |

| · | Fax

your signed proxy to (416) 595-9593; |

| · | Mail

your signed proxy using the business reply envelope accompanying your proxy; |

| · | Scan

and send your signed proxy to proxyvote@tmx.com; or |

| · | Call

by telephone at 1-888-489-5760. |

Information for Non-Registered Holders

Non-registered shareholders will receive a voting

instruction form with their physical copy of this notice. If you wish to vote, but not attend the meeting, the voting instruction form

must be completed, signed and returned in accordance with the directions on the form. You may also vote by telephone or on the Internet

prior to the meeting by following the instructions on the voting instruction form.

If you wish to appoint a proxyholder, you must

complete the additional step of registering the proxyholder by calling our transfer agent, TSX Trust Company, at 1-866-751-6315 (within

North America) or (416) 682-3860 (outside of North America) or online at https://www.tsxtrust.com/control-number-request by no

later than 5:00 p.m. (Toronto time) on Thursday, January 23, 2025.

Canada Post Disruption

On November 15, 2024, the Canadian Union

of Postal Workers entered a legal strike position, which has resulted in the disruption or delay of the mail service of Canada Post (the

“Canada Post Disruption”). If the Canada Post Disruption continues, or the mail service of Canada Post is delayed after the

Canada Post Disruption has been resolved, BAM may obtain exemptive

relief from the Canadian securities regulatory

authorities that would allow the meeting to be held without completing the mailing of the Circular and related materials on timelines

prescribed by Canadian securities laws to certain holders of Class A Shares affected by the Canada Post Disruption. If BAM obtains

exemptive relief, BAM will issue a press release with additional information as to how affected holders of Class A Shares can access

the Circular and related materials and vote in advance of the Meeting.

| |

|

|

By

Order of the Board |

|

| |

|

|

|

|

| |

|

|

/s/

Justin B. Beber |

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

Justin

B. Beber

Chief Operating Officer |

|

| |

|

|

|

|

| |

|

|

December 1,

2024 |

|

LETTER

TO SHAREHOLDERS

To our shareholders,

You

are invited to attend a special meeting of holders of shares of Brookfield Asset Management Ltd. (“BAM”). The meeting will

occur at 10:00 a.m. (Toronto time) on Monday, January 27, 2025 in a virtual meeting format via live audio webcast at: https://meetings.lumiconnect.com/400-755-930-608.

At the meeting, you will be asked to consider the transaction described below. This management information circular (the “Circular”)

also provides important information on voting your shares at the meeting. Additional details on how to access our live audio webcast

and participate in the meeting can be found in the “Q&A on Voting” section of the Circular.

It has been nearly two years since we launched

BAM as a pure-play, leading global alternative asset management business. Creating BAM has provided shareholders with direct access to

our asset management franchise; increased operational and financial transparency, enabling our investors and analysts to compare and

evaluate our business more easily against appropriate peers and benchmarks; and resulted in a significant expansion of our shareholder

base.

We believe, however, that there is more we can

do to broaden our shareholder base and gain access to the deepest pools of capital. The most common feedback that we hear from investors

encourages us to position BAM for inclusion in some of the most widely followed global large cap stock indices, including in the U.S.

We have considered various means to deliver on

these outcomes and believe that an important first step is to increase BAM’s market capitalization such that it reflects 100% of

the value of our asset management business. To facilitate this, Brookfield Corporation (“BN”) has agreed to exchange its

equity ownership of the asset management business, which it holds through common shares of our asset management company, Brookfield Asset

Management ULC (the “Asset Management Company”), for newly-issued Class A Shares of BAM on a one-for-one basis. We are

proposing to implement this transaction pursuant to an arrangement (the “Arrangement”) under the provisions of Division 5

Part 9 of the Business Corporations Act (British Columbia). Upon completion of the Arrangement, BAM would own, directly and

indirectly, 100% of the common shares of the Asset Management Company and BN would own approximately 73% of our issued and outstanding

Class A Shares. As part of the Arrangement, our articles would also be amended to ensure that BN maintains indirect control of our

asset management business for so long as it holds a majority of the voting shares of BAM.

The accompanying Circular provides a detailed

description of the Arrangement and the other matters to be considered at the meeting. You are urged to read this information carefully

and, if you require assistance, to consult your own legal, financial or other professional advisors.

Shareholder Meeting

At the meeting, you will be asked to pass a special

resolution approving the Arrangement, as described in detail in the accompanying Circular.

The Governance, Nominating and Compensation Committee

(the “GNCC”) of the board of directors of BAM (the “Board”), comprised solely of independent directors of BAM,

who are also independent of BN within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders

in Special Transactions, being Olivia Garfield, Nili Gilbert, Diana Noble and Satish Rai, reviewed and considered the terms of the

Arrangement and received independent advice, including obtaining a formal valuation and fairness opinion. Following this process, the

GNCC unanimously determined that the Arrangement is in the best interests of BAM and unanimously recommended that the Board determine

that the Arrangement is in the best interests of BAM, approve the Arrangement and recommend that the shareholders vote FOR

the special resolution in respect of the Arrangement (the “Arrangement Resolution”).

The Board, based on, among other things, the

recommendation of the GNCC, unanimously determined that the Arrangement is in the best interests of BAM and unanimously approved the

Arrangement. Accordingly, the Board unanimously recommends that shareholders vote FOR the Arrangement Resolution at the meeting.

To become effective, the Arrangement Resolution

must be approved by: (a) not less than 662/3% of the votes cast at the meeting by the holders of our Class A Shares,

present in person or represented by proxy at the meeting; (b) not less than 662/3% of the votes cast at the meeting by

the holder of our Class B Shares, present in person or represented by proxy at the meeting; and (c) not less than a majority

of the votes cast at the meeting by the holders of our Class A Shares other than the votes attaching to our Class A Shares

held, directly or indirectly, by an “interested party” within the meaning of Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special Transactions or otherwise required to be excluded under the requirements of such instrument.

The Arrangement is also subject to the satisfaction

of certain other conditions, including the receipt of the approval of the Supreme Court of British Columbia. Subject to the receipt of

all required approvals and the satisfaction or waiver, as applicable, of the other conditions contained in the arrangement agreement

between BAM and BN, it is anticipated that the Arrangement will be completed in early 2025.

Your vote is important regardless of the number

of shares you own. Whether or not you plan to attend the meeting, please take the time to vote by using the Internet or by telephone

as described in the Circular or by completing the enclosed proxy card and mailing it in the enclosed envelope. Information about the

meeting and the Arrangement is contained in the Circular. You are urged to read the Circular carefully.

If you are not registered as the holder of your

shares but hold your shares through a broker or other intermediary, you should follow the instructions provided by your broker or other

intermediary to vote your shares. See the section in the Circular entitled “Q&A on Voting – If my shares are not registered

in my name but are held in the name of an Intermediary, how do I vote my shares?” for further information on how to vote your shares.

On behalf of the Board, I express our appreciation

for your continued support. We look forward to having you join us on January 27, 2025.

Yours truly,

/s/ Mark Carney

Mark Carney

Chair

December 1, 2024

MANAGEMENT

INFORMATION CIRCULAR

Table

of Contents

| Part One

– Q&A Regarding the Arrangement |

1 |

| Part Two

– Voting Information |

3 |

| |

Who Can Vote |

3 |

| |

Notice and Access |

4 |

| |

Q&A on Voting |

5 |

| |

Principal Holders of Voting Shares |

10 |

| Part Three

– Business of the Meeting |

12 |

| |

1. |

The Arrangement |

12 |

| |

2. |

Increase in Number of Directors |

23 |

| Part Four

– Certain Legal and Regulatory Matters |

24 |

| |

Completion of

the Arrangement |

24 |

| |

Timing |

24 |

| |

Shareholder Approval |

24 |

| |

Court Approval |

25 |

| |

Canadian Securities

Law Matters |

25 |

| Part Five

– Information Concerning BAM AND THE ASSET MANAGEMENT COMPANY |

27 |

| |

Overview and

Documents Incorporated by Reference |

27 |

| |

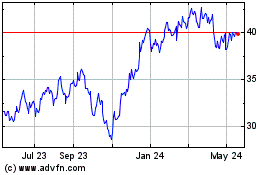

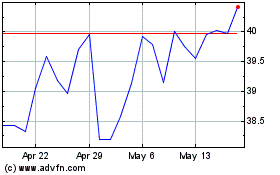

Trading Price

and Volume of Class A Shares |

28 |

| |

Prior Sales |

28 |

| |

Changes Resulting

from the Arrangement |

28 |

| Part Six

– Risk Factors |

31 |

| |

Risks Relating

to the Arrangement |

31 |

| Part Seven

– Other Information |

33 |

| |

Interest of Directors

and Executives in Matters to be Acted Upon |

33 |

| |

Interest of Informed

Persons in Material Transactions |

33 |

| |

Indebtedness

of Directors, Officers and Employees |

33 |

| |

Auditor |

33 |

| |

Interests of

Experts |

33 |

| |

Cautionary Statement

Regarding the Use of Non-GAAP Measures and Forward-Looking Statements |

33 |

| |

Availability

of Disclosure Documents |

34 |

| |

Other Business |

34 |

| |

Directors’

Approval |

34 |

| Part Eight

– Consent of KPMG |

35 |

| Part Nine

– Glossary of Terms |

36 |

| Appendix A

|

– |

Arrangement

Resolution |

A-1 |

| Appendix B

|

–

|

Arrangement

Agreement |

B-1 |

| Appendix C

|

–

|

Interim

order |

C-1 |

| Appendix D

|

–

|

Formal

Valuation and Fairness Opinion |

D-1 |

| Appendix E

|

–

|

Pro

Forma Financial Statements |

E-1 |

| Appendix F

|

– |

SPECIAL

RESOLUTION INCREASING THE NUMBER OF DIRECTORS |

F-1 |

Part One – Q&A

Regarding the Arrangement

The following briefly addresses some questions

you may have regarding the Arrangement. The below information is only a summary of certain information contained elsewhere in this Circular

and is qualified in its entirety by the more detailed information and statements contained in or referred to elsewhere in this Circular,

including the Appendices and documents that are incorporated by reference herein, all of which are important and should be reviewed carefully.

Capitalized terms used in these questions and answers but not otherwise defined herein have the meanings set forth in the section entitled

“Part Nine – Glossary of Terms” in this Circular.

| Questions |

Answers about the Arrangement |

What am I being asked to vote

on at the meeting? |

At the meeting, you are asked to consider

and, if thought advisable, pass the Arrangement Resolution approving the Arrangement. The Arrangement involves the issuance of Class A

Shares to BN in exchange for Common Shares held by BN and its subsidiaries on a one-for-one basis. Upon completion of the Arrangement,

BAM would own, directly and indirectly, 100% of the Common Shares and BN would own approximately 73% of the issued and outstanding Class A

Shares.

As part of the Arrangement, BAM’s

articles would also be amended to ensure that BN maintains indirect control of the Asset Management Company for so long as it holds a

majority of the voting shares of BAM. See “Details of the Arrangement”.

|

| Why is BAM pursuing the Arrangement? |

The creation of BAM in 2022 helped to

simplify BAM’s story and BAM has significantly expanded its shareholder base since. The Arrangement will continue to broaden BAM’s

shareholder base and simplify the structure of the Asset Management Company further by having its ownership consolidated under BAM, rather

than being split between BN and BAM. The Arrangement will also result in BAM’s market capitalization reflecting 100% of the value

of the asset management business, which management believes will align BAM’s size and structure with its U.S.-based global alternative

asset management business peers and position BAM for potential Index Admission in the future. In the view of management, the potential

benefits of Index Admission include: (i) increased corporate profile with U.S. investors, analysts and media; (ii) an increased

demand for shares given that there are significantly more index tracking funds in the U.S. than in Canada; (iii) a wider and more

diversified shareholder base; and (iv) increased access to the deepest pools of public capital.

For more information, see “Details

of the Arrangement”.

|

| How does the Board recommend I vote on the Arrangement Resolution? |

The Board, based on, among other things,

the recommendation of the GNCC, has unanimously determined that the Arrangement is in the best interests of BAM and unanimously approved

the Arrangement. Accordingly, the Board unanimously recommends that you vote FOR the Arrangement Resolution at the meeting.

For more information, see “Recommendation of the Board”.

|

| Why should I vote FOR the Arrangement Resolution? |

The Board carefully evaluated the

Arrangement and believes that the Arrangement is in the best interests of BAM and unanimously approved the Arrangement. In the course

of its evaluation, the Board considered, among other things, the following factors:

|

| |

· |

The

Arrangement will simplify the structure of the asset management business further by having

its ownership consolidated under BAM, rather than being split between BN and BAM. The Arrangement

will also result in BAM’s market capitalization reflecting 100% of the value of the

asset management business, which management believes will help broaden BAM’s shareholder

base and align BAM’s size and structure with its U.S.-based global alternative asset

management business peers. Management believes that simplifying the structure of the asset

management business in this way will make it easier for investors to understand and accurately

value the Class A Shares.

|

| |

· |

Management

believes that the Arrangement and BAM’s increased market capitalization resulting therefrom,

together with other potential steps, will position BAM for potential Index Admission in the future.

|

| |

· |

KPMG,

the independent valuator retained by the GNCC, delivered the Formal Valuation in accordance with

MI 61-101 and the Fairness Opinion.

|

| |

· |

The

GNCC considered the compensation arrangements of KPMG, |

| Questions |

Answers about the Arrangement |

| |

|

was

engaged to provide the Formal Valuation and the Fairness Opinion on a fixed fee basis that was

not contingent on the conclusions reached in the Formal Valuation, the outcome of the Fairness

Opinion or the completion of the Arrangement.

|

| |

· |

The

process leading up to the Arrangement was conducted under the oversight of the GNCC, which is comprised

solely of independent directors and was advised by experienced, qualified and independent advisors.

In addition, the procedures by which the Arrangement will be approved, including both shareholder

approval and approval of the Court, offers substantial protection to shareholders.

|

| |

· |

The

Arrangement is intrinsically fair and treats all the stakeholders of BAM fairly, including shareholders,

employees, lenders to and debtholders of BAM. Moreover, BAM will acquire control of the asset management

business, there will be no change to BAM’s status as a Canadian-domiciled corporation in

connection with the Arrangement and the Arrangement is not expected to have any material adverse

Canadian or U.S. federal income tax consequences for holders of Class A

Shares. There will be no change to the business and operations of BAM or the asset management business

as a result of the Arrangement.

|

| |

For

a full description of these factors, among others, considered by the Board, see “Reasons

for the Arrangement”.

|

When

will the Arrangement be

completed? |

BAM expects to complete the Arrangement

once all approvals have been obtained. It is currently expected that the Arrangement will be completed in early 2025.

|

What

approvals are required of

holders of Class A Shares and

Class B Shares at the meeting? |

To become effective, the Arrangement

Resolution must be approved by: (i) not less than 662/3% of the votes cast at the meeting by the holders of Class A

Shares present in person or represented by proxy at the meeting; (ii) not less than 662/3% of the votes cast at the

meeting by the holders of Class B Shares present or in person or represented by proxy at the meeting, and (iii) not less

than a majority of the votes cast by Minority Shareholders.

For more information see “Canadian Securities Law

Matters”.

|

What

other approvals are

required for the Arrangement to

become effective? |

The Arrangement is also subject

to the satisfaction of certain other conditions, including the receipt of the Final Order, the approvals of NYSE and the TSX and

no material adverse effect having occurred in respect of the Asset Management Company. On November 11, 2024, the TSX provided

its conditional approval of the issuance of Class A Shares to BN pursuant to the Arrangement. For more information, see “Part Four

– Certain Legal and Regulatory Matters” and “The Arrangement – Arrangement Agreement”.

|

Whom

do I contact for

information regarding BAM and

the Arrangement? |

Inquiries related to the Arrangement

should be directed to:

Brookfield Asset Management Ltd.

Brookfield Place

250 Vesey Street, 15th Floor

New York, New York

10281-0221

United States

The transfer agent and registrar

for the Class A Shares is:

TSX Trust Company

301–100 Adelaide Street West

Toronto, Ontario M5H 4H1 |

Part Two – Voting

Information

This management information circular (“Circular”)

is provided in connection with the solicitation by management of Brookfield Asset Management Ltd. (“BAM”) of proxies for

the special meeting of shareholders of BAM (the “meeting”) referred to in BAM’s notice of special meeting of shareholders

dated December 1, 2024 (the “Notice”) to be held in a virtual meeting format only on Monday, January 27, 2025 at

10:00 a.m. (Toronto time). The meeting will be broadcast live by audio webcast. See “Q&A on Voting” on page 5

of this Circular for further information.

All capitalized terms used in this Circular,

including the Appendices hereto, but not otherwise defined have the meanings set forth under “Part Nine – Glossary of

Terms”. References in this Circular to “BAM”, “we,” or “our” are to Brookfield Asset Management

Ltd., and references to “Brookfield” include BAM and Brookfield Corporation (“BN”), collectively. All references

in this Circular to the “Board” in respect of its determination regarding the Arrangement and its recommendation regarding

the Arrangement Resolution should be read as the board of directors of BAM with Bruce Flatt, who serves as CEO of both BAM and BN, having

abstained.

This

solicitation will be made primarily by sending proxy materials to shareholders by mail and email, and in relation to the delivery of

this Circular, by posting this Circular on our website at https://bam.brookfield.com

under “Notice and Access 2025”, on our System for Electronic Data Analysis and Retrieval+ (“SEDAR+”) profile

at www.sedarplus.ca and on our Electronic Data Gathering, Analysis, and Retrieval

system (“EDGAR”) profile at www.sec.gov/edgar pursuant to Notice and

Access. See “Notice and Access” below for further information. Proxies may also be solicited personally or by telephone

by regular employees of BAM at nominal cost. The cost of solicitation will be borne by BAM.

No person has been authorized to give any information

or make any representation in connection with the matters to be considered at the meeting other than those contained, or incorporated

by reference, in this Circular and, if given or made, any such information or representation must not be relied upon as having been authorized.

Shareholders should not construe the contents

of this Circular as legal, tax or financial advice and should consult with their own legal, tax, financial or other professional advisors

in considering the matters contained in this Circular.

The information in this Circular is given as

at December 1, 2024, unless otherwise indicated. As BAM operates in U.S. dollars and reports its financial results in U.S. dollars,

all financial information in this Circular is denominated in U.S. dollars, unless otherwise indicated. All references to C$ are to Canadian

dollars.

Canada Post Disruption

On November 15, 2024, the Canadian Union

of Postal Workers entered a legal strike position, which has resulted in the disruption or delay of the mail service of Canada Post (the

“Canada Post Disruption”). If the Canada Post Disruption continues, or the mail service of Canada Post is delayed after the

Canada Post Disruption has been resolved, BAM may obtain exemptive relief from the Canadian securities regulatory authorities that would

allow the meeting to be held without completing the mailing of the Circular and related materials on timelines prescribed by Canadian

securities laws to certain holders of Class A Shares affected by the Canada Post Disruption. If BAM obtains exemptive relief, BAM

will issue a press release with additional information as to how affected holders of Class A Shares can access the Circular and

related materials and vote in advance of the Meeting.

Who Can Vote

As at December 1, 2024, BAM had 443,040,820

Class A Limited Voting Shares (“Class A Shares”) and 21,280 Class B Limited Voting Shares (“Class B

Shares”) outstanding. The Class A Shares are co-listed on the New York Stock Exchange (“NYSE”)

and the Toronto Stock Exchange (“TSX”)

under the symbol “BAM”. The Class B Shares are all privately held (see “Principal Holders of Voting Shares”

on page 10 of this Circular for further information). Each registered holder of record of Class A Shares and Class B Shares

as at the close of business on Tuesday, November 12, 2024 will be entitled to receive notice of and to vote at the meeting. Except

as otherwise provided in this Circular, each holder of a Class A Share or Class B Share on such date shall be entitled to vote

on all matters to come before the meeting or any adjournment thereof, either in person or by proxy.

The share conditions for the Class A Shares

and Class B Shares provide that, subject to applicable law and in addition to any other required shareholder approvals, all matters

to be approved by shareholders (other than the election of directors) must be approved by a majority, or in the case of matters that

require approval by special resolution, at least two-thirds, of the votes cast by the holders of Class A Shares and by the holders

of Class B Shares who vote in respect of the resolution, each voting as a separate class.

Notice and Access

BAM

is using the Notice and Access provisions of National Instrument 54-101 — Communication with Beneficial Owners of

Securities of a Reporting Issuer and National Instrument 51-102 — Continuous Disclosure Obligations (“Notice

and Access”) to provide meeting materials electronically for both registered and non-registered shareholders. Instead of

mailing meeting materials to shareholders, BAM has posted this Circular and form of proxy on its website at https://bam.brookfield.com

under “Notice and Access 2025”, in addition to posting it on SEDAR+ at www.sedarplus.ca

and EDGAR at www.sec.gov/edgar. BAM will send the Notice and a form of proxy or

voting instruction form (collectively, the “Notice Package”) to all shareholders informing them that this Circular is

available online and explaining how this Circular may be accessed. See “Canada Post Disruption” above. BAM will not

directly send the Notice Package to non-registered shareholders. Instead, BAM will pay Intermediaries (as defined on page 5 of

this Circular) to forward the Notice Package to all non-registered shareholders.

BAM has elected to utilize Notice and Access

because it allows for a reduction in the use of printed paper materials, and is therefore consistent with BAM’s philosophy towards

sustainability. Additionally, adopting Notice and Access has significantly lowered printing and mailing costs associated with BAM’s

shareholder meetings.

Registered

and non-registered shareholders who have signed up for electronic delivery of this Circular will continue to receive it by email. No

shareholders will receive a paper copy of this Circular unless they contact BAM at 1-866-989-0311 or bam.enquiries@brookfield.com,

in which case BAM will mail this Circular within three business days of any request, provided the request is made before the date of

the meeting or any adjournment thereof. We must receive your request before 5:00 p.m. (Toronto time) on January 9, 2025 to

ensure you will receive paper copies in advance of the deadline to submit your vote. If your request is made after the meeting and within

one year of this Circular being filed, BAM will mail this Circular within 10 calendar days of such request.

Q&A on Voting

What am I voting on?

| Resolution |

Who

Votes |

|

| Arrangement

Resolution |

Class A Shareholders

Class B Shareholders |

|

| Increase

in Number of Directors |

Class A Shareholders

Class B Shareholders |

|

Who is entitled to vote?

Holders of Class A Shares and holders of

Class B Shares as at the close of business on November 12, 2024 will each be entitled to one vote per share on the items of

business as identified above.

Registered shareholders and duly appointed proxyholders

will be able to attend the virtual meeting, submit questions and vote in real time, provided they are connected to the Internet, have

a control number and follow the instructions in the Circular. Non-registered shareholders who have not duly appointed themselves as proxyholder

will be able to attend the virtual meeting as guests but will not be able to ask questions or vote at the virtual meeting.

Shareholders who wish to appoint a person other

than the management nominees identified in the form of proxy or voting instruction form (including a non-registered shareholder who wishes

to appoint themselves to attend the virtual meeting) must carefully follow the instructions in the Circular and on their form of proxy

or voting instruction form. These instructions include the additional step of registering such proxyholder with our transfer agent, TSX

Trust Company (“TSX Trust”), after submitting the form of proxy or voting instruction form by calling TSX Trust at 1-866-751-6315

(within North America) or (416) 682-3860 (outside North America) or online at https://www.tsxtrust.com/control-number-request

no later than 5:00 p.m. (Toronto time) on January 23, 2025 and providing TSX Trust with information on your appointee. TSX

Trust will provide your appointee with a 13 digit control number which will allow your appointee to log in to and vote at the meeting.

Failure to register the proxyholder with our transfer agent will result in the proxyholder not receiving a 13 digit control number

to participate in the virtual meeting and only being able to attend as a guest. Guests will be able to listen to the virtual meeting

but will not be able to ask questions or vote.

Am I a registered shareholder or a non-registered shareholder?

Registered shareholders have a share certificate

or Direct Registration System statement issued in their name or appear as the registered shareholder on the books of BAM.

Non-registered shareholders are beneficial owners

of shares of BAM that are not registered shareholders. In many cases, Class A Shares that are beneficially owned by a non-registered

shareholder are registered either:

| · | in

the name of an intermediary such as a bank, trust company, securities dealer, broker or other

intermediary (each, an “Intermediary” and collectively, “Intermediaries”)

with whom the non-registered shareholder maintains an account, or a trustee or administrator

of self-administered RRSPs, RRIFs, RESPs and similar plans; or |

| · | in

the name of a depository such as CDS Clearing and Depository Services Inc. (“CDS”)

or the Depository Trust Company (“DTC”), of which the Intermediary is a participant. |

If you are a non-registered shareholder and your

shares are held in the name of an Intermediary, see “If my shares are not registered in my name but are held in the name of an

Intermediary, how do I vote my shares?” on page 9 of this Circular for voting instructions.

If you are not sure whether you are a registered

or non-registered shareholder, please contact TSX Trust. See “How do I contact the transfer agent?” on page 9 of this

Circular.

How do I vote?

Holders of Class A Shares and holders of

Class B Shares of BAM can vote in one of two ways, as follows:

| · | by

submitting your voting instructions prior to the meeting, or |

| · | during

the meeting by online ballot through the live webcast platform |

What if I plan to attend the meeting and vote by online ballot?

If you are a registered shareholder or a duly

appointed proxyholder (including non-registered shareholders who have duly appointed themselves as proxyholder by following the instructions

under the heading “If my shares are not registered in my name but are held in the name of an Intermediary, how do I vote my shares?”

on page 9 of this Circular), you can attend and vote during the meeting by completing an online ballot through the live webcast

platform. Guests (including non-registered shareholders who have not duly appointed themselves as proxyholder) can log into the meeting.

Guests will be able to listen to the meeting but will not be able to ask questions or vote during the virtual meeting. In order to attend

the virtual meeting, you will need to complete the following steps:

Step

1: Log in online at: https://meetings.lumiconnect.com/400-755-930-608

Step

2: Follow these instructions:

Registered

shareholders: Click “I have a login” and then enter your 13 digit control number and password “brookfield2025”

(case sensitive). The 13 digit control number located on the form of proxy or in the email notification you received from TSX Trust is

your control number. If you use your control number to log in to the meeting, any vote you cast at the meeting will revoke any proxy

you previously submitted. If you do not wish to revoke a previously submitted proxy, you should not vote during the meeting.

Duly

appointed proxyholders: Click “I have a login” and then enter your 13 digit control number and password “brookfield2025”

(case sensitive). Proxyholders who have been duly appointed and registered with TSX Trust as described in this Circular will receive

a 13 digit control number by email from TSX Trust after the proxy voting deadline has passed.

Guests:

Click “I am a Guest” and then complete the online form.

The meeting website will be accessible 60 minutes

prior to the start of the meeting. It is important that all attendees log in to the meeting website at least ten minutes prior to the

start of the meeting to allow enough time to complete the log in process. You will need the latest versions of Chrome, Safari, Edge or

Firefox. Please ensure your browser is compatible by logging in early. Please do not use Internet Explorer.

Internal network security protocols including

firewalls and VPN connections may block access to the Lumi platform for the meeting. If you are experiencing any difficulty connecting

to or watching the meeting, ensure your VPN setting is disabled or use a computer on a network not restricted to security settings of

your organization.

What if I plan to vote by proxy in advance of the meeting?

If you are a registered shareholder, you can

vote by proxy up to 5:00 p.m. (Toronto time) on Thursday, January 23, 2025 (or 48 hours prior to the time of any adjourned

meeting), as follows:

| · | to

vote by Internet, accessing www.meeting-vote.com and following the instructions

for electronic voting. You will need your control number; |

| · | sign

the form of proxy sent to you and vote your shares at the meeting and submit your executed

proxy via any of the following options: |

| (i) | by mail: in the envelope provided

or in one addressed to TSX Trust Company, Attention: Proxy Department, P.O. Box 721,

Agincourt, Ontario M1S 0A1; |

| (ii) | by fax: to (416) 595-9593; or |

| (iii) | by email: scan and send the

proxy to proxyvote@tmx.com. |

You

can appoint the persons named in the form of proxy or some other person (who need not be a shareholder of BAM) to represent you as proxyholder

at the meeting by writing the name of this person (or company) in the blank space on the form of proxy. If you wish to appoint

a person other than the management nominees identified in the form of proxy, you will need to complete the additional step of registering

your proxyholder by calling TSX Trust at 1-866-751-6315 (within North America) or (416) 682-3860 (outside of North America) or online

at https://www.tsxtrust.com/control-number-request by no later than 5:00 p.m. (Toronto time) on Thursday, January 23,

2025.

| · | to

vote by telephone, call toll-free at 1-888-489-5760. You will be prompted to provide

the control number printed on the form of proxy sent to you. The telephone voting service

is not available on the day of the meeting. |

If you are a non-registered shareholder and your

shares are held in the name of an Intermediary, to direct the votes of shares beneficially owned, see “If my shares are not registered

in my name but are held in the name of an Intermediary, how do I vote my shares?” on page 9 of this Circular for voting instructions.

Who is soliciting my proxy?

The proxy is being solicited by management of

BAM and the associated costs will be borne by BAM.

What happens if I sign the proxy sent to me?

Signing the proxy appoints Marcel R. Coutu or

Samuel J.B. Pollock, each of whom is a director of BAM, or another person you have appointed, to vote or withhold from voting your shares

at the meeting.

Can I appoint someone other than these directors to vote my shares?

Yes,

you may appoint another person or company other than the BAM directors named on the form of proxy or voting instruction form to be your

proxyholder. Write the name of this person (or company) in the blank space on the form of proxy or voting instruction form.

The person you appoint does not need to be a shareholder. Please make sure that such other person you appoint is attending the meeting

and knows he or she has been appointed to vote your shares. You will need to complete the additional step of registering such proxyholder

with our transfer agent, TSX Trust, after submitting the form of proxy or voting instruction form. See “If my shares are not registered

in my name but are held in the name of an Intermediary, how do I vote my shares?” on page 9 of this Circular for instructions

on registering your proxy with TSX Trust.

What do I do with my completed form of proxy?

Return it to TSX Trust in the envelope provided

to you by mail, by fax at (416) 595-9593 or scan and send by email to proxyvote@tmx.com no later than 5:00 p.m. (Toronto

time) on Thursday, January 23, 2025, which is two business days before the day of the meeting.

Can I vote by Internet in advance of the meeting?

Yes. If you are a registered shareholder, go

to www.meeting-vote.com and follow the instructions on this website. You will need your control number (located on the form of

proxy) to identify yourself to the system. You must submit your vote by no later than 5:00 p.m. (Toronto time) on Thursday, January 23,

2025, which is two business days before the day of the meeting.

If you are a non-registered shareholder and your

Intermediary makes this option available, go to www.proxyvote.com and follow the instructions on this website. You will need your

control number (located on the voting instruction form) to identify yourself to the system. You must submit your vote by no later than

5:00 p.m. (Toronto time) on Wednesday, January 22, 2025, which is one business day before the proxy deposit date of

Thursday, January 23, 2025. Refer to the instructions on your voting instruction form for more details.

If I change my mind, can I submit another proxy or take back my

proxy once I have given it?

Yes. If you are a registered shareholder, you

may deliver another properly executed form of proxy with a later date to replace the original proxy in the same way you delivered the

original proxy. If you wish to revoke your proxy, prepare a written statement to this effect signed by you (or your attorney as authorized

in writing) or, if the shareholder is a corporation, under its corporate seal or by a duly authorized officer or attorney of the corporation.

This statement must be delivered to the Corporate Secretary of BAM at the address below no later than 5:00 p.m. (Toronto time)

on the last business day preceding the date of the meeting, Friday, January 24, 2025, or any adjournment of the meeting, or to the

Chair of the Board (the “Chair”) prior to the start of the meeting on Monday, January 27, 2025, or the day of the adjourned

meeting. You may also vote during the virtual meeting by submitting an online ballot, which will revoke your previous proxy.

Corporate Secretary

Brookfield Asset Management Ltd.

Brookfield Place

250 Vesey Street, 15th Floor

New York, New York

10281-0221

United States

For non-registered shareholders, if you have

provided your voting instructions and change your mind about your vote, you can revoke your proxy or voting instructions by contacting

your intermediary. If your intermediary provides the option of voting over the Internet, you can change your instructions by updating

your voting instructions on the website provided by your intermediary, so long as you submit your new instructions before the intermediary’s

deadline.

How will my shares be voted if I give my proxy?

The persons named on the form of proxy must vote

your shares for or against or withhold from voting, in accordance with your directions, or you can let your proxyholder decide for you.

If you specify a choice with respect to any matter to be acted upon, your shares will be voted accordingly. In the absence of voting

directions, proxies received by management will be voted in favor of all resolutions put before shareholders of the meeting. See “Part Three

– Business of the Meeting” on page 12 of this Circular for further information.

What if amendments are made to these matters or if other matters

are brought before the meeting?

The persons named on the proxy will have discretionary

authority with respect to amendments or variations to matters identified in the Notice and with respect to other matters which may properly

come before the meeting.

As at the date of this Circular, management of

BAM is not aware of any amendment, variation or other matter expected to come before the meeting. If any other matters properly come

before the meeting, the persons named on the form of proxy will vote on them in accordance with their best judgment.

Who counts the votes?

BAM’s transfer agent, TSX Trust, counts

and tabulates the proxies.

How do I contact the transfer agent?

For general shareholder enquiries, you can contact

TSX Trust as follows:

| Mail |

Telephone/Fax |

Online |

| |

|

|

TSX Trust Company

301–100 Adelaide Street West

Toronto, Ontario M5H 4H1 |

Tel: (416) 682-3860

within Canada and the United States

toll free at 1-800-387-0825

Fax: 1-888-249-6189 or

(514) 985-8843 |

Email: shareholderinquiries@tmx.com

Website: www.tsxtrust.com |

If my shares are not registered in my name but are held in the

name of an Intermediary, how do I vote my shares?

Your Intermediary is required to send you a voting

instruction form for the number of shares you beneficially own. Non-registered shareholders should follow the instructions

on the forms they receive and contact their Intermediaries promptly if they need assistance.

A non-registered shareholder who does not wish

to attend and vote at the meeting and wishes to vote prior to the meeting must complete and sign the voting instruction form and return

it in accordance with the directions on the form. If your Intermediary makes these options available, you may also vote by telephone

prior to the meeting by following the directions on the voting instruction form on the Internet prior to the meeting by going to www.proxyvote.com

and following the instructions on this website. See “Can I vote by Internet in advance of the meeting?” on page 8

of this Circular.

Since BAM has limited access to the names of

its non-registered shareholders, if you attend the virtual meeting, BAM may have no record of your shareholdings or of your entitlement

to vote unless your Intermediary has appointed you as proxyholder. Therefore, if you wish to vote by online ballot at the meeting, you

will need to complete the following steps:

Step

1: insert your name in the space provided on the voting instruction form and return it by following the instructions provided

therein.

Step

2: you must complete the additional step of registering yourself (or your appointees other than if your appointees are the

management nominees) as the proxyholder by calling TSX Trust at 1-866-751-6315 (within North America) or (416) 682-3860 (outside of North

America) or online at https://www.tsxtrust.com/control-number-request by no later than 5:00 p.m. (Toronto time) on Thursday,

January 23, 2025.

Failing to register as a proxyholder will result

in the proxyholder not receiving a control number, which is required to vote at the meeting. Non-registered shareholders who have not

duly appointed themselves as proxyholder will not be able to vote at the meeting but will be able to participate as a guest.

Principal Holders of Voting Shares

Executives of Brookfield hold a substantial portion

of their individual investments in Class A Shares in partnership with one another, and also have stewardship of the Class B

Shares. We refer to this as the “Partnership”. The Partnership’s members include both current and former senior executives

and directors of BAM and its predecessors (each, a “Partner” and collectively, the “Partners”). This ownership

framework among the Partners has been an important tradition underpinning Brookfield’s culture for over 50 years.

The Partnership is instrumental in ensuring the

orderly management succession of BAM, while fostering a culture of strong governance and mutual respect, a commitment to collective excellence

and achievement, and a focus on long-term value creation for all stakeholders.

We believe that the Partnership promotes decision-making

that is entrepreneurial, collaborative and aligned with the long-term interests of BAM. The financial strength and sustainability of

the Partnership is characterized by a consistent focus on renewal—longstanding members mentoring new generations of leaders and

financially supporting their admission as Partners. This is a critical component to preserving our culture and vision.

Consistent with the role that it has played within

BN over many decades, the Partnership remains resolutely focused on the long-term success of BAM for the benefit of all stakeholders,

through both future economic downturns and financial disruptions. This long-term focus is considered critical to the sustainability of

BAM.

The Partners collectively own interests in approximately

96 million Class A Shares (on a fully diluted basis). These economic interests consist primarily of (i) the direct ownership

of Class A Shares, as well as indirect ownership (such as Class A Shares that are held through holding companies and by foundations),

by the Partners on an individual basis; and (ii) the Partners’ proportionate beneficial interests in Class A Shares held

by Partners Value Investments L.P. (“PVI”). PVI is a publicly-listed investment partnership whose principal business activity

is owning equity interests in Brookfield for the long-term. As of December 1, 2024, the Partners owned not less than 90% of PVI’s

equity units. PVI owns approximately 31 million Class A Shares (on a fully diluted basis).

In order to foster the long-term stability and

continuity of BAM, a group of longstanding senior leaders of the Partnership have been designated to oversee stewardship of the Class B

Shares. Under these arrangements, the Class B Shares are held in a trust (the “BAM Partnership”). The beneficial interests

in the BAM Partnership, and the voting interests in its trustee, are held as follows: one-third by Mr. Bruce Flatt, one-third by

Mr. Jack L. Cockwell, and one-third jointly by Messrs. Brian W. Kingston, Brian D. Lawson, Cyrus Madon, Samuel J.B. Pollock

and Sachin Shah in equal parts. As such, no single individual or entity controls the BAM Partnership. The BAM Partnership owns 21,280

Class B Shares, representing 100% of the Class B Shares.

In the event of a fundamental disagreement among

the shareholders of the trustee (and until the disagreement is resolved), three individuals have been granted the authority to govern

and direct the actions of the BAM Partnership. These individuals are, and their successors are required to be, longstanding and respected

business colleagues associated with Brookfield. The individuals, at the current time, none of whom are Partners, are Marcel R. Coutu,

Frank J. McKenna and Lord O’Donnell.

Under these arrangements, the BAM Partnership

has become a party to the trust agreement with Computershare Trust Company of Canada as trustee for the holders of Class A Shares,

dated December 9, 2022 (the “2022 Trust Agreement”). The 2022 Trust Agreement provides, among other things, that the

BAM Partnership not sell any Class B Shares, directly or indirectly, pursuant

to a takeover bid at a price per share in excess

of 115% of the market price of the Class A Shares or as part of a transaction involving purchases made from more than five persons

or companies in the aggregate, unless a concurrent offer is made to all holders of Class A Shares.

The concurrent offer must be: (i) for the

same percentage of Class A Shares as the percentage of Class B Shares offered to be purchased from the BAM Partnership; (ii) at

a price per share at least as high as the highest price per share paid pursuant to the takeover bid for the Class B Shares; and

(iii) on the same terms in all material respects as the offer for the Class B Shares. These provisions in the 2022 Trust Agreement

also apply to any transaction that would be deemed an indirect offer for the Class B Shares under applicable takeover bid legislation

in Canada. Additionally, the BAM Partnership will agree to prevent any person or company from carrying out a direct or indirect sale

of Class B Shares in contravention of the 2022 Trust Agreement.

To the knowledge of the directors and officers

of BAM, there are no other persons or corporations that beneficially own, exercise control or direction over, have contractual arrangements

such as options to acquire, or otherwise hold voting securities of BAM carrying more than 10% of the votes attached to any class of outstanding

voting securities of BAM.

Part Three –

Business of the Meeting

We will address the following items at the meeting:

| 1. | to consider, pursuant to a varied interim

order (the “Interim Order”) of the Supreme Court of British Columbia dated December 9,

2024, and, if deemed advisable, to pass a special resolution (the “Arrangement Resolution”),

the full text of which is set forth in Error! Reference source not found. to the accompanying

Circular, with or without variation, approving an arrangement (the “Arrangement”)

involving BAM, Brookfield Corporation and others under the provisions of Division 5

Part 9 of the Business Corporations Act (British Columbia) and as more particularly

described in the Circular; |

| 2. | to consider and, if deemed advisable,

to pass a special resolution increasing the number of directors of BAM from 12 to 14; and |

| 3. | to transact such other business as may

properly come before the meeting or any adjournment or postponement thereof. |

As at the date of this Circular, management is

not aware of any changes to these items and does not expect any other items to be brought forward at the meeting. If there are changes

or new items, you or your proxyholder can vote your shares on these items as you or your proxyholder sees fit. The persons named on the

form of proxy will have discretionary authority with respect to any changes or new items which may properly come before the meeting and

will vote on them in accordance with their best judgment.

Background to the Arrangement

The following is a summary of certain relevant

background information that informed the deliberations of the board of directors of BAM (the “Board”) and the Governance,

Nominating and Compensation Committee of the Board (the “GNCC”), as well as the principal events leading up to the public

announcement on October 31, 2024 of the arrangement agreement between BAM and BN (the “Arrangement Agreement”) and the

meetings, discussions and actions that preceded the public announcement of the Arrangement.

BAM was created on December 9, 2022 to provide

investors with access to Brookfield’s leading global alternative asset management business (the “asset management business”).

While creating BAM helped simplify BAM’s story, and BAM has significantly expanded its shareholder base since, BAM believes there

is more it can do to broaden its shareholder base and gain access to the deepest pools of capital. The most common feedback BAM has received

from investors on how to broaden its shareholder base is to position BAM for inclusion in some of the most widely followed global large

cap stock indices, including in the U.S. (“Index Admission”). Management believes that BAM would also benefit from more closely

aligning its structure and size with what it considers to be its peers, namely, U.S.-based global alternative asset management businesses.

BAM is constantly evaluating opportunities for

growth and considering the views and opinions of its investors, including assessing potential pathways to Index Admission. In April 2023,

a significant barrier to Index Admission for BAM was removed when S&P Dow Jones Indices announced that it had updated its share class

eligibility rule for additions to certain indices such that companies with multiple share class structures, which would have included

BAM as a result of its Class A Shares and Class B Shares, may be considered eligible candidates. Since this announcement, several

companies with multiple share class structures, including certain of BAM’s U.S.-based global alternative asset management business

peers, have been admitted to the S&P 500 index. As a result of these developments, the prospects and rationale for positioning BAM

for Index

Admission was discussed by the Board and management

was tasked with undertaking a more thorough analysis of its viability and other potential structural changes to more closely align BAM

with its peers.

In conducting its analysis, management determined

that an important step in achieving these goals is to increase BAM’s market capitalization so that it reflects 100% of the value

of the asset management business. Management identified an efficient means to effect this change by requesting that BN exchange its common

shares of the Asset Management Company (the “Common Shares”) for newly issued Class A Shares on a one-for-one basis

pursuant to the Arrangement. This structure has the benefit of simplifying the structure of the asset management business, as its ownership

would be consolidated under BAM, rather than split between BN and BAM. Upon completion of the Arrangement, BAM would own, directly and

indirectly, 100% of the Common Shares and BN would own approximately 73% of the Class A Shares. Management decided to explore this

structure more closely with external advisors before making its final recommendation to the Board.

In July 2024, representatives of BAM met

with BAM’s external counsel, Torys LLP (“Torys”), to discuss the proposed structure of the Arrangement. It was determined

that the GNCC would review and oversee the Arrangement on behalf of BAM. The GNCC is comprised solely of independent BAM directors, being

Olivia Garfield, Nili Gilbert, Diana Noble and Satish Rai, that are also independent of BN within the meaning of Multilateral Instrument

61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). On August 26, 2024,

the GNCC retained Goodmans LLP (“Goodmans”) to act as independent legal counsel. The GNCC also reviewed the credentials of

a number of investment banks and valuators to act as independent valuator and considered the independence requirements for valuators

under MI 61-101. Also, on August 26, 2024, the GNCC engaged KPMG LLP (“KPMG”) to act as independent valuator and prepare

a formal valuation in accordance with the requirements of MI 61-101 (the “Formal Valuation”). Following its engagement, KPMG

commenced work on the Formal Valuation. During the course of its engagement, KPMG met several times with BAM management.

Prior to the first formal meeting of the GNCC

on September 30, 2024, Ms. Garfield, as Chair of the GNCC, held an initial meeting with Goodmans, together with representatives

of BAM management, to discuss, among other things, process and timeline and the anticipated manner in which the GNCC’s review would

be conducted.

The GNCC held a meeting on September 30,

2024 with Goodmans to discuss, among other things, the Arrangement and next steps. During the meeting, the GNCC considered additional

factors that may be relevant to the independence of its advisors and determined that, notwithstanding prior interactions with Brookfield

and various of its affiliates, the GNCC was satisfied with their independence. The GNCC also received advice from Goodmans regarding

the duties and responsibilities of the GNCC and the legal requirements applicable to the Arrangement, including the application of MI

61-101 and the requirement to obtain the Formal Valuation.

At the GNCC meeting held on October 16,

2024, management reviewed (i) the proposed changes to the BAM governance structure, including the proposed amendment to BAM’s

articles that would entitle BN to elect a majority of the Board consistent with its economic interest in BAM, and (ii) the benefits

to BAM in connection with the Arrangement. KPMG also reviewed with the GNCC its preliminary financial analysis of the Arrangement relating

to both its analysis of the Asset Management Company and the Class A Shares. The GNCC also discussed various other matters, including

the GNCC’s responsibilities with respect to the Arrangement and the Formal Valuation. Following discussion, the GNCC determined

to instruct KPMG to prepare a fairness opinion in respect of the Arrangement (the “Fairness Opinion”).

On October 16, 2024, Torys provided an initial

draft of the Arrangement Agreement. Thereafter, in parallel with the GNCC’s consideration of the Arrangement, Goodmans engaged

in ongoing discussions and negotiations with Torys regarding the documentation and implementation of the Arrangement and exchanged drafts

of the Arrangement Agreement and the other key documents necessary to give effect to the Arrangement.

At the GNCC meeting held on October 22,

2024, KPMG reviewed additional information and analysis relating to its findings, including in response to questions raised during the

October 16th meeting. The GNCC also discussed and considered the factors and considerations relevant to its review, consideration

and analysis of the Arrangement and sought advice and input from Goodmans and KPMG.

Between each of the formal meetings of the GNCC,

there was informal consideration of relevant matters among various members of the GNCC and Goodmans. Each of the other independent directors

of BAM were invited to attend each of the meetings of the GNCC.

On the afternoon of October 31, 2024, the

GNCC met to review and consider the terms of the proposed Arrangement and the Arrangement Agreement. During the meeting, the GNCC received

a presentation from KPMG regarding the conclusion of the Formal Valuation and KPMG provided its opinion to the GNCC that, as of October 31,

2024, and based on the scope of KPMG’s review and subject to the assumptions and limitations to be set forth in the Formal Valuation,

the fair market value of the Common Shares was in the range of $75.8 billion to $84.5 billion, or $80.1 billion at midpoint (or $46.35

to $51.67, or $48.98 at midpoint, on a per share basis), and that the fair market value of the Class A Shares is in the range of

$20.1 billion to $22.4 billion, or $21.2 billion at midpoint (or $46.43 to $51.63, or $49.01 at midpoint, on a per share basis). KPMG

also provided its opinion that, based on the scope of KPMG’s review and subject to the assumptions and limitations to be set forth

in the Fairness Opinion, the Arrangement is fair, from a financial point of view, to Minority Shareholders. At the meeting, Goodmans

and management of BAM reviewed with the GNCC the terms of the Arrangement, including the material terms of the Arrangement Agreement,

the benefits and risks of the Arrangement and the steps required for approval of the Arrangement.

Following the presentations provided by the GNCC’s

advisors at the October 31st meeting, the GNCC met in camera with Goodmans to consider the Arrangement. After

consideration and discussion of the advice and opinions provided to the GNCC, the GNCC unanimously determined, based on the factors set

forth below under “Reasons for the Arrangement”, that the Arrangement is in the best interests of BAM. The GNCC also unanimously

resolved to recommend that the Board: (i) determine that the Arrangement is in the best interests of BAM and approve the Arrangement;

and (ii) recommend that shareholders of BAM vote in favor of the Arrangement Resolution.

The Board met late in the afternoon of October 31,

2024, following the conclusion of the GNCC’s meeting. After receiving the recommendation of the GNCC, the Board unanimously resolved,

based on the recommendation of the GNCC and the factors set forth below under “Reasons for the Arrangement”, to: (i) determine

that the Arrangement is in the best interests of BAM and approve the Arrangement; and (ii) recommend that shareholders of BAM vote

in favor of the Arrangement Resolution.

The Arrangement Agreement was finalized and executed

in the evening of October 31, 2024 and entry into the Arrangement Agreement was publicly announced promptly thereafter.