Dun & Bradstreet Holdings, Inc. (NYSE: DNB), a leading

global provider of business decisioning data and analytics, today

announced unaudited financial results for the third quarter ended

September 30, 2024. A reconciliation of U.S. generally accepted

accounting principles (“GAAP”) to non-GAAP financial measures has

been provided in this press release, including the accompanying

tables. An explanation of these measures is also included below

under the heading “Use of Non-GAAP Financial Measures.”

- Revenue for the third quarter of 2024 was $609.1 million, an

increase of 3.5% and 3.2% on a constant currency basis compared to

the third quarter of 2023.

- Organic revenue increased 3.4% on a constant currency basis

compared to the third quarter of 2023.

- GAAP net income for the third quarter of 2024 was $3.2 million,

or diluted earnings per share of $0.01, compared to net income of

$4.4 million, or diluted earnings per share of $0.01 for the prior

year quarter. Adjusted net income was $116.0 million, or adjusted

net earnings per diluted share of $0.27, compared to adjusted net

income of $116.2 million, or adjusted net earnings per diluted

share of $0.27 for the prior year quarter.

- Adjusted EBITDA for the third quarter of 2024 was $247.4

million, an increase of 5.1% compared to the prior year quarter.

Adjusted EBITDA margin for the third quarter of 2024 was

40.6%.

“We are pleased to deliver another solid quarter of financial

results and strategic progress. Organic revenue growth of 3.4% was

ahead of our expectations, and we delivered Adjusted EBITDA margin

expansion of 60 basis points and improved free cash flow conversion

during the third quarter. We continue to see strong demand for our

core Master Data Management and Risk Solutions in both our

International and North America segments,” said Anthony Jabbour,

Dun & Bradstreet Chief Executive Officer. “We remain focused on

bringing innovation to drive value to our clients across their most

critical use cases, as demonstrated by the renewals, expansions and

new wins across our business. In particular, we are excited about

the recent release of Chat D&B, our generative AI assistant

that produces instantaneous and actionable business insights on

companies and professional contacts.”

- Revenue for the nine months ended September 30, 2024 was

$1,749.8 million, an increase of 3.9% and 3.8% on a constant

currency basis compared to the nine months ended September 30,

2023.

- Organic revenue increased 3.9% on a constant currency basis

compared to the nine months ended September 30, 2023.

- GAAP net loss for the nine months ended September 30, 2024 was

$36.4 million, or loss per share of $0.08, compared to net loss of

$48.7 million, or loss per share of $0.11 for the prior year

period. Adjusted net income was $300.1 million, or adjusted net

earnings per diluted share of $0.69, compared to adjusted net

income of $291.8 million, or adjusted net earnings per diluted

share of $0.68 for the prior year period.

- Adjusted EBITDA for the nine months ended September 30, 2024

was $666.6 million, an increase of 5.5% compared to the nine months

ended September 30, 2023. Adjusted EBITDA margin for the nine

months ended September 30, 2024 was 38.1%.

Segment Results

North America

For the third quarter of 2024, North America revenue was $432.5

million, an increase of $11.1 million or 2.6% and 2.7% on a

constant currency basis compared to the third quarter of 2023.

- Finance and Risk revenue for the third quarter of 2024 was

$237.7 million, an increase of $2.8 million or 1.2% compared to the

third quarter of 2023.

- Sales and Marketing revenue for the third quarter of 2024 was

$194.8 million, an increase of $8.3 million or 4.5% compared to the

third quarter of 2023.

North America adjusted EBITDA for the third quarter of 2024 was

$207.7 million, an increase of 6.2%, with adjusted EBITDA margin of

48.0%.

For the nine months ended September 30, 2024, North America

revenue was $1,223.7 million, an increase of $36.0 million or 3.0%

and 3.1% on a constant currency basis compared to the nine months

ended September 30, 2023.

- Finance and Risk revenue for the nine months ended September

30, 2024 was $661.8 million, an increase of $15.1 million or 2.3%

and 2.4% on a constant currency basis compared to the nine months

ended September 30, 2023.

- Sales and Marketing revenue for the nine months ended September

30, 2024 was $561.9 million, an increase of $20.9 million or 3.9%

compared to the nine months ended September 30, 2023.

North America adjusted EBITDA for the nine months ended

September 30, 2024 was $538.0 million, an increase of 3.5%, with

adjusted EBITDA margin of 44.0%.

International

International revenue for the third quarter of 2024 was $176.6

million, an increase of $9.5 million or 5.7% and 4.7% on a constant

currency basis compared to the third quarter of 2023. Excluding the

impact of the divestiture of a business-to-consumer business in

Finland and the positive impact of foreign exchange of $1.8

million, International organic revenue increased 5.1%.

- Finance and Risk revenue for the third quarter of 2024 was

$121.6 million, an increase of $8.0 million or 7.1% and 6.3% on a

constant currency basis compared to the third quarter of 2023.

- Sales and Marketing revenue for the third quarter of 2024 was

$55.0 million, an increase of $1.5 million or 2.7% and 1.1% on a

constant currency basis compared to the third quarter of 2023.

Excluding the impact of the divestiture and the positive impact of

foreign exchange, organic revenue increased 2.4%.

International adjusted EBITDA for the third quarter of 2024 was

$59.1 million, an increase of 6.5%, with adjusted EBITDA margin of

33.5%.

International revenue for the nine months ended September 30,

2024 was $526.1 million, an increase of $30.2 million or 6.1% and

5.7% on a constant currency basis compared to the nine months ended

September 30, 2023. Excluding the impact of the divestiture of a

business-to-consumer business in Finland and the positive impact of

foreign exchange of $2.0 million, International organic revenue

increased 6.1%.

- Finance and Risk revenue for the nine months ended September

30, 2024 was $358.1 million, an increase of $25.9 million or 7.8%

and 7.4% on a constant currency basis compared to the nine months

ended September 30, 2023.

- Sales and Marketing revenue for the nine months ended September

30, 2024 was $168.0 million, an increase of $4.3 million or 2.6%

and 2.2% on a constant currency basis compared to the nine months

ended September 30, 2023. Excluding the impact of the divestiture

and the positive impact of foreign exchange, organic revenue

increased 3.4%.

International adjusted EBITDA for the nine months ended

September 30, 2024 was $177.2 million, an increase of 10.6%, with

adjusted EBITDA margin of 33.7%.

Balance Sheet

As of September 30, 2024, we had cash and cash equivalents of

$288.7 million and total principal amount of debt of $3,681.1

million. We had $717.0 million available on our $850 million

revolving credit facility as of September 30, 2024.

Stock Repurchase Program

During the nine months ended September 30, 2024, we repurchased

961,360 shares of Dun & Bradstreet common stock for $9.3

million, net of accrued excise tax, at an average price of $9.71

per share. There was no share repurchase activity during the three

months ended September 30, 2024. We currently have over 9 million

shares remaining under our existing buyback authorization.

Business Outlook

- Revenues after the impact of foreign exchange are expected to

be at the low end of our previously communicated range of $2,400

million to $2,440 million, or approximately 3.7% to 5.4%.

- Organic revenue growth is also expected to be at the low end of

our previously communicated range of 4.1% to 5.1%.

- Adjusted EBITDA is expected to continue to be in the range of

$930 million to $950 million.

- Adjusted EPS is expected to continue to be in the range of

$1.00 to $1.04.

The foregoing forward-looking statements reflect Dun &

Bradstreet’s expectations as of today's date and Revenue assumes

constant foreign currency rates. Dun & Bradstreet does not

present a qualitative reconciliation of its forward-looking

non-GAAP financial measures to the most directly comparable GAAP

measure due to the inherent difficulty, without unreasonable

efforts, in forecasting and quantifying with reasonable accuracy

significant items required for this reconciliation. Given the

number of risk factors, uncertainties and assumptions discussed

below, actual results may differ materially. Dun & Bradstreet

does not intend to update its forward-looking statements until its

next quarterly results announcement, other than in publicly

available statements.

Earnings Conference Call and Audio Webcast

Dun & Bradstreet will host a conference call to discuss the

third quarter 2024 financial results on October 31, 2024 at 8:30am

ET. The conference call can be accessed live over the phone by

dialing 1-844-481-2520 (USA), or 1-412-317-0548 (International).

The telephone replay will be available from 11:30am ET on October

31, 2024, through November 14, 2024, by dialing 1-877-344-7529

(USA) or 1-412-317-0088 (International). The replay passcode will

be 6582331.

The call will also be webcast live from Dun & Bradstreet’s

investor relations website at https://investor.dnb.com. Following

the completion of the call, a recorded replay of the webcast will

be available on the website.

About Dun & Bradstreet

Dun & Bradstreet, a leading global provider of business

decisioning data and analytics, enables companies around the world

to improve their business performance. Dun & Bradstreet’s Data

Cloud fuels solutions and delivers insights that empower customers

to accelerate revenue, lower cost, mitigate risk, and transform

their businesses. Since 1841, companies of every size have relied

on Dun & Bradstreet to help them manage risk and reveal

opportunity. For more information on Dun & Bradstreet, please

visit www.dnb.com.

Use of Non-GAAP Financial Measures

In addition to reporting GAAP results, we evaluate performance

and report our results on the non-GAAP financial measures discussed

below. We believe that the presentation of these non-GAAP measures

provides useful information to investors and rating agencies

regarding our results, operating trends and performance between

periods. These non-GAAP financial measures include organic revenue,

adjusted earnings before interest, taxes, depreciation and

amortization (‘‘adjusted EBITDA’’), adjusted EBITDA margin,

adjusted net income and adjusted net earnings per diluted share.

Adjusted results are non-GAAP measures that adjust for the impact

due to certain acquisition and divestiture related revenue and

expenses, such as costs for banker fees, legal fees, due diligence,

retention payments and contingent consideration adjustments,

restructuring charges, equity-based compensation, transition costs

and other non-core gains and charges that are not in the normal

course of our business, such as costs associated with early debt

redemptions, gains and losses on sales of businesses, impairment

charges, the effect of significant changes in tax laws and material

tax and legal settlements. We exclude amortization of recognized

intangible assets resulting from the application of purchase

accounting because it is non-cash and not indicative of our ongoing

and underlying operating performance. Intangible assets are

recognized as a result of historical merger and acquisition

transactions. We believe that recognized intangible assets by their

nature are fundamentally different from other depreciating assets

that are replaced on a predictable operating cycle. Unlike other

depreciating assets, such as developed and purchased software

licenses or property and equipment, there is no replacement cost

once these recognized intangible assets expire and the assets are

not replaced. Additionally, our costs to operate, maintain and

extend the life of acquired intangible assets and purchased

intellectual property are reflected in our operating costs as

personnel, data fees, facilities, overhead and similar items.

Management believes it is important for investors to understand

that such intangible assets were recorded as part of purchase

accounting and contribute to revenue generation. Amortization of

recognized intangible assets will recur in future periods until

such assets have been fully amortized. In addition, we isolate the

effects of changes in foreign exchange rates on our revenue growth

because we believe it is useful for investors to be able to compare

revenue from one period to another, both after and before the

effects of foreign exchange rate changes. The change in revenue

performance attributable to foreign currency rates is determined by

converting both our prior and current periods’ foreign currency

revenue by a constant rate. As a result, we monitor our revenue

growth both after and before the effects of foreign exchange rate

changes. We believe that these supplemental non-GAAP financial

measures provide management and other users with additional

meaningful financial information that should be considered when

assessing our ongoing performance and comparability of our

operating results from period to period. Our management regularly

uses our supplemental non-GAAP financial measures internally to

understand, manage and evaluate our business and make operating

decisions. These non-GAAP measures are among the factors management

uses in planning for and forecasting future periods. Non-GAAP

financial measures should be viewed in addition to, and not as an

alternative to our reported results prepared in accordance with

GAAP.

Our non-GAAP or adjusted financial measures reflect adjustments

based on the following items, as well as the related income

tax.

Organic Revenue

We define organic revenue as reported revenue before the effect

of foreign exchange excluding revenue from acquired businesses, if

applicable, for the first twelve months. In addition, organic

revenue excludes current and prior year revenue associated with

divested businesses, if applicable. We believe the organic measure

provides investors and analysts with useful supplemental

information regarding the Company’s underlying revenue trends by

excluding the impact of acquisitions and divestitures.

Adjusted EBITDA and Adjusted EBITDA Margin

We define adjusted EBITDA as net income (loss) attributable to

Dun & Bradstreet Holdings, Inc. excluding the following

items:

- depreciation and amortization;

- interest expense and income;

- income tax benefit or provision;

- other non-operating expenses or income;

- equity in net income of affiliates;

- net income attributable to non-controlling interests;

- equity-based compensation;

- merger, acquisition and divestiture-related operating

costs;

- transition costs primarily consisting of non-recurring expenses

associated with investments to transform our technology and

back-office infrastructure, including investment in the

architecture of our technology platforms and cloud-focused

infrastructure. The transformation efforts require us to dedicate

separate resources in order to develop the new cloud-based

infrastructure in parallel with our current environment. These

costs, as well as other expenses associated with transformational

activities, are incremental and redundant costs that will not recur

after we achieve our objectives and are not representative of our

underlying operating performance. We believe that excluding these

costs from our non-GAAP measures provides a better reflection of

our ongoing cost structure; and

- other adjustments include non-recurring charges such as legal

expense associated with significant legal and regulatory matters

and impairment charges.

We calculate adjusted EBITDA margin by dividing adjusted EBITDA

by revenue.

Adjusted Net Income

We define adjusted net income as net income (loss) attributable

to Dun & Bradstreet Holdings, Inc. adjusted for the following

items:

- incremental amortization resulting from the application of

purchase accounting. We exclude amortization of recognized

intangible assets resulting from the application of purchase

accounting because it is non-cash and is not indicative of our

ongoing and underlying operating performance. The Company believes

that recognized intangible assets by their nature are fundamentally

different from other depreciating assets that are replaced on a

predictable operating cycle. Unlike other depreciating assets, such

as developed and purchased software licenses or property and

equipment, there is no replacement cost once these recognized

intangible assets expire and the assets are not replaced.

Additionally, the Company’s costs to operate, maintain and extend

the life of acquired intangible assets and purchased intellectual

property are reflected in the Company’s operating costs as

personnel, data fees, facilities, overhead and similar items;

- equity-based compensation;

- merger, acquisition and divestiture-related operating

costs;

- transition costs primarily consisting of non-recurring expenses

associated with investments to transform our technology and

back-office infrastructure, including investment in the

architecture of our technology platforms and cloud-focused

infrastructure. The transformation efforts require us to dedicate

separate resources in order to develop the new cloud-based

infrastructure in parallel with our current environment. These

costs, as well as other expenses associated with transformational

activities, are incremental and redundant costs that will not recur

after we achieve our objectives and are not representative of our

underlying operating performance. We believe that excluding these

costs from our non-GAAP measures provides a better reflection of

our ongoing cost structure;

- merger, acquisition and divestiture-related non-operating

costs;

- debt refinancing and extinguishment costs;

- non-operating pension-related income (expenses) includes

certain costs and income associated with our pension and

postretirement plans, consisting of interest cost, expected return

on plan assets and amortized actuarial gains or losses, prior

service credits and if applicable, plan settlement charges. These

adjustments are non-cash and market-driven, primarily due to the

changes in the value of pension plan assets and liabilities which

are tied to financial market performance and conditions;

- non-cash gain and loss resulting from the modification of our

interest rate swaps;

- other adjustments include non-recurring charges such as legal

expense associated with significant legal and regulatory matters

and impairment charges;

- tax effect of the non-GAAP adjustments; and

- other tax effect adjustments related to the tax impact of

statutory tax rate changes on deferred taxes and other discrete

items.

Adjusted Net Earnings Per Diluted Share

We calculate adjusted net earnings per diluted share by dividing

adjusted net income (loss) by the weighted average number of common

shares outstanding for the period plus the dilutive effect of

common shares potentially issuable in connection with awards

outstanding under our stock incentive plan.

Forward-Looking Statements

The statements contained in this release that are not purely

historical are forward-looking statements, including statements

regarding expectations, hopes, intentions or strategies regarding

the future. Forward-looking statements are based on Dun &

Bradstreet’s management’s beliefs, as well as assumptions made by,

and information currently available to, them. Forward-looking

statements can be identified by words such as “anticipates,”

“intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and

similar references to future periods, or by the inclusion of

forecasts or projections. Examples of forward-looking statements

include, but are not limited to, statements we make regarding the

outlook for our future business and financial performance. Because

such statements are based on expectations as to future financial

and operating results and are not statements of fact, actual

results may differ materially from those projected. It is not

possible to predict or identify all risk factors. Consequently, the

risks and uncertainties listed below should not be considered a

complete discussion of all of our potential trends, risks and

uncertainties. We undertake no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

The risks and uncertainties that forward-looking statements are

subject to include, but are not limited to: (i) our ability to

implement and execute our strategic plans to transform the

business; (ii) our ability to develop or sell solutions in a timely

manner or maintain client relationships; (iii) competition for our

solutions; (iv) harm to our brand and reputation; (v) unfavorable

global economic conditions including, but not limited to,

volatility in interest rates, foreign currency markets, inflation,

and supply chain disruptions; (vi) risks associated with operating

and expanding internationally; (vii) failure to prevent

cybersecurity incidents or the perception that confidential

information is not secure; (viii) failure in the integrity of our

data or systems; (ix) system failures and personnel disruptions,

which could delay the delivery of our solutions to our clients; (x)

loss of access to data sources or ability to transfer data across

the data sources in markets where we operate; (xi) failure of our

software vendors and network and cloud providers to perform as

expected or if our relationship is terminated; (xii) loss or

diminution of one or more of our key clients, business partners or

government contracts; (xiii) dependence on strategic alliances,

joint ventures and acquisitions to grow our business; (xiv) our

ability to protect our intellectual property adequately or

cost-effectively; (xv) claims for intellectual property

infringement; (xvi) interruptions, delays or outages to

subscription or payment processing platforms; (xvii) risks related

to acquiring and integrating businesses and divestitures of

existing businesses; (xviii) our ability to retain members of the

senior leadership team and attract and retain skilled employees;

(xix) compliance with governmental laws and regulations; (xx) risks

related to registration and other rights held by certain of our

largest shareholders; (xxi) an outbreak of disease, global or

localized health pandemic or epidemic, or the fear of such an

event, including the global economic uncertainty and measures taken

in response; (xxii) increased economic uncertainty related to the

ongoing conflict between Russia and Ukraine, the conflict in the

Middle East, and associated trends in macroeconomic conditions, and

(xxiii) the other factors described under the headings “Risk

Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” “Cautionary Note Regarding

Forward-Looking Statements” and other sections of our Annual Report

on Form 10-K filed with the Securities and Exchange Commission

("SEC") on February 22, 2024.

Dun & Bradstreet Holdings,

Inc.

Consolidated Statements of

Operations

(In millions, except per share

data)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Revenue

$

609.1

$

588.5

$

1,749.8

$

1,683.6

Cost of services (exclusive of

depreciation and amortization) (1)

219.5

211.8

663.7

631.8

Selling and administrative expenses

(1)

174.8

176.3

525.6

527.8

Depreciation and amortization

144.8

146.7

430.1

437.1

Restructuring charges

7.8

1.6

14.5

10.4

Operating costs

546.9

536.4

1,633.9

1,607.1

Operating income (loss)

62.2

52.1

115.9

76.5

Interest income

2.1

1.7

4.9

4.2

Interest expense

(61.3

)

(57.0

)

(205.6

)

(168.4

)

Other income (expense) - net

(0.9

)

(3.3

)

0.6

(1.2

)

Non-operating income (expense) - net

(60.1

)

(58.6

)

(200.1

)

(165.4

)

Income (loss) before provision (benefit)

for income taxes and equity in net income of affiliates

2.1

(6.5

)

(84.2

)

(88.9

)

Less: provision (benefit) for income

taxes

(1.8

)

(11.2

)

(48.9

)

(40.5

)

Equity in net income of affiliates

0.3

0.6

1.9

2.1

Net income (loss)

4.2

5.3

(33.4

)

(46.3

)

Less: net (income) loss attributable to

the non-controlling interest

(1.0

)

(0.9

)

(3.0

)

(2.4

)

Net income (loss) attributable to Dun

& Bradstreet Holdings, Inc.

$

3.2

$

4.4

$

(36.4

)

$

(48.7

)

Basic earnings (loss) per share of

common stock attributable to Dun & Bradstreet Holdings,

Inc.

$

0.01

$

0.01

$

(0.08

)

$

(0.11

)

Diluted earnings (loss) per share of

common stock attributable to Dun & Bradstreet Holdings,

Inc.

$

0.01

$

0.01

$

(0.08

)

$

(0.11

)

Weighted average number of shares

outstanding-basic

432.4

430.8

432.2

430.3

Weighted average number of shares

outstanding-diluted

435.6

432.2

432.2

430.3

(1)

Prior year period results have been recast to reflect the change

in presentation and to conform to the current period presentation.

For the three and nine months ended September 30, 2023, we

reclassified $5.3 million and $24.4 million, respectively, from

Selling and administrative expenses to Cost of services (exclusive

of depreciation and amortization). This reclassification has no

impact on total operating costs, operating income, net income

(loss), earnings (loss) per share or segment results. Additionally,

the reclassification has no impact on the unaudited consolidated

balance sheets or unaudited consolidated statement of cash

flows.

Dun & Bradstreet Holdings,

Inc.

Consolidated Balance

Sheets

(In millions, except share

data and per share data)

September 30,

2024

December 31,

2023

Assets

Current assets

Cash and cash equivalents

$

288.7

$

188.1

Accounts receivable, net of allowance of

$25.3 at September 30, 2024 and $20.1 at December 31, 2023

242.4

258.0

Prepaid taxes

52.7

51.8

Other prepaids

92.0

100.1

Other current assets

34.4

58.3

Total current assets

710.2

656.3

Non-current assets

Property, plant and equipment, net of

accumulated depreciation of $52.3 at September 30, 2024 and $45.7

at December 31, 2023

94.1

102.1

Computer software, net of accumulated

amortization of $636.2 at September 30, 2024 and $507.1 at December

31, 2023

704.4

666.3

Goodwill

3,447.5

3,445.8

Other intangibles

3,629.4

3,915.9

Deferred costs

163.4

161.7

Other non-current assets

255.9

187.8

Total non-current assets

8,294.7

8,479.6

Total assets

$

9,004.9

$

9,135.9

Liabilities

Current liabilities

Accounts payable

$

108.9

$

111.7

Accrued payroll

91.9

111.9

Short-term debt

31.0

32.7

Deferred revenue

564.9

590.0

Other accrued and current liabilities

214.3

196.1

Total current liabilities

1,011.0

1,042.4

Long-term pension and postretirement

benefits

127.1

143.9

Long-term debt

3,626.9

3,512.5

Deferred income tax

782.8

887.3

Other non-current liabilities

109.9

118.2

Total liabilities

5,657.7

5,704.3

Commitments and contingencies

Equity

Common Stock, $0.0001 par value per share,

authorized—2,000,000,000 shares; 443,419,716 shares issued and

441,571,436 shares outstanding at September 30, 2024 and

439,735,256 shares issued and 438,848,336 shares outstanding at

December 31, 2023

—

—

Capital surplus

4,401.0

4,429.2

Accumulated deficit

(847.5

)

(811.1

)

Treasury Stock, 1,848,280 shares at

September 30, 2024 and 886,920 shares at December 31, 2023

(9.7

)

(0.3

)

Accumulated other comprehensive loss

(212.0

)

(198.7

)

Total stockholders' equity

3,331.8

3,419.1

Non-controlling interest

15.4

12.5

Total equity

3,347.2

3,431.6

Total liabilities and stockholders'

equity

$

9,004.9

$

9,135.9

Dun & Bradstreet Holdings,

Inc.

Condensed Consolidated

Statements of Cash Flows

(In millions)

Nine months ended September

30,

2024

2023

Cash flows provided by (used in)

operating activities:

Net income (loss)

$

(33.4

)

$

(46.3

)

Reconciliation of net income (loss) to net

cash provided by (used in) operating activities:

Depreciation and amortization

430.1

437.1

Amortization of unrecognized pension loss

(gain)

(1.3

)

(2.1

)

Deferred debt issuance costs amortization

and write-off

41.9

14.0

Equity-based compensation expense

52.4

66.1

Restructuring charge

14.5

10.4

Restructuring payments

(11.3

)

(12.1

)

Changes in deferred income taxes

(97.3

)

(114.3

)

Changes in operating assets and

liabilities:

(Increase) decrease in accounts

receivable

11.5

47.0

(Increase) decrease in prepaid taxes,

other prepaids and other current assets

0.4

(24.4

)

Increase (decrease) in deferred

revenue

(22.3

)

4.6

Increase (decrease) in accounts

payable

(3.7

)

(9.6

)

Increase (decrease) in accrued payroll

(22.7

)

(21.5

)

Increase (decrease) in other accrued and

current liabilities

(1.8

)

(32.8

)

(Increase) decrease in other long-term

assets

(32.6

)

3.2

Increase (decrease) in long-term

liabilities

(47.7

)

(34.0

)

Net, other non-cash adjustments

10.2

(1.6

)

Net cash provided by (used in)

operating activities

286.9

283.7

Cash flows provided by (used in)

investing activities:

Cash settlements of foreign currency

contracts and net investment hedges

7.6

7.7

Capital expenditures

(3.8

)

(3.7

)

Additions to computer software and other

intangibles

(153.7

)

(126.2

)

Other investing activities, net (1)

(10.5

)

1.9

Net cash provided by (used in)

investing activities

(160.4

)

(120.3

)

Cash flows provided by (used in)

financing activities:

Cash paid for repurchase of treasury

shares

(9.3

)

—

Payments of dividends

(65.8

)

(64.6

)

Proceeds from borrowings on Credit

Facility

404.5

380.3

Proceeds from borrowings on Term Loan

Facility

3,103.6

—

Payments of borrowings on Credit

Facility

(296.5

)

(316.0

)

Payments on Term Loan Facility

(3,119.2

)

(24.5

)

Payment of debt issuance costs

(26.6

)

—

Payment for purchase of non-controlling

interests

—

(95.7

)

Other financing activities, net

(21.9

)

(18.8

)

Net cash provided by (used in)

financing activities

(31.2

)

(139.3

)

Effect of exchange rate changes on cash

and cash equivalents

5.7

(2.4

)

Increase (decrease) in cash, cash

equivalents and restricted cash

101.0

21.7

Cash, Cash Equivalents and Restricted

Cash, Beginning of Period

188.1

208.4

Cash, Cash Equivalents and Restricted

Cash, End of Period

$

289.1

$

230.1

Supplemental Disclosure of Cash Flow

Information:

Reconciliation of cash, cash

equivalents and restricted cash

Cash and cash equivalents in the condensed

consolidated balance sheet

$

288.7

$

230.1

Restricted cash included within other

current assets (2)

0.4

—

Total cash, cash equivalents and

restricted cash reported in the statements of cash flow

$

289.1

$

230.1

Cash Paid for:

Income taxes payments (refunds), net

$

70.1

$

75.5

Interest

$

157.3

$

151.2

(1)

Higher payments for other investing activities for the nine

months ended September 30, 2024 were primarily related to a payment

to acquire a minority interest holding.

(2)

Restricted cash represents funds set aside associated with

customer refunds.

Dun & Bradstreet Holdings,

Inc.

Reconciliation of Net Income

(Loss) to Adjusted EBITDA

(In millions)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net income (loss) attributable to Dun

& Bradstreet Holdings, Inc.

$

3.2

$

4.4

$

(36.4

)

$

(48.7

)

Depreciation and amortization

144.8

146.7

430.1

437.1

Interest expense - net

59.2

55.3

200.7

164.2

(Benefit) provision for income tax -

net

(1.8

)

(11.2

)

(48.9

)

(40.5

)

EBITDA

205.4

195.2

545.5

512.1

Other income (expense) - net

0.9

3.3

(0.6

)

1.2

Equity in net income of affiliates

(0.3

)

(0.6

)

(1.9

)

(2.1

)

Net income (loss) attributable to

non-controlling interest

1.0

0.9

3.0

2.4

Equity-based compensation

16.3

20.8

52.4

66.1

Restructuring charges

7.8

1.6

14.5

10.4

Merger, acquisition and

divestiture-related operating costs

0.4

1.4

1.4

5.4

Transition costs

14.7

11.7

47.3

31.1

Other adjustments

1.2

1.1

5.0

5.0

Adjusted EBITDA

$

247.4

$

235.4

$

666.6

$

631.6

North America

$

207.7

$

195.6

$

538.0

$

519.6

International

59.1

55.5

177.2

160.2

Corporate and other

(19.4

)

(15.7

)

(48.6

)

(48.2

)

Adjusted EBITDA

$

247.4

$

235.4

$

666.6

$

631.6

Adjusted EBITDA Margin

40.6

%

40.0

%

38.1

%

37.5

%

Dun & Bradstreet Holdings,

Inc.

Segment Revenue and Adjusted

EBITDA (Unaudited)

(In millions)

Three months ended September

30, 2024

North America

International

Corporate and Other

Total

Revenue

$

432.5

$

176.6

$

—

$

609.1

Total operating costs

253.2

124.3

21.1

398.6

Operating income (loss)

179.3

52.3

(21.1

)

210.5

Depreciation and amortization

28.4

6.8

1.7

36.9

Adjusted EBITDA

$

207.7

$

59.1

$

(19.4

)

$

247.4

Adjusted EBITDA margin

48.0

%

33.5

%

N/A

40.6

%

Nine months ended September

30, 2024

North America

International

Corporate and Other

Total

Revenue

$

1,223.7

$

526.1

$

—

$

1,749.8

Total operating costs

765.8

367.6

53.9

1,187.3

Operating income (loss)

457.9

158.5

(53.9

)

562.5

Depreciation and amortization

80.1

18.7

5.3

104.1

Adjusted EBITDA

$

538.0

$

177.2

$

(48.6

)

$

666.6

Adjusted EBITDA margin

44.0

%

33.7

%

N/A

38.1

%

Three months ended September

30, 2023

North America

International

Corporate and Other

Total

Revenue

$

421.4

$

167.1

$

—

$

588.5

Total operating costs

250.1

116.7

17.3

384.1

Operating income (loss)

171.3

50.4

(17.3

)

204.4

Depreciation and amortization

24.3

5.1

1.6

31.0

Adjusted EBITDA

$

195.6

$

55.5

$

(15.7

)

$

235.4

Adjusted EBITDA margin

46.4

%

33.2

%

N/A

40.0

%

Nine months ended September

30, 2023

North America

International

Corporate and Other

Total

Revenue

$

1,187.7

$

495.9

$

—

$

1,683.6

Total operating costs

734.9

351.0

53.1

1,139.0

Operating income (loss)

452.8

144.9

(53.1

)

544.6

Depreciation and amortization

66.8

15.3

4.9

87.0

Adjusted EBITDA

$

519.6

$

160.2

$

(48.2

)

$

631.6

Adjusted EBITDA margin

43.7

%

32.3

%

N/A

37.5

%

Dun & Bradstreet Holdings,

Inc.

Reconciliation of Net Income

(Loss) to Adjusted Net Income (Loss)

(In millions, except per share

data)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net income (loss) attributable to Dun

& Bradstreet Holdings, Inc.

$

3.2

$

4.4

$

(36.4

)

$

(48.7

)

Incremental amortization of intangible

assets resulting from the application of purchase accounting

107.9

115.7

326.0

350.1

Equity-based compensation

16.3

20.8

52.4

66.1

Restructuring charges

7.8

1.6

14.5

10.4

Merger, acquisition and

divestiture-related operating costs

0.4

1.4

1.4

5.4

Transition costs

14.7

11.7

47.3

31.1

Debt refinancing and extinguishment

costs

—

2.5

37.1

2.5

Non-operating pension-related income

(4.8

)

(4.6

)

(14.8

)

(13.8

)

Non-cash gain from interest rate swap

amendment (1)

4.5

(2.6

)

1.3

(2.6

)

Other adjustments

1.2

2.2

5.0

6.1

Tax effect of non-GAAP adjustments

(34.9

)

(36.9

)

(129.2

)

(116.5

)

Other tax effect adjustments

(0.3

)

—

(4.5

)

1.7

Adjusted net income (loss) attributable to

Dun & Bradstreet Holdings, Inc.

$

116.0

$

116.2

$

300.1

$

291.8

Adjusted net earnings per diluted

share

$

0.27

$

0.27

$

0.69

$

0.68

Weighted average number of shares

outstanding - diluted

435.6

432.2

435.6

431.8

(1)

Amount represents non-cash amortization gain resulted from the

amendment of our interest rate swap derivatives. The amount is

reported within "Interest expense-net" for the three and nine

months ended September 30, 2024 and 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030944456/en/

For more information, please contact: Investor

Contact: 904-648-8006 IR@dnb.com Media Contact: Ginny

Walthour 904-528-1506 Walthourg@dnb.com

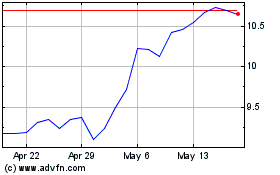

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

From Jan 2024 to Jan 2025