Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

04 September 2024 - 8:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-39436

KE Holdings Inc.

(Registrant’s Name)

Oriental Electronic Technology Building,

No. 2 Chuangye Road, Haidian District,

Beijing 100086

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KE Holdings Inc. |

| |

|

|

|

| |

By |

: |

/s/ XU Tao |

| |

Name |

: |

XU Tao |

| |

Title |

: |

Chief Financial Officer |

Date: September 4, 2024

Exhibit

99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

KE Holdings Inc.

貝殼控股有限公司

(A company controlled through

weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock Code: 2423)

GRANT OF RESTRICTED SHARE UNITS

The Company approved to grant

an aggregate of 50,136 RSUs (representing equal number of underlying Class A ordinary shares), comprising (i) 35,094 RSUs to

Ms. Xiaohong Chen, an independent non-executive Director of the Company, and (ii) 15,042 RSUs to Mr. Hansong Zhu, an independent

non-executive Director of the Company (each a “Director Grant” and collectively, the “Director Grants”),

on September 3, 2024 pursuant to the 2020 Share Incentive Plan. Such Director Grants will not be subject to the Shareholders’

approval.

The

Director Grants are subject to the terms and conditions of the 2020 Share Incentive Plan, and the director service agreement and award

agreement entered into between the Company and each of Ms. Xiaohong Chen and Mr. Hansong Zhu. The principal terms of the 2020

Share Incentive Plan were set out in the section headed “Statutory and General Information — The Share Incentive Plans

— 2020 Share Incentive Plan” in Appendix IV to the listing

document of the Company dated May 5, 2022 and the 2023 annual report of the Company dated April 26, 2024.

Details of the Director Grants

are set out below:

| Date of grant |

|

September 3, 2024 |

| |

|

|

| Total number of RSUs granted |

|

50,136 RSUs, comprising 35,094 RSUs to Ms. Xiaohong

Chen and 15,042 RSUs to Mr. Hansong Zhu |

| |

|

|

| Purchase

price of RSUs granted |

|

Nil |

| |

|

|

| Closing

price of the Class A ordinary shares on the date of grant |

|

HK$38.55 per share |

| Vesting condition and periods |

|

Subject to the terms of the director

service agreement and award agreement entered into between the Company and each of Ms. Xiaohong Chen and Mr. Hansong Zhu and the

2020 Share Incentive Plan, the RSUs granted to Ms. Xiaohong Chen and Mr. Hansong Zhu under the Director Grants shall fully vest on

the first anniversary of the date of grant. |

| |

|

|

| Performance targets |

|

The vesting of the RSUs under the Director Grants

is not subject to any performance targets. The Compensation Committee is of the view that it is not necessary to set performance

targets for each of the Director Grants because it (i) forms part of the remuneration package of such independent non-executive Directors;

(ii) is in line with the recommended best practice E.1.9 of Part 2 of the Corporate Governance Code contained in Appendix C1 to the

Listing Rules, which recommends issuers not to grant equity-based remuneration with performance-related elements to independent non-executive

directors as this may lead to bias in their decision-making and compromise their objectivity and independence; and (iii) is subject

to clawback mechanisms as detailed below. |

| |

|

|

| Clawback mechanisms |

|

Pursuant to the terms of the Director Grants and

the 2020 Share Incentive Plan, if Grantee’s termination of service is by reason of cause set out in the 2020 Share Incentive

Plan, the Grantee’s right to any vested and unvested RSUs shall terminate concurrently with his/her termination of services.

Under such circumstances, the balance of the RSUs that have not vested shall lapse and be forfeited. For the vested RSUs, the Board

or the Compensation Committee may in its discretion determine (acting fairly and reasonably) that Grantee should repay to the Company

(whether by re-transfer of Shares (or withholding the transfer of Shares where such transfer has not occurred), payment of cash proceeds

or deductions from or set offs against any amounts owed to the Grantee by any member of the Group) an amount equal to the benefit,

calculated on an after-tax basis, received or to be received by the Grantee from such vesting, provided that the Board or the Compensation

Committee may, at its discretion, determine that a lesser amount should be repaid. |

Each of the Director Grants was

approved by the independent non-executive Directors (each excluding the independent non-executive Director who is the Grantee). Vesting

of the 50,136 RSUs granted under the Director Grants will be satisfied through utilizing the existing Class A ordinary shares registered

in the name of the depositary bank issued before the Listing.

The Listing Committee of the

Hong Kong Stock Exchange had granted approval for the listing of, and permission to deal in, the existing Class A ordinary shares

registered in the name of the depositary bank issued before the Listing.

The Director Grants would not

result in the options and awards granted and to be granted to the Grantees in the 12-month period up to and including the date of such

grant in aggregate to exceed 1% of the Shares in issue.

CLASS A ORDINARY SHARES

AVAILABLE FOR FUTURE GRANT UNDER THE 2020 SHARE INCENTIVE PLAN

According to the 2020 Share Incentive

Plan, the maximum aggregate number of Class A ordinary shares which may be further issued pursuant to all Awards under the 2020

Share Incentive Plan as at the date of the Listing shall be 253,246,913. As at the date of this announcement and following the Director

Grants, 177,770,420 Awards (representing equal number of underlying Class A ordinary shares) may be further granted under the 2020

Share Incentive Plan.

The amended 2020 Share Incentive

Plan took effective from May 11, 2022 (the “Effective Date”) and will expire on the tenth anniversary of the

Effective Date (the “Expiration Date”) unless earlier terminated. Upon expiry of the 2020 Share Incentive Plan, any

Awards that have been granted and are outstanding as of the Expiration Date shall remain in force according to the terms of the 2020

Share Incentive Plan and the applicable award agreement.

DEFINITIONS

In this announcement, the following

expressions shall have the following meanings unless the context requires otherwise:

| “2020 Share Incentive Plan” |

|

the 2020 Global Share Incentive Plan

adopted by the Shareholders in July 2020 and amended in April 2022, which permits the grant of awards in the forms of options, restricted

shares, and RSUs or other types of awards approved by the Board or the Compensation Committee |

| |

|

|

| “ADSs” |

|

American depositary shares, each of which represents

three Class A ordinary shares |

| |

|

|

| “Award(s)” |

|

award(s) in the form of option, restricted shares,

RSUs or other types of awards approved by the Board or the Compensation Committee pursuant to the 2020 Share Incentive Plan to Participant(s) |

| |

|

|

| “Board” |

|

the board of Directors of the Company |

| |

|

|

| “Class A ordinary shares” |

|

Class A ordinary shares of the share capital of the

Company with a par value of US$0.00002 each, conferring a holder of a Class A ordinary share one vote per share on all matters subject

to the vote at general meetings of the Company |

| |

|

|

| “Class B ordinary shares” |

|

Class B ordinary shares of the share capital of the

Company with a par value of US$0.00002 each, conferring weighted voting rights in the Company such that a holder of a Class B ordinary

share is entitled to ten votes per share on all matters subject to the vote at general meetings of the Company, subject to the requirements

under Rule 8A.24 of the Listing Rules that the reserved matters shall be voted on a one vote per share basis |

| |

|

|

| “Company” |

|

KE Holdings Inc., an exempted company with limited

liability incorporated in the Cayman Islands on July 6, 2018 |

| |

|

|

| “Compensation Committee” |

|

the compensation committee of the Board |

| |

|

|

| “Director(s)” |

|

the director(s) of the Company |

| |

|

|

| “Grantee(s)” |

|

Ms. Xiaohong Chen and Mr. Hansong Zhu |

| |

|

|

| “Group” |

|

the Company and its subsidiaries and consolidated

affiliated entities from time to time |

| |

|

|

| “HK$” |

|

Hong Kong dollars, the lawful currency of Hong Kong |

| “Hong Kong Stock Exchange” |

|

The Stock Exchange of Hong Kong Limited |

| |

|

|

| “Listing” |

|

the listing of the Class A ordinary shares on the

Main Board of the Hong Kong Stock Exchange |

| |

|

|

| “Listing Rules” |

|

the Rules Governing the Listing of Securities on

The Stock Exchange of Hong Kong Limited |

| |

|

|

| “Participant(s)” |

|

a person who, as a director, consultant or employee

of any member of the Group, has been granted an Award pursuant to the 2020 Share Incentive Plan |

| |

|

|

| “RSU(s)” |

|

restricted share unit(s) |

| |

|

|

| “Share(s)” |

|

the Class A ordinary shares and Class B ordinary

shares in the share capital of the Company, as the context so requires |

| |

|

|

| “Shareholder(s)” |

|

holder(s) of Shares and, where the context requires,

ADSs |

| |

|

|

| “US$” |

|

U.S. dollars, the lawful currency of the United States

of America |

| |

|

|

| “%” |

|

per cent |

| |

By order of the Board |

| |

KE Holdings Inc. |

| |

Yongdong Peng |

| |

Chairman

and Chief Executive Officer |

Hong Kong, September 3,

2024

As

at the date of this announcement, the board of directors of the Company comprises Mr. Yongdong Peng, Mr. Yigang Shan, Mr. Wangang

Xu and Mr. Tao Xu as the executive directors, Mr. Jeffrey Zhaohui Li as the non-executive director, and Ms. Xiaohong Chen,

Mr. Hansong Zhu and Mr. Jun Wu as the independent non-executive directors.

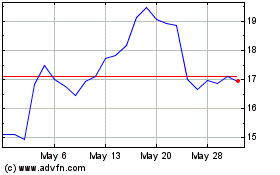

KE (NYSE:BEKE)

Historical Stock Chart

From Dec 2024 to Jan 2025

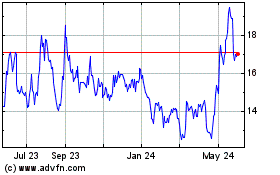

KE (NYSE:BEKE)

Historical Stock Chart

From Jan 2024 to Jan 2025