0001702750false00017027502025-01-232025-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 23, 2025

BYLINE BANCORP, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

|

|

|

|

|

|

001-38139 |

|

36-3012593 |

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

180 North LaSalle Street, Suite 300 |

|

|

Chicago, Illinois |

|

60601 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(773) 244-7000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

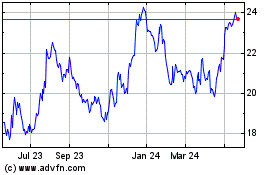

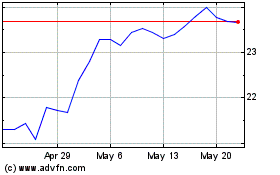

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

BY |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02. |

Results of Operations and Financial Condition. |

|

|

On January 23, 2025, Byline Bancorp, Inc., (“Byline" or the "Company”) issued a press release announcing its financial results for the fourth quarter ended December 31, 2024. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

On January 23, 2025, the Company made available on its website a slide presentation regarding the Company’s fourth quarter 2024 financial results, which will be used as part of a publicly accessible conference call on January 24, 2025. A copy of the slide presentation is attached as Exhibit 99.2 and is incorporated herein by reference.

The information included in Item 2.02 this Current Report on Form 8-K (including the information in the attached exhibits 99.1 and 99.2) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in any such filing.

|

|

Item 9.01. |

Financial Statements and Exhibits. |

|

|

(d) Exhibits.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgment and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication.

No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication.

Certain risks and important factors that could affect Byline’s future results are identified in our Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise unless required under the federal securities laws.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BYLINE BANCORP, INC. |

|

|

|

|

Date: January 23, 2025 |

|

|

|

By: |

/s/ Roberto R. Herencia |

|

|

|

|

Name: |

Roberto R. Herencia |

|

|

|

|

Title: |

Executive Chairman and Chief Executive Officer |

Exhibit 99.1

Byline Bancorp, Inc. Reports Fourth Quarter and Full Year 2024 Financial Results

Fourth quarter net income of $30.3 million, $0.69 diluted earnings per share

Full year net income of $120.8 million, $2.75 diluted earnings per share

Chicago, IL, January 23, 2025 – Byline Bancorp, Inc. (NYSE: BY), today reported:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or For the quarter |

|

Full Year Highlights (compared to prior year) |

|

|

|

4Q24 |

|

3Q24 |

|

4Q23 |

|

|

Financial Results ($ in thousands) |

|

|

|

|

|

|

|

|

|

|

• Net income increased $12.9 million, or 11.9% |

|

Net interest income |

|

$ |

88,524 |

|

$ |

87,455 |

|

$ |

86,285 |

|

|

|

Non-interest income |

|

|

16,149 |

|

|

14,385 |

|

|

14,503 |

|

• Net interest income up $17.4 million, |

|

Total revenue(1) |

|

|

104,673 |

|

|

101,840 |

|

|

100,788 |

|

or 5.3%; NIM of 3.97% |

|

Non-interest expense (NIE) |

|

|

57,431 |

|

|

54,327 |

|

|

53,584 |

|

|

|

Pre-tax pre-provision net income (PTPP)(1) |

|

|

47,242 |

|

|

47,513 |

|

|

47,204 |

|

• PTPP net income of $188.1 million(1), up 6.1% |

|

Provision for credit losses |

|

|

6,878 |

|

|

7,475 |

|

|

7,235 |

|

|

|

Provision for income taxes |

|

|

10,044 |

|

|

9,710 |

|

|

10,365 |

|

• NIE/AA: 2.38%, down 22 bps |

|

Net Income |

|

$ |

30,320 |

|

$ |

30,328 |

|

$ |

29,604 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• Total assets of $9.5 billion, an increase of |

Per Share |

|

|

|

|

|

|

|

|

|

|

$614.6 million, or 6.9% |

|

Diluted earnings per share (EPS) |

|

$ |

0.69 |

|

$ |

0.69 |

|

$ |

0.68 |

|

|

|

Dividends declared per common share |

|

|

0.09 |

|

|

0.09 |

|

|

0.09 |

|

• TBV per share of $20.09(1), up 11.7% |

|

Book value per share |

|

|

24.55 |

|

|

24.70 |

|

|

22.62 |

|

|

|

Tangible book value (TBV) per share(1) |

|

|

20.09 |

|

|

20.21 |

|

|

17.98 |

|

4Q24 Highlights |

|

|

(compared to prior quarter) |

Balance Sheet & Credit Quality ($ in thousands) |

|

|

|

|

|

|

|

|

|

|

• Net interest income of $88.5 million, an |

|

Total deposits |

|

$ |

7,458,628 |

|

$ |

7,497,887 |

|

$ |

7,176,999 |

|

increase of $1.1 million, or 1.2% |

|

Total loans and leases |

|

|

6,910,022 |

|

|

6,899,401 |

|

|

6,702,311 |

|

|

|

Net charge-offs |

|

|

7,792 |

|

|

8,467 |

|

|

12,186 |

|

• NIM of 4.01%, up 13 bps |

|

Allowance for credit losses (ACL) |

|

|

97,988 |

|

|

98,860 |

|

|

101,686 |

|

|

|

ACL to total loans and leases held for investment |

|

|

1.42% |

|

|

1.44% |

|

|

1.52% |

|

• Non-interest income of $16.1 million, an |

|

|

|

|

|

|

|

|

|

|

|

|

increase of $1.8 million, or 12.3% |

Select Ratios (annualized where applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio(1) |

|

|

53.58% |

|

|

52.02% |

|

|

51.63% |

|

• PTPP net income of $47.2 million(1) |

|

Return on average assets (ROAA) |

|

|

1.31% |

|

|

1.29% |

|

|

1.34% |

|

|

|

Return on average stockholders' equity |

|

|

11.03% |

|

|

11.39% |

|

|

12.56% |

|

• PTPP ROAA of 2.04%(1), 9th consecutive |

|

Return on average tangible common equity(1) |

|

|

13.92% |

|

|

14.49% |

|

|

16.68% |

|

quarter greater than 2.00% |

|

Net interest margin (NIM) |

|

|

4.01% |

|

|

3.88% |

|

|

4.08% |

|

|

|

Common equity to total assets |

|

|

11.49% |

|

|

11.63% |

|

|

11.15% |

|

• NPA/total assets 0.71%, down 4 bps |

|

Tangible common equity to tangible assets(1) |

|

|

9.61% |

|

|

9.72% |

|

|

9.06% |

|

|

|

Common equity tier 1 |

|

|

11.70% |

|

|

11.35% |

|

|

10.35% |

|

• CET1 of 11.70%, up 35 bps |

|

CEO/President Commentary |

|

Roberto R. Herencia, Executive Chairman and CEO of Byline Bancorp, commented, "We continued to execute our strategy of becoming the preeminent commercial bank in Chicago throughout 2024, characterized by delivering record full-year financial results, adding new banking talent, attracting new commercial customers to the Bank and executing our M&A strategy with our pending acquisition of First Security Bancorp, Inc. As we enter 2025, we are committed to advancing our strategy, strengthening our franchise, and creating lasting value for our stockholders." Alberto J. Paracchini, President of Byline Bancorp, added, "Our results in the fourth quarter, highlighted by strong earnings and profitability, cap off a successful 2024, underscoring the momentum we’ve built and our commitment to driving long-term value. Our business units performed well during the year, and we’re pleased with our progress and excited about the opportunities ahead. We believe we are well positioned to support our continued growth and I want to thank all our employees who enabled our strong performance for their dedication, talent and contributions." |

(1)Represents non-GAAP financial measures. See “Reconciliation of non-GAAP Financial Measures” for a reconciliation to the most directly comparable GAAP financial measure.

Byline Bancorp, Inc.

Page 2 of 15

Board Declares Cash Dividend of $0.10 per Share

On January 21, 2025, the Company's Board of Directors declared a cash dividend of $0.10 per share which represents an 11.1% increase from the previous quarterly dividend of $0.09 per share. The dividend will be paid on February 18, 2025, to stockholders of record of the Company's common stock as of February 4, 2025.

STATEMENTS OF OPERATIONS HIGHLIGHTS

Net Interest Income

Quarterly results

Net interest income for the fourth quarter of 2024 was $88.5 million, an increase of $1.1 million, or 1.2%, from the third quarter of 2024. The increase in net interest income was primarily due to decreases in interest expense on deposits and interest expense on other borrowings primarily due to the lower interest rate environment. These were offset by decreases in interest and fees on loans and leases primarily due to lower yields as a result of the lower interest rate environment.

Tax-equivalent net interest margin(1) for the fourth quarter of 2024 was 4.02%, an increase of 13 basis points compared to the third quarter of 2024. Net loan accretion income positively contributed 12 basis points to the net interest margin for the current quarter compared to 13 basis points for the prior quarter.

The average cost of total deposits was 2.48% for the fourth quarter of 2024, a decrease of 28 basis points compared to the third quarter of 2024, as a result of lower rates paid on interest bearing deposits. Average non-interest-bearing demand deposits were 23.8% of average total deposits for the current quarter compared to 23.2% during the prior quarter.

Full-year results

Net interest income for the year ended December 31, 2024 was $348.0 million, an increase of $17.4 million, or 5.3%, for the year ended December 31, 2023. The increase in net interest income was primarily due to increases in interest and dividend income due to growth in the loan and lease portfolio, offset by increases in deposit interest expense due to growth in the deposit base.

Tax-equivalent net interest margin(1) for the year ended December 31, 2024 was 3.98%, a decrease of 34 basis points compared to 4.32% the year ended December 31, 2023. Net loan accretion income positively contributed 15 basis points to the net interest margin during 2024 compared to 22 basis points during 2023.

The average cost of total deposits was 2.61% for the year ended December 31, 2024, an increase of 71 basis points compared to the year ended December 31, 2023, as a result of deposit growth, shift in deposit mix, and higher average rates paid on time deposits and money market accounts. Average non-interest-bearing demand deposits were 24.4% of average total deposits for the year ended December 31, 2024 compared to 30.7% during the prior year.

Provision for Credit Losses

Quarterly results

The provision for credit losses was $6.9 million for the fourth quarter of 2024, a decrease of $597,000 compared to $7.5 million for the third quarter of 2024, mainly attributed to decreases in non-performing loans and leases. The provision for credit losses for the quarter is comprised of a provision for loan and lease losses of $6.9 million compared to $7.6 million in the third quarter of 2024, and a recapture of the provision for unfunded commitments of $42,000 compared to $122,000 in the third quarter of 2024.

Full-year results

The provision for credit losses was $27.0 million for the year ended December 31, 2024, a decrease of $4.6 million compared to $31.7 million for the year ended December 31, 2023, mainly attributable to lower non-performing loans and leases, and no day one provision resulting from acquisition accounting. The provision for credit losses for the current year was comprised of a provision for loan and lease losses of $28.3 million compared to $32.2 million in the prior year, and a recapture of the provision for unfunded commitments of $1.2 million compared to $567,000 in the prior year.

(1) Represents non-GAAP financial measures. See “Reconciliation of non-GAAP Financial Measures” for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure.

Byline Bancorp, Inc.

Page 3 of 15

Non-interest Income

Quarterly results

Non-interest income for the fourth quarter of 2024 was $16.1 million, an increase of $1.8 million, or 12.3%, compared to $14.4 million for the third quarter of 2024. The increase in total non-interest income was primarily due to increases in net gains on sales of loans, and increased net loan servicing income. The increase in net gains on sales of loans was primarily due to higher volumes and premiums.

Net gains on sales of loans were $7.1 million for the current quarter, an increase of $1.2 million, or 21.2% compared to the prior quarter. During the fourth quarter of 2024, we sold $88.9 million of U.S. government guaranteed loans compared to $79.5 million during the third quarter of 2024.

Full-year results

Non-interest income for the year ended December 31, 2024 was $58.9 million, an increase of $2.5 million, or 4.5%, compared to $56.3 million for the year ended December 31, 2023. The increase in total non-interest income was primarily due to increases in other non-interest income due to increased swap fee activity and increases in net gains on sales of loans due to higher premiums; offset by lower net loan servicing income.

Net gains on sales of loans were $24.5 million for the year ended December 31, 2024, an increase of $1.7 million or 7.6% compared to the prior year. During the year ended December 31, 2024, we sold $314.8 million of U.S. government guaranteed loans compared to $348.4 million during the prior year.

Non-interest Expense

Quarterly results

Non-interest expense for the fourth quarter of 2024 was $57.4 million, an increase of $3.1 million, or 5.7%, compared to $54.3 million for the third quarter of 2024. The increase in non-interest expense was mainly due to increases in salaries and employee benefits and net loss recognized on other real estate owned and other related expenses. The increases in salaries and employee benefits were due to higher incentive and equity-based compensation expense, and enhancements to our employee benefits. The increase in net loss recognized on other real estate owned and other related expenses due to additions to the other real estate owned portfolio.

Our efficiency ratio was 53.58% for the fourth quarter of 2024 compared to 52.02% for the third quarter of 2024, an increase of 156 basis points. Our adjusted efficiency ratio was 53.37%(1) for the fourth quarter of 2024 compared to 51.62%(1) for the third quarter of 2024, an increase of 175 basis points.

Full-year results

Non-interest expense for the year ended December 31, 2024 was $218.8 million, an increase of $9.2 million, or 4.4%, compared to $209.6 million for the year ended December 31, 2023. The increase in non-interest expense was mainly due to increased salaries and employee benefits, due to higher salaries and incentives; partially offset by lower data processing expenses due to merger-related data processing expenses incurred during 2023.

Our efficiency ratio was 52.45% for the year ended December 31, 2024 compared to 52.62% for the year ended December 31, 2023, a decrease of 17 basis points. Our adjusted efficiency ratio was 52.24%(1) for the year ended December 31, 2024 compared to 49.61%(1) for the year ended December 31, 2023, an increase of 263 basis points.

Income Taxes

Quarterly results

We recorded income tax expense of $10.0 million during the fourth quarter of 2024, compared to $9.7 million during the third quarter of 2024. The effective tax rates were 24.9% and 24.3% for the fourth quarter of 2024 and third quarter of 2024, respectively. The increase in the effective tax rate was due to income tax benefits related to share-based compensation taken in the third quarter.

Full-year results

We recorded income tax expense of $40.3 million during the year ended December 31, 2024, compared to $37.8 million during the year ended December 31, 2023. The effective tax rates were 25.0% and 25.9% for the current year and prior year, respectively. The decrease in the effective tax rate was due to higher income tax benefits related to share-based compensation.

(1) Represents non-GAAP financial measures. See “Reconciliation of non-GAAP Financial Measures” for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure.

Byline Bancorp, Inc.

Page 4 of 15

STATEMENTS OF FINANCIAL CONDITION HIGHLIGHTS

Assets

Total assets were $9.5 billion as of December 31, 2024, an increase of $72.2 million, or 0.8%, compared to $9.4 billion at September 30, 2024, and an increase of $614.6 million from $8.9 billion as of December 31, 2023.

The increase for the current quarter was mainly due to an increase in cash and cash equivalents of $110.5 million, primarily due to higher FHLB advances, offset by decreases in securities available-for-sale of $86.4 million.

The increase for the current year was mainly due to an increase in cash and cash equivalents of $337.0 million due to higher FHLB advances, an increase in net loans and leases of $226.2 million due to organic growth, and an increase in securities available-for-sale of $73.2 million due to purchases of securities.

Asset and Credit Quality

The ACL was $98.0 million as of December 31, 2024, a decrease of $872,000, or 0.9%, from $98.9 million at September 30, 2024, mainly due to net charge-offs. The ACL decreased $3.7 million from $101.7 million as of December 31, 2023, primarily due to lower provision for credit losses and higher charge-offs during 2024 compared to 2023.

Net charge-offs of loans and leases during the fourth quarter of 2024 were $7.8 million, or 0.45% of average loans and leases, on an annualized basis. This was a decrease of $675,000 compared to net charge-offs of $8.5 million, or 0.49% of average loans and leases, during the third quarter of 2024. The decrease for the quarter was primarily due to higher recoveries compared to the prior quarter.

Net charge-offs of loans and leases during the year ended December 31, 2024 were $32.0 million, or 0.47% of average loans and leases, an increase of $8.9 million, compared to $23.1 million, or 0.38% of average loans and leases, during the year ended December 31, 2023. The increase for the current year was due to resolution of several non-performing loans.

Non-performing assets were $67.2 million, or 0.71% of total assets, as of December 31, 2024, a decrease of $3.8 million from $71.0 million, or 0.75% of total assets, at September 30, 2024. The decrease was primarily in non-accrual conventional loans due to active resolutions. The government guaranteed portion of non-performing loans included in non-performing assets was $9.9 million at December 31, 2024 compared to $11.3 million at September 30, 2024, a decrease of $1.5 million.

Non-performing assets increased $1.9 million compared to December 31, 2023, primarily due to increases in other real estate owned. The government guaranteed portion of non-performing loans included in non-performing assets at December 31, 2024 increased $5.7 million compared to $4.1 million at December 31, 2023.

Deposits and Other Liabilities

Total deposits decreased $39.3 million to $7.5 billion at December 31, 2024 compared to $7.5 billion at September 30, 2024, and increased $281.6 million from $7.2 billion at December 31, 2023. The decrease in deposits in the current quarter was due to decreases in time deposits, offset by increases in money market demand accounts. The increase in deposits for the full year was primarily due to increased money market demand accounts and interest bearing checking accounts.

Total borrowings and other liabilities were $946.4 million at December 31, 2024, an increase of $116.3 million from $830.1 million at September 30, 2024, and an increase of $231.6 million compared to $714.8 million at December 31, 2023. The increases were primarily driven by increased FHLB advances.

Stockholders’ Equity

Total stockholders’ equity was $1.1 billion at December 31, 2024, a decrease of $4.8 million, or 0.4%, from September 30, 2024, primarily due to an increase in accumulated other comprehensive loss, offset by increases to retained earnings from net income. Total stockholders' equity increased by $101.3 million, or 10.2% compared to $990.2 million at December 31, 2023, primarily due to retained earnings from net income.

(1) Represents non-GAAP financial measures. See “Reconciliation of non-GAAP Financial Measures” for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure.

Byline Bancorp, Inc.

Page 5 of 15

Conference Call, Webcast and Slide Presentation

We will host a conference call and webcast at 9:00 a.m. Central Time on Friday, January 24, 2025, to discuss our quarterly financial results. Analysts and investors may participate in the question-and-answer session. The call can be accessed via telephone at (833) 470-1428; passcode 861322. A recorded replay can be accessed through February 7, 2025, by dialing (866) 813-9403; passcode: 409178.

A slide presentation relating to our fourth quarter 2024 results will be accessible prior to the conference call. The slide presentation and webcast of the conference call can be accessed on our investor relations website at www.bylinebancorp.com.

About Byline Bancorp, Inc.

Headquartered in Chicago, Byline Bancorp, Inc. is the parent company of Byline Bank, a full service commercial bank serving small- and medium-sized businesses, financial sponsors, and consumers. Byline Bank has approximately $9.5 billion in assets and operates 46 branch locations throughout the Chicago and Milwaukee metropolitan areas. Byline Bank offers a broad range of commercial and community banking products and services including small ticket equipment leasing solutions and is one of the top Small Business Administration lenders in the United States.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgment and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication.

No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication.

Certain risks and important factors that could affect Byline’s future results are identified in our Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise unless required under the federal securities laws.

Contacts:

|

Investors / Media: |

Brooks Rennie |

Investor Relations Director |

312-660-5805 |

brennie@bylinebank.com |

|

Byline Bancorp, Inc.

Page 6 of 15

BYLINE BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

(dollars in thousands) |

|

2024 |

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

58,759 |

|

|

$ |

77,047 |

|

|

$ |

60,431 |

|

Interest bearing deposits with other banks |

|

|

504,379 |

|

|

|

375,549 |

|

|

|

165,705 |

|

Cash and cash equivalents |

|

|

563,138 |

|

|

|

452,596 |

|

|

|

226,136 |

|

Equity and other securities, at fair value |

|

|

9,865 |

|

|

|

9,132 |

|

|

|

8,743 |

|

Securities available-for-sale, at fair value |

|

|

1,415,696 |

|

|

|

1,502,108 |

|

|

|

1,342,480 |

|

Securities held-to-maturity, at amortized cost |

|

|

605 |

|

|

|

605 |

|

|

|

1,157 |

|

Restricted stock, at cost |

|

|

27,452 |

|

|

|

22,743 |

|

|

|

16,304 |

|

Loans held for sale |

|

|

3,200 |

|

|

|

19,955 |

|

|

|

18,005 |

|

Loans and leases: |

|

|

|

|

|

|

|

|

|

Loans and leases |

|

|

6,906,822 |

|

|

|

6,879,446 |

|

|

|

6,684,306 |

|

Allowance for credit losses - loans and leases |

|

|

(97,988 |

) |

|

|

(98,860 |

) |

|

|

(101,686 |

) |

Net loans and leases |

|

|

6,808,834 |

|

|

|

6,780,586 |

|

|

|

6,582,620 |

|

Servicing assets, at fair value |

|

|

18,952 |

|

|

|

18,945 |

|

|

|

19,844 |

|

Premises and equipment, net |

|

|

60,502 |

|

|

|

63,135 |

|

|

|

66,627 |

|

Other real estate owned, net |

|

|

5,170 |

|

|

|

532 |

|

|

|

1,200 |

|

Goodwill and other intangible assets, net |

|

|

198,098 |

|

|

|

199,443 |

|

|

|

203,478 |

|

Bank-owned life insurance |

|

|

100,083 |

|

|

|

99,295 |

|

|

|

96,900 |

|

Deferred tax assets, net |

|

|

56,458 |

|

|

|

37,737 |

|

|

|

50,058 |

|

Accrued interest receivable and other assets |

|

|

228,476 |

|

|

|

217,504 |

|

|

|

248,415 |

|

Total assets |

|

$ |

9,496,529 |

|

|

$ |

9,424,316 |

|

|

$ |

8,881,967 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

Non-interest-bearing demand deposits |

|

$ |

1,756,098 |

|

|

$ |

1,729,908 |

|

|

$ |

1,905,876 |

|

Interest-bearing deposits |

|

|

5,702,530 |

|

|

|

5,767,979 |

|

|

|

5,271,123 |

|

Total deposits |

|

|

7,458,628 |

|

|

|

7,497,887 |

|

|

|

7,176,999 |

|

Other borrowings |

|

|

618,773 |

|

|

|

518,786 |

|

|

|

395,190 |

|

Subordinated notes, net |

|

|

74,040 |

|

|

|

73,997 |

|

|

|

73,866 |

|

Junior subordinated debentures issued to

capital trusts, net |

|

|

70,890 |

|

|

|

70,783 |

|

|

|

70,452 |

|

Accrued expenses and other liabilities |

|

|

182,701 |

|

|

|

166,551 |

|

|

|

175,309 |

|

Total liabilities |

|

|

8,405,032 |

|

|

|

8,328,004 |

|

|

|

7,891,816 |

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Common stock |

|

|

455 |

|

|

|

454 |

|

|

|

451 |

|

Additional paid-in capital |

|

|

717,763 |

|

|

|

714,864 |

|

|

|

710,488 |

|

Retained earnings |

|

|

533,901 |

|

|

|

507,576 |

|

|

|

429,036 |

|

Treasury stock |

|

|

(46,935 |

) |

|

|

(47,904 |

) |

|

|

(49,707 |

) |

Accumulated other comprehensive loss, net of tax |

|

|

(113,687 |

) |

|

|

(78,678 |

) |

|

|

(100,117 |

) |

Total stockholders’ equity |

|

|

1,091,497 |

|

|

|

1,096,312 |

|

|

|

990,151 |

|

Total liabilities and stockholders’ equity |

|

$ |

9,496,529 |

|

|

$ |

9,424,316 |

|

|

$ |

8,881,967 |

|

Byline Bancorp, Inc.

Page 7 of 15

BYLINE BANCORP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

(dollars in thousands, |

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

except per share data) |

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

INTEREST AND DIVIDEND INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans and leases |

|

$ |

123,702 |

|

|

$ |

128,336 |

|

|

$ |

124,042 |

|

|

$ |

502,353 |

|

|

$ |

440,984 |

|

Interest on securities |

|

|

11,710 |

|

|

|

11,260 |

|

|

|

9,227 |

|

|

|

43,218 |

|

|

|

30,801 |

|

Other interest and dividend income |

|

|

4,191 |

|

|

|

6,840 |

|

|

|

2,345 |

|

|

|

20,358 |

|

|

|

7,693 |

|

Total interest and dividend income |

|

|

139,603 |

|

|

|

146,436 |

|

|

|

135,614 |

|

|

|

565,929 |

|

|

|

479,478 |

|

INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

46,725 |

|

|

|

52,076 |

|

|

|

43,252 |

|

|

|

192,366 |

|

|

|

121,436 |

|

Other borrowings |

|

|

1,466 |

|

|

|

3,919 |

|

|

|

3,051 |

|

|

|

13,669 |

|

|

|

17,161 |

|

Subordinated notes and debentures |

|

|

2,888 |

|

|

|

2,986 |

|

|

|

3,026 |

|

|

|

11,848 |

|

|

|

10,260 |

|

Total interest expense |

|

|

51,079 |

|

|

|

58,981 |

|

|

|

49,329 |

|

|

|

217,883 |

|

|

|

148,857 |

|

Net interest income |

|

|

88,524 |

|

|

|

87,455 |

|

|

|

86,285 |

|

|

|

348,046 |

|

|

|

330,621 |

|

PROVISION FOR CREDIT LOSSES |

|

|

6,878 |

|

|

|

7,475 |

|

|

|

7,235 |

|

|

|

27,041 |

|

|

|

31,653 |

|

Net interest income after provision for

credit losses |

|

|

81,646 |

|

|

|

79,980 |

|

|

|

79,050 |

|

|

|

321,005 |

|

|

|

298,968 |

|

NON-INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees and service charges on deposits |

|

|

2,648 |

|

|

|

2,591 |

|

|

|

2,486 |

|

|

|

10,214 |

|

|

|

9,211 |

|

Loan servicing revenue |

|

|

3,151 |

|

|

|

3,174 |

|

|

|

3,377 |

|

|

|

12,905 |

|

|

|

13,503 |

|

Loan servicing asset revaluation |

|

|

(1,350 |

) |

|

|

(2,183 |

) |

|

|

(1,234 |

) |

|

|

(6,704 |

) |

|

|

(5,089 |

) |

ATM and interchange fees |

|

|

1,083 |

|

|

|

1,143 |

|

|

|

1,082 |

|

|

|

4,464 |

|

|

|

4,462 |

|

Net realized losses on securities

available-for-sale |

|

|

(699 |

) |

|

|

— |

|

|

|

— |

|

|

|

(699 |

) |

|

|

— |

|

Change in fair value of equity securities, net |

|

|

732 |

|

|

|

388 |

|

|

|

841 |

|

|

|

1,122 |

|

|

|

1,071 |

|

Net gains on sales of loans |

|

|

7,107 |

|

|

|

5,864 |

|

|

|

5,480 |

|

|

|

24,540 |

|

|

|

22,805 |

|

Wealth management and trust income |

|

|

1,110 |

|

|

|

1,101 |

|

|

|

1,256 |

|

|

|

4,310 |

|

|

|

4,158 |

|

Other non-interest income |

|

|

2,367 |

|

|

|

2,307 |

|

|

|

1,215 |

|

|

|

8,699 |

|

|

|

6,194 |

|

Total non-interest income |

|

|

16,149 |

|

|

|

14,385 |

|

|

|

14,503 |

|

|

|

58,851 |

|

|

|

56,315 |

|

NON-INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

37,281 |

|

|

|

34,974 |

|

|

|

31,974 |

|

|

|

140,119 |

|

|

|

126,979 |

|

Occupancy and equipment expense, net |

|

|

4,407 |

|

|

|

4,373 |

|

|

|

4,346 |

|

|

|

18,703 |

|

|

|

18,508 |

|

Impairment charge on assets held for sale |

|

|

— |

|

|

|

— |

|

|

|

1,980 |

|

|

|

— |

|

|

|

2,000 |

|

Loan and lease related expenses |

|

|

660 |

|

|

|

703 |

|

|

|

649 |

|

|

|

2,789 |

|

|

|

2,936 |

|

Legal, audit, and other professional fees |

|

|

3,358 |

|

|

|

3,643 |

|

|

|

2,352 |

|

|

|

13,428 |

|

|

|

12,946 |

|

Data processing |

|

|

4,473 |

|

|

|

4,215 |

|

|

|

4,982 |

|

|

|

16,869 |

|

|

|

19,509 |

|

Net loss recognized on other real estate

owned and other related expenses |

|

|

654 |

|

|

|

74 |

|

|

|

89 |

|

|

|

568 |

|

|

|

385 |

|

Other intangible assets amortization expense |

|

|

1,345 |

|

|

|

1,345 |

|

|

|

1,550 |

|

|

|

5,380 |

|

|

|

6,011 |

|

Other non-interest expense |

|

|

5,253 |

|

|

|

5,000 |

|

|

|

5,662 |

|

|

|

20,921 |

|

|

|

20,329 |

|

Total non-interest expense |

|

|

57,431 |

|

|

|

54,327 |

|

|

|

53,584 |

|

|

|

218,777 |

|

|

|

209,603 |

|

INCOME BEFORE PROVISION FOR INCOME TAXES |

|

|

40,364 |

|

|

|

40,038 |

|

|

|

39,969 |

|

|

|

161,079 |

|

|

|

145,680 |

|

PROVISION FOR INCOME TAXES |

|

|

10,044 |

|

|

|

9,710 |

|

|

|

10,365 |

|

|

|

40,320 |

|

|

|

37,802 |

|

NET INCOME |

|

$ |

30,320 |

|

|

$ |

30,328 |

|

|

$ |

29,604 |

|

|

$ |

120,759 |

|

|

$ |

107,878 |

|

EARNINGS PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.69 |

|

|

$ |

0.70 |

|

|

$ |

0.69 |

|

|

$ |

2.78 |

|

|

$ |

2.69 |

|

Diluted |

|

$ |

0.69 |

|

|

$ |

0.69 |

|

|

$ |

0.68 |

|

|

$ |

2.75 |

|

|

$ |

2.67 |

|

Byline Bancorp, Inc.

Page 8 of 15

BYLINE BANCORP, INC. AND SUBSIDIARIES

SELECTED FINANCIAL DATA (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of or For the Three Months Ended |

|

|

As of or For the Year Ended |

|

(dollars in thousands, except share |

December 31, |

|

|

September 30, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

and per share data) |

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Earnings per Common Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

0.69 |

|

|

$ |

0.70 |

|

|

$ |

0.69 |

|

|

$ |

2.78 |

|

|

$ |

2.69 |

|

Diluted earnings per common share |

$ |

0.69 |

|

|

$ |

0.69 |

|

|

$ |

0.68 |

|

|

$ |

2.75 |

|

|

$ |

2.67 |

|

Adjusted diluted earnings per common share(1)(3) |

$ |

0.69 |

|

|

$ |

0.70 |

|

|

$ |

0.73 |

|

|

$ |

2.76 |

|

|

$ |

2.89 |

|

Weighted average common shares outstanding (basic) |

|

43,656,793 |

|

|

|

43,516,006 |

|

|

|

43,065,294 |

|

|

|

43,448,856 |

|

|

|

40,045,208 |

|

Weighted average common shares outstanding (diluted) |

|

44,179,818 |

|

|

|

43,966,189 |

|

|

|

43,537,778 |

|

|

|

43,853,939 |

|

|

|

40,445,553 |

|

Common shares outstanding |

|

44,459,584 |

|

|

|

44,384,706 |

|

|

|

43,764,056 |

|

|

|

44,459,584 |

|

|

|

43,764,056 |

|

Cash dividends per common share |

$ |

0.09 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

|

$ |

0.36 |

|

|

$ |

0.36 |

|

Dividend payout ratio on common stock |

|

13.04 |

% |

|

|

13.04 |

% |

|

|

13.24 |

% |

|

|

13.09 |

% |

|

|

13.48 |

% |

Book value per common share |

$ |

24.55 |

|

|

$ |

24.70 |

|

|

$ |

22.62 |

|

|

$ |

24.55 |

|

|

$ |

22.62 |

|

Tangible book value per common share(1) |

$ |

20.09 |

|

|

$ |

20.21 |

|

|

$ |

17.98 |

|

|

$ |

20.09 |

|

|

$ |

17.98 |

|

Key Ratios and Performance Metrics

(annualized where applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin |

|

4.01 |

% |

|

|

3.88 |

% |

|

|

4.08 |

% |

|

|

3.97 |

% |

|

|

4.31 |

% |

Net interest margin, fully taxable equivalent (1)(4) |

|

4.02 |

% |

|

|

3.89 |

% |

|

|

4.09 |

% |

|

|

3.98 |

% |

|

|

4.32 |

% |

Average cost of deposits |

|

2.48 |

% |

|

|

2.76 |

% |

|

|

2.42 |

% |

|

|

2.61 |

% |

|

|

1.90 |

% |

Efficiency ratio(1)(2) |

|

53.58 |

% |

|

|

52.02 |

% |

|

|

51.63 |

% |

|

|

52.45 |

% |

|

|

52.62 |

% |

Adjusted efficiency ratio(1)(2)(3) |

|

53.37 |

% |

|

|

51.62 |

% |

|

|

48.64 |

% |

|

|

52.24 |

% |

|

|

49.61 |

% |

Non-interest income to total revenues(1) |

|

15.43 |

% |

|

|

14.13 |

% |

|

|

14.39 |

% |

|

|

14.46 |

% |

|

|

14.55 |

% |

Non-interest expense to average assets |

|

2.48 |

% |

|

|

2.31 |

% |

|

|

2.42 |

% |

|

|

2.38 |

% |

|

|

2.60 |

% |

Adjusted non-interest expense to average assets(1)(3) |

|

2.47 |

% |

|

|

2.29 |

% |

|

|

2.28 |

% |

|

|

2.37 |

% |

|

|

2.46 |

% |

Return on average stockholders' equity |

|

11.03 |

% |

|

|

11.39 |

% |

|

|

12.56 |

% |

|

|

11.61 |

% |

|

|

12.50 |

% |

Adjusted return on average stockholders' equity(1)(3) |

|

11.10 |

% |

|

|

11.53 |

% |

|

|

13.50 |

% |

|

|

11.68 |

% |

|

|

13.53 |

% |

Return on average assets |

|

1.31 |

% |

|

|

1.29 |

% |

|

|

1.34 |

% |

|

|

1.31 |

% |

|

|

1.34 |

% |

Adjusted return on average assets(1)(3) |

|

1.32 |

% |

|

|

1.30 |

% |

|

|

1.44 |

% |

|

|

1.32 |

% |

|

|

1.45 |

% |

Pre-tax pre-provision return on average assets(1) |

|

2.04 |

% |

|

|

2.02 |

% |

|

|

2.13 |

% |

|

|

2.05 |

% |

|

|

2.20 |

% |

Adjusted pre-tax pre-provision return on average assets(1)(3) |

|

2.05 |

% |

|

|

2.03 |

% |

|

|

2.27 |

% |

|

|

2.06 |

% |

|

|

2.35 |

% |

Return on average tangible common stockholders' equity(1) |

|

13.92 |

% |

|

|

14.49 |

% |

|

|

16.68 |

% |

|

|

14.85 |

% |

|

|

16.46 |

% |

Adjusted return on average tangible common

stockholders' equity(1)(3) |

|

14.02 |

% |

|

|

14.67 |

% |

|

|

17.89 |

% |

|

|

14.94 |

% |

|

|

17.76 |

% |

Non-interest-bearing deposits to total deposits |

|

23.54 |

% |

|

|

23.07 |

% |

|

|

26.56 |

% |

|

|

23.54 |

% |

|

|

26.56 |

% |

Loans and leases held for sale and loans and lease

held for investment to total deposits |

|

92.64 |

% |

|

|

92.02 |

% |

|

|

93.39 |

% |

|

|

92.64 |

% |

|

|

93.39 |

% |

Deposits to total liabilities |

|

88.74 |

% |

|

|

90.03 |

% |

|

|

90.94 |

% |

|

|

88.74 |

% |

|

|

90.94 |

% |

Deposits per branch |

$ |

162,144 |

|

|

$ |

162,998 |

|

|

$ |

149,521 |

|

|

$ |

162,144 |

|

|

$ |

149,521 |

|

Asset Quality Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-performing loans and leases to total loans and leases

held for investment, net before ACL |

|

0.90 |

% |

|

|

1.02 |

% |

|

|

0.96 |

% |

|

|

0.90 |

% |

|

|

0.96 |

% |

Total non-performing assets as a percentage

of total assets |

|

0.71 |

% |

|

|

0.75 |

% |

|

|

0.74 |

% |

|

|

0.71 |

% |

|

|

0.74 |

% |

ACL to total loans and leases held for investment, net before ACL |

|

1.42 |

% |

|

|

1.44 |

% |

|

|

1.52 |

% |

|

|

1.42 |

% |

|

|

1.52 |

% |

Net charge-offs to average total loans and leases held for

investment, net before ACL - loans and leases |

|

0.45 |

% |

|

|

0.49 |

% |

|

|

0.73 |

% |

|

|

0.47 |

% |

|

|

0.38 |

% |

Capital Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common equity to total assets |

|

11.49 |

% |

|

|

11.63 |

% |

|

|

11.15 |

% |

|

|

11.49 |

% |

|

|

11.15 |

% |

Tangible common equity to tangible assets(1) |

|

9.61 |

% |

|

|

9.72 |

% |

|

|

9.06 |

% |

|

|

9.61 |

% |

|

|

9.06 |

% |

Leverage ratio |

|

11.74 |

% |

|

|

11.18 |

% |

|

|

10.86 |

% |

|

|

11.74 |

% |

|

|

10.86 |

% |

Common equity tier 1 capital ratio |

|

11.70 |

% |

|

|

11.35 |

% |

|

|

10.35 |

% |

|

|

11.70 |

% |

|

|

10.35 |

% |

Tier 1 capital ratio |

|

12.73 |

% |

|

|

12.39 |

% |

|

|

11.39 |

% |

|

|

12.73 |

% |

|

|

11.39 |

% |

Total capital ratio |

|

14.74 |

% |

|

|

14.41 |

% |

|

|

13.38 |

% |

|

|

14.74 |

% |

|

|

13.38 |

% |

(1) Represents a non-GAAP financial measure. See “Reconciliation of non-GAAP Financial Measures” for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure.

(2) Represents non-interest expense less amortization of intangible assets divided by net interest income and non-interest income.

(3) Calculation excludes merger-related expenses and impairment charges on ROU assets.

(4) Interest income and rates include the effects of a tax equivalent adjustment to adjust tax exempt investment income on tax exempt investment securities to a fully taxable basis, assuming a federal income tax rate of 21%.

Byline Bancorp, Inc.

Page 9 of 15

BYLINE BANCORP, INC. AND SUBSIDIARIES

QUARTER-TO-DATE STATEMENT OF AVERAGE INTEREST-EARNING ASSETS AND AVERAGE INTEREST-BEARING LIABILITIES (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

December 31, 2024 |

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

(dollars in thousands) |

Average

Balance(5) |

|

|

Interest

Inc / Exp |

|

|

Avg.

Yield /

Rate |

|

|

Average

Balance(5) |

|

|

Interest

Inc / Exp |

|

|

Avg.

Yield /

Rate |

|

|

Average

Balance(5) |

|

|

Interest

Inc / Exp |

|

|

Avg.

Yield /

Rate |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

272,409 |

|

|

$ |

2,721 |

|

|

|

3.97 |

% |

|

$ |

468,852 |

|

|

$ |

5,771 |

|

|

|

4.90 |

% |

|

$ |

201,862 |

|

|

$ |

1,822 |

|

|

|

3.58 |

% |

Loans and leases(1) |

|

6,828,128 |

|

|

|

123,702 |

|

|

|

7.21 |

% |

|

|

6,827,726 |

|

|

|

128,336 |

|

|

|

7.48 |

% |

|

|

6,632,827 |

|

|

|

124,042 |

|

|

|

7.42 |

% |

Taxable securities |

|

1,529,134 |

|

|

|

12,317 |

|

|

|

3.20 |

% |

|

|

1,508,987 |

|

|

|

11,467 |

|

|

|

3.02 |

% |

|

|

1,389,580 |

|

|

|

8,848 |

|

|

|

2.53 |

% |

Tax-exempt securities(2) |

|

155,505 |

|

|

|

1,093 |

|

|

|

2.80 |

% |

|

|

156,085 |

|

|

|

1,091 |

|

|

|

2.78 |

% |

|

|

163,608 |

|

|

|

1,142 |

|

|

|

2.77 |

% |

Total interest-earning assets |

$ |

8,785,176 |

|

|

$ |

139,833 |

|

|

|

6.33 |

% |

|

$ |

8,961,650 |

|

|

$ |

146,665 |

|

|

|

6.51 |

% |

|

$ |

8,387,877 |

|

|

$ |

135,854 |

|

|

|

6.43 |

% |

Allowance for credit losses -

loans and leases |

|

(100,281 |

) |

|

|

|

|

|

|

|

|

(101,001 |

) |

|

|

|

|

|

|

|

|

(106,474 |

) |

|

|

|

|

|

|

All other assets |

|

516,740 |

|

|

|

|

|

|

|

|

|

513,200 |

|

|

|

|

|

|

|

|

|

506,233 |

|

|

|

|

|

|

|

TOTAL ASSETS |

$ |

9,201,635 |

|

|

|

|

|

|

|

|

$ |

9,373,849 |

|

|

|

|

|

|

|

|

$ |

8,787,636 |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest checking |

$ |

717,222 |

|

|

$ |

3,478 |

|

|

|

1.93 |

% |

|

$ |

754,586 |

|

|

$ |

4,439 |

|

|

|

2.34 |

% |

|

$ |

570,706 |

|

|

$ |

2,335 |

|

|

|

1.62 |

% |

Money market accounts |

|

2,480,805 |

|

|

|

19,951 |

|

|

|

3.20 |

% |

|

|

2,386,909 |

|

|

|

21,371 |

|

|

|

3.56 |

% |

|

|

2,159,841 |

|

|

|

18,730 |

|

|

|

3.44 |

% |

Savings |

|

486,262 |

|

|

|

130 |

|

|

|

0.11 |

% |

|

|

495,541 |

|

|

|

190 |

|

|

|

0.15 |

% |

|

|

560,372 |

|

|

|

208 |

|

|

|

0.15 |

% |

Time deposits |

|

2,020,225 |

|

|

|

23,166 |

|

|

|

4.56 |

% |

|

|

2,134,587 |

|

|

|

26,076 |

|

|

|

4.86 |

% |

|

|

1,861,279 |

|

|

|

21,979 |

|

|

|

4.68 |

% |

Total interest-bearing

deposits |

|

5,704,514 |

|

|

|

46,725 |

|

|

|

3.26 |

% |

|

|

5,771,623 |

|

|

|

52,076 |

|

|

|

3.59 |

% |

|

|

5,152,198 |

|

|

|

43,252 |

|

|

|

3.33 |

% |

Other borrowings |

|

301,959 |

|

|

|

1,466 |

|

|

|

1.93 |

% |

|

|

474,498 |

|

|

|

3,919 |

|

|

|

3.29 |

% |

|

|

395,711 |

|

|

|

3,051 |

|

|

|

3.06 |

% |

Subordinated notes and

debentures |

|

144,853 |

|

|

|

2,888 |

|

|

|

7.93 |

% |

|

|

144,702 |

|

|

|

2,986 |

|

|

|

8.21 |

% |

|

|

144,230 |

|

|

|

3,026 |

|

|

|

8.32 |

% |

Total borrowings |

|

446,812 |

|

|

|

4,354 |

|

|

|

3.88 |

% |

|

|

619,200 |

|

|

|

6,905 |

|

|

|

4.44 |

% |

|

|

539,941 |

|

|

|

6,077 |

|

|

|

4.47 |

% |

Total interest-bearing liabilities |

$ |

6,151,326 |

|

|

$ |

51,079 |

|

|

|

3.30 |

% |

|

$ |

6,390,823 |

|

|

$ |

58,981 |

|

|

|

3.67 |

% |

|

$ |

5,692,139 |

|

|

$ |

49,329 |

|

|

|

3.44 |

% |

Non-interest-bearing

demand deposits |

|

1,777,273 |

|

|

|

|

|

|

|

|

|

1,741,250 |

|

|

|

|

|

|

|

|

|

1,950,644 |

|

|

|

|

|

|

|

Other liabilities |

|

179,011 |

|

|

|

|

|

|

|

|

|

182,148 |

|

|

|

|

|

|

|

|

|

209,656 |

|

|

|

|

|

|

|

Total stockholders’ equity |

|

1,094,025 |

|

|

|

|

|

|

|

|

|

1,059,628 |

|

|

|

|

|

|

|

|

|

935,197 |

|

|

|

|

|

|

|

TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

$ |

9,201,635 |

|

|

|

|

|

|

|

|

$ |

9,373,849 |

|

|

|

|

|

|

|

|

$ |

8,787,636 |

|

|

|

|

|

|

|

Net interest spread(3) |

|

|

|

|

|

|

|

3.03 |

% |

|

|

|

|

|

|

|

|

2.84 |

% |

|

|

|

|

|

|

|

|

2.99 |

% |

Net interest income, fully

taxable equivalent |

|

|

|

$ |

88,754 |

|

|

|

|

|

|

|

|

$ |

87,684 |

|

|

|

|

|

|

|

|

$ |

86,525 |

|

|

|

|

Net interest margin, fully

taxable equivalent(2)(4) |

|

|

|

|

|

|

|

4.02 |

% |

|

|

|

|

|

|

|

|

3.89 |

% |

|

|

|

|

|

|

|

|

4.09 |

% |

Less: Tax-equivalent adjustment |

|

|

|

|

230 |

|

|

|

0.01 |

% |

|

|

|

|

|

229 |

|

|

|

0.01 |

% |

|

|

|

|

|

240 |

|

|

|

0.01 |

% |

Net interest income |

|

|

|

$ |

88,524 |

|

|

|

|

|

|

|

|

$ |

87,455 |

|

|

|

|

|

|

|

|

$ |

86,285 |

|

|

|

|

Net interest margin(4) |

|

|

|

|

|

|

|

4.01 |

% |

|

|

|

|

|

|

|

|

3.88 |

% |

|

|

|

|

|

|

|

|

4.08 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loan accretion impact

on margin |

|

|

|

$ |

2,590 |

|

|

|

0.12 |

% |

|

|

|

|

$ |

2,982 |

|

|

|

0.13 |

% |

|

|

|

|

$ |

5,110 |

|

|

|

0.24 |

% |

(1) Loan and lease balances are net of deferred origination fees and costs and initial direct costs. Non-accrual loans and leases are included in total loan and lease balances.

(2) Interest income and rates include the effects of a tax equivalent adjustment to adjust tax exempt investment income on tax exempt investment securities to a fully taxable basis, assuming a federal income tax rate of 21%.

(3) Represents the average rate earned on interest-earning assets minus the average rate paid on interest-bearing liabilities.

(4) Represents net interest income (annualized) divided by total average earning assets.

(5) Average balances are average daily balances.

Byline Bancorp, Inc.

Page 10 of 15

BYLINE BANCORP, INC. AND SUBSIDIARIES

YEAR-TO-DATE STATEMENT OF AVERAGE INTEREST-EARNING ASSETS AND AVERAGE INTEREST-BEARING LIABILITIES (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended |

|

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

(dollars in thousands) |

|

Average

Balance(4) |

|

|

Interest

Inc / Exp |

|

|

Average

Yield /

Rate |

|

|

Average

Balance(4) |

|

|

Interest

Inc / Exp |

|

|

Average

Yield /

Rate |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

346,777 |

|

|

$ |

15,635 |

|

|

|

4.51 |

% |

|

$ |

157,754 |

|

|

$ |

5,029 |

|

|

|

3.19 |

% |

Loans and leases(1) |

|

|

6,786,547 |

|

|

|

502,353 |

|

|

|

7.40 |

% |

|

|

6,038,797 |

|

|

|

440,984 |

|

|

|

7.30 |

% |

Taxable securities |

|

|

1,483,640 |

|

|

|

44,476 |

|

|

|

3.00 |

% |

|

|

1,322,379 |

|

|

|

30,068 |

|

|

|

2.27 |

% |

Tax-exempt securities(2) |

|

|

157,050 |

|

|

|

4,386 |

|

|

|

2.79 |

% |

|

|

158,918 |

|

|

|

4,300 |

|

|

|

2.71 |

% |

Total interest-earning assets |

|

$ |

8,774,014 |

|

|

$ |

566,850 |

|

|

|

6.46 |

% |

|

$ |

7,677,848 |

|

|

$ |

480,381 |

|

|

|

6.26 |

% |

Allowance for credit losses - loans and leases |

|

|

(101,695 |

) |

|

|

|

|

|

|

|

|

(98,067 |

) |

|

|

|

|

|

|

All other assets |

|

|

515,023 |

|

|

|

|

|

|

|

|

|

468,550 |

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

9,187,342 |

|

|

|

|

|

|

|

|

$ |

8,048,331 |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest checking |

|

$ |

695,156 |

|

|

$ |

14,442 |

|

|

|

2.08 |

% |

|

$ |

574,335 |

|

|

$ |

9,212 |

|

|

|

1.60 |

% |

Money market accounts |

|

|

2,344,309 |

|

|

|

80,960 |

|

|

|

3.45 |

% |

|

|

1,802,675 |

|

|

|

53,933 |

|

|

|

2.99 |

% |

Savings |

|

|

506,889 |

|

|

|

711 |

|

|

|

0.14 |

% |

|

|

585,820 |

|

|

|

883 |

|

|

|

0.15 |

% |

Time deposits |

|

|

2,024,942 |

|

|

|

96,253 |

|

|

|

4.75 |

% |

|

|

1,468,836 |

|

|

|

57,408 |

|

|

|

3.91 |

% |

Total interest-bearing deposits |

|

|

5,571,296 |

|

|

|

192,366 |

|

|

|