false000113811800011381182025-01-142025-01-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 14, 2025

CBRE GROUP, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-32205 |

94-3391143 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

2121 North Pearl Street Suite 300 Dallas, Texas |

|

75201 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(214) 979-6100

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A Common Stock, $0.01 par value per share |

|

"CBRE" |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This Current Report on Form 8-K is filed by CBRE Group, Inc., a Delaware corporation (the “Company”), in connection with the matters described herein.

Item 2.02 Results of Operations and Financial Condition.

On January 14, 2025, the Company issued a press release announcing preliminary full year 2024 revenue results for a newly created Building Operations & Experience segment. A copy of that press release is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

The information included in this Current Report on Form 8-K under this Item 2.02 (including Exhibit 99.1 hereto) is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), except as expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On January 14, 2025, the Company issued a press release announcing (i) a definitive agreement to acquire Industrious National Management Company, LLC (“Industrious”), a leading provider of flexible office solutions, (ii) certain changes in executive leadership responsibilities and (iii) the creation of a new Building Operations & Experience segment. A copy of that press release is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

The information included in this Current Report on Form 8-K under this Item 7.01 (including Exhibit 99.1 hereto) is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any filing under the Securities Act, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

In connection with the Industrious acquisition, the Company will create a new business segment called Building Operations & Experience (“BOE”). The new BOE segment will consist of the Company’s Enterprise Facilities Management, Local Facilities Management and Property Management business lines and Industrious. With this change, the Company’s four business segments for 2025 will be: Advisory Services, Building Operations & Experience, Project Management and Real Estate Investments.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following documents are attached as exhibits to this Current Report on Form 8-K:

*Furnished herewith.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date: January 14, 2025 |

|

CBRE GROUP, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ EMMA E. GIAMARTINO |

|

|

|

|

|

|

Emma E. Giamartino |

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

|

|

Press Release |

|

|

|

|

FOR IMMEDIATE RELEASE |

|

|

|

|

|

For further information: |

|

|

Chandni Luthra |

Steve Iaco |

Jamie Hodari |

CBRE-Investors |

CBRE-Media |

Industrious |

Chandni.Luthra@cbre.com |

Steven.Iaco@cbre.com |

press@industriousoffice.com |

CBRE Group to Acquire Industrious, Create New Business Segment

•New Building Operations & Experience (BOE) segment to deliver end-to-end building operating solutions at a global scale

•Industrious CEO and co-founder Jamie Hodari to join CBRE as CEO, BOE & Chief Commercial Officer

•Chief Operating Officer Vikram Kohli promoted with added role as CEO, Advisory Services

Dallas – January 14, 2025 – CBRE Group, Inc. (NYSE: CBRE) today announced a definitive agreement to acquire Industrious National Management Company, LLC, a leading provider of flexible workplace solutions. In conjunction with the acquisition, CBRE will create a new business segment called Building Operations & Experience (BOE). This new segment will unify building operations, workplace experience and property management, positioning CBRE to deliver scalable, future-ready solutions for offices, data centers, warehouses and other facilities. The transaction is expected to close later this month.

Since late 2020, CBRE has invested in Industrious through an approximately 40% equity interest and a $100 million convertible note. The company will acquire the remaining equity stake for approximately $400 million, reflecting an implied enterprise valuation of approximately $800 million. The transaction is expected to be immediately accretive to 2025 core EBITDA and free cash flow. The acquisition underscores CBRE’s strong conviction about Industrious’ expertise in workplace experience and operations and the long-term growth prospects for the flexible workplace market.

Industrious is known for its pioneering asset-light business model that emphasizes partnership agreements, which drive alignment with property owners. Since 2021, Industrious’ revenue has grown at a compound annual rate of more than 50%, and its footprint has grown to more than 200 units across over 65 cities. Its industry-leading customer outcomes are the result of an ongoing investment into understanding what makes for a great workplace, paired with continuous operational improvement.

The new BOE segment will be led by Jamie Hodari, Industrious’ chief executive officer and co-founder, and will consist of CBRE’s Enterprise Facilities Management, Local Facilities Management, Property Management and Industrious. This segment produced approximately $20 billion of combined revenue, including Industrious, in 2024 and comprises CBRE’s entire 7+ billion sq. ft. global property and corporate facilities management portfolio.

CBRE Chief Operating Officer Vikram Kohli has been promoted and taken on increased responsibilities. He now has the additional title of CEO, Advisory Services, with responsibility for driving growth for CBRE’s largest business segment, which spans leasing, capital markets and valuation activities. As Chief Operating Officer for CBRE, Kohli will drive company-wide strategy and ensure the company is taking maximum advantage of opportunities to collaborate, realize efficiencies and achieve positive synergies across business segments and key platform functions.

“The advancements we’ve announced today support our strategy of investing in resilient businesses that benefit from secular tailwinds, creating new and differentiated products and continually improving the capabilities of our leadership team,” said Bob Sulentic, CBRE’s chair and chief executive officer.

“Both Jamie and Vikram are highly accomplished executives. Jamie is creative, entrepreneurial and a strong strategic and operational leader. Vikram has exceptional leadership skills that include driving growth across geographies, keen financial and digital insight and a deep knowledge of our global business.”

“The global economy needs physical spaces to make it hum — safe and efficient logistics centers for our goods, magnetic offices for our teams and secure and resilient data centers for our information. Running these spaces with excellence requires sophistication at scale,” said Hodari. “I have found CBRE to be second-to-none in this respect, and I’m thrilled to be joining — not just because of how great it already is, but because of the opportunity ahead of us. I believe the new Building Operations & Experience segment will transform how buildings are operated, creating immense value for building users and owners.”

Hodari will also act as CBRE’s Chief Commercial Officer, with responsibility for marketing and branding activities across all CBRE businesses.

With today’s announcement, CBRE’s four business segments for 2025 will be: Advisory Services, Building Operations & Experience, Project Management and Real Estate Investments. The company will provide historical financial results under the new segment structure in a supplemental non-GAAP disclosure when it announces fourth-quarter 2024 earnings.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world’s largest commercial real estate services and investment firm (based on 2023 revenue). The company has more than 130,000 employees (including Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com. We routinely post important information on our website, including corporate and investor presentations and financial information. We intend to use our website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Such disclosures will be included in the Investor Relations section of our website at https://ir.cbre.com. Accordingly, investors should monitor such portion of our website, in

addition to following our press releases, Securities and Exchange Commission filings and public conference calls and webcasts.

About Industrious

Industrious delivers the world’s best workplaces by making the office a welcoming, empowering, and delightful experience. From private offices to suites, meeting rooms, and desks, Industrious makes it easy to find a workspace that works for just about anyone – whether they come in just a few days a week, want the flexibility to work from more than one location, or need a full HQ. Founded in 2012 and recognized as one of America’s 500 fastest-growing companies by Inc. Magazine, Industrious offers flexible workplaces at more than 200 locations in over 65 cities globally. For more information, visit industriousoffice.com.

Forward-Looking Statements

Certain of the statements in this release regarding the acquisition of the remaining interest in Industrious National Management Company, LLC and the creation of a new Building Operations & Experience (BOE) business segment that do not concern purely historical data are forward-looking statements within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are made based on our management’s expectations and beliefs concerning future events affecting us and are subject to uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Accordingly, actual performance, results and events may vary materially from those indicated in forward-looking statements, and you should not rely on forward-looking statements as predictions of future performance, results or events. Numerous factors could cause actual future performance, results and events to differ materially from those indicated in forward-looking statements, including, but not limited to, the further growth of the flexible office space market and Industrious’ ability to execute its strategy to capitalize on this growth, and CBRE’s ability to establish the new BOE business segment and to benefit from synergies among the business lines that comprise this segment, as well as other risks and uncertainties discussed in our filings with the U.S. Securities and Exchange Commission (SEC). Any forward-looking statements speak only as of the date of this release. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. For additional information concerning factors that may cause actual results to differ from those anticipated in the forward-looking statements and other risks and uncertainties to our business in general, please refer to our SEC filings, including our Form 10-K for the fiscal year ended December 31, 2023 and our most recent quarterly filings on Form 10-Q. Such filings are available publicly and may be obtained from our website at www.cbre.com or upon request from the CBRE Investor Relations Department at investorrelations@cbre.com.

v3.24.4

Document and Entity Information

|

Jan. 14, 2025 |

| Cover [Abstract] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001138118

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 14, 2025

|

| Entity Registrant Name |

CBRE GROUP, INC.

|

| Entity Incorporation State Country Code |

DE

|

| Entity File Number |

001-32205

|

| Entity Tax Identification Number |

94-3391143

|

| Entity Address, Address Line One |

2121 North Pearl

|

| Entity Address, Address Line Two |

Street

|

| Entity Address, Address Line Three |

Suite 300

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| City Area Code |

(214)

|

| Local Phone Number |

979-6100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Security 12b Title |

Class A Common Stock, $0.01 par value per share

|

| Trading Symbol |

CBRE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

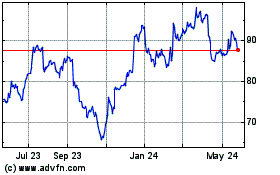

CBRE (NYSE:CBRE)

Historical Stock Chart

From Mar 2025 to Apr 2025

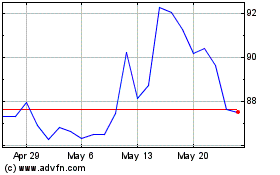

CBRE (NYSE:CBRE)

Historical Stock Chart

From Apr 2024 to Apr 2025