Gateway Fiber Upsizes Credit Facility to $250 Million, Funding Continued Growth in Nationwide Fiber Deployment

03 December 2024 - 4:22AM

Business Wire

Gateway Fiber, a leading fiber internet provider, is pleased to

announce the closing of an incremental $75 million in debt

financing. Proceeds from the capital raise will fund continued

expansion of Gateway’s fiber network through 2025 in three key

markets – Missouri, Minnesota, and Massachusetts.

Gateway has raised a total of $250 million of debt financing

this year with Texas Capital acting as the Administrative Agent and

Texas Capital Securities as Lead Arranger alongside three joint

lead arrangers: JPMorgan Chase Bank, Third Coast Bank, and CIBC.

The combination of the expanded credit facility and the ongoing

support of Gateway’s equity sponsor, CBRE Investment Management,

provides Gateway ample capital to pursue growth.

“We appreciate the tremendous support of Texas Capital, our

lenders, and CBRE IM,” said Gateway Fiber CFO Betsy Toney. “With a

strong balance sheet and great capital partners, we are confident

in our ability to further grow our platform in 2025 and take

advantage of opportunities in the residential and commercial fiber

internet markets. As we expand, we will continue to invest in our

capabilities to maintain outstanding quality of service for our

customers.”

About Gateway Fiber

Gateway Fiber is helping communities thrive through a fairer,

friendlier, faster internet experience. As data requirements for

residences and businesses continue to expand, Gateway is creating a

leading, national fiber-to-the-home platform to serve this critical

unmet need. Gateway provides faster, more reliable internet with a

simple pricing model and industry-leading customer service. For

more information, visit gatewayfiber.com.

About Texas Capital

Texas Capital Bancshares, Inc. (NASDAQ®: TCBI), a member of the

Russell 2000® Index and the S&P MidCap 400®, is the parent

company of Texas Capital Bank (“TCB”). Texas Capital is the

collective brand name for TCB and its separate, non-bank affiliates

and wholly-owned subsidiaries. Texas Capital is a full-service

financial services firm that delivers customized solutions to

businesses, entrepreneurs and individual customers. Founded in

1998, the institution is headquartered in Dallas with offices in

Austin, Houston, San Antonio and Fort Worth, and has built a

network of clients across the country. With the ability to service

clients through their entire lifecycles, Texas Capital has

established commercial banking, consumer banking, investment

banking and wealth management capabilities. All services are

subject to applicable laws, regulations, and service terms. Deposit

and lending products and services are offered by TCB. For deposit

products, member FDIC. For more information, please visit

www.texascapital.com.

Trading in securities and financial instruments, strategic

advisory, and other investment banking activities are performed by

TCBI Securities, Inc., doing business as Texas Capital Securities.

TCBI Securities, Inc. is a member of FINRA and SIPC and has

registered with the SEC and other state securities regulators as a

broker dealer. TCBI Securities, Inc. is a subsidiary of TCB. All

investing involves risks, including the loss of principal. Past

performance does not guarantee future results. Securities and other

investment products offered by TCBI Securities, Inc. are not FDIC

insured, may lose value and are not bank guaranteed.

About CBRE Investment Management

CBRE Investment Management is a leading global real assets

investment management firm with $148.3 billion in assets under

management* as of September 30, 2024, operating in more than 30

offices and 20 countries around the world. Through its

investor-operator culture, the firm seeks to deliver sustainable

investment solutions across real assets categories, geographies,

risk profiles and execution formats so that its clients, people and

communities thrive.

CBRE Investment Management is an independently operated

affiliate of CBRE Group, Inc. (NYSE:CBRE), the world’s largest

commercial real estate services and investment firm (based on 2023

revenue). The company has more than 130,000 employees (including

Turner & Townsend employees) serving clients in more than 100

countries. CBRE Investment Management harnesses CBRE’s data and

market insights, investment sourcing and other resources for the

benefit of its clients. For more information, please visit

www.cbreim.com.

*Assets under management (AUM) refers to the fair market value

of real assets-related investments with respect to which CBRE

Investment Management provides, on a global basis, oversight,

investment management services and other advice and which generally

consist of investments in real assets; equity in funds and joint

ventures; securities portfolios; operating companies and real

assets-related loans. This AUM is intended principally to reflect

the extent of CBRE Investment Management’s presence in the global

real assets market, and its calculation of AUM may differ from the

calculations of other asset managers and from its calculation of

regulatory assets under management for purposes of certain

regulatory filings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241202484350/en/

For more information, press only: David Workman PR &

Communications Manager 314-265-8974

David.Workman@gatewayfiber.com

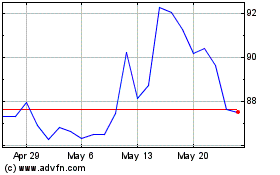

CBRE (NYSE:CBRE)

Historical Stock Chart

From Dec 2024 to Jan 2025

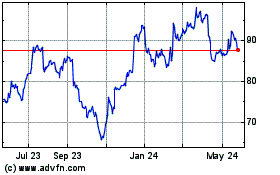

CBRE (NYSE:CBRE)

Historical Stock Chart

From Jan 2024 to Jan 2025