0000894627VAALCO ENERGY INC /DE/false00008946272025-01-212025-01-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 21, 2025

VAALCO Energy, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-32167 | | 76-0274813 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| |

2500 CityWest Blvd. Suite 400 Houston,Texas | | 77042 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (713) 623-0801

Not Applicable

(Former Name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.10 | EGY | New York Stock Exchange |

| Common Stock, par value $0.10 | EGY | London Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On January 21, 2025, VAALCO Energy, Inc. (the “Company”) issued a press release providing an operational update including annual and fourth quarter production and sales volumes. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

99.1 | |

|

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| VAALCO Energy, Inc. | |

| (Registrant) | |

| | | |

| | | |

| Date: January 21, 2025 | | | |

| By: | /s/ Lynn Willis | |

| Name: | Lynn Willis | |

| Title: | Chief Accounting Officer | |

VAALCO ENERGY, INC. ANNOUNCES RECORD PRODUCTION AND SALES VOLUMES FOR 2024

HOUSTON – January 21, 2025 – VAALCO Energy, Inc. (NYSE: EGY; LSE: EGY) (“Vaalco” or the “Company”) today provided an operational update that included record production and sales volumes for 2024.

Highlights and Key Items:

•Recorded full year 2024 sales volumes of 24,100 to 24,600 working interest (“WI”) barrels of oil equivalent per day (“BOEPD”), at the midpoint of its guidance range of 23,500 to 25,100 WI BOEPD;

oFull year 2024 sales volumes were 19,400 to 19,800 net revenue interest (“NRI”) BOEPD, at the midpoint of the Company’s guidance range of 18,800 to 20,300 NRI BOEPD;

•Generated Q4 2024 sales volumes of about 23,600 to 24,000 WI BOEPD, or 19,100 to 19,500 NRI BOEPD, both within guidance;

•Produced between 24,550 and 25,050 WI BOEPD for full year 2024, in line with the midpoint of its full year guidance range of 24,100 to 25,400 WI BOEPD;

oFull year 2024 production volumes were 19,800 to 20,200 NRI BOEPD, above the midpoint of the Company’s guidance range of 19,300 to 20,600 NRI BOEPD; and

•Delivered Q4 2024 production of about 25,100 to 25,600 WI BOEPD, or 20,600 to 21,000 NRI BOEPD, in line with guidance.

George Maxwell, Vaalco’s Chief Executive Officer commented, “We completed another successful year in 2024 where the Company achieved record operational performance. As we look forward to 2025, we are excited about the major projects that we have planned which are expected to deliver a step-change in organic growth across our portfolio in the coming years. I am proud of what we have accomplished over the past several years and believe that we are well-positioned to take Vaalco to another level with the opportunities we plan to pursue. We remain focused on maximizing value and generating strong operational cash flow to fund our numerous organic opportunities moving forward, all while continuing to return capital to our shareholders through the quarterly dividend policy.”

About Vaalco

Vaalco, founded in 1985 and incorporated under the laws of Delaware, is a Houston, Texas, USA based, independent energy company with a diverse portfolio of production, development and exploration assets across Gabon, Egypt, Cote d’Ivoire, Equatorial Guinea, Nigeria and Canada.

For Further Information

| | | | | |

| | |

| Vaalco Energy, Inc. (General and Investor Enquiries) | +00 1 713 543 3422 |

| Website: | www.vaalco.com |

| |

| Al Petrie Advisors (US Investor Relations) | +00 1 713 543 3422 |

| Al Petrie / Chris Delange | |

| | |

| Buchanan (UK Financial PR) | +44 (0) 207 466 5000 |

| Ben Romney / Barry Archer | Vaalco@buchanan.uk.com |

| |

Forward Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created by those laws and other applicable laws and “forward-looking information” within the meaning of applicable Canadian securities laws. Where a forward-looking statement expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. All statements other than statements of historical fact may be forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “forecast,” “outlook,” “aim,” “target,” “will,” “could,” “should,” “may,” “likely,” “plan” and “probably” or similar words may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this press release include, but are not limited to, statements relating to (i) estimates of future drilling, production, sales and costs of acquiring crude oil, natural gas and natural gas liquids; (ii) expectations regarding Vaalco's ability to effectively integrate assets and properties it has acquired as a result of the Svenska acquisition into its operations; (iii) expectations regarding future exploration and the development, growth and potential of Vaalco’s operations, project pipeline and investments, and schedule and anticipated benefits to be derived therefrom; (iv)

expectations regarding future acquisitions, investments or divestitures; (v) expectations of future dividends; (vi) expectations of future balance sheet strength; and (vii) expectations of future equity and enterprise value.

Such forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to: risks relating to any unforeseen liabilities of Vaalco; the ability to generate cash flows that, along with cash on hand, will be sufficient to support operations and cash requirements; risks relating to the timing and costs of completion for scheduled maintenance of the FPSO servicing the Baobab field; and the risks described under the caption “Risk Factors” in Vaalco’s 2023 Annual Report on Form 10-K filed with the SEC on March 15, 2024 and subsequent Quarterly Reports on Form 10-Q filed with the SEC.

Dividends beyond the fourth quarter of 2024 have not yet been approved or declared by the Board of Directors for Vaalco. The declaration and payment of future dividends remains at the discretion of the Board and will be determined based on Vaalco’s financial results, balance sheet strength, cash and liquidity requirements, future prospects, crude oil and natural gas prices, and other factors deemed relevant by the Board. The Board reserves all powers related to the declaration and payment of dividends. Consequently, in determining the dividend to be declared and paid on Vaalco common stock, the Board may revise or terminate the payment level at any time without prior notice.

Inside Information

This announcement contains inside information as defined in Regulation (EU) No. 596/2014 on market abuse which is part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”) and is made in accordance with the Company’s obligations under article 17 of MAR. The person responsible for arranging the release of this announcement on behalf of Vaalco is Matthew Powers, Corporate Secretary of Vaalco.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

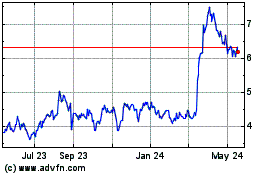

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Dec 2024 to Jan 2025

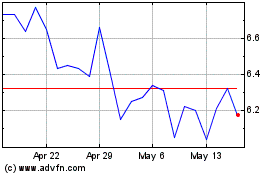

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Jan 2024 to Jan 2025