Form 8-K - Current report

04 September 2024 - 8:08PM

Edgar (US Regulatory)

false

COMMUNITY FINANCIAL SYSTEM, INC.

0000723188

0000723188

2024-09-04

2024-09-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 4, 2024

(Exact name of registrant as specified in

its charter)

| Delaware |

001-13695 |

16-1213679 |

(State or other

jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| 5790 Widewaters Parkway, DeWitt, New York |

13214 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (315)

445-2282

Community Bank System, Inc.

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, $1.00 par value per share |

CBU |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On September 6,

2024, beginning at 9:00 AM ET, Community Financial System, Inc. (the “Company”) will hold an in-person and virtual Investor

Day at the New York Stock Exchange conference facilities where the senior leadership team will provide insights into the Company’s

strategies, performance and future outlook. A link to register for the live virtual webcast is included within the Company’s Investor

Day Microsite at: https://investorday.communityfinancialsystem.com.

The Company’s

Investor Day presentation is attached as Exhibit 99.1 to this Report on Form 8-K. The presentation is also available on the

Company’s investor relations website at: https://communityfinancialsystem.com/news-presentations/presentations/.

The information in this Form 8-K, including

Exhibit 99.1 attached hereto, is being furnished under Item 7.01 and shall not be deemed to be “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any

filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such filing.

This Report on Form 8-K (including Exhibit 99.1

attached hereto) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For more

information regarding the forward-looking statements included in this Report on Form 8-K (including Exhibit 99.1 attached hereto),

see the Forward-Looking Statements section of the presentation included in Exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibit is being furnished pursuant

to Item 7.01 above.

| 104 | Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Community Financial System, Inc. |

| |

By: |

/s/ Joseph E. Sutaris |

| |

Name: |

Joseph E. Sutaris |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Dated: September 4, 2024

Exhibit Index

Exhibit 99.1

| Investor Day

2024 |

| ‐

‐

Disclaimers |

| Welcome & Opening Remarks

•

•

•

•

• |

| Investor Day Agenda |

| Investor Day Speakers |

| Company Overview &

Investment Thesis |

| Company Overview

•

•

•

•

•

•

• |

| About CBU

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

• |

| How We Operate: Our Core Values |

| Our Evolution

Into a Diversified

Financial

Company

•

•

•

•

• |

| Our Investment Thesis:

•

•

•

•

•

• |

| Below Average Risk |

| Above Average Returns |

| Our System Produces Premium Results

10Yr Avg. Relative Premium to KRX (median): 4.2x

5Yr Avg. Relative Premium to KRX (median): 6.1x

Current Relative Premium to KRX (median): 5.0x |

| Our Opportunity Set:

Banking (CBNA)

2023 Summary of Deposits

$ in Millions

Buffalo, NY

MSA

Rochester, NY

MSA

Syracuse, NY

MSA

Albany, NY

MSA

Deposit Market Size: $76,153 $32,626 $18,975 $47,811

Market 5-Year CAGR: 11.8% 7.4% 6.4% 16.1%

CBNA Deposits: $237 $813 $1,052 $183

CBNA Market Share: 0.3% 2.5% 5.5% 0.4%

CBNA 5-Year CAGR: 12.6% 14.1% 4.9% 1.0%

CBNA Branches: 3 12 14 6

CBNA De Novo: 3 3 4 3

2023 Summary of Deposits

$ in Millions

Allentown, PA

MSA

Springfield, MA

MSA

Manchester NH,

MSA

Total Selected

MSAs

Deposit Market Size: $25,180 $15,924 $18,790 $235,459

Market 5-Year CAGR: 11.6% 6.5% 7.1% 10.6%

CBNA Deposits: $62 $31 $0 $2,378

CBNA Market Share: 0.3% 0.2% 0.0% 1.0%

CBNA 5-Year CAGR: 6.6% (3.6%) NA 7.6%

CBNA Branches: 2 1 0 38

CBNA De Novo: 3 1 1 18

#1 or #2 deposit market share position in 66% of the

towns we do business in |

| Our Opportunity Set:

Employee Benefit Services (BPAS)

Industry Note

5:

There are over 111 million benefit plan participants in the United States

BPAS

10Yr Operating Revenue CAGR2

:12.1%

5Yr Operating Revenue CAGR2

: 5.9%

3Yr Operating Revenue CAGR2

: 6.1%

880,000+

6

Top 5 |

| Our Opportunity Set:

Insurance Services (OneGroup)

OneGroup

7Yr Operating Revenue CAGR3

: 9.8%

5Yr Operating Revenue CAGR3

: 8.6%

3Yr Operating Revenue CAGR3

: 13.9%

Top 5

13

66th

Industry Note

6:

The top 75 insurance agencies have grown revenue at a 13% CAGR (2019 – 2022) |

| Wealth

10Yr Operating Revenue CAGR2

: 8.3%

5Yr Operating Revenue CAGR2

: 6.1%

3Yr Operating Revenue CAGR2

: 3.6%

Our Opportunity Set:

Wealth Management Services

$12.5B

15.4% |

| Consistently Improving Productivity

5Yr Op. Rev / FTE CAGR2

: 4.6% 5Yr Op. Rev / FTE CAGR2

: 1.6%

5Yr Op. Rev / FTE CAGR2

: 5.5% 5Yr Op. Rev / FTE CAGR2

: 3.4% |

| How Our System Works

•

•

Banking

•

•

•

•

•

•

•

Insurance

Wealth

Benefits

•

Insurance

Wealth

Banking

Our Community Our Financial Solutions Our System

•

•

•

Benefits |

| •

Local Growth Opportunities

•

•

•

•

•

•

U.S. Avg:

1.60%

> 2.5%

1.5% - 2.5%

0% - 1.5%

< 0%

Non-MSA; excluded |

| Banking |

| Banking

•

•

•

•

•

•

• |

| CBNA at a Glance

•

•

•

•

•

•

•

Ranked as one of America’s most

trustworthy banks of 2023 by

Newsweek |

| Liquidity & Credit Are Our

Foundational Strengths

•

•

• 2

2 |

| We Have Grown Net Interest Income

Every Year Since 2006 |

| Business Line Summary

•

•

•

•

•

•

•

•

•

• |

| Loan Portfolios & Asset Quality |

| Our Banking Evolution

▪

▪

▪

▪

▪

▪

▪

▪

▪

▪ |

| De-centralized Regional Structure |

| Established Growth Capabilities

Across All Regions |

| Retail & Business Banking

•

•

•

•

•

•

•

•

•

•

•

• |

| Optimizing

Delivery Channels

for Growth

•

•

•

• |

| •

•

•

•

•

•

•

•

•

Digital

Banking

Capabilities |

| Consumer Lending

•

•

•

•

•

•

•

•

• • • |

| •

•

•

•

•

•

Consumer Lending |

| Commercial Banking |

| Commercial Lending

0.07% 10-year average

net-charge off ratio

(2014-2023)

NOO CRE represents 197% of total

bank-level capital compared to the KRX

bank-held median of 242% |

| Commercial Banking Initiatives

•

•

•

•

•

•

•

•

•

•

•

• |

| Expansion Markets Opportunity

2023 Summary of Deposits

$ in Millions

Buffalo, NY

MSA

Rochester, NY

MSA

Syracuse, NY

MSA

Albany, NY

MSA

Allentown, PA

MSA

Springfield, MA

MSA

Manchester NH,

MSA

Deposit Market Size: $76,153 $32,626 $18,975 $47,811 $25,180 $15,924 $18,790

Market 5-Year CAGR: 11.8% 7.4% 6.4% 16.1% 11.6% 6.5% 7.1%

CBNA Deposits: $237 $813 $1,052 $183 $62 $31 $0

CBNA Market Share: 0.3% 2.5% 5.5% 0.4% 0.3% 0.2% 0.0%

CBNA 5-Year CAGR: 12.6% 14.1% 4.9% 1.0% 6.6% (3.6%) NA

CBNA Branches: 3 12 14 6 2 1 0

CBNA De Novo: 3 3 4 3 3 1 1

#1 Market Share Company: M&T Bank Corp. ESL FCU M&T Bank Corp. Citizens Financial

Group Inc. Wells Fargo & Co. Peoples Bancorp Citizens Financial

Group Inc.

2023 Market Share: 65.4% 17.2% 19.5% 23.6% 16.2% 14.3% 24.2%

Top 3 Institution Market Share: 79.6% 40.4% 46.8% 55.5% 35.2% 38.8% 61.8%

Top Non-Super Regional,

Non-Credit Union Market Share:

Northwest

Bancshares, Inc.

Canandaigua

National Corp. NBT Bancorp Inc. TrustCo Bank

Corp NY Fulton Financial Corp Peoples Bancorp Primary Bank

2023 Market Share: 3.2% 11.0% 6.8% 7.2% 7.3% 14.3% 3.1% |

| Expansion

Markets |

| What the Future Brings |

| Employee Benefit

Services |

| Employee Benefit Services

•

•

•

•

•

•

• |

| One Company, One Call

•

•

•

•

•

•

•

• |

| BPAS at a Glance |

| Our History |

| Well Positioned For Success in a

Growing Industry |

| Business Line Summary

•

• • •

•

• |

| Revenue Model &

Performance

10Yr Operating Revenue CAGR1,4: 12.1%

3Yr Avg. Operating Margin3,5: 42.9%

TTM Revenue by Source

51% asset-based

45% fee-based

4% other |

| Recordkeeping

& TPA

•

•

•

•

•

•

•

•

•

•

•

•

•

• |

| How We Win in Recordkeeping

•

•

•

•

•

•

•

•

•

•

•

•

• |

| State of the Art Technology |

| Other Revenue Verticals

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

• |

| CIT Fund Administration

BPAS is one of the three largest

special purpose trust companies

focused on collective funds3

•

•

•

•

•

•

•

Industry Note:

Morningstar notes that CITs now represent 49% of total DC plan assets and will

overtake mutual funds this year as the most popular target-date vehicle

2 |

| Future Outlook |

| Insurance Services |

| Insurance Services

•

•

•

•

•

• |

| Insurance Services

•

•

•

•

•

•

•

•

•

•

•

• |

| OneGroup at a Glance |

| •

•

•

•

Insurance

Brokerage

Industry |

| Favorable Business Mix

With Deep Specialties |

| Lines of Business

•

•

•

•

•

•

•

•

•

• |

| Revenue Performance

7Yr Operating Revenue CAGR1,4: 9.8%

3Yr Avg. Operating Margin3,5: 18.8% |

| Carrier Depth •

• |

| Future Outlook |

| Wealth Management

Services |

| Wealth Management Services

•

•

•

•

• |

| Wealth Management Services

•

•

•

•

•

•

•

•

•

•

• |

| Well Positioned For Success in a

Growing Industry |

| Uniquely Broad and Deep Capabilities

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

• |

| Trended

Results |

| Wealth Management Services:

Financial Performance

10Yr Operating Revenue CAGR1,4: 8.3%

3Yr Avg. Operating Margin3,5: 31.2% |

| Future Outlook |

| Risk Management |

| Risk Management

•

•

•

•

•

•

• |

| Risk Management Framework |

| CBNA’s Lending Philosophy & Credit

Risk Management |

| Debt-to-Income Ratio |

| Loan Losses |

| Loan Mix Comparison |

| Retail Lending |

| Funding Metrics |

| Deposit Granularity

$17 $32

$0

$100

$200

$300

$400

$500

$600

CBNA Industry

Thousands

Average Deposit Account Balance

$201

$508

$1,120

$0

$200

$400

$600

$800

$1,000

$1,200

First Republic Signature SVB

Thousands

Average Deposit Account Balance |

| Financial Performance |

| Financial Performance

•

•

•

•

•

•

•

• |

| Fundamental Elements of Our

Enduring Success |

| •

•

Focus on

Revenue

Quality,

Diversification

and Sustainable

Results |

| Strong Asset Quality |

| Allowance Industry Comparison |

| •

•

•

•

•

Core Deposit

Strength

22% cycle to date deposit beta1

24% cycle to date funding beta1

30% cycle to date interest-bearing

deposit beta1 |

| Liquidity Position & Sources

•

•

•

•

• |

| •

•

Solid Capital

Position |

| Outperformance During Turbulence |

| Company Performance

9.3%

4.5% 1.29% 40%

$1.29

0.06%

$0.95 0.05% |

| Segment Performance

10Yr Operating Revenue CAGR3

: 12.1%

3Yr Avg. Operating Margin4

: 42.9%

10Yr Operating Revenue CAGR3

: 5.4%

3Yr Avg. Operating Margin4

: 38.9%

7Yr Operating Revenue CAGR3

: 9.8%

3Yr Avg. Operating Margin4

: 18.8%

10Yr Operating Revenue CAGR3

: 8.3%

3Yr Avg. Operating Margin4

: 31.2% |

| Capital Deployment

Since 12/31/2018

46.5% operating payout ratio

53.1% payout ratio |

| Catalysts for Earnings Growth &

Shareholder Value Creation |

| •

•

Loan Repricing

Opportunity

28% of outstanding loan

balances are expected to

reprice or be repaid in

the next 12 months1 |

| •

•

Securities

Redeployment

Opportunity |

| Opportunities and Financial Targets

•

•

•

•

•

•

•

•

•

•

• |

| Valuation

Considerations |

| Valuation Considerations

10Yr Avg. Relative Premium to KRX (median): 4.2x

5Yr Avg. Relative Premium to KRX (median): 6.1x

Current Relative Premium to KRX (median): 5.0x |

| P/E Reference Framework |

| 5Yr

Avg

10Yr

Avg

KRX (median): 1.52x 1.71x

KRX (top quartile): 1.80x 2.05x

Illustrative P/TBV Context |

| Closing Remarks |

| Closing Remarks

▪

▪

▪

▪

▪

▪ |

| Thank you! |

| Appendix |

| Glossary of Terms |

| Primary

Subsidiaries |

| Board of Directors |

| KRX Peer Group |

| Multifamily & NOO CRE by Location |

| •

•

•

•

Reconciliation of GAAP and Non-GAAP |

| Pre-tax, Pre-provision Components |

| Operating Net Income |

| Net Interest Margin & Operating ROA |

| Operating Revenues |

| Equity-to-Assets |

| Book Value |

| Operating Noninterest Expenses |

| Core Results |

Cover

|

Sep. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 04, 2024

|

| Entity File Number |

001-13695

|

| Entity Registrant Name |

COMMUNITY FINANCIAL SYSTEM, INC.

|

| Entity Central Index Key |

0000723188

|

| Entity Tax Identification Number |

16-1213679

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

5790 Widewaters Parkway

|

| Entity Address, City or Town |

DeWitt

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

13214

|

| City Area Code |

315

|

| Local Phone Number |

445-2282

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $1.00 par value per share

|

| Trading Symbol |

CBU

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Community Bank System, Inc.

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

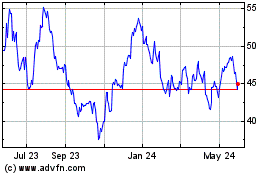

Community Financial System (NYSE:CBU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Community Financial System (NYSE:CBU)

Historical Stock Chart

From Nov 2023 to Nov 2024