Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

22 February 2025 - 9:06AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433 under the Securities

Act of 1933

Registration Statement No. 333-285032

Issuer Free Writing Prospectus, dated February 21,

2025

American Medical Systems Europe B.V.

€1,500,000,000

Senior Notes Offering

Terms

and Conditions – 6-Year Fixed Rate Notes

| Issuer |

American

Medical Systems Europe B.V. (the “Issuer”) |

| Guarantor |

Boston

Scientific Corporation (“Boston Scientific”) |

| Note

Type |

Senior

Notes |

| Form of

Offering |

SEC

Registered |

Issuer Ratings

(M/S&P/F)1 |

Baa1

/ A- / A- (Positive/Stable/Stable) |

Expected Ratings

(M/S&P/F) |

Baa1

/ A- / A- |

| Principal

Amount |

€850,000,000 |

| Trade

Date |

February 21,

2025 |

| Settlement

Date (T+3*) |

February 26,

2025 |

| Maturity

Date |

March 8,

2031 |

| Coupon |

3.000%

per annum |

| Yield

to Maturity |

3.016%

per annum |

| Price

to Public |

99.912%

of the principal amount |

| Reference

to Mid-Swaps Rate |

2.316% |

| Spread

to Mid-Swaps Rate |

Plus

70 basis points |

| Benchmark

Bund |

DBR

0.000% due February 15, 2031 |

| Spread

to Benchmark Bund |

Plus

79.6 basis points |

| Benchmark

Bund Yield/Price |

2.220%

/ €87.71 |

*

It is expected that delivery of the notes will be made to purchasers on or about February 26, 2025, which is the third business day following

the date of pricing of the notes (such settlement cycle referred to as T+3), through Clearstream Banking S.A. and Euroclear Bank SA/NV.

Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle

in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade

the notes on any date prior to third business days before delivery of the notes will be required, by virtue of the fact that the notes

will settle in T+3, to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement; such purchasers

should consult their own advisors in this regard.

| Interest

Payment Dates |

Annually

on March 8, beginning March 8, 2026 |

| Par

Call Date |

On

or after December 8, 2030 (the date that is three months prior to the maturity date) |

| Make-whole

Call |

Plus

15 basis points |

| Stabilization |

Stabilization/FCA |

| Day

Count Basis |

ACTUAL/ACTUAL

(ICMA) |

| Minimum

Denominations |

€100,000

and integral multiples of €1,000 in excess thereof |

| Common

Code / ISIN |

Common Code: 299337669

ISIN: XS2993376693 |

| Clearing

and Settlement |

Clearstream

Banking S.A. / Euroclear Bank SA/NV |

| Trustee |

U.S.

Bank Trust Company, National Association |

| Registrar

and Paying Agent |

U.S.

Bank Europe DAC |

| Expected

Listing |

Application

will be made to list the notes on the Official List of the Irish Stock Exchange plc for trading as Euronext Dublin and to admit the

notes to trading on the Global Exchange Market thereof |

| Joint Bookrunners |

Barclays Bank PLC

Citigroup Global Markets Europe AG

Wells Fargo Securities Europe S.A.

BofA Securities Europe SA

J.P. Morgan SE

Société Générale

BNP Paribas

Deutsche Bank Aktiengesellschaft

Goldman Sachs & Co. LLC

RBC Europe Limited

Scotiabank (Ireland) Designated Activity Company

Standard Chartered Bank

TD Global Finance unlimited company |

| Co-Manager |

MUFG Securities (Europe) N.V. |

| Use

of Proceeds |

We

intend to use the net proceeds from this offering, together with cash on hand, to fund the repayment at maturity of the Issuer’s

0.750% Senior Notes due March 8, 2025 and to pay accrued and unpaid interest with respect to such notes, and for general corporate

purposes, which may include, among other things, short term investments, reduction of short term debt, funding of working capital

and potential future acquisitions. |

Terms

and Conditions – 9-Year Fixed Rate Notes

| Issuer |

American

Medical Systems Europe B.V. (the “Issuer”) |

| Guarantor |

Boston

Scientific Corporation (“Boston Scientific”) |

| Note

Type |

Senior

Notes |

| Form of

Offering |

SEC

Registered |

Issuer Ratings

(M/S&P/F)1 |

Baa1

/ A- / A- (Positive/Stable/Stable) |

Expected Ratings

(M/S&P/F) |

Baa1

/ A- / A- |

| Principal

Amount |

€650,000,000 |

| Trade

Date |

February 21,

2025 |

| Settlement

Date (T+3*) |

February 26,

2025 |

| Maturity

Date |

March 8,

2034 |

| Coupon |

3.250%

per annum |

| Yield

to Maturity |

3.287%

per annum |

| Price

to Public |

99.714%

of the principal amount |

| Reference

to Mid-Swaps Rate |

2.387% |

| Spread

to Mid-Swaps Rate |

Plus

90 basis points |

| Benchmark

Bund |

DBR

2.200% due February 15, 2034 |

| Spread

to Benchmark Bund |

Plus

87.0 basis points |

| Benchmark

Bund Yield/Price |

2.417%

/ €98.27 |

| Interest

Payment Dates |

Annually

on March 8, beginning March 8, 2026 |

| Par

Call Date |

On

or after December 8, 2033 (the date that is three months prior to the maturity date) |

* It is expected that delivery of the notes will be made to purchasers

on or about February 26, 2025, which is the third business day following the date of pricing of the notes (such settlement cycle referred

to as T+3), through Clearstream Banking S.A. and Euroclear Bank SA/NV. Under Rule 15c6-1 under the Securities Exchange Act of 1934, as

amended, trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade expressly

agree otherwise. Accordingly, purchasers who wish to trade the notes on any date prior to third business days before delivery of the

notes will be required, by virtue of the fact that the notes will settle in T+3, to specify an alternative settlement cycle at the time

of any such trade to prevent a failed settlement; such purchasers should consult their own advisors in this regard.

| Make-whole

Call |

Plus

15 basis points |

| Stabilization |

Stabilization/FCA |

| Day

Count Basis |

ACTUAL/ACTUAL

(ICMA) |

| Minimum

Denominations |

€100,000

and integral multiples of €1,000 in excess thereof |

| Common

Code / ISIN |

Common Code: 299338088

ISIN: XS2993380885 |

| Clearing

and Settlement |

Clearstream

Banking S.A. / Euroclear Bank SA/NV |

| Trustee |

U.S.

Bank Trust Company, National Association |

| Registrar

and Paying Agent |

U.S.

Bank Europe DAC |

| Expected

Listing |

Application

will be made to list the notes on the Official List of the Irish Stock Exchange plc for trading as Euronext Dublin and to admit the

notes to trading on the Global Exchange Market thereof |

| Joint Bookrunners |

Barclays Bank PLC

Citigroup Global Markets Europe AG

Wells Fargo Securities Europe S.A.

BofA Securities Europe SA

J.P. Morgan SE

Société Générale

BNP Paribas

Deutsche Bank Aktiengesellschaft

Goldman Sachs & Co. LLC

RBC Europe Limited

Scotiabank (Ireland) Designated Activity Company

Standard Chartered Bank

TD Global Finance unlimited company |

| Co-Manager |

MUFG Securities (Europe) N.V. |

| Use

of Proceeds |

We

intend to use the net proceeds from this offering, together with cash on hand, to fund the repayment at maturity of the Issuer’s

0.750% Senior Notes due March 8, 2025 and to pay accrued and unpaid interest with respect to such notes, and for general corporate

purposes, which may include, among other things, short term investments, reduction of short term debt, funding of working capital

and potential future acquisitions. |

Note:

| 1 | A

securities rating is not a recommendation to buy, sell or hold securities and may be subject

to revision or withdrawal at any time. |

MiFID II and UK MiFIR professional clients and ECPs only/No PRIIPs

KID: Manufacturer target market (MiFID II and UK MiFIR product governance) is eligible counterparties and professional clients only (all

distribution channels). No PRIIPs key information document (KID) has been prepared as the notes are not available to retail investors

in the European Economic Area or the United Kingdom.

The Issuer has filed a registration statement (including a preliminary

prospectus supplement and accompanying prospectus) with the U.S. Securities and Exchange Commission (the “SEC”) for the offering

to which this communication relates. Before you invest, you should read the preliminary prospectus supplement and accompanying prospectus

and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating

in the offering will arrange to send you the preliminary prospectus supplement and accompanying prospectus if you request it by calling

Barclays Bank PLC toll-free at (888) 603-5847, Citigroup Global Markets Europe AG toll-free at (800) 831-9146 or Wells Fargo Securities

Europe S.A. toll-free at (800) 645-3751.

Any disclaimers or other notices that may appear below are not

applicable to this communication and should be disregarded. Such disclaimers or other notices were automatically generated as a result

of this communication being sent via Bloomberg or another email system.

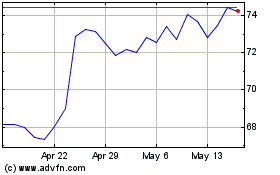

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Feb 2024 to Feb 2025