UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-39436

KE Holdings Inc.

(Registrant’s Name)

Oriental Electronic Technology Building,

No. 2 Chuangye Road, Haidian District,

Beijing 100086

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KE Holdings Inc. |

| |

|

|

|

| |

By |

: |

/s/ XU Tao |

| |

Name |

: |

XU Tao |

| |

Title |

: |

Chief Financial Officer |

| |

|

|

|

| Date: December 12, 2024 |

|

|

|

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

KE Holdings Inc.

貝殼控股有限公司

(A company controlled through

weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock Code: 2423)

CONTINUING

CONNECTED TRANSACTIONS

ENTERING

INTO THE NEW CLOUD SERVICES AND TECHNICAL SERVICES FRAMEWORK AGREEMENT

ENTERING

INTO THE NEW CLOUD SERVICES AND TECHNICAL SERVICES FRAMEWORK AGREEMENT

The

Board is pleased to announce that, on December 11, 2024 (after trading hour), the Company entered into the cloud services and technical

services framework agreement (the “New Cloud Services and Technical Services Framework Agreement”) with Tencent Computer

with a term of three years from January 1, 2025 to December 31, 2027. Pursuant to the New Cloud Services and Technical Services

Framework Agreement, Tencent Computer (for itself and on behalf of the Represented Tencent Group) will provide cloud services and other

technical services to the Group.

LISTING

RULES IMPLICATIONS

Tencent

Computer is a consolidated affiliated entity of Tencent, which is one of the Company’s substantial shareholders, and is therefore

a connected person of the Company. As such, the transactions under the New Cloud Services and Technical Services Framework Agreement

constitute continuing connected transactions of the Company under Chapter 14A of the Listing Rules.

As the highest of

the applicable percentage ratio calculated under Chapter 14A of the Listing Rules in respect of the annual caps for the services

fees payable by the Group under the New Cloud Services and Technical Services Framework Agreement is more than 0.1% but less than 5%,

the transactions contemplated under the New Cloud Services and Technical Services Framework Agreement are subject to the reporting, announcement

and annual review requirements but are exempt from the independent Shareholders’ approval requirement under Chapter 14A of the

Listing Rules.

BACKGROUND

We refer to the section headed

“Connected Transactions” of the listing document dated May 5, 2022 published by the Company on the website of the Hong

Kong Stock Exchange, which disclosed, among other things, that on April 28, 2022, the Company entered into the cloud services and

technical services framework agreement (the “Previous Cloud Services and Technical Services Framework Agreement”) with

Tencent Computer, pursuant to which, Tencent Computer (for itself and on behalf of the Represented Tencent Group) had agreed to provide

cloud services and other technical services, including but not limited to cloud servers, cloud object storage, classic load balancer,

cloud database, live streaming, video on demand, cloud communications, cloud security, domain name resolution services and other products

and services, to the Group. The term of the Previous Cloud Services and Technical Services Framework Agreement will expire on December 31,

2024.

The Board is pleased to announce

that, on December 11, 2024 (after trading hour), the Company entered into the New Cloud Services and Technical Services Framework

Agreement with Tencent Computer with a term of three years from January 1, 2025 to December 31, 2027, subject to the negotiation

at renewal with mutual consent and in compliance with the requirements of the Listing Rules.

PRINCIPAL TERMS OF THE NEW CLOUD SERVICES AND TECHNICAL

SERVICES FRAMEWORK AGREEMENT

| Parties: |

(i) |

the Company; and |

| (ii) | Tencent Computer (for itself and on behalf of the Represented Tencent Group) |

| Term: | The term will be three years from January 1, 2025 to December 31, 2027, subject to the negotiation

at renewal with mutual consent and in compliance with the requirements of the Listing Rules. |

| Subject matter: |

Tencent Computer (for itself and on behalf of the Represented Tencent Group) will provide cloud services and other technical services,

including but not limited to cloud servers, cloud-native technologies, cloud object storage, classic load balancer, cloud database, live

streaming, video on demand, cloud communications, cloud security, domain name resolution services and other products and services, to

the Group. |

| |

|

| |

Subject to the terms of

the New Cloud Services and Technical Services Framework Agreement, the Company will enter into specific agreements or place specific orders

with the Represented Tencent Group to set out specific terms and conditions in respect of the cloud services and technical services. |

| Pricing basis: |

The service fees of cloud services and technical services

contemplated under the New Cloud Services and Technical Services Framework Agreement shall be determined on an arm’s length basis

between the Group and the Represented Tencent Group based on the fee rates disclosed on the relevant official platforms or websites of

the Represented Tencent Group and with reference to the prevailing market prices. Before entering into any specific technical service

agreement pursuant to the New Cloud Services and Technical Services Framework Agreement, our business department will assess our business

needs, collect and compare the service fee rates proposed by the Represented Tencent Group with the fee rates offered by other comparable

service providers. In addition, we will take into account a number of factors, including but not limited to (i) the exact type of

services involved; (ii) the quality, reliability and stability of cloud services and technical services of different service providers;

and (iii) the service fee rates. The fee quotes and comparison results will be submitted to the relevant responsible manager of

our business department, certain senior management and the audit committee (if applicable) for approval. We will only purchase cloud

services and technical services from the Represented Tencent Group when (i) the terms and conditions are fair and reasonable and

based on normal or no less favorable commercial terms than those offered by other service providers who can provide comparable services;

and (ii) it is in the best interests of the Company and the Shareholders as a whole. |

HISTORICAL AMOUNTS

The historical transaction amounts

of the transactions contemplated under the Previous Cloud Services and Technical Services Framework Agreement were RMB159.3 million, RMB119.0

million and RMB120.4 million, for the years ended December 31, 2022 and December 31, 2023, and the nine months ended September 30,

2024, respectively.

ANNUAL CAPS AND BASIS OF ANNUAL

CAPS

The proposed annual caps of the

service fees contemplated under the New Cloud Services and Technical Services Framework Agreement for the years ending December 31,

2025, 2026 and 2027 are RMB338.0 million, RMB394.0 million and RMB462.0 million, respectively.

In arriving at the above annual

caps, the Directors have considered, among other things,

| (i) | the historical amounts of the service fees paid to the Represented Tencent Group in respect of the cloud services and technical services

and the existing agreements between the Group and the Represented Tencent Group; |

| (ii) | our growing demand in managing the number of servers with more flexibility. Leveraging the elasticity and scalability of cloud computing

technology in IT system management, the cloud services and technical services under the New Cloud Services and Technical Services Framework

Agreement allow us to handle the fluctuations in business volume more efficiently as well as reduce the complexity of infrastructure management; |

| (iii) | the expected increase of expenses in respect of the cloud services and technical services to be incurred by the Group in the next

three years to maintain and further improve the efficiency, security and stability of our IT system; and |

| (iv) | the growing needs of cloud services and technical services resulting from the expected overall growth of our business, expansion of

our new businesses and development of our new technology. |

REASONS FOR AND BENEFITS OF

ENTERING INTO THE NEW CLOUD SERVICES AND TECHNICAL SERVICES FRAMEWORK AGREEMENT

The Represented Tencent Group

is a leading integrated service provider in the PRC which provides a wide range of high quality, reliable and cost-efficient cloud services

and technical services. By deploying our certain business on the Represented Tencent Group’s cloud server, we are capable to leverage

the elasticity of the cloud computing and support the growth of our business traffic. The Group has a strong demand for cloud services

and technical services during its ordinary course of business, and we believe that obtaining such services from an integrated service

provider is a cost-effective alternative to build all supporting technology infrastructure internally. In addition, we established strategic

cooperation relationship with Tencent Computer in respect of the cloud services and other technical services in 2017 and had been utilizing

such resources and services rendered by Represented Tencent Group since then. By entering into the New Cloud Services and Technical Services

Framework Agreement, we believe that we will be able to (i) improve our IT efficiency, safety and reliability, and (ii) reduce

unnecessary resources and costs incurred from the procurement of additional technology hardware and tools, and recruitment of additional

information technology and maintenance staff.

INFORMATION ON THE PARTIES

The Company

The Company is an exempted company

with limited liability incorporated in the Cayman Islands on July 6, 2018. The Company is a leading integrated online and offline

platform for housing transactions and services, and a pioneer in building infrastructure and standards to reinvent how service providers

and customers efficiently navigate and complete housing transactions and services in China, ranging from existing and new home sales,

home rentals, to home renovation and furnishing, and other services.

Tencent Computer

Tencent Computer is a company

incorporated in the PRC with limited liability and a consolidated affiliated entity of Tencent Holdings Limited, a substantial shareholder

of the Company. Tencent Computer is primarily engaged in provision of value-added services, marketing services, fintech and business services

in the PRC.

CONFIRMATION FROM THE DIRECTORS

The Directors (including the independent

non-executive Directors) consider that the terms of the New Cloud Services and Technical Services Framework Agreement (including the proposed

annual caps thereunder for the years ending December 31, 2025, 2026 and 2027) are fair and reasonable, and the transactions contemplated

thereunder are in the ordinary and usual course of business of the Group, on normal commercial terms, and in the interests of the Company

and its Shareholders as a whole.

Mr. Jeffrey Zhaohui Li, a

non-executive Director of the Company, holds positions in Tencent and has therefore abstained from voting on the relevant Board resolutions

approving the New Cloud Services and Technical Services Framework Agreement and the transactions contemplated thereunder.

Save as disclosed above, none

of the Directors has any material interest in the matters contemplated therein nor is required to abstain from voting on the relevant

Board resolutions approval the New Cloud Services and Technical Services Framework Agreement and the transactions contemplated thereunder.

INTERNAL CONTROL MEASURES

To safeguard the interests of

the Company and the Shareholders as a whole, including the minority Shareholders, the Company has put in place certain internal approval

and monitoring procedures relating to the proposed connected transactions contemplated under the New Cloud Services and Technical Services

Framework Agreement, which include:

| · | we have adopted and implemented a management system on connected transactions. Under such system, the

Board is responsible for conducting reviews on compliance with relevant laws, regulations, the Company’s policies and the Listing

Rules in respect of the continuing connected transactions. In addition, the Board and various internal departments of the Company

(including but not limited to the finance department and legal department) are jointly responsible for evaluating the terms under framework

agreements for the continuing connected transactions, in particular, the fairness of the pricing policies and annual caps under each agreement; |

| · | the audit committee, the Board and various other internal departments of the Company (including but not

limited to the finance department and legal department) also regularly monitor the fulfillment status and the transaction updates under

the framework agreements. In addition, the management of the Company also regularly reviews the pricing policies of the specific business

agreements entered into under the framework agreements; |

| · | the independent non-executive Directors and auditors of the Company will conduct annual review of the

non-fully exempt continuing connected transactions and non-exempt continuing connected transactions and provide annual confirmations in

accordance with the Listing Rules that those transactions are conducted in accordance with terms of the relevant agreements, on normal

commercial terms, in accordance with relevant pricing policies and do not exceed the proposed applicable annual caps; |

| · | when considering service fees for the services to be provided to the Group by the connected persons, the

Group will regularly research into prevailing market conditions and practices and make reference to the pricing and terms between the

Group and independent third parties for comparable transactions, to make sure that the terms and conditions offered by the connected persons

from mutual commercial negotiations are fair and reasonable and are based on normal or no less favorable commercial terms than those offered

by other comparable independent third parties; |

| · | when considering any renewal or revisions to the framework agreement, the Board, and our independent non-executive

Directors and independent Shareholders have the right to consider if the terms of the non-fully exempt continuing connected transactions

and non-exempt continuing connected transactions (including the proposed annual caps, if applicable) (as the case may be) are fair and

reasonable, and on normal commercial terms and in the interests of the Company and the Shareholders as a whole; and |

| · | the finance department and legal department are responsible for monitoring the transaction amounts of

the continuing connected transactions. For transactions the amount(s) of which exceed(s) or is/are about to exceed the proposed

annual cap(s), we will comply with the Listing Rules and seek approval(s) for increasing the annual cap(s) and make additional

disclosure as appropriate. |

LISTING RULES IMPLICATIONS

Tencent Computer is a consolidated

affiliated entity of Tencent, which is one of the Company’s substantial shareholders, and is therefore a connected person of the

Company. As such, the transactions under the New Cloud Services and Technical Services Framework Agreement constitute continuing connected

transactions of the Company under Chapter 14A of the Listing Rules.

As the highest of the applicable

percentage ratio calculated under Chapter 14A of the Listing Rules in respect of the annual caps for the services fees payable by

the Group under the New Cloud Services and Technical Services Framework Agreement is more than 0.1% but less than 5%, the transactions

contemplated under the New Cloud Services and Technical Services Framework Agreement are subject to the reporting, announcement and annual

review requirements but are exempt from the independent Shareholders’ approval requirement under Chapter 14A of the Listing Rules.

DEFINITIONS

In this announcement, unless the

context requires otherwise, the following terms shall have the meanings set out below:

| “Board” |

the board of directors of the Company |

| |

|

| “Company” |

KE Holdings Inc. |

| |

|

| “connected person(s)” |

has the meaning ascribed thereto under the Listing Rules |

| |

|

| “Director(s)” |

the director(s) of the Company |

| “Group” |

the Company and its subsidiaries and consolidated affiliated entities from time to time |

| |

|

| “Hong Kong” |

Hong Kong Special Administrative Region of the PRC |

| |

|

| “Hong Kong Stock Exchange” |

The Stock Exchange of Hong Kong Limited |

| |

|

| “Listing Rules” |

the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited |

|

|

| “PRC” or “China” |

the People’s Republic of China, but for the purpose of this announcement only, excluding Hong Kong, Macau Special Administrative Region and Taiwan |

| |

|

| “Represented Tencent Group” |

group members of Tencent Holdings Limited (Stock Code: 0700.HK), excluding China Literature Limited, Tencent Music Entertainment Group and their respective subsidiaries |

| |

|

| “RMB” |

Renminbi, the lawful currency of the PRC |

| |

|

| “Shareholder(s)” |

holder(s) of the share(s) of the Company |

| |

|

| “substantial shareholder(s)” |

has the meaning ascribed thereto under the Listing Rules |

| |

|

| “Tencent Computer” |

Shenzhen Tencent Computer Systems Company

Limited (深圳市騰訊計算機系統有限公司) |

| |

|

| “%” |

per cent |

| |

By Order of the Board |

| |

KE Holdings Inc. |

| |

Yongdong Peng |

| |

Chairman and Chief Executive Officer |

| |

|

| Hong Kong, December 11, 2024 |

|

As

at the date of this announcement, the board of directors of the Company comprises Mr. Yongdong Peng, Mr. Yigang Shan, Mr. Wangang

Xu and Mr. Tao Xu as the executive directors, Mr. Jeffrey Zhaohui Li as the non-executive director, and Ms. Xiaohong Chen,

Mr. Hansong Zhu and Mr. Jun Wu as the independent non-executive directors.

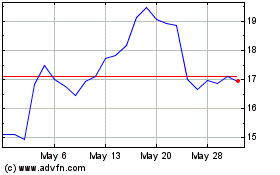

KE (NYSE:BEKE)

Historical Stock Chart

From Jan 2025 to Feb 2025

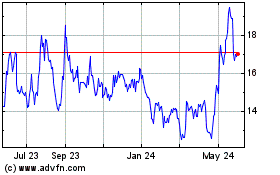

KE (NYSE:BEKE)

Historical Stock Chart

From Feb 2024 to Feb 2025