Next-generation solutions empower lenders to

achieve up to 1.5x higher pull-through rates and accelerate

time-to-close by over 50%, significantly enhancing operational

efficiency and borrower satisfaction.

Blend Labs, Inc. (NYSE: BLND), a leading origination platform

for digital banking solutions, today announced the launch of Rapid

Home Lending, a breakthrough suite of software solutions designed

to help lenders respond faster to a dynamic housing market.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250226831722/en/

Designed for both refinance and home equity lending, Rapid Home

Lending from Blend provides lenders with tools to increase

retention and deliver significantly faster, more personalized

borrower experiences. By eliminating friction through automated,

connected workflows, lenders can engage borrowers early, offer

tailored solutions upfront, and accelerate loan closings with

greater efficiency.

“The lending landscape has fundamentally changed—market cycles

move fast, and success depends on agility and digital solutions

that adapt in real time,” said Srini Venkatramani, Head of Product,

Technology and Customer Operations at Blend. “We’re redefining

refinance and home equity by flipping the traditional application

process on its head. Instead of making borrowers fill out lengthy

forms, we push pre-qualified offers and pre-filled applications to

them upfront—eliminating friction and delivering the seamless,

personalized experience today’s borrowers expect.”

Unlocking Home Equity and Refinancing Opportunities in a

Competitive Market

In today’s fast-moving housing market, millions of homeowners

are locked into high-interest mortgages or sitting on substantial

untapped home equity. With the average U.S. homeowner holding

$315,000 in tappable equity¹ and 24% of mortgage holders paying

interest rates of 5% or higher² according to industry data, lenders

face both a challenge and a significant opportunity.

Despite advancements in digital lending technology, many

financial institutions struggle to retain borrowers when it comes

to refinancing or home equity solutions. The traditional mortgage

origination process remains slow, manual, and document-heavy,

creating friction that impacts conversion rates, slows down closing

timelines, and increases operational costs.

Challenges holding lenders

back:

- Lengthy, complex workflows create friction at every step of the

borrower journey.

- Failure to personalize interactions using available borrower

data treats current customer borrowers like first-time

applicants.

- Manual document collection and verification slow loan

origination and hinder scalability during high-volume periods.

Home Lending, Reimagined for Today’s Market

Blend’s Rapid Home Lending Solutions empower lenders to boost

conversions, accelerate closings, and enhance borrower

engagement—all while adapting seamlessly to market conditions. By

combining automation, data intelligence, and a modern borrower

experience, Blend is transforming the way home loans are

originated.

Lender benefits include:

- Seamless Data Connectivity Eliminates Friction – Deep

data connectivity and automation enable lenders to seamlessly

verify and pre-fill borrower information in the background,

reducing manual input and delays.

- Personalized Offers Drive Higher Conversions –

Intelligent data-driven approach surfaces tailored, pre-qualified

products upfront, so borrowers see exactly what’s available to

them––right at the start.

- One Platform for Refinance & Home Equity – Blend’s

single, integrated platform seamlessly connects refinance and home

equity journeys in one dynamic experience, empowering the borrower

to choose the best product for their goals.

- Faster Closings with Automated Workflows – By automating

qualification, disclosure handling, and capturing

Intent-To-Proceed, borrowers can move quickly and effortlessly

through the entire process, creating a truly rapid experience.

Proven Impact: Faster Closings, Higher Pull-Through, Better

Borrower Engagement

Early results from initial Blend customers suggest significant

pull-through lift, faster time to close, and enhanced utilization

of the home equity lines, including:

- Up to 1.5x higher pull through rates – Real-time data

validation and instant, personalized offers keep borrowers engaged

from start to finish.

- Over 50% Faster Time to Close – The traditional 30-45

day home equity process has been cut down to 5-10 days, enhancing

operational efficiency and borrower satisfaction.

- Better Borrower Engagement – Over 60% of borrowers

leveraged in-workflow debt consolidation, maximizing utilization of

home equity lines.

For Blend’s Rapid Refi solution, the first refinance

types—conventional cash-out and FHA Streamline—are generally

available. Additional types, including VA IRRRL and conventional

rate/term refinances, are slated for release in the first half of

2025.

To learn how Blend’s Rapid Home Lending Solutions can help you

close loans faster, visit Blend.com/Rapid-Home-Lending.

About Blend

Blend Labs Inc., (NYSE: BLND) is a leading origination platform

for digital banking solutions. Financial providers— from large

banks, fintechs, and credit unions to community and independent

mortgage banks—use Blend’s platform to transform banking

experiences for their customers. Better banking starts on Blend. To

learn more, visit blend.com.

Forward-Looking Disclaimer

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements generally relate to future events, future

performance or expectations and involve substantial risks and

uncertainties. Forward-looking statements in this press release may

include, but are not limited to, our expectations regarding our

product roadmap, future products/features, the timing of new

product/feature introductions, market size and growth

opportunities, macroeconomics and industry conditions, capital

expenditures, plans for future operations, competitive position,

technological capabilities and strategic relationships, as well as

assumptions relating to the foregoing. The forward-looking

statements contained in this press release are subject to risks and

uncertainties that could cause actual outcomes to differ materially

from the outcomes predicted. In some cases, you can identify

forward-looking statements by terminology such as “may,” “will,”

“should,” “expect,” “plan,” “anticipate,” “could,” “would,”

“intend,” “target,” “project,” “contemplate,” “believe,”

“estimate,” “predict,” “potential” or “continue” or the negative of

these terms or other comparable terminology that concern Blend’s

expectations, strategy, plans or intentions. You should not put

undue reliance on any forward-looking statements. Forward-looking

statements should not be read as a guarantee of future performance

or results and will not necessarily be accurate indications of the

times at, or by which such performance or results will be achieved,

if at all. Further information on these risks and uncertainties are

set forth in our filings with the Securities and Exchange

Commission. All forward-looking statements in this press release

are based on information available to Blend and assumptions and

beliefs as of the date hereof. New risks and uncertainties emerge

from time to time, and it is not possible for us to predict all

risks and uncertainties that could have an impact on the

forward-looking statements contained in this press release. Except

as required by law, Blend does not undertake any obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future developments, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226831722/en/

Press Contact Chloé Demeunynck Corporate Communications

press@blend.com

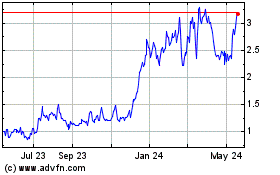

Blend Labs (NYSE:BLND)

Historical Stock Chart

From Jan 2025 to Feb 2025

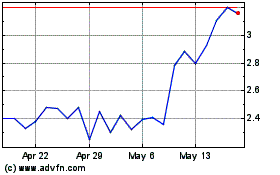

Blend Labs (NYSE:BLND)

Historical Stock Chart

From Feb 2024 to Feb 2025