false

0000857949

CN

0000857949

2023-12-28

2023-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 28, 2023

CHINA GREEN AGRICULTURE, INC.

(Exact name of Registrant as specified in charter)

| Nevada |

|

001-34260 |

|

36-3526027 |

| (State or other jurisdiction |

|

(Commission File No.) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

3rd Floor, Borough A, Block A.

No.181 South Taibai Road

Xi’an, Shaanxi Province

People’s Republic of China 710065

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code: +86-29-88266368

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17CFR230.425) |

| ☐ |

Soliciting material pursuant to Rule14a-12 under the Exchange Act (17CFR240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock |

|

CGA |

|

NYSE |

Item 5.02. Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective December 27, 2023, Mr. Shiyu Zhang resigned

from his position as a director of China Green Agriculture, Inc., a corporation incorporated in the State of Nevada (the “Company”).

Consequently, he also resigned from his positions as member of our Audit Committee, member

of our Nominating Committee and member of our Compensation Committee. The Board of Directors (the “Board”) accepted

Mr. Zhang’s resignation.

Effective December 28, 2023, the Board, upon the

recommendation of its Nominating Committee, appointed Ms. Cui Song to serve in the class of directors on the Board of the Company. Ms.

Song will serve on the Nominating Committee, Audit Committee, and Compensation Committee of the Company’s Board.

Biographical information of Ms. Cui Song is as

follows:

Ms. Cui Song is an experienced

marketing professional and entrepreneur. She has previously held the position of Regional Manager for the Chongqing area at Peking University

Resources Company in Beijing. Additionally, Ms. Song is a co-founder of the Chinese children’s amusement brand – Wonderland. Ms.

Song is an alumna of Zhejiang University of Media and Communications, where she graduated with a Bachelor’s degree in Journalism and Communication.

A copy of the Employment Agreement, dated as of

December 28, 2023, between the Company and Ms. Cui Song is attached as Exhibit 10.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements

and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: December 29, 2023 |

CHINA GREEN AGRICULTURE, INC. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/ Zhuoyu Li |

| |

|

Zhuoyu Li |

| |

|

Chairman of the Board of Directors,

Chief Executive Officer, and President |

2

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Employment Agreement (the “Agreement”)

is made and entered into as of December 28, 2023 by and between China Green Agriculture Inc., a Nevada corporation (the “Company”),

having its principal place of business at 3rd Floor, Borough A, Block A. No.181, South Taibai Road, Xi’an, Shaanxi

Province, People’s Republic of China 710065, and Cui Song (the “Executive”), having a passport number: E83562205. The

Company and the Executive may be referred to herein individually as a “Party” and collectively as the “Parties.”

WITNESSETH:

WHEREAS, the Company desires

to retain the services of Executive as a Board Director of the Company; and

WHEREAS, Executive has represented

that she has the experience, background and expertise necessary to enable she to be the Company’s Board Director; and

WHEREAS, based on such representation,

and the Company’s reasonable due diligence, the Company wishes to employ Executive as its Board Director, and Executive wishes to

be so employed, in each case, upon the terms hereinafter set forth.

NOW, THEREFORE, in consideration

of the foregoing premises and the mutual covenants and agreements herein contained, and other good and valuable consideration, the Parties

agree as follows:

| |

1. |

DEFINITIONS. As used herein, the following terms shall have the following meanings: |

1.1 “Affiliate”

means any Person controlling, controlled by or under common control with the Company.

1.2 “Board”

means the Board of Directors of the Company.

1.3 “Common Stock”

means the Company’s $.001 par value per share common stock.

1.4 “Cause”

means (i) conviction of any crime whether or not committed in the course of her employment by the Company; (ii) Executive’s refusal

to carry out instructions of the Board which are consistent with Executive’s role as Board Director; or (iii) the breach of any

representation, warranty or agreement between Executive and Company.

1.5 “Date of Termination”

means (a) in the case of a termination for which a Notice of Termination (as hereinafter defined in Section 5.3) is required, 30 days

from the date of actual receipt of such Notice of Termination or, if later, the date specified therein, as the case may be, and (b) in

all other cases, the actual date on which the Executive’s employment terminates during the Term of Employment (as hereinafter defined

in Section 3) (it being understood that nothing contained in this definition of “Date of Termination” shall affect any of

the cure rights provided to the Executive or the Company in this Agreement).

1.6 “Disability”

means Executive’s inability to render, for a period of three consecutive months, services hereunder due to her physical or mental

incapacity.

1.7 “Effective Date”

means December 28, 2023.

1.8 “Person(s)”

means any individual or entity of any kind or nature, including any other person as defined in Section 3(a)(9) of the Securities Exchange

Act of 1934, and as used in Sections 13(d) and 14(d) thereof.

1.9 “Prospective Customer”

shall mean any Person which has either (a) entered into a nondisclosure agreement with the Company or any Company subsidiary or Affiliate

or (b) has within the preceding 12 months received a currently pending and not rejected written proposal in reasonable detail from the

Company or any of the Company’s subsidiary or Affiliate.

2.1 Agreement to Employ.

As of the Effective Date, the Company hereby agrees to employ Executive, and Executive hereby agrees to serve, subject to the provisions

of this Agreement, as an officer and employee of the Company.

2.2 Duties and Schedule.

Executive shall serve as the Company’s Board Director and shall have such responsibilities as designated by the Company’s

Board that are not inconsistent with applicable laws, regulations and rules. Executive shall report directly to the Company’s Board,

or any designated Committee thereof, as circumstances may require.

Unless Executive’s employment

shall sooner terminate pursuant to Section 5, the Company shall employ Executive for a term commencing on the Effective Date and ending

on the first anniversary thereof (the “Term”). The term shall automatically renew for an additional year unless either

Party provides notice to the other that the Term shall not continue within 60 days prior to the end of the prior Term. The period during

which Executive is employed pursuant to this Agreement shall be referred to as the “Term” or the “Term of

Employment”.

4.1 Salary. Executive’s

salary during the Term shall be $18,000 per year (the “Salary”), and such compensation is subject to annual review

and adjustment by the Board. A discretionary bonus, if any, may be paid each year as determined solely by the Board.

4.2 Vacation. Executive

shall be entitled to fifteen (15) days of paid vacation per year taken at such times so as to not materially impede her duties hereunder.

Executive shall be entitled to a pro rata number of days of paid vacation during the period beginning on the Effective

Date through the end of the first fiscal year. Vacation days that are not taken may not be carried over into future years. Illness days

shall be consistent with the Company’s standard policies and applicable U.S. law. Executive should be entitled to standard U.S.

federal government holidays in addition to vacation or illness days.

4.3 Business Expenses.

Executive shall be reimbursed by the Company for all ordinary and necessary expenses incurred by Executive in the performance of her duties

hereunder on behalf of the Company, such expenses not to exceed $500 per month without the prior written approval of the Company.

4.4 Section 409A Compliance.

The Executive and the Company intend that any compensation under this Agreement shall be paid in compliance with Section 409A of the Internal

Revenue Code such that there are no adverse tax consequences, interest, or penalties as a result of the payments. Notwithstanding any

other provisions of this Agreement to the contrary, any payment or benefits otherwise due to the Executive upon the Executive’s

termination from employment with the Company shall not be made until and unless such termination from employment constitutes a “Separation

from Service”, as such term is defined under Section 409A of the Internal Revenue Code. These provisions shall have no effect on

payments or benefits otherwise due or payable to the Executive or on the Executive’s behalf, which are not on account of the Executive’s

termination from employment with the Company, including as a result of the Executive’s death. Furthermore, if the Company reasonably

determines that the Executive is a “Specified Employee” as defined by Section 409A, upon termination of Executive’s

employment for any reason other than death (whether by resignation or otherwise), no amount may be paid to the Executive earlier than

six months after the date of termination of Executive’s employment if such payment would violate Section 409A and the regulations

issued thereunder, and payment shall be made, or commence to be made, as the case may be, on the date that is six months and one day after

the termination of Executive’s employment. Each payment made under this Agreement shall be designated as a “separate payment”

within the meaning of Section 409A.

5.1 Termination Due

to Death or Disability.

5.1.1 Death. This

Agreement shall terminate immediately upon the death of Executive. Upon Executive’s death, Executive’s estate or Executive’s

legal representative, as the case may be, shall be entitled to Executive’s accrued and unpaid Salary and vacation as of the date

of Executive’s death, plus all other compensation and benefits that were vested through the date of Executive’s death.

5.1.2 Disability.

In the event of Executive’s Disability, this Agreement shall terminate and Executive shall be entitled to (a) accrued and unpaid

vacation through the first date that a Disability is determined; and (b) all other compensation and benefits that were vested through

the first date that a Disability has been determined.

5.2 Termination.

Both the Company and the Executive may terminate the employment hereunder by delivery of written notice to the other party at least thirty

(30) days prior to termination date or with a shorter notice period if agreed upon by the Parties. At Company’s sole discretion,

it may substitute thirty (30) days salary in lieu of such written notice. However, that in the event of a breach of this Agreement by

the Executive or an event which would constitute “Cause”, the Company may immediately terminate this Agreement upon written

notice with no waiting period or substituting salary. Upon the effective date of termination under this Section 5.2, Executive shall be

entitled to (a) accrued and unpaid vacation through such effective date; and (b) all other compensation and benefits that were vested

through such effective date.

5.3 Notice of Termination.

Any termination of the Employment by the Company or the Executive shall be communicated by a notice in accordance with Section 8.4 of

this Agreement (the “Notice of Termination”).

5.4 Payment. The

Executive shall not be entitled to severance payments upon any termination provided in Section 5 herein. Except as otherwise provided

in this Agreement, any payments to which the Executive shall be entitled under this Section 5, including, without limitation, any economic

equivalent of any benefit, shall be made as promptly as possible following the Date of Termination, but in no event more than 30 days

after the Date of Termination. If the amount of any payment due to the Executive cannot be finally determined within thirty (30) days

after the Date of Termination, such amount shall be reasonably estimated on a good faith basis by the Company and the estimated amount

shall be paid no later than thirty (30) days after such Date of Termination. As soon as practicable thereafter, the final determination

of the amount due shall be made and any adjustment requiring a payment to Executive shall be made as promptly as practicable. The payment

of any amounts under this Section 5 shall not affect Executive’s rights to receive any workers’ compensation benefits.

6. EXECUTIVE’S

REPRESENTATION. The Executive represents and warrants to the Company that: (a) she is subject to no contractual, fiduciary or other

obligation which may affect the performance of her duties under this Agreement; (b) she has terminated, in accordance with their terms,

any contractual obligation which may affect her performance under this Agreement; and (c) her

employment with the Company will not require she to use or disclose proprietary or confidential information of any other person or entity.

| |

7. |

NON-COMPETITION: NON-DISCLOSURE; INVENTIONS. |

7.1 Trade Secrets.

Executive acknowledges that her employment position with the Company is one of trust and confidence. Executive further understands and

acknowledges that, during the course of Executive’s employment with the Company, Executive will be entrusted with access to certain

confidential information, specialized knowledge and trade secrets which belong to the Company, or its subsidiaries, including, but not

limited to, their methods of operation and developing customer base, its manner of cultivating customer relations, its practices and preferences,

current and future market strategies, formulas, patterns, patents, devices, secret inventions, processes, compilations of information,

records, and customer lists, all of which are regularly used in the operation of their business and which Executive acknowledges have

been acquired, learned and developed by them only through the expenditure of substantial sums of money, time and effort, which are not

readily ascertainable, and which are discoverable only with substantial effort, and which thus are the confidential and the exclusive

Property of the Company and its subsidiaries (hereinafter “Trade Secrets”). Executive covenants and agrees to use her best

efforts and utmost diligence to protect those Trade Secrets from disclosure to third parties. Executive further acknowledges that, absent

the protections afforded the Company and its subsidiaries in Section 7, Executive would not be entrusted with any of such Trade Secrets.

Accordingly, Executive agrees and covenants (which agreement and covenant shall survive the termination of this Agreement regardless of

the reason) as follows:

7.1.1 Executive will at no

time take any action or make any statement that will disparage or discredit the Company, any of its subsidiaries or their products or

services;

7.1.2 During the period of

Executive’s employment with the Company and for sixty (60) months immediately following the termination of such employment, Executive

will not disclose or reveal to any person, firm or corporation other than in connection with the business of the Company and its subsidiaries

or as may be required by law, any Trade Secret used or useable by the Company or any of its subsidiaries, divisions or Affiliates (collectively

the “Companies”) in connection with their respective businesses, known to Executive as a result of her employment by

the Company, or other relationship with the Companies, and which is not otherwise publicly available. Executive further agrees that during

the term of this Agreement and at all times thereafter, she will keep confidential and not disclose or reveal to any person, firm or corporation

other than in connection with the business of the Companies or as may be required by applicable law, any information received by she during

the course of her employment with regard to the financial, business, or other affairs of the Companies, their respective officers, directors,

customers or suppliers which is not publicly available;

7.1.3 Upon the termination

of Executive’s employment with the Company, Executive will return to the Company all documents, customer lists, customer information,

product samples, presentation materials, drawing specifications, equipment and other materials relating to the business of any of the

Companies, which Executive hereby acknowledges are the sole and exclusive property of the Companies or any one of them. Nothing in this

Agreement shall prohibit Executive from retaining, at all times any document relating to her personal entitlements and obligations, her

rolodex, her personal correspondence files; and any additional personal property;

7.1.4 During the term of the

Agreement and, for a period of three (3) months immediately following the termination of the Executive’s employment with the Company,

Executive will not: compete, or participate as a shareholder, director, officer, partner (limited or general), trustee, holder of a beneficial

interest, employee, agent of or representative in any business competing directly with the Companies without the prior written consent

of the Company, which may be withheld in the Company’s sole discretion; provided, however, that nothing contained herein shall be

construed to limit or prevent the purchase or beneficial ownership by Executive of less than five percent of any security registered under

Section 12 or 15 of the Securities Exchange Act of 1934;

7.1.5 During the term of the Agreement and, for

a period of eighteen (18) months immediately following the termination of the Executive’s employment with the Company, Executive

will not:

7.1.5.1 solicit or accept

competing business from any customer of any of the Companies or any person or entity known by Executive to be or have been, during the

preceding 18 months, a customer or Prospective Customer of any of the Companies without the prior written consent of the Company;

7.1.5.2 encourage, request

or advise any such customer or Prospective Customer of any of the Companies to withdraw or cancel any of their business from or with any

of the Companies; or

7.1.6 Executive will not during the period of her

employment with the Company and, subject to the provisions hereof for a period of eighteen (18) months immediately following the termination

of Executive’s employment with the Company,

7.1.6.1 conspire with any

person employed by any of the Companies with respect to any of the matters covered by this Section 7;

7.1.6.2 encourage, induce

or solicit any person employed by any of the Companies to facilitate Executive’s violation of the covenants contained in this Section

7;

7.1.6.3 assist any entity

to solicit the employment of any employee of any of the Companies; or

7.1.6.4 employ or hire any

employee of any of the Companies, or solicit or induce any such person to join the Executive as a partner, investor, coventurer, or otherwise

encourage or induce them to terminate their employment with any of the Companies.

7.2 Executive expressly acknowledges

that all of the provisions of this Section 7 of this Agreement have been bargained for and Executive’s agreement hereto is an integral

part of the consideration to be rendered by the Executive which justifies the rate and extent of the compensation provided for hereunder.

7.3 Executive acknowledges and

agrees that a violation of any one of the covenants contained in this Section 7 shall cause irreparable injury to the Company, that the

remedy at law for such a violation would be inadequate and that the Company shall thus be entitled to temporary injunctive relief to enforce

that covenant until such time that a court of competent jurisdiction either (a) grants or denies permanent injunctive relief or (b) awards

other equitable remedy(s) as it sees fit.

7.4 Successors.

7.4.1 Executive.

This Agreement is personal to Executive and, without the prior express written consent of the Company, shall not be assignable by Executive,

except that Executive’s rights to receive any compensation or benefits under this Agreement may be transferred or disposed of pursuant

to testamentary disposition, intestate succession or a qualified domestic relations order or in connection with a Disability. This Agreement

shall inure to the benefit of and be enforceable by Executive’s estate, heirs, beneficiaries, and/or legal representatives.

7.4.2 The Company.

This Agreement shall inure to the benefit of and be binding upon the Company and its successors and assigns.

7.5 Inventions and Patents.

The Company shall be entitled to the sole benefit and exclusive ownership of any inventions or improvements in products, processes, or

other things that may be made or discovered by Executive while he is in the service of the Company, and all patents for the same. During

the Term, Executive shall do all acts necessary or required by the Company to give effect to this section and, following the Term, Executive

shall do all acts reasonably necessary or required by the Company to give effect to this section. In all cases, the Company shall pay

all costs and fees associated with such acts by Executive.

8.1 Indemnification.

The Company and each of its subsidiaries shall, to the maximum extent provided under applicable law, indemnify and hold Executive harmless

from and against any expenses, including reasonable attorney’s fees, judgments, fines, settlements and other legally permissible

amounts (“Losses”), incurred in connection with any proceeding arising out of, or related to, Executive’s employment

by the Company, other than any such Losses incurred as a result of Executive’s negligence or willful misconduct. The Company shall,

or shall cause a subsidiary thereof to, advance to Executive any expenses, including attorney’s fees and costs of settlement, incurred

in defending any such proceeding to the maximum extent permitted by applicable law. Such costs and expenses incurred by Executive in defense

of any such proceeding shall be paid by the Company or applicable subsidiary in advance of the final disposition of such proceeding promptly

upon receipt by the Company of (a) written request for payment; (b) appropriate documentation evidencing the incurrence, amount and nature

of the costs and expenses for which payment is being sought; and (c) an undertaking adequate under applicable law made by or on behalf

of Executive to repay the amounts so advanced if it shall ultimately be determined pursuant to any non-appealable judgment or settlement

that Executive is not entitled to be indemnified by the Company or any subsidiary thereof. the Company will provide Executive with coverage

under all director’s and officer’s liability insurance policies which is has in effect during the Term, with no deductible

to Executive.

8.2 Applicable Law.

Except as may be otherwise provided herein, this Agreement shall be governed by and construed in accordance with the laws of the State

of New York, applied without reference to principles of conflict of laws.

8.3 Amendments.

This Agreement may not be amended or modified otherwise than by a written agreement executed by the parties hereto or their respective

successors or legal representatives.

8.4 Notices. All

notices and other communications hereunder shall be in writing and shall be given by hand-delivery to the other party or by registered

or certified mail, return receipt requested, postage prepaid, addressed as follows:

If to the Executive:

Zhibiao Pan

3rd Floor, Borough A, Block A. No.181

South Taibai Road, Xi’an, Shaanxi Province,

People’s Republic of China 710065

If to the Company:

3rd Floor, Borough A, Block A. No.181

South Taibai Road, Xi’an, Shaanxi Province,

People’s Republic of China 710065

Attn: Mr. Zhuoyu Li, Chief Executive Officer

Tel: (86-29) 8826-6368

Or to such other address as either party shall

have furnished to the other in writing in accordance herewith. Notices and communications shall be effective when actually received by

the addressee.

8.5 Withholding.

The Company may withhold from any amounts payable under the Agreement, such federal, state and local income, unemployment, social security

and similar employment related taxes and similar employment related withholdings as shall be required to be withheld pursuant to any applicable

law or regulation.

8.6 Severability.

The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision

of this Agreement, and any such provision which is not valid or enforceable in whole shall be enforced to the maximum extent permitted

by law.

8.7 Captions. The

captions of this Agreement are not part of the provisions and shall have no force or effect.

8.8 Entire Agreement.

This Agreement contains the entire agreement among the parties concerning the subject matter hereof and supersedes all prior agreements,

understandings, discussions, negotiations and undertakings, whether written or oral, between the parties with respect thereto.

8.9 Survivorship.

The respective rights and obligations of the parties hereunder shall survive any termination of this Agreement or the Executive’s

employment hereunder to the extent necessary to the intended preservation of such rights and obligations.

8.10 Waiver. Either

Party’s failure to enforce any provision or provisions of this Agreement shall not in any way be construed as a waiver of any such

provision or provisions, or prevent that party thereafter from enforcing each and every other provision of this Agreement.

8.11 Joint Efforts/Counterparts.

Preparation of this Agreement shall be deemed to be the joint effort of the parties hereto and shall not be construed more severely against

any party. This Agreement may be signed in two or more counterparts, each of which shall be deemed an original and all of which together

shall constitute one and the same instrument.

8.12 Representation

by Counsel. Each Party hereby represents that it has had the opportunity to be represented by legal counsel of its choice in connection

with the negotiation and execution of this Agreement.

-- Signature page follows --

IN WITNESS WHEREOF, the parties have executed this Agreement as of

the day and year first above written.

|

Executive:

|

|

CHINA GREEN AGRICULTURE, INC. |

| |

|

| /s/

Cui Song |

|

/s/ Zhuoyu Li |

| Cui Song |

|

Zhuoyu Li |

| |

|

Chairman of the Board of Directors,

Chief Executive Officer, and President |

8

v3.23.4

Cover

|

Dec. 28, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 28, 2023

|

| Entity File Number |

001-34260

|

| Entity Registrant Name |

CHINA GREEN AGRICULTURE, INC.

|

| Entity Central Index Key |

0000857949

|

| Entity Tax Identification Number |

36-3526027

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

3rd Floor

|

| Entity Address, Address Line Two |

Borough A, Block A

|

| Entity Address, Address Line Three |

No.181 South Taibai Road

|

| Entity Address, City or Town |

Xi’an

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

710065

|

| City Area Code |

+86

|

| Local Phone Number |

29-88266368

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CGA

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

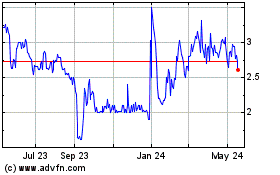

China Green Agriculture (NYSE:CGA)

Historical Stock Chart

From Nov 2024 to Dec 2024

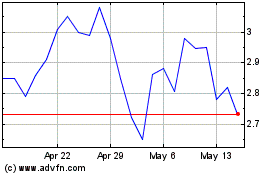

China Green Agriculture (NYSE:CGA)

Historical Stock Chart

From Dec 2023 to Dec 2024