CoreCivic, Inc. (NYSE: CXW) (CoreCivic or the

Company) announced today its second quarter 2024 financial

results.

Financial Highlights – Second Quarter 2024

- Total revenue of $490.1 million

- CoreCivic Safety revenue of $455.4

million

- CoreCivic Community revenue of $30.3

million

- CoreCivic Properties revenue of $4.4

million

- Net income of $19.0 million; Adjusted Net Income of $21.8

million

- Diluted earnings per share of $0.17; Adjusted Diluted EPS of

$0.20

- Normalized FFO per diluted share of $0.42, an increase of

27%

- Adjusted EBITDA of $83.9 million, an increase of 16%

Damon T. Hininger, CoreCivic's President and Chief

Executive Officer, commented, "CoreCivic carried its strong

operating momentum into the second quarter of 2024. Revenue

increased 6% versus the second quarter of 2023, with federal,

state, and local revenues all increasing. Occupancy increased to

74.3% from 70.3% in the prior year quarter, and our cost management

initiatives are proving effective."

"In addition to our solid quarterly financial

results," Hininger added, "we are also proud of our continued

progress toward our capital structure targets. During the quarter,

we repurchased 1.3 million shares of our common stock for a total

cost of $20.1 million. Through a thoughtful and disciplined capital

allocation strategy, we ended the quarter with leverage, measured

as net debt to Adjusted EBITDA, at 2.5x for the trailing twelve

months - placing us at the midpoint of our target leverage range of

2.25x to 2.75x that we established in August 2020. Our balance

sheet strength and readily available bed capacity position us well

to respond to the dynamics of our industry."

"Finally, we want to recognize the accomplishments

of our South Texas Family Residential Center (South Texas Facility)

in Dilley, Texas over the past decade. As we previously disclosed,

U.S. Immigrations & Customs Enforcement (ICE) will discontinue

using this facility as of August 9, 2024. The South Texas Facility

was created in collaboration with ICE and a third-party lessor to

address the unique challenges posed by then unprecedented levels of

family immigration in 2014. This pioneering facility was initially

designed to provide a family-oriented environment, featuring

educational, medical, dining and athletic facilities. During 2021,

this facility's mission shifted to detention of single adults. We

appreciate the trust placed in CoreCivic to launch this unique

facility, and we appreciate our excellent leadership and staff at

the South Texas Facility, whom we have offered employment

opportunities at other facilities within the CoreCivic

portfolio."

Second Quarter 2024 Financial Results Compared With

Second Quarter 2023

Net income in the second quarter of 2024 was $19.0

million, or $0.17 per diluted share, compared with net income in

the second quarter of 2023 of $14.8 million, or $0.13 per diluted

share. However, when adjusted for special items, Adjusted Net

Income for the second quarter of 2024 improved to $21.8 million, or

$0.20 per diluted share (Adjusted Diluted EPS), compared with

Adjusted Net Income in the second quarter of 2023 of $13.6 million,

or $0.12 per diluted share. Special items for each period are

presented in detail in the calculation of Adjusted Diluted EPS in

the Supplemental Financial Information following the financial

statements presented herein.

The increased adjusted earnings per share amounts

resulted from higher federal, state, and local populations,

particularly at our facilities serving ICE, combined with lower

interest expense and a decrease in shares of common stock

outstanding, both resulting from our capital allocation strategy.

These earnings increases were achieved despite being partially

offset by the expiration of our leases with the California

Department of Corrections and Rehabilitation (CDCR) at our

California City Correctional Center on March 31, 2024, and with the

Oklahoma Department of Corrections (ODC) at our North Fork

Correctional Facility on June 30, 2023, which collectively

accounted for a per share reduction of $0.06.

We continue to realize improvements in our cost

structure, both as a result of operating leverage stemming from

improving facility occupancy versus the prior year, as well as from

other initiatives, particularly those related to labor attraction

and retention. The costs of registry nursing, temporary labor

resources, including associated travel expenses, overtime and

incentives, declined meaningfully from the prior year quarter as

well as sequentially.

Revenue from ICE, our largest government partner,

increased 10.5% compared with the second quarter of 2023, when the

impact of Title-42 restrictions remained. Under Title 42, which

ended May 11, 2023, asylum-seekers and anyone crossing the border

without proper documentation or authority were denied entry at the

United States border to contain the spread of COVID-19. Revenue

from ICE declined slightly versus the first quarter of 2024,

reflecting a slight decline in ICE detention populations

nationwide. During the second quarter of 2024, revenue from ICE was

$151.0 million compared to $136.7 million during the second quarter

of 2023, and compared to $153.8 million during the first quarter of

2024.

Earnings before interest, taxes, depreciation and

amortization (EBITDA) was $79.8 million in the second quarter of

2024. Adjusted EBITDA, which excludes special items, was $83.9

million in the second quarter of 2024, compared with $72.1 million

in the second quarter of 2023. The increase in Adjusted

EBITDA was attributable to an increase in occupancy, combined with

a general reduction in temporary staffing incentives and related

labor costs, partially offset by the expiration of the leases with

the CDCR at the California City facility and with the ODC at the

North Fork facility.

Funds From Operations (FFO) for the second quarter

of 2024 was $43.8 million. Normalized FFO, which excludes special

items, increased to $46.6 million, or $0.42 per diluted share, in

the second quarter of 2024, compared with $37.8 million, or $0.33

per diluted share, in the second quarter of 2023, representing an

increase in Normalized FFO per share of 27%. Normalized FFO was

impacted by the same factors that affected Adjusted EBITDA, further

improved by a reduction in interest expense resulting from our debt

reduction strategy that is not reflected in Adjusted EBITDA, as

well as a 2% reduction in weighted average shares outstanding

compared with the prior year quarter.

Adjusted Net Income, EBITDA, Adjusted EBITDA, FFO,

and Normalized FFO, and, where appropriate, their corresponding per

share amounts, are measures calculated and presented on the basis

of methodologies other than in accordance with generally accepted

accounting principles (GAAP). Please refer to the Supplemental

Financial Information and the note following the financial

statements herein for further discussion and reconciliations of

these measures to net income, the most directly comparable GAAP

measure.

Business Updates

Capital Strategy

Share Repurchases. During 2022, our Board of

Directors approved a share repurchase program authorizing the

Company to repurchase up to $225.0 million of our common stock. On

May 16, 2024, our Board of Directors authorized an additional

$125.0 million in shares of our common stock for our share

repurchase program, increasing the total aggregate authorization to

$350.0 million. During the three months ended June 30, 2024, we

repurchased 1.3 million shares of our common stock at an aggregate

purchase price of $20.1 million, excluding fees, commissions and

other costs related to the repurchases. Since the share repurchase

program was authorized, through June 30, 2024, we have repurchased

a total of 14.1 million shares at an aggregate price of $172.1

million, or $12.20 per share, excluding fees, commissions and other

costs related to the repurchases.

As of June 30, 2024, we had $177.9 million remaining under the

share repurchase program. Additional repurchases of common stock

will be made in accordance with applicable securities laws and may

be made at management’s discretion within parameters set by the

Board of Directors from time to time in the open market, through

privately negotiated transactions, or otherwise. The share

repurchase program has no time limit and does not obligate us to

purchase any particular amount of our common stock. The

authorization for the share repurchase program may be terminated,

suspended, increased or decreased by our Board of Directors in its

discretion at any time. As a result of ICE's discontinued use of

the South Texas Facility and the impact such discontinuation will

have on our leverage ratios, we intend to prioritize the use of our

free cash flow to further reduce our debt, although we may exercise

discretion in repurchasing additional shares of our common stock in

accordance with the repurchase program.

Debt Refinancing. On April 15, 2024, we

redeemed the remaining $98.8 million outstanding principal balance

of our 8.25% senior unsecured notes due 2026 (the 2026 Notes), at a

redemption price of 104.125% of the principal amount, plus accrued

and unpaid interest on such notes to, but not including April 15,

2024, resulting in a charge of $4.1 million reported during the

second quarter of 2024. This redemption completed the refinancing

transactions begun during the first quarter of 2024 with the

underwritten registered public offering of $500 million aggregate

principal amount of 8.25% senior unsecured notes due 2029 (the 2029

Notes). The net proceeds from the offering of the 2029 Notes,

amounting to $490.3 million, together with borrowings under our

revolving credit facility and cash on hand, were used to fund the

tender offer for, and subsequent redemption of, the 2026 Notes,

which had an outstanding principal balance of $593.1 million.

Following the completion of the tender offer of $494.3 million, or

83.3% of the aggregate principal amount of the 2026 Notes

then-outstanding during the first quarter of 2024, and the

redemption of the remaining $98.8 million principal balance

outstanding during the second quarter of 2024, we have no debt

maturities until 2027, when $243.7 million principal amount of our

4.75% senior unsecured notes mature.

Contract Updates

New Management Contract with State of Montana.

On July 25, 2024, following a competitive bid process, we received

a Notice of Intent to Award a new management contract from the

state of Montana to care for additional residents at CoreCivic

facilities. During the third quarter of 2024, we anticipate

receiving 120 residents at our 1,896-bed Saguaro Correctional

Facility in Eloy, Arizona, doubling the population from the state

of Montana residing at this facility under an existing management

contract. As of June 30, 2024, we also cared for approximately

1,000 residents from Hawaii, and nearly 600 residents from the

state of Idaho at the Saguaro Correctional Facility. Should the

state of Montana need additional capacity, the State may approve

the utilization of any other facility we own or operate, subject to

availability. The Notice of Intent to Award a management contract

is an expansion of our relationship with the state of Montana,

where we also manage the fully occupied company-owned Crossroads

Correctional Center in Shelby, Montana for the state of Montana

pursuant to a separate management contract.

South Texas Family Residential Center. As

disclosed on June 10, 2024, we received notification from ICE that

the agency intends to terminate an inter-governmental service

agreement (IGSA) for services at the South Texas Facility on August

9, 2024. We lease the facility and the site upon which it was

constructed from a third-party lessor, and we have provided notice

of lease termination to the lessor, also effective August 9,

2024. Total revenue at this facility was $39.3 million and

$156.6 million for the three months ended June 30, 2024 and the

twelve months ended December 31, 2023, respectively. The impact of

this contract termination is included in our updated 2024 financial

guidance.

2024 Financial Guidance

CoreCivic previously withdrew its financial guidance during the

second quarter of 2024. Based on current business conditions, we

are providing the following financial guidance for the full year

2024:

|

|

GuidanceFull Year 2024 |

|

• Net income |

$42.0 million to $50.4 million |

|

• Adjusted Net Income |

$65.6 million to $73.6 million |

|

• Diluted EPS |

$0.37 to $0.45 |

|

• Adjusted Diluted EPS |

$0.58 to $0.66 |

|

• FFO per diluted share |

$1.28 to $1.36 |

|

• Normalized FFO per diluted share |

$1.48 to $1.56 |

|

• EBITDA |

$268.0 million to $274.6 million |

|

• Adjusted EBITDA |

$302.4 million to $308.4 million |

During 2024, we expect to invest $70.0 million to $76.0 million

in capital expenditures, consisting of $30.0 million to $31.0

million in maintenance capital expenditures on real estate assets,

$32.0 million to $35.0 million for maintenance capital expenditures

on other assets and information technology, and $8.0 million to

$10.0 million for other capital investments, including costs to

prepare an idle facility for activation in the possible event an

opportunity presents.

Supplemental Financial Information and Investor

Presentations

We have made available on our website supplemental financial

information and other data for the second quarter of

2024. Interested parties may access this information

through our website at http://ir.corecivic.com/ under “Financial

Information” of the Investors section. We do not

undertake any obligation and disclaim any duties to update any of

the information disclosed in this report.

Management may meet with investors from time to

time during the third quarter of 2024. Written

materials used in the investor presentations will also be available

on our website beginning on or about August 26, 2024.

Interested parties may access this information through our website

at http://ir.corecivic.com/ under “Events & Presentations” of

the Investors section.

Conference Call, Webcast and Replay

Information

We will host a webcast conference call at 10:00 a.m. central

time (11:00 a.m. eastern time) on Thursday, August 8, 2024, which

will be accessible through the Company's website at

www.corecivic.com under the “Events & Presentations” section of

the "Investors" page. To participate via telephone and join the

call live, please register in advance here

https://register.vevent.com/register/BIdd7601382fc644b791a9a7cfbbe4f556.

Upon registration, telephone participants will receive a

confirmation email detailing how to join the conference call,

including the dial-in number and a unique passcode.

About CoreCivic

CoreCivic is a diversified, government-solutions company with

the scale and experience needed to solve tough government

challenges in flexible, cost-effective ways. We provide a broad

range of solutions to government partners that serve the public

good through high-quality corrections and detention management, a

network of residential and non-residential alternatives to

incarceration to help address America’s recidivism crisis, and

government real estate solutions. We are the nation’s largest owner

of partnership correctional, detention and residential reentry

facilities, and one of the largest prison operators in the United

States. We have been a flexible and dependable partner for

government for over 40 years. Our employees are driven by a deep

sense of service, high standards of professionalism and a

responsibility to help government better the public good. Learn

more at www.corecivic.com.

Forward-Looking Statements

This press release contains statements as to our beliefs and

expectations of the outcome of future events that are

"forward-looking" statements within the meaning of Section 21E of

the Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995, as amended. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from the

statements made. These include, but are not limited to, the risks

and uncertainties associated with: (i) changes in government

policy, legislation and regulations that affect utilization of the

private sector for corrections, detention, and residential reentry

services, in general, or our business, in particular, including,

but not limited to, the continued utilization of our correctional

and detention facilities by the federal government, including as a

consequence of the United States Department of Justice not renewing

contracts as a result of President Biden's Executive Order on

Reforming Our Incarceration System to Eliminate the Use of

Privately Operated Criminal Detention Facilities, impacting

utilization primarily by the United States Federal Bureau of

Prisons and the United States Marshals Service, and the impact of

any changes to immigration reform and sentencing laws (we do not,

under longstanding policy, lobby for or against policies or

legislation that would determine the basis for, or duration of, an

individual’s incarceration or detention); (ii) our ability to

obtain and maintain correctional, detention, and residential

reentry facility management contracts because of reasons including,

but not limited to, sufficient governmental appropriations,

contract compliance, negative publicity and effects of inmate

disturbances; (iii) changes in the privatization of the

corrections and detention industry, the acceptance of our services,

the timing of the opening of new facilities and the commencement of

new management contracts (including the extent and pace at which

new contracts are utilized), as well as our ability to utilize

available beds; (iv) general economic and market conditions,

including, but not limited to, the impact governmental budgets can

have on our contract renewals and renegotiations, per diem rates,

and occupancy; (v) fluctuations in our operating results

because of, among other things, changes in occupancy levels;

competition; contract renegotiations or terminations; inflation and

other increases in costs of operations, including a continuing rise

in labor costs; fluctuations in interest rates and risks of

operations; (vi) government budget uncertainty, the impact of the

debt ceiling and the potential for government shutdowns and

changing budget priorities; (vii) our ability to successfully

identify and consummate future development and acquisition

opportunities and realize projected returns resulting therefrom;

(viii) our ability to have met and maintained qualification for

taxation as a real estate investment trust, or REIT, for the years

we elected REIT status; and (ix) the availability of debt and

equity financing on terms that are favorable to us, or at all.

Other factors that could cause operating and financial results to

differ are described in the filings we make from time to time with

the Securities and Exchange Commission.

We take no responsibility for updating the information contained

in this press release following the date hereof to reflect events

or circumstances occurring after the date hereof or the occurrence

of unanticipated events or for any changes or modifications made to

this press release or the information contained herein by any

third-parties, including, but not limited to, any wire or internet

services, except as may be required by law.

###

CORECIVIC, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT PER

SHARE AMOUNTS)

| |

|

June 30, |

|

December 31, |

|

ASSETS |

|

|

2024 |

|

|

|

2023 |

|

| Cash and cash equivalents |

|

$ |

60,186 |

|

|

$ |

121,845 |

|

| Restricted cash |

|

|

7,497 |

|

|

|

7,111 |

|

| Accounts receivable, net of

credit loss reserve of $4,803 and $6,827,

respectively |

|

|

273,670 |

|

|

|

312,174 |

|

| Prepaid expenses and other

current assets |

|

|

39,446 |

|

|

|

26,304 |

|

| Assets held for sale |

|

|

2,211 |

|

|

|

7,480 |

|

|

Total current assets |

|

|

383,010 |

|

|

|

474,914 |

|

| Real estate and related

assets: |

|

|

|

|

| Property and equipment, net of

accumulated depreciation of $1,872,601 and $1,821,015,

respectively |

|

|

2,083,178 |

|

|

|

2,114,522 |

|

| Other real estate assets |

|

|

196,059 |

|

|

|

201,561 |

|

| Goodwill |

|

|

4,844 |

|

|

|

4,844 |

|

| Other assets |

|

|

236,120 |

|

|

|

309,558 |

|

|

Total assets |

|

$ |

2,903,211 |

|

|

$ |

3,105,399 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| Accounts payable and accrued

expenses |

|

$ |

254,634 |

|

|

$ |

285,857 |

|

| Current portion of long-term

debt |

|

|

11,832 |

|

|

|

11,597 |

|

|

Total current liabilities |

|

|

266,466 |

|

|

|

297,454 |

|

| Long-term debt, net |

|

|

1,007,148 |

|

|

|

1,083,476 |

|

| Deferred revenue |

|

|

13,899 |

|

|

|

18,315 |

|

| Non-current deferred tax

liabilities |

|

|

88,501 |

|

|

|

96,915 |

|

| Other liabilities |

|

|

79,676 |

|

|

|

131,673 |

|

|

Total liabilities |

|

|

1,455,690 |

|

|

|

1,627,833 |

|

| Commitments and

contingencies |

|

|

|

|

| Preferred stock – $0.01 par

value; 50,000 shares authorized; none issued and outstanding

at June 30, 2024 and December

31, 2023 |

|

|

— |

|

|

|

— |

|

| Common stock – $0.01 par value;

300,000 shares authorized; 110,271 and 112,733 shares

issued and outstanding at June 30, 2024 and December 31,

2023, respectively |

|

|

1,103 |

|

|

|

1,127 |

|

| Additional paid-in capital |

|

|

1,726,768 |

|

|

|

1,785,286 |

|

| Accumulated deficit |

|

|

(280,350 |

) |

|

|

(308,847 |

) |

|

Total stockholders' equity |

|

|

1,447,521 |

|

|

|

1,477,566 |

|

|

Total liabilities and stockholders' equity |

|

$ |

2,903,211 |

|

|

$ |

3,105,399 |

|

| |

|

|

|

|

CORECIVIC, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT PER

SHARE AMOUNTS)

| |

For the Three Months Ended |

|

For the Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| REVENUE: |

|

|

|

|

|

|

|

|

Safety |

$ |

455,373 |

|

|

$ |

421,743 |

|

|

$ |

913,119 |

|

|

$ |

839,393 |

|

|

Community |

|

30,302 |

|

|

|

28,364 |

|

|

|

60,202 |

|

|

|

54,778 |

|

|

Properties |

|

4,416 |

|

|

|

13,574 |

|

|

|

17,455 |

|

|

|

27,411 |

|

|

Other |

|

18 |

|

|

|

1 |

|

|

|

19 |

|

|

|

102 |

|

|

|

|

490,109 |

|

|

|

463,682 |

|

|

|

990,795 |

|

|

|

921,684 |

|

|

EXPENSES: |

|

|

|

|

|

|

|

|

Operating: |

|

|

|

|

|

|

|

|

Safety |

|

348,121 |

|

|

|

335,726 |

|

|

|

698,219 |

|

|

|

664,124 |

|

|

Community |

|

24,134 |

|

|

|

22,905 |

|

|

|

48,278 |

|

|

|

45,620 |

|

|

Properties |

|

3,462 |

|

|

|

3,324 |

|

|

|

7,297 |

|

|

|

6,685 |

|

|

Other |

|

18 |

|

|

|

53 |

|

|

|

44 |

|

|

|

116 |

|

|

Total operating expenses |

|

375,735 |

|

|

|

362,008 |

|

|

|

753,838 |

|

|

|

716,545 |

|

|

General and administrative |

|

33,910 |

|

|

|

32,612 |

|

|

|

70,375 |

|

|

|

65,291 |

|

|

Depreciation and amortization |

|

32,145 |

|

|

|

31,615 |

|

|

|

63,875 |

|

|

|

62,657 |

|

|

|

|

441,790 |

|

|

|

426,235 |

|

|

|

888,088 |

|

|

|

844,493 |

|

| OTHER INCOME

(EXPENSE): |

|

|

|

|

|

|

|

|

Interest expense, net |

|

(17,110 |

) |

|

|

(18,268 |

) |

|

|

(35,723 |

) |

|

|

(37,419 |

) |

|

Expenses associated with debt repayments

and

refinancing transactions |

|

(4,074 |

) |

|

|

(226 |

) |

|

|

(31,316 |

) |

|

|

(226 |

) |

|

Gain (loss) on sale of real estate assets, net |

|

- |

|

|

|

(25 |

) |

|

|

568 |

|

|

|

(25 |

) |

|

Other income |

|

444 |

|

|

|

78 |

|

|

|

386 |

|

|

|

31 |

|

| INCOME BEFORE INCOME

TAXES |

|

27,579 |

|

|

|

19,006 |

|

|

|

36,622 |

|

|

|

39,552 |

|

|

Income tax expense |

|

(8,625 |

) |

|

|

(4,176 |

) |

|

|

(8,125 |

) |

|

|

(12,322 |

) |

| NET

INCOME |

$ |

18,954 |

|

|

$ |

14,830 |

|

|

$ |

28,497 |

|

|

$ |

27,230 |

|

|

|

|

|

|

|

|

|

|

| BASIC EARNINGS PER

SHARE |

$ |

0.17 |

|

|

$ |

0.13 |

|

|

$ |

0.26 |

|

|

$ |

0.24 |

|

|

|

|

|

|

|

|

|

|

| DILUTED EARNINGS PER

SHARE |

$ |

0.17 |

|

|

$ |

0.13 |

|

|

$ |

0.25 |

|

|

$ |

0.24 |

|

CORECIVIC, INC. AND

SUBSIDIARIESSUPPLEMENTAL FINANCIAL

INFORMATION (UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS)

CALCULATION OF ADJUSTED NET INCOME AND ADJUSTED DILUTED

EPS

| |

For the Three Months Ended |

|

For the Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income |

$ |

18,954 |

|

|

$ |

14,830 |

|

|

$ |

28,497 |

|

|

$ |

27,230 |

|

| Special items: |

|

|

|

|

|

|

|

|

Expenses associated with debt repayments and refinancing

transactions |

|

4,074 |

|

|

|

226 |

|

|

|

31,316 |

|

|

|

226 |

|

|

Income tax expense (benefit) associated with change in

corporate tax structure |

|

- |

|

|

|

(1,378 |

) |

|

|

- |

|

|

|

930 |

|

|

Loss (gain) on sale of real estate assets, net |

|

- |

|

|

|

25 |

|

|

|

(568 |

) |

|

|

25 |

|

|

Income tax benefit for special items |

|

(1,277 |

) |

|

|

(75 |

) |

|

|

(9,635 |

) |

|

|

(75 |

) |

| Adjusted net income |

$ |

21,751 |

|

|

$ |

13,628 |

|

|

$ |

49,610 |

|

|

$ |

28,336 |

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - basic |

|

110,954 |

|

|

|

113,628 |

|

|

|

111,630 |

|

|

|

113,840 |

|

| Effect of dilutive

securities: |

|

|

|

|

|

|

|

| Restricted stock-based

awards |

|

578 |

|

|

|

324 |

|

|

|

879 |

|

|

|

631 |

|

| Weighted average shares and

assumed conversions - diluted |

|

111,532 |

|

|

|

113,952 |

|

|

|

112,509 |

|

|

|

114,471 |

|

|

|

|

|

|

|

|

|

|

| Adjusted Diluted EPS |

$ |

0.20 |

|

|

$ |

0.12 |

|

|

$ |

0.44 |

|

|

$ |

0.25 |

|

|

|

|

|

|

|

|

|

|

CORECIVIC, INC. AND

SUBSIDIARIESSUPPLEMENTAL FINANCIAL

INFORMATION (UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS)

CALCULATION OF FUNDS FROM OPERATIONS AND NORMALIZED

FUNDS FROM OPERATIONS

| |

For the Three Months Ended |

|

For the Six Months Ended |

| |

June 30, |

|

June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income |

$ |

18,954 |

|

|

$ |

14,830 |

|

|

$ |

28,497 |

|

|

$ |

27,230 |

|

| Depreciation and amortization

of real estate assets |

|

24,843 |

|

|

|

24,198 |

|

|

|

49,627 |

|

|

|

48,369 |

|

| Loss (gain) on sale of real

estate assets, net |

|

- |

|

|

|

25 |

|

|

|

(568 |

) |

|

|

25 |

|

| Income tax expense (benefit)

for special items |

|

- |

|

|

|

(7 |

) |

|

|

178 |

|

|

|

(7 |

) |

|

Funds From Operations |

$ |

43,797 |

|

|

$ |

39,046 |

|

|

$ |

77,734 |

|

|

$ |

75,617 |

|

| |

|

|

|

|

|

|

|

| Expenses associated with debt

repayments and refinancing transactions |

|

4,074 |

|

|

|

226 |

|

|

|

31,316 |

|

|

|

226 |

|

| Income tax expense (benefit)

associated with change in corporate tax structure |

|

- |

|

|

|

(1,378 |

) |

|

|

- |

|

|

|

930 |

|

| Income tax benefit for special

items |

|

(1,277 |

) |

|

|

(68 |

) |

|

|

(9,813 |

) |

|

|

(68 |

) |

| Normalized Funds From

Operations |

$ |

46,594 |

|

|

$ |

37,826 |

|

|

$ |

99,237 |

|

|

$ |

76,705 |

|

| |

|

|

|

|

|

|

|

| Funds from Operations Per

Diluted Share |

$ |

0.39 |

|

|

$ |

0.34 |

|

|

$ |

0.69 |

|

|

$ |

0.66 |

|

| Normalized Funds From

Operations Per Diluted Share |

$ |

0.42 |

|

|

$ |

0.33 |

|

|

$ |

0.88 |

|

|

$ |

0.67 |

|

|

|

|

|

|

|

|

|

|

CORECIVIC, INC. AND

SUBSIDIARIESSUPPLEMENTAL FINANCIAL

INFORMATION (UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS)

CALCULATION OF EBITDA AND ADJUSTED EBITDA

| |

For the Three Months Ended |

|

For the Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

|

2023 |

| Net income |

$ |

18,954 |

|

$ |

14,830 |

|

$ |

28,497 |

|

|

$ |

27,230 |

| Interest expense |

|

20,060 |

|

|

21,214 |

|

|

42,118 |

|

|

|

43,303 |

| Depreciation and

amortization |

|

32,145 |

|

|

31,615 |

|

|

63,875 |

|

|

|

62,657 |

| Income tax expense |

|

8,625 |

|

|

4,176 |

|

|

8,125 |

|

|

|

12,322 |

| EBITDA |

$ |

79,784 |

|

$ |

71,835 |

|

$ |

142,615 |

|

|

$ |

145,512 |

| |

|

|

|

|

|

|

|

| Expenses associated with debt

repayments and refinancing transactions |

|

4,074 |

|

|

226 |

|

|

31,316 |

|

|

|

226 |

| Loss (gain) on sale of real

estate assets, net |

|

- |

|

|

25 |

|

|

(568 |

) |

|

|

25 |

| Adjusted EBITDA |

$ |

83,858 |

|

$ |

72,086 |

|

$ |

173,363 |

|

|

$ |

145,763 |

| |

|

|

|

|

|

|

|

CORECIVIC, INC. AND

SUBSIDIARIESSUPPLEMENTAL FINANCIAL

INFORMATION (UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS)

GUIDANCE -- CALCULATION OF ADJUSTED NET INCOME, FUNDS

FROM OPERATIONS, NORMALIZED FUNDS FROM OPERATIONS, EBITDA &

ADJUSTED EBITDA

| |

For the Year Ending |

| |

December 31, 2024 |

| |

Low End ofGuidance |

|

High End ofGuidance |

|

Net income |

$ |

41,970 |

|

|

$ |

50,389 |

|

|

Expenses associated with debt repayments and refinancing

transactions |

|

31,316 |

|

|

|

31,316 |

|

|

Gain on sale of real estate assets, net |

|

(568 |

) |

|

|

(568 |

) |

|

Asset impairments |

|

3,600 |

|

|

|

3,000 |

|

|

Income tax benefit for special items |

|

(10,718 |

) |

|

|

(10,537 |

) |

| Adjusted net income |

$ |

65,600 |

|

|

$ |

73,600 |

|

| |

|

|

|

| Net income |

$ |

41,970 |

|

|

$ |

50,389 |

|

|

Depreciation and amortization of real estate assets |

|

100,000 |

|

|

|

101,000 |

|

|

Gain on sale of real estate assets, net |

|

(568 |

) |

|

|

(568 |

) |

|

Impairment of real estate assets |

|

2,600 |

|

|

|

2,600 |

|

|

Income tax benefit for special items |

|

(612 |

) |

|

|

(612 |

) |

| Funds From Operations |

$ |

143,390 |

|

|

$ |

152,809 |

|

|

Expenses associated with debt repayments and refinancing

transactions |

|

31,316 |

|

|

|

31,316 |

|

|

Other asset impairments |

|

1,000 |

|

|

|

400 |

|

|

Income tax benefit for special items |

|

(10,106 |

) |

|

|

(9,925 |

) |

| Normalized Funds From

Operations |

$ |

165,600 |

|

|

$ |

174,600 |

|

| |

|

|

|

| Diluted EPS |

$ |

0.37 |

|

|

$ |

0.45 |

|

| |

|

|

|

| Adjusted Diluted EPS |

$ |

0.58 |

|

|

$ |

0.66 |

|

| |

|

|

|

| FFO per diluted share |

$ |

1.28 |

|

|

$ |

1.36 |

|

| |

|

|

|

| Normalized FFO per diluted

share |

$ |

1.48 |

|

|

$ |

1.56 |

|

| |

|

|

|

| Net income |

$ |

41,970 |

|

|

$ |

50,389 |

|

| Interest expense |

|

80,750 |

|

|

|

79,750 |

|

| Depreciation and

amortization |

|

129,000 |

|

|

|

129,000 |

|

| Income tax expense |

|

16,282 |

|

|

|

15,463 |

|

|

EBITDA |

$ |

268,002 |

|

|

$ |

274,602 |

|

| Expenses associated with debt

repayments and refinancing transactions |

|

31,316 |

|

|

|

31,316 |

|

| Gain on sale of real estate

assets, net |

|

(568 |

) |

|

|

(568 |

) |

| Asset impairments |

|

3,600 |

|

|

|

3,000 |

|

|

Adjusted EBITDA |

$ |

302,350 |

|

|

$ |

308,350 |

|

| |

|

|

|

NOTE TO SUPPLEMENTAL FINANCIAL INFORMATION

Adjusted Net Income, EBITDA, Adjusted EBITDA, FFO, and

Normalized FFO, and, where appropriate, their corresponding per

share metrics are non-GAAP financial measures. The Company believes

that these measures are important operating measures that

supplement discussion and analysis of the Company's results of

operations and are used to review and assess operating performance

of the Company and its properties and their management teams. The

Company believes that it is useful to provide investors, security

analysts, and other interested parties disclosures of its results

of operations on the same basis that is used by

management.

FFO, in particular, is a widely accepted non-GAAP supplemental

measure of performance of real estate companies, grounded in the

standards for FFO established by the National Association of Real

Estate Investment Trusts (NAREIT). NAREIT defines FFO

as net income computed in accordance with GAAP, excluding gains (or

losses) from sales of property and extraordinary items, plus

depreciation and amortization of real estate and impairment of

depreciable real estate and after adjustments for unconsolidated

partnerships and joint ventures calculated to reflect funds from

operations on the same basis. As a company with

extensive real estate holdings, we believe FFO and FFO per share

are important supplemental measures of our operating performance

and believe they are frequently used by securities analysts,

investors and other interested parties in the evaluation of REITs

and other real estate operating companies, many of which present

FFO and FFO per share when reporting results. EBITDA, Adjusted

EBITDA, and FFO are useful as supplemental measures of performance

of the Company's properties because such measures do not take into

account depreciation and amortization, or with respect to EBITDA,

the impact of the Company's tax provisions and financing

strategies. Because the historical cost accounting convention used

for real estate assets requires depreciation (except on land), this

accounting presentation assumes that the value of real estate

assets diminishes at a level rate over time. Because of

the unique structure, design and use of the Company's properties,

management believes that assessing performance of the Company's

properties without the impact of depreciation or amortization is

useful. The Company may make adjustments to FFO from time to time

for certain other income and expenses that it considers

non-recurring, infrequent or unusual, even though such items may

require cash settlement, because such items do not reflect a

necessary or ordinary component of the ongoing operations of the

Company. Normalized FFO excludes the effects of such

items. The Company calculates Adjusted Net Income by adding to GAAP

Net Income expenses associated with the Company’s debt repayments

and refinancing transactions, and certain impairments and other

charges that the Company believes are unusual or non-recurring to

provide an alternative measure of comparing operating performance

for the periods presented.

Other companies may calculate Adjusted Net Income, EBITDA,

Adjusted EBITDA, FFO, and Normalized FFO differently than the

Company does, or adjust for other items, and therefore

comparability may be limited. Adjusted Net Income,

EBITDA, Adjusted EBITDA, FFO, and Normalized FFO and, where

appropriate, their corresponding per share measures are not

measures of performance under GAAP, and should not be considered as

an alternative to cash flows from operating activities, a measure

of liquidity or an alternative to net income as indicators of the

Company's operating performance or any other measure of performance

derived in accordance with GAAP. This data should be

read in conjunction with the Company's consolidated financial

statements and related notes included in its filings with the

Securities and Exchange Commission.

| Contact: |

|

Investors: Mike Grant - Managing

Director, Investor Relations - (615) 263-6957Financial Media: David

Gutierrez, Dresner Corporate Services - (312) 780-7204 |

| |

|

|

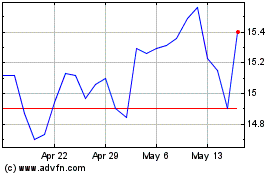

CoreCivic (NYSE:CXW)

Historical Stock Chart

From Oct 2024 to Nov 2024

CoreCivic (NYSE:CXW)

Historical Stock Chart

From Nov 2023 to Nov 2024