| |

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement

No. 333-272447

(To Prospectus dated September 5, 2023,

Prospectus Supplement dated September 5, 2023 and

Product Supplement

EQUITY SUN-1 dated September 27, 2023) |

767,703

Units

$10 principal amount per

unit

CUSIP No. 13608R554

|

Pricing

Date

Settlement Date

Maturity Date |

December 19,

2024

December 30,

2024

January 2,

2026 |

|

| |

|

|

|

Market-Linked

One Look Notes Linked to the VanEck®

Gold Miners ETF

§ Maturity

of approximately 1 year

§ If

the Underlying Fund is greater than or equal to the Starting Value, a return of 30.00%

§ 1-to-1

downside exposure to decreases in the Underlying Fund, with up to 100.00% of your principal at risk

§ All

payments occur at maturity and are subject to the credit risk of Canadian Imperial Bank of Commerce

§ No

periodic interest payments

§ In

addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.05 per unit. See “Structuring

the Notes”

§ Limited

secondary market liquidity, with no exchange listing

§ The

notes are unsecured debt securities and are not savings accounts or insured deposits of a bank. The notes are not insured or guaranteed

by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other governmental agency of the

United States, Canada, or any other jurisdiction |

| |

| |

|

|

|

|

|

The notes are being issued by Canadian Imperial Bank of Commerce

(“CIBC”). There are important differences between the notes and a conventional debt security, including different investment

risks and certain additional costs. See “Risk Factors” and “Additional Risk Factors” beginning on page TS-6

of this term sheet and “Risk Factors” beginning on page PS-7 of product supplement EQUITY SUN-1.

The initial estimated value of the notes as of the pricing date is

$9.961 per unit, which is less than the public offering price listed below. See “Summary” on the following page, “Risk

Factors” beginning on page TS-6 of this term sheet and “Structuring the Notes” on page TS-12 of this term

sheet for additional information. The actual value of your notes at any time will reflect many factors and cannot be predicted with accuracy.

None of the Securities and Exchange Commission (the “SEC”),

any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note

Prospectus (as defined below) is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per

Unit |

Total |

| Public

offering price |

$ 10.00 |

$7,677,030.00 |

| Underwriting

discount |

$ 0.15 |

$ 115,155.45 |

| Proceeds,

before expenses, to CIBC |

$ 9.85 |

$7,561,874.55 |

The notes:

| Are

Not FDIC Insured |

Are

Not Bank Guaranteed |

May Lose

Value |

BofA Securities

December 19, 2024

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

Summary

The Market-Linked One Look Notes Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 (the “notes”) are our senior unsecured debt securities. The notes are not guaranteed

or insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other governmental agency

of the United States, Canada or any other jurisdiction or secured by collateral. The notes are not bail-inable debt securities (as defined

on page 6 of the prospectus). The notes will rank equally with all of our other unsecured and unsubordinated debt. Any payments

due on the notes, including any repayment of principal, will be subject to the credit risk of CIBC. The notes provide you with a

Step Up Payment if the Ending Value of the Market Measure, which is the VanEck® Gold Miners ETF (the “Underlying

Fund”), is equal to or greater than the Starting Value. If the Ending Value is less than the Starting Value, you will lose all

or a portion of the principal amount of your notes. Any payments on the notes will be calculated based on the $10 principal amount per

unit and will depend on the performance of the Market Measure, subject to our credit risk. See “Terms of the Notes” below.

The economic terms of the notes (including the Step Up Payment) are

based on our internal funding rate, which is the rate we would pay to borrow funds through the issuance of market-linked notes, and the

economic terms of certain related hedging arrangements. Our internal funding rate is typically lower than the rate we would pay when

we issue conventional fixed rate debt securities. This difference in funding rate, as well as the underwriting discount and the hedging-related

charge and certain service fee described below, reduced the economic terms of the notes to you and the initial estimated value of the

notes on the pricing date. Due to these factors, the public offering price you pay to purchase the notes is greater than the initial

estimated value of the notes.

On the cover page of this term sheet, we have provided the initial

estimated value for the notes. This initial estimated value was determined based on our pricing models, and was based on our internal

funding rate on the pricing date, market conditions and other relevant factors existing at that time, and our assumptions about market

parameters. For more information about the initial estimated value and the structuring of the notes, see “Structuring the Notes”

on page TS-12.

| Terms

of the Notes |

|

Redemption

Amount Determination |

| Issuer: |

Canadian

Imperial Bank of Commerce (“CIBC”) |

|

Notwithstanding anything

to the contrary in the accompanying product supplement, the Redemption Amount will be determined as set forth in this term sheet. On

the maturity date, you will receive a cash payment per unit determined as follows:

|

| Principal

Amount: |

$10.00

per unit |

|

|

| Term: |

Approximately

1 year |

|

| Market

Measure: |

The VanEck®

Gold Miners ETF (Bloomberg symbol “GDX”) |

|

| Starting

Value: |

34.39 |

|

| Ending

Value: |

The

Closing Market Price of the Underlying Fund on the calculation day times the Price Multiplier on that day. The scheduled calculation

day is subject to postponement in the event of Market Disruption Events, as described beginning on page PS-25 of product supplement

EQUITY SUN-1. |

|

| Step

Up Payment: |

$3.00

per unit, which represents a return of 30.00% over the principal amount. |

|

| Threshold

Value: |

34.39

(100.00% of the Starting Value) |

|

| Calculation

Day: |

December 26,

2025 |

|

| Price

Multiplier: |

1,

subject to adjustment for certain corporate events relating to the Underlying Fund, as described beginning on page PS-28 of

product supplement EQUITY SUN-1. |

|

| Fees

and Charges: |

The

underwriting discount of $0.15 per unit listed on the cover page and the hedging-related charge of $0.05 per unit described

in “Structuring the Notes” on page TS-12. |

|

| Calculation

Agent: |

BofA

Securities, Inc. (“BofAS”). |

|

| Market-Linked One Look Notes | TS-2 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

The terms and risks of the notes are contained in this term sheet and

in the following:

These documents (together, the “Note Prospectus”) have been

filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website as indicated above or

obtained from Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) or BofAS by calling 1-800-294-1322.

Before you invest, you should read the Note Prospectus, including this term sheet, for information about us and this offering. Any prior

or contemporaneous oral statements and any other written materials you may have received are superseded by the Note Prospectus. Capitalized

terms used but not defined in this term sheet have the meanings set forth in product supplement EQUITY SUN-1. Unless otherwise indicated

or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or

similar references are to CIBC.

To the extent the determination of the Redemption Amount and other terms

described in this term sheet are inconsistent with those described in the accompanying product supplement, prospectus supplement or prospectus,

the determination of the Redemption Amount and other terms described in this term sheet shall control.

Investor Considerations

| You

may wish to consider an investment in the notes if: |

|

The

notes may not be an appropriate investment for you if: |

| |

|

|

§ You

anticipate that the Ending Value will not be less than the Starting Value.

§ You

accept that the return on the notes will be limited to the return represented by the Step Up Payment.

§ You

are willing to risk a loss of principal if the Underlying Fund decreases from the Starting Value to the Ending Value.

§ You

are willing to forgo the interest payments that are paid on conventional interest bearing debt securities.

§ You

are willing to forgo dividends or other rights and benefits of owning shares of the Underlying Fund or the securities held by the

Underlying Fund.

§ You

are willing to accept a limited or no market for sales prior to maturity, and understand that the market prices for the notes, if

any, will be affected by various factors, including our actual and perceived creditworthiness, our internal funding rate and fees

and charges on the notes.

§ You

are willing to assume our credit risk, as issuer of the notes, for all payments under the notes, including the Redemption Amount. |

|

§ You

believe that the Underlying Fund will decrease from the Starting Value to the Ending Value or that it will increase by more than

the return represented by the Step Up Payment.

§ You

seek an uncapped return on your investment.

§ You

seek principal repayment or preservation of capital.

§ You

seek interest payments or other current income on your investment.

§ You

want to receive dividends or other distributions paid on shares of the Underlying Fund or the securities held by the Underlying Fund.

§ You

seek an investment for which there will be a liquid secondary market.

§ You

are unwilling or are unable to take market risk on the notes or to take our credit risk as issuer of the notes. |

We urge you to consult your investment, legal, tax, accounting, and

other advisors before you invest in the notes.

| Market-Linked One Look Notes | TS-3 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

Hypothetical Payout Profile and Examples of Payments

at Maturity

Market-Linked

One Look Notes

|

This graph reflects the returns on the

notes, based on the Threshold Value of 100.00% of the Starting Value and the Step Up Payment of $3.00 per unit. The green line reflects

the returns on the notes, while the dotted gray line reflects the returns of a direct investment in the Underlying Fund, excluding

dividends.

This graph has been prepared for purposes

of illustration only. |

The following table and examples are for purposes of illustration only.

They are based on hypothetical values and show hypothetical returns on the notes. They illustrate the calculation of the

Redemption Amount and total rate of return based on a hypothetical Starting Value of 100.00, a hypothetical Threshold Value of 100.00,

the Step Up Payment of $3.00 per unit and a range of hypothetical Ending Values. The actual amount you receive and the resulting total

rate of return will depend on the actual Starting Value, Threshold Value and Ending Value, and whether you hold the notes to maturity.

The following examples do not take into account any tax consequences from investing in the notes.

For recent actual prices of the Underlying Fund, see “The Underlying

Fund” section below. In addition, all payments on the notes are subject to issuer credit risk.

Ending

Value |

|

Percentage

Change from the

Starting Value to the Ending Value |

|

Redemption

Amount

per Unit |

|

Total Rate

of Return on the

Notes |

| 0.00 |

|

-100.00% |

|

$0.00 |

|

-100.00% |

| 50.00 |

|

-50.00% |

|

$5.00 |

|

-50.00% |

| 80.00 |

|

-20.00% |

|

$8.00 |

|

-20.00% |

| 85.00 |

|

-15.00% |

|

$8.50 |

|

-15.00% |

| 90.00 |

|

-10.00% |

|

$9.00 |

|

-10.00% |

| 95.00 |

|

-5.00% |

|

$9.50 |

|

-5.00% |

| 100.00(1)(2) |

|

0.00% |

|

$13.00(3) |

|

30.00% |

| 105.00 |

|

5.00% |

|

$13.00 |

|

30.00% |

| 110.00 |

|

10.00% |

|

$13.00 |

|

30.00% |

| 115.00 |

|

15.00% |

|

$13.00 |

|

30.00% |

| 130.00 |

|

30.00% |

|

$13.00 |

|

30.00% |

| 160.00 |

|

60.00% |

|

$13.00 |

|

30.00% |

| 200.00 |

|

100.00% |

|

$13.00 |

|

30.00% |

| (1) | This is the hypothetical Threshold Value. |

| (2) | The hypothetical Starting Value of 100.00 used in these examples

has been chosen for illustrative purposes only. The actual Starting Value is 34.39, which

was the Closing Market Price of the Underlying Fund on the pricing date. |

| (3) | This amount represents the sum of the principal amount and the Step Up

Payment of $3.00. |

| Market-Linked One Look Notes | TS-4 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

Redemption Amount Calculation Examples

In this example, even though the Ending Value is significantly greater

than the Starting Value, your return on the notes will be limited to the return represented by the Step Up Payment.

| Market-Linked One Look Notes | TS-5 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

Risk Factors

There are important differences between the notes and a conventional

debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more

detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page PS-7 of product

supplement EQUITY SUN-1, page S-1 of the prospectus supplement, and page 1 of the prospectus identified above. We also urge

you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

Structure-related Risks

| § | Depending

on the performance of the Underlying Fund as measured shortly before the maturity date, you

may lose up to 100% of the principal amount. |

| § | Your

investment return is limited to the return represented by the Step Up Payment and may be

less than a comparable investment directly in the Underlying Fund or the securities held

by the Underlying Fund. |

| § | Your

return on the notes may be less than the yield you could earn by owning a conventional fixed

or floating rate debt security of comparable maturity. |

| § | Payments

on the notes are subject to our credit risk, and actual or perceived changes in our creditworthiness

are expected to affect the value of the notes. If we become insolvent or are unable to pay

our obligations, you may lose your entire investment. |

Valuation- and Market-related

Risks

| § | Our

initial estimated value of the notes is lower than the public offering price of the notes.

The public offering price of the notes exceeds our initial estimated value because costs

associated with selling and structuring the notes, as well as hedging the notes, all as further

described in “Structuring the Notes” on page TS-12, are included in the

public offering price of the notes. |

| § | Our

initial estimated value does not represent future values of the notes and may differ from

others’ estimates. Our initial estimated value is only an estimate, which was determined

by reference to our internal pricing models when the terms of the notes were set. This estimated

value was based on market conditions and other relevant factors existing at that time, our

internal funding rate on the pricing date and our assumptions about market parameters, which

can include volatility, dividend rates, interest rates and other factors. Different pricing

models and assumptions could provide valuations for the notes that are greater or less than

our initial estimated value. In addition, market conditions and other relevant factors in

the future may change, and any assumptions may prove to be incorrect. On future dates, the

market value of the notes could change significantly based on, among other things, changes

in market conditions, including the price of the Underlying Fund, our creditworthiness, interest

rate movements and other relevant factors, which may impact the price at which MLPF&S,

BofAS or any other party would be willing to buy notes from you in any secondary market transactions.

Our estimated value does not represent a minimum price at which MLPF&S, BofAS or any

other party would be willing to buy your notes in any secondary market (if any exists) at

any time. |

| § | Our

initial estimated value of the notes was not determined by reference to credit spreads for

our conventional fixed-rate debt. The internal funding rate that was used in the determination

of our initial estimated value of the notes generally represents a discount from the credit

spreads for our conventional fixed-rate debt. The discount is based on, among other things,

our view of the funding value of the notes as well as the higher issuance, operational and

ongoing liability management costs of the notes in comparison to those costs for our conventional

fixed-rate debt. If we were to have used the interest rate implied by our conventional fixed-rate

debt, we would expect the economic terms of the notes to be more favorable to you. Consequently,

our use of an internal funding rate for market-linked notes had an adverse effect on the

economic terms of the notes and the initial estimated value of the notes on the pricing date,

and could have an adverse effect on any secondary market prices of the notes. |

| § | A

trading market is not expected to develop for the notes. None of us, MLPF&S or BofAS

is obligated to make a market for, or to repurchase, the notes. There is no assurance that

any party will be willing to purchase your notes at any price in any secondary market. |

Conflict-related Risks

| § | Our

business, hedging and trading activities, and those of MLPF&S, BofAS and our respective

affiliates (including trades in shares of the Underlying Fund or the securities held by the

Underlying Fund), and any hedging and trading activities we, MLPF&S, BofAS or our respective

affiliates engage in for our clients’ accounts, may affect the market value and return

of the notes and may create conflicts of interest with you. |

| § | There

may be potential conflicts of interest involving the calculation agent, which is BofAS. We

have the right to appoint and remove the calculation agent. |

Market Measure-related Risks

| § | The

Underlying Fund holds the stocks of foreign companies. Therefore, your return on the notes

may be affected by factors affecting the international securities markets, including emerging

markets. In addition, exchange rate movements may adversely impact the value of notes. |

| Market-Linked One Look Notes | TS-6 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

| § | The

sponsor or the investment advisor of the Underlying Fund may adjust the Underlying Fund in

a way that could adversely affect the price of the Underlying Fund and consequently, the

return on the notes, and has no obligation to consider your interests. |

| § | The

publisher of the NYSE® Arca Gold Miners Index® (the “Underlying

Index”) may adjust the Underlying Index in a way that affects its level, and has no

obligation to consider your interests. |

| § | As

a noteholder, you will have no rights to receive shares of the Underlying Fund or the securities

held by the Underlying Fund, and you will not be entitled to receive securities, dividends

or other distributions on those securities. |

| § | While

we, MLPF&S, BofAS or our respective affiliates may from time to time own securities held

by the Underlying Fund, we, MLPF&S, BofAS and our respective affiliates do not control

any company included in the Underlying Fund, and have not verified any disclosure made by

any other company. |

| § | There

are liquidity and management risks associated with the Underlying Fund. |

| § | Risks

associated with the Underlying Index or the securities held by the Underlying Fund will affect

the price of the Underlying Fund and hence, the value of the notes. |

| § | The

performance of the Underlying Fund may not correlate with the performance of the Underlying

Index as well as the net asset value per share of the Underlying Fund, especially during

periods of market volatility when the liquidity and the market price of shares of the Underlying

Fund and/or securities held by the Underlying Fund may be adversely affected, sometimes materially. |

| § | The

payments on the notes will not be adjusted for all corporate events that could affect the

Underlying Fund. See “Description of the Notes—Anti-Dilution and Discontinuance

Adjustments Relating to Underlying Funds” beginning on page PS-28 of product supplement

EQUITY SUN-1. |

Tax-related Risks

| § | The

U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a

holder of the notes. See “Summary of U.S. Federal Income Tax Consequences” below

and “U.S. Federal Income Tax Summary” beginning on page PS-41 of product

supplement EQUITY SUN-1. For a discussion of the Canadian federal income tax consequences

of investing in the notes, see “Material Income Tax Consequences—Canadian Taxation”

in the prospectus as supplemented by the discussion under “Summary of Canadian Federal

Income Tax Considerations” herein. |

Additional Risk Factors

A limited number of securities may affect the price of the Underlying

Fund, and the Underlying Index is not necessarily representative of the gold and silver mining industry.

The number of securities held by the Underlying Fund is limited. In

addition, a few top securities held by the Underlying Fund may constitute a substantial portion of its net assets. Any reduction in the

market price of those securities is likely to have a substantial adverse impact on the price of the Underlying Fund and the value of

the notes.

While the securities included in the Underlying Index are common stocks,

American Depositary Receipts (“ADRs”) or global depositary receipts (“GDRs”) of companies generally considered

to be involved in various segments of the gold and silver mining industry, the securities included in the Underlying Index may not follow

the price movements of the entire gold and silver mining industry generally. If the securities included in the Underlying Index (and,

accordingly, the securities held by the Underlying Fund) decline in value, the Underlying Fund will decline in value even if security

prices in the gold and silver mining industry generally increase in value.

The notes will be subject to small-capitalization or mid-capitalization

companies risk.

The Underlying Fund may invest in companies that may be considered small-capitalization

or mid-capitalization companies. These companies often have greater stock price volatility, lower trading volume and less liquidity than

large-capitalization companies and therefore the Underlying Fund’s share price may be more volatile than an investment in stocks

issued by large-capitalization companies. Stock prices of small-capitalization or mid-capitalization companies are also more vulnerable

than those of large-capitalization companies to adverse business and economic developments, and the stocks of small-capitalization or

mid-capitalization companies may be thinly traded, making it difficult for the Underlying Fund to buy and sell them. In addition, small-capitalization

or mid-capitalization companies are typically less stable financially than large-capitalization companies and may depend on a small number

of key personnel, making them more vulnerable to loss of personnel. Small-capitalization or mid-capitalization companies are often subject

to less analyst coverage and may be in early, and less predictable, periods of their corporate existences. Such companies tend to have

smaller revenues, less diverse product lines, smaller shares of their product or service markets, fewer financial resources and less

competitive strengths than large-capitalization companies and are more susceptible to adverse developments related to their products.

These factors could adversely affect the price of the Underlying Fund during the term of the notes, which may adversely affect the value

of your notes.

| Market-Linked One Look Notes | TS-7 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

NYSE Arca, Inc. (“NYSE Arca”), the sponsor and compiler

of the Underlying Index, retains significant control and discretionary decision-making over the Underlying Index and is responsible

for decisions regarding the interpretation of and amendments to the rules of the Underlying Index, which may have an adverse effect

on the price of the Underlying Fund, the market value of the notes and the amount payable on the notes.

NYSE Arca is the compiler of the Underlying Index and, as such, is responsible

for the day-to-day management of the Underlying Index and for decisions regarding the interpretation of the rules governing the

Underlying Index. NYSE Arca has the discretion to make operational adjustments to the Underlying Index and to the components of the Underlying

Index, including discretion to exclude companies that otherwise meet the minimum criteria for inclusion in the Underlying Index. In addition,

NYSE Arca retains the power to supplement, amend in whole or in part, revise or withdraw the rules of the Underlying Index at any

time, any of which may lead to changes in the way the Underlying Index is compiled or calculated or adversely affect the Underlying Index

in another way. Any of these adjustments to the Underlying Index or the rules or the Underlying Index may adversely affect the composition

of the Underlying Index, the price of the Underlying Fund, the market value of the notes and the amount payable on the notes. The index

sponsor of the Underlying Index has no obligation to take the needs of any buyer, seller or holder of the notes into consideration at

any time.

The performance of the Underlying Fund may be adversely influenced

by gold and silver prices, which may change unpredictably and adversely affect the value of the notes in unforeseeable ways.

Most or all of the securities held by the Underlying Fund are issued

by companies in the gold and silver mining industry. Although there is no direct correlation between the price of the Underlying Fund

and gold and silver prices and the price of the Underlying Fund is not necessarily representative of gold and silver price, the prices

of the Underlying Fund may be adversely affected by gold prices and silver prices. Those prices are subject to volatile price movements

over short periods of time, represent trading in commodities markets, which are substantially different from equities markets, and are

affected by numerous factors. These include economic factors, including the structure of and confidence in the global monetary system,

expectations of the future rate of inflation, the relative strength of, and confidence in, the U.S. dollar (the currency in which the

prices of gold and silver are generally quoted), interest rates and gold and silver borrowing and lending rates, and global or regional

economic, financial, political, regulatory, judicial, or other events.

Gold prices and silver prices may also be affected by industry factors

such as industrial and jewelry demand, lending, sales and purchases of gold and silver by the official sector, including central banks

and other governmental agencies and multilateral institutions which hold gold and silver, levels of gold and silver production and production

costs, and short-term changes in supply and demand because of trading activities in the gold and silver markets. It is not possible to

predict the aggregate effects of all or any combination of these factors. Any negative developments with respect to these factors may

have an adverse effect on gold and silver prices and, as a result, on the prices of the Underlying Fund. In addition, the value of the

notes may be subject to greater volatility and be more adversely affected by a single economic, political or regulatory occurrence affecting

gold and silver prices than a different investment linked to a more broadly diversified group of commodities. All of these factors could

adversely affect the price of the Underlying Fund and, therefore, the return on the notes.

| Market-Linked One Look Notes | TS-8 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

The Underlying Fund

All disclosures contained in this term sheet regarding the Underlying

Fund and the Underlying Index, including, without limitation, their make-up, method of their calculation, and changes in their components

have been derived from publicly available sources, which we have not independently verified. The information reflects the policies of,

and is subject to change by Van Eck Associates Corporation (“VanEck”). The consequences of any discontinuance of the Underlying

Fund or the Underlying Index are discussed in the section entitled “Description of the Notes— Anti-Dilution and Discontinuance

Adjustments Relating to Underlying Funds—Discontinuance of or Material Change to an Underlying Fund” beginning on page PS-31

of product supplement EQUITY SUN-1. None of us, the calculation agent, MLPF&S or BofAS accepts any responsibility for the calculation,

maintenance or publication of the Underlying Fund, the Underlying Index or any successor fund or index.

Description of the VanEck® Gold Miners ETF

The VanEck® Gold Miners ETF is an investment portfolio

maintained and managed by VanEck® ETF Trust (the “VanEck Trust”). Van Eck Associates Corporation (“Van

Eck”) is the investment adviser to the Underlying Fund. Prior to September 1, 2021, the VanEck® Gold Miners

ETF’s name was the VanEck Vectors® Gold Miners ETF. The Underlying Fund is an exchange-traded fund that is listed

and trades on the NYSE Arca under the ticker symbol “GDX.”

Information provided to or filed with the SEC by the VanEck Trust pursuant

to the Securities Act and the Investment Company Act can be located by reference to SEC file numbers 333-123257 and 811-10325, respectively,

through the SEC’s website at http://www.sec.gov.

Investment Objective and Strategy

The Underlying Fund seeks to provide investment results that correspond

generally to the price and yield performance, before fees and expenses, of the NYSE® Arca Gold Miners Index®.

The Underlying Index, calculated by NYSE Arca, is a modified market capitalization-weighted index consisting of common stocks and ADRs

of publicly traded companies involved primarily in mining for gold and silver.

The Underlying Fund normally invests at least 80% of its total assets

in common stocks and ADRs of companies involved in the gold and silver mining industry. The Underlying Fund’s 80% investment policy

is non-fundamental and requires 60 days’ prior written notice to shareholders before it can be changed. The Underlying Fund, using

a “passive” or indexing investment approach, attempts to approximate the investment performance of the Underlying Index by

investing in a portfolio of securities that generally replicates the Underlying Index. The returns of the Underlying Fund may be affected

by certain management fees and other expenses, which are detailed in its prospectus.

The Underlying Fund may choose to concentrate its investments in a particular

industry or group of industries to the extent that the Underlying Index concentrates in an industry or group of industries.

Correlation

The Underlying Index is a theoretical financial calculation, while the

Underlying Fund is an actual investment portfolio. The performance of the Underlying Fund and the Underlying Index will vary somewhat

due to transaction costs, market impact, corporate actions (such as mergers and spin-offs) and timing variances. The Underlying Fund,

using a “passive” or indexing investment approach, attempts to approximate the investment performance of the Underlying Index

by investing in a portfolio of securities that generally replicates the Underlying Index. Unlike many investment companies that try to

“beat” the performance of a benchmark index, the Underlying Fund does not try to “beat” the Underlying Index

and does not seek temporary defensive positions that are inconsistent with its investment objective of seeking to replicate the Underlying

Index.

Description of the NYSE® Arca Gold Miners Index®

The Underlying Index was developed by the NYSE Amex (formerly the American

Stock Exchange) and is calculated, maintained and published by the NYSE Arca. The Underlying Index is reported by Bloomberg under the

ticker symbol “Underlying Index.” The index benchmark was 500.00 at the close of trading on December 20, 2002.

Objectives and Guiding Principles Underlying the Underlying Index

The Underlying Index is a modified market capitalization weighted index

comprised of publicly traded companies involved primarily in the mining of gold or silver. The Underlying Index includes common stocks,

ADRs or GDRs of selected companies that are involved in mining for gold and silver and that are listed for trading and electronically

quoted on a major stock market that is accessible by foreign investors. Generally, this includes exchanges in most developed markets

and major emerging markets, and includes companies that are cross-listed, i.e., both U.S. and Canadian listings. NYSE Arca will use its

discretion to avoid exchanges and markets that are considered “frontier” in nature or have major restrictions to foreign

ownership. The index includes companies that derive at least 50% of their revenues from gold mining and related activities (40% for companies

that are already included in the index). Also, the index will maintain an exposure to companies with a significant revenue exposure to

silver mining in addition to gold mining, which will not exceed 20% of the index weight at each rebalance. Only companies with market

capitalization greater than $750 million that have a daily average trading volume of at least 50,000 shares and an average daily value

traded of at least $1 million over the past three months are eligible for inclusion in the Underlying Index. Starting in December 2013,

for companies already included in the index, the market capitalization requirement at each rebalance will be $450 million, the average

daily volume requirement will be at least 30,000 shares over the past three months and the average daily value traded requirement will

be at least $600,000 over the past three months. NYSE Arca has the discretion to not include all companies that meet the minimum criteria

for inclusion.

| Market-Linked One Look Notes | TS-9 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

Index Calculation

The Underlying Index is calculated on a price return basis using a modified

market capitalization weighting methodology divided by a divisor. The divisor was determined on the initial capitalization base of the

index at the base level and may be adjusted as a result of corporate actions and composition changes. The index is calculated on a price

return, gross total return, net total return and short net total return basis in multiple currencies (USD, AUD, EUR, GBP, INR, JPY).

The current index level would be calculated by dividing the current modified index market capitalization by the index divisor. The divisor

was determined off of the initial capitalization base of the index and the base level. The divisor is updated as a result of corporate

actions and composition changes.

Index Maintenance

Removal of constituents. Components will be removed from the

Underlying Index during the quarterly review if either (1) the market capitalization falls below $450 million or (2) the traded

average daily shares for the previous three months is less than 30,000 shares and the average daily traded value for the previous three

months is less than $600,000.

Selected line. Only one listing is permitted per company and

the listing representing the company’s ordinary shares is generally used. If an ADR, GDR, or U.S. cross-listing is available for

a given stock and it satisfies the minimum liquidity requirements, that ADR, GDR, or U.S. cross-listing will be used instead of the locally

listed ordinary share. This logic will be followed even in the cases where the stock’s local listing has a greater liquidity than

the ADR, GDR, or U.S. cross-listing. If multiple share classes are available for a particular listing line, the shares outstanding for

each class will be added up and be attributed to the most liquid class. There is no rules-based consideration of the amount of free float

shares available for each company. Instead, the index administrator evaluates, on a discretionary basis, the amount of free float shares

available to the public while performing its review of the universe.

Periodical update of weighting. The Underlying Index is weighted

based on the market capitalization of each of the component stocks, modified to conform to the following asset diversification requirements,

which are applied in conjunction with the scheduled quarterly adjustments to the index as described above. The information utilized in

this modification process will be taken from the close of trading on the second Friday of the rebalance month:

1. The weight of any single component stock may

not account for more than 20% of the total value of the Underlying Index;

2. The components stocks are split into two subgroups –

(1) Large and (2) Small, ranked by their unadjusted market capitalization weight in the index. Large stocks are defined as

having a starting index weight greater than or equal to 5%. Small stocks are defined as having a starting index weight below 5%;

3. The final aggregate weight of those component stocks which

individually represent more than 4.5% of the total value of the Underlying Index may not account for more than 45% of the total Underlying

Index value.

Diversification Rule 1: If any component stock exceeds 20%

of the total value of the Underlying Index, then all stocks greater than 20% of the Underlying Index are reduced to represent 20% of

the value of the Underlying Index. The aggregate amount by which all component stocks are reduced is redistributed proportionately across

the remaining stocks that represent less than 20% of the index value. After this redistribution, if any other stock then exceeds 20%,

the stock is set to 20% of the index value and the redistribution is repeated.

If there is no component stock over 20% of the total value of the Underlying

Index to start, then Diversification Rule 1 is not executed.

Diversification Rule 2: The components are sorted into two

groups – (1) Large components, with a starting index weight of 5% or greater, and (2) Small components, with a weight

of under 5% (after any adjustments for Diversification Rule 1).

If there are no components that classify as Large components after Diversification

Rule 1 is run, then Diversification Rule 2 is not executed. Alternatively, if the starting aggregate weight of the Large components

after Diversification Rule 1 is run is not greater than 45% of the starting index weight, then Diversification Rule 2 is not

executed.

If Diversification Rule 2 is indeed executed, then the (1) large

group and (2) small group will represent 45% and 55%, respectively, of the final index weight. This will be adjusted for through

the following process:

1.The weight of each of the large stocks will be scaled down

proportionately (with a floor of 5%) so that the aggregate weight of the large components will be reduced to represent 45% of the Underlying

Index. If any large component stock falls below a weight equal to the product of 5% and the proportion by which the stocks were scaled

down following this distribution, then the weight of the stock is set equal to 5% and the components with weights greater than 5% will

be reduced proportionately.

2. The weight of each of the small components will be scaled

up proportionately from the redistribution of the large components. If any small component stock exceeds a weight equal to the product

of 4.5% and the proportion by which the stocks were scaled down following this distribution, then the weight of the stock is set equal

to 4.5%. The redistribution of weight to the remaining stocks is repeated until the entire amount has been redistributed.

Corporate Actions. The Underlying Index may be adjusted in order

to maintain the continuity of the index level and the composition. The underlying aim is that the index continues to reflect as closely

as possible the index’s objective of identifying and selecting stocks from a particular market segment that have a greater potential

for capital appreciation. Adjustments take place in reaction to events that occur with constituents in order to mitigate or eliminate

the effect of that event on the index performance.

| Market-Linked One Look Notes | TS-10 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

The following graph shows the daily historical performance of

the Underlying Fund on its primary exchange in the period from January 1, 2014 through December 19, 2024. We obtained this

historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from

Bloomberg L.P. On the pricing date, the Closing Market Price of the Underlying Fund was $34.39. The graph below may have been adjusted

to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of the Underlying Fund

This historical data on the Underlying Fund is not necessarily

indicative of its future performance or what the value of the notes may be. Any historical upward or downward trend in the price of the

Underlying Fund during any period set forth above is not an indication that the price of the Underlying Fund is more or less likely to

increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available

sources for the prices and trading pattern of the Underlying Fund.

| Market-Linked One Look Notes | TS-11 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

Supplement to the Plan of Distribution

Under our distribution agreement with BofAS, BofAS will purchase the

notes from us as principal at the public offering price indicated on the cover of this term sheet, less the indicated underwriting discount.

MLPF&S will in turn purchase the notes from BofAS for resale, and it will receive a selling concession in connection with the sale

of the notes in an amount up to the full amount of the underwriting discount set forth on the cover of this term sheet.

We will pay a fee to a broker dealer in which an affiliate of BofAS

has an ownership interest for providing certain services with respect to this offering, which will reduce the economic terms of the notes

to you.

We will deliver the notes against payment therefor in New York, New

York on a date that is greater than one business day following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act

of 1934, trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade expressly

agree otherwise. Accordingly, purchasers who wish to trade the notes more than one business day prior to the original issue date will

be required to specify alternative settlement arrangements to prevent a failed settlement.

The notes will not be listed on any securities exchange. In the original

offering of the notes, the notes will be sold in minimum investment amounts of 100 units. If you place an order to purchase the notes,

you are consenting to MLPF&S and/or one of its affiliates acting as a principal in effecting the transaction for your account.

MLPF&S and BofAS may repurchase and resell the notes, with repurchases

and resales being made at prices related to then-prevailing market prices or at negotiated prices, and these prices will include MLPF&S’s

and BofAS’s trading commissions and mark-ups or mark-downs. MLPF&S and BofAS may act as principal or agent in these market-making

transactions; however, neither is obligated to engage in any such transactions. At their discretion, for a short, undetermined initial

period after the issuance of the notes, MLPF&S and BofAS may offer to buy the notes in the secondary market at a price that may exceed

the initial estimated value of the notes. Any price offered by MLPF&S or BofAS for the notes will be based on then-prevailing market

conditions and other considerations, including the performance of the Market Measure and the remaining term of the notes. However, none

of us, MLPF&S, BofAS or any of our respective affiliates is obligated to purchase your notes at any price or at any time, and we

cannot assure you that we, MLPF&S, BofAS or any of our respective affiliates will purchase your notes at a price that equals or exceeds

the initial estimated value of the notes.

The value of the notes shown on your account statement will be based

on BofAS’s estimate of the value of the notes if BofAS or another of its affiliates were to make a market in the notes, which it

is not obligated to do. That estimate will be based upon the price that BofAS may pay for the notes in light of then-prevailing market

conditions, and other considerations, as mentioned above, and will include transaction costs. At certain times, this price may be higher

than or lower than the initial estimated value of the notes.

The distribution of the Note Prospectus in connection with these offers

or sales will be solely for the purpose of providing investors with the description of the terms of the notes that was made available

to investors in connection with their initial offering. Secondary market investors should not, and will not be authorized to, rely on

the Note Prospectus for information regarding CIBC or for any purpose other than that described in the immediately preceding sentence.

Structuring the Notes

The notes are our debt securities, the return on which is linked to

the performance of the Market Measure. As is the case for all of our debt securities, including our market-linked notes, the economic

terms of the notes reflect our actual or perceived creditworthiness at the time of pricing. The internal funding rate we use in pricing

the market-linked notes is typically lower than the rate we would pay when we issue conventional fixed-rate debt securities of comparable

maturity. This difference is based on, among other things, our view of the funding value of the notes as well as the higher issuance,

operational and ongoing liability management costs of the notes in comparison to those costs for our conventional fixed-rate debt. This

generally relatively lower internal funding rate, which is reflected in the economic terms of the notes, along with the fees and charges

associated with market-linked notes, resulted in the initial estimated value of the notes on the pricing date being less than their public

offering price.

At maturity, we are required to pay the Redemption Amount to holders

of the notes, which will be calculated based on the performance of the Market Measure and the $10 per unit principal amount. In order

to meet these payment obligations, at the time we issue the notes, we may choose to enter into certain hedging arrangements (which may

include call options, put options or other derivatives) with BofAS or one of its affiliates. The terms of these hedging arrangements

are determined by seeking bids from market participants, including BofAS and its affiliates, and take into account a number of factors,

including our creditworthiness, interest rate movements, the volatility of the Market Measure, the tenor of the notes and the tenor of

the hedging arrangements. The economic terms of the notes and their initial estimated value depend in part on the terms of these hedging

arrangements.

BofAS has advised us that the hedging arrangements will include a hedging-related

charge of approximately $0.05 per unit, reflecting an estimated profit to be credited to BofAS from these transactions. Since hedging

entails risk and may be influenced by unpredictable market forces, additional profits and losses from these hedging arrangements may

be realized by BofAS or any third party hedge providers.

For further information, see “Risk Factors—Valuation- and

Market-related Risks” beginning on page PS-8 of product supplement EQUITY SUN-1 and “Use of Proceeds” on page S-14

of prospectus supplement.

| Market-Linked One Look Notes | TS-12 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

Summary of Canadian Federal Income Tax Considerations

In the opinion of Blake, Cassels & Graydon LLP, our Canadian

tax counsel, the following summary describes the principal Canadian federal income tax considerations under the Income Tax Act (Canada)

and the regulations thereto (the “Canadian Tax Act”) generally applicable at the date hereof to a purchaser who acquires

beneficial ownership of a note pursuant to this term sheet and who for the purposes of the Canadian Tax Act and at all relevant times:

(a) is neither resident nor deemed to be resident in Canada; (b) deals at arm’s length with CIBC and any transferee resident

(or deemed to be resident) in Canada to whom the purchaser disposes of the note; (c) does not use or hold and is not deemed to use

or hold the note in, or in the course of, carrying on a business in Canada; (d) is entitled to receive all payments (including any

interest and principal) made on the note; (e) is not a, and deals at arm’s length with any, “specified shareholder”

of CIBC for purposes of the thin capitalization rules in the Canadian Tax Act; and (f) is not an entity in respect of which

CIBC or any transferee resident (or deemed to be resident) in Canada to whom the purchaser disposes of, loans or otherwise transfers

the note is a “specified entity”, and is not a “specified entity” in respect of such a transferee, in each case,

for purposes of the Hybrid Mismatch Rules, as defined below (a “Non-Resident Holder”). Special rules which apply to

non-resident insurers carrying on business in Canada and elsewhere are not discussed in this summary.

This summary assumes that no amount paid or payable to a holder described

herein will be the deduction component of a “hybrid mismatch arrangement” under which the payment arises within the meaning

of the rules in the Canadian Tax Act with respect to “hybrid mismatch arrangements” (the “Hybrid Mismatch Rules”).

Investors should note that the Hybrid Mismatch Rules are highly complex and there remains significant uncertainty as to their interpretation

and application.

This summary is supplemental to and should be read together with the

description of material Canadian federal income tax considerations relevant to a Non-Resident Holder owning notes under “Material

Income Tax Consequences—Canadian Taxation” in the accompanying prospectus and a Non-Resident Holder should carefully read

that description as well.

This summary is of a general nature only and is not intended to be,

nor should it be construed to be, legal or tax advice to any particular Non-Resident Holder. Non-Resident Holders are advised to consult

with their own tax advisors with respect to their particular circumstances.

Based on Canadian tax counsel’s understanding of the Canada Revenue

Agency’s administrative policies, and having regard to the terms of the notes, interest payable on the notes should not be considered

to be “participating debt interest” as defined in the Canadian Tax Act and accordingly, a Non-Resident Holder should not

be subject to Canadian non-resident withholding tax in respect of amounts paid or credited or deemed to have been paid or credited by

CIBC on a note as, on account of or in lieu of payment of, or in satisfaction of, interest.

Non-Resident Holders should consult their own advisors regarding the

consequences to them of a disposition of the notes to a person with whom they are not dealing at arm’s length for purposes of the

Canadian Tax Act.

| Market-Linked One Look Notes | TS-13 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

Summary of U.S. Federal Income Tax Consequences

The following discussion is a brief summary of the material U.S. federal

income tax considerations relating to an investment in the notes. The following summary is not complete and is both qualified and supplemented

by, or in some cases supplements, the discussion entitled “U.S. Federal Income Tax Summary” in product supplement EQUITY

SUN-1, which you should carefully review prior to investing in the notes.

The U.S. federal income tax considerations of your investment in the

notes are uncertain. No statutory, judicial or administrative authority directly discusses how the notes should be treated for U.S. federal

income tax purposes. In the opinion of our tax counsel, Mayer Brown LLP, it would generally be reasonable to treat the notes as prepaid

cash-settled derivative contracts. Pursuant to the terms of the notes, you agree to treat the notes in this manner for all U.S. federal

income tax purposes. If this treatment is respected, subject to the discussion in the product supplement concerning the potential application

of the “constructive ownership” rules under Section 1260 of the Code, you should generally recognize capital gain

or loss upon the sale, exchange, redemption or payment on maturity in an amount equal to the difference between the amount you receive

at such time and the amount that you paid for your notes. Such gain or loss should generally be long-term capital gain or loss if you

have held your notes for more than one year. Non-U.S. holders should consult the section entitled “U.S. Federal Income Tax Summary—Non-U.S.

Holders” in product supplement EQUITY SUN-1.

The expected characterization of the notes is not binding on the U.S.

Internal Revenue Service (the “IRS”) or the courts. Thus, it is possible that the IRS would seek to characterize your notes

in a manner that results in tax consequences to you that are different from those described above or in the accompanying product supplement.

Such alternate treatments could include a requirement that a holder accrue ordinary income over the life of the notes or treat all gain

or loss at maturity as ordinary gain or loss. For a more detailed discussion of certain alternative characterizations with respect to

your notes and certain other considerations with respect to your investment in the notes, you should consider the discussion set forth

in “U.S. Federal Income Tax Summary” of the product supplement. We are not responsible for any adverse consequences that

you may experience as a result of any alternative characterization of the notes for U.S. federal income tax or other tax purposes.

With respect to the discussion in the product supplement regarding “dividend

equivalent” payments, the IRS has issued a notice that provides that withholding on dividend equivalent payments will not apply

to specified ELIs that are not delta-one instruments and that are issued before January 1, 2027.

You should consult your tax advisor as to the tax consequences of

such characterization and any possible alternative characterizations of the notes for U.S. federal income tax purposes. You should also

consult your tax advisor concerning the U.S. federal income tax and other tax consequences of your investment in the notes in your particular

circumstances, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax

laws.

Validity of the Notes

In the opinion of Blake, Cassels & Graydon LLP, as Canadian

counsel to CIBC, the issue and sale of the notes has been duly authorized by all necessary corporate action of CIBC in conformity with

the indenture, and when the notes have been duly executed, authenticated and issued in accordance with the indenture, the notes will

be validly issued and, to the extent validity of the notes is a matter governed by the laws of the Province of Ontario or the federal

laws of Canada applicable therein, will be valid obligations of CIBC, subject to applicable bankruptcy, insolvency and other laws of

general application affecting creditors’ rights, equitable principles, and subject to limitations as to the currency in which judgments

in Canada may be rendered, as prescribed by the Currency Act (Canada). This opinion is given as of the date hereof and is limited to

the laws of the Province of Ontario and the federal laws of Canada applicable therein. In addition, this opinion is subject to customary

assumptions about the Trustee’s authorization, execution and delivery of the indenture and the genuineness of signature, and to

such counsel’s reliance on CIBC and other sources as to certain factual matters, all as stated in the opinion letter of such counsel

dated June 6, 2023, which has been filed as Exhibit 5.2 to CIBC’s Registration Statement on Form F-3 filed with

the SEC on June 6, 2023.

In the opinion of Mayer Brown LLP, when the notes have been duly completed

in accordance with the indenture and issued and sold as contemplated by this term sheet and the accompanying product supplement, prospectus

supplement and prospectus, the notes will constitute valid and binding obligations of CIBC, entitled to the benefits of the indenture,

subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability relating

to or affecting creditors’ rights and to general equity principles. This opinion is given as of the date hereof and is limited

to the laws of the State of New York. This opinion is subject to customary assumptions about the Trustee’s authorization, execution

and delivery of the indenture and such counsel’s reliance on CIBC and other sources as to certain factual matters, all as stated

in the legal opinion dated June 6, 2023, which has been filed as Exhibit 5.1 to CIBC’s Registration Statement on Form F-3

filed with the SEC on June 6, 2023.

Where You Can Find More Information

We have filed a registration statement (including a product supplement,

a prospectus supplement and a prospectus) with the SEC for the offering to which this term sheet relates. Before you invest, you should

read the Note Prospectus, including this term sheet, and the other documents that we have filed with the SEC, for more complete information

about us and this offering. You may get these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively,

we, any agent, or any dealer

| Market-Linked One Look Notes | TS-14 |

Market-Linked

One Look Notes

Linked to the VanEck®

Gold Miners ETF, due January 2, 2026 |

|

participating in this offering will arrange to send you these documents

if you so request by calling MLPF&S or BofAS toll-free at 1-800-294-1322.

| Market-Linked One Look Notes | TS-15 |

F-3

424B2

EX-FILING FEES

333-272447

0001045520

CANADIAN IMPERIAL BANK OF COMMERCE /CAN/

0001045520

2024-12-19

2024-12-19

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

F-3

|

|

CANADIAN IMPERIAL BANK OF COMMERCE /CAN/

|

|

The maximum aggregate offering price of the securities to which the prospectus relates is $7,677,030. The prospectus is a final prospectus for the related offering.

|

|

|

v3.24.4

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_RegnFileNb |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.4

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FnlPrspctsFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NrrtvDsclsr |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NrrtvMaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

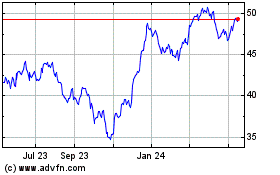

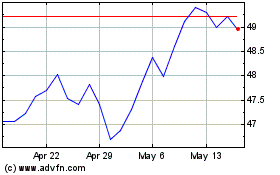

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Dec 2023 to Dec 2024