0000701347false00007013472024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

July 31, 2024

Central Pacific Financial Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Hawaii | | 001-31567 | | 99-0212597 |

(State or other

jurisdiction of

incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

220 South King Street, Honolulu, Hawaii

(Address of principal executive offices)

96813

(Zip Code)

(808) 544-0500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, No Par Value | | CPF | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On July 31, 2024, Central Pacific Financial Corp. (the "Company") issued a press release regarding its results of operations and financial condition for the quarter ended June 30, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

ITEM 7.01. REGULATION FD DISCLOSURE

On July 31, 2024, Central Pacific Financial Corp. will hold an investor conference call and webcast to discuss financial results for the quarter ended June 30, 2024, including the attached press release and other matters relating to the Company.

The Company has also made available on its website a slide presentation containing certain additional information about the Company's financial results for the quarter ended June 30, 2024 (the "Earnings Supplement"). The Earnings Supplement is furnished herewith as Exhibit 99.2 and is incorporated herein by reference. All information in Exhibit 99.2 is presented as of the particular date or dates referenced therein, and the Company does not undertake any obligation to, and disclaims any duty to, update any of the information provided except as required by law.

The Earnings Supplement contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and, as such, may involve known and unknown risks, uncertainties and assumptions. These forward-looking statements relate to the Company’s current expectations and are subject to the limitations and qualifications set forth in the attached presentation as well as in the Company’s other documents filed with the Securities and Exchange Commission, including, without limitation, that actual events and/or results may differ materially from those projected in such forward-looking statements.

The information provided in Items 2.02 and 7.01 of this Current Report, including Exhibits 99.1 and 99.2, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall the information in Exhibits 99.1 and 99.2 be deemed incorporated by reference in any filings under the Securities Act of 1933, as amended.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

| | | | | | | | | | | | | | |

| (d) | | Exhibits |

| | 99.1 | | |

| | 99.2 | | |

| | | | |

| | 104 | | Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | Central Pacific Financial Corp. |

| | | (Registrant) |

| | |

| | | |

| | | |

| Date: | July 31, 2024 | /s/ David S. Morimoto |

| | David S. Morimoto |

| | Senior Executive Vice President and Chief Financial Officer |

| | |

Exhibit 99.1

| | | | | | | | | | | |

| | | | FOR IMMEDIATE RELEASE |

| | | | |

| Investor Contact: | Ian Tanaka | Media Contact: | Tim Sakahara |

| | SVP, Treasury Manager | | AVP, Corporate Communications Manager |

| | (808) 544-3646 | | (808) 544-5125 |

| | ian.tanaka@cpb.bank | | tim.sakahara@cpb.bank |

CENTRAL PACIFIC FINANCIAL REPORTS SECOND QUARTER 2024 EARNINGS OF $15.8 MILLION

Highlights include:

•Net income of $15.8 million, or $0.58 per diluted share, an increase of 22.2% compared to the $12.9 million earned in the previous quarter

•Net interest margin of 2.97% increased by 14 bps from 2.83% in the previous quarter

•Total loans of $5.38 billion decreased by $17.8 million from the previous quarter

•Core deposits of $5.91 billion increased by $16.7 million from the previous quarter. Total deposits of $6.58 billion decreased by $36.4 million from the previous quarter, which included a decrease in government time deposits of $41.6 million.

•Net charge-offs of $3.8 million decreased by $0.8 million from the previous quarter

•Total risk-based capital and common equity tier 1 ratios of 15.1% and 11.9%, respectively

•The CPF Board of Directors approved a quarterly cash dividend of $0.26 per share

HONOLULU, HI, July 31, 2024 – Central Pacific Financial Corp. (NYSE: CPF) (the "Company"), parent company of Central Pacific Bank (the "Bank" or "CPB"), today reported net income of $15.8 million, or fully diluted earnings per share ("EPS") of $0.58 for the second quarter of 2024, compared to net income of $12.9 million, or EPS of $0.48 in the previous quarter and net income of $14.5 million, or EPS of $0.53 in the year-ago quarter.

"We continue to navigate the current environment and positive trends are developing. We are pleased with our strong second quarter financial results, which included the highest net income in our last five quarters," said Arnold Martines, Chairman, President and Chief Executive Officer. "Key contributors included NIM expansion of 14 bps, core deposit growth and improvement in net charge-offs. At the same time, we maintained solid liquidity and grew our capital levels further."

"We were recently recognized by Forbes Magazine as one of America’s Best Banks as well as the Best-In-State Bank for Hawaii in 2024. We are humbled by this recognition, proud of our employees, and thankful to our customers for the trust they place in Central Pacific Bank," Martines said.

The Board of Directors has also appointed Mr. Martines as Chairman of the Board of the Company and the Bank. Mr. Martines replaces Ms. A. Catherine Ngo who continues to serve as a member of the Board of Directors of the Company and the Bank.

Central Pacific Financial Reports Second Quarter 2024 Earnings of $15.8 Million

Page 2

Earnings Highlights

Net interest income was $51.9 million for the second quarter of 2024, which increased by $1.7 million, or 3.5% from the previous quarter, and decreased by $0.8 million, or 1.5% from the year-ago quarter. Net interest margin ("NIM") was 2.97% for the second quarter of 2024, an increase of 14 basis points ("bp" or "bps") from the previous quarter and 1 bp from the year-ago quarter. The sequential quarter increase in net interest income and NIM was primarily due to higher average yields earned on investment securities and loans, while interest-bearing liability costs remained relatively stable. The higher average yield earned on investment securities includes $0.9 million in income from an interest rate swap that became effective on March 31, 2024.

The Company recorded a provision for credit losses of $2.2 million in the second quarter of 2024, compared to a provision of $3.9 million in the previous quarter and a provision of $4.3 million in the year-ago quarter. The provision in the second quarter consisted of a provision for credit losses on loans of $2.4 million and a credit to the provision for off-balance sheet exposures of $0.2 million.

Other operating income totaled $12.1 million for the second quarter of 2024, compared to $11.2 million in the previous quarter and $10.4 million in the year-ago quarter. The higher other operating income was primarily due to higher mortgage banking income of $0.4 million and higher investment services fees of $0.6 million (included in other service charges and fees).

Other operating expense totaled $41.2 million for the second quarter of 2024, compared to $40.6 million in the previous quarter and $39.9 million in the year-ago quarter. The higher other operating expense was primarily due to higher salaries and employee benefits.

The efficiency ratio was 64.26% for the second quarter of 2024, compared to 66.05% in the previous quarter and 63.17% in the year-ago quarter.

The effective tax rate was 23.4% for the second quarter of 2024, compared to 23.5% in the previous quarter and 23.6% in the year-ago quarter.

Balance Sheet Highlights

Total assets of $7.39 billion at June 30, 2024 decreased by $23.0 million, or 0.3% from $7.41 billion at March 31, 2024, and decreased by $180.6 million, or 2.4% from $7.57 billion at June 30, 2023. The Company had $298.9 million in cash on its balance sheet and $2.56 billion in total other liquidity sources, including available borrowing capacity and unpledged investment securities at June 30, 2024. Total available sources of liquidity as a percentage of uninsured and uncollateralized deposits was 121% at June 30, 2024, compared to 118% at March 31, 2024 and 128% at June 30, 2023. During the second quarter of 2024, excess balance sheet liquidity was used to pay off $41.6 million in higher cost government time deposits.

Total loans, net of deferred fees and costs, of $5.38 billion at June 30, 2024 decreased by $17.8 million, or 0.3% from $5.40 billion at March 31, 2024, and decreased by $137.0 million, or 2.5% from $5.52 billion at June 30, 2023. Average yields earned on loans during the second quarter of 2024 was 4.80%, compared to 4.67% in the previous quarter and 4.37% in the year-ago quarter.

Total deposits of $6.58 billion at June 30, 2024 decreased by $36.4 million or 0.5% from $6.62 billion at March 31, 2024, and decreased by $223.3 million, or 3.3% from $6.81 billion at June 30, 2023. Core deposits, which include demand deposits, savings and money market deposits and time deposits up to $250,000, totaled $5.91 billion at June 30, 2024, and increased by $16.7 million, or 0.3% from $5.90 billion at March 31, 2024. Average rates paid on total deposits during the second quarter of 2024 was 1.33%, compared to 1.32% in the previous quarter and 0.84% in the year-ago quarter. Approximately 64%, 65% and 65% of the Company's total deposits were FDIC-insured or fully collateralized at June 30, 2024, March 31, 2024 and June 30, 2023, respectively.

Asset Quality

Nonperforming assets totaled $10.3 million, or 0.14% of total assets at June 30, 2024, compared to $10.1 million, or 0.14% of total assets at March 31, 2024 and $11.1 million, or 0.15% of total assets at June 30, 2023.

Net charge-offs totaled $3.8 million in the second quarter of 2024, compared to net charge-offs of $4.5 million in the previous quarter, and net charge-offs of $3.4 million in the year-ago quarter. Annualized net charge-offs as a percentage of average loans was 0.28%, 0.34% and 0.24% during the three months ended June 30, 2024, March 31, 2024 and June 30, 2023, respectively.

The allowance for credit losses, as a percentage of total loans was 1.16% at June 30, 2024, compared to 1.18% at March 31, 2024, and 1.16% at June 30, 2023.

Central Pacific Financial Reports Second Quarter 2024 Earnings of $15.8 Million

Page 3

Capital

Total shareholders' equity was $518.6 million at June 30, 2024, compared to $507.2 million and $476.3 million at March 31, 2024 and June 30, 2023, respectively.

During the second quarter of 2024, the Company did not repurchase any shares of common stock. As of June 30, 2024, $19.1 million in share repurchase authorization remained available under the Company's share repurchase program.

The Company's leverage, tier 1 risk-based capital, total risk-based capital, and common equity tier 1 capital ratios were 9.3%, 12.8%, 15.1%, and 11.9%, respectively, at June 30, 2024, compared to 9.0%, 12.6%, 14.8%, and 11.6%, respectively, at March 31, 2024.

On July 30, 2024, the Company's Board of Directors declared a quarterly cash dividend of $0.26 per share on its outstanding common shares. The dividend will be payable on September 16, 2024 to shareholders of record at the close of business on August 30, 2024.

Conference Call

The Company's management will host a conference call today at 1:00 p.m. Eastern Time (7:00 a.m. Hawaii Time) to discuss the quarterly results. Individuals are encouraged to listen to the live webcast of the presentation by visiting the investor relations page of the Company's website at http://ir.cpb.bank. Alternatively, investors may participate in the live call by dialing 1-800-715-9871 (conference ID: 9836028). A playback of the call will be available through August 30, 2024 by dialing 1-800-770-2030 (playback ID: 9836028) and on the Company's website. Information which may be discussed in the conference call is provided in an earnings supplement presentation on the Company's website at http://ir.cpb.bank.

About Central Pacific Financial Corp.

Central Pacific Financial Corp. is a Hawaii-based bank holding company with approximately $7.39 billion in assets as of June 30, 2024. Central Pacific Bank, its primary subsidiary, operates 27 branches and 55 ATMs in the State of Hawaii. For additional information, please visit the Company's website at http://www.cpb.bank.

**********

Central Pacific Financial Reports Second Quarter 2024 Earnings of $15.8 Million

Page 4

Forward-Looking Statements

This document may contain forward-looking statements ("FLS") concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, payment or nonpayment of dividends, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. (the "Company") or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; statements of future economic performance including anticipated performance results from our business initiatives; or any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believe," "plan," "anticipate," "seek," "expect," "intend," "forecast," "hope," "target," "continue," "remain," "estimate," "will," "should," "may" and other similar expressions are intended to identify FLS but are not the exclusive means of identifying such statements.

While we believe that our FLS and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons, including, but not limited to: the effects of inflation and interest rate fluctuations; the adverse effects of recent bank failures and the potential impact of such developments on customer confidence, deposit behavior, liquidity and regulatory responses thereto; the adverse effects of the COVID-19 pandemic virus (and its variants) and other pandemic viruses on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees, as well as the effects of government programs and initiatives in response thereto; supply chain disruptions; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, and earthquakes) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau, government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings and lawsuits we are or may become subject to, or regulatory or other governmental inquiries and proceedings and the resolution thereof; the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulations or regulatory orders or actions we are or may become subject to, and the effect of any recurring or special FDIC assessments; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters and the cost and resources required to implement such changes; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System; securities market and monetary fluctuations, including the impact resulting from the elimination of the London Interbank Offered Rate Index; negative trends in our market capitalization and adverse changes in the price of the Company's common stock; the effects of any acquisitions or dispositions we may make; political instability; acts of war or terrorism; changes in consumer spending, borrowings and savings habits; technological changes and developments; cybersecurity and data privacy breaches and the consequence therefrom; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; our ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; changes in the competitive environment among financial holding companies and other financial service providers; our ability to successfully implement our initiatives to lower our efficiency ratio; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; our ability to successfully implement and achieve the objectives of our Banking-as-a-Service initiatives, including adoption of the initiatives by customers and risks faced by any of our bank collaborations including reputational and regulatory risk; and our success at managing the risks involved in the foregoing items.

For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the FLS, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and, in particular, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the FLS contained in this document. FLS speak only as of the date on which such statements are made. We undertake no obligation to update any FLS to reflect events or circumstances after the date on which such statements are made, or to reflect the occurrence of unanticipated events except as required by law.

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Financial Highlights | |

| (Unaudited) | TABLE 1 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| (Dollars in thousands, | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, | | Jun 30, |

| except for per share amounts) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | 2024 | | 2023 |

| CONDENSED INCOME STATEMENT | | | | | | | | | | | | | | |

| Net interest income | | $ | 51,921 | | | $ | 50,187 | | | $ | 51,142 | | | $ | 51,928 | | | $ | 52,734 | | | $ | 102,108 | | | $ | 106,930 | |

| Provision for credit losses | | 2,239 | | | 3,936 | | | 4,653 | | | 4,874 | | | 4,319 | | | 6,175 | | | 6,171 | |

| | | | | | | | | | | | | | |

| Total other operating income | | 12,121 | | | 11,244 | | | 15,172 | | | 10,047 | | | 10,435 | | | 23,365 | | | 21,444 | |

| Total other operating expense | | 41,151 | | | 40,576 | | | 42,522 | | | 39,611 | | | 39,903 | | | 81,727 | | | 82,010 | |

| | | | | | | | | | | | | | |

| Income tax expense | | 4,835 | | | 3,974 | | | 4,273 | | | 4,349 | | | 4,472 | | | 8,809 | | | 9,531 | |

| Net income | | 15,817 | | | 12,945 | | | 14,866 | | | 13,141 | | | 14,475 | | | 28,762 | | | 30,662 | |

| Basic earnings per share | | $ | 0.58 | | | $ | 0.48 | | | $ | 0.55 | | | $ | 0.49 | | | $ | 0.54 | | | $ | 1.06 | | | $ | 1.14 | |

| Diluted earnings per share | | 0.58 | | | 0.48 | | | 0.55 | | | 0.49 | | | 0.53 | | | 1.06 | | | 1.13 | |

| Dividends declared per share | | 0.26 | | | 0.26 | | | 0.26 | | | 0.26 | | | 0.26 | | | 0.52 | | | 0.52 | |

| | | | | | | | | | | | | | |

| PERFORMANCE RATIOS | | | | | | | | | | | | | | |

| Return on average assets (ROA) [1] | | 0.86 | % | | 0.70 | % | | 0.79 | % | | 0.70 | % | | 0.78 | % | | 0.78 | % | | 0.82 | % |

| Return on average shareholders’ equity (ROE) [1] | | 12.42 | | | 10.33 | | | 12.55 | | | 10.95 | | | 12.12 | | | 11.38 | | | 13.03 | |

| | | | | | | | | | | | | | |

| Average shareholders’ equity to average assets | | 6.94 | | | 6.73 | | | 6.32 | | | 6.39 | | | 6.40 | | | 6.83 | | | 6.31 | |

| Efficiency ratio [2] | | 64.26 | | | 66.05 | | | 64.12 | | | 63.91 | | | 63.17 | | | 65.14 | | | 63.88 | |

| Net interest margin (NIM) [1] | | 2.97 | | | 2.83 | | | 2.84 | | | 2.88 | | | 2.96 | | | 2.90 | | | 3.02 | |

| Dividend payout ratio [3] | | 44.83 | | | 54.17 | | | 47.27 | | | 53.06 | | | 49.06 | | | 49.06 | | | 46.02 | |

| | | | | | | | | | | | | | |

| SELECTED AVERAGE BALANCES | | | | | | | | | | | | | | |

| Average loans, including loans held for sale | | $ | 5,385,829 | | | $ | 5,400,558 | | | $ | 5,458,245 | | | $ | 5,507,248 | | | $ | 5,543,398 | | | $ | 5,393,193 | | | $ | 5,534,741 | |

| Average interest-earning assets | | 7,032,515 | | | 7,140,264 | | | 7,208,613 | | | 7,199,866 | | | 7,155,606 | | | 7,086,389 | | | 7,134,111 | |

| Average assets | | 7,338,714 | | | 7,449,661 | | | 7,498,097 | | | 7,510,537 | | | 7,463,629 | | | 7,394,188 | | | 7,453,753 | |

| Average deposits | | 6,542,767 | | | 6,659,812 | | | 6,730,883 | | | 6,738,071 | | | 6,674,650 | | | 6,601,290 | | | 6,665,208 | |

| Average interest-bearing liabilities | | 4,910,998 | | | 5,009,542 | | | 5,023,321 | | | 4,999,820 | | | 4,908,120 | | | 4,960,270 | | | 4,864,633 | |

| Average shareholders’ equity | | 509,507 | | | 501,120 | | | 473,708 | | | 480,118 | | | 477,711 | | | 505,314 | | | 470,673 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| [1] ROA and ROE are annualized based on a 30/360 day convention. Annualized net interest income and expense in the NIM calculation are based on the day count interest payment conventions at the interest-earning asset or interest-bearing liability level (i.e. 30/360, actual/actual). |

| [2] Efficiency ratio is defined as total other operating expense divided by total revenue (net interest income and total other operating income). |

| [3] Dividend payout ratio is defined as dividends declared per share divided by diluted earnings per share. | | | | |

| | | | |

| | | | | | | | | | | | | | |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Financial Highlights | |

| (Unaudited) | TABLE 1 (CONTINUED) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| REGULATORY CAPITAL RATIOS | | | | | | | | | | |

| Central Pacific Financial Corp. | | | | | | | | | | |

| Leverage ratio | | 9.3 | % | | 9.0 | % | | 8.8 | % | | 8.7 | % | | 8.7 | % |

| Tier 1 risk-based capital ratio | | 12.8 | | | 12.6 | | | 12.4 | | | 11.9 | | | 11.8 | |

| Total risk-based capital ratio | | 15.1 | | | 14.8 | | | 14.6 | | | 14.1 | | | 13.9 | |

| Common equity tier 1 capital ratio | | 11.9 | | | 11.6 | | | 11.4 | | | 11.0 | | | 10.9 | |

| Central Pacific Bank | | | | | | | | | | |

| Leverage ratio | | 9.6 | | | 9.4 | | | 9.2 | | | 9.1 | | | 9.1 | |

| Tier 1 risk-based capital ratio | | 13.3 | | | 13.1 | | | 12.9 | | | 12.4 | | | 12.3 | |

| Total risk-based capital ratio | | 14.5 | | | 14.3 | | | 14.1 | | | 13.7 | | | 13.5 | |

| Common equity tier 1 capital ratio | | 13.3 | | | 13.1 | | | 12.9 | | | 12.4 | | | 12.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| (dollars in thousands, except for per share amounts) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| BALANCE SHEET | | | | | | | | | | |

| Total loans, net of deferred fees and costs | | $ | 5,383,644 | | | $ | 5,401,417 | | | $ | 5,438,982 | | | $ | 5,508,710 | | | $ | 5,520,683 | |

| Total assets | | 7,386,952 | | | 7,409,999 | | | 7,642,796 | | | 7,637,924 | | | 7,567,592 | |

| Total deposits | | 6,582,455 | | | 6,618,854 | | | 6,847,592 | | | 6,874,745 | | | 6,805,737 | |

| Long-term debt | | 156,223 | | | 156,163 | | | 156,102 | | | 156,041 | | | 155,981 | |

| Total shareholders’ equity | | 518,647 | | | 507,203 | | | 503,815 | | | 468,598 | | | 476,279 | |

| Total shareholders’ equity to total assets | | 7.02 | % | | 6.84 | % | | 6.59 | % | | 6.14 | % | | 6.29 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| ASSET QUALITY | | | | | | | | | | |

| Allowance for credit losses (ACL) | | $ | 62,225 | | | $ | 63,532 | | | $ | 63,934 | | | $ | 64,517 | | | $ | 63,849 | |

| Nonaccrual loans | | 10,257 | | | 10,132 | | | 7,008 | | | 6,652 | | | 11,061 | |

| Non-performing assets (NPA) | | 10,257 | | | 10,132 | | | 7,008 | | | 6,652 | | | 11,061 | |

| Ratio of ACL to total loans | | 1.16 | % | | 1.18 | % | | 1.18 | % | | 1.17 | % | | 1.16 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| Ratio of NPA to total assets | | 0.14 | % | | 0.14 | % | | 0.09 | % | | 0.09 | % | | 0.15 | % |

| | | | | | | | | | |

| PER SHARE OF COMMON STOCK OUTSTANDING | | | | | | | | | | |

| Book value per common share | | $ | 19.16 | | | $ | 18.76 | | | $ | 18.63 | | | $ | 17.33 | | | $ | 17.61 | |

| | | | | | | | | | |

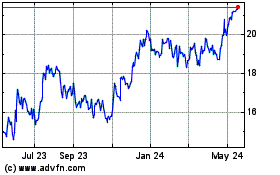

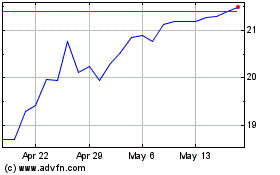

| Closing market price per common share | | 21.20 | | | 19.75 | | | 19.68 | | | 16.68 | | | 15.71 | |

| | | | | | | | | | |

|

|

|

|

|

|

|

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Consolidated Balance Sheets | |

| (Unaudited) | TABLE 2 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| (Dollars in thousands, except share data) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| ASSETS | | | | | | | | | | |

| Cash and due from financial institutions | | $ | 103,829 | | | $ | 98,410 | | | $ | 116,181 | | | $ | 108,818 | | | $ | 129,071 | |

| Interest-bearing deposits in other financial institutions | | 195,062 | | | 214,472 | | | 406,256 | | | 329,913 | | | 181,913 | |

| Investment securities: | | | | | | | | | | |

| Available-for-sale debt securities, at fair value | | 676,719 | | | 660,833 | | | 647,210 | | | 625,253 | | | 664,071 | |

| Held-to-maturity debt securities, at amortized cost; fair value of: $528,088 at June 30, 2024, $541,685 at March 31, 2024, $565,178 at December 31, 2023, $531,887 at September 30, 2023, and $581,222 at June 30, 2023 | | 615,867 | | | 624,948 | | | 632,338 | | | 640,053 | | | 649,946 | |

| | | | | | | | | | |

| Total investment securities | | 1,292,586 | | | 1,285,781 | | | 1,279,548 | | | 1,265,306 | | | 1,314,017 | |

| Loans held for sale | | 3,950 | | | 755 | | | 1,778 | | | — | | | 2,593 | |

| Loans, net of deferred fees and costs | | 5,383,644 | | | 5,401,417 | | | 5,438,982 | | | 5,508,710 | | | 5,520,683 | |

| Less: allowance for credit losses | | (62,225) | | | (63,532) | | | (63,934) | | | (64,517) | | | (63,849) | |

| Loans, net of allowance for credit losses | | 5,321,419 | | | 5,337,885 | | | 5,375,048 | | | 5,444,193 | | | 5,456,834 | |

| Premises and equipment, net | | 100,646 | | | 97,688 | | | 96,184 | | | 97,378 | | | 96,479 | |

| Accrued interest receivable | | 23,184 | | | 21,957 | | | 21,511 | | | 21,529 | | | 20,463 | |

| Investment in unconsolidated entities | | 40,155 | | | 40,780 | | | 41,546 | | | 42,523 | | | 45,218 | |

| | | | | | | | | | |

| Mortgage servicing rights | | 8,636 | | | 8,599 | | | 8,696 | | | 8,797 | | | 8,843 | |

| | | | | | | | | | |

| Bank-owned life insurance | | 173,716 | | | 172,228 | | | 170,706 | | | 168,543 | | | 168,136 | |

| Federal Home Loan Bank of Des Moines ("FHLB") stock | | 6,925 | | | 6,921 | | | 6,793 | | | 10,995 | | | 10,960 | |

| Right-of-use lease assets | | 32,081 | | | 32,079 | | | 29,720 | | | 32,294 | | | 33,247 | |

| Other assets | | 84,763 | | | 92,444 | | | 88,829 | | | 107,635 | | | 99,818 | |

| Total assets | | $ | 7,386,952 | | | $ | 7,409,999 | | | $ | 7,642,796 | | | $ | 7,637,924 | | | $ | 7,567,592 | |

| LIABILITIES | | | | | | | | | | |

| Deposits: | | | | | | | | | | |

| Noninterest-bearing demand | | $ | 1,847,173 | | | $ | 1,848,554 | | | $ | 1,913,379 | | | $ | 1,969,523 | | | $ | 2,009,387 | |

| Interest-bearing demand | | 1,283,669 | | | 1,290,321 | | | 1,329,189 | | | 1,345,843 | | | 1,359,978 | |

| Savings and money market | | 2,234,111 | | | 2,211,966 | | | 2,209,733 | | | 2,209,550 | | | 2,184,652 | |

| Time | | 1,217,502 | | | 1,268,013 | | | 1,395,291 | | | 1,349,829 | | | 1,251,720 | |

| Total deposits | | 6,582,455 | | | 6,618,854 | | | 6,847,592 | | | 6,874,745 | | | 6,805,737 | |

| | | | | | | | | | |

| Long-term debt, net of unamortized debt issuance costs of: $324 at June 30, 2024, $384 at March 31, 2024, $445 at December 31, 2023, $506 at September 30, 2023 and $566 at June 30, 2023 | | 156,223 | | | 156,163 | | | 156,102 | | | 156,041 | | | 155,981 | |

| Lease liabilities | | 33,422 | | | 33,169 | | | 30,634 | | | 33,186 | | | 34,111 | |

| | | | | | | | | | |

| Accrued interest payable | | 14,998 | | | 16,654 | | | 18,948 | | | 16,752 | | | 11,402 | |

| Other liabilities | | 81,207 | | | 77,956 | | | 85,705 | | | 88,602 | | | 84,082 | |

| Total liabilities | | 6,868,305 | | | 6,902,796 | | | 7,138,981 | | | 7,169,326 | | | 7,091,313 | |

| EQUITY | | | | | | | | | | |

| Shareholders' equity: | | | | | | | | | | |

| Preferred stock, no par value, authorized 1,000,000 shares; issued and outstanding: none at June 30, 2024, March 31, 2024, December 31, 2023, September 30, 2023, and June 30, 2023 | | — | | | — | | | — | | | — | | | — | |

| Common stock, no par value, authorized 185,000,000 shares; issued and outstanding: 27,063,644 at June 30, 2024, 27,042,326 at March 31, 2024, 27,045,033 at December 31, 2023, 27,043,169 at September 30, 2023, and 27,045,792 at June 30, 2023 | | 404,494 | | | 404,494 | | | 405,439 | | | 405,439 | | | 405,511 | |

| Additional paid-in capital | | 104,161 | | | 103,130 | | | 102,982 | | | 102,550 | | | 101,997 | |

| Retained earnings | | 132,683 | | | 123,902 | | | 117,990 | | | 110,156 | | | 104,046 | |

| Accumulated other comprehensive loss | | (122,691) | | | (124,323) | | | (122,596) | | | (149,547) | | | (135,275) | |

| Total shareholders' equity | | 518,647 | | | 507,203 | | | 503,815 | | | 468,598 | | | 476,279 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total liabilities and equity | | $ | 7,386,952 | | | $ | 7,409,999 | | | $ | 7,642,796 | | | $ | 7,637,924 | | | $ | 7,567,592 | |

| | | | | | | | | | |

|

| | | | | | | | | | |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Consolidated Statements of Income | |

| (Unaudited) | TABLE 3 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, | | Jun 30, |

| (Dollars in thousands, except per share data) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | 2024 | | 2023 |

| Interest income: | | | | | | | | | | | | | | |

| Interest and fees on loans | | $ | 64,422 | | | $ | 62,819 | | | $ | 62,429 | | | $ | 62,162 | | | $ | 60,455 | | | $ | 127,241 | | | $ | 118,724 | |

| Interest and dividends on investment securities: | | | | | | | | | | | | | | |

| Taxable investment securities | | 8,466 | | | 7,211 | | | 7,292 | | | 7,016 | | | 7,145 | | | 15,677 | | | 14,481 | |

| Tax-exempt investment securities | | 598 | | | 655 | | | 686 | | | 709 | | | 727 | | | 1,253 | | | 1,517 | |

| | | | | | | | | | | | | | |

| Interest on deposits in other financial institutions | | 2,203 | | | 3,611 | | | 3,597 | | | 2,412 | | | 877 | | | 5,814 | | | 1,154 | |

| Dividend income on FHLB stock | | 151 | | | 106 | | | 109 | | | 113 | | | 120 | | | 257 | | | 256 | |

| Total interest income | | 75,840 | | | 74,402 | | | 74,113 | | | 72,412 | | | 69,324 | | | 150,242 | | | 136,132 | |

| Interest expense: | | | | | | | | | | | | | | |

| Interest on deposits: | | | | | | | | | | | | | | |

| Interest-bearing demand | | 490 | | | 499 | | | 467 | | | 460 | | | 411 | | | 989 | | | 774 | |

| Savings and money market | | 8,977 | | | 8,443 | | | 7,459 | | | 6,464 | | | 4,670 | | | 17,420 | | | 8,056 | |

| Time | | 12,173 | | | 12,990 | | | 12,741 | | | 11,268 | | | 8,932 | | | 25,163 | | | 15,196 | |

| Interest on short-term borrowings | | 1 | | | — | | | — | | | — | | | 378 | | | 1 | | | 1,139 | |

| Interest on long-term debt | | 2,278 | | | 2,283 | | | 2,304 | | | 2,292 | | | 2,199 | | | 4,561 | | | 4,037 | |

| Total interest expense | | 23,919 | | | 24,215 | | | 22,971 | | | 20,484 | | | 16,590 | | | 48,134 | | | 29,202 | |

| Net interest income | | 51,921 | | | 50,187 | | | 51,142 | | | 51,928 | | | 52,734 | | | 102,108 | | | 106,930 | |

| Provision for credit losses | | 2,239 | | | 3,936 | | | 4,653 | | | 4,874 | | | 4,319 | | | 6,175 | | | 6,171 | |

| Net interest income after provision for credit losses | | 49,682 | | | 46,251 | | | 46,489 | | | 47,054 | | | 48,415 | | | 95,933 | | | 100,759 | |

| Other operating income: | | | | | | | | | | | | | | |

| Mortgage banking income | | 1,040 | | | 613 | | | 611 | | | 765 | | | 690 | | | 1,653 | | | 1,216 | |

| Service charges on deposit accounts | | 2,135 | | | 2,103 | | | 2,312 | | | 2,193 | | | 2,137 | | | 4,238 | | | 4,248 | |

| Other service charges and fees | | 5,869 | | | 5,261 | | | 5,349 | | | 5,203 | | | 4,994 | | | 11,130 | | | 9,979 | |

| Income from fiduciary activities | | 1,449 | | | 1,435 | | | 1,272 | | | 1,234 | | | 1,068 | | | 2,884 | | | 2,389 | |

| Income from bank-owned life insurance | | 1,234 | | | 1,522 | | | 2,015 | | | 379 | | | 1,185 | | | 2,756 | | | 2,476 | |

| Net loss on sales of investment securities | | — | | | — | | | (1,939) | | | (135) | | | — | | | — | | | — | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Other | | 394 | | | 310 | | | 5,552 | | | 408 | | | 361 | | | 704 | | | 1,136 | |

| Total other operating income | | 12,121 | | | 11,244 | | | 15,172 | | | 10,047 | | | 10,435 | | | 23,365 | | | 21,444 | |

| Other operating expense: | | | | | | | | | | | | | | |

| Salaries and employee benefits | | 21,246 | | | 20,735 | | | 20,164 | | | 19,015 | | | 20,848 | | | 41,981 | | | 42,871 | |

| Net occupancy | | 4,597 | | | 4,600 | | | 4,676 | | | 4,725 | | | 4,310 | | | 9,197 | | | 8,784 | |

| Computer software | | 4,381 | | | 4,287 | | | 4,026 | | | 4,473 | | | 4,621 | | | 8,668 | | | 9,227 | |

| Legal and professional services | | 2,506 | | | 2,320 | | | 2,245 | | | 2,359 | | | 2,469 | | | 4,826 | | | 5,355 | |

| Equipment | | 995 | | | 1,010 | | | 968 | | | 1,112 | | | 932 | | | 2,005 | | | 1,878 | |

| Advertising | | 901 | | | 914 | | | 1,045 | | | 968 | | | 942 | | | 1,815 | | | 1,875 | |

| Communication | | 657 | | | 837 | | | 632 | | | 809 | | | 791 | | | 1,494 | | | 1,569 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Other | | 5,868 | | | 5,873 | | | 8,766 | | | 6,150 | | | 4,990 | | | 11,741 | | | 10,451 | |

| Total other operating expense | | 41,151 | | | 40,576 | | | 42,522 | | | 39,611 | | | 39,903 | | | 81,727 | | | 82,010 | |

| Income before income taxes | | 20,652 | | | 16,919 | | | 19,139 | | | 17,490 | | | 18,947 | | | 37,571 | | | 40,193 | |

| Income tax expense | | 4,835 | | | 3,974 | | | 4,273 | | | 4,349 | | | 4,472 | | | 8,809 | | | 9,531 | |

| Net income | | $ | 15,817 | | | $ | 12,945 | | | $ | 14,866 | | | $ | 13,141 | | | $ | 14,475 | | | $ | 28,762 | | | $ | 30,662 | |

| Per common share data: | | | | | | | | | | | | | | |

| Basic earnings per share | | $ | 0.58 | | | $ | 0.48 | | | $ | 0.55 | | | $ | 0.49 | | | $ | 0.54 | | | $ | 1.06 | | | $ | 1.14 | |

| Diluted earnings per share | | 0.58 | | | 0.48 | | | 0.55 | | | 0.49 | | | 0.53 | | | 1.06 | | | 1.13 | |

| Cash dividends declared | | 0.26 | | | 0.26 | | | 0.26 | | | 0.26 | | | 0.26 | | | 0.52 | | | 0.52 | |

| Basic weighted average shares outstanding | | 27,053,549 | | | 27,046,525 | | | 27,044,121 | | | 27,042,762 | | | 27,024,043 | | | 27,050,037 | | | 27,011,659 | |

| Diluted weighted average shares outstanding | | 27,116,349 | | | 27,099,101 | | | 27,097,285 | | | 27,079,484 | | | 27,071,478 | | | 27,106,267 | | | 27,090,258 | |

| | | | | | | | | | | | | | |

|

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Average Balances, Interest Income & Expense, Yields and Rates (Taxable Equivalent) | |

| (Unaudited) | TABLE 4 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Three Months Ended | | Three Months Ended |

| | June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| | | Average | | Average | | | | Average | | Average | | | | Average | | Average | | |

| (Dollars in thousands) | | Balance | | Yield/Rate | | Interest | | Balance | | Yield/Rate | | Interest | | Balance | | Yield/Rate | | Interest |

| ASSETS |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits in other financial institutions | | $ | 162,393 | | | 5.46 | % | | $ | 2,203 | | | $ | 265,418 | | | 5.47 | % | | $ | 3,611 | | | $ | 69,189 | | | 5.08 | % | | $ | 877 | |

| Investment securities: | | | | | | | | | | | | | | | | | | |

| Taxable | | 1,335,100 | | | 2.54 | | | 8,466 | | | 1,324,657 | | | 2.18 | | | 7,211 | | | 1,379,319 | | | 2.07 | | | 7,145 | |

| Tax-exempt [1] | | 142,268 | | | 2.13 | | | 757 | | | 142,830 | | | 2.32 | | | 829 | | | 151,979 | | | 2.42 | | | 920 | |

| Total investment securities | | 1,477,368 | | | 2.50 | | | 9,223 | | | 1,467,487 | | | 2.19 | | | 8,040 | | | 1,531,298 | | | 2.11 | | | 8,065 | |

| Loans, including loans held for sale | | 5,385,829 | | | 4.80 | | | 64,422 | | | 5,400,558 | | | 4.67 | | | 62,819 | | | 5,543,398 | | | 4.37 | | | 60,455 | |

| FHLB stock | | 6,925 | | | 8.71 | | | 151 | | | 6,801 | | | 6.24 | | | 106 | | | 11,721 | | | 4.10 | | | 120 | |

| Total interest-earning assets | | 7,032,515 | | | 4.34 | | | 75,999 | | | 7,140,264 | | | 4.19 | | | 74,576 | | | 7,155,606 | | | 3.89 | | | 69,517 | |

| Noninterest-earning assets | | 306,199 | | | | | | | 309,397 | | | | | | | 308,023 | | | | | |

| Total assets | | $ | 7,338,714 | | | | | | | $ | 7,449,661 | | | | | | | $ | 7,463,629 | | | | | |

| | | | | | | | | | | | | | | | | | |

| LIABILITIES AND EQUITY |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | |

| Interest-bearing demand deposits | | $ | 1,273,901 | | | 0.15 | % | | $ | 490 | | | $ | 1,296,865 | | | 0.15 | % | | $ | 499 | | | $ | 1,367,878 | | | 0.12 | % | | $ | 411 | |

| Savings and money market deposits | | 2,221,754 | | | 1.63 | | | 8,977 | | | 2,218,250 | | | 1.53 | | | 8,443 | | | 2,172,680 | | | 0.86 | | | 4,670 | |

| Time deposits up to $250,000 | | 555,809 | | | 3.29 | | | 4,548 | | | 544,279 | | | 3.21 | | | 4,339 | | | 390,961 | | | 1.82 | | | 1,770 | |

| Time deposits over $250,000 | | 703,280 | | | 4.36 | | | 7,625 | | | 794,019 | | | 4.38 | | | 8,651 | | | 790,864 | | | 3.63 | | | 7,162 | |

| Total interest-bearing deposits | | 4,754,744 | | | 1.83 | | | 21,640 | | | 4,853,413 | | | 1.82 | | | 21,932 | | | 4,722,383 | | | 1.19 | | | 14,013 | |

| | | | | | | | | | | | | | | | | | |

| FHLB advances and other short-term borrowings | | 66 | | | 5.60 | | | 1 | | | — | | | — | | | — | | | 29,791 | | | 5.09 | | | 378 | |

| Long-term debt | | 156,188 | | | 5.86 | | | 2,278 | | | 156,129 | | | 5.88 | | | 2,283 | | | 155,946 | | | 5.65 | | | 2,199 | |

| Total interest-bearing liabilities | | 4,910,998 | | | 1.96 | | | 23,919 | | | 5,009,542 | | | 1.94 | | | 24,215 | | | 4,908,120 | | | 1.36 | | | 16,590 | |

| Noninterest-bearing deposits | | 1,788,023 | | | | | | | 1,806,399 | | | | | | | 1,952,267 | | | | | |

| Other liabilities | | 130,186 | | | | | | | 132,600 | | | | | | | 125,531 | | | | | |

| Total liabilities | | 6,829,207 | | | | | | | 6,948,541 | | | | | | | 6,985,918 | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Total equity | | 509,507 | | | | | | | 501,120 | | | | | | | 477,711 | | | | | |

| Total liabilities and equity | | $ | 7,338,714 | | | | | | | $ | 7,449,661 | | | | | | | $ | 7,463,629 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net interest income | | | | | | $ | 52,080 | | | | | | | $ | 50,361 | | | | | | | $ | 52,927 | |

| | | | | | | | | | | | | | | | | | |

| Interest rate spread | | | | 2.38 | % | | | | | | 2.25 | % | | | | | | 2.53 | % | | |

| | | | | | | | | | | | | | | | | | |

| Net interest margin | | | | 2.97 | % | | | | | | 2.83 | % | | | | | | 2.96 | % | | |

| | | | | | | | | | | | | | | | | | |

|

| [1] Interest income and resultant yield information for tax-exempt investment securities is expressed on a taxable-equivalent basis using a federal statutory tax rate of 21%. |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Average Balances, Interest Income & Expense, Yields and Rates (Taxable Equivalent) | |

| (Unaudited) | TABLE 5 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended | | Six Months Ended |

| | June 30, 2024 | | June 30, 2023 |

| | | Average | | Average | | | | Average | | Average | | |

| (Dollars in thousands) | | Balance | | Yield/Rate | | Interest | | Balance | | Yield/Rate | | Interest |

| ASSETS |

| Interest-earning assets: | | | | | | | | | | | | |

| Interest-bearing deposits in other financial institutions | | $ | 213,905 | | | 5.47 | % | | $ | 5,814 | | | $ | 47,195 | | | 4.93 | % | | $ | 1,154 | |

| Investment securities: | | | | | | | | | | | | |

| Taxable | | 1,329,879 | | | 2.36 | | | 15,677 | | | 1,387,606 | | | 2.09 | | | 14,481 | |

| Tax-exempt [1] | | 142,549 | | | 2.23 | | | 1,586 | | | 152,520 | | | 2.52 | | | 1,920 | |

| Total investment securities | | 1,472,428 | | | 2.34 | | | 17,263 | | | 1,540,126 | | | 2.13 | | | 16,401 | |

| Loans, including loans held for sale | | 5,393,193 | | | 4.74 | | | 127,241 | | | 5,534,741 | | | 4.32 | | | 118,724 | |

| FHLB stock | | 6,863 | | | 7.49 | | | 257 | | | 12,049 | | | 4.26 | | | 256 | |

| Total interest-earning assets | | 7,086,389 | | | 4.26 | | | 150,575 | | | 7,134,111 | | | 3.85 | | | 136,535 | |

| Noninterest-earning assets | | 307,799 | | | | | | | 319,642 | | | | | |

| Total assets | | $ | 7,394,188 | | | | | | | $ | 7,453,753 | | | | | |

| | | | | | | | | | | | |

| LIABILITIES AND EQUITY |

| Interest-bearing liabilities: | | | | | | | | | | | | |

| Interest-bearing demand deposits | | $ | 1,285,383 | | | 0.15 | % | | $ | 989 | | | $ | 1,391,386 | | | 0.11 | % | | $ | 774 | |

| Savings and money market deposits | | 2,220,002 | | | 1.58 | | | 17,420 | | | 2,177,783 | | | 0.75 | | | 8,056 | |

| Time deposits up to $250,000 | | 550,044 | | | 3.25 | | | 8,887 | | | 366,316 | | | 1.60 | | | 2,907 | |

| Time deposits over $250,000 | | 748,649 | | | 4.37 | | | 16,276 | | | 740,428 | | | 3.35 | | | 12,289 | |

| Total interest-bearing deposits | | 4,804,078 | | | 1.82 | | | 43,572 | | | 4,675,913 | | | 1.04 | | | 24,026 | |

| | | | | | | | | | | | |

| FHLB advances and other short-term borrowings | | 33 | | | 5.60 | | | 1 | | | 47,031 | | | 4.88 | | | 1,139 | |

| Long-term debt | | 156,159 | | | 5.87 | | | 4,561 | | | 141,689 | | | 5.75 | | | 4,037 | |

| Total interest-bearing liabilities | | 4,960,270 | | | 1.95 | | | 48,134 | | | 4,864,633 | | | 1.21 | | | 29,202 | |

| Noninterest-bearing deposits | | 1,797,212 | | | | | | | 1,989,295 | | | | | |

| Other liabilities | | 131,392 | | | | | | | 129,152 | | | | | |

| Total liabilities | | 6,888,874 | | | | | | | 6,983,080 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total equity | | 505,314 | | | | | | | 470,673 | | | | | |

| Total liabilities and equity | | $ | 7,394,188 | | | | | | | $ | 7,453,753 | | | | | |

| | | | | | | | | | | | |

| Net interest income | | | | | | $ | 102,441 | | | | | | | $ | 107,333 | |

| | | | | | | | | | | | |

| Interest rate spread | | | | 2.31 | % | | | | | | 2.64 | % | | |

| | | | | | | | | | | | |

| Net interest margin | | | | 2.90 | % | | | | | | 3.02 | % | | |

| | | | | | | | | | | | |

|

| [1] Interest income and resultant yield information for tax-exempt investment securities is expressed on a taxable-equivalent basis using a federal statutory tax rate of 21%. |

| | | | | | | | | | | | |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Loans by Geographic Distribution | |

| (Unaudited) | TABLE 6 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| HAWAII: | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Commercial and industrial | | $ | 415,538 | | | $ | 420,009 | | | $ | 421,736 | | | $ | 406,433 | | | $ | 374,601 | |

| Real estate: | | | | | | | | | | |

| Construction | | 147,657 | | | 145,213 | | | 163,337 | | | 174,057 | | | 168,012 | |

| Residential mortgage | | 1,913,177 | | | 1,924,889 | | | 1,927,789 | | | 1,930,740 | | | 1,942,906 | |

| Home equity | | 706,811 | | | 729,210 | | | 736,524 | | | 753,980 | | | 750,760 | |

| Commercial mortgage | | 1,150,703 | | | 1,103,174 | | | 1,063,969 | | | 1,045,625 | | | 1,037,826 | |

| Consumer | | 287,295 | | | 306,563 | | | 322,346 | | | 338,248 | | | 327,790 | |

| | | | | | | | | | |

| Total loans, net of deferred fees and costs | | 4,621,181 | | | 4,629,058 | | | 4,635,701 | | | 4,649,083 | | | 4,601,895 | |

| Less: Allowance for credit losses | | (47,902) | | | (48,739) | | | (48,189) | | | (48,105) | | | (44,828) | |

| Loans, net of allowance for credit losses | | $ | 4,573,279 | | | $ | 4,580,319 | | | $ | 4,587,512 | | | $ | 4,600,978 | | | $ | 4,557,067 | |

| | | | | | | | | | |

| U.S. MAINLAND: [1] | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Commercial and industrial | | $ | 169,318 | | | $ | 156,087 | | | $ | 153,971 | | | $ | 157,373 | | | $ | 170,557 | |

| Real estate: | | | | | | | | | | |

| Construction | | 23,865 | | | 23,356 | | | 22,182 | | | 37,455 | | | 32,807 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Commercial mortgage | | 314,667 | | | 319,088 | | | 318,933 | | | 319,802 | | | 329,736 | |

| Consumer | | 254,613 | | | 273,828 | | | 308,195 | | | 344,997 | | | 385,688 | |

| | | | | | | | | | |

| Total loans, net of deferred fees and costs | | 762,463 | | | 772,359 | | | 803,281 | | | 859,627 | | | 918,788 | |

| Less: Allowance for credit losses | | (14,323) | | | (14,793) | | | (15,745) | | | (16,412) | | | (19,021) | |

| Loans, net of allowance for credit losses | | $ | 748,140 | | | $ | 757,566 | | | $ | 787,536 | | | $ | 843,215 | | | $ | 899,767 | |

| | | | | | | | | | |

| TOTAL: | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Commercial and industrial | | $ | 584,856 | | | $ | 576,096 | | | $ | 575,707 | | | $ | 563,806 | | | $ | 545,158 | |

| Real estate: | | | | | | | | | | |

| Construction | | 171,522 | | | 168,569 | | | 185,519 | | | 211,512 | | | 200,819 | |

| Residential mortgage | | 1,913,177 | | | 1,924,889 | | | 1,927,789 | | | 1,930,740 | | | 1,942,906 | |

| Home equity | | 706,811 | | | 729,210 | | | 736,524 | | | 753,980 | | | 750,760 | |

| Commercial mortgage | | 1,465,370 | | | 1,422,262 | | | 1,382,902 | | | 1,365,427 | | | 1,367,562 | |

| Consumer | | 541,908 | | | 580,391 | | | 630,541 | | | 683,245 | | | 713,478 | |

| | | | | | | | | | |

| Total loans, net of deferred fees and costs | | 5,383,644 | | | 5,401,417 | | | 5,438,982 | | | 5,508,710 | | | 5,520,683 | |

| Less: Allowance for credit losses | | (62,225) | | | (63,532) | | | (63,934) | | | (64,517) | | | (63,849) | |

| Loans, net of allowance for credit losses | | $ | 5,321,419 | | | $ | 5,337,885 | | | $ | 5,375,048 | | | $ | 5,444,193 | | | $ | 5,456,834 | |

| | | | | | | | | | |

| [1] U.S. Mainland includes territories of the United States. |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Deposits | |

| (Unaudited) | TABLE 7 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Noninterest-bearing demand | | $ | 1,847,173 | | | $ | 1,848,554 | | | $ | 1,913,379 | | | $ | 1,969,523 | | | $ | 2,009,387 | |

| Interest-bearing demand | | 1,283,669 | | | 1,290,321 | | | 1,329,189 | | | 1,345,843 | | | 1,359,978 | |

| Savings and money market | | 2,234,111 | | | 2,211,966 | | | 2,209,733 | | | 2,209,550 | | | 2,184,652 | |

| Time deposits up to $250,000 | | 547,212 | | | 544,600 | | | 533,898 | | | 465,543 | | | 427,864 | |

| Core deposits | | 5,912,165 | | | 5,895,441 | | | 5,986,199 | | | 5,990,459 | | | 5,981,881 | |

| Government time deposits | | 193,833 | | | 235,463 | | | 374,581 | | | 400,130 | | | 383,426 | |

| | | | | | | | | | |

| Other time deposits greater than $250,000 | | 476,457 | | | 487,950 | | | 486,812 | | | 484,156 | | | 440,430 | |

| Total time deposits greater than $250,000 | | 670,290 | | | 723,413 | | | 861,393 | | | 884,286 | | | 823,856 | |

| Total deposits | | $ | 6,582,455 | | | $ | 6,618,854 | | | $ | 6,847,592 | | | $ | 6,874,745 | | | $ | 6,805,737 | |

| | | | | | | | | | |

|

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Nonperforming Assets and Accruing Loans 90+ Days Past Due | |

| (Unaudited) | TABLE 8 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Nonaccrual loans: | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Commercial and industrial | | $ | 355 | | | $ | 357 | | | $ | 432 | | | $ | 352 | | | $ | 319 | |

| Real estate: | | | | | | | | | | |

| Construction | | — | | | — | | | — | | | — | | | 4,851 | |

| Residential mortgage | | 7,991 | | | 7,979 | | | 4,962 | | | 4,949 | | | 4,385 | |

| Home equity | | 1,247 | | | 929 | | | 834 | | | 677 | | | 797 | |

| Commercial mortgage | | 77 | | | 77 | | | 77 | | | 77 | | | 77 | |

| Consumer | | 587 | | | 790 | | | 703 | | | 597 | | | 632 | |

| | | | | | | | | | |

| Total nonaccrual loans | | 10,257 | | | 10,132 | | | 7,008 | | | 6,652 | | | 11,061 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other real estate owned ("OREO") | | — | | | — | | | — | | | — | | | — | |

| Total nonperforming assets ("NPAs") | | 10,257 | | | 10,132 | | | 7,008 | | | 6,652 | | | 11,061 | |

| Accruing loans 90+ days past due: | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Real estate: | | | | | | | | | | |

| Construction | | — | | | 588 | | | — | | | — | | | — | |

| Residential mortgage | | 1,273 | | | 386 | | | — | | | 794 | | | 959 | |

| Home equity | | 135 | | | 560 | | | 229 | | | — | | | 133 | |

| | | | | | | | | | |

| Consumer | | 896 | | | 924 | | | 1,083 | | | 2,120 | | | 2,207 | |

| | | | | | | | | | |

| Total accruing loans 90+ days past due | | 2,304 | | | 2,458 | | | 1,312 | | | 2,914 | | | 3,299 | |

| Total NPAs and accruing loans 90+ days past due | | $ | 12,561 | | | $ | 12,590 | | | $ | 8,320 | | | $ | 9,566 | | | $ | 14,360 | |

| | | | | | | | | | |

| Ratio of total nonaccrual loans to total loans | | 0.19 | % | | 0.19 | % | | 0.13 | % | | 0.12 | % | | 0.20 | % |

| Ratio of total NPAs to total assets | | 0.14 | | | 0.14 | | | 0.09 | | | 0.09 | | | 0.15 | |

| Ratio of total NPAs to total loans and OREO | | 0.19 | | | 0.19 | | | 0.13 | | | 0.12 | | | 0.20 | |

| Ratio of total NPAs and accruing loans 90+ days past due to total loans and OREO | | 0.23 | | | 0.23 | | | 0.15 | | | 0.17 | | | 0.26 | |

| | | | | | | | | | |

| Quarter-to-quarter changes in NPAs: | | | | | | | | | | |

| Balance at beginning of quarter | | $ | 10,132 | | | $ | 7,008 | | | $ | 6,652 | | | $ | 11,061 | | | $ | 5,313 | |

| Additions | | 1,920 | | | 4,792 | | | 1,836 | | | 2,311 | | | 7,105 | |

| Reductions: | | | | | | | | | | |

| Payments | | (363) | | | (263) | | | (268) | | | (5,718) | | | (290) | |

| Return to accrual status | | (27) | | | (198) | | | (137) | | | (207) | | | (212) | |

| | | | | | | | | | |

| Charge-offs, valuation and other adjustments | | (1,405) | | | (1,207) | | | (1,075) | | | (795) | | | (855) | |

| Total reductions | | (1,795) | | | (1,668) | | | (1,480) | | | (6,720) | | | (1,357) | |

| Balance at end of quarter | | $ | 10,257 | | | $ | 10,132 | | | $ | 7,008 | | | $ | 6,652 | | | $ | 11,061 | |

| | | | | | | | | | |

|

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Allowance for Credit Losses on Loans | |

| (Unaudited) | TABLE 9 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, | | Jun 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | 2024 | | 2023 |

| Allowance for credit losses: | | | | | | | | | | | | | | |

| Balance at beginning of period | | $ | 63,532 | | | $ | 63,934 | | | $ | 64,517 | | | $ | 63,849 | | | $ | 63,099 | | | $ | 63,934 | | | $ | 63,738 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Provision for credit losses on loans | | 2,448 | | | 4,121 | | | 4,959 | | | 4,526 | | | 4,135 | | | 6,569 | | | 5,750 | |

| | | | | | | | | | | | | | |

| Charge-offs: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Commercial and industrial | | (519) | | | (682) | | | (419) | | | (402) | | | (362) | | | (1,201) | | | (1,141) | |

| Real estate: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Residential mortgage | | (284) | | | — | | | — | | | — | | | — | | | (284) | | | — | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Consumer | | (4,345) | | | (4,838) | | | (5,976) | | | (4,710) | | | (3,873) | | | (9,183) | | | (6,559) | |

| | | | | | | | | | | | | | |

| Total charge-offs | | (5,148) | | | (5,520) | | | (6,395) | | | (5,112) | | | (4,235) | | | (10,668) | | | (7,700) | |

| | | | | | | | | | | | | | |

| Recoveries: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Commercial and industrial | | 130 | | | 90 | | | 84 | | | 261 | | | 125 | | | 220 | | | 375 | |

| Real estate: | | | | | | | | | | | | | | |

| Construction | | — | | | — | | | — | | | 1 | | | — | | | — | | | — | |

| Residential mortgage | | 9 | | | 8 | | | 7 | | | 10 | | | 7 | | | 17 | | | 60 | |

| Home equity | | — | | | 6 | | | 42 | | | — | | | 15 | | | 6 | | | 15 | |

| | | | | | | | | | | | | | |

| Consumer | | 1,254 | | | 893 | | | 720 | | | 982 | | | 703 | | | 2,147 | | | 1,611 | |

| | | | | | | | | | | | | | |

| Total recoveries | | 1,393 | | | 997 | | | 853 | | | 1,254 | | | 850 | | | 2,390 | | | 2,061 | |

Net charge-offs | | (3,755) | | | (4,523) | | | (5,542) | | | (3,858) | | | (3,385) | | | (8,278) | | | (5,639) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Balance at end of period | | $ | 62,225 | | | $ | 63,532 | | | $ | 63,934 | | | $ | 64,517 | | | $ | 63,849 | | | $ | 62,225 | | | $ | 63,849 | |

| | | | | | | | | | | | | | |

| Average loans, net of deferred fees and costs | | $ | 5,385,829 | | | $ | 5,400,558 | | | $ | 5,458,245 | | | $ | 5,507,248 | | | $ | 5,543,398 | | | $ | 5,393,193 | | | $ | 5,534,741 | |

| Ratio of annualized net charge-offs to average loans | | 0.28 | % | | 0.34 | % | | 0.41 | % | | 0.28 | % | | 0.24 | % | | 0.31 | % | | 0.20 | % |

| Ratio of ACL to total loans | | 1.16 | | | 1.18 | | | 1.18 | | | 1.17 | | | 1.16 | | | 1.16 | % | | 1.16 | % |

| | | | | | | | | | | | | | |

|

|

2nd Quarter 2024 Earnings Supplement July 31, 2024

2Central Pacific Financial Corp. Forward-Looking Statements This document may contain forward-looking statements (“FLS”) concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, the payment or nonpayment of dividends, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. (the "Company") or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; statements of future economic performance including anticipated performance results from our business initiatives; or any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believe," "plan," "anticipate," "seek," "expect," "intend," "forecast," "hope," "target," "continue," "remain," "estimate," "will," "should," "may" and other similar expressions are intended to identify FLS but are not the exclusive means of identifying such statements. While we believe that our FLS and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons, including, but not limited to: the effects of inflation and interest rate fluctuations; the adverse effects of recent bank failures and the potential impact of such developments on customer confidence, deposit behavior, liquidity and regulatory responses thereto; the adverse effects of the COVID-19 pandemic virus (and its variants) and other pandemic viruses on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees, as well as the effects of government programs and initiatives in response thereto; supply chain disruptions; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, and earthquakes) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau, government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings and lawsuits we are or may become subject to, or regulatory or other governmental inquiries and proceedings and the resolution thereof; the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulations or regulatory orders or actions we are or may become subject to, and the effect of any recurring or special FDIC assessments; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters and the cost and resources required to implement such changes; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System; securities market and monetary fluctuations, including the impact resulting from the elimination of the London Interbank Offered Rate Index; negative trends in our market capitalization and adverse changes in the price of the Company's common stock; the effects of any acquisitions or dispositions we may make; political instability; acts of war or terrorism; changes in consumer spending, borrowings and savings habits; technological changes and developments; cybersecurity and data privacy breaches and the consequence therefrom; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; our ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; changes in the competitive environment among financial holding companies and other financial service providers; our ability to successfully implement our initiatives to lower our efficiency ratio; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; our ability to successfully implement and achieve the objectives of our Banking-as-a-Service initiatives, including adoption of the initiatives by customers and risks faced by any of our bank collaborations including reputational and regulatory risk; and our success at managing the risks involved in the foregoing items. For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the FLS, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and, in particular, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the FLS contained in this document. FLS speak only as of the date on which such statements are made. We undertake no obligation to update any FLS to reflect events or circumstances after the date on which such statements are made, or to reflect the occurrence of unanticipated events except as required by law.

3Central Pacific Financial Corp. 2nd Quarter 2024 Financial Highlights • Net income of $15.8MM increased 22% from prior quarter • NIM expanded 14 bps sequential quarter • Core deposits grew $16.7MM from prior quarter • TCE ratio improved to 7.0% • Quarterly cash dividend maintained at $0.26 2Q24 1Q24 NET INCOME / DILUTED EPS $15.8MM / $0.58 $12.9MM / $0.48 PRE-PROVISION NET REVENUE (PPNR) $22.9MM $20.9MM RETURN ON ASSETS (ROA) 0.86% 0.70% RETURN ON EQUITY (ROE) 12.42% 10.33% TOTAL LOAN GROWTH/DECLINE -$17.8MM (-0.3%) -$37.6MM (-0.7%) TOTAL DEPOSIT GROWTH/DECLINE -$36.4MM (-0.5%) -$228.7MM (-3.3%) NET INTEREST MARGIN (NIM) 2.97% 2.83% TANGIBLE COMMON EQUITY (TCE) 7.00% 6.83% * Comparison to prior quarter * *

4Central Pacific Financial Corp. Tourism Visitor arrivals compared to pre-pandemic 92% 1 Employment Unemployment Rate June 2024 2.9% 1 FACTORS FOR A FAVORABLE HAWAII OUTLOOK • Maui tourism recovery from Maui wildfires in August 2023 continues with visitor arrivals at 78% of the previous year in June 2024 • Japanese visitor return slowly improving, with counts up 28% from a year ago, yet still at ~50% of pre-pandemic levels • Low unemployment and strong real estate market • Substantial Federal government contracts and military investments • Increase in public and private investments to address housing shortage 1 Source: Hawaii Department of Business, Economic Development & Tourism. Tourism represents total visitor in June 2024 compared to June 2019. 2 Source: Honolulu Board of Realtors. Resilient Hawaii Economy Housing Oahu Median Single- Family Home Price June 2024 $1.1MM 2 1

5Central Pacific Financial Corp. • Conservative growth approach and healthy pipeline in the current environment • Strong and diverse loan portfolio, with nearly 80% secured by real estate • Overall portfolio yield improved 13 bps to 4.80% in the 2Q24 Diversified Loan Portfolio2 1.22 1.34 1.43 1.60 1.69 1.88 1.94 1.93 1.92 1.91 0.88 0.98 1.04 1.12 1.16 1.22 1.36 1.38 1.42 1.47 0.36 0.41 0.47 0.49 0.55 0.64 0.74 0.74 0.73 0.71 0.45 0.47 0.49 0.57 0.48 0.62 0.80 0.63 0.58 0.54 0.51 0.50 0.58 0.57 0.96 0.62 0.55 0.57 0.58 0.58 3.52 3.77 4.08 4.45 4.96 5.10 5.56 5.44 5.40 5.38 - 1.00 2.00 3.00 4.00 5.00 6.00 2016 2017 2018 2019 2020 2021 2022 2023 1Q24 2Q24 $ B il li o n s Loan Portfolio Composition Residential Mortgage Commercial Mortgage Home Equity Consumer Commercial & Industrial Construction

6Central Pacific Financial Corp. Relationship Deposits – Diversified & Granular • 59% of deposits FDIC insured; 64% including collateralized deposits • 55% Commercial (Average account balance of $103,000) / 45% Consumer (Average account balance of $19,000) • 52% Long-tenured customers with CPB 10 years or longer • No brokered deposits 1.39 1.48 1.45 1.60 1.93 2.23 2.20 2.21 2.21 2.23 1.27 1.40 1.44 1.45 1.79 2.29 2.09 1.91 1.85 1.85 0.86 0.93 0.95 1.04 1.18 1.42 1.46 1.33 1.29 1.28 0.39 0.46 0.48 0.50 0.40 0.49 0.70 1.02 1.03 1.03 0.70 0.69 0.63 0.53 0.50 0.21 0.29 0.38 0.24 0.19 4.61 4.96 4.95 5.12 5.80 6.64 6.74 6.85 6.62 6.58 - 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 2016 2017 2018 2019 2020 2021 2022 2023 1Q24 2Q24 $ B il li o n s Deposit Portfolio Composition Savings and Money Market Noninterest-Bearing Demand Interest-Bearing Demand Time Deposits excluding Government Government Time Deposits

7Central Pacific Financial Corp. 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 1Q24 2Q24 Total Deposit Cost CPF Peer average* Fed Funds Deposit Cost Advantage * Public banks $3-10B in total assets as of 1Q24. Source: S&P Global. Cycle-to-date total deposit beta of 24% as of 2Q24 99 bps funding advantage Proven history of funding cost advantage with recent cost stabilization

8Central Pacific Financial Corp. 0.11% 0.12% 0.13% 0.19% 0.19% 0.09% 0.20% 2Q23 3Q23 4Q23 1Q24 2Q24 NPAs/Total Loans 5 * NPA increase relates to 2 Hawaii construction loans to a single borrower that subsequently paid off in full in mid-July 2023. 2Q23 NPAs/Total Loans ratio is 0.11% excluding the 2 Hawaii construction loans mentioned above. Strong credit risk management continues to drive low levels of problem assets * Solid Credit Profile 0.06% 0.05% 0.02% 0.05% 0.05% 2Q23 3Q23 4Q23 1Q24 2Q24 Delinquencies 90+Days/Total Loans 1.34% 1.09% 0.92% 0.56% 0.66% 2Q23 3Q23 4Q23 1Q24 2Q24 Criticized/Total Loans 0.04% 0.05% 0.07% 0.10% 0.08% 0.20% 0.23% 0.34% 0.24% 0.20% 0.24% 0.28% 0.41% 0.34% 0.28% 2Q23 3Q23 4Q23 1Q24 2Q24 Annualized NCO/Avg Loans All Other NCO/Avg Loans Mainland Consumer NCO/Avg Loans

9Central Pacific Financial Corp. • $2.4MM provision for credit loss on loans in 2Q24 driven by net charge-offs, offset by a credit of $0.2MM to the reserve for unfunded commitments, for a total provision for credit loss of $2.2MM • Strong ACL coverage ratio of 1.16% for 2Q24 Note: Totals may not sum due to rounding. Allowance for Credit Losses $ Millions 2Q23 3Q23 4Q23 1Q24 2Q24 Beginning Balance 63.1 63.8 64.5 63.9 63.5 Net Charge-offs (3.4) (3.9) (5.5) (4.5) (3.8) Provision for Credit Losses 4.1 4.5 5.0 4.1 2.4 Ending Balance 63.8 64.5 63.9 63.5 62.2 Coverage Ratio (ACL to Total Loans) 1.16% 1.17% 1.18% 1.18% 1.16%

10Central Pacific Financial Corp. High Quality Securities Portfolio • $1.3B or 17% of total assets • 92% AAA rated • Portfolio mix: AFS 52% / HTM 48% • $29.7MM in investment securities purchased in 2Q24 at weighted average yield of 4.73% • Interest rate swap on $115.5MM of municipal securities started on 3/31/24; added $0.9MM to interest income in 2Q24 (pay fixed at 2.1%, receive float at Fed Funds) U.S. Treasury & Gov't Agency 82% Municipals 12% Non-Agency CMBS/RMBS 2% Corporate 3% Other 1% Investment Portfolio Composition as of June 30, 2024

11Central Pacific Financial Corp. • Ample alternative sources of liquidity available • Available sources of liquidity total 121% of uninsured/uncollateralized deposits Available Sources of Liquidity $ Millions June 30, 2024 Cash on Balance Sheet 299 Other Funding Sources: Unpledged Securities 509 FHLB Available Borrowing Capacity 1,739 FRB Available Borrowing Capacity 238 Other Funding Lines 75 Total 2,561 Total Sources of Liquidity 2,860 Uninsured/Uncollateralized Deposits 2,367 % of Uninsured/Uncollateralized Deposits 121%

121Central Pacific Financial Corp. 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Tier 1 Leverage CET1 Total Capital Regulatory Capital Ratios As June 30, 2024 Regulatory Minimum Well-Capitalized CPF Solid Capital Position 9.3% $270MM capital cushion to well capitalized minimum 11.9% 15.1% STRONG CAPITAL AND SHAREHOLDER RETURN • TCE ratio of 7.0% and CET1 ratio of 11.9% both increasing with retained earnings • Maintained quarterly cash dividend at $0.26 per share which will be payable on September 16, 2024 • No shares repurchased in the 2Q24. $19.1MM remaining available authorization under the share repurchase program $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 2016 2017 2018 2019 2020 2021 2022 2023 2024 Cash Dividends Declared per Common Share * * Annualized

13Central Pacific Financial Corp. Appendix

14Central Pacific Financial Corp. Commercial Real Estate Portfolio OFFICE RETAIL TOTAL BALANCE $174.2MM $296.0MM % OF TOTAL CRE 12% 20% % OF TOTAL LOANS 3% 6% WA LTV 55% 65% WA MONTHS TO MATURITY 69 65 INVESTOR / OWNER-OCCUPIED $129.1MM / $45.1MM $218.5MM / $77.5MM • Hawaii 79% / Mainland 21% • Investor 76% / Owner-Occupied 24% Industrial/ Warehouse 27% Retail 20% Apartment 20% Office 12% Hotel 11% Other 5% Shopping Center 3% Storage 2% CRE Portfolio Composition as of June 30, 2024

15Central Pacific Financial Corp. • Total Hawaii Consumer $287MM / Total Mainland Consumer $255MM • Weighted average origination FICO: • 744 for Hawaii Consumer • 737 for Mainland Consumer • Consumer net charge-offs peaked in 4Q23 and declined for 2 consecutive quarters in 2024 thus far • Mainland Unsecured: Highly granular with average loan amounts of $12,000 Consumer Loan Portfolio HI Auto $161 , 30% HI Other $126 , 23% Mainland Home Improvement $103 , 19% Mainland Unsecured $69 , 13% Mainland Auto $83 , 15% Consumer Portfolio Composition as of June 30, 2024 ($ Millions)

16Central Pacific Financial Corp. CPB Named Best Bank in Hawaii by Newsweek, Forbes, and Honolulu Star-Advertiser • Newsweek’s Best In State Bank 2024 • Forbes’ Best-In-State Banks 2024 • Forbes’ America’s Best Banks 2024 • Honolulu Star-Advertiser’s Best Bank in Hawaii 2024

17Central Pacific Financial Corp. Environmental, Social & Governance (ESG) Focus 2023 ESG Report available here: https://www.cpb.bank/esg

18Central Pacific Financial Corp. Mahalo

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |