Equus Announces Fourth Quarter Net Asset Value

04 April 2024 - 12:00AM

Equus Total Return, Inc. (NYSE: EQS) (“Equus” or

the “Company”) reports net assets as of December 31, 2023, of $48.3

million. Net asset value per share increased to $3.55 as of

December 31, 2023, from $3.49 as of September 30, 2023. Comparative

data is summarized below (in thousands, except per share amounts):

|

As of the Quarter Ended |

12/31/2023 |

9/30/2023 |

6/30/2023 |

3/31/2023 |

12/31/2022 |

|

|

|

Net assets |

$48,287 |

$47,128 |

$40,051 |

$34,106 |

$35,237 |

|

Shares outstanding |

13,586 |

13,518 |

13,518 |

13,518 |

13,518 |

|

Net assets per share |

$3.55 |

$3.49 |

$2.96 |

$2.52 |

$2.61 |

|

|

The following were the principal contributors to

the changes in fair value of the Company’s portfolio holdings in

the fourth quarter of 2023:

Increase in Fair Value of Morgan

E&P. On May 22, 2023, Morgan E&P, LLC

(“Morgan”), a wholly-owned subsidiary of the Company, completed the

acquisition of 4,747.52 net acres in the Bakken/Three Forks

formation in the Williston Basin of North Dakota and subsequently

acquired an additional 1,150 net acres in the third quarter of

2023. During the fourth quarter of 2023, Morgan successfully

completed the drilling of two horizontal wells and commenced

production of hydrocarbons from these wells, resulting in a

significant portion of Morgan’s proved reserves being reclassified

as proved developed producing. As of December 31, 2023, we recorded

the fair value of Morgan’s equity at approximately $22.6 million,

an increase of $7.6 million from September 30, 2023.

Decrease in Fair Value of Equus

Energy. During the fourth quarter of 2023, the

fair value of the Company’s holding in Equus Energy, LLC (“Equus

Energy”) decreased $5.5 million, from $15.5 million to $10.0

million, largely as a consequence of the exclusion of certain gas

reserves held by Equus Energy that had become uneconomic to develop

as a result of changes in the forward pricing curve for natural

gas.

The Company received advice and assistance from

a third-party valuation firm to support its determination of the

fair value of its investments in Morgan and Equus Energy.

About Equus

The Company is a business development company

that trades as a closed-end fund on the New York Stock Exchange

under the symbol “EQS”. Additional information on the Company may

be obtained from the Company’s website at www.equuscap.com.

This press release may contain certain

forward-looking statements regarding future circumstances. These

forward-looking statements are based upon the Company’s current

expectations and assumptions and are subject to various risks and

uncertainties that could cause actual results to differ materially

from those contemplated in such forward-looking statements

including, in particular, the performance of the Company, including

our ability to achieve our expected financial and business

objectives, and the other risks and uncertainties described in the

Company’s filings with the SEC. Actual results, events, and

performance may differ. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

to the date hereof. Except as required by law, the Company

undertakes no obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the Company or any

other person that the events or circumstances described in such

statements are material.

Contact:

Patricia BaronowskiPristine Advisers, LLC(631)

756-2486

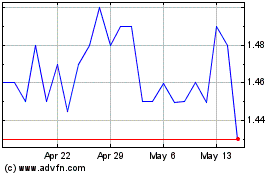

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Oct 2024 to Nov 2024

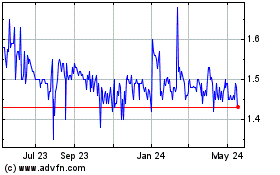

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Nov 2023 to Nov 2024