Form 8-K - Current report

17 May 2024 - 3:21AM

Edgar (US Regulatory)

___________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

Date of Report (Date of earliest event reported): May

16, 2024

EQUUS TOTAL RETURN, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

814-00098 |

76-0345915 |

| (State or Other Jurisdiction |

(Commission File |

(IRS Employer |

| Of Incorporation) |

Number) |

Identification No.) |

|

700 Louisiana Street, 48th Floor Houston,

Texas |

77002 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area

code: (713) 529-0900

N/A

(Former Name or Former Address, if Changed Since Last

Report)

Check the appropriate box below if the Form 8-k filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2). ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

On May 16, 2024, Equus Total Return, Inc. issued a

press release announcing its net asset value for the quarter ended March 31, 2024. The text of the press release is included as Exhibit

99.1 to this Current Report and is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

99.1 Press release issued on May 16, 2024.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Equus Total Return, Inc. |

| Date: May 16,

2024 |

By: /s/ Kenneth I. Denos |

| |

Name: Kenneth I. Denos |

| |

Title: Secretary |

EXHIBIT

99.1

Contact:

Patricia Baronowski

Pristine Advisers, LLC

(631) 756-2486

EQUUS ANNOUNCES FIRST QUARTER NET ASSET VALUE

HOUSTON, TX – May 16, 2024 – Equus

Total Return, Inc. (NYSE: EQS) (“Equus” or the “Company”) reports net assets as of March 31, 2024, of $45.9

million. Net asset value per share decreased to $3.38 as of March 31, 2024, from $3.55 as of December 31, 2023. Comparative data is summarized

below (in thousands, except per share amounts):

| As of the Quarter Ended |

3/31/2024 |

12/31/2023 |

9/30/2023 |

6/30/2023 |

3/31/2023

|

| Net assets |

$45,892 |

$48,287 |

$47,128 |

$40,051 |

$34,106 |

| Shares outstanding |

13,586 |

13,586 |

13,518 |

13,518 |

13,518 |

| Net assets per share |

$3.38 |

$3.55 |

$3.49 |

$2.96 |

$2.52 |

Morgan E&P, LLC (“Morgan”), a wholly-owned subsidiary of

the Company, acquired 5,897.52 net leasehold acres in the Bakken/Three Forks formation in the Williston Basin of North Dakota and commenced

production on two wells drilled in the fourth quarter of 2023. During the first quarter of 2024, Morgan’s debt increased by $2.2

million. A combination of qualitative and quantitative factors resulted in a decrease in the fair value of Morgan by $1.35 million to

$21.25 million.

The Company received advice and assistance from a

third-party valuation firm to support its determination of the fair value of its investment in Morgan.

In addition, the Company incurred operating expenses

during the first quarter of 2024 which consisted principally of professional fees and insurance.

About Equus

The Company is a business development company that

trades as a closed-end fund on the New York Stock Exchange under the symbol "EQS". Additional information on the Company may

be obtained from the Company’s website at www.equuscap.com.

This press release may contain certain

forward-looking statements regarding future circumstances. These forward-looking statements are based upon the Company’s current

expectations and assumptions and are subject to various risks and uncertainties that could cause actual results to differ materially from

those contemplated in such forward-looking statements including, in particular, the performance of the Company, including our ability

to achieve our expected financial and business objectives, and the other risks and uncertainties described in the Company’s filings

with the SEC. Actual results, events, and performance may differ. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as to the date hereof. Except as required by law, the Company undertakes no obligation to release publicly

any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect

the occurrence of unanticipated events. The inclusion of any statement in this release does not constitute an admission by the Company

or any other person that the events or circumstances described in such statements are material.

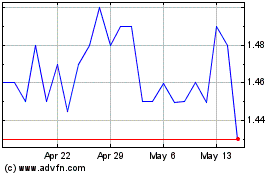

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Oct 2024 to Nov 2024

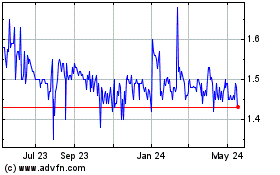

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Nov 2023 to Nov 2024