Program successfully doubles the strike length

of Southern Silver Zone mineralization Presence of elevated

critical minerals suggest closer proximity to heat source Regional

exploration identifies new high-priority district targets

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today

provided initial results of its 2024 exploration program at its

wholly-owned Silvertip polymetallic critical minerals exploration

project in northern British Columbia, which included the most

extensive surface program completed by Coeur since acquiring the

property in 2017.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241218851908/en/

Figure 1: Plan view map showing location

of 2024 diamond drillholes. (Graphic: Business Wire)

The 48-hole program, totaling approximately $12 million and over

68,000 feet (nearly 21,000 meters) of drilling, achieved its three

priorities of: (i) drilling from underground to grow the known

resource along-strike and down-dip; (ii) drilling large step-out

holes on major structures to increase the deposit’s footprint for

future resource growth; and (iii) conducting district-scale field

work to identify other structures similar to Silvertip with

potential to host large ore bodies.

“Silvertip’s three-pronged 2024 exploration strategy

successfully expanded known areas of mineralization doubled the

strike length of the Southern Silver Zone to over 2,000 meters, and

identified three new large targets located on our over 50,000

hectare (over 125,000 acre) land package,” said Mitchell J. Krebs,

Chairman, President and Chief Executive Officer. “We anticipate

continued exploration success in 2025 as we seek to expand the size

and enhance our knowledge of this world-class deposit. We remain

enthusiastic about Silvertip’s potential to become a future

high-quality source of growth for the Company and an important

future source of Canadian-based critical minerals.”

Key Highlights1,2

- Continued growth adjacent to the current resource –

Drilling from underground extended the Southern Silver Zone by

approximately 1,150 feet (350 meters) along strike and the Saddle

Zone by roughly 280 feet (85 meters) along strike. Notable assay

results include:

Southern Silver Zone

- Hole 65Z23-485-012-029: 22.3 feet at 3.61 ounces per ton

(“oz/t”) (5.8 meters at 123.7 grams per tonne (“g/t”)) silver, 2.0%

lead, and 1.84% zinc

- Hole 65Z23-485-009-005: 36.9 feet at 1.38 oz/t (11.3 meters at

47.4 g/t) silver, 0.36% lead, and 9.85% zinc

- Hole 65Z23-485-012-031: 14.8 feet at 23.17 oz/t (4.5 meters at

794.2 g/t) silver, 14.62% lead, and 12.32% zinc

Saddle Zone

- Hole SDZ24-485-015-001: 21.7 feet at 2.75 oz/t (6.6 meters at

94.5 g/t) silver, 0.91% lead, and 13.98% zinc

- Hole SDZ23-485-013-017: 25.6 feet at 1.89 oz/t (7.8 meters at

64.9 g/t) silver, 0.31% lead, and 15.07% zinc, and 13.8 feet at

10.53 oz/t (4.2 meters at 361.1 g/t) silver, 6.66% lead, 5.75%

zinc

- Hole SDZ23-485-013-021: 11.2 feet 3.25 oz/t (3.4 meters at

133.4 g/t) silver, 1.68% lead, 10.77% zinc

- Hole SDZ23-PAD-007-003: 22.8 feet at 5.91 oz/t (7.0 meters at

202.5 g/t) silver, 4.58% lead, and 7.0% zinc

- Large drill step-outs on the Southern Silver Zone confirm

mineralization up to 1,000 meters along strike, highlighting

considerable growth potential – All five surface step-out holes

were drilled up to 1,000 meters from the boundary comprising the

2023 resource and intersected significant visual massive sulfide

mineralization. To date, assays have been received for two

holes:

- Hole SSZ24-Pad34-001: 17.6 feet at 3.47 oz/t (5.4 meters at

119.1 g/t) silver, 2.79% lead, and 8.89% zinc

- Hole SSZ24-Pad34-002: 26.3 feet at 5.76 oz/t (8.0 meters at

197.5 g/t) silver, 2.94% lead, and 3.93% zinc, and 26.6 feet at

0.33 oz/t (8.12 meters at 11.3 g/t) silver, 0.11% lead, and 13.37%

zinc

The assay values for copper, gold, tin,

gallium, and indium suggest hotter hydrothermal fluids and

proximity to a heat source. High concentrations of silver, zinc,

and lead, along with critical metals, indicate multiple stages of

mineralization that are typical of Carbonate Replacement Deposit

(CRD) systems like Silvertip.

- District exploration identified three high-priority targets

showing geological similarities to Silvertip – The

district-wide program included geophysical surveys over

approximately 37,000 hectares (91,000 acres) to improve

understanding of the geology and structure, which are primary

factors controlling mineralization at Silvertip. Fieldwork included

helicopter-supported reconnaissance geological mapping, as well as

rock, soil and stream sediment geochemical surveys. Mapping has

confirmed all areas have the same geological setting as the

Silvertip deposit. Following on from the results of this work,

Coeur secured an option from CMC Metals Ltd (“CMC Metals”) on

approximately 10,000 hectares of additional prospective ground

adjacent to Silvertip’s current land package.

“The initial results of our 2024 drilling program have already

successfully identified three high priority targets that show

grades and geology similar to the Silvertip Carbonate Replacement

Deposit (CRD) mineralization,” said Aoife McGrath, Senior Vice

President of Exploration. “Our district-scale evaluation, including

geophysical surveys plus stream and soil geochemical surveys, have

set the groundwork for upcoming field programs and are already

providing an enhanced understanding of regional geology and

structure, in addition to the recognition of new possible

mineralization centers. We expect other targets to emerge from this

year’s program as results are received, and I am confident that

2025 will be another very exciting year at Silvertip as we continue

to explore and develop Silvertip as an emerging Tier 1 CRD

District.”

For a complete table of all year-to-date 2024 drill results,

including previously unpublished results from late 2023 drilling,

please refer to the following link:

https://www.coeur.com/files/doc_downloads/2024/12/2024-12-18-Exploration-Update-Appendix-Final.pdf.

Please see the “Cautionary Statements” section for additional

information regarding drill results.

Detail of Work

Undertaken

The key areas of resource expansion and step-out drilling were

focused on the Southern Silver Zone and Saddle Zone (see Figure 1),

with a total of 68,326 feet (20,827 meters) completed. A total of

34 holes were drilled from underground, of which assay results have

been received for five holes, while 14 holes were drilled from

surface, of which assay results have been received for two holes.

Assay results from these remaining holes will be published when

received.

Near-Mine Exploration and Expansion Drilling

Between March and October, one diamond drill was active in the

Silvertip underground. This phase of the program aimed to expand

the known resource by taking moderate step-outs adjacent to the

resource area. This drilling encountered notable mineralization in

both the Saddle Zone and the Southern Silver Zone. Assay results

for most of this drilling are pending but key highlights from

results received so far are outlined above and shown below in

Figure 2.

Exploration and Step-out Drilling

Between July and November, surface drilling focused on large

step-outs along Southern Silver Zone to rapidly increase the

footprint for future resource growth. Five surface diamond drill

holes were completed for a total of approximately 18,560 feet

(5,658 meters). All five holes cut visually significant massive

sulfide mineralization. Assay results have been received for holes

SSZ24-PAD34-001 and SSZ24-PAD34-002 and are highlighted in Figure

3. These mineralized intervals are up to 1,000 meters away from the

established Southern Silver Zone resource (see Figure 1) and remain

open to the southeast. Combined with mineralized intercepts from

previous years along this trend, the Southern Silver Zone structure

continues to show potential for lateral continuity and resource

expansion.

District-Scale Exploration

Surface exploration was conducted between June and September

with a focus on evaluating targets over a significantly larger

portion of the Silvertip claim blocks. This was the first year of a

systematic, multi-year exploration program designed to explore for

other CRD style deposits elsewhere on nearly 40,000 hectares of

Coeur’s claims, to identify possible intrusive heat sources and to

delineate the limits of the system to assist with vectoring.

Early in 2024 the program commenced with remote sensing (ASTER

and Sentinel-2) to identify alteration and geological patterns

similar to those at the Silvertip deposit. Historic mapping, rock

geochemistry and stream sediment geochemistry were combined with

this to prioritize areas for more detailed follow-up during the

summer months. Field work entailed 1:10,000 scale bedrock mapping,

rock sampling, reconnaissance-scale stream sediment sampling and a

soil geochemical orientation study (Figures 4 and 5). A total of

157 rock samples, 153 stream sediment samples and 234 soil samples

were collected. Due to the short summer season, work was undertaken

on only a portion of the claims, with further reconnaissance and

follow-up work planned for upcoming summer seasons.

Compilation and field reconnaissance led to the prioritization

of three key target areas: Berg, Weiram Mountain-Hamlet Mountain

and Brinco Hill. Mapping has confirmed all areas have the same

geological setting as the Silvertip deposit, where the McDame Group

carbonates are the host lithology, capped by Earn Group sediments.

Stratigraphically deeper carbonates of the Atan Group (Rosella

Formation) were mapped locally on surface and remain prospective

for further exploration both on surface and at depth.

Mineralization at the newly optioned Silverknife area is hosted in

the Atan Group limestones. Further similarities to Silvertip

include the presence of mafic dykes, quartz and calcite breccia

zones, and oxide gossans. Assays from rock chip sampling confirmed

mineralization similar to that seen at Silvertip mine.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing

precious metals producer with four wholly-owned operations: the

Palmarejo gold-silver complex in Mexico, the Rochester silver-gold

mine in Nevada, the Kensington gold mine in Alaska and the Wharf

gold mine in South Dakota. In addition, the Company wholly-owns the

Silvertip polymetallic critical minerals exploration project in

British Columbia.

Cautionary Statements

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding exploration efforts and plans,

exploration expenditures and investments, drill results, resource

delineation, expansion, upgrade or conversion. Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause Coeur’s actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others, the

risk that anticipated additions or upgrades to reserves and

resources are not attained, the risk that planned drilling programs

may be curtailed or canceled due to budget constraints or other

reasons, the risks and hazards inherent in the mining business

(including risks inherent in developing large-scale mining

projects, environmental hazards, industrial accidents, weather or

geologically related conditions), changes in the market prices of

gold, silver, zinc and lead and a sustained lower price

environment, the uncertainties inherent in Coeur’s production,

exploratory and developmental activities, including risks relating

to permitting and regulatory delays (including the impact of

government shutdowns), ground conditions, grade and recovery

variability, any future labor disputes or work stoppages, the

uncertainties inherent in the estimation of mineral reserves,

changes that could result from Coeur’s future acquisition of new

mining properties or businesses, the loss of any third-party

smelter to which Coeur markets its production, the effects of

environmental and other governmental regulations, the risks

inherent in the ownership or operation of or investment in mining

properties or businesses in foreign countries, Coeur’s ability to

raise additional financing necessary to conduct its business, make

payments or refinance its debt, as well as other uncertainties and

risk factors set out in filings made from time to time with the

United States Securities and Exchange Commission, and the Canadian

securities regulators, including, without limitation, Coeur’s most

recent reports on Form 10-K and Form 10-Q. Actual results,

developments and timetables could vary significantly from the

estimates presented. Readers are cautioned not to put undue

reliance on forward-looking statements. Coeur disclaims any intent

or obligation to update publicly such forward-looking statements,

whether as a result of new information, future events or otherwise.

Additionally, Coeur undertakes no obligation to comment on

analyses, expectations or statements made by third parties in

respect of Coeur, its financial or operating results or its

securities.

The scientific and technical information concerning our mineral

projects in this news release have been reviewed and approved by a

“qualified person” under S-K 1300, namely our Senior Director,

Technical Services, Christopher Pascoe. For a description of the

key assumptions, parameters and methods used to estimate mineral

reserves and mineral resources included in this news release, as

well as data verification procedures and a general discussion of

the extent to which the estimates may be affected by any known

environmental, permitting, legal, title, taxation, sociopolitical,

marketing or other relevant factors, please review the Technical

Report Summaries for each of the Company’s material properties

which are available at www.sec.gov.

Notes

The ranges of potential tonnage and grade (or quality) of the

exploration results described in this news release are conceptual

in nature. There has been insufficient exploration work to estimate

a mineral resource. It is uncertain if further exploration will

result in the estimation of a mineral resource. The exploration

results described in this news release therefore does not

represent, and should not be construed to be, an estimate of a

mineral resource or mineral reserve.

For additional information regarding 2022 mineral reserves and

mineral resources, see.

- For a complete table of all drill results included in this

release, please refer to the following link:

https://www.coeur.com/files/doc_downloads/2024/12/2024-12-18-Exploration-Update-Appendix-Final.pdf.

- Rounding of grades, to significant figures, may result in

apparent differences.

Conversion Table

1 short ton

=

0.907185 metric tons

1 troy ounce

=

31.10348 grams

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241218851908/en/

Coeur Mining, Inc. 200 S. Wacker Drive, Suite 2100 Chicago,

Illinois 60606 Attention: Jeff Wilhoit, Senior Director, Investor

Relations Phone: (312) 489-5800 www.coeur.com

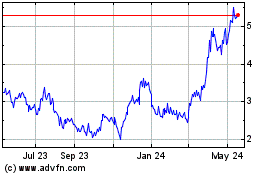

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Dec 2023 to Dec 2024