Highlights include:

- Net income of $15.8 million, or $0.58 per diluted share, an

increase of 22.2% compared to the $12.9 million earned in the

previous quarter

- Net interest margin of 2.97% increased by 14 bps from 2.83%

in the previous quarter

- Total loans of $5.38 billion decreased by $17.8 million from

the previous quarter

- Core deposits of $5.91 billion increased by $16.7 million

from the previous quarter. Total deposits of $6.58 billion

decreased by $36.4 million from the previous quarter, which

included a decrease in government time deposits of $41.6

million.

- Net charge-offs of $3.8 million decreased by $0.8 million

from the previous quarter

- Total risk-based capital and common equity tier 1 ratios of

15.1% and 11.9%, respectively

- The CPF Board of Directors approved a quarterly cash

dividend of $0.26 per share

Central Pacific Financial Corp. (NYSE: CPF) (the "Company"),

parent company of Central Pacific Bank (the "Bank" or "CPB"), today

reported net income of $15.8 million, or fully diluted earnings per

share ("EPS") of $0.58 for the second quarter of 2024, compared to

net income of $12.9 million, or EPS of $0.48 in the previous

quarter and net income of $14.5 million, or EPS of $0.53 in the

year-ago quarter.

"We continue to navigate the current environment and positive

trends are developing. We are pleased with our strong second

quarter financial results, which included the highest net income in

our last five quarters," said Arnold Martines, Chairman, President

and Chief Executive Officer. "Key contributors included NIM

expansion of 14 bps, core deposit growth and improvement in net

charge-offs. At the same time, we maintained solid liquidity and

grew our capital levels further."

"We were recently recognized by Forbes Magazine as one of

America’s Best Banks as well as the Best-In-State Bank for Hawaii

in 2024. We are humbled by this recognition, proud of our

employees, and thankful to our customers for the trust they place

in Central Pacific Bank," Martines said.

The Board of Directors has also appointed Mr. Martines as

Chairman of the Board of the Company and the Bank. Mr. Martines

replaces Ms. A. Catherine Ngo who continues to serve as a member of

the Board of Directors of the Company and the Bank.

Earnings Highlights

Net interest income was $51.9 million for the second quarter of

2024, which increased by $1.7 million, or 3.5% from the previous

quarter, and decreased by $0.8 million, or 1.5% from the year-ago

quarter. Net interest margin ("NIM") was 2.97% for the second

quarter of 2024, an increase of 14 basis points ("bp" or "bps")

from the previous quarter and 1 bp from the year-ago quarter. The

sequential quarter increase in net interest income and NIM was

primarily due to higher average yields earned on investment

securities and loans, while interest-bearing liability costs

remained relatively stable. The higher average yield earned on

investment securities includes $0.9 million in income from an

interest rate swap that became effective on March 31, 2024.

The Company recorded a provision for credit losses of $2.2

million in the second quarter of 2024, compared to a provision of

$3.9 million in the previous quarter and a provision of $4.3

million in the year-ago quarter. The provision in the second

quarter consisted of a provision for credit losses on loans of $2.4

million and a credit to the provision for off-balance sheet

exposures of $0.2 million.

Other operating income totaled $12.1 million for the second

quarter of 2024, compared to $11.2 million in the previous quarter

and $10.4 million in the year-ago quarter. The higher other

operating income was primarily due to higher mortgage banking

income of $0.4 million and higher investment services fees of $0.6

million (included in other service charges and fees).

Other operating expense totaled $41.2 million for the second

quarter of 2024, compared to $40.6 million in the previous quarter

and $39.9 million in the year-ago quarter. The higher other

operating expense was primarily due to higher salaries and employee

benefits.

The efficiency ratio was 64.26% for the second quarter of 2024,

compared to 66.05% in the previous quarter and 63.17% in the

year-ago quarter.

The effective tax rate was 23.4% for the second quarter of 2024,

compared to 23.5% in the previous quarter and 23.6% in the year-ago

quarter.

Balance Sheet Highlights

Total assets of $7.39 billion at June 30, 2024 decreased by

$23.0 million, or 0.3% from $7.41 billion at March 31, 2024, and

decreased by $180.6 million, or 2.4% from $7.57 billion at June 30,

2023. The Company had $298.9 million in cash on its balance sheet

and $2.56 billion in total other liquidity sources, including

available borrowing capacity and unpledged investment securities at

June 30, 2024. Total available sources of liquidity as a percentage

of uninsured and uncollateralized deposits was 121% at June 30,

2024, compared to 118% at March 31, 2024 and 128% at June 30, 2023.

During the second quarter of 2024, excess balance sheet liquidity

was used to pay off $41.6 million in higher cost government time

deposits.

Total loans, net of deferred fees and costs, of $5.38 billion at

June 30, 2024 decreased by $17.8 million, or 0.3% from $5.40

billion at March 31, 2024, and decreased by $137.0 million, or 2.5%

from $5.52 billion at June 30, 2023. Average yields earned on loans

during the second quarter of 2024 was 4.80%, compared to 4.67% in

the previous quarter and 4.37% in the year-ago quarter.

Total deposits of $6.58 billion at June 30, 2024 decreased by

$36.4 million or 0.5% from $6.62 billion at March 31, 2024, and

decreased by $223.3 million, or 3.3% from $6.81 billion at June 30,

2023. Core deposits, which include demand deposits, savings and

money market deposits and time deposits up to $250,000, totaled

$5.91 billion at June 30, 2024, and increased by $16.7 million, or

0.3% from $5.90 billion at March 31, 2024. Average rates paid on

total deposits during the second quarter of 2024 was 1.33%,

compared to 1.32% in the previous quarter and 0.84% in the year-ago

quarter. Approximately 64%, 65% and 65% of the Company's total

deposits were FDIC-insured or fully collateralized at June 30,

2024, March 31, 2024 and June 30, 2023, respectively.

Asset Quality

Nonperforming assets totaled $10.3 million, or 0.14% of total

assets at June 30, 2024, compared to $10.1 million, or 0.14% of

total assets at March 31, 2024 and $11.1 million, or 0.15% of total

assets at June 30, 2023.

Net charge-offs totaled $3.8 million in the second quarter of

2024, compared to net charge-offs of $4.5 million in the previous

quarter, and net charge-offs of $3.4 million in the year-ago

quarter. Annualized net charge-offs as a percentage of average

loans was 0.28%, 0.34% and 0.24% during the three months ended June

30, 2024, March 31, 2024 and June 30, 2023, respectively.

The allowance for credit losses, as a percentage of total loans

was 1.16% at June 30, 2024, compared to 1.18% at March 31, 2024,

and 1.16% at June 30, 2023.

Capital

Total shareholders' equity was $518.6 million at June 30, 2024,

compared to $507.2 million and $476.3 million at March 31, 2024 and

June 30, 2023, respectively.

During the second quarter of 2024, the Company did not

repurchase any shares of common stock. As of June 30, 2024, $19.1

million in share repurchase authorization remained available under

the Company's share repurchase program.

The Company's leverage, tier 1 risk-based capital, total

risk-based capital, and common equity tier 1 capital ratios were

9.3%, 12.8%, 15.1%, and 11.9%, respectively, at June 30, 2024,

compared to 9.0%, 12.6%, 14.8%, and 11.6%, respectively, at March

31, 2024.

On July 30, 2024, the Company's Board of Directors declared a

quarterly cash dividend of $0.26 per share on its outstanding

common shares. The dividend will be payable on September 16, 2024

to shareholders of record at the close of business on August 30,

2024.

Conference Call

The Company's management will host a conference call today at

1:00 p.m. Eastern Time (7:00 a.m. Hawaii Time) to discuss the

quarterly results. Individuals are encouraged to listen to the live

webcast of the presentation by visiting the investor relations page

of the Company's website at http://ir.cpb.bank. Alternatively,

investors may participate in the live call by dialing

1-800-715-9871 (conference ID: 9836028). A playback of the call

will be available through August 30, 2024 by dialing 1-800-770-2030

(playback ID: 9836028) and on the Company's website. Information

which may be discussed in the conference call is provided in an

earnings supplement presentation on the Company's website at

http://ir.cpb.bank.

About Central Pacific Financial Corp.

Central Pacific Financial Corp. is a Hawaii-based bank holding

company with approximately $7.39 billion in assets as of June 30,

2024. Central Pacific Bank, its primary subsidiary, operates 27

branches and 55 ATMs in the State of Hawaii. For additional

information, please visit the Company's website at

http://www.cpb.bank.

Equal Housing Lender Member FDIC NYSE Listed: CPF

Forward-Looking Statements

This document may contain forward-looking statements ("FLS")

concerning: projections of revenues, expenses, income or loss,

earnings or loss per share, capital expenditures, payment or

nonpayment of dividends, capital position, credit losses, net

interest margin or other financial items; statements of plans,

objectives and expectations of Central Pacific Financial Corp. (the

"Company") or its management or Board of Directors, including those

relating to business plans, use of capital resources, products or

services and regulatory developments and regulatory actions;

statements of future economic performance including anticipated

performance results from our business initiatives; or any

statements of the assumptions underlying or relating to any of the

foregoing. Words such as "believe," "plan," "anticipate," "seek,"

"expect," "intend," "forecast," "hope," "target," "continue,"

"remain," "estimate," "will," "should," "may" and other similar

expressions are intended to identify FLS but are not the exclusive

means of identifying such statements.

While we believe that our FLS and the assumptions underlying

them are reasonably based, such statements and assumptions are by

their nature subject to risks and uncertainties, and thus could

later prove to be inaccurate or incorrect. Accordingly, actual

results could differ materially from those statements or

projections for a variety of reasons, including, but not limited

to: the effects of inflation and interest rate fluctuations; the

adverse effects of recent bank failures and the potential impact of

such developments on customer confidence, deposit behavior,

liquidity and regulatory responses thereto; the adverse effects of

the COVID-19 pandemic virus (and its variants) and other pandemic

viruses on local, national and international economies, including,

but not limited to, the adverse impact on tourism and construction

in the State of Hawaii, our borrowers, customers, third-party

contractors, vendors and employees, as well as the effects of

government programs and initiatives in response thereto; supply

chain disruptions; the increase in inventory or adverse conditions

in the real estate market and deterioration in the construction

industry; adverse changes in the financial performance and/or

condition of our borrowers and, as a result, increased loan

delinquency rates, deterioration in asset quality, and losses in

our loan portfolio; the impact of local, national, and

international economies and events (including natural disasters

such as wildfires, volcanic eruptions, hurricanes, tsunamis,

storms, and earthquakes) on the Company's business and operations

and on tourism, the military, and other major industries operating

within the Hawaii market and any other markets in which the Company

does business; deterioration or malaise in domestic economic

conditions, including any destabilization in the financial industry

and deterioration of the real estate market, as well as the impact

of declining levels of consumer and business confidence in the

state of the economy in general and in financial institutions in

particular; changes in estimates of future reserve requirements

based upon the periodic review thereof under relevant regulatory

and accounting requirements; the impact of the Dodd-Frank Wall

Street Reform and Consumer Protection Act, changes in capital

standards, other regulatory reform and federal and state

legislation, including but not limited to regulations promulgated

by the Consumer Financial Protection Bureau, government-sponsored

enterprise reform, and any related rules and regulations which

affect our business operations and competitiveness; the costs and

effects of legal and regulatory developments, including legal

proceedings and lawsuits we are or may become subject to, or

regulatory or other governmental inquiries and proceedings and the

resolution thereof; the results of regulatory examinations or

reviews and the effect of, and our ability to comply with, any

regulations or regulatory orders or actions we are or may become

subject to, and the effect of any recurring or special FDIC

assessments; the effect of changes in accounting policies and

practices, as may be adopted by the regulatory agencies, as well as

the Public Company Accounting Oversight Board, the Financial

Accounting Standards Board and other accounting standard setters

and the cost and resources required to implement such changes; the

effects of and changes in trade, monetary and fiscal policies and

laws, including the interest rate policies of the Board of

Governors of the Federal Reserve System; securities market and

monetary fluctuations, including the impact resulting from the

elimination of the London Interbank Offered Rate Index; negative

trends in our market capitalization and adverse changes in the

price of the Company's common stock; the effects of any

acquisitions or dispositions we may make; political instability;

acts of war or terrorism; changes in consumer spending, borrowings

and savings habits; technological changes and developments;

cybersecurity and data privacy breaches and the consequence

therefrom; failure to maintain effective internal control over

financial reporting or disclosure controls and procedures; our

ability to address deficiencies in our internal controls over

financial reporting or disclosure controls and procedures; changes

in the competitive environment among financial holding companies

and other financial service providers; our ability to successfully

implement our initiatives to lower our efficiency ratio; our

ability to attract and retain key personnel; changes in our

personnel, organization, compensation and benefit plans; our

ability to successfully implement and achieve the objectives of our

Banking-as-a-Service initiatives, including adoption of the

initiatives by customers and risks faced by any of our bank

collaborations including reputational and regulatory risk; and our

success at managing the risks involved in the foregoing items.

For further information with respect to factors that could cause

actual results to materially differ from the expectations or

projections stated in the FLS, please see the Company's publicly

available Securities and Exchange Commission filings, including the

Company's Form 10-K for the last fiscal year and, in particular,

the discussion of "Risk Factors" set forth therein. We urge

investors to consider all of these factors carefully in evaluating

the FLS contained in this document. FLS speak only as of the date

on which such statements are made. We undertake no obligation to

update any FLS to reflect events or circumstances after the date on

which such statements are made, or to reflect the occurrence of

unanticipated events except as required by law.

CENTRAL PACIFIC FINANCIAL CORP. AND

SUBSIDIARIES

Financial Highlights

(Unaudited)

TABLE 1

Three Months Ended

Six Months Ended

(Dollars in thousands,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Jun 30,

Jun 30,

except for per share amounts)

2024

2024

2023

2023

2023

2024

2023

CONDENSED INCOME STATEMENT

Net interest income

$

51,921

$

50,187

$

51,142

$

51,928

$

52,734

$

102,108

$

106,930

Provision for credit losses

2,239

3,936

4,653

4,874

4,319

6,175

6,171

Total other operating income

12,121

11,244

15,172

10,047

10,435

23,365

21,444

Total other operating expense

41,151

40,576

42,522

39,611

39,903

81,727

82,010

Income tax expense

4,835

3,974

4,273

4,349

4,472

8,809

9,531

Net income

15,817

12,945

14,866

13,141

14,475

28,762

30,662

Basic earnings per share

$

0.58

$

0.48

$

0.55

$

0.49

$

0.54

$

1.06

$

1.14

Diluted earnings per share

0.58

0.48

0.55

0.49

0.53

1.06

1.13

Dividends declared per share

0.26

0.26

0.26

0.26

0.26

0.52

0.52

PERFORMANCE RATIOS

Return on average assets (ROA) [1]

0.86

%

0.70

%

0.79

%

0.70

%

0.78

%

0.78

%

0.82

%

Return on average shareholders’ equity

(ROE) [1]

12.42

10.33

12.55

10.95

12.12

11.38

13.03

Average shareholders’ equity to average

assets

6.94

6.73

6.32

6.39

6.40

6.83

6.31

Efficiency ratio [2]

64.26

66.05

64.12

63.91

63.17

65.14

63.88

Net interest margin (NIM) [1]

2.97

2.83

2.84

2.88

2.96

2.90

3.02

Dividend payout ratio [3]

44.83

54.17

47.27

53.06

49.06

49.06

46.02

SELECTED AVERAGE BALANCES

Average loans, including loans held for

sale

$

5,385,829

$

5,400,558

$

5,458,245

$

5,507,248

$

5,543,398

$

5,393,193

$

5,534,741

Average interest-earning assets

7,032,515

7,140,264

7,208,613

7,199,866

7,155,606

7,086,389

7,134,111

Average assets

7,338,714

7,449,661

7,498,097

7,510,537

7,463,629

7,394,188

7,453,753

Average deposits

6,542,767

6,659,812

6,730,883

6,738,071

6,674,650

6,601,290

6,665,208

Average interest-bearing liabilities

4,910,998

5,009,542

5,023,321

4,999,820

4,908,120

4,960,270

4,864,633

Average shareholders’ equity

509,507

501,120

473,708

480,118

477,711

505,314

470,673

[1]

ROA and ROE are annualized based

on a 30/360 day convention. Annualized net interest income and

expense in the NIM calculation are based on the day count interest

payment conventions at the interest-earning asset or

interest-bearing liability level (i.e. 30/360, actual/actual).

[2]

Efficiency ratio is defined as

total other operating expense divided by total revenue (net

interest income and total other operating income).

[3]

Dividend payout ratio is defined

as dividends declared per share divided by diluted earnings per

share.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Financial Highlights

(Unaudited)

TABLE 1 (CONTINUED)

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Jun 30,

2024

2024

2023

2023

2023

REGULATORY CAPITAL RATIOS

Central Pacific Financial Corp.

Leverage ratio

9.3

%

9.0

%

8.8

%

8.7

%

8.7

%

Tier 1 risk-based capital ratio

12.8

12.6

12.4

11.9

11.8

Total risk-based capital ratio

15.1

14.8

14.6

14.1

13.9

Common equity tier 1 capital ratio

11.9

11.6

11.4

11.0

10.9

Central Pacific Bank

Leverage ratio

9.6

9.4

9.2

9.1

9.1

Tier 1 risk-based capital ratio

13.3

13.1

12.9

12.4

12.3

Total risk-based capital ratio

14.5

14.3

14.1

13.7

13.5

Common equity tier 1 capital ratio

13.3

13.1

12.9

12.4

12.3

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Jun 30,

(dollars in thousands, except for per

share amounts)

2024

2024

2023

2023

2023

BALANCE SHEET

Total loans, net of deferred fees and

costs

$

5,383,644

$

5,401,417

$

5,438,982

$

5,508,710

$

5,520,683

Total assets

7,386,952

7,409,999

7,642,796

7,637,924

7,567,592

Total deposits

6,582,455

6,618,854

6,847,592

6,874,745

6,805,737

Long-term debt

156,223

156,163

156,102

156,041

155,981

Total shareholders’ equity

518,647

507,203

503,815

468,598

476,279

Total shareholders’ equity to total

assets

7.02

%

6.84

%

6.59

%

6.14

%

6.29

%

ASSET QUALITY

Allowance for credit losses (ACL)

$

62,225

$

63,532

$

63,934

$

64,517

$

63,849

Nonaccrual loans

10,257

10,132

7,008

6,652

11,061

Non-performing assets (NPA)

10,257

10,132

7,008

6,652

11,061

Ratio of ACL to total loans

1.16

%

1.18

%

1.18

%

1.17

%

1.16

%

Ratio of NPA to total assets

0.14

%

0.14

%

0.09

%

0.09

%

0.15

%

PER SHARE OF COMMON STOCK OUTSTANDING

Book value per common share

$

19.16

$

18.76

$

18.63

$

17.33

$

17.61

Closing market price per common share

21.20

19.75

19.68

16.68

15.71

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited)

TABLE 2

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Jun 30,

(Dollars in thousands, except share

data)

2024

2024

2023

2023

2023

ASSETS

Cash and due from financial

institutions

$

103,829

$

98,410

$

116,181

$

108,818

$

129,071

Interest-bearing deposits in other

financial institutions

195,062

214,472

406,256

329,913

181,913

Investment securities:

Available-for-sale debt securities, at

fair value

676,719

660,833

647,210

625,253

664,071

Held-to-maturity debt securities, at

amortized cost; fair value of: $528,088 at June 30, 2024, $541,685

at March 31, 2024, $565,178 at December 31, 2023, $531,887 at

September 30, 2023, and $581,222 at June 30, 2023

615,867

624,948

632,338

640,053

649,946

Total investment securities

1,292,586

1,285,781

1,279,548

1,265,306

1,314,017

Loans held for sale

3,950

755

1,778

—

2,593

Loans, net of deferred fees and costs

5,383,644

5,401,417

5,438,982

5,508,710

5,520,683

Less: allowance for credit losses

(62,225

)

(63,532

)

(63,934

)

(64,517

)

(63,849

)

Loans, net of allowance for credit

losses

5,321,419

5,337,885

5,375,048

5,444,193

5,456,834

Premises and equipment, net

100,646

97,688

96,184

97,378

96,479

Accrued interest receivable

23,184

21,957

21,511

21,529

20,463

Investment in unconsolidated entities

40,155

40,780

41,546

42,523

45,218

Mortgage servicing rights

8,636

8,599

8,696

8,797

8,843

Bank-owned life insurance

173,716

172,228

170,706

168,543

168,136

Federal Home Loan Bank of Des Moines

("FHLB") stock

6,925

6,921

6,793

10,995

10,960

Right-of-use lease assets

32,081

32,079

29,720

32,294

33,247

Other assets

84,763

92,444

88,829

107,635

99,818

Total assets

$

7,386,952

$

7,409,999

$

7,642,796

$

7,637,924

$

7,567,592

LIABILITIES

Deposits:

Noninterest-bearing demand

$

1,847,173

$

1,848,554

$

1,913,379

$

1,969,523

$

2,009,387

Interest-bearing demand

1,283,669

1,290,321

1,329,189

1,345,843

1,359,978

Savings and money market

2,234,111

2,211,966

2,209,733

2,209,550

2,184,652

Time

1,217,502

1,268,013

1,395,291

1,349,829

1,251,720

Total deposits

6,582,455

6,618,854

6,847,592

6,874,745

6,805,737

Long-term debt, net of unamortized debt

issuance costs of: $324 at June 30, 2024, $384 at March 31, 2024,

$445 at December 31, 2023, $506 at September 30, 2023 and $566 at

June 30, 2023

156,223

156,163

156,102

156,041

155,981

Lease liabilities

33,422

33,169

30,634

33,186

34,111

Accrued interest payable

14,998

16,654

18,948

16,752

11,402

Other liabilities

81,207

77,956

85,705

88,602

84,082

Total liabilities

6,868,305

6,902,796

7,138,981

7,169,326

7,091,313

EQUITY

Shareholders' equity:

Preferred stock, no par value, authorized

1,000,000 shares; issued and outstanding: none at June 30, 2024,

March 31, 2024, December 31, 2023, September 30, 2023, and June 30,

2023

—

—

—

—

—

Common stock, no par value, authorized

185,000,000 shares; issued and outstanding: 27,063,644 at June 30,

2024, 27,042,326 at March 31, 2024, 27,045,033 at December 31,

2023, 27,043,169 at September 30, 2023, and 27,045,792 at June 30,

2023

404,494

404,494

405,439

405,439

405,511

Additional paid-in capital

104,161

103,130

102,982

102,550

101,997

Retained earnings

132,683

123,902

117,990

110,156

104,046

Accumulated other comprehensive loss

(122,691

)

(124,323

)

(122,596

)

(149,547

)

(135,275

)

Total shareholders' equity

518,647

507,203

503,815

468,598

476,279

Total liabilities and equity

$

7,386,952

$

7,409,999

$

7,642,796

$

7,637,924

$

7,567,592

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Consolidated Statements of

Income

(Unaudited)

TABLE 3

Three Months Ended

Six Months Ended

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Jun 30,

Jun 30,

(Dollars in thousands, except per share

data)

2024

2024

2023

2023

2023

2024

2023

Interest income:

Interest and fees on loans

$

64,422

$

62,819

$

62,429

$

62,162

$

60,455

$

127,241

$

118,724

Interest and dividends on investment

securities:

Taxable investment securities

8,466

7,211

7,292

7,016

7,145

15,677

14,481

Tax-exempt investment securities

598

655

686

709

727

1,253

1,517

Interest on deposits in other financial

institutions

2,203

3,611

3,597

2,412

877

5,814

1,154

Dividend income on FHLB stock

151

106

109

113

120

257

256

Total interest income

75,840

74,402

74,113

72,412

69,324

150,242

136,132

Interest expense:

Interest on deposits:

Interest-bearing demand

490

499

467

460

411

989

774

Savings and money market

8,977

8,443

7,459

6,464

4,670

17,420

8,056

Time

12,173

12,990

12,741

11,268

8,932

25,163

15,196

Interest on short-term borrowings

1

—

—

—

378

1

1,139

Interest on long-term debt

2,278

2,283

2,304

2,292

2,199

4,561

4,037

Total interest expense

23,919

24,215

22,971

20,484

16,590

48,134

29,202

Net interest income

51,921

50,187

51,142

51,928

52,734

102,108

106,930

Provision for credit losses

2,239

3,936

4,653

4,874

4,319

6,175

6,171

Net interest income after provision for

credit losses

49,682

46,251

46,489

47,054

48,415

95,933

100,759

Other operating income:

Mortgage banking income

1,040

613

611

765

690

1,653

1,216

Service charges on deposit accounts

2,135

2,103

2,312

2,193

2,137

4,238

4,248

Other service charges and fees

5,869

5,261

5,349

5,203

4,994

11,130

9,979

Income from fiduciary activities

1,449

1,435

1,272

1,234

1,068

2,884

2,389

Income from bank-owned life insurance

1,234

1,522

2,015

379

1,185

2,756

2,476

Net loss on sales of investment

securities

—

—

(1,939

)

(135

)

—

—

—

Other

394

310

5,552

408

361

704

1,136

Total other operating income

12,121

11,244

15,172

10,047

10,435

23,365

21,444

Other operating expense:

Salaries and employee benefits

21,246

20,735

20,164

19,015

20,848

41,981

42,871

Net occupancy

4,597

4,600

4,676

4,725

4,310

9,197

8,784

Computer software

4,381

4,287

4,026

4,473

4,621

8,668

9,227

Legal and professional services

2,506

2,320

2,245

2,359

2,469

4,826

5,355

Equipment

995

1,010

968

1,112

932

2,005

1,878

Advertising

901

914

1,045

968

942

1,815

1,875

Communication

657

837

632

809

791

1,494

1,569

Other

5,868

5,873

8,766

6,150

4,990

11,741

10,451

Total other operating expense

41,151

40,576

42,522

39,611

39,903

81,727

82,010

Income before income taxes

20,652

16,919

19,139

17,490

18,947

37,571

40,193

Income tax expense

4,835

3,974

4,273

4,349

4,472

8,809

9,531

Net income

$

15,817

$

12,945

$

14,866

$

13,141

$

14,475

$

28,762

$

30,662

Per common share data:

Basic earnings per share

$

0.58

$

0.48

$

0.55

$

0.49

$

0.54

$

1.06

$

1.14

Diluted earnings per share

0.58

0.48

0.55

0.49

0.53

1.06

1.13

Cash dividends declared

0.26

0.26

0.26

0.26

0.26

0.52

0.52

Basic weighted average shares

outstanding

27,053,549

27,046,525

27,044,121

27,042,762

27,024,043

27,050,037

27,011,659

Diluted weighted average shares

outstanding

27,116,349

27,099,101

27,097,285

27,079,484

27,071,478

27,106,267

27,090,258

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Average Balances, Interest Income &

Expense, Yields and Rates (Taxable Equivalent)

(Unaudited)

TABLE 4

Three Months Ended

Three Months Ended

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Average

Average

Average

Average

Average

Average

(Dollars in thousands)

Balance

Yield/Rate

Interest

Balance

Yield/Rate

Interest

Balance

Yield/Rate

Interest

ASSETS

Interest-earning assets:

Interest-bearing deposits in other

financial institutions

$

162,393

5.46

%

$

2,203

$

265,418

5.47

%

$

3,611

$

69,189

5.08

%

$

877

Investment securities:

Taxable

1,335,100

2.54

8,466

1,324,657

2.18

7,211

1,379,319

2.07

7,145

Tax-exempt [1]

142,268

2.13

757

142,830

2.32

829

151,979

2.42

920

Total investment securities

1,477,368

2.50

9,223

1,467,487

2.19

8,040

1,531,298

2.11

8,065

Loans, including loans held for sale

5,385,829

4.80

64,422

5,400,558

4.67

62,819

5,543,398

4.37

60,455

FHLB stock

6,925

8.71

151

6,801

6.24

106

11,721

4.10

120

Total interest-earning assets

7,032,515

4.34

75,999

7,140,264

4.19

74,576

7,155,606

3.89

69,517

Noninterest-earning assets

306,199

309,397

308,023

Total assets

$

7,338,714

$

7,449,661

$

7,463,629

LIABILITIES AND EQUITY

Interest-bearing liabilities:

Interest-bearing demand deposits

$

1,273,901

0.15

%

$

490

$

1,296,865

0.15

%

$

499

$

1,367,878

0.12

%

$

411

Savings and money market deposits

2,221,754

1.63

8,977

2,218,250

1.53

8,443

2,172,680

0.86

4,670

Time deposits up to $250,000

555,809

3.29

4,548

544,279

3.21

4,339

390,961

1.82

1,770

Time deposits over $250,000

703,280

4.36

7,625

794,019

4.38

8,651

790,864

3.63

7,162

Total interest-bearing deposits

4,754,744

1.83

21,640

4,853,413

1.82

21,932

4,722,383

1.19

14,013

FHLB advances and other short-term

borrowings

66

5.60

1

—

—

—

29,791

5.09

378

Long-term debt

156,188

5.86

2,278

156,129

5.88

2,283

155,946

5.65

2,199

Total interest-bearing liabilities

4,910,998

1.96

23,919

5,009,542

1.94

24,215

4,908,120

1.36

16,590

Noninterest-bearing deposits

1,788,023

1,806,399

1,952,267

Other liabilities

130,186

132,600

125,531

Total liabilities

6,829,207

6,948,541

6,985,918

Total equity

509,507

501,120

477,711

Total liabilities and equity

$

7,338,714

$

7,449,661

$

7,463,629

Net interest income

$

52,080

$

50,361

$

52,927

Interest rate spread

2.38

%

2.25

%

2.53

%

Net interest margin

2.97

%

2.83

%

2.96

%

[1]

Interest income and resultant

yield information for tax-exempt investment securities is expressed

on a taxable-equivalent basis using a federal statutory tax rate of

21%.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Average Balances, Interest Income &

Expense, Yields and Rates (Taxable Equivalent)

(Unaudited)

TABLE 5

Six Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

Average

Average

Average

Average

(Dollars in thousands)

Balance

Yield/Rate

Interest

Balance

Yield/Rate

Interest

ASSETS

Interest-earning assets:

Interest-bearing deposits in other

financial institutions

$

213,905

5.47

%

$

5,814

$

47,195

4.93

%

$

1,154

Investment securities:

Taxable

1,329,879

2.36

15,677

1,387,606

2.09

14,481

Tax-exempt [1]

142,549

2.23

1,586

152,520

2.52

1,920

Total investment securities

1,472,428

2.34

17,263

1,540,126

2.13

16,401

Loans, including loans held for sale

5,393,193

4.74

127,241

5,534,741

4.32

118,724

FHLB stock

6,863

7.49

257

12,049

4.26

256

Total interest-earning assets

7,086,389

4.26

150,575

7,134,111

3.85

136,535

Noninterest-earning assets

307,799

319,642

Total assets

$

7,394,188

$

7,453,753

LIABILITIES AND EQUITY

Interest-bearing liabilities:

Interest-bearing demand deposits

$

1,285,383

0.15

%

$

989

$

1,391,386

0.11

%

$

774

Savings and money market deposits

2,220,002

1.58

17,420

2,177,783

0.75

8,056

Time deposits up to $250,000

550,044

3.25

8,887

366,316

1.60

2,907

Time deposits over $250,000

748,649

4.37

16,276

740,428

3.35

12,289

Total interest-bearing deposits

4,804,078

1.82

43,572

4,675,913

1.04

24,026

FHLB advances and other short-term

borrowings

33

5.60

1

47,031

4.88

1,139

Long-term debt

156,159

5.87

4,561

141,689

5.75

4,037

Total interest-bearing liabilities

4,960,270

1.95

48,134

4,864,633

1.21

29,202

Noninterest-bearing deposits

1,797,212

1,989,295

Other liabilities

131,392

129,152

Total liabilities

6,888,874

6,983,080

Total equity

505,314

470,673

Total liabilities and equity

$

7,394,188

$

7,453,753

Net interest income

$

102,441

$

107,333

Interest rate spread

2.31

%

2.64

%

Net interest margin

2.90

%

3.02

%

[1]

Interest income and resultant

yield information for tax-exempt investment securities is expressed

on a taxable-equivalent basis using a federal statutory tax rate of

21%.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Loans by Geographic

Distribution

(Unaudited)

TABLE 6

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Jun 30,

(Dollars in thousands)

2024

2024

2023

2023

2023

HAWAII:

Commercial and industrial

$

415,538

$

420,009

$

421,736

$

406,433

$

374,601

Real estate:

Construction

147,657

145,213

163,337

174,057

168,012

Residential mortgage

1,913,177

1,924,889

1,927,789

1,930,740

1,942,906

Home equity

706,811

729,210

736,524

753,980

750,760

Commercial mortgage

1,150,703

1,103,174

1,063,969

1,045,625

1,037,826

Consumer

287,295

306,563

322,346

338,248

327,790

Total loans, net of deferred fees and

costs

4,621,181

4,629,058

4,635,701

4,649,083

4,601,895

Less: Allowance for credit losses

(47,902

)

(48,739

)

(48,189

)

(48,105

)

(44,828

)

Loans, net of allowance for credit

losses

$

4,573,279

$

4,580,319

$

4,587,512

$

4,600,978

$

4,557,067

U.S. MAINLAND: [1]

Commercial and industrial

$

169,318

$

156,087

$

153,971

$

157,373

$

170,557

Real estate:

Construction

23,865

23,356

22,182

37,455

32,807

Commercial mortgage

314,667

319,088

318,933

319,802

329,736

Consumer

254,613

273,828

308,195

344,997

385,688

Total loans, net of deferred fees and

costs

762,463

772,359

803,281

859,627

918,788

Less: Allowance for credit losses

(14,323

)

(14,793

)

(15,745

)

(16,412

)

(19,021

)

Loans, net of allowance for credit

losses

$

748,140

$

757,566

$

787,536

$

843,215

$

899,767

TOTAL:

Commercial and industrial

$

584,856

$

576,096

$

575,707

$

563,806

$

545,158

Real estate:

Construction

171,522

168,569

185,519

211,512

200,819

Residential mortgage

1,913,177

1,924,889

1,927,789

1,930,740

1,942,906

Home equity

706,811

729,210

736,524

753,980

750,760

Commercial mortgage

1,465,370

1,422,262

1,382,902

1,365,427

1,367,562

Consumer

541,908

580,391

630,541

683,245

713,478

Total loans, net of deferred fees and

costs

5,383,644

5,401,417

5,438,982

5,508,710

5,520,683

Less: Allowance for credit losses

(62,225

)

(63,532

)

(63,934

)

(64,517

)

(63,849

)

Loans, net of allowance for credit

losses

$

5,321,419

$

5,337,885

$

5,375,048

$

5,444,193

$

5,456,834

[1]

U.S. Mainland includes

territories of the United States.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Deposits

(Unaudited)

TABLE 7

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Jun 30,

(Dollars in thousands)

2024

2024

2023

2023

2023

Noninterest-bearing demand

$

1,847,173

$

1,848,554

$

1,913,379

$

1,969,523

$

2,009,387

Interest-bearing demand

1,283,669

1,290,321

1,329,189

1,345,843

1,359,978

Savings and money market

2,234,111

2,211,966

2,209,733

2,209,550

2,184,652

Time deposits up to $250,000

547,212

544,600

533,898

465,543

427,864

Core deposits

5,912,165

5,895,441

5,986,199

5,990,459

5,981,881

Government time deposits

193,833

235,463

374,581

400,130

383,426

Other time deposits greater than

$250,000

476,457

487,950

486,812

484,156

440,430

Total time deposits greater than

$250,000

670,290

723,413

861,393

884,286

823,856

Total deposits

$

6,582,455

$

6,618,854

$

6,847,592

$

6,874,745

$

6,805,737

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Nonperforming Assets and Accruing Loans

90+ Days Past Due

(Unaudited)

TABLE 8

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Jun 30,

(Dollars in thousands)

2024

2024

2023

2023

2023

Nonaccrual loans:

Commercial and industrial

$

355

$

357

$

432

$

352

$

319

Real estate:

Construction

—

—

—

—

4,851

Residential mortgage

7,991

7,979

4,962

4,949

4,385

Home equity

1,247

929

834

677

797

Commercial mortgage

77

77

77

77

77

Consumer

587

790

703

597

632

Total nonaccrual loans

10,257

10,132

7,008

6,652

11,061

Other real estate owned ("OREO")

—

—

—

—

—

Total nonperforming assets ("NPAs")

10,257

10,132

7,008

6,652

11,061

Accruing loans 90+ days past due:

Real estate:

Construction

—

588

—

—

—

Residential mortgage

1,273

386

—

794

959

Home equity

135

560

229

—

133

Consumer

896

924

1,083

2,120

2,207

Total accruing loans 90+ days past due

2,304

2,458

1,312

2,914

3,299

Total NPAs and accruing loans 90+ days

past due

$

12,561

$

12,590

$

8,320

$

9,566

$

14,360

Ratio of total nonaccrual loans to total

loans

0.19

%

0.19

%

0.13

%

0.12

%

0.20

%

Ratio of total NPAs to total assets

0.14

0.14

0.09

0.09

0.15

Ratio of total NPAs to total loans and

OREO

0.19

0.19

0.13

0.12

0.20

Ratio of total NPAs and accruing loans 90+

days past due to total loans and OREO

0.23

0.23

0.15

0.17

0.26

Quarter-to-quarter changes in NPAs:

Balance at beginning of quarter

$

10,132

$

7,008

$

6,652

$

11,061

$

5,313

Additions

1,920

4,792

1,836

2,311

7,105

Reductions:

Payments

(363

)

(263

)

(268

)

(5,718

)

(290

)

Return to accrual status

(27

)

(198

)

(137

)

(207

)

(212

)

Charge-offs, valuation and other

adjustments

(1,405

)

(1,207

)

(1,075

)

(795

)

(855

)

Total reductions

(1,795

)

(1,668

)

(1,480

)

(6,720

)

(1,357

)

Balance at end of quarter

$

10,257

$

10,132

$

7,008

$

6,652

$

11,061

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Allowance for Credit Losses on

Loans

(Unaudited)

TABLE 9

Three Months Ended

Six Months Ended

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Jun 30,

Jun 30,

(Dollars in thousands)

2024

2024

2023

2023

2023

2024

2023

Allowance for credit losses:

Balance at beginning of period

$

63,532

$

63,934

$

64,517

$

63,849

$

63,099

$

63,934

$

63,738

Provision for credit losses on loans

2,448

4,121

4,959

4,526

4,135

6,569

5,750

Charge-offs:

Commercial and industrial

(519

)

(682

)

(419

)

(402

)

(362

)

(1,201

)

(1,141

)

Real estate:

Residential mortgage

(284

)

—

—

—

—

(284

)

—

Consumer

(4,345

)

(4,838

)

(5,976

)

(4,710

)

(3,873

)

(9,183

)

(6,559

)

Total charge-offs

(5,148

)

(5,520

)

(6,395

)

(5,112

)

(4,235

)

(10,668

)

(7,700

)

Recoveries:

Commercial and industrial

130

90

84

261

125

220

375

Real estate:

Construction

—

—

—

1

—

—

—

Residential mortgage

9

8

7

10

7

17

60

Home equity

—

6

42

—

15

6

15

Consumer

1,254

893

720

982

703

2,147

1,611

Total recoveries

1,393

997

853

1,254

850

2,390

2,061

Net charge-offs

(3,755

)

(4,523

)

(5,542

)

(3,858

)

(3,385

)

(8,278

)

(5,639

)

Balance at end of period

$

62,225

$

63,532

$

63,934

$

64,517

$

63,849

$

62,225

$

63,849

Average loans, net of deferred fees and

costs

$

5,385,829

$

5,400,558

$

5,458,245

$

5,507,248

$

5,543,398

$

5,393,193

$

5,534,741

Ratio of annualized net charge-offs to

average loans

0.28

%

0.34

%

0.41

%

0.28

%

0.24

%

0.31

%

0.20

%

Ratio of ACL to total loans

1.16

1.18

1.18

1.17

1.16

1.16

%

1.16

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731076743/en/

Investor Contact: Ian Tanaka SVP, Treasury Manager (808)

544-3646 ian.tanaka@cpb.bank Media Contact: Tim Sakahara

AVP, Corporate Communications Manager (808) 544-5125

tim.sakahara@cpb.bank

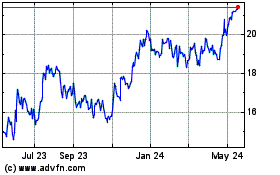

Central Pacific Financial (NYSE:CPF)

Historical Stock Chart

From Nov 2024 to Dec 2024

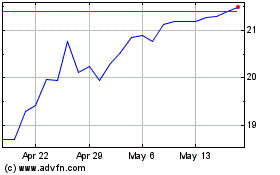

Central Pacific Financial (NYSE:CPF)

Historical Stock Chart

From Dec 2023 to Dec 2024