Boot Barn Holdings, Inc. (NYSE: BOOT) (the “Company”) today

announced its financial results for the third fiscal quarter ended

December 28, 2024. A Supplemental Financial Presentation is

available at investor.bootbarn.com.

For the quarter ended December 28, 2024 compared to the quarter

ended December 30, 2023:

- Net sales increased 16.9% over the prior-year period to $608.2

million.

- Same store sales increased 8.6% compared to the prior-year

period, comprised of an increase of 8.2% in retail store same store

sales and an increase of 11.1% in e-commerce same store sales.

- Income from operations increased to $99.5 million, compared to

$75.1 million in the prior-year period. Included in income from

operations for the current period is a net benefit of $6.7 million

primarily related to the Company’s former Chief Executive Officer’s

(“CEO”) forfeiture of unvested long-term equity incentive

compensation and the reversal of fiscal 2025 cash incentive bonus

expense as a result of his resignation. These expenses were not

deductible for income taxes.

- Net income was $75.1 million, or $2.43 per diluted share,

compared to $55.6 million, or $1.81 per diluted share, in the

prior-year period. Included in the current period’s net income per

diluted share is an estimated $0.22 benefit related to the former

CEO’s resignation.

- The Company opened 13 new stores, bringing its total store

count to 438 as of the quarter end.

John Hazen, Interim Chief Executive Officer, commented, “I want

to thank the entire Boot Barn team for their excellent execution

and dedication during a busy holiday season, which resulted in

strong third quarter results and earnings per diluted share above

the high-end of our guidance range. The strength we saw in the

business was once again driven by broad-based growth across all

major merchandise categories, channels and geographies, resulting

in a consolidated same store sales increase of 8.6%. We also grew

total sales 16.9% compared to the prior-year period, driven in part

by the 13 new stores we opened in the third quarter and the 39 new

stores we have opened year-to-date through our third fiscal

quarter. In addition to strong sales, we continued to maintain our

full-price selling model, resulting in merchandise margin expansion

of 130 basis points. As we enter our fourth fiscal quarter, we feel

very good about the overall tone of the business and the future

growth potential of the brand.”

Operating Results for the Third Quarter Ended December 28,

2024 Compared to the Third Quarter Ended December 30, 2023

- Net sales increased 16.9% to $608.2 million from $520.4 million

in the prior-year period. Consolidated same store sales increased

8.6%, with retail store same store sales increasing 8.2% and

e-commerce same store sales increasing 11.1%. The increase in net

sales was the result of incremental sales from new stores and the

increase in consolidated same store sales.

- Gross profit was $238.9 million, or 39.3% of net sales,

compared to $199.1 million, or 38.3% of net sales, in the

prior-year period. Gross profit increased primarily due to an

increase in sales and merchandise margin, partially offset by the

occupancy costs of new stores. The increase in gross profit rate of

100 basis points was driven primarily by a 130 basis-point increase

in merchandise margin rate, partially offset by 30 basis points of

deleverage in buying, occupancy and distribution center costs. The

increase in merchandise margin rate was primarily the result of

supply chain efficiencies, better buying economies of scale, and

growth in exclusive brand penetration. The deleverage in buying,

occupancy and distribution center costs was driven by the occupancy

costs of new stores.

- Selling, general and administrative expenses were $139.4

million, or 22.9% of net sales, compared to $124.0 million, or

23.8% of net sales, in the prior-year period. The increase in

selling, general and administrative expenses compared to the

prior-year period was primarily the result of higher store payroll

and store-related expenses associated with operating more stores,

marketing expenses, and incentive-based compensation in the current

year, partially offset by the Company’s former CEO’s forfeiture of

unvested long-term equity incentive compensation and the reversal

of fiscal 2025 cash incentive bonus expense as a result of his

resignation. Selling, general and administrative expenses as a

percentage of net sales decreased by 90 basis points primarily as a

result of the aforementioned forfeiture of unvested long-term

equity incentive compensation and reversal of 2025 cash incentive

bonus expense.

- Income from operations increased $24.3 million to $99.5

million, or 16.4% of net sales, compared to $75.1 million, or 14.4%

of net sales, in the prior-year period, primarily due to the

factors noted above.

- Income tax expense was $24.1 million, or a 24.3% effective tax

rate, compared to $19.4 million, or a 25.8% effective tax rate, in

the prior-year period. The decrease in effective tax rate was

primarily due to reductions in nondeductible expenses.

- Net income was $75.1 million, or $2.43 per diluted share,

compared to $55.6 million, or $1.81 per diluted share, in the

prior-year period. The increase in net income is primarily

attributable to the factors noted above.

Operating Results for the Nine Months Ended December 28, 2024

Compared to the Nine Months Ended December 30, 2023

- Net sales increased 14.0% to $1.457 billion from $1.279 billion

in the prior-year period. Consolidated same store sales increased

5.4%, with retail store same store sales increasing 4.8% and

e-commerce same store sales increasing 9.7%. The increase in net

sales was the result of incremental sales from new stores and the

increase in consolidated same store sales.

- Gross profit was $548.5 million, or 37.6% of net sales,

compared to $475.0 million, or 37.2% of net sales, in the

prior-year period. Gross profit increased primarily due to an

increase in sales and merchandise margin, partially offset by the

occupancy costs of new stores. The increase in gross profit rate of

50 basis points was driven primarily by a 100 basis-point increase

in merchandise margin rate, partially offset by 50 basis points of

deleverage in buying, occupancy and distribution center costs. The

increase in merchandise margin rate was primarily the result of

supply chain efficiencies, while the deleverage in buying,

occupancy and distribution center costs was driven primarily by the

occupancy costs of new stores.

- Selling, general and administrative expenses were $358.8

million, or 24.6% of net sales, compared to $315.0 million, or

24.6% of net sales, in the prior-year period. The increase in

selling, general and administrative expenses as compared to the

prior-year period was primarily the result of higher store payroll

and store-related expenses associated with operating more stores,

corporate general and administrative expenses, and marketing

expenses in the current year, partially offset by the Company’s

former CEO’s forfeiture of unvested long-term equity incentive

compensation and the reversal of fiscal 2025 cash incentive bonus

expense as a result of his resignation. Selling, general and

administrative expenses as a percentage of net sales was flat when

compared to the prior-year period.

- Income from operations increased $29.7 million to $189.7

million, or 13.0% of net sales, compared to $160.0 million, or

12.5% of net sales, in the prior-year period, primarily due to the

factors noted above.

- Income tax expense was $46.8 million, or a 24.6% effective tax

rate, compared to $40.9 million, or a 25.8% effective tax rate, in

the prior-year period. The decrease in effective tax rate was

primarily due to reductions in nondeductible expenses and a higher

tax benefit caused by an increase in tax deductions for share-based

compensation in the current period, and changes to state enacted

tax rates for the prior-year period.

- Net income was $143.4 million, or $4.64 per diluted share,

compared to net income of $117.6 million, or $3.84 per diluted

share, in the prior-year period. The increase in net income is

primarily attributable to the factors noted above.

Sales by Channel

The following table includes total net sales growth, same store

sales (“SSS”) growth/(decline) and e-commerce as a percentage of

net sales for the periods indicated below.

Thirteen Weeks

Preliminary

Ended

Four Weeks

Four Weeks

Five Weeks

Four Weeks

December 28, 2024

Fiscal October

Fiscal November*

Fiscal December*

Fiscal January

Total Net Sales Growth

16.9

%

14.4

%

7.0

%

23.2

%

19.3

%

Retail Stores SSS

8.2

%

4.6

%

(2.4

)%

16.0

%

7.2

%

E-commerce SSS

11.1

%

13.7

%

2.2

%

13.5

%

17.1

%

Consolidated SSS

8.6

%

5.5

%

(1.9

)%

15.6

%

8.3

%

E-commerce as a % of Net Sales

12.2

%

9.6

%

10.2

%

14.4

%

11.3

%

*Thanksgiving and Black Friday shifted from Fiscal November in

fiscal year 2024 to Fiscal December in fiscal year 2025.

Balance Sheet Highlights as of December 28, 2024

- Cash of $153 million.

- Zero drawn under the $250 million revolving credit

facility.

- Average inventory per store increased approximately 1.0% on a

same store basis compared to December 30, 2023.

Fiscal Year 2025 Outlook

The Company is providing updated guidance for the fiscal year

ending March 29, 2025, superseding in its entirety the previous

guidance issued in its second quarter earnings report on October

28, 2024.

For the fiscal year ending March 29, 2025 the Company now

expects:

- To open a total of 60 new stores.

- Total sales of $1.908 billion to $1.918 billion, representing

growth of 14.5% to 15.1% over the prior year.

- Same store sales growth of approximately 5.4% to 5.9%, with

retail store same store sales growth of approximately 4.8% to 5.4%

and e-commerce same store sales growth of approximately 9.7% to

10.2%.

- Gross profit between $711.6 million and $716.3 million, or

approximately 37.3% to 37.4% of sales.

- Selling, general and administrative expenses between $474.3

million and $475.2 million, or approximately 24.9% to 24.8% of

sales.

- Income from operations between $237.3 million and $241.1

million, or approximately 12.4% to 12.6% of sales.

- Net income of $179.4 million to $182.2 million.

- Net income per diluted share of $5.81 to $5.90, based on 30.9

million weighted average diluted shares outstanding.

- Capital expenditures between $115.0 million and $120.0 million,

which is net of estimated landlord tenant allowances of $30.2

million.

For the fiscal fourth quarter ending March 29, 2025, the Company

expects:

- Total sales of $451 million to $460 million, representing

growth of 16.1% to 18.4% over the prior-year period.

- Same store sales growth of approximately 5.3% to 7.8%, with

retail store same store sales growth of approximately 4.7% to 7.2%

and e-commerce same store sales growth of approximately 9.6% to

12.1%.

- Gross profit between $163.1 million and $167.8 million, or

approximately 36.2% to 36.5% of sales.

- Selling, general and administrative expenses between $115.4

million and $116.4 million, or approximately 25.6% to 25.3% of

sales.

- Income from operations between $47.7 million and $51.4 million,

or approximately 10.6% to 11.2% of sales.

- Effective tax rate of 25.4%.

- Net income per diluted share of $1.17 to $1.26, based on 30.9

million weighted average diluted shares outstanding.

Conference Call Information

A conference call to discuss the financial results for the third

quarter of fiscal year 2025 is scheduled for today, January 30,

2025, at 4:30 p.m. ET (1:30 p.m. PT). Investors and analysts

interested in participating in the call are invited to dial (844)

481-2552. The conference call will also be available to interested

parties through a live webcast at investor.bootbarn.com. Please

visit the website and select the “Events and Presentations” link at

least 15 minutes prior to the start of the call to register and

download any necessary software. A Supplemental Financial

Presentation is also available on the investor relations section of

the Company’s website. A telephone replay of the call will be

available until February 28, 2025, by dialing (844) 512-2921

(domestic) or (412) 317-6671 (international) and entering the

conference identification number: 10196376. Please note

participants must enter the conference identification number in

order to access the replay.

About Boot Barn

Boot Barn is the nation’s leading lifestyle retailer of western

and work-related footwear, apparel and accessories for men, women

and children. The Company offers its loyal customer base a wide

selection of work and lifestyle brands. As of the date of this

release, Boot Barn operates 441 stores in 46 states, in addition to

an e-commerce channel www.bootbarn.com. The Company also operates

www.sheplers.com, the nation’s leading pure play online western and

work retailer and www.countryoutfitter.com, an e-commerce site

selling to customers who live a country lifestyle. For more

information, call 888-Boot-Barn or visit www.bootbarn.com.

Forward Looking Statements

This press release contains forward-looking statements that are

subject to risks and uncertainties. All statements other than

statements of historical fact included in this press release are

forward-looking statements. Forward-looking statements refer to the

Company’s current expectations and projections relating to, by way

of example and without limitation, the Company’s financial

condition, liquidity, profitability, results of operations,

margins, plans, objectives, strategies, future performance,

business and industry. You can identify forward-looking statements

by the fact that they do not relate strictly to historical or

current facts. These statements may include words such as

“anticipate”, “estimate”, “expect”, “project”, “plan“, “intend”,

“believe”, “may”, “might”, “will”, “could”, “should”, “can have”,

“likely”, “outlook” and other words and terms of similar meaning in

connection with any discussion of the timing or nature of future

operating or financial performance or other events, but not all

forward-looking statements contain these identifying words. These

forward-looking statements are based on assumptions that the

Company’s management has made in light of their industry experience

and on their perceptions of historical trends, current conditions,

expected future developments and other factors that they believe

are appropriate under the circumstances. As you consider this press

release, you should understand that these statements are not

guarantees of performance or results. They involve risks,

uncertainties (some of which are beyond the Company’s control) and

assumptions. These risks, uncertainties and assumptions include,

but are not limited to, the following: decreases in consumer

spending due to declines in consumer confidence, local economic

conditions or changes in consumer preferences; the Company’s

ability to effectively execute on its growth strategy; and the

Company’s failure to maintain and enhance its strong brand image,

to compete effectively, to maintain good relationships with its key

suppliers, and to improve and expand its exclusive product

offerings. The Company discusses the foregoing risks and other

risks in greater detail under the heading “Risk factors” in the

periodic reports filed by the Company with the Securities and

Exchange Commission. Although the Company believes that these

forward-looking statements are based on reasonable assumptions, you

should be aware that many factors could affect the Company’s actual

financial results and cause them to differ materially from those

anticipated in the forward-looking statements. Because of these

factors, the Company cautions that you should not place undue

reliance on any of these forward-looking statements. New risks and

uncertainties arise from time to time, and it is impossible for the

Company to predict those events or how they may affect the Company.

Further, any forward-looking statement speaks only as of the date

on which it is made. Except as required by law, the Company does

not intend to update or revise the forward-looking statements in

this press release after the date of this press release.

Boot Barn Holdings, Inc.

Consolidated Balance Sheets (In thousands, except per share

data) (Unaudited)

December 28,

March 30,

2024

2024

Assets

Current assets:

Cash and cash equivalents

$

152,914

$

75,847

Accounts receivable, net

10,239

9,964

Inventories

690,285

599,120

Prepaid expenses and other current

assets

45,942

44,718

Total current assets

899,380

729,649

Property and equipment, net

398,157

323,667

Right-of-use assets, net

453,051

390,501

Goodwill

197,502

197,502

Intangible assets, net

58,677

58,697

Other assets

6,252

5,576

Total assets

$

2,013,019

$

1,705,592

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

129,265

$

132,877

Accrued expenses and other current

liabilities

209,483

116,477

Short-term lease liabilities

70,302

63,454

Total current liabilities

409,050

312,808

Deferred taxes

37,789

42,033

Long-term lease liabilities

471,148

403,303

Other liabilities

4,460

3,805

Total liabilities

922,447

761,949

Stockholders’ equity:

Common stock, $0.0001 par value; December

28, 2024 - 100,000 shares authorized, 30,885 shares issued; March

30, 2024 - 100,000 shares authorized, 30,572 shares issued

3

3

Preferred stock, $0.0001 par value; 10,000

shares authorized, no shares issued or outstanding

—

—

Additional paid-in capital

243,779

232,636

Retained earnings

866,429

723,026

Less: Common stock held in treasury, at

cost, 298 and 228 shares at December 28, 2024 and March 30, 2024,

respectively

(19,639)

(12,022)

Total stockholders’ equity

1,090,572

943,643

Total liabilities and stockholders’

equity

$

2,013,019

$

1,705,592

Boot Barn Holdings, Inc.

Consolidated Statements of Operations (In thousands, except

per share data) (Unaudited)

Thirteen Weeks Ended

Thirty-Nine Weeks

Ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Net sales

$

608,170

$

520,399

$

1,457,355

$

1,278,550

Cost of goods sold

369,301

321,292

908,879

803,564

Gross profit

238,869

199,107

548,476

474,986

Selling, general and administrative

expenses

139,405

123,960

358,811

315,016

Income from operations

99,464

75,147

189,665

159,970

Interest expense

416

522

1,151

2,008

Other income, net

110

351

1,655

525

Income before income taxes

99,158

74,976

190,169

158,487

Income tax expense

24,092

19,352

46,766

40,930

Net income

$

75,066

$

55,624

$

143,403

$

117,557

Earnings per share:

Basic

$

2.46

$

1.84

$

4.70

$

3.90

Diluted

$

2.43

$

1.81

$

4.64

$

3.84

Weighted average shares outstanding:

Basic

30,559

30,293

30,501

30,117

Diluted

30,898

30,649

30,876

30,575

Boot Barn Holdings, Inc.

Consolidated Statements of Cash Flows (In thousands)

(Unaudited)

Thirty-Nine Weeks

Ended

December 28,

December 30,

2024

2023

Cash flows from operating

activities

Net income

$

143,403

$

117,557

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

45,801

35,801

Stock-based compensation

8,194

10,429

Amortization of intangible assets

20

41

Noncash lease expense

49,316

40,361

Amortization and write-off of debt

issuance fees and debt discount

81

81

Loss on disposal of assets

119

660

Deferred taxes

(4,244)

6,689

Changes in operating assets and

liabilities:

Accounts receivable, net

(252)

2,905

Inventories

(91,165)

26,116

Prepaid expenses and other current

assets

(1,515)

(5,945)

Other assets

(676)

855

Accounts payable

(3,388)

2,588

Accrued expenses and other current

liabilities

80,678

28,476

Other liabilities

655

916

Operating leases

(36,340)

(27,071)

Net cash provided by operating

activities

$

190,687

$

240,459

Cash flows from investing

activities

Purchases of property and equipment

(108,361)

(91,297)

Proceeds from sale of property and

equipment

55

—

Net cash used in investing activities

$

(108,306)

$

(91,297)

Cash flows from financing

activities

Payments on line of credit, net

—

(66,043)

Repayments on debt and finance lease

obligations

(646)

(655)

Tax withholding payments for net share

settlement

(7,617)

(2,420)

Proceeds from the exercise of stock

options

2,949

8,929

Net cash used in financing activities

$

(5,314)

$

(60,189)

Net increase in cash and cash

equivalents

77,067

88,973

Cash and cash equivalents, beginning of

period

75,847

18,193

Cash and cash equivalents, end of

period

$

152,914

$

107,166

Supplemental disclosures of cash flow

information:

Cash paid for income taxes

$

29,220

$

45,637

Cash paid for interest

$

1,047

$

1,931

Supplemental disclosure of non-cash

activities:

Unpaid purchases of property and

equipment

$

28,370

$

15,427

Boot Barn Holdings, Inc.

Store Count

Quarter Ended

Quarter Ended

Quarter Ended

Quarter Ended

Quarter Ended

Quarter Ended

Quarter Ended

Quarter Ended

December 28,

September 28,

June 29,

March 30,

December 30,

September 30,

July 1,

April 1,

2024

2024

2024

2024

2023

2023

2023

2023

Store Count (BOP)

425

411

400

382

371

361

345

333

Opened/Acquired

13

15

11

18

11

10

16

12

Closed

—

(1)

—

—

—

—

—

—

Store Count (EOP)

438

425

411

400

382

371

361

345

Boot Barn Holdings, Inc.

Selected Store Data

Fourteen

Thirteen Weeks Ended

Weeks Ended

December 28,

September 28,

June 29,

March 30,

December 30,

September 30,

July 1,

April 1,

2024

2024

2024

2024

2023

2023

2023

2023

Selected Store Data:

Same Store Sales growth/(decline)

8.6

%

4.9

%

1.4

%

(5.9)

%

(9.7)

%

(4.8)

%

(2.9)

%

(5.5)

%

Stores operating at end of period

438

425

411

400

382

371

361

345

Comparable stores operating during

period(1)

374

363

349

335

322

312

302

290

Total retail store selling square footage,

end of period (in thousands)

4,877

4,720

4,547

4,371

4,153

4,027

3,914

3,735

Average retail store selling square

footage, end of period

11,134

11,105

11,063

10,929

10,872

10,855

10,841

10,825

Average sales per comparable store (in

thousands)(2)

$

1,301

$

952

$

980

$

917

$

1,256

$

950

$

1,014

$

1,092

_______________________ (1)

Comparable stores have been open at least

13 full fiscal months as of the end of the applicable reporting

period.

(2)

Average sales per comparable store is

calculated by dividing comparable store trailing three-month sales

for the applicable period by the number of comparable stores

operating during the period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130517794/en/

Investor Contact: ICR, Inc. Brendon Frey, 203-682-8216

BootBarnIR@icrinc.com or Company Contact: Boot Barn

Holdings, Inc. Mark Dedovesh, 949-453-4489 Senior Vice President,

Investor Relations & Financial Planning

BootBarnIRMedia@bootbarn.com

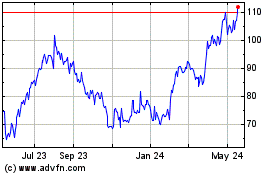

Boot Barn (NYSE:BOOT)

Historical Stock Chart

From Jan 2025 to Feb 2025

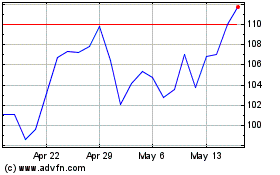

Boot Barn (NYSE:BOOT)

Historical Stock Chart

From Feb 2024 to Feb 2025