0001669811false00016698112025-02-182025-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 18, 2025

Donnelley Financial Solutions, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

001-37728 |

|

36-4829638 |

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

391 Steel Way, |

|

|

Lancaster, Pennsylvania |

|

17601 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(800) 823-5304

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each Class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

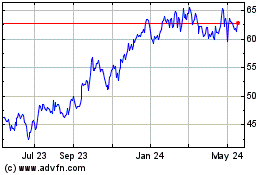

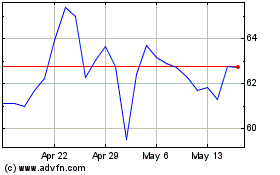

Common Stock (Par Value $0.01) |

|

DFIN |

|

NYSE |

Item 2.02. Results of Operations and Financial Condition

On February 18, 2025, Donnelley Financial Solutions, Inc. (the “Company”) issued a press release reporting the Company’s financial results for the fourth quarter and full year ended December 31, 2024.

Information in this Item 2.02 and Exhibit 99.1 of Item 9.01 below shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise incorporated by reference into any filing pursuant to the Securities Act of 1933, as amended, or the Exchange Act except as otherwise expressly stated in such a filing.

Item 9.01. Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

DONNELLEY FINANCIAL SOLUTIONS, INC. |

|

|

|

|

|

Date: February 18, 2025 |

|

By: |

|

/s/ DAVID A. GARDELLA |

|

|

|

|

David A. Gardella |

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

DFIN Reports Fourth-Quarter and Full-Year 2024 Results

CHICAGO – February 18, 2025 – Donnelley Financial Solutions, Inc. (NYSE: DFIN) (the “Company” or “DFIN”) today reported financial results for the fourth quarter and full year of 2024.

Highlights:

•Fourth-quarter software solutions net sales of $81.6 million, an increase of 10.7%, or 11.6% on an organic basis(a), from the fourth quarter of 2023; Software solutions net sales accounted for 52.2% of total fourth-quarter net sales.

•Full-year software solutions net sales of $329.7 million, an increase of 12.6%, or 13.8% on an organic basis(a), from the full year of 2023; Software solutions net sales accounted for 42.2% of total full-year net sales.

•Fourth-quarter net earnings of $6.3 million, or $0.21 per diluted share; Full-year net earnings of $92.4 million, or $3.06 per diluted share, as compared to $82.2 million, or $2.69 per diluted share, for the full year of 2023.

•Fourth-quarter Adjusted EBITDA(a) of $31.7 million and Adjusted EBITDA margin(a) of 20.3%.

•Full-year Adjusted EBITDA(a) of $217.3 million, up $9.9 million, or 4.8%, from the full year of 2023; Full-year Adjusted EBITDA margin(a) of 27.8%, an increase of approximately 180 basis points from the full year of 2023.

•Fourth-quarter Operating Cash Flow(b) of $56.4 million; Fourth-quarter Free Cash Flow(a) of $41.3 million.

•Full-year Operating Cash Flow(b) of $171.1 million and Free Cash Flow(a) of $105.2 million, improvements of $47.1 million and $43.0 million, respectively, from the full year of 2023.

•Gross leverage(a) of 0.6x and net leverage(a) of 0.3x as of December 31, 2024.

•During the fourth quarter, the Company repurchased 281,753 shares for $17.4 million at an average price of $61.67 per share. For full-year 2024, the Company repurchased 947,288 shares for $58.7 million at an average price of $61.97 per share. As of December 31, 2024, the remaining share repurchase authorization was $91.3 million.

(a) Adjusted EBITDA, Adjusted EBITDA margin, Free Cash Flow, organic net sales, gross leverage and net leverage are non-GAAP financial measures that exclude the impact of certain items noted in the reconciliation tables below. The tables below provide reconciliations to the most comparable GAAP measures.

(b) Defined as net cash provided by operating activities.

“I am pleased with our continued progress to increase the adoption of our software solutions offerings. During the fourth quarter, the growth in software solutions net sales was led by the performance of our recurring compliance software products, ActiveDisclosure and Arc Suite, which posted net sales growth of approximately 19% in aggregate, an improvement compared to the recent trend. Net sales of Venue, our dataroom offering, grew approximately 2% despite lapping very strong results from the fourth quarter of last year,” said Daniel N. Leib, DFIN’s president and chief executive officer.

Leib continued, “For full-year 2024, we delivered organic software solutions net sales growth of 13.8%, yielding total software solutions net sales of $329.7 million, which represents approximately 42% of our full-year consolidated net sales, up from approximately 37% of full-year consolidated net sales in 2023. In addition, we achieved an important milestone in our transformation journey during 2024, with software solutions net sales exceeding each of tech-enabled services net sales and print and distribution net sales to become the largest component of our consolidated full-year net sales, demonstrating another positive proof point of our software-centric strategy. The improved sales mix, combined with our continued cost discipline, generated strong full-year profitability, as we delivered $217.3 million of Adjusted EBITDA and 27.8% in Adjusted EBITDA margin, both of which exceeded the levels we achieved in 2023, despite continued softness in the capital markets transactional environment which resulted in the third consecutive year of lower transactional revenue.”

“Heading into 2025, we are encouraged by the performance of our software solutions and remain well positioned to capture future opportunities. While our transactional offering is always subject to uncertainty, we are encouraged by the uptick in capital markets transactional activity to start the year. Our portfolio of market-leading regulatory and compliance offerings and deep domain and service expertise position us well to serve current and future needs of our clients,” Leib concluded.

Net Sales

Net sales in the fourth quarter of 2024 were $156.3 million, a decrease of $20.2 million, or 11.4% (a decrease of 11.0% on an organic basis), from the fourth quarter of 2023. Net sales decreased primarily due to a reduction in capital markets and investment companies transactional revenue, which decreased $19.5 million in aggregate, and lower print and distribution volumes within capital markets and investment companies compliance offerings, partially offset by higher software solutions net sales.

Net Earnings

For the fourth quarter of 2024, net earnings were $6.3 million, or $0.21 per diluted share, as compared to $10.6 million, or $0.35 per diluted share, in the fourth quarter of 2023. Net earnings in the fourth quarter of 2024 included after-tax charges of $5.7 million, or $0.19 per diluted share, primarily related to share-based compensation expense and restructuring, impairment and other charges, net. Net earnings in the fourth quarter of 2023 included after-tax charges of $8.2 million, or $0.26 per diluted share, primarily related to share-based compensation expense, the acceleration of rent expense associated with abandoned operating leases and restructuring, impairment and other charges, net.

Adjusted EBITDA and Non-GAAP Net Earnings

For the fourth quarter of 2024, Adjusted EBITDA was $31.7 million, a decrease of $9.6 million as compared to the fourth quarter of 2023. Adjusted EBITDA margin was 20.3%, a decrease of approximately 310 basis points as compared to the fourth quarter of 2023. The decrease in Adjusted EBITDA and Adjusted EBITDA margin was primarily due to lower capital markets and investment companies transactional volumes, partially offset by higher software solutions net sales, cost control initiatives, and lower selling expenses as a result of the decrease in sales volume.

For the fourth quarter of 2024, non-GAAP net earnings were $12.0 million, or $0.40 per diluted share, as compared to $18.8 million, or $0.61 per diluted share, in the fourth quarter of 2023.

Reconciliations of net sales to organic net sales and consolidated net earnings to Adjusted EBITDA, Adjusted EBITDA margin and non-GAAP net earnings are presented in the tables.

Company Results and Conference Call

DFIN’s earnings press release for the fourth-quarter and full-year 2024, which is included as Exhibit 99.1 to the Company’s Current Report on Form 8-K that has been furnished to the SEC on February 18, 2025, is available on the Company’s investor relations website at investor.dfinsolutions.com. A supplemental trending schedule of historical results, including additional breakouts of segment-level net sales, is also available on the Company’s investor relations website.

DFIN will hold a conference call and webcast on February 18, 2025, at 9:00 a.m. Eastern time to discuss financial results for the fourth quarter of 2024, provide a general business update and respond to analyst questions.

A live webcast of the call will also be available on the Company’s investor relations website. Please visit investor.dfinsolutions.com at least fifteen minutes prior to the start of the event to register, download and install any necessary audio software.

If you are unable to participate live, a replay of the webcast will be available following the conference call on the Company’s investor relations website, along with the earnings press release and related financial tables.

About DFIN

DFIN is a leading global provider of innovative software and technology-enabled financial regulatory and compliance solutions. We provide domain expertise, enterprise software and data analytics for every stage of our clients’ business and investment lifecycles. Markets fluctuate, regulations evolve, technology advances, and through it all, DFIN delivers confidence with the right solutions in moments that matter. Learn about DFIN’s end-to-end risk and compliance solutions online at DFINsolutions.com or you can also follow us on X (formerly Twitter) @DFINSolutions or on LinkedIn.

Investor Contact:

Mike Zhao

Investor Relations

investors@dfinsolutions.com

Use of Non-GAAP Information

This news release contains certain non-GAAP financial measures, including non-GAAP gross profit, adjusted non-GAAP gross profit, non-GAAP gross margin, adjusted non-GAAP selling, general and administrative expenses (“SG&A”), adjusted non- GAAP income from operations, adjusted non-GAAP operating margin, Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP earnings before income taxes, non- GAAP effective tax rate, adjusted non-GAAP net earnings, adjusted non-GAAP diluted earnings per share, Free Cash Flow and organic net sales. The Company believes that these non-GAAP financial measures, when presented in conjunction with comparable GAAP measures, provide useful information about the Company’s operating results and liquidity and enhance the overall ability to assess the Company’s financial performance. The Company uses these measures, together with other measures of performance under GAAP, to compare the relative performance of operations in planning, budgeting and reviewing the performance of its business.

The Company’s non-GAAP statement of operations measures, which include non-GAAP gross profit, adjusted non-GAAP gross profit, non-GAAP gross margin, adjusted non-GAAP SG&A, adjusted non-GAAP income from operations, adjusted non- GAAP operating margin, Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP earnings before income taxes, non-GAAP effective tax rate, adjusted non-GAAP net earnings and adjusted non-GAAP diluted earnings per share, are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing operations. These adjusted measures exclude the impact of expenses associated with the Company’s non-income tax, net, accelerated rent expense, share-based compensation and eliminate potential differences in results of operations between periods caused by factors such as historic cost and age of assets, financing and capital structures, taxation positions or regimes, restructuring, impairment and other charges, net and gain or loss on certain investments, business sales and asset sales.

Free Cash Flow is a non-GAAP financial measure and is defined by the Company as net cash flow provided by operating activities less capital expenditures. By adjusting for the level of capital investment in operations, the Company believes that free cash flow can provide useful additional basis for understanding the Company’s ability to generate cash after capital investment and provides a comparison to peers with differing capital intensity.

Organic net sales is a non-GAAP financial measure and is defined by the Company as reported net sales adjusted for the changes in foreign currency exchange rates and the impact of dispositions.

These non-GAAP financial measures should be considered in addition to, not a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. In addition, these measures are defined differently by different companies in our industry and, accordingly, such measures may not be comparable to similarly-titled measures of other companies.

Use of Forward-Looking Statements

This news release includes certain “forward-looking statements” within the meaning of, and subject to the safe harbor created by, Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the business, strategy and plans of DFIN and its expectations relating to future financial condition and performance. Statements that are not historical facts, including statements about DFIN management’s beliefs and expectations, are forward-looking statements. Words such as “believes,” “anticipates,” “estimates,” “expects,” “intends,” “aims,” “potential,” “will,” “would,” “could,” “considered,” “likely,” “estimate” and variations of these words and similar future or conditional expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. While DFIN believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond DFIN’s control. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend upon future circumstances that may or may not occur. Actual results may differ materially from DFIN’s current expectations depending upon a number of factors affecting the business and risks associated with the performance of the business. These factors include such risks and uncertainties detailed in DFIN periodic public filings with the SEC, including but not limited to those discussed under “Special Note Regarding Forward-Looking Statements” and in Part I, Item 1A. Risk Factors of DFIN’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, those discussed under “Special Note Regarding Forward-Looking Statements” in DFIN’s Quarterly Reports on Form 10-Q and in other investor communications of DFIN’s from time to time. DFIN does not undertake to and specifically declines any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect future events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

Donnelley Financial Solutions, Inc. and Subsidiaries (“DFIN”)

Condensed Consolidated Balance Sheets

(UNAUDITED)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

57.3 |

|

|

$ |

23.1 |

|

Receivables, less allowances for expected losses of $25.0 in 2024 (2023 - $18.9) |

|

|

138.0 |

|

|

|

151.8 |

|

Prepaid expenses and other current assets |

|

|

37.2 |

|

|

|

31.0 |

|

Assets held for sale |

|

|

— |

|

|

|

2.6 |

|

Total current assets |

|

|

232.5 |

|

|

|

208.5 |

|

Property, plant and equipment, net |

|

|

8.9 |

|

|

|

13.5 |

|

Operating lease right-of-use assets |

|

|

12.3 |

|

|

|

16.4 |

|

Software, net |

|

|

96.5 |

|

|

|

87.6 |

|

Goodwill |

|

|

405.4 |

|

|

|

405.8 |

|

Deferred income taxes, net |

|

|

56.4 |

|

|

|

45.8 |

|

Other noncurrent assets |

|

|

29.6 |

|

|

|

29.3 |

|

Total assets |

|

$ |

841.6 |

|

|

$ |

806.9 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

28.7 |

|

|

$ |

33.9 |

|

Operating lease liabilities |

|

|

10.3 |

|

|

|

14.0 |

|

Accrued liabilities |

|

|

185.1 |

|

|

|

153.7 |

|

Total current liabilities |

|

|

224.1 |

|

|

|

201.6 |

|

Long-term debt |

|

|

124.7 |

|

|

|

124.5 |

|

Deferred compensation liabilities |

|

|

12.2 |

|

|

|

13.1 |

|

Pension and other postretirement benefits plans liabilities |

|

|

23.3 |

|

|

|

34.4 |

|

Noncurrent operating lease liabilities |

|

|

6.4 |

|

|

|

12.1 |

|

Other noncurrent liabilities |

|

|

14.8 |

|

|

|

19.0 |

|

Total liabilities |

|

|

405.5 |

|

|

|

404.7 |

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Preferred stock, $0.01 par value |

|

|

|

|

|

|

Authorized: 1.0 shares; Issued: None |

|

|

— |

|

|

|

— |

|

Common stock, $0.01 par value |

|

|

|

|

|

|

Authorized: 65.0 shares; |

|

|

|

|

|

|

Issued and outstanding: 38.9 shares and 28.7 shares in 2024 (2023 - 38.0 shares and 29.1 shares) |

|

|

0.4 |

|

|

|

0.4 |

|

Treasury stock, at cost: 10.2 shares in 2024 (2023 - 8.9 shares) |

|

|

(344.1 |

) |

|

|

(262.1 |

) |

Additional paid-in capital |

|

|

333.2 |

|

|

|

305.7 |

|

Retained earnings |

|

|

528.5 |

|

|

|

436.1 |

|

Accumulated other comprehensive loss |

|

|

(81.9 |

) |

|

|

(77.9 |

) |

Total equity |

|

|

436.1 |

|

|

|

402.2 |

|

Total liabilities and equity |

|

$ |

841.6 |

|

|

$ |

806.9 |

|

Donnelley Financial Solutions, Inc. and Subsidiaries (“DFIN”)

Condensed Consolidated Statements of Operations

(UNAUDITED)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net sales |

|

|

|

|

|

|

|

|

|

|

|

|

Software solutions |

|

$ |

81.6 |

|

|

$ |

73.7 |

|

|

$ |

329.7 |

|

|

$ |

292.7 |

|

Tech-enabled services |

|

|

60.5 |

|

|

|

73.6 |

|

|

|

320.8 |

|

|

|

336.9 |

|

Print and distribution |

|

|

14.2 |

|

|

|

29.2 |

|

|

|

131.4 |

|

|

|

167.6 |

|

Total net sales |

|

|

156.3 |

|

|

|

176.5 |

|

|

|

781.9 |

|

|

|

797.2 |

|

Cost of sales (a) |

|

|

|

|

|

|

|

|

|

|

|

|

Software solutions |

|

|

27.1 |

|

|

|

27.5 |

|

|

|

107.4 |

|

|

|

108.7 |

|

Tech-enabled services |

|

|

26.9 |

|

|

|

28.0 |

|

|

|

120.6 |

|

|

|

127.6 |

|

Print and distribution |

|

|

8.6 |

|

|

|

18.4 |

|

|

|

69.9 |

|

|

|

97.0 |

|

Total cost of sales |

|

|

62.6 |

|

|

|

73.9 |

|

|

|

297.9 |

|

|

|

333.3 |

|

Selling, general and administrative expenses (a) |

|

|

68.0 |

|

|

|

70.0 |

|

|

|

290.9 |

|

|

|

282.1 |

|

Depreciation and amortization |

|

|

14.8 |

|

|

|

15.5 |

|

|

|

60.2 |

|

|

|

56.7 |

|

Restructuring, impairment and other charges, net |

|

|

2.1 |

|

|

|

1.4 |

|

|

|

6.6 |

|

|

|

9.8 |

|

Other operating (income) loss, net |

|

|

(0.5 |

) |

|

|

5.9 |

|

|

|

(10.3 |

) |

|

|

5.3 |

|

Income from operations |

|

|

9.3 |

|

|

|

9.8 |

|

|

|

136.6 |

|

|

|

110.0 |

|

Interest expense, net |

|

|

2.5 |

|

|

|

3.6 |

|

|

|

12.9 |

|

|

|

15.8 |

|

Investment and other income, net |

|

|

(0.3 |

) |

|

|

(0.5 |

) |

|

|

(1.4 |

) |

|

|

(7.8 |

) |

Earnings before income taxes |

|

|

7.1 |

|

|

|

6.7 |

|

|

|

125.1 |

|

|

|

102.0 |

|

Income tax expense (benefit) |

|

|

0.8 |

|

|

|

(3.9 |

) |

|

|

32.7 |

|

|

|

19.8 |

|

Net earnings |

|

$ |

6.3 |

|

|

$ |

10.6 |

|

|

$ |

92.4 |

|

|

$ |

82.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.22 |

|

|

$ |

0.36 |

|

|

$ |

3.16 |

|

|

$ |

2.81 |

|

Diluted |

|

$ |

0.21 |

|

|

$ |

0.35 |

|

|

$ |

3.06 |

|

|

$ |

2.69 |

|

Weighted-average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

28.9 |

|

|

|

29.2 |

|

|

|

29.2 |

|

|

|

29.3 |

|

Diluted |

|

|

29.9 |

|

|

|

30.6 |

|

|

|

30.2 |

|

|

|

30.6 |

|

__________

(a)Exclusive of depreciation and amortization.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

Components of depreciation and amortization: |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Cost of sales |

|

$ |

14.4 |

|

|

$ |

14.1 |

|

|

$ |

58.2 |

|

|

$ |

51.2 |

|

Selling, general and administrative expenses |

|

|

0.4 |

|

|

|

1.4 |

|

|

|

2.0 |

|

|

|

5.5 |

|

Total depreciation and amortization |

|

$ |

14.8 |

|

|

$ |

15.5 |

|

|

$ |

60.2 |

|

|

$ |

56.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional information: |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (b) |

|

$ |

79.3 |

|

|

$ |

88.5 |

|

|

$ |

425.8 |

|

|

$ |

412.7 |

|

Exclude: Depreciation and amortization |

|

|

14.4 |

|

|

|

14.1 |

|

|

|

58.2 |

|

|

|

51.2 |

|

Non-GAAP gross profit |

|

$ |

93.7 |

|

|

$ |

102.6 |

|

|

$ |

484.0 |

|

|

$ |

463.9 |

|

Gross margin (b) |

|

|

50.7 |

% |

|

|

50.1 |

% |

|

|

54.5 |

% |

|

|

51.8 |

% |

Non-GAAP gross margin |

|

|

59.9 |

% |

|

|

58.1 |

% |

|

|

61.9 |

% |

|

|

58.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

SG&A as a % of total net sales (a) |

|

|

43.5 |

% |

|

|

39.7 |

% |

|

|

37.2 |

% |

|

|

35.4 |

% |

Operating margin |

|

|

6.0 |

% |

|

|

5.6 |

% |

|

|

17.5 |

% |

|

|

13.8 |

% |

Effective tax rate |

|

|

11.3 |

% |

|

nm |

|

|

|

26.1 |

% |

|

|

19.4 |

% |

__________

(b)Inclusive of depreciation and amortization.

nm - Not meaningful.

Donnelley Financial Solutions, Inc. and Subsidiaries (“DFIN”)

Reconciliation of GAAP to Non-GAAP Measures

For the Three and Twelve Months Ended December 31, 2024

(UNAUDITED)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, 2024 |

|

|

Gross profit |

|

|

SG&A (a) |

|

|

Income (loss)

from

operations |

|

|

Operating

margin |

|

|

Net

earnings (loss) |

|

|

Net

earnings (loss)

per diluted

share |

|

GAAP basis measures |

$ |

79.3 |

|

|

$ |

68.0 |

|

|

$ |

9.3 |

|

|

|

6.0 |

% |

|

$ |

6.3 |

|

|

$ |

0.21 |

|

Exclude: Depreciation and amortization |

|

14.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP measures |

|

93.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP % of total net sales |

|

59.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring, impairment and other charges, net |

|

— |

|

|

|

— |

|

|

|

2.1 |

|

|

|

1.3 |

% |

|

|

1.7 |

|

|

|

0.06 |

|

Share-based compensation expense |

|

— |

|

|

|

(6.0 |

) |

|

|

6.0 |

|

|

|

3.8 |

% |

|

|

4.4 |

|

|

|

0.15 |

|

Gain on sale of a business |

|

— |

|

|

|

— |

|

|

|

(0.4 |

) |

|

|

(0.3 |

%) |

|

|

(0.3 |

) |

|

|

(0.01 |

) |

Non-income tax, net |

|

— |

|

|

|

0.1 |

|

|

|

(0.1 |

) |

|

|

(0.1 |

%) |

|

|

(0.1 |

) |

|

|

— |

|

Total Non-GAAP adjustments (b) |

|

— |

|

|

|

(5.9 |

) |

|

|

7.6 |

|

|

|

4.9 |

% |

|

|

5.7 |

|

|

|

0.19 |

|

Adjusted Non-GAAP measures (b) |

$ |

93.7 |

|

|

$ |

62.1 |

|

|

$ |

16.9 |

|

|

|

10.8 |

% |

|

$ |

12.0 |

|

|

$ |

0.40 |

|

Adjusted Non-GAAP % of total net sales |

|

59.9 |

% |

|

|

39.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended December 31, 2024 |

|

|

Gross profit |

|

|

SG&A (a) |

|

|

Income (loss)

from

operations |

|

|

Operating

margin |

|

|

Net

earnings (loss) |

|

|

Net

earnings (loss)

per diluted

share |

|

GAAP basis measures |

$ |

425.8 |

|

|

$ |

290.9 |

|

|

$ |

136.6 |

|

|

|

17.5 |

% |

|

$ |

92.4 |

|

|

$ |

3.06 |

|

Exclude: Depreciation and amortization |

|

58.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP measures |

|

484.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP % of total net sales |

|

61.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring, impairment and other charges, net |

|

— |

|

|

|

— |

|

|

|

6.6 |

|

|

|

0.8 |

% |

|

|

5.0 |

|

|

|

0.17 |

|

Share-based compensation expense |

|

— |

|

|

|

(25.2 |

) |

|

|

25.2 |

|

|

|

3.2 |

% |

|

|

14.8 |

|

|

|

0.49 |

|

Gain on sale of long-lived assets |

|

— |

|

|

|

— |

|

|

|

(9.8 |

) |

|

|

(1.3 |

%) |

|

|

(7.0 |

) |

|

|

(0.23 |

) |

Non-income tax, net |

|

— |

|

|

|

1.1 |

|

|

|

(1.1 |

) |

|

|

(0.1 |

%) |

|

|

(0.7 |

) |

|

|

(0.02 |

) |

Gain on sale of a business |

|

— |

|

|

|

— |

|

|

|

(0.4 |

) |

|

|

(0.1 |

%) |

|

|

(0.3 |

) |

|

|

(0.01 |

) |

Gain on investments in equity securities (c) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.3 |

) |

|

|

(0.01 |

) |

Total non-GAAP adjustments (b) |

|

— |

|

|

|

(24.1 |

) |

|

|

20.5 |

|

|

|

2.6 |

% |

|

|

11.5 |

|

|

|

0.38 |

|

Adjusted Non-GAAP measures (b) |

$ |

484.0 |

|

|

$ |

266.8 |

|

|

$ |

157.1 |

|

|

|

20.1 |

% |

|

$ |

103.9 |

|

|

$ |

3.44 |

|

Adjusted Non-GAAP % of total net sales |

|

61.9 |

% |

|

|

34.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

__________

(a)Exclusive of depreciation and amortization.

(b)Totals may not foot due to rounding.

(c)Gain on investments in equity securities is recorded within investment and other income, net on the Company’s Unaudited Condensed Consolidated Statements of Operations.

Donnelley Financial Solutions, Inc. and Subsidiaries (“DFIN”)

Reconciliation of GAAP to Non-GAAP Measures

For the Three and Twelve Months Ended December 31, 2023

(UNAUDITED)

(in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, 2023 |

|

|

Gross profit |

|

|

SG&A (a) |

|

|

Income (loss)

from

operations |

|

|

Operating

margin |

|

|

Net

earnings (loss) |

|

|

Net

earnings (loss)

per diluted

share |

|

GAAP basis measures |

$ |

88.5 |

|

|

$ |

70.0 |

|

|

$ |

9.8 |

|

|

|

5.6 |

% |

|

$ |

10.6 |

|

|

$ |

0.35 |

|

Exclude: Depreciation and amortization |

|

14.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP measures |

|

102.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP % of total net sales |

|

58.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring, impairment and other charges, net |

|

— |

|

|

|

— |

|

|

|

1.4 |

|

|

|

0.8 |

% |

|

|

1.4 |

|

|

|

0.05 |

|

Share-based compensation expense |

|

— |

|

|

|

(5.4 |

) |

|

|

5.4 |

|

|

|

3.1 |

% |

|

|

4.2 |

|

|

|

0.14 |

|

Loss on sale of a business |

|

— |

|

|

|

— |

|

|

|

6.1 |

|

|

|

3.5 |

% |

|

|

— |

|

|

|

— |

|

Accelerated rent expense |

|

2.9 |

|

|

|

(0.2 |

) |

|

|

3.1 |

|

|

|

1.8 |

% |

|

|

2.8 |

|

|

|

0.09 |

|

Disposition-related expenses |

|

— |

|

|

|

(0.3 |

) |

|

|

0.3 |

|

|

|

0.2 |

% |

|

|

0.2 |

|

|

|

0.01 |

|

Gain on sale of long-lived assets |

|

|

|

|

— |

|

|

|

(0.2 |

) |

|

|

(0.1 |

%) |

|

|

(0.2 |

) |

|

|

(0.01 |

) |

Non-income tax, net |

|

— |

|

|

|

0.1 |

|

|

|

(0.1 |

) |

|

|

(0.1 |

%) |

|

|

(0.1 |

) |

|

|

— |

|

Gain on investments in equity securities (c) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.1 |

) |

|

|

— |

|

Total Non-GAAP adjustments (b) |

|

2.9 |

|

|

|

(5.8 |

) |

|

|

16.0 |

|

|

|

9.0 |

% |

|

|

8.2 |

|

|

|

0.26 |

|

Adjusted Non-GAAP measures (b) |

$ |

105.5 |

|

|

$ |

64.2 |

|

|

$ |

25.8 |

|

|

|

14.6 |

% |

|

$ |

18.8 |

|

|

$ |

0.61 |

|

Adjusted Non-GAAP % of total net sales |

|

59.8 |

% |

|

|

36.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended December 31, 2023 |

|

|

Gross profit |

|

|

SG&A (a) |

|

|

Income (loss)

from

operations |

|

|

Operating

margin |

|

|

Net

earnings (loss) |

|

|

Net

earnings (loss)

per diluted

share |

|

GAAP basis measures |

$ |

412.7 |

|

|

$ |

282.1 |

|

|

$ |

110.0 |

|

|

|

13.8 |

% |

|

$ |

82.2 |

|

|

$ |

2.69 |

|

Exclude: Depreciation and amortization |

|

51.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP measures |

|

463.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP % of total net sales |

|

58.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring, impairment and other charges, net |

|

— |

|

|

|

— |

|

|

|

9.8 |

|

|

|

1.2 |

% |

|

|

7.5 |

|

|

|

0.25 |

|

Share-based compensation expense |

|

— |

|

|

|

(22.5 |

) |

|

|

22.5 |

|

|

|

2.8 |

% |

|

|

13.3 |

|

|

|

0.43 |

|

Loss on sale of a business |

|

— |

|

|

|

— |

|

|

|

6.1 |

|

|

|

0.8 |

% |

|

|

— |

|

|

|

— |

|

Accelerated rent expense |

|

3.4 |

|

|

|

(0.3 |

) |

|

|

3.7 |

|

|

|

0.5 |

% |

|

|

3.2 |

|

|

|

0.10 |

|

Disposition-related expenses |

|

— |

|

|

|

(0.3 |

) |

|

|

0.3 |

|

|

|

— |

|

|

|

0.2 |

|

|

|

0.01 |

|

Non-income tax, net |

|

— |

|

|

|

0.9 |

|

|

|

(0.9 |

) |

|

|

(0.1 |

%) |

|

|

(0.6 |

) |

|

|

(0.02 |

) |

Gain on sale of long-lived assets |

|

— |

|

|

|

— |

|

|

|

(0.8 |

) |

|

|

(0.1 |

%) |

|

|

(0.6 |

) |

|

|

(0.02 |

) |

Gain on investments in equity securities (c) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5.1 |

) |

|

|

(0.17 |

) |

Total non-GAAP adjustments (b) |

|

3.4 |

|

|

|

(22.2 |

) |

|

|

40.7 |

|

|

|

5.1 |

% |

|

|

17.9 |

|

|

|

0.58 |

|

Adjusted Non-GAAP measures (b) |

$ |

467.3 |

|

|

$ |

259.9 |

|

|

$ |

150.7 |

|

|

|

18.9 |

% |

|

$ |

100.1 |

|

|

$ |

3.27 |

|

Adjusted Non-GAAP % of total net sales |

|

58.6 |

% |

|

|

32.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

__________

(a)Exclusive of depreciation and amortization.

(b)Totals may not foot due to rounding.

(c)Gain on investments in equity securities is recorded within investment and other income, net on the Company’s Unaudited Condensed Consolidated Statements of Operations.

Donnelley Financial Solutions, Inc. and Subsidiaries (“DFIN”)

Segment Adjusted EBITDA and Supplementary Information

(UNAUDITED)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Markets - Software Solutions |

|

|

Capital Markets - Compliance and Communications Management |

|

|

Investment Companies - Software Solutions |

|

|

Investment Companies - Compliance and Communications Management |

|

|

Corporate |

|

|

Consolidated (a) |

|

For the Three Months Ended December 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

50.0 |

|

|

$ |

53.3 |

|

|

$ |

31.6 |

|

|

$ |

21.4 |

|

|

$ |

— |

|

|

$ |

156.3 |

|

Adjusted EBITDA |

|

$ |

13.3 |

|

|

$ |

13.6 |

|

|

$ |

11.7 |

|

|

$ |

4.8 |

|

|

$ |

(11.7 |

) |

|

$ |

31.7 |

|

Adjusted EBITDA margin % |

|

|

26.6 |

% |

|

|

25.5 |

% |

|

|

37.0 |

% |

|

|

22.4 |

% |

|

nm |

|

|

|

20.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

$ |

7.3 |

|

|

$ |

1.4 |

|

|

$ |

5.1 |

|

|

$ |

1.0 |

|

|

$ |

— |

|

|

$ |

14.8 |

|

Capital expenditures |

|

$ |

8.2 |

|

|

$ |

1.8 |

|

|

$ |

4.1 |

|

|

$ |

0.4 |

|

|

$ |

0.6 |

|

|

$ |

15.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

48.0 |

|

|

$ |

68.3 |

|

|

$ |

25.7 |

|

|

$ |

34.5 |

|

|

$ |

— |

|

|

$ |

176.5 |

|

Adjusted EBITDA |

|

$ |

12.7 |

|

|

$ |

21.0 |

|

|

$ |

8.1 |

|

|

$ |

10.4 |

|

|

$ |

(10.9 |

) |

|

$ |

41.3 |

|

Adjusted EBITDA margin % |

|

|

26.5 |

% |

|

|

30.7 |

% |

|

|

31.5 |

% |

|

|

30.1 |

% |

|

nm |

|

|

|

23.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

$ |

8.0 |

|

|

$ |

2.4 |

|

|

$ |

4.0 |

|

|

$ |

1.1 |

|

|

$ |

— |

|

|

$ |

15.5 |

|

Capital expenditures |

|

$ |

8.1 |

|

|

$ |

2.6 |

|

|

$ |

6.5 |

|

|

$ |

0.4 |

|

|

$ |

1.2 |

|

|

$ |

18.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Markets - Software Solutions |

|

|

Capital Markets - Compliance and Communications Management |

|

|

Investment Companies - Software Solutions |

|

|

Investment Companies - Compliance and Communications Management |

|

|

Corporate |

|

|

Consolidated (a) |

|

For the Twelve Months Ended December 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

213.6 |

|

|

$ |

321.7 |

|

|

$ |

116.1 |

|

|

$ |

130.5 |

|

|

$ |

— |

|

|

$ |

781.9 |

|

Adjusted EBITDA |

|

$ |

63.5 |

|

|

$ |

110.9 |

|

|

$ |

39.7 |

|

|

$ |

41.5 |

|

|

$ |

(38.3 |

) |

|

$ |

217.3 |

|

Adjusted EBITDA margin % |

|

|

29.7 |

% |

|

|

34.5 |

% |

|

|

34.2 |

% |

|

|

31.8 |

% |

|

nm |

|

|

|

27.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

$ |

27.6 |

|

|

$ |

9.8 |

|

|

$ |

18.2 |

|

|

$ |

4.5 |

|

|

$ |

0.1 |

|

|

$ |

60.2 |

|

Capital expenditures |

|

$ |

32.5 |

|

|

$ |

7.7 |

|

|

$ |

21.1 |

|

|

$ |

2.7 |

|

|

$ |

1.9 |

|

|

$ |

65.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

185.9 |

|

|

$ |

355.4 |

|

|

$ |

106.8 |

|

|

$ |

149.1 |

|

|

$ |

— |

|

|

$ |

797.2 |

|

Adjusted EBITDA |

|

$ |

45.2 |

|

|

$ |

119.4 |

|

|

$ |

36.9 |

|

|

$ |

49.4 |

|

|

$ |

(43.5 |

) |

|

$ |

207.4 |

|

Adjusted EBITDA margin % |

|

|

24.3 |

% |

|

|

33.6 |

% |

|

|

34.6 |

% |

|

|

33.1 |

% |

|

nm |

|

|

|

26.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

$ |

29.8 |

|

|

$ |

8.0 |

|

|

$ |

14.2 |

|

|

$ |

4.6 |

|

|

$ |

0.1 |

|

|

$ |

56.7 |

|

Capital expenditures |

|

$ |

31.5 |

|

|

$ |

7.4 |

|

|

$ |

18.8 |

|

|

$ |

1.8 |

|

|

$ |

2.3 |

|

|

$ |

61.8 |

|

__________

(a)Reconciliation of consolidated Adjusted EBITDA to net earnings is presented below.

nm - Not meaningful.

Donnelley Financial Solutions, Inc. and Subsidiaries (“DFIN”)

Condensed Consolidated Statements of Cash Flows

(UNAUDITED)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

Operating Activities |

|

|

|

|

|

|

Net earnings |

|

$ |

92.4 |

|

|

$ |

82.2 |

|

Adjustments to reconcile net earnings to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

60.2 |

|

|

|

56.7 |

|

Provision for expected losses on accounts receivable |

|

|

17.6 |

|

|

|

13.7 |

|

Share-based compensation expense |

|

|

25.2 |

|

|

|

22.5 |

|

Deferred income taxes |

|

|

(9.4 |

) |

|

|

(14.6 |

) |

Net pension plan income |

|

|

(1.1 |

) |

|

|

(0.5 |

) |

Gain on sale of long-lived assets |

|

|

(9.8 |

) |

|

|

(0.8 |

) |

Gain on sales of investments in equity securities |

|

|

(0.2 |

) |

|

|

(7.0 |

) |

(Gain) loss on sales of businesses |

|

|

(0.4 |

) |

|

|

6.1 |

|

Amortization of operating lease right-of-use assets |

|

|

9.3 |

|

|

|

15.4 |

|

Other |

|

|

3.0 |

|

|

|

1.5 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Receivables, net |

|

|

(4.4 |

) |

|

|

(2.3 |

) |

Prepaid expenses and other current assets |

|

|

(6.3 |

) |

|

|

1.7 |

|

Accounts payable |

|

|

(5.7 |

) |

|

|

(15.3 |

) |

Income taxes payable and receivable |

|

|

(0.5 |

) |

|

|

(3.6 |

) |

Accrued liabilities and other |

|

|

16.9 |

|

|

|

(13.8 |

) |

Operating lease liabilities |

|

|

(13.8 |

) |

|

|

(16.1 |

) |

Pension and other postretirement benefits plans contributions |

|

|

(1.9 |

) |

|

|

(1.8 |

) |

Net cash provided by operating activities |

|

|

171.1 |

|

|

|

124.0 |

|

Investing Activities |

|

|

|

|

|

|

Capital expenditures |

|

|

(65.9 |

) |

|

|

(61.8 |

) |

Proceeds from sale of long-lived assets |

|

|

12.4 |

|

|

|

— |

|

Proceeds from sales of investments in equity securities |

|

|

0.2 |

|

|

|

10.0 |

|

Proceeds from sale of a business |

|

|

— |

|

|

|

0.5 |

|

Net cash used in investing activities |

|

|

(53.3 |

) |

|

|

(51.3 |

) |

Financing Activities |

|

|

|

|

|

|

Revolving facility borrowings |

|

|

159.5 |

|

|

|

302.0 |

|

Payments on revolving facility borrowings |

|

|

(159.5 |

) |

|

|

(347.0 |

) |

Treasury share repurchases |

|

|

(81.6 |

) |

|

|

(40.3 |

) |

Cash received for common stock issuances |

|

|

2.4 |

|

|

|

3.1 |

|

Finance lease payments |

|

|

(2.9 |

) |

|

|

(2.4 |

) |

Net cash used in financing activities |

|

|

(82.1 |

) |

|

|

(84.6 |

) |

Effect of exchange rate on cash and cash equivalents |

|

|

(1.5 |

) |

|

|

0.8 |

|

Net increase (decrease) in cash and cash equivalents |

|

|

34.2 |

|

|

|

(11.1 |

) |

Cash and cash equivalents at beginning of year |

|

|

23.1 |

|

|

|

34.2 |

|

Cash and cash equivalents at end of year |

|

$ |

57.3 |

|

|

$ |

23.1 |

|

Supplemental cash flow information: |

|

|

|

|

|

|

Income taxes paid (net of refunds) |

|

$ |

40.8 |

|

|

$ |

38.3 |

|

Interest paid |

|

$ |

13.3 |

|

|

$ |

16.6 |

|

Non-cash investing activities: |

|

|

|

|

|

|

Capitalized software included in accounts payable |

|

$ |

0.6 |

|

|

$ |

0.1 |

|

Non-cash consideration from sale of investment in an equity security |

|

$ |

— |

|

|

$ |

2.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, |

|

|

For the Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net cash provided by operating activities |

|

$ |

56.4 |

|

|

$ |

74.8 |

|

|

$ |

171.1 |

|

|

$ |

124.0 |

|

Less: capital expenditures |

|

|

15.1 |

|

|

|

18.8 |

|

|

|

65.9 |

|

|

|

61.8 |

|

Free Cash Flow |

|

$ |

41.3 |

|

|

$ |

56.0 |

|

|

$ |

105.2 |

|

|

$ |

62.2 |

|

Donnelley Financial Solutions, Inc. and Subsidiaries (“DFIN”)

Reconciliation of Reported to Organic Net Sales - By Segment

(UNAUDITED)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Markets - Software Solutions |

|

|

Capital Markets - Compliance and Communications Management |

|

|

Investment Companies - Software Solutions |

|

|

Investment Companies - Compliance and Communications Management |

|

|

Consolidated |

|

Reported Net Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, 2024 |

|

$ |

50.0 |

|

|

$ |

53.3 |

|

|

$ |

31.6 |

|

|

$ |

21.4 |

|

|

$ |

156.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, 2023 |

|

$ |

48.0 |

|

|

$ |

68.3 |

|

|

$ |

25.7 |

|

|

$ |

34.5 |

|

|

$ |

176.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales change |

|

|

4.2 |

% |

|

|

(22.0 |

%) |

|

|

23.0 |

% |

|

|

(38.0 |

%) |

|

|

(11.4 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplementary non-GAAP information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-over-year impact of changes in foreign exchange rates |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-over-year impact of the eBrevia disposition |

|

|

(1.5 |

%) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.4 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net organic sales change |

|

|

5.7 |

% |

|

|

(22.0 |

%) |

|

|

23.0 |

% |

|

|

(38.0 |

%) |

|

|

(11.0 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Markets - Software Solutions |

|

|

Capital Markets - Compliance and Communications Management |

|

|

Investment Companies - Software Solutions |

|

|

Investment Companies - Compliance and Communications Management |

|

|

Consolidated |

|

Reported Net Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended December 31, 2024 |

|

$ |

213.6 |

|

|

$ |

321.7 |

|

|

$ |

116.1 |

|

|

$ |

130.5 |

|

|

$ |

781.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended December 31, 2023 |

|

$ |

185.9 |

|

|

$ |

355.4 |

|

|

$ |

106.8 |

|

|

$ |

149.1 |

|

|

$ |

797.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales change |

|

|

14.9 |

% |

|

|

(9.5 |

%) |

|

|

8.7 |

% |

|

|

(12.5 |

%) |

|

|

(1.9 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplementary non-GAAP information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-over-year impact of changes in foreign exchange rates |

|

|

— |

|

|

|

— |

|

|

|

0.2 |

% |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-over-year impact of the eBrevia disposition |

|

|

(2.0 |

%) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.5 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net organic sales change |

|

|

16.9 |

% |

|

|

(9.5 |

%) |

|

|

8.5 |

% |

|

|

(12.5 |

%) |

|

|

(1.4 |

%) |

Donnelley Financial Solutions, Inc. and Subsidiaries (“DFIN”)

Reconciliation of Reported to Organic Net Sales - By Services and Products

(UNAUDITED)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Software Solutions |

|

|

Tech-enabled Services |

|

|

Print and Distribution |

|

|

Consolidated |

|

Reported Net Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, 2024 |

|

$ |

81.6 |

|

|

$ |

60.5 |

|

|

$ |

14.2 |

|

|

$ |

156.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, 2023 |

|

$ |

73.7 |

|

|

$ |

73.6 |

|

|

$ |

29.2 |

|

|

$ |

176.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales change |

|

|

10.7 |

% |

|

|

(17.8 |

%) |

|

|

(51.4 |

%) |

|

|

(11.4 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplementary non-GAAP information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-over-year impact of changes in foreign exchange rates |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-over-year impact of the eBrevia disposition |

|

|

(0.9 |

%) |

|

|

— |

|

|

|

— |

|

|

|

(0.4 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net organic sales change |

|

|

11.6 |

% |

|

|

(17.8 |

%) |

|

|

(51.4 |

%) |

|

|

(11.0 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Software Solutions |

|

|

Tech-enabled Services |

|

|

Print and Distribution |

|

|

Consolidated |

|

Reported Net Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended December 31, 2024 |

|

$ |

329.7 |

|

|

$ |

320.8 |

|

|

$ |

131.4 |

|

|

$ |

781.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended December 31, 2023 |

|

$ |

292.7 |

|

|

$ |

336.9 |

|

|

$ |

167.6 |

|

|

$ |

797.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales change |

|

|

12.6 |

% |

|

|

(4.8 |

%) |

|

|

(21.6 |

%) |

|

|

(1.9 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplementary non-GAAP information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-over-year impact of changes in foreign exchange rates |

|

|

0.1 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-over-year impact of the eBrevia disposition |

|

|

(1.3 |

%) |

|

|

— |

|

|

|

— |

|

|

|

(0.5 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net organic sales change |

|

|

13.8 |

% |

|

|

(4.8 |

%) |

|

|

(21.6 |

%) |

|

|

(1.4 |

%) |

Donnelley Financial Solutions, Inc. and Subsidiaries (“DFIN”)

Reconciliation of Net Earnings to Adjusted EBITDA

(UNAUDITED)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve

Months Ended |

|

|

For the Three Months Ended |

|

|

|

December 31, 2024 |

|

|

December 31, 2024 |

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

March 31, 2024 |

|

Net earnings |

|

$ |

92.4 |

|

|

$ |

6.3 |

|

|

$ |

8.7 |

|

|

$ |

44.1 |

|

|

$ |

33.3 |

|

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring, impairment and other charges, net |

|

|

6.6 |

|

|

|

2.1 |

|

|

|

1.4 |

|

|

|

1.3 |

|

|

|

1.8 |

|

Share-based compensation expense |

|

|

25.2 |

|

|

|

6.0 |

|

|

|

6.7 |

|

|

|

7.4 |

|

|

|

5.1 |

|

Gain on sale of long-lived assets |

|

|

(9.8 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|