UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-41563

Brookfield Asset Management Ltd.

(Translation of registrant's name into English)

Brookfield Place, Suite 100, 181 Bay Street, P.O. Box 762 Toronto, Ontario, Canada M5J 2T3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Brookfield Asset Management Ltd. |

| | | (Registrant) |

| | | |

| | | |

| Date: December 3, 2024 | | /s/ Hadley Peer Marshall |

| | | Hadley Peer Marshall |

| | | Chief Financial Officer |

| | | |

EXHIBIT 99.1

Brookfield Commits to Growing Investment in France

New office hub opened in Paris

Renewable energy, digital infrastructure and real estate in focus

Neoen transaction nears completion of its first stage

NEW YORK, Dec. 03, 2024 (GLOBE NEWSWIRE) -- Brookfield Asset Management (“Brookfield”), a leading global alternative asset manager with over $1 trillion of assets under management, announced today the opening of a new office hub in Paris to deepen its established presence in the market.

Brookfield has been actively investing in France since 2015 and employs over 7,000 people through its operations. Its portfolio extends across AI and other digital infrastructure, renewable energy, residential decarbonization, student and young professional living, hospitality, and logistics.

Sikander Rashid, Head of Europe, Brookfield, said, “At Brookfield we see significant long-term potential to invest in sectors critical to the French economy, including renewables, cellular towers, data centers and real estate. By deepening our presence here, we are demonstrating the high conviction we hold in the long-term opportunity ahead for Brookfield in France.”

Vincent Kerboull, Managing Director and Head of Real Estate Investing in Benelux and France, Brookfield said “As one of the major global economies, France is home to leading global businesses. We are excited to expand our local partnerships, and to bring our global expertise and the Brookfield ecosystem to provide new solutions for critical sectors in France to grow.”

Over the last five years, Brookfield has accelerated its investment in France across several major transactions and acquisitions. Earlier this year, Brookfield announced its intention to acquire a 53% stake in Neoen, a global leader in renewable energy development headquartered in Paris. This transaction is expected to close this year and a tender offer for the remaining shares and convertible bonds is expected to be launched early in 2025. Brookfield’s offer implies an equity value for 100% of the shares of €6.1 billion.

Today, Brookfield’s portfolio in France includes: Data4, a leading European hyperscale data center operator; the French operations of residential decarbonization business HomesServe; Castignac, a vertically integrated logistics manager; UXCO Group, a developer and manager of residential properties for students and young professionals; a partnership with Experimental Group, the boutique hospitality business; and TDF, an independent French tower operator with over 7,000 communication towers.

Brookfield has been investing in Europe since 2003, and today manages approximately €180 billion of assets across the region. London remains the primary investment hub for all investments across the European regions, supported by hubs in Madrid, Frankfurt and Paris.

About Brookfield Asset Management

Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) is a leading global alternative asset manager with over $1 trillion of assets under management across renewable power and transition, infrastructure, private equity, real estate, and credit. We invest client capital for the long-term with a focus on real assets and essential service businesses that form the backbone of the global economy. We offer a range of alternative investment products to investors around the world — including public and private pension plans, endowments and foundations, sovereign wealth funds, financial institutions, insurance companies and private wealth investors. We draw on Brookfield’s heritage as an owner and operator to invest for value and generate strong returns for our clients, across economic cycles.

For more information, please visit our website at www.bam.brookfield.com or contact:

Media:

Simon Maine

Brookfield Asset Management

Tel: +44 739 890 9278

Email: simon.maine@brookfield.com

Notice to Readers

In addition to historical fact, this news release contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of the U.S. Securities Act of 1933, the U.S. Securities Exchange Act of 1934, and, “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and in any applicable Canadian securities regulations (collectively, “forward-looking statements”). Forward-looking statements include statements that are predictive in nature, depend upon or refer to future results, events or conditions, and reflect management’s current estimates, beliefs and assumptions, which are in turn based on the perception of historical trends, current conditions and expected future developments regarding Brookfield, as well as other factors management believes are appropriate in the circumstances. Forward-looking statements include words such as “expect”, “anticipate”, “believe”, “foresee”, “could”, “estimate”, “goal”, “intend”, “plan”, “seek”, “strive”, “will”, “may” and “should” and similar expressions. In particular, the forward-looking statements contained in this news release include statements referring to the expected closing of the Neoen transaction and the potential of the French economy.

Although Brookfield believes that such forward-looking statements are based upon reasonable estimates, beliefs and assumptions, certain factors, risks and uncertainties, which are described from time to time in our documents filed with the securities regulators in Canada and the United States, or that are not presently known to Brookfield or that Brookfield currently believes are not material, could cause actual results or events to differ materially from those expressed or implied by forward-looking statements.

Readers are cautioned not to place undue reliance on forward-looking statements that are included in this news release, which are made as of the date of this news release. Except as required by law, Brookfield undertakes no obligation to publicly update or revise any forward-looking statements, whether written or oral, that may be as a result of new information, future events or otherwise.

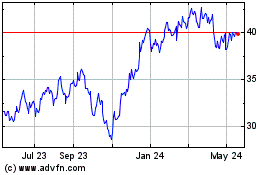

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Nov 2024 to Dec 2024

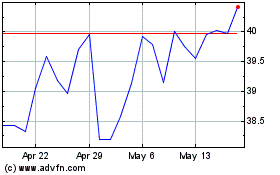

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Dec 2023 to Dec 2024